In 2011, Law No. 228-FZ of July 18, 2011 was adopted “On amendments to certain legislative acts of the Russian Federation in terms of revising methods of protecting the rights of creditors when reducing the authorized capital, changing the requirements for business companies in the event of a discrepancy between the authorized capital and the value of net assets" (hereinafter referred to as Law No. 228-FZ). Basically, the provisions of the Law come into force in 2012. From January 1, 2013, only paragraph 2 of Article 3 and Article 4 of the Law come into force; these norms regulate the provisions on the Unified Federal Register of Information on the Facts of the Activities of Legal Entities (hereinafter referred to as the EFRSLE).

The changes were significant and affected a number of legislative acts, but the situation with net assets did not change dramatically. The value of net assets is still determined on the basis of the Procedure for assessing the value of net assets of joint stock companies, approved by Order of the Ministry of Finance of the Russian Federation No. 10n, FCSM of the Russian Federation No. 03-6/pz dated January 29, 2003.

The net asset value of a joint stock company is determined as the difference between the amounts of assets and liabilities of the joint stock company.

The assessment of assets and liabilities of a joint-stock company is carried out taking into account the requirements of PBU and other regulatory legal acts on accounting.

To assess the value of a joint stock company's net assets, a calculation is made based on financial statements. The procedure establishes the asset and liability items accepted for calculation.

The following assets are taken into account for calculation:

- non-current assets reflected in the first section of the balance sheet (intangible assets, fixed assets, construction in progress, profitable investments in tangible assets, long-term financial investments, other non-current assets);

- current assets reflected in the second section of the balance sheet (inventories, value added tax on acquired assets, accounts receivable, short-term financial investments, cash, other current assets), with the exception of the cost in the amount of actual costs of repurchase of own shares purchased by the joint-stock company from shareholders for their subsequent resale or cancellation, and debts of participants (founders) for contributions to the authorized capital.

The following are taken into account as liabilities:

- long-term liabilities for loans and credits and other long-term liabilities;

- short-term obligations for loans and credits;

- accounts payable;

- debt to participants (founders) for payment of income;

- reserves for future expenses;

- other short-term liabilities.

The assessment of the value of net assets is carried out by the joint-stock company quarterly and at the end of the year on the corresponding reporting dates.

Information on the value of net assets is disclosed in interim and annual financial statements.

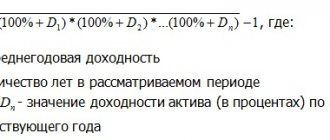

Net assets are calculated as follows:

| Section 1, 2 of the Balance Sheet | — | Section 4, 5 Balance Sheet | + | revenue of the future periods | — | Debt on contributions to the authorized capital | = | Clean assets |

As you can see, the first two indicators are the value of section 3 of the Balance Sheet. Therefore, the formula for determining the value of net assets can be presented in the form:

| Section 3 of the Balance Sheet | + | revenue of the future periods | — | Debt on contributions to the authorized capital | = | Clean assets |

Special rules

This Procedure does not apply to joint stock companies engaged in insurance and banking activities.

The procedure for calculating the value of the net assets of gambling organizers is established by Order of the Ministry of Finance of Russia dated May 2, 2007 No. 29n.

The procedure for assessing the value of the net assets of insurance organizations created in the form of joint-stock companies was approved by Order of the Ministry of Finance of Russia N 7n, Federal Financial Markets Service of the Russian Federation No. 07-10/pz-n dated February 1, 2007.

When determining the value of net assets, one should take into account the changes introduced by Law No. 228-FZ to the relevant regulations. Changes are being made, in particular, to paragraph 3 of Article 35 of the Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” and to paragraph 2 of Article 30 of the Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”. The value of the company's net assets is still assessed based on accounting data. The order is now set:

- Ministry of Finance of the Russian Federation;

- federal executive body in the field of financial markets (FFMS);

- other federal executive authorities, if such an assessment is provided for by other federal laws for certain types of activities.

This calculation procedure does not apply to credit organizations.

Important point

Credit institutions, instead of the value of net assets, must calculate the amount of their own funds (capital), determined in the manner established by the Bank of Russia.

Since 2012, the norms of subparagraph “f” of paragraph 1 of Article 5 of the Law of August 8, 2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs” cease to apply.

Now joint stock companies will not submit quarterly information to the Federal Tax Service on the amount of net assets (subclause “b”, clause 1, article 3 and clause 1, article 6 of Law No. 228-FZ). This is due to the fact that the amount of net assets is excluded from the information reflected in the Unified State Register of Legal Entities.

However, like joint-stock companies in the annual report, the section on the state of net assets is now also filled out by limited liability companies.

Article 30 of the Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” in the new edition was called “Funds and net assets of the company”. According to paragraph 3 of this article, in the company’s annual report, the section on the state of the company’s net assets must contain:

— indicators characterizing the dynamics of changes in the value of the net assets and authorized capital of the company for the last three completed financial years, including the reporting year, or, if the company exists for less than three years, for each completed financial year;

- the results of an analysis of the reasons and factors that, in the opinion of the sole executive body of the company, the board of directors (supervisory board) (if the specified board is formed in the company), led to the fact that the value of the company’s net assets was less than its authorized capital;

— a list of measures to bring the value of the company’s net assets in line with the size of its authorized capital.

Everything is in the REGISTER

Information on the value of net assets as of the last reporting date since 2013 is submitted only to the Unified Federal Register of Information on the Facts of the Activities of Legal Entities. In accordance with the newly introduced Article 7.1 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs,” information subject to publication in accordance with the legislation of the Russian Federation on state registration of legal entities, as well as other information, is entered into the Unified Federal Register of Legal Entities. EFRSUL is a federal information resource and is formed by entering into it the information provided for by Law No. 228-FZ.

The information contained in the Unified Federal Register of Legal Entities is subject to placement on the Internet information and telecommunications network.

The procedure for the formation and maintenance of the Unified Federal Register of Legal Entities is established by the federal executive body authorized by the Government of the Russian Federation and should not be an obstacle to quick and free access of any interested person to the information contained in this register.

Posting of this information on the Internet by state authorities and local government bodies is carried out without charging a fee.

Information on the following facts of activity is subject to mandatory inclusion in the Unified Financial Markets Organization:

- creation of a legal entity, including through reorganization;

- the legal entity is in the process of reorganization;

- the legal entity is in the process of liquidation;

- decision of the authorized federal executive body carrying out state registration of legal entities on the upcoming exclusion of a legal entity from the Unified State Register of Legal Entities;

- exclusion of a legal entity from the Unified State Register of Legal Entities or liquidation of a legal entity;

- termination of the activities of a unitary enterprise, the property complex of which was sold through privatization or made as a contribution to the authorized capital of an open joint-stock company;

- reduction or increase of authorized capital;

- appointment or termination of powers of the sole executive body of a legal entity;

- change of address (location) of a legal entity;

- information on the value of the net assets of a legal entity that is a joint-stock company as of the last reporting date;

- information on the value of the net assets of a legal entity that is a limited liability company, in cases provided for by Law No. 14-FZ;

- information about obtaining a license, suspension, renewal of a license, re-issuance of a license, cancellation of a license or termination for other reasons of a license to carry out a specific type of activity;

- information about the arbitration court’s ruling on the introduction of surveillance;

- information, the entry of which is provided for by other federal laws;

- other information that a legal entity enters at its own discretion, with the exception of information to which access is limited in accordance with the legislation of the Russian Federation.

It is clear that the amount of net assets and other information will be publicly available, since the information contained in the Unified Federal Register of Legal Entities is open, with the exception of information to which access is limited in accordance with the legislation of the Russian Federation.

Alignment with net assets

From January 1, 2012, changes regarding the reduction of the authorized capital of a limited liability company introduced by Law No. 228-FZ come into force.

Thus, from next year, a limited liability company is obliged to make a decision to reduce the authorized capital of the company to an amount not exceeding the value of its net assets, or a decision to liquidate the company if the value of the company’s net assets remains less than its authorized capital at the end of the financial year following the second or each subsequent financial year, at the end of which the value of the company’s net assets was less than its authorized capital. The decision is made by the company no later than six months after the end of the relevant financial year.

Innovation

Since 2012, regardless of the size of net assets at the end of the second financial year, the company may not make a decision to reduce the authorized capital.

By decision of the meeting of the company, the size of net assets can be increased at the expense of contributions from participants. Such an obligation for participants must be provided for by the company's charter. If the obligation was not provided for by the company’s charter upon establishment, then appropriate changes can be made to the charter on the basis of a unanimous decision of the general meeting of the company’s participants.

If the need for a larger number of votes to make such a decision is not provided for by the company's charter, then the decision of the general meeting of participants on making contributions to the company's property may be adopted by a majority of at least two-thirds of the total number of votes of the company's participants.

Net assets: calculation procedure using an example

Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n (registered with the Ministry of Justice on October 14, 2014) approved a new procedure for determining the value of net assets. The order will come into force 10 days after its official publication. Accordingly, the regulations that previously approved the rules for assessing the net assets of joint-stock companies, insurance organizations and gambling organizers were declared invalid.

Scope of the new procedure for determining net assets

The new procedure is applied by joint-stock companies, limited liability companies, state unitary enterprises, municipal unitary enterprises, production cooperatives, housing savings cooperatives, and economic partnerships. It also applies to gambling operators.

The new procedure for determining net assets does not apply to credit institutions and joint-stock investment funds.

How is net asset value determined?

The net asset value is determined as the difference between the value of the organization's assets accepted for calculation and the value of the organization's liabilities accepted for calculation. Accounting items recorded by the organization on off-balance sheet accounts are not taken into account when determining the value of net assets.

The net asset value is determined based on accounting data.

Assets accepted for calculation of net assets

Assets accepted for calculation include all assets of the organization, with the exception of receivables of the founders (participants, shareholders, owners, members) for contributions (contributions) to the authorized capital (authorized fund, mutual fund, share capital), for payment of shares.

In this case, assets are accepted for calculation at the cost to be reflected in the organization’s balance sheet (in net valuation minus regulatory values) based on the rules for evaluating the corresponding balance sheet items.

For example, the assets accepted for calculation include:

— fixed assets and intangible assets at residual value;

— inventories minus reserves for reduction in the value of material assets;

— accounts receivable minus provisions for doubtful debts;

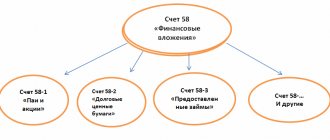

— financial investments for which the current value is not determined, minus reserves for depreciation of financial investments;

— accounts receivable for advances received minus the amount of VAT calculated on this advance for payment to the budget.

Liabilities included in the calculation of net assets

Liabilities accepted for calculation include all obligations of the organization, with the exception of deferred income recognized by the organization in connection with the receipt of government assistance, as well as in connection with the gratuitous receipt of property.

In this case, liabilities are accepted for calculation at the cost to be reflected in the organization’s balance sheet (in net valuation minus regulatory values) based on the rules for evaluating the relevant balance sheet items.

For example, as part of the liabilities accepted for calculation, advances issued are taken into account minus the amount of VAT calculated from this advance and claimed for tax deduction in accordance with the rules established by clause 12 of Art. 171 and paragraph 9 of Art. 172 of the Tax Code of the Russian Federation.

Calculation of net assets using an example

Based on the balance sheet data, we will calculate net assets as of December 31, 2014:

1) assets accepted for calculation:

— non-current assets – 142,094 thousand rubles;

— current assets – 15,826 thousand rubles;

- minus the receivables of the founders for contributions to the authorized capital - (600 thousand rubles)

————————————————-

total assets accepted for calculation – 157,320 thousand rubles;

2) liabilities accepted for calculation:

— long-term liabilities – 31,245 thousand rubles;

— short-term liabilities – 45,297 thousand rubles;

- minus future income - (930 thousand rubles)

—————————————————

total liabilities accepted for calculation – 75,612 thousand rubles;

3) total net assets – 81,708 thousand rubles. (157,320 – 75,612).

See attached for balance sheet

Increasing net assets

Since 2011, the norm of subclause 3.4 of clause 1 of Article 251 of the Tax Code came into force. From the specified period, property, property and non-property rights in the amount of their monetary value that are transferred to a business company or partnership in order to increase net assets, including through the formation of additional capital and (or) funds, by the relevant shareholders and participants are not taken into account when taxing profits.

Previously there was no such possibility. According to subparagraph 11 of paragraph 1 of Article 251 of the Tax Code, income in the form of property received by a Russian organization free of charge from an organization (individual) is exempt from taxation if the authorized capital of the receiving party consists of more than 50 percent of the contribution of the transferring party. And then on the condition that the received property is not transferred to third parties within a year from the date of its receipt, with the exception of cash.

Currently, an increase in net assets can be made in any amount without consequences in tax accounting. There is also no provision for further use of the deposit in the new norm.

If the company allocated funds to increase net assets before 2011, then the corresponding amount of income was taken into account when determining the income tax base. In accordance with Part 2 of Article 4 of the Law of December 28, 2010 No. 409-FZ, the provisions of subclause 3.4 of clause 1 of Article 251 of the Tax Code apply to legal relations that arose from January 1, 2007. That is, companies are given the opportunity to recalculate the tax base. To do this, you will have to fill out updated tax returns and submit them to the tax office.

Receipt of a contribution to property is not taken into account in income when determining the tax base for the tax paid in connection with the application of the simplified tax system, on the basis of subparagraph 1 of paragraph 1.1 of Article 346.15 of the Tax Code.

Important point

An application for a credit or refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the Tax Code (clause 7 of Article 78 of the Tax Code of the Russian Federation).

If the specified period is missed, you can file a claim in court for the return of the overpaid amount from the budget in civil or arbitration proceedings. In this case, the general rules for calculating the limitation period apply - from the day when the person learned or should have learned about the violation of his right (letter of the Federal Tax Service of the Russian Federation for Moscow dated March 22, 2010 No. 16-15 / [email protected] ).

In accounting, the value of property received from a participant as a contribution to property is not recognized as income (clause 2 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n). The accounting regulations do not contain a procedure for reflecting business transactions when receiving a contribution to the property of an LLC. There are clarifications from the Finance Ministry on this matter. The letter of the Ministry of Finance of Russia dated January 29, 2008 No. 07-05-06/18 “Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2007” states that the receipt of a contribution to the property of an LLC is reflected in the debit of the account accounting for the corresponding property in correspondence with the credit of account 83 “Additional capital”.

Consequently, when receiving materials or goods as a contribution to property, an entry is reflected in the accounting records as the debit of account 10 “Materials” or 41 “Goods” in correspondence with the credit of account 83 (clause 2 of PBU 5/01 “Accounting for inventories” , approved by order of the Ministry of Finance of Russia dated June 9, 2001 No. 44n; Instructions for using the Chart of Accounts).

An increase in net assets due to the contribution of cash as a contribution to property is reflected by an entry in the debit of account 51 “Current accounts” and in the credit of account 83 “Additional capital”.

Recommendations for calculating net asset value

When determining the fair value of assets and liabilities, investment fund management companies, non-state pension funds, specialized depositories are required to be guided by International Financial Reporting Standard (IFRS) 13 “Fair Value Measurement” (hereinafter referred to as IFRS 13) taking into account the requirements of Directive No. 3758-U , Instructions No. 4954-U.

In order to optimize the process of determining the fair value of receivables/payables on a daily basis, it is possible to identify groups of assets/liabilities in accordance with their characteristics. For each group, it is advisable to develop its own approach to determining fair value, which, on the one hand, will allow taking into account the characteristics of the asset/liability and its operational nature, and on the other hand, optimizing labor costs for making calculations. Examples of such division:

Accounts receivable (for example, for settlements with a broker, for accrued income, for operating leases, etc.).

Valuation methods may contain impairment criteria that allow for optimal consideration of the characteristics of the assets being valued, using accumulated statistics at the individual/portfolio level.

Taking into account the payment discipline of counterparties, for one type of receivables a delay of one day may be a sign of impairment (for example, receivables from a broker), while for another type it is a relatively normal business practice (for example, receivables from individual tenants real estate).

Accounts payable (for example, for utility costs, rental costs, taxes, etc.).

Valuation methods may contain methods for approximating the amount of liabilities in the absence of information about the exact amount of future payments at the date of calculating the net asset value (NAV).

The amount of lease arrears as of the NAV calculation date (before the invoice date) can be determined based on historical values for previous periods, taking into account the terms of the contract and possible changes (for example, as a result of indexation of the rental rate), which the organization is aware of at the calculation date NAV.

Simplified calculation example:

- The year of issue of the bond is 2014, the year of maturity is 2021.

- Coupon rate - 10%

- The expected yield on comparable bonds maturing in 2020 is 8.05% as of 01/10/2019

As of January 10, 2019, the fund calculated the fair value of the bond at Level 2 of the hierarchy using the present value method.

Let’s say that on January 11, 2019, the yield on comparable bonds was 8.06%. Having sufficient expertise, the fund can conclude that this change, other things being equal, will not lead to a change in the value of the bond being assessed by more than 0.5%. In this case, the fund has the right to accept as the value of the bond as of January 11, 2019 its value determined as of January 10, 2019.

On subsequent dates, the fund needs to analyze changes in input data and potential changes in the fair value of the asset relative to the value determined as of the date of the last calculation (01/10/2019). If on January 15, 2019, the change in the yield on similar bonds is significant (leads to a change in the value of the bond being valued by more than 0.5%), the fund is obliged to recalculate the fair value of the bond using a new discount rate.