Account purpose

Account 71 is intended to record the issuance and return of unspent accountable amounts. Money from the cash register is issued with the execution of an expense cash order and only on the condition that the employee has submitted an advance report on the spent accountable funds received earlier.

To receive funds, the employee writes an application, which must be certified by the head of the company. After the expiration of the period for which the funds were provided, the employee must provide reports within 3 days on the purpose and amount of money spent. Unspent funds are returned to the company's cash desk.

The procedure for receiving money on account

The procedure for issuing finance for reporting is regulated by a special regulatory document approved by the Central Bank of the Russian Federation, which reflects the rules for conducting cash transactions by business entities.

So, before issuing money on account, the accounting department must check whether the employee in question has any debt for previously received resources. If this is the case, then additional funds cannot be issued.

Once it has become clear that there is no such debt, the employee must write a statement addressed to management, indicating the required amount and period.

Now, if there is an application signed by management, an expense cash order is issued, which must be endorsed by the chief accountant, cashier and manager when the accountant is not present.

After completing the designated document and handing it over to the cashier, the cashier checks the correctness of its preparation and the presence of the appropriate signatures of officials. Only after completing all of the above actions, the cashier gives the employee cash resources for reporting.

Characteristics of account 71

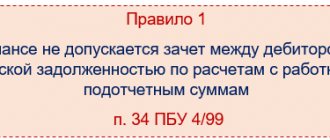

71 accounts are structured as an active account, but the balance at the end of the month can be either a credit or a debit. The loan balance will mean the organization’s debt obligation to the employee: the amount issued for reporting was not enough for confirmed business expenses. The final debit balance indicates the employee’s receivables to the company.

There should be no doubt about which account it is: active or passive. The active-passive account is closer in structure to the active one. An increase in the amount of funds issued will be reflected in a debit, and a decrease in accounts receivable will be reflected in a credit.

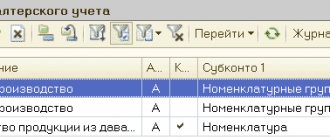

Analytical accounting accounts are opened for each amount issued for reporting. Control over the issuance processes and use of funds for the intended purpose allows you to reduce ineffective expenses of the enterprise.

Correspondence with other accounts

Account 71 is debited when money is issued to the employee on account. For this purpose, they mainly use account 50 if the money was issued from the cash register, and account 51 if the funds were transferred from the current account.

Account 71 is credited with the following accounting accounts:

- non-current assets;

- production process inventories;

- production process costs;

- goods and products;

- funds in cash equivalent;

- settlements with employees and other transactions;

- financial result.

Accounts I–IV of sections of the standard chart of accounts are used in correspondence with the credit of account 71 in the case of issuing accountable amounts for the purchase of materials, inventories and other material assets related to the non-current assets of the organization or the production and sales process.

Accountable amounts not paid on time are written off to the financial result of the enterprise (“Shortages and losses”). In the future, the accountant can reflect the amount of the employee’s debt to the organization in account 70 and write it off from the salary.

Typical entries

There are the following standard accounting entries to reflect transactions for 71 items:

1) Dt 71

Kt 50 – issuance of money against a report from the cash register;

2) Dt 08

Kt 71 – inclusion in the initial cost of intangible assets of the costs of their acquisition and creation;

3) Dt 10

Kt 71 - accounting for materials purchased by an accountable person;

4) Dt 20

Kt 71 – accounting of money spent by accountable persons in the main production;

5) Dt 50

Kt 71 – return to the cash desk of unused imprest amounts, etc.

Accountable travel funds

An employee, going on a business trip, has the right to reimbursement of the amount of travel expenses incurred for the purpose of:

- payment for travel to the destination;

- payment of housing rent;

- payment of daily expenses;

- payment of other expenses agreed with the employer.

It is also necessary to take into account that an employee can only claim travel allowances if he is a full-time employee. The amount of money issued on account is regulated by collective labor agreements or the charter of the enterprise. Funds issued in foreign currencies must be accounted for in separate subaccounts.

Postings for payment of travel allowances

The issuance of travel allowances to an employee is accompanied by accounting entries and execution of relevant documents. Having paid funds from the cash register to the account, the following entry is made: Dt account 71 Kt account 50. If the money was transferred to a corporate payment card, the operation is recorded with the entries: Dt 55 Kt 51, Dt 71 Kt 55.

The further accounting procedure depends on the purpose for which the employee was sent on a business trip. If production needs are fulfilled, accounts 20, 23 or 29 are debited with account 71. Travel of an administrative and managerial nature is written off to account 26, for the sale of goods - to account 44.

A business trip associated with the acquisition of property for an enterprise is included in the cost of the purchased asset and is reflected in the corresponding account for inventory, non-current assets, and goods.

The amount of VAT on travel payments of a production nature is taken into account by the following entries:

- Dt “VAT” Ct “Calculations for accountable amounts” – the VAT amount is accepted for accounting.

- Dt 68 “Calculations for taxes” Kt 19 “VAT” - tax deduction of VAT was carried out.

It should be remembered that VAT is not deducted for expenses not related to production. A posting is made: Dt “Other expenses” Kt “VAT”, meaning VAT is written off.

Confirmed expenditure of travel funds for a large amount is subject to reimbursement by the enterprise in favor of the employee, posting - Dt account 71 Kt account 50. If the employee returns unspent amounts, the operation has the opposite form: Dt “Cash” Kt “Calculations for accountable amounts”.

What is account 08 intended for?

According to the Chart of Accounts, introduced by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, account 08 “Investments in non-current assets” accumulates the costs incurred by the organization in objects that are planned to be used as:

- depreciable and non-depreciable fixed assets (hereinafter referred to as fixed assets);

- intangible assets (hereinafter referred to as intangible assets);

- adult animals belonging to the category of productive (working) livestock.

For key aspects of accounting for investments in non-current assets, see the article “Rules for accounting for investments in non-current assets”.

For information on how to reflect data on account 08 in reporting, see the article “On which line should the balance of account 08 be reflected in the balance sheet?”

Reportable amounts for other transactions

In addition to travel expenses, the company can issue funds to the employee as an account for the purpose of paying for:

- business and operating expenses;

- purchases of small wholesale goods;

- entertainment expenses.

Business and operating expenses involve the purchase of goods, payment for fuel and lubricants and services. Entertainment expenses are classified as general business expenses and include the costs of receiving foreign representatives, buffet services, translation services, etc. They do not include expenses for entertainment events and recreation in health resorts.

Reflection of entertainment expenses in accounting

To account for the issued accountable amounts for the purpose of paying for entertainment events, entries are made for 71 accounts:

- DT “Calculations for accountable amounts” CT “Cash” - money was issued for reporting.

- DT “General business expenses” CT “Calculations for accountable amounts” – reflects the amount of entertainment expenses.

- Dt “VAT” Ct “Calculations for accountable amounts” – the amount of VAT is taken into account.

- Dt "Cash" Kt "Settlements for imprest amounts" - unused funds are returned to the enterprise's cash desk.

- DT “Calculations for accountable amounts” CT “Cash” - funds were issued as compensation to the employee for overexpenditure.

- DT “Retained profit/loss” DT “Calculations for taxes” - in case of excess of standardized expenses, the amount of VAT on the overexpenditure is restored.

The amount of entertainment expenses should not exceed 4% of labor costs in the reporting period.

Accounting for business and operational accountable amounts

Goods purchased with cash issued on account are recorded in the accounts of non-current assets, inventories or goods.

Let's consider an example: 3,000 rubles were issued from the cash register for the purchase of materials, of which 2,500 rubles were actually spent. The accountant makes the following entries:

- DT “Calculations for accountable amounts” CT “Cash desk” – 3000 rub. – issued to an accountable person for the purchase of materials.

- Dt “Materials” Kt “Calculations for accountable amounts” – 2500 rub. – reflects the amount of expenses for materials.

- Dt “Cash desk” Kt “Settlements for accountable amounts” – 500 rub. – the accountable person returned unused funds to the cash desk.

If the remaining accountable amounts are not returned by the employee within the prescribed period, or an advance report on the funds spent has not been provided, the following posting is made: Dt 94 Kt 71. Depending on the method of withholding the amount, postings can be made:

- Dt “Payroll calculations” Kt “Shortages and losses” – deduction of the accountable amount from the employee’s salary;

- DT “Settlements with employees for other transactions” DT “Shortages and losses” – the employee’s receivables for the unreturned accountable amount are displayed.

Before using account 71 in accounting to draw up correspondence on transactions for recording and collecting accountable amounts from an employee, you need to familiarize yourself with the accounting policies of the enterprise. In special cases with a score of 71, accounts 91 and 99 can also be used.

Dt 91 “Other income and expenses”

Kt 71 “Settlements with accountable persons” - by writing off the amounts of travel expenses to increase other expenses, the costs of business trips related to other activities of the organization, as well as for business trips in connection with emergency circumstances or the elimination of their consequences are recorded;

Dt 50 "Cash desk"

Kt 71 “Settlements with accountable persons” - for the amount of the unused balance of the accountable amount handed over by the accountable person to the organization’s cash desk;

Dt 51 “Current accounts”

Kt 71 “Settlements with accountable persons” - for the amount of the unused balance deposited by the accountable person upon announcement directly to the bank account;

Dt 55 “Special bank accounts”

Kt 71 “Settlements with accountable persons” - for the amount of the unused balance deposited by the accountable person upon announcement directly to a special bank account. The same posting reflects the return of an unused letter of credit;

Dt 70 “Settlements with personnel for wages”

Kt 71 “Settlements with accountable persons” - for the amount of the unused balance of the accountable amount withheld from the salary of the accountable person.

In addition, under certain conditions, permanent tax liabilities may arise in connection with the recording of travel expenses. A similar situation may occur if the employment contract provides for the possibility of paying business trip expenses in excess of the norms established by law. In this case, the following entry is made in accounting:

Dt 99 “Profits and losses”

Kt 68 , subaccount “Organizational Income Tax” - for the amount of permanent tax liability.

Example.

The employee is sent on a business trip for five days to purchase supplies. Based on the calculation, he was given 100,000 rubles on account, including 1,000 rubles. – daily allowance for a business trip, 19,000 rubles. – to pay the cost of travel, 5000 rubles. – to pay for accommodation, 70,000 rubles. - to pay for purchased materials.

Upon returning from a business trip, the employee submitted an advance report for a total amount of 85,000 rubles, including the cost of purchased materials - 60,000 rubles, travel documents - 9,000 rubles, payment for accommodation at the place of business trip - 5,000 rubles, daily allowance - 1,000 rubles. (in accordance with the collective labor agreement). The business trip is directly related to the acquisition of materials. In accordance with the accounting policy of the organization, the actual cost of materials is formed on account 15. The unused balance is not returned to the cash desk.

The following entries were made in the accounting records:

Dt 71 “Settlements with accountable persons”

Kt 50 “Cash desk” – 100,000 rubles. – the amount of cash issued on account;

Dt 15 “Procurement and acquisition of material assets”

Kt 71 “Settlements with accountable persons” – 60,000 rubles. – the amount of the cost of purchased materials;

Dt 15 “Procurement and acquisition of material assets”

Kt 71 “Settlements with accountable persons” – 9,000 rubles. – the amount of payment for the cost of travel to the place of business trip and back;

Dt 15 “Procurement and acquisition of material assets”

Kt 71 “Settlements with accountable persons” – 5000 rubles. – the amount of payment for the cost of living;

Dt 15 “Procurement and acquisition of material assets”

Kt 71 “Settlements with accountable persons” – 1000 rubles. – the amount of accrued daily allowance;

Dt 70 “Settlements with personnel for wages”

Kt 71 “Settlements with accountable persons” – 15,000 rubles. – for the amount of the unused balance of the accountable amount withheld from the accrued wages of the posted employee;

Dt 99 “Profits and losses”

Kt 68 “Calculations for taxes and fees” – 120 rubles. – for the amount of permanent tax liability based on the amount of the difference between the actually accrued daily allowances and their standard amount. The amount of the cost of purchased materials in tax accounting, in our opinion, should subsequently be written off in the amount of their actual cost formed in accounting, that is, without taking into account permanent tax obligations, since the amount of profit in excess of the actual amount of daily allowance (included in the cost of materials) is already accrued.

The actual cost of materials is written off from the credit of account 15 to the debit of account 10 upon completion of all necessary operations related to bringing them to a state in which they are suitable for use for the planned purposes, and accordingly accounting for all additional expenses.

Travel expenses are included in production and distribution costs in the amount actually incurred. For tax purposes, business travel expenses are accepted within the established norms. Travel expenses in excess of the norms increase the tax base. VAT on excess costs is not presented to the budget as a credit, but is written off from the enterprise’s own funds.

Daily allowances issued in excess of the norms are included in the total annual income of the reporting person and are subject to personal income tax. Insurance premiums under the Unified Social Tax are not charged on daily allowances issued in excess of the norms.

Persons who received cash on account are required to submit to the accounting department a report on the amounts spent with supporting documents attached, return unspent amounts or receive overspent amounts from the cash register.

Cash issuance on account is subject to a complete report on previously issued amounts.

CONCLUSION

Based on the above, we can conclude that in the life of any enterprise, calculations occupy one of the main places in the accounting system. It is no coincidence that in the Chart of Accounts of the total number of accounting accounts, settlement transactions account for almost 1/5 of their total number.

Mastering the methodology for accounting for settlements with accountable persons is important in the entire accounting system, since the mobility of funds makes this area of the economic activity of an economic entity the most vulnerable from the point of view of various violations and abuses.

A scientifically based system of organizing accounting contributes to effective control over the availability and flow of funds of an enterprise, timely prevention of negative facts in business activities, obtaining complete and reliable information about business processes, performance results and financial condition of the organization.

In the course of their financial and economic activities, enterprises and organizations often make cash settlements (not related to the payment of wages) with both legal entities and individuals. Funds for these purposes are usually issued on account.

Accountable persons are employees of the organization (including part-time workers) who were given cash from the cash register with the condition of submitting a report on their use (hence the term “on account”).

The organization can issue funds to accountable persons: for travel expenses; for economic needs; for payment of entertainment expenses. The reporting form for amounts issued to accountable persons is an advance report.

To summarize information on settlements for accountable amounts in accordance with the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, active account 71 “Settlements with accountable persons” is used.

In the accounting of the enterprise, the issuance of funds is recorded as the debit of account 71 “Settlements with accountable persons”. Account 71 is credited for amounts spent by accountable persons in correspondence with accounts that record expenses and acquired values, as well as other accounts depending on the nature of the expenses incurred. Analytical accounting for account 71 is carried out for each amount issued for reporting.

Expenses incurred by accountable persons may be included in the cost of products (works, services), increase the actual costs of acquiring fixed assets, intangible assets, inventories, or be covered by the net profit of the enterprise.

This paper examines the basics of accounting for settlements with accountable persons, identifies the main directions for spending accountable amounts, and examines the main primary documents and regulations used in the preparation of settlements with accountable persons in accounting.

To summarize information on settlements with employees on the amounts issued to them for reporting on administrative, economic and operating expenses, the Chart of Accounts for accounting of financial and economic activities of organizations provides for account 71 “Settlements with accountable persons”. This is an active-passive account, the balance of which reflects the amount of debt of accountable persons to the enterprise or the amount of unreimbursed overexpenditure. On the debit side of the account, the amounts of reimbursed overexpenditures and again issued for reporting on the basis of cash outgoing orders are recorded, on the credit side - the amounts used according to advance reports and handed over under incoming cash orders (unused).

Accountable amounts to control their expenditure are taken into account for each employee of the enterprise in account 71 “Settlements with accountable persons”. The basis for filling out these documents are cash receipts and expenditure orders - when issuing funds for reporting and returning them to the cash register, as well as an advance report - when writing off spent amounts.

Properly organized accounting of settlements with accountable persons at the enterprise will ensure control over the use of funds and will not create problems with taxation and audit.