Types of employment contracts

Labor contracts are classified according to several principles:

Articles on the topic (click to view)

- What to do if the employer does not give the employment contract

- What is the difference between a collective agreement and an employment contract?

- Apprenticeship contract with an enterprise employee: sample 2021

- Terms of remuneration in an employment contract: sample 2021

- Go on maternity leave from the labor exchange

- Notice of extension of a fixed-term employment contract: sample 2021

- Notice of termination of a fixed-term employment contract: sample 2021

- Due to time restrictions.

- On labor relations.

- Depending on the employer.

- By employee status.

- According to the conditions (nature) of work.

Let's take a closer look at each type. The first two types are the main ones. The rest are considered secondary.

According to time restrictions

Any contract, regardless of its content and purpose, has a validity period. The labor type is no exception. The validity period of the document can be indefinite or specific. That is, spelled out in a separate paragraph. Typically, upon employment, a document is drawn up for five years. Less often - for a year. Such relationships are called fixed-term. And they expire when the specified period arrives. After the contract expires, the parties can extend it. Or sign a new one.

Permanent contracts are still used more often. From a legal point of view, they are more convenient because they do not require renewal. And the parties can terminate and terminate the relationship by mutual agreement or by decision of one of the parties. But all these provisions must be reflected in the document as a separate paragraph.

Article 59 of the Labor Code of the Russian Federation lists cases in which it is possible to conclude only fixed-term contracts. For example, if an employee is hired for a position temporarily instead of an absent permanent employee. A woman goes on maternity leave or when she needs to do one-time work. In this case, the duration of the current contract is an additional condition. And here there is an important nuance - if the period is not specified, then the contract is considered concluded for an indefinite period. And it refers to the indefinite.

By type of employment relationship

Labor relations vary in nature.

This classification is influenced by the following points:

- Place of main work.

- Part-time job. An entire chapter of the Labor Code, No. 44, is devoted to such relations.

- Temporary activity. If an employee is employed for a period of no more than two months, a temporary agreement is drawn up for this period. For example, if one employee came to replace someone who was sick or on vacation. The procedure for such legal relations is regulated by Chapter 45 of the Labor Code of the Russian Federation.

- Seasonal work. Such employment relationships are also temporary, but they have a longer term. For example, a contract is concluded for three autumn months for the purpose of harvesting. “Seasonal” contracts are prescribed in Chapter 46 of the code.

- Necessary work. Work from home agreement. For example, if a person does not visit the office, but prepares documentation for the enterprise while at home. Home work includes many types of activities. And all of them are subject to legal regulation through an appropriate agreement. Such relations are regulated by Chapter 49 of the Labor Code.

- State or municipal service. This type of agreement is drawn up between authorized employees of public sector sectors and hired government or municipal employees. The Labor Code does not control such relations. All relevant provisions are collected in a special law.

Depending on the employer

This classification is based on the legal status of the employer. There are organizations (legal entities) and individual entrepreneurs that register without forming a legal entity.

Depending on who the employee is hired to work with, different contracts are created:

- Between the employee and the organization.

- Between employee and entrepreneur.

There is another type of employer – individuals. This includes, for example, owners of large houses and plots who hire workers to help. Gardeners, nannies, cooks, and cleaners are included in this area. They must also document their relationship in writing with an appropriate agreement. All the rules of such agreements are prescribed in Chapter 48 of the Labor Code. At the same time, all payments due to the employee are not lost. Even if the employer is not registered with the tax authority, he is obliged to make appropriate insurance and pension payments to his subordinate.

By employee status

Job applicants vary in their civil status.

This is important to know: Irregular working hours in an employment contract: sample 2021

Depending on this, employment contracts have different specifics and corresponding conditions:

- With minors. Persons under 18 years of age have privileges and rights. Additional clauses in this regard are included in the contracts. They cannot be indefinite, for example. Children have a different work-rest schedule, unlike emancipated workers.

- With persons fulfilling family obligations.

- With citizens of other states (with foreigners).

- With persons who temporarily do not have Russian citizenship.

According to working conditions

The nature (conditions) of work also differ.

This must be written down in the documentation, since the consequences and attitudes towards employees change.

- Normal conditions. The generally accepted rules for TD (employment contracts) apply here.

- Night work.

- Severe climatic zones - work in the Far North and nearby territories.

- Hazardous or harmful conditions.

The second, third and fourth points relate to unusual (heavy) working conditions.

Drawing up an employment contract, sample

A sample of the new contract (2021) is available by clicking the button:

You can quickly and correctly draw up an employment contract by downloading this form in Word.

Note! It is not enough to fill out an employment contract correctly. A standard contract often needs to be adjusted taking into account the labor characteristics of a particular enterprise.

Registration of an employment contract consists of three stages.

Submission of documents

The employee provides the following documents to the HR department of the enterprise to conclude an employment contract:

- passport or other identity document;

- employment history;

- insurance certificate of state pension insurance;

- certificate of assignment of a taxpayer identification number (TIN);

- educational documents;

- military ID, military registration documents;

- medical insurance policy;

- medical certificate of the established form, health book.

If an employee enters an official place of work for the first time, the work book, state pension insurance certificate and TIN are issued by the employer (HR department).

How to draw up an employment contract with an employee

There is no single sample employment contract. Each employer, in accordance with the norms and requirements of the Labor Code of the Russian Federation, develops its own employment contract form. There are generally accepted rules on how to correctly draw up an employment contract.

The document is in written form in Russian; in constituent entities of the Russian Federation where the language of the indigenous population is widespread, there may be a translation; in the case of an international partnership – additionally in one of the foreign languages.

The employment contract is concluded in at least two copies: after both parties have signed the document, one copy is given to the employee, and the second is kept by the employer in the human resources department.

Contents of the employment contract, based on Art. 57 of the Labor Code of the Russian Federation, must include the following mandatory conditions:

- full name of the enterprise (organization), legal address, OGRN (main state registration number) - for an organization or OGRNIP - for an individual entrepreneur;

- Full name of the employee, date of birth, registration and residence address;

- The position for which the employee is hired, the job responsibilities associated with it, and the place of work are also best indicated in the employment contract.

- work start date;

- responsibilities and rights of the employee; if he undergoes training at the employer’s expense, he may be required to work for a certain period of time after completing his studies;

- rights and obligations of the employer;

- labor discipline: work schedule, working hours and rest hours, breaks, vacation periods, as well as requirements for appearance in the workplace, wearing work clothes and uniforms;

- description of working conditions, characteristics of the workplace;

- salary;

- probationary period (if provided by the employer): duration, daily working hours for the internship period; paid or not paid;

- type of employment contract - fixed-term (for what period) or indefinite, simple or with important annexes;

- types of social insurance;

- Details of the employee and the company, signatures of both parties, seal of the organization.

Working conditions can be changed and included in the employment contract by mutual consent of both parties.

If an entrepreneur unilaterally makes changes to an employment agreement regarding working conditions, he is obliged to notify the employee no later than 14 calendar days before they enter into force.

In case of changes in legislation, it is not necessary to conclude a new version of the employment contract. All you need to do is draw up and sign an additional agreement.

Employment contract with trade secrets and financial liability

The specifics of work activity in some cases require the introduction of special conditions into the agreement between the employee and his employer. Conditions that fall into this category include:

- With a trade secret. Involves consent to non-disclosure by the employee (at the request of the employer) of information. The trade secret regime is notified in writing.

- With financial responsibility. Most often, this condition is formalized in a separate document - an additional agreement.

Trade secret agreement, example:

Appendix to the contract with full financial liability:

Indefinite and fixed-term employment contracts: main differences

The Russian Labor Code provides for the following types of labor agreements:

- Indefinite employment contract. Imprisoned for a term of more than 5 years. An agreement will be considered indefinite even if the term is not specified in it.

- Urgent. They are drawn up for a certain period, but not more than 5 years. Extension of the contract for a new period may be necessary if the full scope of work has not been completed during the specified period.

- Temporary. To perform certain work, for example, repair, seasonal, public works, maintenance services.

- A contract or employment agreement is a type of fixed-term employment contract, where the employer prescribes often strict, uncompromising conditions to achieve a certain goal (once it is achieved, the term of the agreement ends); common in the armed forces, paramilitary units, and show business. A sample contract is available at this link.

An employment contract for an indefinite period is the simplest and most common type of formalization of employment relations.

Employment contract for a probationary period

A probationary period is the period of a candidate’s tenure in a position in order to master the specifics of the job and acquire the missing knowledge and skills. During the internship, a potential employee will be able to understand whether the working conditions are suitable for him. And the employer will evaluate the candidate’s qualifications, compliance with professional standards and prospects.

The labor legislation of Russia regulates the following testing periods in the workplace:

- for most specialties and positions – cannot exceed three months (the specific period of up to three months is determined by the employer);

- for chief accountants, managers and their deputies – no more than six months.

The period of illness or absence of an employee from the workplace is not counted in the probationary period.

If the employer is not satisfied with the candidate, he is obliged to notify him no later than 3 days before the end of the internship of his professional unsuitability for work in this position. At the initiative of one of the parties, an employment contract with a probationary period may be terminated even before the end of the probationary period.

It is prohibited to subject the following persons to a probationary period when hiring:

- minor workers,

- pregnant women,

- mothers with children under the age of one and a half years,

- first time applicant applying for work,

- employee on transfer from another place of work,

- employees hired for a period of up to two months, etc.

If an employee is employed under a fixed-term employment contract for a period of two to six months, the probationary period cannot exceed two weeks. The employment contract for the probationary period must also establish payment for the internship period.

If the document does not contain instructions on preliminary testing, it is considered that the employee was hired without a probationary period.

Civil employment contract

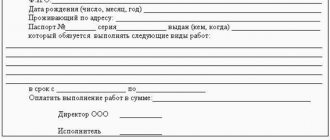

This type of labor agreement, unlike an employment contract, is regulated not by the Labor Code, but by civil law. A civil contract is concluded both with an employee of an enterprise and with a person who is not in an employment relationship with this organization.

The difference is that a standard employment contract specifies the employee’s wages for the process of his work, while a civil contract establishes payment for the result of work.

Under a civil law contract, an employee does not have any social benefits (except for voluntary social insurance) - vacation, sick leave, compensation for damage as a result of an injury at work, etc.

The employee completed his work within the period specified in the contract, received payment for the result that satisfied the customer, and is free.

Such an employee is not obliged to obey the discipline or schedule of the enterprise. He has his own individual work schedule specified in the contract. At the same time, the employer does not bear any responsibility for all kinds of risks and their consequences.

There are the following types of civil law contracts: contract for the provision of services, transportation, hiring.

Collective labor agreement

A collective labor agreement is a type of agreement that is concluded between the employer and the representative body of the workforce (trade union, union of team members elected by employees). Such an agreement is intended to regulate production, socio-economic relations between the employer and the collective of workers, protect the interests of each party, and find compromise solutions in disputes and conflicts.

Such an agreement is concluded at enterprises of any form of ownership where hired labor is used. It is the collective labor agreement :

- explains in detail the rights and obligations of the employee and the employer;

- specifies the work schedule, work and rest schedule (including the duration of annual paid leave, unpaid leave, etc.), individual work schedule for employees combining work with training, advanced training courses;

- establishes wages and the likelihood of its increase, as well as bonuses, compensation, additional payments, etc.;

- describes in detail possible benefits for workers (for example, free delivery to homes, meals at the expense of the employer, health vouchers for large families, etc.);

- considers labor protection conditions;

- standardizes the provision of medical care, health improvement, living space for employees at the expense of the employer, etc.

This local regulatory document cannot prescribe conditions that worsen the position and working conditions of workers in comparison with the regulated conditions of the Labor Code of the Russian Federation.

The collective labor agreement is registered with the regional branch of the Ministry of Labor of the Russian Federation within seven days after signing by both parties. It comes into force from the day it is signed by all members of the workforce and the employer or from the date established in it. Such a document is concluded for a period of 1 to 3 years; upon expiration of the period, it can be extended for a similar period, subject to the consent of both parties.

There are fines for violation and failure to fulfill the obligations of the collective agreement.

Fixed-term contract for seasonal work

The duration of seasonal work cannot exceed 6 months. A short-term employment contract with a seasonal worker is concluded according to general rules.

Such an agreement must indicate the seasonal nature of the work. The probationary period for seasonal employment should not exceed two weeks. This type of work provides paid leave according to the standard scheme - 2 calendar days for each month worked.

In case of early dismissal (at his own request, for health reasons or for other reasons), the seasonal employee is obliged to inform about his decision in writing at least 3 calendar days before leaving.

Employment contract without official employment

In the case of work without drawing up a work book - under an employment contract without employment (civil employment contract) - the employer does not bear any financial liability in the event of an industrial injury, illness of an employee, damage to his work tools, uniform, etc.

The employer's obligation is limited only to monthly contributions to the Russian Pension Fund and to the compulsory health insurance fund. In other labor aspects, the customer is free in his actions. This position of management is beneficial and typical for micro-enterprises: an employment contract without formalizing employees reduces the company’s expenses on taxes and standard social benefits for the employee.

Russian legislation allows employment without an entry in the work book, but with the conclusion of an employment contract. This applies to the following types of contracts:

- author's employment contract without official employment: a person performs one-time creative work (for example, creating an interior design, melodies for a song, etc.);

- contract: performance of repair and construction services by an employee;

- agency agreement: short-term employment of an employee to perform a specific task.

The legal framework provides for work under an employment contract without issuing a work book in the case of part-time employment (the work book is issued at the employee’s main place of employment).

Like a standard employment contract, an employment agreement without a work book must contain clearly defined rights and obligations of the employee, deadlines for completing the work, the amount of payment based on the results of the work, as well as possible fines for violating the contract.

A sample civil contract can be downloaded above.

Sample agreement for a part-time worker:

Free employment contract

According to Russian legislation, an individual (including an entrepreneur) and a legal entity of any form of ownership, on their own initiative, has the right to provide services without payment - on a gratuitous basis. If you have such a desire and opportunity, you need to draw up a gratuitous employment contract.

In form, such an employment agreement does not differ from a standard paid employment contract. The content is especially in that it necessarily has a clause on the gratuitousness of the work and a detailed description of the free service provided.

Download document

Employment contract with a minor employee

Typically, persons over 18 years of age are officially employed. The Labor Code of the Russian Federation prohibits the use of the labor of minors under 14 years of age, otherwise the employer will face administrative and criminal liability.

An exception is the participation of a minor child under the age of 14, with the consent of one of the parents (adoptive parents, guardians, trustees), in the creation and interpretation of works of theater, cinema, circus performances and concert shows.

An individual can enter into an employment contract from the age of 16, if his work duties are not included in the list of works that only persons who have reached the age of majority are allowed to perform.

It is prohibited to use the labor of minors aged 14 to 18 years in the following areas:

- dangerous, harmful production,

- underground works,

- gambling business and entertainment establishments,

- production of alcohol and tobacco products, toxic substances and narcotic drugs.

Persons who have reached the age of 14 years can be hired only with the consent of at least one of the parents (adoptive parents, guardians, trustees). At the same time, such an employee is burdened with exclusively light work without harm to health and performs his duties in his free time from study (correspondence course).

The employment of a 15-year-old worker should not prevent him from obtaining a certificate of complete secondary education.

For an employee aged 14 to 15 years, the working day is 2.5 hours and the working week is 12.5 hours. A minor employee between 15 and 16 years of age must work no more than 5 hours a day and 24 hours a week. For workers aged 16 to 18 years, the following regime is established: a maximum of 7 hours a day and 35 hours a week.

A minor employee is required to take a break and pay an annual leave of 31 calendar days.

An employer does not have the right to issue a power of attorney to an employee aged 14 to 18 years to carry out operations related to making a profit, since a minor does not have full legal capacity.

In this case, the minor employee is responsible for his actions in relation to his work duties. In case of systematic violation of labor discipline (absenteeism, tardiness), negligent attitude towards one’s labor duties, the employer has the right to terminate the employment contract with a minor employee unilaterally.

Employment contract with training pay

If an employee has undergone vocational training at the expense of the company, the employer has the right to stipulate in the employment contract with the young specialist the obligation to work for a certain period of time after training at the enterprise.

Including such an obligation for an employee in an employment agreement is legal if it also states the employer’s obligation to pay for this training.

If an employee is dismissed at his own request without a good reason before the expiration of the established period of service, financial liability arises. The employee will have to reimburse the employer for the funds spent on his training.

The amount of debt is calculated in proportion to the actual time not worked after completion of training: the employee must reimburse expenses only for the period that remains before the deadline for completing work.

An employment contract with training pay must indicate unjustified reasons for dismissal. Or draw up a separate annex to the contract, which will indicate these reasons.

The employer does not have the right to demand reimbursement of training costs for an employee in the event of his early dismissal at his own request, if the employee combined work and study.

Appearance of the document and description of its fields

The employment contract must be drawn up in the proper form. A sample can be viewed on the Internet. But organizations and entrepreneurs have their own forms and forms. Or they prepare individual contracts for each employee.

The text of the agreement must be printed in legal language. That is, to be informationally complete, clearly structured and convincing. Official business style is used for documentation. The text is located on two or more A4 sheets. Ascending numbering is required. In this case, the first (title) page does not count. Numbers should be placed in the middle of the top pages, without a dot. If there are attachments, they are printed under their own numbering.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

There is no need to stitch the pages. Most personnel officers simply fasten them from the left side in the middle with a stapler. According to the law, only those documents certified by a notary are subject to firmware. Or archival documentation.

The fields of the employment contract can also be used when creating it. The employer can place links there that do not correspond to any of the points. That is, important additions for the employee. And, it is recommended to carefully study the existing notes, since after signing, they will have the force of a contract.

The employment contract must be drawn up in two copies: for both parties.

Grounds for termination of an employment contract

There are not many reasons to terminate cooperation between the parties. The reason for this may be either the desire of one of the parties or by mutual consent. Moreover, the dismissal of an employee at the initiative of the employer is provided for in two articles of the Labor Code. In the event of a promotion or transfer of a subordinate (with his consent), the contract also loses force and a new one is drawn up. With a fixed-term employment contract, everything is much simpler; it is valid for the prescribed time.

Content

An employment contract must be concluded before the employee begins working.

A typical contract structure looks like this:

- General provisions.

- Rights and obligations: are prescribed in separate paragraphs for each party.

- Payment.

- Time for rest and work.

- Validity.

- Other conditions.

In addition, the main agreement may be supplemented by annexes. Which are issued separately.

The design and content of the TD are prescribed in Article 57 of the Labor Code of the Russian Federation.

It reflects the following points:

- Information about the employee and employer: first names, patronymics and last names (if both parties are individuals). When applying for a job in an organization, the name of the employing company and the details of the hired employee are written down.

- Employer's TIN.

- If the employer has a representative, his details are indicated.

- Date and place of signing the contract.

- The position for which the employee is registered, the place of his activity.

- If the contract is fixed-term, its start and end dates are indicated.

- Payment (its terms and amount).

- Regime (Rules of work and rest).

- Conditions of compulsory pension and social insurance.

Guarantees and compensation must be paid as a separate item if the employee works in difficult conditions. An additional clause on the nature of the work is also included. If, for example, a person has to travel around the city, go to clients’ homes, etc.

It is important to understand that the content of the employment agreement (contract) cannot include conditions that will worsen the situation or health of the employee. That is, the contract must fully comply with labor legislation.

If a probationary period is provided when hiring, this must also be indicated in the document. When applying for government, commercial or other employment.

A separate chapter of the contract must contain bilateral rights and obligations (employer and employee). But within the limits of labor legislation.

If a foreign citizen is hired, the details of his patent and policy must be entered. In this case, the validity period of the patent cannot exceed the term of the contract.

Where is it used?

Employment contracts are used in all enterprises and organizations that have hired personnel. Without this document, you cannot be hired by individual entrepreneurs. This approach is considered a violation and is punishable by a fine.

In addition to registered employers, employment contracts are also used by individuals who employ people.

It is important to draw up a contract correctly. With a focus on current legislation. Therefore, this procedure should be carried out by professionals.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Layout of an employment contract”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

What your employment contract should look like: rules and samples

The sample employment contract with an employee in 2021 may vary depending on the circumstances. Special forms are accepted for starting cooperation with foreigners, on a part-time basis, with a legal entity, individual entrepreneur or individual, with or without time limits.

A signed formal agreement between a person and his employer is a guarantee of the rights, freedoms and obligations of both parties, which are established by current legislation and agreed upon through negotiations. In simple words, the concluded document establishes the job responsibilities of a specialist, periods of his work, responsibility, procedure and amounts of remuneration. Thus, this is the main document that regulates the relationship between a citizen and the organization where he works.

This is important to know: Civil contract with an employee: sample 2021

This is what the completed document looks like.

Working conditions in the employment contract

The main working conditions that interest workers are primarily the work schedule and wages.

Schedule

The Labor Code of the Russian Federation in 2021 establishes the following requirements:

| Working hours | Requirements of the Labor Code of the Russian Federation |

| Normal | 8 hours per day (excluding 1 hour for lunch break) and 40 hours per week |

| Abbreviated | The work shift can be shortened by 1 hour on the working day before a holiday and in the case of night shift work - from 22.00 to 6.00. For employees aged 14 to 18 years who are students, a shortened working week has been approved. |

| Incomplete | For workers under the age of 14, for pregnant women, parents with children under the age of 14 (especially disabled children), for employees caring for bedridden sick family members - by agreement with the employer, a part-time working day may be established and part-time work. |

Under this regime, wages are paid in proportion to the amount of work performed or time worked. At the same time, such employees are guaranteed annual paid leave in the amount of 28 calendar days and work experience on a general basis.

In the case of part-time work, the duration of work for a part-time worker cannot exceed 4 hours a day and 20 hours a week. Characteristics of working conditions should also be recorded in the document.

At the discretion of the employer, one of the work schedule options can be established:

- 5-day work week with constant two days off (Saturday and Sunday);

- 5-day work week with floating days off (can be during the week);

- 6-day work week with 1 day off.

With any schedule option, the total number of hours worked does not exceed 40 hours per week. An employer has the right to involve an employee in overtime work, but only with the written consent of the employee. The duration of overtime work cannot exceed 4 hours over 2 consecutive days and a total of 120 hours per year. Overtime work must be paid additionally, in addition to the salary (rate) established in the employment contract.

The law provides every employee with the right to a daily lunch break, the duration of which should not be less than 30 minutes and more than 2 hours.

In the event of an employee’s marriage, the birth of a child, or the death of a close relative, the employer is obliged to provide, at the employee’s written request, unpaid leave of no more than 5 days.

Flexible work schedule

Basically, government organizations work according to the standard schedule of the so-called 40-hour five-day week. Private enterprises, whose activities are related to the continuous production of goods and convenient time for the provision of services to the client, choose a flexible work schedule.

The Labor Code of the Russian Federation provides for an employment contract with a sliding work schedule - this is an organization of working time when an employee or team is allowed by the employer to determine the beginning and end of the working day within established limits. In this case, all required working hours must be worked in total for the month. The rotating work schedule means:

- variable time - the employee independently determines the hours of his employment in accordance with the requirements established by the employment agreement;

- fixed time - the obligatory presence of the employee at his workplace during the hours specified in the employment contract (for example, in the evening or at night);

- accounting period - a period agreed with the employer during which all hours determined by labor legislation must be worked.

Simply put, a flexible work schedule allows an employee to perform his work duties at the time most convenient for him (with the official consent of the employer). At the same time, all hours established by Russian labor legislation (8 hours a day, 40 hours a week and 160 hours a month) must be worked, which is confirmed by the summarized accounting. An employment contract with a flexible work schedule determines the accounting period - a working day, a working week or a working month.

The Labor Code of the Russian Federation in 2021 identifies the following types of flexible work schedules:

- staggered work schedule: an employee works a standard 8 hours a day, but his working day may begin and end 2 hours later than other employees.

- free work schedule: the employer does not set a clear time frame for the work, but only determines the deadline for providing its final result; ideal for creative individuals;

- shift work schedule: performance of labor duties is divided into shifts of 8 hours (3 shifts per day), 12 hours (2 shifts per day), 24 hours (1 shift) with rest days and days off (every two or three days) .

Flexible working hours indicating the exact work schedule are mandatory in the employment contract - both open-ended and fixed-term. A flexible work schedule can be changed at the initiative of the employee (at his request to the employer with a request to change the work schedule) or by order of the employer (with notice to the employee 2 months before the change and with his written agreement).

Irregular working hours

If it is necessary to work on weekends or holidays, as well as overtime, an additional agreement is drawn up to the employment contract, where all conditions must be specified. This is what a sample of this document looks like:

Contract with shift work schedule

In case of shift work (every other day, two nights after two, etc.), the employment contract must specifically indicate the frequency of the employee’s work.

Traveling nature of work

A number of modern specialties imply a traveling nature of work, when an employee is obliged, according to an employment contract, to travel every working day (as opposed to rare business trips), since this is his job function. The traveling nature of work is inherent in:

- sales representatives,

- forwarders,

- service operators for installation and repair of household appliances (with visits to the client’s home),

- public services (electricity, heating, internet, etc.),

- some military units, Ministry of Emergency Situations, etc.

In the case of constant business travel, the employment contract contains a clause on reimbursement of travel expenses to the employee, which must be confirmed by relevant documents. To reduce paperwork, the employer often prescribes in the employment contract a fixed bonus for the traveling nature of the work. The list of professions that have a traveling nature due to their labor function and the method of reimbursement of costs must be contained in the collective labor agreement. All these conditions can be stated in an additional annex to the employment contract:

Simplified employment contract

Meaning and types

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Features of the preparation and form of the document are regulated in Chapter 3 of the Labor Code of the Russian Federation. The key importance is the officially established terms of the relationship between the hired specialist and the employer. That is, the document should disclose:

- basic rules and working conditions, determined taking into account current standards and requirements (safety rules, sanitary standards, legal regulations);

- the amount and frequency of payment for labor (wages, compensation and incentive payments, state benefits, bonuses, vacations, etc.);

- job responsibilities and instructions that must be followed;

- features and rules for making changes to the current conditions;

- procedure for termination, termination of TD.

Let us recall that Article 37 of the Constitution establishes the legal right of every citizen to independently choose the type of activity, type of profession and specialization. No one can force you to work.

All existing types of TD are classified according to the following criteria:

| Classification feature | Types of TD |

| By validity period | Unlimited - concluded for an indefinite period. Limited (urgent) - drawn up for a period of no more than 5 years. |

| By the nature of the working relationship | Basic. Agreement with home-based, remote employees. Contract with civil servants. TD with shift workers. |

| According to the legal status of the employee |

|

| By employer status |

|

What must be included in the document

To draw up such contracts and agreements, a unified form is used, approved by Decree of the Government of the Russian Federation No. 858 of August 27, 2016. But this is only a recommended standard form. The company has the opportunity to develop its own.

The TD is drawn up in two copies, the first remains with the employer, the second completed sample employment contract remains with the hired specialist. Each copy is signed by both parties. A document without a signature becomes void (invalid).

IMPORTANT! If a new employee starts work without signing official papers, then the agreement is in fact concluded and has legal force. But the employer is obliged to conclude a written contract within 3 working days.

The cooperation agreement contains the mandatory details specified in Article 57 of the Labor Code of the Russian Federation:

- Name of the employer's company (full name of an individual, private entrepreneur or individual) and full name. employee.

- Passport details of the hired citizen and TIN (OGRN) of the employer.

- Date and place of conclusion of the contract.

Then the conditions relating to the professional activities of personnel should be disclosed:

- workplace (where it is located, what it is provided with);

- profession (position, responsibilities);

- the moment from which it is necessary to start work (end date for urgent TD);

- terms of remuneration (frequency, size, types of remuneration for labor);

- working hours, rest periods;

- conditions and nature of work;

- guarantees and compensation.

Additionally, it contains information about bonuses (premiums) to employees, voluntary medical insurance (if the organization provides it to its staff), and a probationary period (if it is intended). In general, TD describes as fully as possible the relationship between the two parties - the person being hired and the employer.

If some terms of the agreement were adjusted after the parties signed the document, an additional agreement is drawn up, which indicates all these changes. And it is also signed by the applicant for the vacancy and the employer.

An organization cannot unilaterally change TD. This applies to any working conditions that are specified in it: place of work, time, payment, regime, and so on. All changes to these components are changes to the document, which means they occur only with the consent (and signature) of the employee.

Remuneration in an employment contract

Remuneration is the most important issue in any employment contract. Earning is one of the ultimate goals of labor (with the exception of a gratuitous employment contract).

The monthly salary of an employee (at full rate and full working day) should not be lower than the minimum wage - the minimum wage. The calculation should be carried out without taking into account additional payments and allowances, compensation, incentives and benefits.

The size of the tariff rate and official salary must contain a collective labor agreement and an agreement with each employee (employee). There may also be separate local regulations describing payment terms. The section on remuneration describes in detail the accrual system, the amount of wages, the regularity of payments, the method of receiving money, possible allowances, incentive payments, bonuses and fines.

The employment agreement must indicate the tariff rate (official salary) - a fixed amount of remuneration for the employee without taking into account incentive payments, allowances, compensation, etc. The Labor Code of the Russian Federation requires that the exact amount of the salary be indicated in the employment contract, and not its minimum and maximum possible limits.

Employment contracts concluded on the territory of Russia must contain a record of the amount of salary in cash equivalent and exclusively in rubles, and not in foreign currency.

Only upon a written application from the employee can part of his salary be accrued in cash, and the rest - not in cash. The amount of personal income tax is indicated in the agreement with the employee at the discretion of the manager.

The Labor Code of the Russian Federation obliges the employer to compensate for the involvement of the employee in overtime work. The first 2 hours of overtime work are paid at one and a half times the hourly rate, and subsequent hours of overtime - at double the rate.

Instead of compensation for overtime work, an employee can ask in writing (by application) for a paid day off (time off) or add it to annual leave.

The double rate is used to calculate wages for an employee going out on a non-working holiday. Similar wage standards apply in the case of flexible work schedules.

The wage system outlined above, for which hours worked are important, is called hourly (time-based) wages. Today, piecework wages have also become widespread, for which it is not the time worked that is important, but the result - the number of goods and services created or provided during a given working time.

An employment contract with piecework wages must contain the tariff rate per unit of production by the employee. In 2021, the following types of piecework wages are distinguished:

- Direct piecework : calculation is made based on volumes made at established prices per unit of goods or services.

- Piece-bonus : payment for the created quantity of goods or services during the working month + bonus for improving the quality of the product, reducing the number of defective products, etc.

- Piece-progressive : such a system is designed to stimulate employee productivity. If goods or services are produced in excess of the established norm, the employee receives an increased bonus.

- Indirect piecework : appropriate for remunerating workers who monitor the smooth operation of machinery (equipment). The calculation is carried out based on the quantity and quality of products produced during the working month by other workers using this equipment.

- Lump sum : payment is made not per unit of work performed, but for the final result, subject to the deadlines established in the employment contract.

Piecework (and its specific type) or hourly wages must be specified in the employment contract or it must contain a link to such information in the collective labor agreement or local regulatory act. In a time-based contract, the salary is calculated based on the number of hours worked.

The collective labor agreement determines the type of salary:

- cash at the place of work;

- non-cash payment procedure;

- non-monetary form – payment in kind (for example, with the employer’s products) at the place of work or elsewhere.

Employment contract - samples for different cases:

- If you need to prepare documentation for a shift work method, here you can download a free form of an employment contract with an employee (2020) for a shift

- Download urgent TD template

- If you need a 2021 employment contract with a probationary period, download it here

- A contract with an individual (not a labor contract, but a civil contract, but is often used by companies as a replacement for a labor contract for certain jobs).

- Liability agreement with the chief accountant

- Agreement on collective liability

- Driver liability agreement

- Agreement on the seller's liability

- General sample document on financial responsibility

- If you need to download a free sample employment contract with an employee (2020) for a part-time worker, click here

- contract when working abroad

- Using this link you can download a free employment contract with an employee (sample 2021) with a foreigner

Found documents on the topic “layout of an employment contract”

- Layout of an employment contract Employment contract, contract → Layout of an employment contract

employment contract No. date place of preparation (full and abbreviated name of the employer) represented by (position, f... - Layout collective agreement

Enterprise records management documents → Layout of a collective agreementrecommended layout of a collective agreement ; representative of the employer - head of the organization ...

- Layout collective agreement

Enterprise records management documents → Layout of a collective agreement...ikami at the general meeting) (hereinafter referred to as the trade union). The collective agreement was developed in accordance with the requirements of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the federal law “on trade unions, their rights and guarantees of activity...

- Sample agreement to labor agreement

Enterprise records management documents → Sample agreement for an employment contractagreement to the employment contract ..200 No., hereinafter referred to as the employer, represented by, on the one hand, and, referred to as ...

- Sample termination agreement labor agreement

Enterprise records management documents → Sample agreement on termination of an employment contractagreement on termination of the employment contract "" 20 No. city ...

- Sample change agreement labor agreement

Enterprise records management documents → Sample agreement to amend an employment contractagreement to change the terms of the employment contract ..20 No., hereinafter referred to as the employer, represented by, on the one hand, and, referred to as ...

- Labor agreement, Contract

Employment agreement, contractany employment relationship must be properly formalized, that is, an employment agreement or contract must be concluded. according to art...

- Sample notification of changes to the conditions determined by the parties labor agreement

Enterprise records management documents → Sample notification of changes to the terms of the employment contract determined by the parties...limited liability "mir" notification of changes in the terms of the employment contract 01/15/2012 No. 9/2012 to the client manager Yusipova A.G. Dear Anna …

- Minutes of the meeting labor collective for the election of a joint committee (commission) for protection labor and election of an authorized person for the protection labor

Documents of the enterprise's office work → Minutes of the meeting of the labor collective for the election of a joint committee (commission) on labor protection and the election of an authorized person for labor protection...l - secretary - present: man. agenda: 1. elections of a joint committee (commission) on labor . 2. election of an authorized person for labor of the workforce. listened: speaker - director - speak...

- Labor agreement with the watchman

Employment agreement, contract → Employment agreement with a watchmanemployment contract No. (place of conclusion of the contract ) (date of conclusion of the contract ) (full name of the employer) in l ...

- Labor agreement 1

Employment agreement, contract → Employment agreement 1employment contract No. "" 201 . hereinafter referred to as the “employer”, represented by...

- Additional agreement to the employment contract on the transfer of an employee to another position with a change in salary

Enterprise records documents → Additional agreement to the employment contract on the transfer of an employee to another position with a change in salary - Labor agreement with a driver

Employment agreement, contract → Employment agreement with the driveremployment contract No. "" g., hereinafter referred to as "employer", represented by, acting on the basis of ...

- Condition status report labor, benefits and compensation for working in unfavorable conditions labor. Form No. 1 (conditions labor) (Resolution of the State Statistics Committee of the Russian Federation dated July 12, 1994 No. 104)

Statistical reporting → Report on the state of working conditions, benefits and compensation for work in unfavorable working conditions. Form No. 1-t (working conditions) (Resolution of the State Statistics Committee of the Russian Federation dated July 12, 1994 No. 104)...about okpo okdp kopf +- codes are put down by the organization - the report writer +-+ to whom the form n 1-t ( working ) name is submitted, the address of the recipient is approved by the resolution of the State Statistics Committee of Russia dated July 12, 1994 n 104 ministry (department...

- Labor agreement with the chairman of the HOA

Employment agreement, contract → Employment agreement with the chairman of the HOAemployment contract No. “” 20, homeowners association, hereinafter referred to as “employer&...

Sample of filling out an employment contract with an employee

When hiring a new employee, it is convenient to have in front of you for concluding an employment contract a sample filled out for a similar case. Especially for a small organization where such documents have to be prepared occasionally. Having an example before your eyes, it is easier to avoid mistakes and all the troubles arising from incorrect management of intra-organizational document flow.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

How to certify an employment contract

A copy of the employment contract, which must be provided at the place of request to various authorities, must be certified, otherwise the document is invalid and has no legal force. To correctly certify a copy of an employment contract, you must:

- carefully read the original document, checking the correct spelling of the details of the parties to the agreement and the presence of signatures and seals;

- make copies of all original pages;

- using a hole punch, stitch all the copied pages on the left side, without touching the text of the contract, and thread them through;

- on the last page of the copy of the document, stick a piece of paper on strings and write “correctly” and indicate the number of sheets in numbers and words, position, full name of the employee who certified the agreement, date, below - signature and seal;

- If a stapler was used to staple a copy of the employment contract, each page will need to be certified.

Upon written request from the employee, the employer, no later than 3 days later, provides a certified copy of the employment contract, a certificate of salary (income), a certificate of taxes paid, etc. An extract from the employment contract must similarly be provided to the employee within three days from the date submitting an application.

Also, the HR department must draw up and send a notice of concluding an employment contract with a foreign citizen to the territorial division of the FMS (Federal Migration Service) within three days from the date of signing the employment agreement. In case of delay or deliberate concealment of the illegal use of foreigner’s labor, a fine will be imposed on the enterprise.

What must be written in it

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

First of all, Art. 57 of the Labor Code requires that it be shown who acts as an employee and who acts as an employer. Even the simplest agreement requires sufficient information about the parties entering into it. Be sure to mention the place and date.

Then they move on to information related to the work being performed:

- where you will have to perform duties;

- what the functions will be (position, profession, specialty and qualifications);

- when to start;

- how much and what to pay;

- how to go out and get rest days;

- how compulsory social insurance is implemented;

- what is guaranteed and what the compensation will be;

- as special the assessment characterizes working conditions;

- additional conditions.

Points of difficulty

Having before you an approximate option for signing a contract, it is worth limiting yourself to only data related to specific parties. The standard version proposed by Resolution No. 858 is good for almost all cases. It fully complies with the requirements of the Russian Labor Code.

Unfortunately, it is difficult to use when an organization decides to sign a contract with a foreign citizen.

What you should not abuse when registering:

- attempt to unreasonably impose an agreement for a certain period. This is regarded as a narrowing of the employee’s rights;

- strive to combine main work and part-time work in one document;

- offer payment of earnings no more than once a month;

- impose a work schedule that does not comply with the requirements of the Labor Code, etc.

What documents are needed

In Part 1 of Art. 65 of the Labor Code provides a list of documentation that the employer has the right to request from the employee to conclude a contract. It is limited to:

- passport (identity card);

- work book. They do without it during the first employment and in the case of a part-time job;

- SNILS (electronic form is allowed);

- confirmation of military registration;

- confirmation of education, qualifications, special preparedness;

- a certificate confirming that there is no criminal record or criminal prosecution. It is presented only in cases where only persons who meet this requirement of federal law can engage in certain activities;

- a certificate confirming the absence of an imposed administrative penalty due to drug use, etc. It is presented if required by the specifics of the work.

Part 2 specifies the conditions under which additional documents may be required. And Part 3 prohibits employers from arbitrarily expanding the established list.