In the current economic situation, a bank guarantee is one of the most popular financial services. It is an instrument for insuring financial risks that may arise due to the counterparty’s refusal to fulfill obligations.

Bank guarantee agreements can be concluded by credit (insurance) organizations for any required amount and for almost any period not only with legal entities, but also with individual entrepreneurs.

Based on clause 1 of Article 369 of the Civil Code of the Russian Federation, a bank guarantee ensures the proper fulfillment by the principal of his obligation to the beneficiary (the main obligation). Thus, a bank guarantee is one of the forms of securing obligations and is a guarantee of a bank *, which guarantees the fulfillment of the obligation assumed by the company that applied for such a guarantee.

*Another credit organization that has the appropriate license from the Central Bank of the Russian Federation.

In accordance with Article 368 of the Civil Code of the Russian Federation, under a bank guarantee agreement, the bank acting as a guarantor issues, at the request of the client (principal), a written obligation to pay the client’s creditor (beneficiary) a sum of money* upon submission by the beneficiary of a written demand for its payment.

*In accordance with the terms of the obligation given by the guarantor.

Providing a bank guarantee is mandatory in some cases, for example:

- for concluding government contracts,

- when fulfilling government orders,

- to participate in tenders, auctions, competitions,

- and so on.

According to clause 2 of Article 369 of the Civil Code of the Russian Federation, the principal pays a fee to the guarantor for issuing a bank guarantee.

The issuance of guarantees by banks relates to banking operations in accordance with clause 8, part 1, article 5 of the Federal Law of December 2, 1990. No. 395-1 “On banks and banking activities.”

In accordance with the provisions of paragraph 3 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation, operations for the execution of bank guarantees are not subject to taxation (exempt from taxation) of VAT on the territory of the Russian Federation:

- issuance and cancellation of a bank guarantee,

- confirmation and modification of the terms of the specified guarantee,

- payment under such guarantee,

- preparation and verification of documents under this guarantee.

Accordingly, VAT on the amount of remuneration by the bank-guarantor of the company-principal is not charged.

The situation is different with guarantees issued by insurance organizations. When the guarantor is an insurance company, the remuneration for its services is subject to VAT. The amount of “input” VAT on remuneration to the guarantor can be deducted by the principal company subject to the conditions specified in clause 1 of Article 172 of the Tax Code of the Russian Federation.

Our article will discuss the features of accounting and tax accounting of expenses for remuneration to the guarantor of the principal organization.

On the basis of what documents is a bank guarantee reflected in accounting?

According to accounting standards, all transactions reflected in the accounts must be supported by documents. It does not matter whether balance sheet accounts are involved or off-balance sheet accounts.

Based on the norms of Ch. 23 of the Civil Code of the Russian Federation, the principal and the guarantor are not required to draw up a bank guarantee in a separate agreement. However, bankers do not trust the oral form of agreements and describe the nuances of relations with the principal in a separate document - an agreement on the issuance of a bank guarantee.

Such an agreement usually contains all the necessary data for which the beneficiary can make entries in his accounting (guarantee amount, validity period, etc.).

The guarantee can also be issued in electronic form. It is drawn up in the form of an electronic document, which has the same legal force as its paper counterpart. Documents are signed with an electronic signature, which gives the electronic document legal force. If necessary, a paper version of the electronic guarantee can be requested from the bank.

“Not every bank can act as a guarantor to the tax office” will introduce you to the tax nuances of accounting for a bank guarantee .

We will describe below how a bank guarantee is reflected in accounting.

Design methods

When issuing a financial institution, the financial institution stipulates the terms of provision. Often, such information can be found on the official website of a financial institution. At the moment, almost everyone has in their arsenal several ways to receive documents.

Classic allows you to insure an amount of 20 million rubles. The application review period may take up to three weeks. As a rule, this method is used by banking organizations that are not able to provide an expedited review process.

Expedited allows you to receive a decision within five days. In this case, the amount to be issued reaches 15 million rubles.

Electronic allows you to receive 5 million rubles remotely. Documents sent to the bank are certified with an electronic signature. The period for issue and consideration is 4 days.

The fact of receipt/issuance of a bank guarantee in the records of the principal and beneficiary

To account for the cost of the bank guarantee, the beneficiary has an off-balance sheet account 008 “Securities for obligations and payments received.” The received collateral is written off off-balance sheet as the debt is repaid. The beneficiary must keep analytical records for each security received.

There are two positions regarding the reflection of a bank guarantee by the principal in accounting:

Position 1: the principal does not reflect the bank guarantee in his accounting.

Supporters of this position explain their point of view by the fact that the principal of the bank guarantee:

- receives not for himself, but for the beneficiary (his creditor);

- does not issue a guarantee (it is issued by the bank).

Consequently, there are no grounds for the principal to use off-balance sheet accounts 008 “Securities for obligations and payments received” and 009 “Securities for obligations and payments issued” to account for the bank guarantee.

Position 2: the principal needs to reflect the bank guarantee on the balance sheet.

This approach allows:

- take into account the fact of a change of creditor if the principal fails to fulfill an obligation (when the guarantor becomes a creditor instead of a beneficiary);

- reflect additional sanctions established by agreement with the guarantor (for example, special penalties for late fulfillment of obligations to the guarantor).

The accuracy of the assessment by external users of the financial statements of the state of the principal's accounts payable depends on how reliable the information about the bank guarantee reflected on the off-balance sheet accounts is. Reflection of a bank guarantee in the accounting of the principal is of particular importance if the transaction is large and subject to disclosure in the financial statements.

You will find the criteria for a major transaction with explanations in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Entries in the accounting of the beneficiary and the principal in case of failure to fulfill the obligation

The principal does not always manage to fulfill his obligations to the beneficiary in a timely manner. In this case, the beneficiary may demand in writing from the guarantor payment of the amount not received under the agreement.

After receiving documents from the beneficiary and considering his request for compliance with the terms of the issued guarantee, the guarantor makes a decision to pay the principal’s debt (Articles 374-375 of the Civil Code of the Russian Federation).

After the claim is accepted by the guarantor, the beneficiary makes the following entries in the accounting records:

The bank informs the principal:

- about termination of the warranty;

- the need to reimburse the amount paid by the bank to the beneficiary under the guarantee.

Having received a notification from the bank, the principal reflects the bank's recourse claims in his accounting. We will show you with an example what transactions are used to pay for a bank guarantee.

Greenwich LLC issued a bank guarantee for a period of 1 month, but during this period it failed to pay the seller Corrida LLC the amount of 12,378,533 rubles stipulated in the purchase and sale agreement. The bank, which paid off this obligation for Greenwich LLC, demanded that it reimburse the amount paid.

Two entries will appear in the principal’s accounting:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 60 | 76 | 12 378 533 | The bank's recourse claim was recognized |

| 76 | 51 | 12 378 533 | The obligation to the bank has been repaid |

Package of documents

Almost every financial institution has its own list of documents approved in the bank’s internal policy. It is these documents that allow the bank to determine the client’s solvency and issue obligations to him.

As a rule, the standard list includes:

- statutory documents of the organization, as well as accounting entries and constituent documents;

- application form of a representative of the organization;

- extract from the tax service;

- certificate of authority of the company's managers.

Example of transactions with a beneficiary: receipt and write-off of a guarantee

Let's look at an example that helps the beneficiary navigate the main entries in accounting.

Trading LLC purchased a batch of goods worth RUB 1,693,461. on deferred payment terms. The seller PJSC Delivery requested a bank guarantee as security for the payment obligation.

Postings to the beneficiary (PJSC "Supply") after receipt of the guarantee and delivery of the goods:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 008 | — | 1 693 461 | The received bank guarantee is reflected on the balance sheet |

| 62 | 90 | 1 693 461 | The goods were shipped to the buyer LLC Trading |

The buyer did not pay for the goods within the period specified in the contract. PJSC "Supply" sent a written message to the bank about the need to pay the principal's debt under the bank guarantee, attaching the necessary documents.

After reviewing the documents and checking them, the bank transferred the money under the guarantee. The following entries were made in the accounting of PJSC Supply:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 51 | 76 | 1 693 461 | Received money from the bank under a guarantee |

| 76 | 62 | 1 693 461 | The debt of Trading LLC has been repaid |

| — | 008 | 1 693 461 | Payment security written off from off-balance sheet accounting |

If the buyer repaid the debt for the goods on time, there would be significantly fewer accounting entries in the beneficiary's accounting. Everything would be limited to reflecting and writing off the received collateral in an off-balance sheet account.

Advantages and disadvantages of collateral

Despite the recent popularity of BG, it has a number of advantages and disadvantages.

A universal financial product will never be of interest to everyone. Each form has its own characteristics. Therefore, the design must be approached with particular seriousness so as not to receive a low-quality banking product.

Advantages:

- registration of the BG occurs in a short time;

- the bank will not require a large number of documents;

- trust and security of obligations;

- ease of processing compensation;

- there is an opportunity to participate in tenders;

- deferment of payments.

Flaws:

- high price of a financial instrument;

- payment of compensation without the knowledge of the principal based on provided supporting documents;

- the action does not stop even after the work is completed;

- the possibility of revoking the license of the guarantor.

What affects the accounting treatment of payment of a fee for issuing a guarantee?

Issuing a guarantee is a paid service. The credit institution's fee for issuing a guarantee can be set in different ways:

- in a fixed amount;

- as a percentage of the guarantee amount;

- in a different way.

In addition, the guarantor may establish additional conditions for paying the commission for issuing a bank guarantee. He may require the principal to pay the commission in one lump sum in full or in installments during the validity period of the guarantee.

All this affects not only the accounting procedure for this type of expense, but also requires the principal to additionally elaborate his accounting policy (we will talk about this in subsequent sections).

Find out what to consider when drawing up your accounting policies in 2021 in this publication .

Next, we will talk about the nuances of accounting for the commission for issuing a bank guarantee and the entries used to reflect this type of expense.

Two types of entries to reflect the commission on a bank guarantee when purchasing property

The supplier of expensive equipment or the seller of the building may make it a mandatory condition when concluding an agreement with the buyer that there is a bank guarantee. In the buyer's accounting, the guarantor's remuneration will be recognized as an expense. However, the accounting for this expense will be different depending on the moment at which it was made: before the purchased property is registered or after it. In each case, a different set of accounting entries is applied to reflect the commission for issuing a bank guarantee.

- The guarantor's remuneration was paid before the acquired property was reflected in the accounting accounts.

What entries are used to record a bank guarantee from the principal in such a situation? The amount of remuneration to the guarantor is included in the cost of the acquired asset, since this expense is directly related to its acquisition (clause 6 of PBU 5/01 “Accounting for inventories”, clause 8 of PBU 6/01 “Accounting for fixed assets”).

For such a case, the following set of transactions is used:

The specified accounting scheme reflects the transactions for payment of the bank guarantee and for its reflection in accounts payable until the transfer of money by the principal.

PJSC "Modern Technologies" plans to purchase an office building worth RUB 150,364,199. from Real Estate+ LLC. As security for obligations, the buyer provided the seller with a bank guarantee.

Warranty conditions:

- remuneration to the bank (4% of the transaction amount) - 6,014,568 rubles. (RUB 150,364,199 × 4%);

- Warranty period - 1 month;

- The procedure for paying the commission is the entire amount at a time.

PJSC Modern Technologies paid the commission and purchased the property from the seller. The following entries were made in accounting:

| Accounting entries | Amount, rub. | Contents of operation | |

| Debit | Credit | ||

| 76 | 51 | 6 014 568 | Commission transferred to the guarantor bank |

| 08 | 76 | 6 014 568 | The amount of remuneration to the guarantor is included in the cost of the building |

| 08 | 60 | 150 364 199 | The cost of the building is reflected in non-current assets |

| 01 | 08 | 156 378 767 (150 364 199 + 6 014 568) | The building is included in the principal's fixed assets |

We talk about the nuances of tax accounting for a bank guarantee in this article.

- The guarantee is issued after the value of the asset has been generated.

Here, accounting standards do not allow the amount of the guarantor's remuneration to be taken into account in the initial cost of the asset. Once the accounting value of the property has been formed, it is not allowed to change it.

In such a situation, other expenses are recognized and postings are made:

The situation is dangerous if the remuneration to the guarantor, paid before the initial cost of the asset is formed, is taken into account as part of other expenses. This will cause a distortion in the amount of property tax, which is calculated according to accounting data. Considering that from 2021 the value of movable property is excluded from the tax base, the unlawful write-off of remuneration to the guarantor as part of other expenses will distort the property tax base if the buyer purchased real estate.

The classification of expenses depends on the subject of the main transaction

The costs of paying for bank services can be taken into account:

a) as part of other expenses associated with production and sales (subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation);

b) as part of non-operating expenses as costs of carrying out activities not directly related to production and (or) sales (subclause 15, clause 1, article 265 of the Tax Code of the Russian Federation).

In any of the options, the date of expenses is determined on the basis of subparagraph 3 of paragraph 7 of Article 272 of the Tax Code.

Which of these articles should you prefer and what will be the difference? The decision must be made based on the essence of the specific situation. Please note that non-operating expenses are recognized at a time in full, that is, they cannot be distributed over time periods. This rule is established in paragraph 2 of Article 318 of the Tax Code.

If bank guarantees are used to secure obligations directly related to production and sales, then the costs of their acquisition should be considered as other expenses. This category includes guarantees purchased for conducting types of economic activity assigned to your company in the Unified State Register of Legal Entities. Examples:

- subparagraph 2 of paragraph 1 of Article 12.1 of the Federal Law of December 30, 2004 No. 214-FZ “On participation in shared-equity construction of apartment buildings and other real estate ...”;

- paragraph 10 of Article 6 of the Federal Law of December 29, 2006 No. 244-FZ “On state regulation of activities related to the organization and conduct of gambling...”;

- Article 141 of the Federal Law of November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation”.

In legal relations with government authorities, the connection between bank guarantees and production or sales may be indirect. In these cases, the remuneration to the guarantor should be classified as a non-operating expense. This category includes guarantees provided for by tax legislation:

- in connection with a change in the tax payment deadline (clause 5 of Article 61 of the Tax Code of the Russian Federation);

- when collecting arrears, fines and penalties (subclause 1, clause 11, article 101 of the Tax Code of the Russian Federation);

- under the application procedure for VAT refund (subclause 2, clause 2, article 176.1 of the Tax Code of the Russian Federation);

- instead of advance payment of excise taxes (clause 11 of article 204 of the Tax Code of the Russian Federation).

This condition neutralizes risks and ensures immediate revenues to the budget. Bank guarantees can also serve as security for the repayment of budget loans (clause 3 of Article 93.2 of the Budget Code of the Russian Federation).

note

The Russian Ministry of Finance and the Federal Customs Service maintain registers of banks, the guarantees of which are accepted by tax and customs authorities. Obviously, such lists include the most reliable and stable banks that are not in danger of having their licenses revoked. You can rely on these registers when choosing a servicing bank (clause 3 of Article 74.1 of the Tax Code of the Russian Federation, order of the Federal Customs Service of Russia dated September 2, 2013 No. 1644).

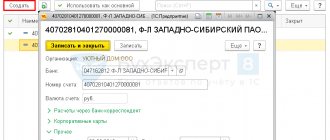

Features of accounting policies and entries when reflecting remuneration to the guarantor under a loan agreement

The borrower may incur expenses for paying remuneration to the guarantor when issuing a guarantee is one of the conditions for receiving borrowed funds. In such circumstances, it is necessary to take into account the norms of PBU 15/2008 “Accounting for expenses on loans and credits”:

- according to clause 7, borrowing costs are classified as other expenses;

- According to clause 8, it is allowed to recognize additional expenses on loans evenly as part of other expenses during the period of validity of the loan agreement.

How the borrower will write off additional expenses on loans, he must indicate in his accounting policy:

What postings are used in accounting in this case, see the figure below:

Whatever method of recording loan costs in the form of remuneration to the guarantor the borrower chooses, the accounting accounts used will be the same.

Bank guarantee under a government contract: what type of expense and how to take it into account?

If a bank guarantee is required to fulfill obligations under a government contract (or government order), the amount of remuneration to the guarantor can be taken into account as:

- expenses for ordinary activities; or

- other expenses.

Whether the guarantor's remuneration is taken into account at one time or gradually depends on the type of company's obligations secured by the guarantee:

The correspondence of accounts for accounting for remuneration to the guarantor is similar to those described above:

The materials on our website will introduce you to the nuances of concluding and executing government contracts:

- “Concluding a contract without limits on budgetary obligations”;

- “Is it legal to pay UTII when selling goods under state and municipal contracts?”.

If the guarantee is issued to secure other obligations

Other obligations mean what type of activity they are associated with:

- if we are talking about the main activity, then accounting is kept on account 90;

- if these are other income and expenses, then account 91 is applied.

You should consider how the income will be received:

- if during one period, then the amount is taken into account in full at the moment when the expense was incurred;

- in a situation where income will be received over several reporting periods, the remuneration should be distributed between them in proportion to the amount of income.

Results

When reflecting a bank guarantee, the beneficiary and the principal use accounting entries using balance sheet and off-balance sheet accounts. The fact of receipt and write-off of the guarantee is recorded on the balance sheet. And when reflecting the costs of paying the commission for its issuance, the correspondence of accounts 51 “Current accounts” and 76 “Settlements with various debtors and creditors” is used. The costs of paying remuneration to the bank for issuing a guarantee are reflected in the accounts depending on the type of asset for the acquisition of which it was issued. If the initial cost of the asset has not been formed and the commission is paid, its amount increases the initial cost. In other cases, the commission is taken into account as another expense and is reflected in accounting in account 91.2 “Other expenses”.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.