Any financial and economic transaction in the activities of the company is reflected in the accounting accounts. All accounts are interconnected. The principle of their interaction is described by the double entry method. The chart of accounts itself is a list in which the number corresponds to a name that reflects the essence of the business transaction. It was approved by Order No. 94n as amended on November 8, 2010.

A product is any purchased or produced valuable item intended for subsequent sale. If an organization produces a product for internal use, it is not a product. Let's look at the basic entries for goods and services in accounting.

The goods accounting account is 41.01, usually it is maintained in both total and quantitative versions. If the company incurred additional expenses directly when purchasing the goods, these expenses are usually also taken into account in account 41.01. There is an alternative option - accounting for costs separately, on account 44.01.

Let's look at the main examples of accounting entries for goods on 41 accounting accounts.

Accounting for goods and materials

Goods and materials are often combined into one accounting group and given a general name - inventory assets, abbreviated as goods and materials.

Inventory materials in finished form intended for further sale are goods. And materials are goods and materials that are purchased for use in the manufacture of the company’s products, or for their own needs that affect the overall production process, provision of services or performance of work.

Inventory and materials are taken into account at the actual cost, which consists of the amounts of funds transferred or paid (in cash) to the supplier and other expenses associated with transportation, commission costs, etc.

Reduced tax payments

In some cases, enterprises can use the definition given in the Tax Code to minimize tax deductions. For example, a 10% VAT rate is used for the sale of certain types of food products. Their list is given in Art. 164 Tax Code (clause 2). These include, but are not limited to, baked goods and bread. To apply the specified rate, the object must act as a product. Many organizations not only produce, but also sell various pies, buns, etc., related to bakery products. According to the definition given in the PBU, they do not act as goods. And in accordance with the interpretation of the Tax Code, they act. This means that when selling, an enterprise can charge a 10% VAT rate (not 20).

How goods are accepted for accounting

Goods are accepted for accounting in the same way as materials, at actual cost. For accounting purposes, account 41 and subaccounts opened to it are used. When carrying out retail trade, you also need account 42 “Trade margin”. If you keep records at accounting prices to reflect the difference between them and actual prices, then accounts 15 and 16 will be needed.

Products are sold wholesale and retail. In this case, accounting is influenced by the organization’s taxation system, and the methods enshrined in the accounting policy, and automation, or its absence at the point of sale, and the presence of intermediaries. When concluding a supply agreement, it is necessary to clearly state all the conditions that relate to prepayment, full payment and shipment, since the write-off of costs and the moment of sale of goods depend on this.

Wholesale trade can be carried out on the following terms:

- Prepayment and subsequent shipment.

- Shipment and then payment for the goods.

- Payment in foreign currency and then shipment. And vice versa.

- Sale of goods with their transportation to the buyer.

There are also many nuances in retail trade:

- Sale of goods at an automated point of sale (ATP) at sales prices in cash and non-cash.

- Sale of goods at a manual point of sale (NTP) at sales prices in cash and non-cash.

- Sale of goods at purchase prices.

Results

Since goods are the main current asset of trading companies, clear and organized inventory accounting is very important for them.

At the same time, the accounting procedure depends on the type of activity, the size of the business, the tax system and the type of legal relationship on the basis of which goods and materials are transferred (accepted) for possession, for safekeeping or sale. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Example of postings for 41 accounts

The Alpha organization carries out wholesale and retail trade. The goods were shipped to Omega after receiving full payment in the amount of RUB 274,520. (VAT RUB 41,876). Three days later the goods were shipped to the buyer.

Cost of goods sold RUB 129,347. In retail, daily revenue amounted to 17,542 rubles. (VAT 2676 rub.). The sale was carried out using ATT. To account for the trade margin, account 42 was used. The amount of the margin was 6,549 rubles.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Money has been deposited into the bank account from Omega | 274 520 | Bank statement |

| 76.AB | 68.02 | An advance invoice has been issued | 41 876 | Outgoing invoice |

| 62.01 | 90.01.1 | Revenue from sales of goods is taken into account | 274 520 | Packing list |

| 90.02 | 68.02 | VAT charged on sales | 41 876 | Packing list |

| 90.02.1 | 41.01 | Sold goods written off | 129 347 | Packing list |

| 62.02 | 62.01 | Advance credited | 274 520 | Packing list |

| An invoice for sales has been issued | 274 520 | Invoice | ||

| 68.02 | 76.AB | VAT deduction on advance payment | 41 876 | Book of purchases |

| 50.01 | 90.01.1 | Retail revenue taken into account | 17 542 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.03 | 68.02 | VAT charged | 2676 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 41.11 | Write-off of goods at sales price | 17 452 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 42 | Accounting for mark-ups on goods | -6549 | Help for calculating the write-off of trade margins on goods sold |

Accounting for the receipt of products at the warehouse

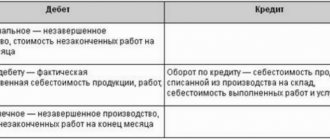

The receipt of goods is taken into account in account 41. Its debit reflects the receipt, and its credit reflects the disposal. There are several accounting methods:

- At cost of sale.

- At book value.

- At cost.

Cost accounting is relevant for wholesale and manufacturing entities. In retail companies, accounting is carried out either at cost or at cost of sales.

Accounting at actual cost

If accounting is kept at cost, you need to record the cost that is written down in the papers from the supplier. If the supplier has calculated VAT and presented an invoice, the amount of tax deductions is placed in a separate sub-account. Capitalization occurs at cost, which does not include VAT. However, the price may include transportation costs. Sometimes these expenses are separately accounted for on the debit of account 44. Let's consider the entries used:

- DT41 KT60 (76). Receipt of products to the warehouse.

- DT19 KT60 (76). Allocation of VAT.

- DT60 KT51. Transfer of funds to the supplier.

Products can be purchased using a loan. In this case, interest on the loan may be included in the cost. In this case, they are recorded on the debit of account 41.

Example of accounting at actual cost

The company took out a loan to purchase goods. Interest is charged on borrowed funds, which is included in the structure of operating expenses. The received goods were later sold. Let's look at the wiring used:

- DT51 KT66. Obtaining borrowed funds.

- DT41 KT60. Posting of goods.

- DT19 KT60. Allocation of tax.

- DT68 KT19. VAT tax deduction.

- DT91/2 KT66. Calculation of interest on the loan.

- DT90/2 KT41. Write-off of the cost of products for sale.

- DT62 KT90/1. Revenues from sales.

- DT90/3 KT68. VAT accrual on products sold.

- DT51 KT62. Receiving payment for goods sold.

The transaction for obtaining a loan must be confirmed by an agreement with the banking institution.

Accounting at cost of sales

If goods are accounted for at the cost of their sale, you will need invoice 42. The trade margin is recorded on it. It includes VAT. To fix the markup, this wiring is used: DT41 KT42. When the goods are sold, the markup is reversed, which is why this posting is needed: DT90/2 KT42.

The seller can discount his products. In this case, the amount of the markdown is written off against the markup. If the size of the markdown is greater than the markup, the difference is included in the structure of other expenses. In this case, this wiring is used: DT91/2 KT41.

If products are written off for the needs of the company, the markup must also be written off for needs. These wirings are required: DT44 KT41, DT44 KT42. If products are disposed of due to spoilage, this entry is used for write-off: DT94 KT41. The extra charge will be written off in DT account 94 . The corresponding account is KT42.

Example of accounting at cost of sales

The company purchased products in the amount of 12,000, the price included VAT in the amount of 2,000 rubles. The VAT rate on sales is 18%. The markup is 30%. Accounting is preceded by these calculations:

- (12,000 – 2,000) * 30% = 3,000 rubles (markup amount).

- (10,000 + 3,000) * 18% = 2,340 rubles (VAT on sales).

- 3,000 + 2,340 = 5,340 rubles (total markup).

The following entries are used in accounting:

- DT41 KT60. Capitalization in the amount of 10,000 rubles excluding VAT.

- DT19 KT60. Allocation of tax on purchased valuables in the amount of 2,000 rubles.

- DT68 KT19. Tax deduction for VAT in the amount of 2,000 rubles.

- DT60 KT51. Transfer of funds to the supplier in the amount of 12,000 rubles.

- DT41 KT42. Trade margin in the amount of 5340 rubles.

- DT90/2 KT41. Write-off of the value of valuables in the amount of 15,340 rubles.

- DT90/2 KT42. Reversal of the markup in the amount of minus 5,340 rubles.

- DT62 KT90/1. Proceeds from the sale in the amount of 15,340 rubles.

- DT90/3 KT68. VAT accrual on goods sold in the amount of 2,340 rubles.

- DT51 KT62. Transfer of payment for goods from the buyer.

Cost and sales value accounting are the most common accounting methods.

Translation of goods into materials

In production and trading organizations, goods are often transferred to the category of materials. Such a movement is documented with the TORG-13 consignment note.

Example

Alpha purchased 920 meters of cable for sale in the amount of RUB 179,412. (VAT RUB 27,383). To carry out electrical installation work, 120 meters of cable were needed, so this amount of goods was converted into materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 152 029 | Packing list |

| 19.03 | 60.01 | VAT included | 27 383 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 27 383 | Invoice |

| 10.01 | 41.01 | Products translated into materials | 19 830 | Internal movement invoice |

Accounting in wholesale trade

Wholesale trade involves selling large quantities of goods at a low cost. Typically, products are sold to retail companies. As part of accounting, ongoing transactions must be reflected: receipt of inventory, their sale, movement within the company.

Receipt of goods and materials

Postings are used to record the receipt of goods. The receipt of valuables is reflected using these entries:

- DT41 KT60. Admission.

- DT19 KT60. Reflection of incoming VAT.

Postings must be confirmed by an invoice in the TORG-12 form, or an invoice. PBU 5/01 states that direct expenses for the purchase of valuables are included in the cost price. Direct expenses include these expenses:

- Delivery of valuables.

- Duty paid at customs.

- Payment for the services of intermediaries and consultants.

- Income that is not reimbursed.

- Insurance.

Direct expenses must be recorded using this posting: DT41 KT60.

ATTENTION! If the company maintains simplified accounting, direct expenses can be taken into account as part of expenses for the main areas of activity. This is only possible if there are no significant balances in the warehouse.

Movement of valuables within a retail facility

Once the values are accepted, they can be moved to other departments. Expenses for internal movement and storage of inventory items are recorded in the cost structure for the main areas of activity. Let's look at the wiring used:

- DT44 KT60. Cost of third party services.

- DT19 KT60. Reflection of incoming VAT.

Postings must be confirmed by contracts with third-party companies, notes on the movement of valuables.

Realization of values

When selling consignments of goods, these postings are used:

- DT62 KT90/1. Sale of valuables.

- DT90/3 KT68. Allocation of VAT on sales.

- DT90/2 KT41. Write-off of sold assets at their actual cost.

Transactions are confirmed by checks and contracts with customers.

Write-off of goods from 41 accounts for the needs of the organization

An organization may need the goods it sells for general business needs. Write-offs can be made by converting goods into materials or bypassing this operation, based on an order.

Example situation:

The organization purchased 87 packs of paper for retail sale for a total amount of 7,905 rubles. (VAT 1206 rub.) For office needs, 5 packs were needed.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 6699 | Packing list |

| 19.03 | 60.01 | VAT included | 1206 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 1206 | Invoice |

| 41.11 | 41.01 | The goods were moved from the wholesale warehouse to the retail warehouse | 6699 | Invoice for internal movement (TORG-13) |

| 41.11 | 42 | Take into account the trade margin | 2609 | Invoice for internal movement (TORG-13) |

| 26 | 41.11 | Products written off for office needs | 604 | Request-invoice |

| 26 | 42 | Adjusting the cost of goods for office needs | 219 | Accounting information |

Tax accounting

The nuances of recognizing expenses and profits are stipulated in Chapter 25 of the Tax Code of the Russian Federation.

Expense recognition criteria

Within the framework of accounting, only financially justified expenses are recognized. The latter are distinguished by these characteristics:

- Related to the main work of the company.

- Required to make a profit in the future.

- Confirmed by documents.

These criteria are established by Article 252 of the Tax Code of the Russian Federation. If expenses are determined using the accrual method, they must be recognized in the period in which they occur. If the cash method is used, expenses are recognized when payment for the item is received.

Including the purchase price of products in the list of expenses

The list of costs does not include the purchase price of valuables. It must be taken into account in the cost structure at the time of sale of the goods. The corresponding rule is stipulated by paragraph 1 of Article 268 of the Tax Code of the Russian Federation. The cost of products for tax purposes can be established using these methods, at the average cost, at the price of a piece of product, at the cost at the time of purchase.

Costs

Costs also need to be taken into account for tax purposes. But first they need to be counted. This is done in several stages:

- Attribution of costs to one or another area of the company's work.

- Expenses related to taxable profit are divided into production, sales and non-operating expenses on the basis of paragraph 2 of Article 252 of the Tax Code of the Russian Federation. If the company uses the cash method, this will be the last step.

- If the company has adopted a method for establishing expenses and profits by accrual, production and sales expenses are divided into direct and indirect expenses on the basis of paragraph 2 of Article 252 of the Tax Code of the Russian Federation.

The rules for classifying expenses into any group are contained in Article 218 of the Tax Code of the Russian Federation. Trading companies must keep in mind a number of nuances that are set out in Article 320 of the Tax Code of the Russian Federation. The Tax Code of the Russian Federation also states that direct costs will include the purchase price of valuables and delivery costs. Other costs are considered indirect. They are written off as expenses for the period. Direct expenses partially reduce taxable profit for the reporting period. However, profits are not reduced by expenses associated with storing valuables in a warehouse.

Typical operations for accounting for goods

- Reflection of additional costs for goods - for example, delivery or storage of goods.

- Return of goods from the buyer - return receipt of goods from the buyer.

- Write-off of goods is a reflection in accounting of damage or loss of goods.

Description of the “Purchased Items” account

Various enterprises using this sub-account, carrying out industrial or other production activities, at the same time using account 41 “Goods”, keep records of the availability and movement of goods (considering that this is in relation to the procedure provided for the inventory account).

Accounting analysis is carried out for individual items (this can be varieties, batches), storage locations and batches. It is important to consider that each item is part of the Nomenclature , and any storage location is part of the Warehouses (storage locations) .

Categories for articles on product accounting:

- Accounting for goods in accounting: postings, examples, laws

- Revaluation of goods in accounting

- Movement of goods through warehouses: postings, rules, examples

- Resale of goods between the commission agent and the principal in accounting

- Reflection of goods in storage in accounting entries

- Expenses for selling goods - postings and examples

- Examples of warehouse postings

- Accounting entries for the transfer of goods free of charge

- Accounting entries for payment for goods and services

- Accounting for goods in transit

- Consignment goods: the relationship between the consignor and the commission agent

- Carrying out an inventory: receipt of surpluses and write-off of shortages

- How does the shipment of goods occur from an accounting point of view?

- Postings for the purchase of goods and services

- Postings for the sale of goods and services

- Returning goods to the supplier: reasons, postings, examples

- Postings for receipt of goods to the warehouse

- How to reflect the return of goods from a buyer in accounting

- Write-off of goods in case of shortage or damage in accounting entries

- Postings according to additional costs for delivery of goods

A short video on how to reflect the sale of a product in 1C 8.3:

When should goods be taken into account off balance sheet?

There are situations when there are valuables of other persons on the company’s territory. For example, when accepting a product, a defect is detected - until the supplier picks up the product, the buyer is obliged to ensure its safety (Clause 1, Article 514 of the Civil Code of the Russian Federation). Or the company provides goods storage services. In such cases, material value not related to the company's own property is subject to off-balance sheet accounting.

The postings for posting goods to the balance sheet will be as follows:

Unreliable supplier

The carelessness or inattention of the supplier can seriously let the buyer down and leave him without a deduction.

More than once, businesses have tried to challenge in court the constitutionality of the provisions of the Tax Code, which make the taxpayer’s right to receive tax deductions dependent on compliance with tax legislation by its counterparties. But, unfortunately, the judges of the Constitutional Court of the Russian Federation did not find anything unconstitutional in these norms.

Russian judicial practice confirms that business liability is limitless. Checking potential counterparties is already a duty. With severe penalties for non-compliance: 1) accusation of complicity and 2) refusal to reduce the tax base and recognize deductions.

Of course, you can argue. But given the budgetary position of the courts, this is not always productive.

Therefore, it is important to calculate the risks and take timely measures to ensure the safety of your business. Stay on top of current events

Know the tricks and understand the right moves.

In a fresh letter dated May 6, 2021 No. 03-07-11/32905, the Ministry of Finance once again warned that a corrected invoice that is not registered by the seller in the sales book deprives the buyer of the right to deduct VAT.

Making your legal right to a deduction dependent on the integrity or mood of the supplier is imprudent and risky. It's worth insuring yourself. It is useful to include in an agreement with a supplier - both a trusted partner and one chosen for the first time - a mandatory condition on the exchange of documents - the presentation by the seller of certified copies:

— additional sheets of the sales book (in case of correction of invoices) and

— current sheets of the sales book (in case of issuing adjustment invoices).

And further. It is advisable to include in contracts with suppliers other additional measures of responsibility that invigorate the counterparty. Eg:

- introduce a condition on a penalty for failure to submit properly executed documents within the established time frame: invoices, certified copies of sales book sheets and others;

- include in the contract a condition on assurances about the circumstances (in accordance with Article 431.2 of the Civil Code);

- stipulate in the contract the responsibility of the counterparty to compensate for property losses resulting from its violation of the law or obligations and guarantees under the contract. In this case, the contract must indicate the basis for compensation for losses;

and other useful conditions given in the article “Agreement with the counterparty. We manage risks."

If an unscrupulous seller delays in submitting documents, additional liability measures will help recover damages from him in a civil dispute. Without waiting for a tax audit and its results.

Income tax

According to Art. 54 of the Tax Code, taxpaying organizations calculate the base based on the results of each period based on accounting registers or on the basis of any data on objects. If errors from previous periods are identified, it is necessary to recalculate the tax base and the amount of the fee payable to the budget. If the period of the error cannot be identified, then the recalculation should be carried out in the current period.

Revenue from the sale of goods is recognized on the date of sale. Adjustment of the sales of the previous period towards a decrease in accounting should also be carried out in NU. That is, the taxpayer must change his tax obligations. This is how downward adjustments are made to the sales of the previous period. At the same time, the organization’s profit also decreases, and an overpayment of taxes occurs.

If the change in value is explained by the discount provided, the seller can adjust the tax base during the period of re-registration of the contract. In this case, the amount by which income is reduced must be reflected as part of non-operating expenses. The resulting loss can be carried forward to future reporting periods, that is, reduced by the amount of profit of the future period. The only condition is that you cannot reduce income received from activities taxed at a 0% rate. The loss can be carried forward to future periods within 10 years.

Let's summarize. And advice.

1. Errors in invoices should not be solely an accountant’s problem. Initiate an order on the persons responsible (managers) for the correct execution of delivery documents in general and invoices in particular.

2. Train your staff, explain the rules for drawing up invoices for employees responsible for purchasing goods. Practice making mistakes so that you can “pressure” suppliers and bring you the correct documents.

Adjustments and corrections are more complicated; you can’t do it without an accountant.

3. Include a payment clause in contracts with suppliers regarding the final payment only after receiving properly executed documents: invoices and certified copies of accounting registers confirming the accrual of taxes.

4. Provide other clear terms of contracts with suppliers to guarantee the submission of correct documents and their correct reflection in accounting. Listed in the article “Agreement with the counterparty. We manage risks."

5. Take a demanding position, do not accept the role of a supplicant. With some suppliers, you may have to fight for the deduction in court. Why not?)

Reliable suppliers to you, colleagues!

Impeccable invoices!

Easy and undisputed tax deductions!