Accounting entries

The receipt of materials into the organization is carried out under supply contracts, by manufacturing materials by the organization, making a contribution to the authorized (share) capital of the organization, receiving the organization free of charge (including a gift agreement). Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials.

The following are accounting entries reflecting the receipt of materials into the organization.

- Accounting for receipt of materials under a supply agreement. Accounting entries

- Accounting for receipt of materials based on advance reports. Accounting entries

- Accounting for the receipt of materials under an exchange agreement. Accounting entries

- Accounting for receipt of materials under constituent agreements. Accounting entries

- Accounting for free receipt of materials. Accounting entries

- Accounting for the receipt of materials produced in-house

List of accounts involved in accounting entries:

|

|

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accounting for the supply of materials with payment to the supplier after receipt of the materials | ||||

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 51 | The fact of repayment of accounts payable to the supplier for previously received materials is reflected. | Purchase price of goods | Bank statementPayment order |

| Postings for accounting for the supply of materials on prepayment | ||||

| 60.02 | 51 | Prepayment to the supplier for materials is reflected | Advance payment amount | Bank statementPayment order |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 60.02 | The previously transferred prepayment is offset against the debt for the materials received. | Purchase cost of materials | Accounting certificate-calculation |

Receipt of goods from the supplier

September 10, 2014 Goods accounting

Goods are material assets that an organization purchases from a supplier (seller) for the purpose of their further resale. Moreover, the sale of goods refers to the usual activities of the enterprise. In this article we will dwell in more detail on how to accept goods for accounting, at what cost they should be received and to what account.

Goods may be received at the enterprise warehouse by:

- Purchase price;

- Sales price;

- Registration prices.

Moreover, wholesale trade enterprises can only use the first and third methods. Retailers can use any of the three presented.

Let us consider in more detail each of these methods of accounting for commodity values.

Accounting for receipt of materials based on advance reports. Accounting entries

Below are accounting entries reflecting the accounting of receipt of materials from accountable persons on the basis of advance reports and the primary documents attached to them (delivery notes, invoices).

The receipt of materials from an accountable person can be reflected in two options:

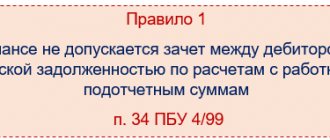

- In the first option, a standard posting scheme is considered, reflecting the receipt of materials from account 71 “Settlements with accountable persons”. The disadvantage of this option is that the accounting does not reflect the supplier from whom the materials were received and for which VAT was refunded.

- In the second option, the receipt of materials is reflected in correspondence with account 60 “Settlements with suppliers and contractors” and further, the debt to the supplier is closed in correspondence with account 71 “Settlements with accountable persons”. With this reflection option, there is an additional opportunity to analyze supplies by supplier

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to the standard scheme | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 71 | The receipt of materials from the accountable person to the organization's warehouse is reflected on the basis of primary documents attached to the advance report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) Advance report |

| 19.3 | 71 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to a scheme using a accounts payable account | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected on the basis of primary documents attached to the expense report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 71 | Reflects payment to the supplier by the accountable person for materials received | Purchase cost of materials | Accounting certificate-calculationAdvance report |

Accounting for inventories in a warehouse

The receipt of goods at the warehouse is reflected using accompanying documents from the supplier:

- TN or TTN;

- SF;

- Universal transfer document.

According to these documents, a receipt order M-4 is created at the warehouse, and based on its indicators, form M-17 is filled out:

Since 2013, the requirement for unified forms has been abolished, but many enterprises continue to use them, since it is advisable to develop their own forms only for cases where the existing ones do not allow reflecting the necessary information.

Accounting for the receipt of materials under an exchange agreement. Accounting entries

The legal basis that determines the procedure for forming an exchange agreement is defined in Chapter 31 “Barter” of the Civil Code of the Russian Federation. The methodology for reflecting supply transactions under an exchange agreement is discussed in more detail in the article “Accounting for the purchase and sale of goods under an exchange agreement”

The cost of materials to be transferred is established based on the price at which, in comparable circumstances, the organization determines the cost of similar materials.

Below are accounting entries reflecting the accounting for the receipt of materials from suppliers under an exchange agreement with the usual procedure for transferring ownership of materials, in accordance with Article 223 “Moment of the emergence of the acquirer’s right of ownership under the agreement” of the Civil Code of the Russian Federation and Article 224 “Transfer of a thing” of the Civil Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 60.01 | The receipt of materials from the supplier under an exchange agreement is reflected. Subaccount 10 is determined by the type of materials received | Market value of materials excluding VAT | Invoice (TMF No. M-15) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Invoice (TMF No. M-15) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | InvoicePurchase book |

| 62.01 | 91.1 | The transfer of exchanged materials to the supplier under the exchange agreement is reflected | Market value of transferred materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 10 | The write-off of transferred materials from the organization’s balance sheet is reflected. Subaccount of account 10 is determined by the type of materials transferred | Cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT accrued on the transferred materials is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 60.01 | 62.01 | The debt of the second party under the exchange agreement is offset | Cost of materials | Accounting certificate-calculation |

Capitalization of materials

To account for the cost of materials, one of the following options is most often used:

- At actual cost;

- At discounted prices.

When accounting for the second option, accounts 15 “Procurement and acquisition of MC” and 16 “Deviation in the cost of MC” are used.

Receipt at discount prices

Afina LLC uses the method of accounting for the cost of inventories at discount prices. A batch of raw materials (flour) of 100 kg was purchased for the amount of 2,360 rubles, incl. VAT 360 rub. Accepted discount prices for this nomenclature are 25 rubles/kg.

Materials have been capitalized to the warehouse at accounting prices; transaction:

| Dt | CT | Operation description | Amount, rub. | Document |

| 15 | 60 | The cost of the consignment is reflected | 2 000 | Invoice |

| 19 | 60 | VAT reflected | 360 | Invoice |

| 10 | 15 | Raw materials accepted at accounting prices (25*100) | 2 500 | Invoice |

| 15 | 16 | Reflection of the excess of the accounting value over the actual value | 500 | Accounting information |

In the case where the accounting value is lower than the actual value, the deviation entry will look like:

| Dt | CT | Operation description | Document |

| 16 | 15 | Reflection of excess cost over planned cost | Accounting information |

Receipt at actual prices

Snezhinka LLC purchased 500 kg of paint for 29,500 rubles, including VAT of 4,500 rubles. 4,720 rubles were paid for delivery, including VAT 720 rubles.

Materials received from wiring supplier:

| Dt | CT | Operation description | Amount, rub. | Document |

| 60 | 51 | Paint payment reflected | 29 500 | Payment order |

| 10 | 60 | Reflection of paint receipt | 25 000 | Invoice |

| 19 | 60 | VAT reflection | 4 500 | Invoice |

| 10 | 60 | Paint delivery reflected | 4 000 | Invoice |

| 19 | 60 | VAT reflection | 720 | Invoice |

| 60 | 51 | Payment for delivery has been transferred | 4 720 | Payment order |

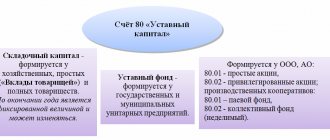

Accounting for receipt of materials under constituent agreements. Accounting entries

According to the constituent agreement, the founders (participants) contribute various types of property, including materials, to the authorized (share) capital of the organization. According to clause 8 of PBU 5/01 “Accounting for inventories”, the actual cost of inventories (materials) contributed to the contribution to the authorized (share) capital of the organization is determined based on their monetary value, agreed upon by the founders (participants) of the organization .

Based on the above provisions, the receipt of materials under the constituent agreement can be reflected in the accounting below with the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 75.1 | We reflect the receipt of materials under the constituent agreement. Subaccount 10 is determined by the type of materials received | Estimated cost of materials agreed upon by the founders | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

| 19 | 83 | If the founder transferring materials to the authorized capital of the organization, in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation, restores VAT, the receiving party must make this posting | The amount of VAT restored by the founder | InvoiceAct of acceptance of transfer of materials |

Paperwork

Often, legally competent drafting of documents upon acceptance of goods and materials helps resolve disputes between the supplier and the buyer if such arise, for example, due to inadequate quality of received materials.

Let's consider the case when a supply agreement is concluded between the supplier and the buyer. If in this case inventories are transported, then the supplier must bring an invoice or bill of lading along with them.

He must also provide an invoice (remember that the invoice is the basis for payment for materials)

Next, an employee of the purchasing company (the financially responsible person) checks the composition of the delivered material with the delivery note and invoice and, if everything is in order, signs the documents (each in 2 copies) and keeps one of the copies for himself. Further, both in the purchasing company and in the supplying company, copies of these documents must be signed by an authorized person, and they must be stamped.

If the received supplies do not correspond to the description in the accompanying document or the packaging is severely damaged, it is necessary to draw up a materials acceptance report.

If everything is in order, the buying company can create a receipt note with a list of received materials.

If a materially responsible person accepts goods outside the warehouse of the purchasing company, then a power of attorney to receive materials must be issued to this person.

The delivery note is the basis document for transactions 1, 2 and 3 in the list of transactions for delivery under a post-payment agreement, a receipt order is for 1, an invoice is for 2. A bank statement is for 4.

What if the oil and gas plant was acquired by an accountable person? Then an advance report, which has already been discussed (in one copy), is required, as well as cash receipts and other documents confirming the fact of payment. In the process of transferring materials to the warehouse by the accountable person, a receipt order is issued.

This receipt order is the basis for posting 2 in the list of postings when materials are received through an accountable person according to the standard scheme, and a delivery note is also required for its posting. For 1 transaction - an expense order. For 3 – invoice and delivery note. For 4 - the same as for 3, and also requires a purchase book.

If the accountant uses a scheme that includes payments to suppliers, then entry 5 from this list will require an accounting statement.

If the goods were received under an exchange agreement, then invoices are required for 1, 2, 3, 4 and 5 transactions; receipt order – for 1; invoices – for 2, 3, 4, 5 and 6; accounting certificate-calculation – for 7.

Accounting for free receipt of materials. Accounting entries

In accounting, according to clause 16 of PBU 9/99 “Income of the organization,” income in the form of gratuitous receipt of property is recognized “as it is generated (identified).”

In tax accounting, according to paragraphs. 1 clause 4 of Article 271 “Procedure for recognizing income under the accrual method” of the Tax Code of the Russian Federation, income in the form of gratuitous receipt of property is recognized on the date the parties sign the property acceptance and transfer act.

According to clause 9 of PBU 5/01 “Accounting for inventories”, “the actual cost of inventories received by an organization under a gift agreement or free of charge ... is determined based on their current market value as of the date of acceptance for accounting.”

Based on the above provisions, the gratuitous receipt of materials can be reflected in the accounting below using the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 91.1 | We reflect the free receipt of materials. Subaccount 10 is determined by the type of materials received | Market value of materials on the date of acceptance for accounting | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

Accounting for goods at purchase price

If a trade organization chooses this method of accounting for goods, then its decision must be reflected in the order on accounting policies.

The purchase price includes the direct cost of the goods indicated in the supplier’s documents, minus VAT. In addition, this includes all associated costs associated with the receipt of goods at the warehouse (transportation costs, procurement costs, etc.).

Transportation and procurement costs (TZR) can either be included in the purchase price of the goods or be allocated separately to the account for accounting expenses for sales. This will be discussed in more detail in this article.

To reflect all transactions related to goods, there is account 41 “Goods”, this is an active account, the debit of which reflects the receipt of goods, and the credit their write-off (disposal). Read about the disposal of goods. We also suggest reading about the transfer of ownership of goods and the corresponding transactions.

When accepting goods for accounting, the accountant performs posting D41 K60. The cost of this transaction does not include VAT. That is, if the supplier presented an invoice with a allocated amount of value added tax, then VAT is allocated from the cost of the goods by posting D19 K60, after which it is sent for reimbursement from the budget D68/VAT K19.

If transportation and procurement costs are also included in the purchase price of the goods, then posting D41 K60 (76) is reflected, VAT on TZR is also allocated separately by posting D19 K60 (76).

Postings upon receipt of goods:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

Accounting for goods at sales price

This method of accounting for goods is used only by retail enterprises. Its essence lies in the fact that commodity values are accounted for in account 41, taking into account the trade margin. For these purposes, additional account 42 “Trade margin” is introduced.

First, goods are debited to the account. 41 at the purchase price (posting D41 K60) excluding VAT, after which a trade margin is added using posting D41 K42.

When the goods are sent for sale, the trade margin will be deducted from the credit account 42 using the “reversal” operation (entry D90/2 K42). In this case, the amount of write-off of the trade margin must be proportional to the goods shipped.

If goods are sent for other needs, then the trade margin is written off to the account to which the goods are written off.

Postings to account 41:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 42 | Trade margin reflected |

Accounting for goods at discount prices

This method involves the use of pre-established discount prices. When goods arrive, they are debited to the account. 41 already at the discount price. In order to reflect the difference between the accounting value and the purchase value, two additional accounts are introduced: 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”. We have already discussed these two accounts in the topic about the receipt of materials.

At the purchase price, goods are debited to the account. 15 using wiring D15 K60 (excluding VAT). After which the goods are credited to the account. 41 at discount prices using wiring D41 K15.

On account 15, a difference has formed between the debit and credit values (purchase and accounting prices), this difference is called a deviation and is written off to the account. 16.

If the purchase price is greater than the accounting price (debit is greater than credit), then the entry for writing off the deviation has the form D16 K15. Posting is carried out exactly for the difference between the book value of the goods and the purchase price.

If the purchase price is less than the accounting price (credit is greater than debit), then the posting looks like D15 K16.

After the manipulations on the account. 16 reflects the deviation in debit or credit, which at the end of the month is written off as selling expenses. If the deviation is reflected in the debit of account 16, then the posting for writing off the deviation looks like D44 K16. If the deviation is reflected on credit account 16, then the “reversal” operation is performed - posting D44 K16.

Postings upon receipt of goods at accounting prices:

| Debit | Credit | the name of the operation |

| 15 | 60 | The cost of goods is reflected according to the supplier’s documents (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 15 | 60 | The cost of TZR is reflected (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 15 | Goods are capitalized at accounting prices |

| 16 | 15 | The deviation between the accounting and purchase price is reflected |

The business transaction “Materials received from supplier” is one of the most common entries in accounting. And in fact, both manufacturing enterprises, of which there are many in Russia, and many other organizations base their activities on the purchase and sale of materials. Therefore, it is very important that this operation is carried out correctly and all the nuances are taken into account.

Accounting for the receipt of materials produced in-house

According to the methodological instructions, materials are accepted for accounting at actual cost. The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials are carried out by the organization in the manner established for determining the cost of relevant types of products. Those. The procedure for reflecting materials produced in-house in accounting depends on the methodology for calculating the cost of products used in the organization.

Currently, the following types of assessment of finished products are used:

- At actual production cost. This method of assessing finished products (manufactured materials) is used relatively rarely, as a rule, in single and small-scale production, as well as in the production of mass products of a small range.

- Based on the incomplete (reduced) production cost of products (manufactured materials), calculated based on actual costs without general business expenses. Can be used in the same industries where the first method of product evaluation is used.

- At standard (planned) cost. It is advisable to use in industries with mass and serial production and a large range of products.

- For other types of prices.

Below we will consider two options for recording the receipt of materials produced in-house in accounting.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for materials at standard (planned) cost. | ||||

| 10 | 40 | The release (manufacturing) of materials is reflected at the planned cost | Planned cost | Receipt order (TMF No. M-4) |

| 40 | 20 | The actual production cost is reflected | Actual cost of manufactured materials | Accounting certificate-calculation |

| 10 | 40 | The write-off of deviations between the cost of materials at actual cost and their cost at standard (planned) cost is reflected. | The amount of deviation is “black” or “red” depending on the balance of the deviation | Accounting certificate-calculation |

| Accounting for materials at actual cost. | ||||

| 10 | 20 | The release (manufacturing) of materials is reflected at actual cost | Actual production cost | Receipt order (TMF No. M-4) |

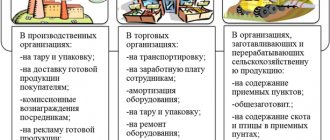

Accounting for transportation and procurement costs

Transportation and procurement costs include:

- Loading and transportation costs;

- Commission fees to intermediaries (suppliers);

- Travel expenses;

- Storage fees at travel points;

- Lost in transit;

- Interest on provided targeted loans and loans, etc.

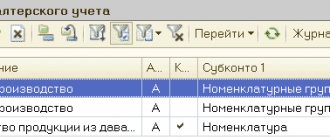

TZR can be taken into account in three ways:

- There are 10 accounts on a special subaccount;

- On the 15th count;

- Included in the actual cost of materials.

TZR increase the cost of materials only when accounting at actual cost. If an organization uses a method of separate accounting for material and equipment, then they are written off as expenses also according to special rules.

When using the first two methods, TZR are written off once a month. Formula for calculating the distribution coefficient for writing off TZR:

The amount of TZR to be written off is calculated using the formula:

- Inventory expenses for the period * Inventory and production coefficient.

If the share of materials and equipment in the period is no more than 10% of the consumption of materials, then this amount can not be distributed, but written off entirely to cost accounts.

Let's consider the theoretical foundations that need to be relied upon when organizing the accounting of materials at the receipt stage. We will also get acquainted with the accounting records of the facts of the economic life of the enterprise, that is, with the postings as a result of solving situational problems. Let's study how to keep track of the receipt of materials using the 10th account Materials.