In this article we will look at accounting for returnable production waste. Let's find out what is considered waste. Let's figure out how the types of waste differ. Let's talk about what documents are used to document waste in a warehouse.

Any company engaged in production inevitably generates waste of various types. Some of them are later put back into use, others are sold, and others are not to be used. In order to correctly process their capitalization, further use or sale, as well as not make mistakes in calculating taxes, an accountant needs to be armed with accurate knowledge. We will talk about what types of waste are, how they differ, what documents are processed and how they affect taxation.

Legislative regulation

The main provisions and responsibilities for waste management are contained in Federal Law-89. Responsibility for waste disposal lies with the original owner, the organization where it was generated.

Production waste is divided into irrecoverable and returnable. The first are materials with completely lost original useful properties. Their implementation or reuse is not possible. The latter can be used in production or sold for further use.

Irrevocable waste is not reflected separately in the balance sheet. These are production (technological) losses, the standard of which is included in the consumption rates of raw materials when calculating the cost of the finished product: shrinkage, volatilization, waste, evaporation. According to the “Basic provisions for calculating the cost of products” clause 27 (approved 20/07/70, valid document), irrecoverable waste is not subject to assessment. This means that the accountant does not need to determine their value and create postings. We can say that indirectly their disposal is paid for by the company itself through the mechanism for calculating production costs. All that is required is their technological accounting.

Returnable waste can be disposed of directly. Federal Law 89 defines waste disposal as its use in the production of products, services, and work. At the same time, for accounting purposes, residues of materials that have retained all their consumer properties and are transferred to other departments and workshops are not recognized as waste (Article 254-6 of the Tax Code of the Russian Federation).

How are the types of waste different?

The separation of irretrievable and returnable waste is carried out according to their characteristics:

| Returnable waste | Irrevocable waste |

| Similarities | |

| Availability of material embodiment* Are a product of manufacturing processes Changed/lost properties in full or part of them | |

| Difference | |

| Bring income For future use: – in all types of production processes with increasing costs - for a purpose that does not correspond to the original one | Does not provide economic benefit Not used in this production, but: – suitable for the manufacture of other types of goods and products – possible release as related (by-product) products |

There is a type of waste classified as irrevocable, which does not have a material form, for example, such as: evaporation, volatilization, attrition, drying of materials.

Disposal procedure

The owner can go two ways.

- Entrust removal and further disposal to a specialized company. To do this, you will need accounting data on waste volumes recorded in documents. Hazardous waste (Article 4.1 of Federal Law-89) requires a disposal license.

- Independently take into account waste and make decisions about its disposal, for example, about transferring waste to production.

In order to have grounds for reflecting recycling in accounting and accounting records, it is necessary to create an internal waste write-off commission. It includes technical specialists, economic service employees, and the manager. The commission determines the inventory items to be disposed of. The decision of the commission is formalized in an act.

Accounting

Due to the variety of types of waste and methods of their disposal, various posting and accounting schemes can be used. Let us dwell on the most significant aspects of waste management by the original owner and by a company working in the field of recycling.

From the owner

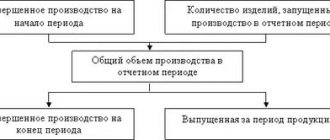

Control over the movement of returnable waste and its disposal begins with the owner building detailed analytical records: by type of product, location of waste generation, information on its qualitative and quantitative composition. To calculate the generated waste, actual measurements, weighings are used, or a calculation method is used according to standards per unit of production.

When recycling by selling returnable waste externally, the following transactions can be generated:

- Dt 10/6 Kt 20, 23 – waste was capitalized from production;

- Dt 62 Kt 91/1 – revenue from the sale of returnable waste is recorded;

- Dt 91/VAT Kt 68/VAT – tax is charged on revenue;

- Dt 91/2 Kt 10/6 – written off from the cost of returnable waste;

- Dt 51 Kt 62 – payment received;

- Dt 90/9 Kt 99 – profit was received from the sale of returnable waste.

The owner can dispose of waste by transferring it to production within his organization. For this purpose, the reverse wiring to that given above is used: Dt 20.23 Kt 10/6 - transfer of waste to production.

In a specialized company

Disposal costs here relate to ordinary activities in accordance with PBU 10/99. Expenses are recognized in the accounting system in accordance with clause 18 of the specified document, depending on whether the cash method of income recognition is used or not.

If returnable waste is purchased for use in your own production, count 10 applies.

Postings:

- Dt 10 Kt 60, 76 – secondary raw materials from the supplier were capitalized;

- Dt 60, 76 Kt 50, 51 – payment to the supplier for secondary raw materials.

If the acquisition was made for further resale, the raw materials act as goods (41).

Let the organization use a common BUT system. The implementation transactions will be as follows:

- Dt 62 Kt 90/1 – sales revenue;

- Dt 90/VAT Kt 68/VAT – VAT is charged on sales;

- Dt 90/2 Kt 41 – written off from the cost of waste sold;

- Dt 51 Kt 62 – money received for sold raw materials;

- Dt 90/9 Kt 99 – profit from the resale of raw materials.

There are often cases when a company enters into an agreement with an organization or a network of retail outlets for the free transfer of waste and garbage, for example, used paper and wooden containers for the purpose of recycling on its own. The terms of the agreement may provide for payment by counterparties. In such cases, the key account will be 98/2 - “deferred income, gratuitous receipts.”

Postings:

- Dt 10, 15 Kt 98/2 – free receipt of goods and materials, in market (contractual) valuation;

- Dt 20, 23 Kt 10 – raw materials sent for processing;

- Dt 98/2 Kt 91/1 – non-operating income from gratuitous receipt of goods and materials;

- Dt 76 Kt 90/1, 91/1 – processing services, revenue from sales (work) is reflected;

- Dt 90/VAT, 91/VAT Kt 68/VAT – charge of VAT on processing services;

- Dt 50, 51 Kt 76 – payment for processing services;

- Dt 40, 43 Kt 20, 23 – production of finished products, the result of waste disposal.

Disposal can be documented with the following primary documents:

- act of acceptance and transfer;

- invoice for the release of materials to the third party;

- packing list;

- processing report;

- certificate of completion;

- demand-invoice;

- limit fence card.

When recycling waste with the help of a specialized company, an agreement is concluded (on disposal, on waste processing).

By the way! When processing customer-supplied raw materials, the customer is the owner of the generated waste. Returnable waste either reduces the cost of the original raw materials transferred for processing, or reduces the cost of the processor's services.

Recycled raw materials

Sources of secondary raw materials can be:

- returnable waste from materials used in the production process (for example, in the woodworking industry - shavings, in the clothing industry - fabric scraps, in metallurgy - scrap metal, etc.);

- irretrievable waste (technological losses), the further use of which in the production of products is impossible (defective products, materials obtained during the dismantling of fixed assets, finished products not sold during the warranty period).

The remnants of industrial products, which, in accordance with the technological process, are transferred to other departments as full-fledged raw materials (materials) for the production of other types of goods (works, services), as well as associated (associated) products obtained as a result of the technological process, are not returnable waste.

The cost of recorded waste is included in the reduction of the cost of materials released into production.

In the case of subsequent use of waste for the manufacture of products (parts, etc.), their release into production is documented by issuing invoice requirements.

Returnable waste is accepted for accounting as the debit of account 10 “Materials”, subaccount 6 “Other materials”, and the credit of accounts 20 “Main production”, 23 “Auxiliary production”, etc.

Subaccount 10-6 “Other materials” takes into account the presence and movement of: production waste (stumps, trimmings, shavings, etc.); irreparable marriage; material assets received from the disposal of fixed assets that cannot be used as materials, fuel or spare parts in a given organization (scrap metal, waste materials); worn tires and scrap rubber, etc. Production waste and secondary material assets used as solid fuel are accounted for in subaccount 10-3 “Fuel” (example 2).

Example 2. Let's assume that returnable waste received in July 2012 is intended for sale. Based on the market price for such raw materials, waste is estimated at 28,000 rubles. and sold in October 2012 for 30,000 rubles. (excluding VAT).

Sales of returnable waste are reflected in table. 2.

table 2

| Correspondence of accounts (sub-accounts) | Amount, rub. | ||

| D-t | Kit | ||

| As of the date of identification of returnable waste (July 2012) | |||

| The amount of expenses for main production was reduced by the market value of returnable waste | 10, subaccount. "Returnable waste" | 20 | 28 000 |

| As of the date of sale of returnable waste (in October 2012) | |||

| Revenue from the sale of returnable waste is reflected | 62 | 91-1 | 35,400 ((30,000 + 30,000) x 18%) |

| The cost of waste sold is reflected | 91-2 | 10, subaccount. "Returnable waste" | 28 000 |

| VAT charged on sales | 91-2 | 68-VAT | 5,400 (30,000 x 18%) |

Tax accounting for the sale of returnable waste is presented in table. 3.

Table 3

| Operation | Type of income | Amount, rub. |

| Based on the results of the month in which returnable waste was identified (July 2012) | ||

| Reduced the amount of material costs for the cost of returnable waste | Adjustment of material costs | 28 000 |

| Based on the results of the month of sales of returnable waste (October 2012) | ||

| Income from the sale of returnable waste is taken into account | Sales income | 30 000 |

| Expenses from the sale of returnable waste are taken into account | Sales expense | 28 000 |

Tax accounting

The above correspondence accounts show: waste disposal operations associated with their sale and processing are subject to VAT. The object of value added tax is any sale, i.e. transfer of ownership rights of both a paid and gratuitous nature (Article 146-1(1), 39-1 of the Tax Code of the Russian Federation). In particular, waste treatment services are equal to revenue from the sale of work. In a situation where the supplier transfers returnable waste to the work contractor free of charge, this operation is recognized as subject to VAT, as is the sale by reducing the cost of services by the cost of the waste. VAT is required to be charged on these transactions.

Starting from this year, operations for the disposal of scrap metal and waste paper are subject to VAT (FZ-424 dated November 27, 2018). The tax agent here will not be the seller, but the buyer, i.e. third party organization, specialized processing company. The seller must have the status of a VAT payer, and the buyer, a tax agent, can apply both the general regime and the “simplified” regime, and other special regimes - he is still obliged to calculate and transfer tax to the budget. Agency responsibilities are also assigned to those buyers who are exempt from VAT (Article 145 of the Tax Code of the Russian Federation). The seller will be obliged to charge tax only if he sells waste to an individual or has not specified VAT in the agreement with the waste buyer, being its payer.

For NU purposes, returnable waste must be included in income tax calculations:

- are valued at market prices (possible sale prices) upon disposal through sale;

- at a reduced price, compared to the original inventory items, if they are disposed of by transferring them into production.

For the taxpayer, this first of all means the opportunity to reduce income tax costs by the market value of secondary waste.

Free receipt of waste is non-operating income. It must be recognized when waste is written off for processing.

Briefly

Accounting for waste disposal, both accounting and tax, is associated with the choice of disposal method: waste is disposed of on site or transferred externally. Transfer to a third party may be paid or gratuitous. In accounting, standard accounts and postings are used for accounting purposes for the sale of products and the transfer of inventory and materials into production.

When transferring to a third party free of charge, the score is 98/2. In NU, all operations related to the sale of waste, including free of charge, are subject to VAT. From this year, VAT is also levied on the disposal of waste paper and scrap metal. The tax agent is not the seller, but the buyer.

For the purpose of accounting for income tax, waste and operations with it are assessed according to the rules of Art. 254 Tax Code of the Russian Federation.

Accounting for a single tax on imputed income

Unlike accounting for returnable waste under the main taxation system, an organization that pays a single tax on imputed income, according to the Tax Code of the Russian Federation, cannot sell goods that it itself produces. Returnable waste also falls under this rule. Such an enterprise can sell only purchased goods at retail using the UTII system. If an enterprise produces products on UTII, then in this case it needs to organize separate accounting:

- When combining “imputation” and the main system - separate accounting for UTII, profit and VAT;

- When combining “imputed” and “simplified” - accounting for UTII and tax according to the simplified tax system.

Returnable waste in accounting

Industrial waste is generated as a result of processing raw materials into finished products. Residues from raw materials and materials that have completely or partially lost their properties are called waste. Waste can be irretrievable or returnable. The first of them cannot be reused by the enterprise due to technological features, and also cannot attract a buyer. They are disposed of and are not reflected in accounting.

Returnable waste (hereinafter referred to as RR), on the contrary, can either be used a second time as raw materials for the main production, or for auxiliary production, or sold to third parties. Examples of VO can be whey in the production of cottage cheese, sawdust in the wood processing industry, scrap metal in the production of metal structures, sunflower husks in the production of vegetable oil, etc.

Accounting for VO is regulated by clause 111 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. When delivering waste from production to a warehouse or when moving it to another workshop, an invoice is issued for the internal movement of materials (clauses 57, 111 of the Methodological Instructions). You can use for these purposes the unified form M-11, approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a, or develop such a primary document yourself. The process of waste collection and transfer is described in internal regulations. To control their safety, it is necessary to organize analytical accounting of VOs by their types and storage locations. VO are accounted for at the prices prevailing for these wastes on the market, that is, at the price of possible use or sale, by posting Dt 10 Kt 20, 23, 29. Thus, waste materials newly supplied to account 10 reduce the cost of materials that are transferred to production . We also note that the chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, provides for waste a separate subaccount 6 “Other materials”.

How to determine the price of VO? There are several options:

- Take the price from the contract for the sale of this waste.

- If the sale price is not yet known, determine the market value at the time the waste is received into the warehouse.

- Conduct an expert assessment of the price of their possible use as the ratio of the consumer properties of the starting materials and VO to their cost.

The first and second methods are relevant if the waste is sold. If they are reused at the enterprise, then the second and third options can be used. The method of determining the price must be fixed in the accounting policy.

For general information about materials accounting, read the article “Accounting entries for materials accounting.”

Valuation in tax accounting

The Tax Office points out that there are two ways to assess waste:

- At the possible price of use in production, which is lower than that of the source material;

- At the market price when the waste is intended for sale.

Important! Tax accounting differs from accounting in that the former depends on the valuation of waste on how it will be used in the future. As in accounting, in tax accounting, if the actual sale price is not identical to the capitalization price, it is not revalued.

Tax accounting of returnable waste

In the Tax Code, the definition of VO is given in paragraph 6 of Art. 254. The legislator clarifies that if the remaining materials are used for the manufacture of other goods by other divisions as full-fledged material, then they are not VO, just like by-products.

It is necessary to reduce the amount of material costs by the cost of returnable materials, and the method for assessing VO directly depends on their future fate:

- use - the price of possible use or the reduced price of raw materials;

- sale - selling price.

In the first case, the assessment method is determined using special calculations, which depend on the type of production, the material used, and the technological process. The calculation takes into account the beneficial properties of the waste, the beneficial properties of the product that will be obtained from this waste, physical indicators, etc. For each enterprise this will be its own specific calculation, which needs to be fixed in the accounting policy.

As for sales, if the sales price is already fixed in the contract or specification, then there are no problems. If it is not yet known what price of the transaction will be set, then the question of its determination will affect the amount of material costs. The desire to reflect the VO at the actual actual selling price that will be established in the future can become a serious problem for the accountant. Why? Let's consider two options:

- the receipt of waste and its sale occurred in the same reporting period;

- The receipt of waste occurred in the current period, and their sale - in the next.

If we did not guess correctly with the selling price and capitalized the waste at an underestimated or overestimated cost, then in the first case we will find that the reduction in material costs and the increase in the cost of goods sold will occur by the same amount. Therefore, the income tax result will not be affected.

If we underestimate the selling price of waste in the second case, then the material costs of the current period will be overestimated, which leads to underpayment of income tax, penalties and fines. And in the next period, on the contrary, it will overpay. You will have to submit clarifications and answer questions from tax specialists, which is extremely undesirable. Therefore, let us turn to the explanations of the Ministry of Finance. Letters dated 04/26/2010 No. 03-03-06/4/49, dated 09/18/2009 No. 03-03-06/1/595 state: “VO should be assessed based on market prices determined in the manner prescribed by Art. 40 of the Code." Let us clarify that the market price is determined at the time of receipt of waste, because that is when we need to evaluate it for reflection in accounting.

The Ministry of Finance also explains in the mentioned letter No. 03-03-06/4/49 that when selling VO, revenue is reduced by their value determined in tax accounting, and profit from such a transaction is taxed. It is worth noting that no one is insured against loss, since the amount of income from the sale determined in accordance with clause 1 of Art. 249 of the Tax Code of the Russian Federation, may be less than the cost of waste, which is included in expenses in accordance with subparagraph. 2 p. 1 art. 268 of the Tax Code of the Russian Federation and for which material costs were reduced. Let's look at the example of accounting and tax accounting of VO.

Example

LesTorg LLC sells VO - sawdust that remains after processing logs into timber. Let's assume that the cost of manufacturing the timber amounted to 8,756,000 rubles. before accounting for VO. 1 ton of sawdust has been received into the warehouse, the selling price of which is 5 rubles. per kg excluding VAT. LesTorg has an agreement concluded with the buyer, which stipulates the specified price. The manufactured timber was sold for RUB 11,388,000, including VAT of RUB 1,737,000.

| Operation | Dt | CT | Amount, thousand rubles |

| The costs of manufacturing timber are reflected | 02, 10, 70, 69, | 8 756 | |

| Posted to the VO warehouse | |||

| The cost of finished products is reflected | 8 751 | ||

| Reflected revenue from the sale of timber | 11 388 | ||

| VAT on the sale of timber is reflected | 1 737 | ||

| The cost of timber is reflected | 8 751 | ||

| Finnish reflected result from the sale of timber | |||

| Reflected revenue from the sale of sawdust | 5,9 | ||

| VAT on the sale of sawdust is reflected | 0,9 | ||

| The cost of sawdust is reflected | |||

| Finnish reflected result from the sale of sawdust |

In tax accounting we receive the following data:

| Index | Finished products - timber, thousand rubles. | Returnable waste - sawdust, thousand rubles. | Total, thousand rubles |

| Sales income | 9 651 | 9 656 | |

| Cost price | 8 751 | 8 756 | |

| Taxable income |

Let's consider the situation if LesTorg LLC did not have an exact amount for the sale of returnable waste, but used market prices. For example, the market price of sawdust at the time of their receipt was 3 rubles. per kg (the selected price can be fixed by attaching, for example, a competitor’s price list to the primary documents). LesTorg LLC sold 1 ton of returnable waste for the same price of 5 rubles. per kg excluding VAT (VAT - 0.9 rubles). We receive the following entries in accounting.

| Operation | Dt | CT | Amount, thousand rubles |

| The costs of manufacturing timber are reflected | 02, 10, 70, 69, | 8 756 | |

| Posted to the VO warehouse | |||

| The cost of finished products is reflected | 8 753 | ||

| Reflected revenue from the sale of timber | 11 388 | ||

| VAT on the sale of timber is reflected | 1 737 | ||

| The cost of timber is reflected | 8 753 | ||

| Finnish reflected result from the sale of timber | |||

| Reflected revenue from the sale of sawdust | 5,9 | ||

| VAT on the sale of sawdust is reflected | 0,9 | ||

| The cost of sawdust is reflected | |||

| Finnish reflected result from the sale of sawdust |

In tax accounting we receive the following data:

| Index | Finished products - timber, thousand rubles. | Returnable waste - sawdust, thousand rubles. | Total, thousand rubles |

| Sales income | 9 651 | 9 656 | |

| Cost price | 8 753 | 8 756 | |

| Taxable income |

Thus, regardless of the assessment of returnable waste, the cost and taxable profit are the same.

Waste accounting at the enterprise

The legislation of the Russian Federation (Part 1, Article 19 of Law No. 89-FZ) obliges all legal entities and individual entrepreneurs, when handling waste, to keep records of waste movement in accordance with the approved order of the Ministry of Natural Resources of Russia dated September 1, 2011 No. 721, the Procedure for accounting in the field of treatment with waste (hereinafter referred to as the Accounting Procedure). All generated, disposed, neutralized, transferred to other persons or received from other persons, as well as disposed waste are subject to accounting. At the moment, the latest version of the Accounting Procedure dated June 25, 2014, as well as terminological amendments to Law No. 458-FZ, have introduced the concepts of “disposal” and “processing” instead of “use”.

The new terminology more specifically expresses the essence of waste management processes when filling out waste accounting data tables (Appendices 2-4 to the Accounting Procedure):

“Waste disposal is the use of waste for the production of goods (products), performance of work, provision of services, including the reuse of waste, including the reuse of waste for its intended purpose (recycling), their return to the production cycle after appropriate preparation (regeneration), and also extracting useful components for their reuse (recovery).

Waste treatment is the preliminary preparation of waste for further disposal, including its sorting, disassembly, and cleaning.”

Basic provisions of the requirements for the Accounting Procedure:

1. Accounting in the field of waste management is carried out separately for each separate division or branch (if any) and for the legal entity (IP) as a whole (paragraph 6 of clause 3).

2 Accounting is carried out on the basis of actual measurements of the amount of waste used, neutralized, transferred to other persons or received from other persons. If it is impossible to make actual changes in the amount of disposed waste used, neutralized, transferred to other persons or received from other persons, accounting is carried out on the basis of the following sources: technical and technological documentation; accounting documentation; acts of acceptance and transfer; contracts (clause 4).

3. All types of waste of IV hazard classes generated, used, transferred or received from other persons, also placed by a legal entity and individual entrepreneur during the accounting period, are subject to accounting (clause 5).

4. Accounting data is summarized based on the results of the next quarter (as of April 1, July 1, and October 1 of the current year), as well as based on the results of the next calendar year (as of January 1 of the year following the accounting year) no later than 10 the th day of the month following the specified period (clause 7).

5. Accounting data is maintained electronically. In the absence of such technical possibility, accounting data shall be documented in writing.

6. Filling out the accounting data tables is carried out by the person responsible for accounting for generated, used, neutralized, transferred to other persons or received from other persons, as well as disposed waste, as waste is generated, used, neutralized, transferred to other persons or received from other persons , waste disposal (clause 6).

7. Tables of accounting data are filled out for the legal entity as a whole, for each of its separate divisions or branches (if any), for individual entrepreneurs (clause 10).

8. All values of waste quantity are taken into account by the mass of waste in tons and are rounded:

• accurate to three decimal places (accurate to the nearest kilogram) - for waste of I, II, and III hazard classes;

• accurate to one decimal place - for waste of hazard classes IV and V.

Obsolete fluorescent lamps containing mercury are reflected by the mass of the product (clause 11).

9. In each filled-in line of the accounting data tables, the values of the amount of waste or, in their absence, zero (point 12) are indicated in the columns.

10. A separate line is allocated for each type of waste. The lines are grouped by waste hazard classes (clause 13).

11. The tables indicate the codes of waste types according to the FKKO; if there is no corresponding type of waste in the FKKO, zero is indicated.

Forms and documents for processing waste in a warehouse

Returnable waste is accounted for on forms and documents as finished products in accordance with Federal Law No. 129 of 1996, where all operations carried out by the organization must be documented. Based on them, primary accounting documents are created and records are kept in the accounting department.

Today, there are few forms that can be used to calculate and register balances for transfer to a warehouse. Some of the common ones:

- form MX-18, invoice article for transfer to the warehouse,

- M-11 – demand-invoice,

- TORG-12 and TORG-13 – invoice for the transfer of finished products, containers for internal movement,

- MX-4 – receipt order,

- MX-5 – logbook for recording the receipt of finished products at storage locations,

- MX-6 – logbook for recording the consumption of finished products in storage areas.

Accounting entries for production waste

Even with modern and efficient equipment, there will always be a working process in which waste from the main stage of raw material processing will remain. Let's consider the main accounting entries for industrial waste and their classification.

Also, waste from the main production may appear due to:

- transportation,

- due to improper storage,

- due to the chemical and physical properties of the products.

Specialists of any production are required to set a specific waste limit. If it is not possible to determine the exact level of such output, then industry regulations and standards are taken as the basis. Production losses must always be formally documented in accounting records, even in transit.

Documentation of waste and posting

Technological losses, the scope of which was previously approved by the chief technologist or engineer, must be constantly under the control of an economist or technologist. The amount of waste must be reflected in the inventory or cleanup report.

Accounting entries for writing off returnable waste if it arose as a result of processing, production, transportation or exceeded its norm. If the losses have not exceeded their limit, then attribute these expenses to the costs of ordinary activities (they affect the write-off of raw materials for the main production).

Typical wiring:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20, 23 | 10.01 | Transfer of materials to production | Material cost | Consignment note, receipt order |

| 91.02 | 20.01, 23 | Write-off of excess losses | The size of the difference with the limit | Write-off act |

| 94 | 41.01 | Reflection of shortages in goods. This happens when processing contaminated products, cleaning cuts, and windward areas of the product. | Shortage amount | Cleanup act |

| 41.01 | 94 | Receipt of waste for further sale | Amount of waste | Receipt invoice, acceptance certificate |

| 44 | 94 | Write off expenses that do not exceed the limit | Amount of expenses | Write-off act |

| 76, 73 | 94 | Write-off of losses in excess of the norm with attribution to the perpetrators (they may be employees or representatives of other organizations) | Amount of difference with limit | Write-off act |

| 91.02 | 94 | Write-off of losses in excess of the norm in cases where the perpetrators were not found | The size of the difference from the norm | Write-off act |

| 94 | 60, 10, 16,41 | Reflection of shortages during transportation | Shortfall amount | Inventory report |

| 20.01, 23 | 94 | Writing off the shortfall as expenses within the established norm | Cost amount | Write-off act |

| 76, 73 | 94 | Transferring costs to the guilty parties in case of excess costs | Amount of losses | Accounting statement, inventory report |

| 91.01 | 94 | Write-off of losses in excess of the norm when the perpetrators are not identified | Amount of difference with limit | Accounting certificate-calculation, write-off act |