In what order to calculate sick leave benefits

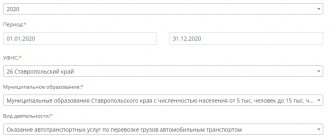

To calculate the amount of sick leave benefits, you need to determine:

- billing period;

- employee's earnings for the pay period;

- employee's average daily earnings;

- percentage of average daily earnings taken into account when calculating benefits;

- maximum amount of earnings (benefits);

- the total amount of sick leave benefits.

Apply this calculation procedure regardless of the cause of disability (illness of the employee himself, a member of his family, domestic injury, industrial accident, etc.). Also, the taxation system that the organization uses does not matter.

This follows from Article 14 of the Law of December 29, 2006 No. 255-FZ and the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

What time of work should be included in the calculation period when calculating sick leave benefits?

| Temporary disability benefit | Two calendar years, or 730 calendar days | No periods can be excluded |

| Maternity benefit, child care benefit | Two calendar years. In this case, you need to take into account the actual number of calendar days in this period | 1. Time of illness 2. Periods of maternity leave and child care 3. Periods when the employee was released from work with full or partial retention of wages, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation were not charged |

But for maternity and child care benefits the situation is different. Firstly, the calculation period for maternity and children must include the actual number of calendar days in a particular year. That is, for 2013 you will take 365 days, and for the 2012 leap year - already 366. This rule directly follows from Part 3.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ.

Secondly, from January 1, 2013, some must be excluded from the total number of days of this billing period. Namely, those days that fell on illness, maternity leave and child care, as well as periods of release of the employee from work with full or partial retention of wages, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation were not charged.

In this case, for example, vacation at your own expense or time when the employee did not work at all will not be deductible. There is no need to exclude periods of annual paid leave. After all, vacation pay is subject to insurance contributions and is included in the total limit of payments taken into account when calculating benefits. The same applies, for example, to average earnings saved during a business trip.

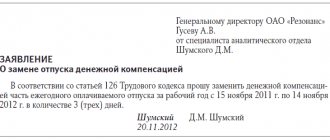

And here's another important detail. There is still one situation where the years in the billing period can be adjusted. Moreover, when calculating any benefits. If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones. And it doesn’t matter whether the employee was on children’s leave for the whole year or just part of it.

The main thing here is that such a replacement of periods is beneficial for the employee herself. Plus she must write a special statement. To avoid wasting time searching for the right wording, show her the example we have given below. It is clear that you can fulfill a woman’s wishes only if she confirms her earnings for a particular year when she worked in another company.

Please note: by replacing the years with earlier ones, you will conduct the calculation according to the same rules, which we will discuss in detail later. But take the real amount of earnings, what it was in those days. That is, there is no need to index the payment.

How to determine earnings for a pay period when calculating sick leave benefits

We've sorted out the billing period. Now let's talk about the next important component, without which it will not be possible to determine the amount of the benefit. This is the average salary.

Here we immediately emphasize that you will take into account those incomes from which contributions to compulsory social insurance were deducted in connection with temporary disability and maternity. And within the limits of the contribution limit that was in force in a particular year.

Thus, for 2012 you can take a maximum of 512,000 rubles. For 2013 - 568,000 rubles. But now you won’t need the limit of 624,000 rubles set for 2014 to calculate benefits. You will be guided by it when you begin to calculate payments in 2015.

Also take into account average earnings such as vacation pay, payments for business trips or downtime. After all, as we have already said, they are subject to contributions to the Social Insurance Fund on a general basis.

During the time included in the pay period, did the employee’s salary increase? Don’t worry, you won’t have to adjust the earnings accrued before the salary increase, as you have to do when calculating vacation pay. Take the salary amount as it actually was in a given period. This is directly stated in paragraph 12 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

Carefully!

Take the increased salary into account when calculating benefits from the moment it was increased.

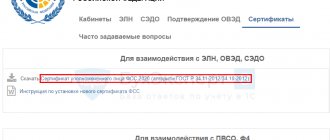

It is possible that during the last two calendar years the employee worked in different organizations. In this case, to calculate benefits you will need a certificate or even several certificates of earnings from each previous place.

The form of this document is approved by Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n

There is no need to force the employee to collect such certificates. After all, it is in his interests. If there is no information, you will simply calculate his allowance based on the amounts he received in your company. And you won’t exclude any periods in this case.

True, it may also be that a person fails to obtain a certificate from previous employers for an objective reason.

For example, the company has already been liquidated. In this case, the employee has the right to write a special statement, on the basis of which you will have to request information about his salary from your Pension Fund branch. After all, this fund stores personalized accounting data for each working person. Take the form for such an application in the order of the Ministry of Health and Social Development of Russia dated January 24, 2011 No. 21n.

Preliminary calculation of benefits, and what features to take into account

And now we come to calculating the amount of the benefit. But here each of them has its own characteristics. Therefore, we will analyze each of the three payments separately.

When benefits are calculated based on the minimum wage

According to clause 11(1) of the Regulations, if the insured person had no earnings during the billing periods*, as well as if the average earnings calculated for these periods, calculated for a full calendar month, are below the minimum wage, the average earnings based on from which benefits are calculated, it is accepted:

- Equal to the minimum wage in force on the day of the insured event.

If the insured person, at the time of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the duration of the insured person’s working hours.

Accordingly, the amount of benefits based on the minimum wage must be calculated using this proportion.

Moreover, in all cases, the monthly child care benefit cannot be less than the minimum amount of the monthly child care benefit (in 2014 - 2,576.63 rubles for the first child, 5,153.24 rubles - for the second and subsequent children ).

*Previous 2 years (for insured events occurring in 2014 - 2013 and 2012), or those years to which the billing periods are transferred.

In districts and localities in which regional coefficients are applied to wages in accordance with the established procedure, calculated for the insured person based on the minimum wage, the amount of benefits is determined taking into account these coefficients.

Based on clause 15(3) of the Regulations, to calculate benefits based on the minimum wage:

- due to temporary disability,

- for pregnancy and childbirth,

The average daily earnings are determined by dividing the minimum wage established by federal law on the day of the occurrence of the insured event , increased by 24 times, by 730.

Thus, in 2014, the average daily earnings calculated based on the minimum wage will be:

- RUB 5,554*24/730 = RUB 182.60

Automatic accrual of sick leave using Kontur.Accounting

You can calculate sick leave in just a few steps using the online service Kontur.Accounting. Calculations comply with the law, all restrictions are taken into account. Also in the service you can calculate salaries, vacation and maternity pay, keep records of employees and dividends, submit reports to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Tax Service. The system is convenient because it saves the accountant’s time and prevents errors when preparing reports.

A special specialist will help you quickly calculate sick leave:

Calculate sick leave automatically and without errors

Find out more

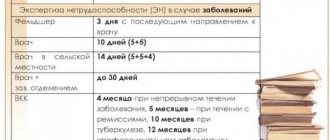

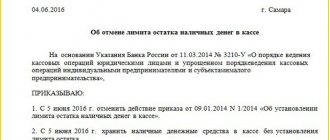

Cases of reducing the amount of temporary disability benefits

In accordance with the provisions of Article 8 of Law No. 255-FZ, the following grounds are provided for reducing the amount of temporary disability benefits:

1. Violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician.

2. Failure of the insured person to appear without good reason at the appointed time for a medical examination or for a medical and social examination.

In this case, the following situation is possible:

The employee presented several sick leave certificates.

In the first of them, for example, from August 3 to August 10, 2013, a note was made about a violation of the regime - on the 7th the employee did not show up for an appointment with the doctor.

Subsequent sick leave certificates, which are continuations of the first one, do not contain such marks.

In this case, in the absence of valid reasons for violating the regime, temporary disability benefits are paid to the insured person in an amount not exceeding the minimum wage for a full calendar month - from the day the violation was committed until the restoration of working capacity.

That is, starting from August 7th and until the day from which the employee must begin work, indicated on the last sick leave.

In this case, from August 3 to August 6, sick leave is paid in the usual manner.

In accordance with the Order of the Ministry of Health and Social Development dated June 29, 2011. No. 624n “On approval of the Procedure for issuing certificates of incapacity for work”, in the line “Notes on violation of the regime”, depending on the type of violation, the following two-digit code is indicated:

- 23 - failure to comply with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician;

- 24 – late attendance at a doctor’s appointment;

- 25 - going to work without being discharged;

- 26 - refusal to refer to a medical and social examination institution;

- 27 - late appearance at the medical and social examination institution;

- 28 - other violations.

The date of the violation is indicated in the “Date” line, and the signature of the attending physician is placed in the “Doctor’s signature” field.

3. Illness or injury resulting from:

- alcoholic,

- narcotic,

- toxic

intoxication or actions related to such intoxication.

In this case, in the line “cause of disability” on the sick leave, after the two-digit code, a three-digit additional code “021” is entered.

If there are one or more of the above grounds for reducing the temporary disability benefit, the benefit is paid to the insured person in an amount not exceeding the minimum wage established by federal law for a full calendar month.

In districts and localities in which regional coefficients are applied to wages in accordance with the established procedure - in an amount not exceeding the minimum wage taking into account these coefficients.

These sanctions apply:

If the rules are violated and the employee fails to appear for inspection:

- from the day the violation was committed.

If the disease or injury is caused by alcohol (etc.) intoxication:

- for the entire period of incapacity.

At the same time, the employer should remember that the notes made on the sick leave:

- about alcohol intoxication,

- violation of the regime and failure to appear,

by themselves are not sufficient to reduce the benefit amount.

The organization needs to obtain a written explanation from the employee, conduct an investigation, and obtain a medical report.

Otherwise, the employee can go to court and appeal against the reduction in benefits.

The procedure for calculating benefits in force in 2014

1. Calculation of sick leave for temporary disability in 2014.

In 2014, the amount of sick leave benefits is calculated in the same way as in 2013.

Only the minimum wage will change (RUB 5,554 from 01/01/2014) and the maximum amount of sick leave payment.

This amount has increased due to changes in the base for calculating insurance premiums for 2 years: the base amount for 2011 will no longer be taken into account in the calculations, the base for 2013 will be added to the base for 2012.

The amount of earnings for 2012 and 2013 is still divided by 730 (days) and multiplied by the number of days of disability (subject to restrictions on the number of days).

In this case, the amount of earnings for 2012 for calculating benefits is taken to be no higher than 512,000 rubles, and for 2013 – no higher than 568,000 rubles.

(512,000 + 568,000)/730 = 1,479.45 rubles.

According to clause 2 of the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as the Regulations), into average earnings, based on which benefits are calculated include:

- all types of payments and other remuneration in favor of the insured person, for which insurance premiums are accrued to the Federal Social Insurance Fund of the Russian Federation in accordance with Federal Law No. 212-FZ of July 24, 2009.

In accordance with clause 14 of the Regulations, bonuses and remunerations are included in average earnings, taking into account the following features:

- monthly bonuses and remunerations paid along with the salary of a given month are included in the earnings of the month for which they are accrued;

- bonuses (except for monthly bonuses and remunerations paid along with the salary of a given month), remunerations based on the results of work for the quarter, for the year, one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, one-time bonuses for particularly important the task is included in earnings in the amount of accrued amounts in the billing period.

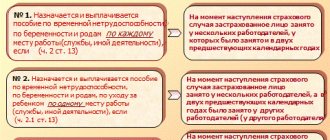

2. Calculation of maternity benefits and child care benefits up to 1.5 years in 2014.

In accordance with the Regulations (as amended in force since 2013), the average daily earnings for calculation:

- maternity benefits,

- monthly child care allowance

determined by dividing the amount of accrued earnings for a two-year period (specified in paragraph 1 of Article 14 of Law No. 255-FZ) by the number of calendar days in this period, with the exception of calendar days falling on the following periods:

1) periods of temporary disability, vacation maternity leave, parental leave;

2) additional paid days off to care for a disabled child;

3) the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if the retained wages for this period are covered by insurance contributions to the Social Insurance Fund in accordance with the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Social Insurance Fund” of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” were not accrued.

In addition, we recall that starting from 2013, in accordance with clause 2 of Law No. 343-FZ, benefits:

- for pregnancy and childbirth,

- monthly allowance for child care up to 1.5 years,

can no longer be calculated according to the rules in force in 2010, which was allowed until December 31, 2012. inclusive (average daily earnings could be calculated based on earnings for the last 12 calendar months preceding the month of the insured event).

Deadlines for applying for benefits

Deadlines for applying for benefits:

- due to temporary disability,

- for pregnancy and childbirth,

- monthly child care allowance,

established by Article 12 of Law No. 255-FZ.

In accordance with the provisions of this article, benefits are assigned no later than six months:

1. From the date of restoration of working capacity (establishment of disability), as well as the end of the period of release from work in cases of caring for a sick family member, quarantine, prosthetics and after-care.

For temporary disability benefits.

2. From the date of termination of maternity leave.

For maternity benefits.

3. From the day the child reaches the age of one and a half years.

For monthly child care benefits up to 1.5 years.

In accordance with paragraph 3 of Article 12, when applying for benefits:

- due to temporary disability,

- for pregnancy and childbirth,

- monthly child care allowance

after the expiration of the six-month period, the decision to assign benefits is made by the territorial body of the Social Insurance Fund if there are good reasons for missing the deadline for applying for benefits.

The list of valid reasons for missing the deadline for applying for benefits was approved by the Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007. No. 74 “On approval of the List of valid reasons for missing the deadline for applying for temporary disability benefits, maternity benefits, and monthly child care benefits.”

In accordance with this List, the following circumstances are recognized as valid reasons:

1. Force majeure, that is, extraordinary, unpreventable circumstances (earthquake, hurricane, flood, fire, etc.).

2. Long-term temporary disability of the insured person due to illness or injury lasting more than six months.

3. Moving to a place of residence in another locality, change of place of stay.

4. Forced absenteeism due to illegal dismissal or suspension from work.

5. Damage to health or death of a close relative.

6. Other reasons recognized as valid in court when insured persons apply to court.

Incorrectly issued sick leave

There are cases when the Social Insurance Fund may not accept sick leave for payment. The most common mistake is incorrectly written date and data. Moreover, the Social Insurance Fund can pay attention to both the date of birth and the date of issue of sick leave.

Often, a mistake is made when extending sick leave, when a patient closes sick leave in one clinic and registers it in another on the same day. Two sick days can only have one day the same.

Those who apply for sick leave due to pregnancy or childbirth must learn one important rule. In the “Physician position” column there should be an entry “obstetrician-gynecologist”! In another case, the sick leave must be replaced.

It often happens that an employer forces you to change your sick leave due to inaccuracies in the name of the organization. Based on FSS Letter N 10-09/10/7103, this is not necessary, since the insured organization is identified by its number.

Cases when temporary disability benefits are not awarded

The grounds for refusal to grant temporary disability benefits are provided for in Article 9 of Law No. 255-FZ.

In accordance with this article, temporary disability benefits are not assigned to insured persons for the following periods:

- for the period of release of the employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation, with the exception of cases of loss of ability by the employee due to illness or injury during the period of annual paid leave;

- for the period of suspension from work in accordance with the legislation of the Russian Federation, if wages are not accrued for this period;

- during the period of detention or administrative arrest;

- during the period of the forensic medical examination;

- for the period of downtime, except for the cases provided for in Part 7 of Article 7 of Law No. 255-FZ.

In accordance with paragraph 2 of Article 9 of Law No. 255-FZ, the grounds for refusal to grant temporary disability benefits are:

1. The onset of temporary disability as a result of a court-established intentional infliction of harm to one’s health by the insured person or an attempted suicide.

2. The onset of temporary disability as a result of the commission of an intentional crime by the insured person.