When concluding a loan agreement, it is imperative to take into account the possibility of returning the borrowed funds. Therefore, all details must be agreed upon by the lender and the borrower before signing it. But even in such cases there is often trouble. And all because the parties to the contract do not always take into account the specifics of this process.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Cash loan repayment between legal entities?

2 tbsp. 819 of the Civil Code of the Russian Federation).

However, there are significant differences between these agreements.

Differences between a credit agreement and a loan agreement

1. A cash loan can only be issued by a bank or a credit organization (clause 1 of Article 819 of the Civil Code of the Russian Federation). A cash loan can be obtained from any citizen, entrepreneur or organization (Clause 1, Article 807 of the Civil Code of the Russian Federation).

2. An organization can receive (return) cash loans only by bank transfer (clauses 2, 3 of Bank of Russia Regulations dated August 31, 1998 No. 54-P). This restriction does not apply to the issuance (repayment) of loans (clause 1 of Article 810 of the Civil Code of the Russian Federation). A similar provision applies to the payment of interest. For the use of a cash loan, an organization has the right to pay only by bank transfer (Clause 1, Article 819 of the Civil Code of the Russian Federation, Clause 3.3. Regulations of the Bank of Russia dated June 26, 1998 No. 39-P). Interest on a loan can be paid both in money and property (Clause 1, Article 809 of the Civil Code of the Russian Federation).

3. A monetary loan agreement can only be interest-bearing (Clause 1, Article 819 of the Civil Code of the Russian Federation). Under a loan agreement, money can be issued without the condition of paying interest (Clause 1, Article 809 of the Civil Code of the Russian Federation).

4. A trade loan agreement is recognized as interest-free only if this is directly stated in its text (clause 1 of Article 819 of the Civil Code of the Russian Federation). A loan agreement in kind is such by default (clause 3 of Article 809 of the Civil Code of the Russian Federation).

Forms of providing a loan (credit)

A loan (credit) provided to an organization can be monetary or property (loan in kind, commodity loan).

This follows from the provisions of Articles 807, 809, 819, 822 of the Civil Code of the Russian Federation.

Terms of the loan agreement

Regardless of the amount, the loan agreement (credit agreement), in which the organization acts as a borrower (lender), conclude it in writing (clause 1 of Article 808, Article 820 of the Civil Code of the Russian Federation). This agreement is considered concluded from the moment of transfer of money or other things under it (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The amount of interest on the loan (credit) can be specified in the agreement. If there is no such clause, the organization must pay the lender interest at the refinancing rate in effect on the date of repayment (the entire amount of the loan (credit) or part thereof).

The procedure for paying interest can also be stipulated in the contract. But if this condition is absent, the organization must pay interest monthly until the loan (credit) is fully repaid.

If the lender (creditor) provides an interest-free loan (credit), this condition must be expressly stated in the agreement (with the exception of a loan issued in kind, which is interest-free by default).

This follows from the provisions of Article 809, paragraph 2 of Article 819 of the Civil Code of the Russian Federation.

When issuing a loan in cash, the lender can transfer the loan amount to a bank account (non-cash) or pay it in cash (clause 1 of Article 810 of the Civil Code of the Russian Federation). An organization can receive a cash loan only in non-cash form (clause 2 of the Bank of Russia Regulations dated August 31, 1998 No. 54-P).

Attention: when receiving a loan from organizations or entrepreneurs in cash, observe the cash payment limit.

The maximum amount for cash payments is RUB 100,000. This limit applies to settlements under one agreement:

– between organizations; – between the organization and the entrepreneur.

This is stated in paragraph 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013.

For failure to comply with the cash payment limit, administrative liability is provided under Article 15.1 of the Code of the Russian Federation on Administrative Offenses.

The fine is:

– for a manager – from 4000 rubles. up to 5000 rub.; – for an organization – from 40,000 rubles. up to 50,000 rub.

Situation: is it possible to accept a cash loan from an employee (or another citizen) if its amount exceeds 100,000 rubles?

Answer: yes, you can.

The cash payment limit applies only to agreements that an organization enters into with other organizations or entrepreneurs. The maximum amount of cash payments between organizations and citizens who are not engaged in entrepreneurial activities has not been established (clause 5 of Bank of Russia Directive No. 3073-U dated October 7, 2013). Therefore, an organization can accept any amount of cash from a person as a loan.

Situation: is it possible to accept a cash loan from the founder if its amount exceeds 100,000 rubles?

The answer to this question depends on who the founder is who provided the loan to the organization: a citizen or another organization.

Under agreements that an organization enters into with other organizations (entrepreneurs), a limit for cash payments is set at 100,000 rubles. (Clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013). This rule fully applies to loan agreements. Therefore, if the founder is another organization, then a cash amount of up to 100,000 rubles can be accepted as a loan. under one loan agreement.

The maximum amount of cash payments between organizations and citizens who are not engaged in entrepreneurial activities has not been established (clause 5 of Bank of Russia Directive No. 3073-U dated October 7, 2013). Therefore, if the founder is a citizen, the organization can accept any amount of cash from him as a loan.

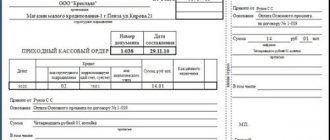

When receiving or repaying a loan in cash, draw up an outgoing or incoming cash order (forms No. KO-2 and No. KO-1, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88).

Notification by the bank of the financial monitoring service

On receipt by the organization of a loan (credit) in non-cash form in the amount of at least 600,000 rubles. banks must notify the financial monitoring service. This happens in the following cases:

– if the organization received an interest-free loan;

– if one of the parties to the loan (credit) agreement is an organization or citizen that is registered, domiciled or located in a state (territory) that does not participate in international cooperation in the field of combating legalization (laundering) of proceeds from crime and financing terrorism;

– one of the parties to the loan (credit) agreement is the person who owns an account in a bank registered in the specified state (in the specified territory).

The list of such states (territories) is established by the Government of the Russian Federation.

This is stated in Article 6 of the Law of August 7, 2001 No. 115-FZ, letter of the Bank of Russia dated April 11, 2006 No. 12-1-3/804.

Repayment of loan (credit)

The organization is obliged to repay the received loan (credit) on time and in the manner prescribed by the agreement. If the repayment period is not established, the organization must repay the loan no later than 30 days after the lender (creditor) made such a demand.

An organization has the right to repay an interest-free loan (credit) early. Early repayment of interest-bearing loans (credits) is allowed only with the consent of the lender (creditor). This procedure is established by Article 810 and paragraph 2 of Article 819 of the Civil Code of the Russian Federation.

The loan can be returned in cash or by bank transfer (Clause 1, Article 810 of the Civil Code of the Russian Federation). A loan received in cash can only be repaid by bank transfer (clauses 2, 3 of Bank of Russia Regulations dated August 31, 1998 No. 54-P).

Issuance and repayment of a loan (credit) in cash

When receiving a loan or returning borrowed funds in cash, draw up an incoming or outgoing cash order (forms No. KO-2 and No. KO-1, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). Receipt of a loan (credit) in non-cash form can be confirmed by an extract from the organization’s current account. Repay the loan (credit) by non-cash method using a payment order in form No. 0401060.

Situation: is it necessary to use cash register when receiving and returning cash loans (credits), as well as when paying interest on them?

Answer: no, it is not necessary.

The use of cash registers is mandatory for cash payments for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). When receiving (repaying) cash loans (credits), the sale of goods (work, services) does not occur (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of August 3, 2004 No. 3009/04). Therefore, neither when receiving a cash loan (credit), nor when returning it, nor when paying interest on the loan, do not use cash registers. The regulatory agencies also agree with this conclusion (letters from the Ministry of Finance of Russia dated May 10, 2011 No. 03-01-15/3-51 and the Federal Tax Service of Russia dated June 10, 2011 No. AS-4-2/9303).

Issuance and repayment of a loan (credit) in kind

In addition to money, the lender (creditor) can lend the organization property that belongs to him. In this case, the transaction is a loan in kind or a trade loan.

From an accounting perspective, there are no differences between a loan agreement in kind and a commodity loan agreement. There are only a few legal specifics.

For example, a loan agreement will come into force at the moment of transfer of things (clause 1 of Article 807 of the Civil Code of the Russian Federation). Trade loan agreement – on the day of signing (paragraph 1 of Article 822 of the Civil Code of the Russian Federation). This means that from the moment the trade credit agreement is signed, the employee will have the obligation to transfer the property specified in it to the organization.

Unlike a loan agreement, in a trade loan agreement it is necessary to more clearly indicate the characteristics of the transferred values (paragraph 2 of Article 822 of the Civil Code of the Russian Federation). In addition, a trade loan agreement is recognized as interest-free only if this is directly stated in its text (clause 1 of Article 819 of the Civil Code of the Russian Federation). A loan agreement in kind is such by default (clause 3 of Article 809 of the Civil Code of the Russian Federation).

The loan must be repaid in kind (commodity credit) with property - an equal amount of other things of the same kind and quality (clause 1 of Article 807, Article 822 of the Civil Code of the Russian Federation).

Home — Articles

What's happened

The process of drawing up a loan agreement involves the transfer of a certain amount of funds from the lender to the borrower, which the borrower undertakes to return to the borrower within a certain period of time with or without interest.

A prerequisite is the execution of documents in accordance with the law. It can also be noted that the loan agreement must contain all the information on the loan, including whether a penalty must be paid in case of late payments or not. In this way, lenders guarantee themselves the return of their funds in full and within a certain period of time.

It is important to note that large delays for a long time entail the accrual of various fines, commissions and penalties. In completely advanced cases, the creditor can begin to collect funds through the court. The law also allows you to assign the rights to a loan to another organization (often these are collectors).

That is why the loan must be repaid within the allotted time frame. The borrower must understand that in the event of their violation and malicious non-payment of the debt, he will only face an increase in the loan, and in extreme cases, legal troubles.

New rules for receiving and spending cash from the cash register

It will soon be necessary to pay in cash with other organizations and entrepreneurs according to new rules. The Bank of Russia established new rules for cash payments in Directive No. 3073-U dated October 7, 2013 “On cash payments.” The new rules come into force on June 1, that is, 10 days after the date of publication of Directive No. 3073-U in the Bulletin of the Bank of Russia (published on May 21).

Note! The old Instruction No. 1843-U, dedicated to cash payments, has been canceled (Instruction of the Bank of Russia dated October 16, 2013

No. 3076-U).

Below you will find a table that will help you quickly determine what amounts are allowed to be paid without complying with the limit and from the proceeds.

What and how can you spend cash?

| Pay | Can it be issued (paid) from cash proceeds? | Is it possible to issue (pay) more than 100,000 rubles. |

| Settlements with employees | ||

| Salaries and employee benefits | Yes | Yes |

| Issuance of cash on account | Yes | Yes |

| Settlements with counterparties | ||

| Payment for goods (except for securities), works, services | Yes | No |

| Payment of money for returned goods (uncompleted work, unrendered service), previously paid in cash | Yes | No |

| Payment of money for returned goods previously paid by bank transfer | No | No |

| Loans, repayment of loans and interest on them | No | No |

| Dividends | No | No |

| Payments under a real estate lease agreement | No | No |

| Cash entrepreneur | ||

| Money for personal purposes not related to running a business | Yes | Yes |

Limit of 100,000 rubles. obligatory for all parties to the contract

The limit for cash payments remains the same - 100,000 rubles. under one contract. That is, the maximum amount should, as before, include the total amount of cash payment for one transaction. Even if one party to the contract transfers money to the other in parts. For example, a buyer pays for a product in installments.

The very rule about the need to conduct cash payments within the limit has been formulated in a new way. There was such a thing as participants in cash payments. They are considered to be any legal entities and entrepreneurs. All of them have the right to pay in cash within the framework of one agreement only within the limit (clause 6 of Directive No. 3073-U).

For exceeding this limit, a fine of up to 50,000 rubles is provided. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, for a long time the question of who the tax authorities have the right to bring to administrative responsibility for this violation remained controversial: both parties to the contract, only the seller who receives cash, or only the buyer who pays with it. Inspectors fined both of them. And the judges recognized this as lawful (resolutions of the FAS Volga-Vyatka District dated November 30, 2010, section No. A28-2959/2010 and the FAS Volga District dated October 12, 2010, section No. A65-6852/2010).

Now there will be no disputes. Administrative liability is established for over-limit payments. Participants in cash payments are both parties to the agreement. So the tax authorities have the right to fine both the one who received more than 100,000 rubles and the one who paid the excess amount for exceeding the limit.

Companies and entrepreneurs can, as before, pay with individuals in cash without any restrictions on amounts. For example, any cash amount can be paid to a private contractor for work or service, or received as a loan from an employee or founder. There was no ban before, but now it is directly permitted by paragraph 5 of Directive No. 3073-U. Thus, officials decided to delay setting a limit on cash payments to ordinary citizens. There was an idea to introduce a limit in the amount of 600,000 rubles in 2014, and from 2016–2017 to reduce it to 300,000 rubles.

What taxes are subject to the transaction?

As a rule, the attraction and subsequent repayment of an interest-free loan in cash is not accompanied by any tax consequences for the shareholder-lender and the borrower company.

Tax consequences arise when we are talking about the repayment of interest accrued on an interest-bearing loan provided by the founder-creditor to a business company.

If the shareholder-lender is an individual, the interest paid to him is considered income subject to personal income tax (standard rate - 13%).

If the shareholder-lender is a legal entity, the interest that he receives is considered income, increasing the tax base of his profit. For the borrowing company, the interest paid is considered an expense that reduces the tax base of its profit.

Limit 100,000 rub. valid regardless of the contract term

The new rules clarify what is meant by payments under one agreement. These are settlements for obligations stipulated by the contract, which are fulfilled both during the validity period of the contract and after its expiration (clause 6 of Directive No. 3073-U). Thus, the limit must be observed even when transferring and receiving cash under a contract that has expired.

Note! The limit must be observed even when receiving or transferring cash under an agreement that has already expired.

Example: A company settles in cash when the contract period has passed

The two companies entered into a service agreement for a period of two months (May-June). The contract price is 150,000 rubles. According to the terms of the contract, the contractor issues a certificate for the services provided and an invoice, which the customer must pay no later than June 30. The customer was late with payment: he was able to pay for the services only on July 10. And although the contract has already expired, the customer has the right to deposit cash only in the amount of 100,000 rubles. And 50,000 rubles. must be transferred by bank transfer. For violation, tax authorities can fine not only the customer, but also the contractor.

The previous Directive No. 1843-U did not have such a clause. But the Bank of Russia officially clarified: the limit also applies to obligations fulfilled after the end of the contract (official clarification dated September 28, 2009 No. 34-OR).

Accounting and postings

Any short-term loans raised by the borrowing company for a period not exceeding 12 (twelve) months are reflected in account 66 in its accounting.

Any long-term loans received by a business company for a period exceeding 12 (twelve) months are accounted for in account 67 of its accounting.

Operations for obtaining and repaying loans issued by the founders are recorded in the accounting records of the borrower company with the following entries:

| Procedure | Debit | Credit |

| The company raises a loan from its founder | 51 | 66 (67) |

| Interest accrued on the borrowed loan is reflected | 91 | 66 (67) |

| Borrowed funds are returned to the founder and creditor | 66(67) | 51 |

| Interest accrued on the loan is transferred to the founder and lender | 66(67) | 51 |

Any amount can be reported from the proceeds

Accountables can be issued from cash proceeds in any amount. Limit of 100,000 rubles. in this case it has no effect. This is now directly stated in paragraphs 2 and 6 of Directive No. 3073-U.

In the previous list of purposes for which proceeds from the cash register can be spent (clause 2 of Directive No. 1843-U), only travel expenses were listed, and accountable expenses were not mentioned. Formally, it turned out that the proceeds from the cash register could be given on account only to those who were going on a business trip. True, the lack of judicial practice indicates that in practice there were no disputes on this matter. That is, the tax authorities did not see a violation in the fact that the company spends cash proceeds on issuing reports not to seconded employees, but to those who need cash to purchase goods or services for the organization. Now the claims are completely excluded.

As for compliance with the limit of 100,000 rubles, the Bank of Russia explained the following. If an employee spends accountable expenses on a business trip, then there is no need to adhere to the limit when paying for housing and travel. If the accountant’s expenses are not related to a business trip, for example, he buys office equipment for the company, then under one agreement you can pay in cash only up to 100,000 rubles. (letter dated December 4, 2007 No. 190-T).

You cannot issue loans and pay rent from the cash register.

Paragraph 4 of Directive No. 3073-U provides a new list of transactions for which the company and entrepreneur can pay exclusively with cash withdrawn from the current account. You cannot use cash proceeds directly from the cash register. This list includes settlements for securities, lease agreements, loans, as well as for the organization and conduct of gambling.

This restriction applies not only to settlements between companies, entrepreneurs, or a company and an entrepreneur. This also applies to their settlements with individuals.

In this case, the limit is 100,000 rubles. must be observed only under agreements concluded either between two companies, or between a company and an entrepreneur, or between two entrepreneurs. If one of the parties to the agreement is an individual, then the limit does not apply (clause 5 of Directive No. 3073-U). Let's take a closer look at the rules on rent and loans.

Rent . To pay cash for renting real estate, you need to withdraw it from your account. The company has no right to use proceeds from the cash register. Moreover, regardless of who the contract was concluded with - with another organization, with an entrepreneur or with a private individual.

Note! Cash proceeds from the cash register can be used to pay for renting a car or other movable property. When renting real estate, you need to withdraw money from your account or pay by bank transfer.

Companies and businessmen must comply with this rule regardless of whether they pay rent in cash or, for example, pay off fines and penalties or make a deposit. In addition, the restriction applies to both tenants and landlords. In most cases, the tenant pays in cash when he makes a payment to the landlord for the use of the property. But another option is also possible. For example, the landlord may return the overpayment under the contract to the tenant. To do this, you also need to use cash withdrawn from the account. After all, Directive No. 3073-U deals with all operations under a lease agreement.

At the same time, this restriction does not apply to the rental of movable property. A company that rents, for example, a car, has the right to repay the next payment from cash proceeds. It is not necessary to first deposit it into your account and then withdraw it in order to pay.

In the previous Directive No. 1843-U there was no direct clause stating that rent must be paid only from money withdrawn from the account. At the same time, rent was not on the list of purposes for which cash proceeds could be spent. That is, formally the restriction existed before. But if until recently tax authorities did not focus their attention on this, now cash payments for rent will certainly begin to arouse close interest among inspectors.

Loan . The ban on the use of cash proceeds from the cash register applies to both the issuance of loans and their repayment and interest payments. That is, it concerns both parties to the contract - both the lender and the borrower. In addition, the ban on spending proceeds applies not only to contracts concluded between two companies or a company and an entrepreneur, but also to contracts signed with an individual. This could be, for example, a founder who gave a loan to his company. Or a director who, on the contrary, received a loan from the organization. It also does not matter what kind of loan was received or issued - interest-bearing or interest-free.

In the previous Directive No. 1843-U, payments under loan agreements were not included in the list of purposes for which cash proceeds can be spent. Referring to this, Bank of Russia specialists explained that such cash cannot be used to issue loans (letter dated December 4, 2007 No. 190-T). The tax authorities fined the violators, and the judges supported them (resolution of the Federal Antimonopoly Service of the West Siberian District dated May 27, 2010, section No. A03-14966/2009). Inspectors also fined those who repaid loans or paid interest on them in cash from the proceeds. It was not possible to cancel these fines (decision of the Moscow City Court dated December 14, 2012, case No. 7-2207/2012).

How to apply

Recently, loans and other types of loans have become very popular not only among the population of the Russian Federation, but also among private entrepreneurs. There are many reasons for this, but the most important is that this is almost the only way to quickly get the funds that a person or enterprise needs.

Today in the lending market you can find a lot of credit institutions of various types that are ready to engage in lending. Among them are:

- banking institutions;

- MFO;

- consumer credit offices.

But you can also borrow from an individual. In this case, a loan agreement is not concluded so often, but it is the only one that guarantees the return of funds from the borrower back to the lender. Neglect of this document causes a lot of unresolved disputes.

The founder of an organization can also act as a creditor if funds from him are directed to the development of the company he created. Such a procedure must also fully rely on the law and not go beyond its limits.

But the type of lending does not directly affect the procedure for drawing up a loan agreement. To do this you should take the following steps:

- submit an application;

- wait for a decision to be made;

- conclude all necessary agreements (if necessary, sign additional papers);

- receive loan funds.

Often, before lending money to someone, lenders will conduct an analysis of the potential borrower's state of affairs. This guarantees a high percentage of loan repayment. Often, in order to ensure loan repayment, lenders require borrowers to have collateral or guarantors.

The borrower should also pay more attention to those clauses of the loan agreement that relate to the repayment of funds. The most important among them are:

- loan interest rate;

- designated refund procedure;

- the possibility and conditions of repaying the loan ahead of schedule;

- is collateral required;

- whether the person will face penalties due to late payment.

Careful study of these points will help the borrower avoid problematic situations and pay his debt on time and in full.

The entrepreneur has the right to take at least all the proceeds from the cash register.

Entrepreneurs were able to withdraw proceeds from the cash register without any fear. To spend the proceeds for personal purposes, a businessman does not need to first deposit them in the bank and then withdraw them from the account. The issuance of money to an entrepreneur for personal needs not related to his activities is now directly named in the list of purposes for which proceeds from the cash register are allowed to be spent (clause 2 of Directive No. 3073-U).

There are also no restrictions on the amount - the entrepreneur has the right to withdraw all accumulated cash proceeds from the cash register. The limit for this operation is 100,000 rubles. does not apply.

Note! A businessman can take money for personal needs directly from the cash register. There is no need to hand them over to the bank and then withdraw them.

Since 2012, entrepreneurs have an obligation to set a limit on the cash balance in the cash register (clause 1.2 of the Bank of Russia Regulations dated October 12, 2011 No. 373-P). In this regard, confusion arose as to whether businessmen could withdraw cash proceeds from the cash register for their own purposes. Or you need to deposit your proceeds into your current account and only then withdraw cash and take it for yourself. The new rules solve this problem: it is now obvious that a businessman does not risk anything if he receives from the cash register all the cash that is there, including proceeds from goods sold. The main thing is to write in the consumables that the money was given to the entrepreneur for personal needs.

May 2014