Before the start of the new year, it is necessary to approve the accounting policy for the next one. But in reality, the chief accountant’s hands often get to this point only after submitting the annual report. We consider the rules for drawing up accounting policies and tell you what needs to be changed in 2021. At the end of the article there are examples of accounting policies for different industries.

Each commercial organization must develop and approve rules for maintaining accounting and tax records based on its specific characteristics of activity. The development of an accounting policy (AP) is usually the responsibility of the person who does the accounting: the chief accountant or an external outsourcer. The UP is approved by the head of the organization:

- for accounting - no later than 90 days from the date of state registration of the organization;

- for tax accounting - no later than the end of the first tax period.

What is the accounting policy on the simplified tax system?

The company's adherence to accounting policies is subject to control by tax authorities. In this regard, it is important to draft the document correctly. The company's accounting policy should include controversial reporting issues and their resolution, ways and methods of writing off the company's expenses and expenses, as well as the competence of the enterprise in regulating the nuances.

The accounting policy of the company allows you to show compliance of the company's activities with legal norms. If a situation arises in which it is necessary to involve the judiciary, with the help of accounting policies you can resolve the dispute with the tax inspectorate in your favor.

There is no legally established form of accounting policy. Its composition is arbitrary, but it is necessary to take into account the rules of law. The composition of the document is developed by the company independently. The formation of the company's accounting policy is the responsibility of the chief accountant.

The order to draw up the document must be issued by the head of the company. The form of the accounting policy form and the sections that will be included in it must be agreed upon by the manager and act as an appendix to the administrative document.

The accounting policy must list the main positions and methods of organizing accounting established by law, as well as the rationale for the company’s choice of method of maintaining reporting documentation. Including clarifications on document flow, if there are none in the legislative norms. The regulatory legal acts themselves do not need to be described in the company’s accounting policies.

An enterprise may have branches and divisions. If the parent company has adopted an accounting policy, then this document will be valid for other branches.

How to make changes to accounting policies

Here's what you need to do to change your accounting policies for 2021.

- Check whether there have been changes in the organization’s activities that require editing the accounting policies.

- Analyze changes in legislation and determine which of them are relevant to the organization.

- Formulate the text of changes and additions with reference to the clause of the regulatory document.

- Determine from what date the changes take effect in the organization.

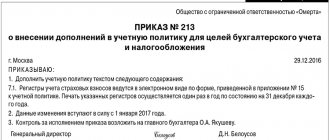

- Approve changes and additions by order of the head of the organization. The order can be drawn up in any form, for example like this. If there are many changes, you can approve not individual items of the accounting policy, but the accounting policy in the new edition.

Why do you need an accounting policy on the simplified tax system?

A document on the company's accounting policy is required to create generalized regulations for the preparation of reporting documentation and maintenance of tax and accounting records. The main part of this document contains information about the primary forms used by the company to reflect financial transactions on accounts. Information and regulations for recording primary documents are also taken into account by the tax authorities during the audit.

The company can choose to use:

- unified forms of primary documentation forms;

- forms developed by the company (this form must first be approved by the territorial body of the Federal Tax Service).

However, own forms are not allowed for all forms of primary documentation. Self-created documents are not allowed regarding the following forms:

- cash documents and forms of banking institutions (for example, cash settlement orders, cashier-operator book and other forms approved by law);

- accounting for monetary remuneration to employees (the forms of these documents are approved by the State Statistics Committee);

- documents used in personnel records management.

In addition, there are company details that must be entered into forms, even documents established by the company. These include:

- document's name;

- calendar date of its compilation;

- Company name;

- description of the transaction performed in relation to the company's account;

- the amount in respect of which the document is drawn up;

- the person responsible for the operation (position and full name must be indicated).

The completed document must always be backed by a personal signature. Forms of primary documents can be carried out both on paper and in electronic form.

The chosen form of “primary” must be enshrined in the company’s accounting policies. To consolidate the rules of tax accounting, the accounting policy document regulates the rules of taxation.

As a rule, the form of an accounting policy document on the simplified tax system should include the following sections:

- Description of the general document flow adopted by the company.

- Company policy regarding the preparation of financial statements.

- The taxation process and the procedure for drawing up documentation for the Federal Tax Service.

Arbitrary drawing up of a company's accounting policy creates a lot of opportunities for the company. At some enterprises, the size of the accounting policy document is 60 or more pages.

Accounting policies are mandatory for companies. This is justified by law (Federal Law No. 402-FZ of December 6, 2011). This requirement also applies to companies that carry out financial and economic activities using a simplified system with the object “income”.

The legislation does not establish a specific list of sections as part of the accounting policy document. Recommendations are listed in PBU 1/2008 “Accounting Policies”.

What needs to be approved in the accounting policy

For accounting

The accounting regulations PBU 1/2008 “Accounting policies of the organization” determine that the following components must be approved in the management program.

- A working chart of accounts is a list of synthetic and analytical accounts selected from the general Chart of Accounts that the organization actually plans to use. Unused accounts and subaccounts should be excluded. If the organization is a small business and has the right to use simplified accounting methods, synthetic accounts can be combined. Read more about this in our article.

- Forms of primary accounting documents, accounting registers and financial statements. If you plan to use only unified primary forms, please indicate this. If, in accordance with Article 9 of the Law “On Accounting” No. 402-FZ, you are developing your own forms, provide them in the appendices to the UP. If you submit financial statements using simplified forms, do not forget to mention this.

- The procedure for conducting an inventory of the organization's assets and liabilities. Determine the list of property and liabilities that you will check, establish the situations in which the inventory is carried out and the timing of the check, approve the list of primary documents that you will use to complete the inventory, and describe the procedure for conducting the inventory from the order of the manager and the creation of an inventory commission to the approval of the inventory lists .

- Methods for assessing assets and liabilities. If accounting standards allow the choice of alternative valuation methods or independent development of a method, this choice must be fixed in the management program. Determine which valuation method you will use for inventories when they are written off for production or sale: FIFO, at average cost or at the cost of a unit of inventory. Select depreciation methods for fixed assets and intangible assets: straight-line, declining balance, or proportional to output. And so on for all types of assets and liabilities.

- Rules of document flow and technology for processing accounting information : who draws up and signs what primary documents, the number of copies drawn up, the procedure and timing for transferring documents between performers, which documents are drawn up in paper form and which in electronic form.

- The procedure for monitoring business operations. Here you need to provide what control measures will be carried out and who is responsible for them. In a large business this may be the internal audit service, in a small enterprise - the manager and chief accountant. The UP approves the procedure for forming a commission for the acceptance and write-off of fixed assets, a list of persons responsible for strict reporting forms, a list of financially responsible employees and employees who can sign powers of attorney on behalf of the organization.

- Other solutions necessary for organizing accounting. This is any information that is important for the organization of accounting, but is not disclosed in the previous paragraphs. For example, the frequency of preparation of financial statements or the software products used.

For tax accounting

Taxpayers who use OSNO are required to form a UE for tax purposes. For simplifiers, this document is important when you need to choose a method for accounting for specific transactions when applying the simplified tax system or unified agricultural tax.

UP for tax purposes involves choosing from possible tax accounting options proposed by law, for example:

- method of determining income and expenses (cash or accrual);

- methods of recognition, measurement and distribution of income and expenses;

- selection of other indicators, without which the accounting will be incomplete or incorrect. For example, an indicator for calculating the share of profit for a separate division.

Example 1.

The organization uses unified document forms in accounting, and maintains tax accounting in independently developed registers. Therefore, in its UP it will be written: “Tax accounting is carried out separately from accounting in analytical tax accounting registers developed by the organization independently. The list of tax accounting registers and their forms are given in Appendix No. 1 to the Accounting Policy for Taxation Purposes.”

Also, the UP for tax purposes defines the procedure for tax accounting in cases where the Tax Code assigns it to the taxpayer. For example:

- composition of direct expenses that reduce sales revenue;

- the procedure for forming the value of work in progress;

- organization of separate accounting when calculating VAT.

Is an individual entrepreneur obligated to formulate accounting policies?

Entrepreneurs are not required to keep accounting records and are not required to formulate accounting policies for accounting. There are no such exceptions for anyone in tax accounting. If an individual entrepreneur pays taxes under OSNO, he is obliged to formulate an accounting policy.

And only if the activities of an individual entrepreneur do not involve the use of different accounting options and maintaining separate accounting, the entrepreneur has the right not to approve the accounting policy for tax purposes. For example, this may happen when applying the simplified tax system (income) or the patent taxation system (PTS).

Accounting policies for

The company's accounting policy documentation reflects its accounting policies and reporting process. As a rule, small enterprises operate under a simplified tax calculation regime. For them, drawing up an accounting policy document is also mandatory.

The same applies to homeowners' associations (TSN). The accounting policies of such companies will be similar. The document in the HOA (TSN) must contain generally established standards for maintaining records in the company.

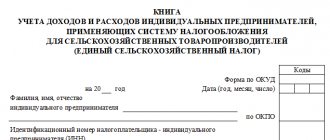

The accounting policy should also include the procedure for submitting reports to regulatory authorities. The appendix to the document must indicate the accounting registers for recording real estate and other assets. The unified tax register for tax accounting is KUDiR.

Accounting policy for individual entrepreneurs

Entrepreneurs do not have to keep accounting records. An individual entrepreneur may not prepare a balance sheet and make entries using the double entry method. Individual entrepreneurs' accounts are not required to undergo a total audit for compliance with accounting standards.

However, tax accounting must be maintained by companies regardless of the type of ownership rights and legal form of business. Individual entrepreneurs must regulate in their accounting policies only reporting for tax purposes.

The accounting policy of an individual entrepreneur must reflect:

- the taxation system that was adopted by the organization (STS);

- selected object for calculating the tax base;

- the process of maintaining cash basis accounting, as well as asset accounting.

The company's accounting policy accepts documentation for accounting in both electronic and paper versions.

Accounting policy for LLC

If an organization starts operating on the simplified tax system, it needs to reflect the process of maintaining reporting documentation in the company in its accounting policies. For organizations operating on a simplified taxation system, the following accounting options are established:

- subject to compliance with legal accounting standards;

- in the conditions of application of accounting standards for small enterprises.

In the appropriate section of the document, you must indicate the selected taxation system under which the company will operate. In addition, you will need to indicate the amount of profit and other nuances. In order for tax payments and their calculation to be controlled, it is necessary to maintain KUDiR.

How is the accounting policy formed on the simplified tax system?

An accounting policy document is subject to formation upon the creation of a legal entity and the beginning of its activities. Changes to the approved form are possible for good reasons, including:

- changes in the norms of current legislation (if they directly relate to the activities of the enterprise);

- major changes to the established record keeping process;

- changes in the characteristics of the company (change of type of activity, tax regime, etc.).

If any changes occur, they must be made before the start of the calendar year.

The composition of the document should reflect as much as possible the rules of accounting and document flow in the company. As a rule, the responsibility for drawing up accounting policies rests with the chief accountant, but another employee can also be appointed as the responsible person.

Procedure for drawing up an accounting policy document:

- Drawing up a chart of accounts. The list should take into account the need for further analytical analysis of activities. The information is checked for compliance with the company's activities.

- Compiling a list of documents that will be involved in primary accounting.

- Drawing up a list of documentation for all areas, indicating the person authorized to keep records.

- Determining deadlines for submitting reports and each document for further processing.

- Development of instructions for officials who are related to accounting.

The document is approved by the head of the company and comes into force from the moment the corresponding order is drawn up. Every year, if no adjustments have been made to the accounting policy, its validity period is postponed to the next year by an administrative document from the manager.

A sample accounting policy for the simplified tax system “income” or other taxation regimes will include standard sections. The LLC accounting policy document includes three sections. Accounting policy of individual entrepreneurs, since they do not keep accounting records - two. Regardless of the tax regime, accounting policies are developed, agreed upon and come into force in the organization in a general manner. A sample document can be viewed below.

When to make changes to accounting policies

For accounting

The third section of PBU 1/2008 is devoted to the rules for making changes to the UP for accounting purposes. Accounting policies need to be adjusted if:

- legislation or accounting regulations have changed. Changes to the UP are valid from the moment the amended norms come into force;

- the business conditions of the organization have changed significantly, for example, reorganization has occurred or the types of activities have changed. Changes in the UP are effective from the moment the business conditions change;

- The organization has developed a new accounting method that improves the quality of accounting information. Changes to the UP are effective from the beginning of next year.

Example 2.

On January 1, 2021, FSBU 5/2019 “Inventories” came into force. This fact must be reflected in the organization’s management program as follows.

- Delete references to regulations that are no longer in force: PBU 5/01 “Accounting for inventories”, Guidelines for the accounting of inventories (Order of the Ministry of Finance dated December 28, 2001 No. 119n), Guidelines for the accounting of special tools, special devices, special equipment and special clothing (Order of the Ministry of Finance dated December 26, 2002 No. 135n).

- Select a method for migrating to the new standard. Paragraph 47 of FSBU 5/2019 provides for retrospective (adjustment of opening balances according to the new rules as if the new standard had always been applied) and prospective (new rules to apply only to new facts of economic activity) transition options.

- Indicate which deviations from the requirements of the standard will be used if the organization has the right to such deviations. For example, paragraph 2 of FSBU 5/2019 allows not to apply the standard for inventories that are intended for management needs and to write off their cost as expenses of the period. If such a decision is made, it must be reflected in the accounting policies.

- Adjust the rules for recognizing and measuring inventories in accordance with the new standard. For example, if work in progress in 2021 was estimated at the cost of raw materials, materials and semi-finished products, you need to choose a different method, since this method is not available in FAS 5/2019. The same applies to the write-off of general business expenses to the cost of production.

For tax accounting

In accordance with Art. 313 of the Tax Code of the Russian Federation, it is necessary to adjust the accounting policy for tax accounting if:

- The legislation on taxes and fees has changed. Changes to the UP are valid from the moment the amended norms come into force;

- new types of activities have appeared. Changes in the UP are effective from the moment new types of activities appear;

- Accounting methods have changed. Changes to the UP are effective from the beginning of next year.

Example 3.

From January 1, 2021, an addition to Art. 288 of the Tax Code of the Russian Federation states that if a taxpayer applies reduced income tax rates and has separate divisions, it is necessary to determine the share of profit of each division separately for each tax base. Therefore, it is necessary to add an additional clause to the UE on the choice of indicator for calculation:

- average number of employees;

- labor costs.