Transactions that are reflected in accounting on account 71

Account 71 in the accounting department is intended to reflect the company's settlements with its accountables, i.e., with persons who received money on account from the company to pay for any of its needs.

Such expenses may include:

- procurement of goods and materials;

- payment for work or services;

- expenses associated with business trips.

Only persons working for the company under an employment contract or within the framework of the GPA can be accountable. The issuance of money on account can be carried out on an ongoing basis or on a one-time basis.

The list of employees who receive money regularly is approved in the order of the manager. It also indicates the period for which the employee is given the company's money. To receive money one-time, the employee must write an application indicating the amount and period for which it is required.

The employee who received the money, in accordance with clause 6.3 of the instructions of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions” dated March 11, 2014 No. 3210-U, must report on expenses no later than 3 days:

- after the end of the period for which the money was issued;

- completion of a business trip;

- the end of the period of incapacity;

- coming out of vacation.

Accountable persons report by filling out an advance report. How to reflect in accounting the expenses of an accountable person and exchange rate differences on an advance report in foreign currency? The answer to this question can be found in a ready-made solution from ConsultantPlus experts. If you don't already have access to the system, get a free trial online.

Operations on account 71 “Settlements with accountable persons” are carried out in accordance with the requirements of the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 30, 2000 No. 94n.

How are settlements with accountable persons reflected in accounting?

In settlements with accountable persons, certain rules should be followed:

- the issuance of money is carried out on the basis of an order from management, at the request of an employee or an order for the enterprise with the execution of an expense cash order;

- do not issue accountable amounts to persons who are not indicated as financially responsible persons (except for business travelers);

- do not issue accountable amounts to persons who are not employees of the organization;

- employees who received funds for reporting, after the expiration of the period specified in the company’s accounting policy for which the money was issued, must report on their use and submit an advance report to the accounting department with documents confirming expenses;

- seconded workers submit an advance report on the use of money upon returning from a business trip;

- the issuance of money for reporting is carried out only if the employee has no debt on previous amounts received;

- The deadlines for issuing funds for reporting are established by order of the head of the enterprise or organization.

Accounting for settlements with accountable persons should ensure:

- timely and correct execution of orders (instructions) on sending employees on business trips;

- purpose and actual use of advances;

- travel certificates with notes on places of stay in accordance with the order of the administration;

- correctness and timeliness of preparation and submission of advance reports;

- the correctness of reimbursement of travel expenses and expenses for operational and economic needs;

- the correctness of the preparation of correspondence accounts for transactions with accountable persons;

- timely repayment of debt on previously issued advances;

- availability of supporting documents for all transactions.

The list of accountable persons and the rules for settlements with them, in accordance with the Accounting Rules (hereinafter referred to as the Rules), approved by order of the Minister of Finance of the Republic of Kazakhstan dated March 31, 2015 No. 241, must be included in the accounting policy of the enterprise. Accountable amounts are issued only to employees of the enterprise, and accounting of accountable amounts is maintained for each employee. The deadlines for submitting an advance report of an accountable person and returning cash are established depending on the purpose of the funds issued for the account.

Documenting

All business transactions of an organization must be documented with supporting documents, which are primary documents. In accordance with Article 7 of the Law of the Republic of Kazakhstan “On Accounting and Financial Reporting” dated February 28, 2007 No. 234-III, all accounting entries are made on the basis of primary documents.

Primary documents are accepted for accounting if they are drawn up in a form or in accordance with the requirements approved by the central government body that regulates activities in the field of accounting and financial reporting in accordance with the legislation of the Republic of Kazakhstan:

1. Resolution of the Board of the National Bank of the Republic of Kazakhstan “On approval of the Instructions for the preparation, use and execution of payment orders, payment requests-orders, collection orders” dated April 25, 2000 No. 179.

2. Order of the Minister of Finance of the Republic of Kazakhstan “On approval of forms of primary accounting documents” dated December 20, 2012 No. 562 (hereinafter referred to as Order No. 562).

3. Order and. O. Minister of Finance of the Republic of Kazakhstan “On approval of the Album of forms of accounting documentation for government agencies” dated August 2, 2011 No. 390.

Primary documents, both on paper and electronic media, the forms of which or the requirements for which are not approved by the regulatory legal acts of the Republic of Kazakhstan, are developed independently by individual entrepreneurs and organizations and must contain the following mandatory details:

1) name of the document (form);

2) date of compilation;

3) the name of the organization or the surname and initials of the individual entrepreneur on whose behalf the document was drawn up;

4) the content of the operation or event;

5) units of measurement of an operation or event (in quantitative and monetary terms);

6) names of positions, surnames, initials and signatures of persons responsible for the transaction (confirmation of the event) and the correctness of its (his) execution;

7) identification number.

Primary documents must be drawn up at the time of the transaction or event or immediately after its completion.

The most common use of imprest is for travel expenses.

Travel expenses

A business trip is a trip by an employee of an enterprise to another location to perform official tasks for a certain period of time and by order of the head of this enterprise. An employee connected with the enterprise by an employment contract can be sent on a business trip.

The basis for sending on a business trip is an order signed by the head of the enterprise. The order must contain an indication of the employee being sent, the destination and name of the institution, the purposes and timing of the trip. Copies of travel orders and supporting documents are located in a separate folder. The order may directly instruct the accounting department to calculate the amount of travel expenses.

According to Article 127 of the Labor Code, employees sent on business trips are paid:

1) daily allowance for calendar days of being on a business trip, including travel time;

2) travel expenses to the destination and back;

3) expenses for renting residential premises.

The need to take into account settlements with accountable persons is also determined in the Tax Code. The determination of taxable income of legal entities is calculated as the difference between total annual income and established deductions. Deductions in tax law refer to expenses associated with generating income from business activities. Expenses recognized as deductions must be supported by documents; otherwise, undocumented expenses cannot be deducted from the total annual income. Taxation rules provide for a number of expenses, which, when included in deductions, are normalized, that is, they are not deducted in full, but only within the limits provided for by regulations. The main part of the expenses that most enterprises must include in the normalized deductions are expenses for business trips, entertainment expenses, etc. Expenses for these purposes may exceed the maximum established norms, but the difference exceeding this limit must be made at the expense of net income, i.e., not included in deductions. It should be borne in mind that if reimbursement of expenses to an employee, for example for business trips, is carried out based on actual expenses incurred that exceed the norm, then this difference is included in the employee’s total annual income with the subsequent calculation of taxes. Only daily allowance amounts are included in the employee’s total income.

According to Article 101 of the Tax Code, compensation for business trips subject to deduction includes:

1) actual expenses incurred for travel to the place of business trip and back, including payment of expenses for the reservation, on the basis of documents confirming the expenses for travel and for the reservation (including an electronic ticket if there is a document confirming the fact of payment of its cost);

2) actual expenses incurred for renting residential premises, including payment of expenses for the reservation, on the basis of documents confirming the costs of renting residential premises and for the reservation;

3) daily allowances paid to the employee while on a business trip, in the amount established by decision of the taxpayer.

The time spent on a business trip is determined based on:

- an order or written instruction from the employer to send the employee on a business trip;

- the number of business trip days based on the dates of departure to the place of business trip and arrival back, indicated in the documents confirming travel. In the absence of such documents, the number of business trip days is determined based on other documents confirming the date of departure to the place of business trip and (or) the date of arrival back, provided for by the taxpayer’s tax accounting policy;

4) expenses incurred by the taxpayer when obtaining an entry visa (cost of a visa, consular services, compulsory health insurance), based on documents confirming the costs of obtaining an entry visa (cost of a visa, consular services, compulsory health insurance).

The amount of daily allowance can be set by the head of the company in the form of an appropriate order, but, as a rule, their amount corresponds to the amount that, in accordance with the Tax Code, is allowed to be deducted:

- for a business trip within the Republic of Kazakhstan - daily allowance not exceeding 6 times the monthly calculation index established by the law on the republican budget and valid as of January 1 of the corresponding financial year, for each calendar day of being on a business trip - for a period not exceeding forty calendar days of being on a business trip business trip;

- for a business trip outside the Republic of Kazakhstan - daily allowance not exceeding 8 times the monthly calculation index established by the law on the republican budget and valid as of January 1 of the corresponding financial year, for each calendar day of being on a business trip - for a period not exceeding forty calendar days of being on a business trip on a business trip (clause 4, clause 3, article 155 of the Tax Code).

In practice, the daily allowance in the accounting policies of organizations usually does not exceed 3–5 MCI. The estimate approved by the manager is filed with an expense order, according to which the employee going on a business trip is given the calculated amount of travel expenses.

Based on the order, the posted employee is issued a travel certificate signed by the manager before the start of the business trip. In this case, the entire front side of the travel certificate is filled out, and on the reverse side a note is made about the employee’s departure from the organization on a business trip. The date of departure is considered to be the start date of the business trip, specified in the order, for which a ticket must be purchased for which the employee travels to the city of the business trip.

The posted employee must make a note on the second side of the travel certificate indicating his arrival in the posted city in the organization to which he is sent, as well as a note indicating his departure from this city. It is by the marks in the travel certificate about the date of arrival at the destination and the date of departure from the destination that the actual time of stay in the places of business is determined. If an employee is sent to different localities, notes on the date of arrival and date of departure are made in each of them, as well as a note on return to his organization.

Registration of employees who left on a business trip and arrived from a business trip is carried out in a special journal according to the established form, where notes are made about the employee’s arrival.

Direct accounting of travel expenses themselves begins after the employee returns from a business trip and submits an advance report to the accounting department.

An advance report is drawn up by the employee within three days of returning from a business trip. On the front side of the advance report, the employee fills out information such as:

- name of company;

- department, position and last name, first name, patronymic of the employee who arrived from a business trip;

- number and date of preparation of the advance report;

- the purpose of the advance received is travel expenses;

- the amount of money received from the cash register;

- the amount of expenses actually incurred, which corresponds to the total of all expenses indicated on the reverse side of the expense report;

- the amount of the balance of unspent funds (the excess of the amount received from the cash register over the amount actually spent) or overexpenditure (the excess of the amount actually spent over the amount received from the cash register).

Before filling out the last two indicators, the accountable person fills out the back side of the expense report based on the available documents.

Advance reports with the documents attached to them are submitted to an accountant, who checks the legality and expediency of the expenses incurred, their compliance with approved standards, as well as the correctness of the accounts and documents.

The verified advance report is approved by the chief accountant and the head of the enterprise. Incorrectly completed advance reports and documents attached to them are returned to accountable persons for re-registration. The documents attached to the advance reports are stamped or handwritten with “Paid” or “Repaid” indicating the date (year, day, month). The accounting service ensures the timely submission of the advance report and the remaining cash in the report.

Cash for business needs

Amounts for economic needs are issued to financially responsible persons by order of the manager. The issuance is formalized by an expenditure cash order (f. KO-2, Appendix 2 to Order No. 562), where the specified amount is approved by the manager and chief accountant. This cash disbursement order indicates the purpose (purpose of use) of the money issued. Then the expenditure cash order must be registered in the logbook for registering incoming and outgoing cash documents in the KO-3 form (Appendix 3 to Order No. 562).

Advance reports have a standard form that is applicable in any situation: both when preparing a report on travel expenses and business expenses.

All business transactions involving the expenditure of accountable amounts must be confirmed by appropriate documentation issued to a legal entity, i.e., to the organization on whose behalf the employee makes purchases or pays bills.

These documents are primary accounting documents that record the fact of a transaction or event.

When paying for work, services, or purchasing goods from legal entities, it is necessary to draw up an advance report with the following primary documents attached:

- invoices;

- overhead;

- sales receipt;

- receipts for the cash receipt order;

- fiscal check.

The absence or incorrect execution of the above documents, even when confirming the fact of registration of material assets, will lead to the recognition of income of the reporting person, which is subject to income, social tax and contributions to the pension fund.

If the entire amount of expenses is documented, the manager signs an expense report verified by an accountant. If the funds are not completely spent, then they are returned to the organization with the drawing up of a cash receipt order (f. KO-1, Appendix 1 to Order No. 562) for the amount of the return. In this case, the front side of the advance report indicates the number and date of the PKO, according to which the accountable person returned the balance of unspent funds. In case of overexpenditure, the employee, on the contrary, is given the amount of overexpenditure according to the cash settlement system, also indicating his details on the title page of the expense report.

Accounting

According to the Standard Chart of Accounts, subsection 1200 “Short-term receivables” is intended for accounting for short-term receivables, which includes a group of accounts for calculating employee receivables 1250 “Short-term receivables of employees.” This group of accounts reflects transactions related to the movement of accounts receivable from employees for:

- funds issued as an account for the purchase of assets, payment for services, business trips and others;

- loans provided to employees, as well as calculations for compensation for material damage (shortage, theft, damage, etc.) caused to the organization by the employee, and other short-term receivables of employees.

In the case when the accountable person first provides a report on the use of his own funds and only after that the company reimburses him for the expenses incurred, subaccount 3392 “Short-term accounts payable for business trips” of the “Other short-term accounts payable” account is used.

The issuance of money from the cash register to the account is reflected in the correspondence:

D-account 1251 “Short-term receivables of employees: debt on accountable amounts”,

Account set 1010 “Cash on hand”.

An advance report reveals the purposes for which a company employee uses funds. If, when issuing money from the cash register to the account, account 1251 “Debt on accountable amounts” was debited, then when submitting the advance report, account 1251 will be credited, i.e., it will reflect for what purposes the accountable amounts were spent. In this case, it is necessary to indicate to the debit of which account, corresponding to the credit of account 1251, travel and other expenses will be written off.

It should be taken into account that the amount of costs excluding VAT for travel, bed, reservation, accommodation and daily allowance, i.e. direct costs of a business trip, can be charged to the following accounts:

- account 7210 “Administrative expenses”, if this is a business trip of an employee who is part of the administrative and managerial apparatus, as a result of which issues related to the entire activity of the organization are resolved;

- account 7110 “Expenses for the sale of products and provision of services”, if this is a business trip of an employee involved in the sale of products, goods or services of the company, and sales issues are resolved during the business trip;

- account 8048 “Other overhead expenses”, if this is a business trip for employees of the main production, which is related to the production process.

Correspondence of accounts D-t 3350 – K-t 1251 means that the employee’s debt to the organization for accountable amounts will be repaid through deduction from wages. If the head of the company does not satisfy the employee’s request for reimbursement of expenses incurred but not confirmed, then the salary due to the employee for personal payment will be reduced by the corresponding amount.

Expenses reimbursed to the employee (in the absence of documents) are considered additional income of the employee, which will be accrued to him in addition to the basic salary. In this case, correspondence of accounts will be compiled:

D-account 7210 “Administrative expenses”,

Account number 3350 “Short-term wage arrears.”

All income received by the employee (salary and reimbursable expenses) is subject to individual taxation, social taxes, social contributions and contributions to the accumulative pension fund.

In this case, these expenses are included as expenses in account 7210, but not as expenses of accountable persons from account 1251, but as additional income of the employee from account 3350.

When purchasing any material assets, you must first capitalize them, that is, show in accounting that they arrived at the enterprise's warehouse, and then draw up an act on their use and write them off from the warehouse for the company's expenses. Stationery purchased by an accountable person, if they are delivered to the warehouse, is reflected in account 1315 “Other materials”. But in the case when office supplies are not delivered to the warehouse, but are used immediately after purchase, for example during a business trip, then they should be written off as expenses to account 7210.

All amounts of allocated VAT on invoices, tickets, and receipts received from suppliers are reflected in account 1420 “Value Added Tax.” The accountant issues corresponding accounts, checking all attached primary documents.

Basic standard business transactions for accounting with accountable persons:

| Contents of a business transaction | D-t | Kit |

| Money was issued from the cash register for reporting | 1250 | 1010 |

| An overexpenditure on the advance report was issued from the cash register | 1250 | 1010 |

| Travel expenses are written off from the report | 7210 | 1250 |

| Written off from the report for the procurement of materials | 1310 | 1250 |

| VAT on them (materials) | 1420 | 1250 |

| The balance of the accountable amount was returned to the cashier | 1010 | 1250 |

| The balance of the accountable amount is withheld from wages | 3350 | 1250 |

It is necessary to carry out internal control of documentation relating to the expenditure of accountable amounts. For the manager or owner of an enterprise, control is necessary in order to preserve the assets of the enterprise and ensure that they are spent for their intended purpose. The control system aims not only to protect the owner’s property, but also to ensure the normal operation of the entire enterprise and all those working on it.

Account 71 active or passive

To understand whether account 71 is active or passive, you need to understand what the postings reflected on it show.

Accounting account 71 is a synthetic account, the analytics of which are carried out for each accountable amount. It can have a credit and debit balance both for analytical accounts and for the account as a whole. Therefore, account 71 in accounting is classified as active-passive accounts.

At the same time, this is essentially an active account. After all, what is shown here are settlements with employees for amounts received to pay for the company’s needs, and not at all settlements for “hidden lending” to the organization by its employees in the form of payment for production and business expenses.

When preparing financial statements, the balance of settlements with accountable persons on account 71 is shown in detail. The debit balance of account 71 is shown as part of short-term receivables on line 1230, and the credit balance is shown as part of short-term accounts payable, which is shown on line 1520.

Small enterprises that have the right to keep records in a simplified manner in accordance with clause 4 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, reflect credit balances in line 1230 “Financial and other assets”, and credit balances in line 1520 “ Accounts payable".

Filling out the balance: two general rules

If on the date of drawing up the balance sheet for account 71 you have non-zero debit and/or credit balances, the “accountable” debt must be reflected in it. In this case, two important rules should be observed:

This means that the debt of reporting entities is reflected in the balance sheet in expanded form: separately for debit and credit - if the relevant data is available in the records.

The second rule for reflecting settlements with accountables in the balance sheet is related to the period of circulation (repayment) of accountable amounts:

Typically, settlements with accountable persons occur multiple times within a calendar year, that is, they are short-term in nature. Therefore, they are reflected in the assets of the balance sheet in section II “Current assets”, and in the liabilities in section V “Current liabilities”.

If, based on the specifics of the company’s work and the specifics of relationships with accountable persons, certain amounts are repaid within a period exceeding 12 months after the reporting date, these amounts should be shown in the balance sheet based on the general rules - as part of long-term assets.

What does the debit of account 71 show?

The debit of account 71 shows the issuance of funds for reporting to employees of the organization in correspondence with accounts reflecting the accounting of funds:

- Dt 71 Kt 50 - the employee was given money for household needs from the company’s cash desk;

- Dt 71 Kt 51 (52) - money was transferred to the employee from the company’s current or foreign currency account for travel expenses,

Where:

accounts 50, 51, 52 - accounts on which funds are kept. The operation shows the advance of expenses made by the employee in the interests of the company. Such transactions are reflected in the left table on the front side of the expense report. The debit balance of 71 accounts consists of funds remaining in the hands of the accountants.

What does account credit 71 show?

Credit 71 of the account shows expenses made by the accountant for the needs of the organization. At the same time, the debit side of the transaction indicates the accounts on which the costs of purchasing goods and materials, services, etc. are kept. They show for what purposes the money received under the report was spent:

- Dt 10, 11, 41 Kt 71 - inventory items paid by the accountable were capitalized;

- Dt 19 Kt 71 - VAT issued by suppliers is accepted for accounting;

- Dt 76 Kt 71 - paid for the services of a third party;

- Dt 20, 26, 44 Kt 71 - reflects the payment of costs associated directly with the needs of the main production, general economic needs or with the sale of goods;

- Dt 50 (51) Kt 71 - the accountant returned unused money to the cash desk or to the company’s current account,

Where:

- accounts 10, 11, 41 - accounts for recording material assets;

- account 19 - “VAT on acquired values”;

- accounts 20, 26, 44 - accounts for recording costs for main production, economic needs or sales of goods;

- account 76 - “Settlements with other debtors and creditors.”

These entries to account 71 are made after the accountable person submits the advance report and are reflected in the right table on the front side of the advance report.

The credit balance of the account shows the presence of overspending on the accountant.

Postings and accounting of unreturned imprest amounts

Amounts not returned on time by the accountable person are shown on credit account 71 in correspondence with account 94 “Shortages and losses from damage to valuables”:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Dt 94 Kt 71 - writing off amounts not returned by the accountable as shortages.

Thereafter, depending on the circumstances, such amounts may be reflected as follows:

- deductions from the employee’s salary - Dt 70 Dt 94;

- other settlements with employees - Dt 73 Dt 94.

The unspent amount of the account can be withheld from the employee’s salary only within one month after the date by which the advance must be returned (Article 137 of the Labor Code of the Russian Federation). The deduction is made on the basis of a written order from the manager with the consent of the employee.

In all other cases, this amount is included in other expenses with the employee.

Note! According to Art. 138 of the Labor Code of the Russian Federation, the amount of deduction cannot exceed 20% of the wages paid to the employee.

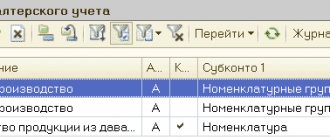

What can the balance sheet show for account 71

The balance sheet for account 71 allows you to see the process of forming balances on the synthetic account in the context of its analytics.

The analytical attribute (subconto) on which the statement is constructed is the accountable persons.

The balance sheet is formed over a certain period of time and allows you to control:

- incoming and final debt of accountable persons to the organization;

- incoming and final debt of the company to employees;

- amounts received for reporting;

- amounts reported by accountables.

It consists of 7 columns:

- the first indicates the score and its analytical sign;

- in the 2nd and 3rd - the balance at the beginning of the period;

- in the 4th and 5th - debit and credit turnover of account 71;

- in the 6th and 7th - the balance at the end of the period.

A separate final result is displayed for each column of the table.

Penalty for errors in reporting

If you show the final balance of payments in the balance sheet (the difference between accounts receivable and accounts payable on account 71), the indicators on line 1230 “Accounts receivable” of the asset and line 1520 “Accounts payable” on the liability side of the balance sheet will be unreliable. And this is fraught with negative consequences: a distortion of any balance sheet indicator by 10% or more is considered a gross violation of accounting rules.

The punishment for this violation is a fine on company officials from 5,000 to 10,000 rubles. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation). If the violation is committed and detected again, the fine will double. And the top officials of the company may be disqualified for a period of 1 to 2 years.

An example of filling out a balance sheet

As of 04/01/2020, the accountable Simonov S. has an overexpenditure of one amount received under the report in the amount of 1000 rubles. and debt on the second in the amount of 5,000 rubles. The deadline for the report has not yet arrived. The amounts are reflected in the opening balances.

In the second quarter, S. Simonov received 1,000 rubles from the cash register. (debit turnover) and compiled an advance report for the second amount in the amount of 4,500 rubles. (credit turnover).

After this, another accountable Vasiliev A. received an amount for household needs - 2800 rubles. (debit turnover).

Now the ending balance in the statement will look like:

Simonov S. - final debit balance: 500 rub.

Vasiliev A. - final debit balance: 2800 rub.

The company records settlements with accountants using subaccount 71.01 “Settlements with accountants in rubles.”

Note! An employee can receive a new sum of money against the report before the previous one is fully settled.

Reportable debts in a simplified balance sheet

Debt on accountable amounts must also be reflected in the simplified balance sheet. The same rules and approaches apply as described above for a regular balance.

The only clarification is that in the simplified balance sheet, the lines where accountable debt falls are called slightly differently:

Let us remind you that clause 4 of Art. 6 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. Small enterprises, non-profit organizations, and participants in the Skolkovo project have the right to draw up a simplified balance sheet using the form from Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

***

Account 71 reflects settlements between the organization and its accountable persons. The debit of the account shows the amounts issued to pay for the needs of the company, and the credit of the account shows paid goods, works, and services. To clearly monitor the movement of amounts in an account, a balance sheet is used.

Even more materials on the topic can be found in the “Accounting” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account characteristics

Synthetic accounting of settlements with persons to whom accountable amounts have been issued is organized on account 71. To answer whether this account is active or passive, you need to remember that its balance can be located either as a debit or as a credit. Thus, account 71 is an active-passive account with a double balance.

The balance at the beginning of the period in the debit of the account reflects the debt of the company's accountable persons for the money issued to them for established purposes. The account credit balance records the company's debt to the employee for expenses incurred at his own expense in the interests of the organization.

The debit of account 71 reflects the issuance of money for the purposes established by the enterprise or reimbursement to the employee of expenses approved by management that were previously made at his expense.

The credit of the account reflects the approved expenses of the accountable person, which are accepted by management, as well as the return of unspent funds to the cash desk or withholding them from the salary of the accountable person, if they are presented with an application for this method of repaying the debt.

To determine the ending balance, you must use the following algorithm:

- If the opening balance on account 71 is in debit, then you need to add the debit turnover on the account to it and subtract the amounts for the selected period on the loan. If you get a positive value, then the balance at the end will be a debit. Otherwise, it is reflected in the credit of the account.

- If the opening balance on account 71 is located in the credit of the account, then the turnover on the credit of the account should be added to it and subtract the total amount of movement on the debit of the account for the period under review. If the total value is greater than zero, it must be reflected as a credit to the account. A negative amount must be reflected in the debit of the account.

You might be interested in:

Account 69 in accounting: what is it used for, characteristics, subaccounts, typical transactions