Who is required to fill out and submit the 4-OS report?

Those who must submit Form 4-OS include the following subjects:

- Entrepreneurial activities – legal entities and individuals;

- Those who operate funds of environmental significance, as well as objects that harm the environment;

- Implementing measures aimed at protecting the atmosphere, water and subsoil from negative impacts from these or other objects.

According to the old order (dated August 24, 2017 No. 545), the list of persons who are required to submit Form 4-OS included all the same entities that operate wastewater treatment plants.

The combination of all these factors obliges such entities to fill out the specified form and submit it to the regulatory authorities in a timely manner. This should be done not only by domestic entities, but also by branches of foreign companies, their branches that officially operate in Russia.

It is important to know! The amount of expenses for environmental protection measures must be at least 100 thousand rubles. This includes the cost of services with a similar purpose.

Form 4-OS is completed and submitted for the reporting period until January 25 of the following year. The document is sent to the territorial body of Rosstat. Here you can see a sample of filling out form 4-OS with an example.

Report form on form 4=OS (429 Downloads) Instructions for filling out a report on form 4-OS (312 Downloads)

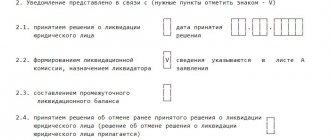

When is the OS-4 form used?

It is common practice for buildings and equipment to cease to be used during the operation of an organization. In the process of work, situations arise when repair, restoration or modernization of an object is not economically feasible. In this case, a decision is made to write off the OS object.

The procedure for writing off an unsuitable object is described in PBU 6/01 and FSBU 6/2020 “Fixed Assets”. It is carried out in several stages:

- Convening a special commission to establish the fact that the building or equipment is unsuitable for further use in the company. The commission consists of at least three people; it must include the person financially responsible for the object. A legal entity has the right to invite a third-party expert to join the commission.

- The commission issues its conclusion, on the basis of which the manager issues an order to dispose of the fixed asset.

- Members of the commission draw up a write-off act.

The document is drawn up in two copies, one of which remains with the person responsible for the inspected asset, the second is transferred to the accounting department to reflect the fact of disposal in accounting and tax accounting. In accounting, expenses and income arising from the disposal of a fixed asset are included in “other” and are reflected on account 91 in correspondence with account 01.

Based on the write-off act, depreciation of the fixed asset ceases, and the object is not taken into account for the purpose of calculating property tax.

Procedure for filling out and submitting 4-OS reports

The new reporting form 4-OS was approved by Rosstat Order No. 412 dated July 18, 2019.

When filling out a report on Form 4-OS, you must indicate:

- Full name of the subject in accordance with the data specified in the Unified State Register of Legal Entities, legal and actual address, if they differ. All this information fits into the lines of the title page;

- The amount of funds spent on environmental protection measures;

- Cash receipts from the sale of by-products;

- List of all exploited environmental facilities;

- List of activities aimed at protecting the environment.

For reference! In the latter case, the types of activities are indicated in accordance with the international classifier CE 2000.

Detailed instructions for filling out Form 4-OS are contained in Rosstat Order No. 412 dated July 18, 2019. There are detailed explanations for each item where information needs to be entered.

The completed report is submitted, as indicated above, to the territorial body of Rosstat. It is sent by a valuable letter or personally through a responsible employee of the authority against signature and indicating the date of acceptance.

Legislative framework of the Russian Federation

valid Editorial from 09.08.2012

detailed information

| Name of document | ORDER of Rosstat dated 08/09/2012 N 441 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING FEDERAL STATISTICAL OBSERVATION OF AGRICULTURE AND THE NATURAL ENVIRONMENT” |

| Document type | order |

| Receiving authority | Rosstat |

| Document Number | 441 |

| Acceptance date | 09.08.2012 |

| Revision date | 09.08.2012 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

ORDER of Rosstat dated 08/09/2012 N 441 “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING FEDERAL STATISTICAL OBSERVATION OF AGRICULTURE AND THE NATURAL ENVIRONMENT”

Instructions for filling out form N 4-OS

Legal entities, as well as individuals engaged in business activities without forming a legal entity (hereinafter referred to as individual entrepreneurs), having treatment facilities, carrying out environmental protection measures (independently or in the form of consuming third-party environmental services), as well as making payments for the negative impact on environment, fill out this form and submit it to the territorial body of Rosstat at their location.

If a legal entity has separate divisions, this form is filled out both for each separate division and for a legal entity without these separate divisions.

Information is provided for a legal entity (separate division), individual entrepreneur with an amount of expenses and (or) with a fee for negative impact on the environment of more than 10 thousand rubles. in year.

The completed forms are submitted by the legal entity to the territorial bodies of Rosstat at the location of the corresponding separate division (for a separate division) and at the location of the legal entity (without separate divisions). In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place where it actually carries out activities. Individual entrepreneurs provide primary statistical data to the territorial bodies of Rosstat at their location.

Bankrupt organizations where bankruptcy administration has been introduced are not exempt from providing information in the specified form. Only after the arbitration court has issued a decision on the completion of bankruptcy proceedings regarding the organization and entry into the unified state register of legal entities of its liquidation (clause 3 of Article 149 of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”), the organization - the debtor is considered liquidated and is exempt from providing information in the specified form.

The head of a legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

The address part indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets. The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs.

In the line “Postal address” the name of the subject of the Russian Federation, legal address with postal code are indicated; if the actual address does not coincide with the legal address, then the actual postal address is also indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated.

A legal entity or individual entrepreneur enters the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) in the code part of the form on the basis of the Notification of assignment of the OKPO code sent (issued) to them by the territorial bodies of Rosstat.

For territorially separate subdivisions of a legal entity, an identification number is indicated, which is established by the territorial body of Rosstat at the location of the territorially separate subdivision.

In the code part of the form in column 3, respondents carrying out activities under OKVED codes 01 - 99, with the exception of code 75, as well as the activities of specialized suppliers (code 90), must indicate - 1 (commercial sector).

Respondents carrying out activities under OKVED code 90 must indicate in column 3 - 2 (specialized providers of environmental services).

Respondents who provide specialized environmental services, such as wastewater collection and treatment, solid waste collection and processing, sewage disposal, site cleaning, etc., but these services do not relate to the main economic activity, must prepare two reports, one - for specialized environmental services provided by the enterprise, and the second for other types of economic activities engaged in by the legal entity. For example, legal entities operating under OKVED code 41 submit two reports (one for the main activity, which is included in the commercial sector, the second for activities related to environmental services (wastewater treatment), which is included in the sector of specialized environmental service providers ). Wastewater treatment services should not be included in the core activity report.

Activities and costs shown in this form must be primarily environmental in nature and aimed primarily at environmental protection.

This form does not reflect the activities and costs of their implementation:

— on health protection, improvement of working conditions and safety measures, implemented for technical reasons, but giving a positive environmental effect;

— on the direct use of natural resources (for example, water supply);

— to prevent or combat the consequences of natural disasters and disasters. In particular, activities for forecasting (prevention) and eliminating the consequences of drought, frost, earthquakes, avalanches, landslides, etc. are not included.

In addition, this form does not take into account: mineral extraction tax, water tax, payments for water use under contracts, forest taxes, taxes and fees for the use of biological resources, other similar taxes and payments for the use of natural resources and for the use of natural resources, with the exception of the payments given in section 3 of the form.

The form is filled out based on the primary accounting data of actual environmental protection costs and environmental payments. Data is presented in thousands of rubles.

Section 1. Current costs of environmental protection and revenues (receipts) from the sale of by-products

Section 1 reflects the actual amount of current costs generated in the process of internal production activities and covered by own funds, funds from budgets of all levels and other sources, as well as additional costs and revenues associated with environmental protection.

Current costs are indicated without value added tax.

The amount of current costs for environmental protection includes expenses for carrying out activities, ensuring the ongoing operation of technological processes and production facilities, as well as for the maintenance and operation of machinery and equipment that are designed and operate to prevent, reduce, clean (recycle) and/or eliminate pollutants substances (products) or the contamination itself.

The section reflects data on the following current costs for environmental protection:

— maintenance and operation of fixed assets for environmental protection: raw materials, materials and other products, fuel and electricity used in the operation of environmental funds; costs for routine repairs of these funds, for the maintenance of personnel servicing these funds; rental (leasing) payments, insurance payments relating to environmental structures and equipment (the list of environmental funds is given in Appendix 2);

— costs of collection, storage/disposal and processing/neutralization, destruction, disposal of production and consumption waste on our own;

— organization of independent control over harmful effects on the environment and monitoring activities, scientific and technical research, management of environmental activities in the organization;

— for current measures to preserve and restore the quality of the environment disturbed as a result of previously conducted economic activities;

— other ongoing measures to reduce harmful impacts on the environment.

The section does not reflect data on costs for:

construction of environmental protection facilities,

overhaul of environmental fixed assets,

depreciation charges for fixed assets for environmental purposes,

procurement of environmental services from external organizations (payments to third-party organizations for the reception and treatment of wastewater, as well as for the removal, processing, burial, etc. of production and consumption waste, for the provision of other environmental protection services).

Line 01 shows current (operating) costs in general for all environmental protection measures, which in lines 02 - 10 are distributed according to areas of environmental activities in accordance with the “List of fixed assets for environmental purposes” (Appendix 1) and “List of types of environmental protection activities "(Appendix 2).

Line 02 indicates current costs aimed at protecting atmospheric air and preventing climate change, which are included in current (operating) costs:

— for the maintenance and operation of fixed assets for the protection of atmospheric air and the prevention of climate change,

— to monitor emissions of pollutants into the air (including monitoring compliance with standards for the content of pollutants in exhaust gases from motor vehicles), laboratory research,

— to organize monitoring and control of the quality of atmospheric air,

— modification (improvement) of production processes, transition to other types of fuel, raw materials, materials in order to reduce (eliminate) emissions of pollutants into the air,

— for administration and environmental management, information support, educational activities in the field of air protection and climate change prevention,

— for other ongoing activities in the field of air protection and climate change prevention.

Line 03 includes current costs aimed at collecting and treating wastewater, which are included in current (operating) costs:

— for the maintenance and operation of fixed assets for the collection, transportation, treatment of wastewater, recycling and reuse water supply systems, local treatment facilities,

— to reduce the formation of contaminated wastewater in the production process,

— for reuse of cooling water and purification of cooling water before discharge,

— to monitor the quality of discharged wastewater, laboratory research,

— for administration and environmental management, information support, educational activities on wastewater collection and treatment,

— for other ongoing activities for the collection and treatment of wastewater.

The current costs of wastewater collection and treatment do not include:

costs for the maintenance and operation of industrial and municipal water pipelines, including facilities for the preliminary purification of collected water (water treatment) and its transportation to the consumer,

costs for the maintenance and operation of urban, industrial and other sewer networks that are not connected to treatment facilities and discharge contaminated wastewater directly into natural water bodies.

Line 04 indicates current costs aimed at waste management activities (including processing of low-level radioactive waste, composting, estimates for street cleaning, disposal), which are included in current (operating) costs:

— for the maintenance and operation of fixed assets for environmental protection from production and consumption waste (for collection, separation into types (sorting), placement, neutralization and (or) use of production and consumption waste,

- for activities for the collection, separation by type, storage and transportation of production and consumption waste to specially organized places for their placement, neutralization or use, which are under the jurisdiction of the reporting facility or other organizations (landfills, landfills, waste processing and incineration installations and factories), also to places of their authorized unorganized storage,

— to carry out instrumental measurements and control over the amount and structure of the formation and disposal of production and consumption waste, laboratory research in the field of waste management,

— to determine the physical and chemical composition of waste and (or) to determine the hazard class of waste,

— for administration and environmental management, information support, educational activities in the field of waste management,

— for other ongoing waste management activities.

Line 05 indicates current costs aimed at protecting and rehabilitating lands, surface and ground waters, which are included in current (operating) costs:

— for the maintenance and operation of fixed assets for the protection and rehabilitation of lands, surface and groundwater, including general construction and special equipment,

— for the elimination of landfills, landfills, sedimentation tanks, dumps, “tailings” of enrichment organizations,

— to prevent the infiltration of pollutants into soils, surface and underground water bodies,

— for measures to maintain water protection zones in the established order, to regulate flow and maintain a favorable hydrological regime and sanitary condition of small rivers,

— to clean soils and water bodies from pollution and contamination,

— to prevent erosion and other types of soil degradation,

— to prevent salinization and desalinization of soils,

— for reclamation of disturbed lands,

— instrumental measurements and control, laboratory studies of the qualitative condition of lands, surface and underground water bodies,

— for administration and environmental management, information support, educational activities in the field of protection of lands, surface and underground water bodies,

— for other ongoing activities for the protection and rehabilitation of lands, surface and ground waters.

Line 06 indicates current costs aimed at protecting the environment from noise, vibration and other types of physical impact, which are included in current (operating) costs:

— for the maintenance and operation of fixed assets for environmental protection, prevention and reduction of noise, vibration and other types of physical impact in transport, industrial production and other stationary sources of noise and vibration, for the use of anti-noise and vibration-isolating structures,

— instrumental measurements and control, laboratory studies in the field of noise, vibration and other types of physical impact on the environment,

— for administration and environmental management, information support, educational activities in the field of environmental protection from noise, vibration and other types of physical impact,

- for other current events.

Line 07 includes current costs aimed at preserving biodiversity and protecting natural areas, which are included in current (operating) costs:

— to protect and restore species of animals, plants and fungi and to preserve their habitat (to preserve and restore rare and endangered species, to carry out artificial reproduction of natural populations, to reintroduce (reacclimatize), to prevent the uncontrolled spread of invasive alien species , for the conservation and restoration of rare and endangered species through the use of cryopreservation technologies and the creation of other types of repositories of genetic material to restore extinct populations and species, as well as for maintaining or restoring genetic diversity in heavily disturbed populations, for monitoring, for conducting inventories (accounting), maintaining Red Books, etc.),

— on the conservation and restoration of natural areas,

— instrumental measurements and control, laboratory research in the field of biodiversity conservation and protection of natural areas,

— for administration and environmental management, information support, educational activities in the field of biodiversity conservation and protection of natural areas,

— for other ongoing activities to preserve biodiversity and protect natural areas.

Line 08 indicates current costs aimed at ensuring environmental radiation safety, which are included in current (operating) costs:

— to reduce radiation impact on the environment (to rehabilitate natural areas exposed to radioactive contamination of forests, water bodies, and lands),

— on radioactive waste management (on collection, transportation, processing, storage (localization) of radioactive waste, disposal of radioactive waste),

— instrumental measurements and control, laboratory research in the field of radiation safety,

— for administration and environmental management, information support, educational activities in the field of environmental radiation safety,

— for other ongoing activities in the field of environmental radiation safety.

Current costs aimed at ensuring environmental radiation safety do not include:

costs of preventing and eliminating emergency situations,

costs for collection and processing of low-level radioactive waste.

Line 09 indicates current costs aimed at research and development activities to reduce negative anthropogenic impacts on the environment, which are included in current (operating) costs. They include costs for developments in the field of atmospheric air protection, climate change prevention and ozone layer protection, in the field of wastewater collection and treatment, including the prevention (or treatment) of discharges into surface waters, in the field of waste management, soil protection and rehabilitation, underground and surface waters, environmental protection from noise, vibration and other types of physical impact, conservation of biodiversity and protection of natural areas, etc.

Line 10 indicates current costs for other areas of activity in the field of environmental protection, which are part of current (operating) costs. They include costs for environmental protection and not included in other classes: general administrative and management activities, activities for environmental certification and environmental audit, environmental management and consulting, environmental education and information support in the field of environmental protection, information support for civil society on the state of the environment, on the organization and development of an environmental education system, on the education and formation of an environmental culture, on the education, training and advanced training of specialists in the field of environmental protection, etc. This includes costs that do not fall under other groups of types of environmental activities.

Column 3 reflects information about the actual current (operating) costs for environmental protection incurred during the year.

Column 4 reflects information on current (operating) costs for environmental protection at the expense of enterprises’ own funds.

Column 5 indicates material costs, including costs for the purchase of raw materials and (or) supplies; tools, devices, inventory; components and (or) semi-finished products; fuel, energy of all types necessary for the operation of fixed assets for environmental protection purposes and the performance of other environmental protection work. The costs of land reclamation are also equal to material costs. When filling out column 5, data from the primary accounting reporting forms is used (receipt invoices for purchased raw materials and materials, payment documents, invoices, etc.).

Column 6 reflects the costs of wages and social contributions (including the unified social tax) to employees associated with the operation of environmental equipment and other environmental protection measures, which include the amount of wages and social benefits accrued to employees on the payroll and external part-time workers. This includes workers directly involved in the operation and maintenance of environmental facilities. In addition, wages and social benefits are included when carrying out other environmental protection measures (reclamation of disturbed lands, removal and disposal of production and consumption waste, etc.). This indicator also reflects the remuneration of workers of factory laboratories carrying out monitoring (control measurements, accounting, control, etc.) in the field of environmental protection.

When simultaneously servicing both environmental and other facilities not related to environmental protection (for example, repair crews, electricians, etc.), the corresponding salary and payments should be determined by calculation - based on the share of time spent on servicing environmental equipment or carrying out environmental protection measures, and/or other methods.

Column 7 includes the amount of actual payment for current services to third-party organizations for: a) reception, transportation and treatment of wastewater; b) collection, transportation (removal), temporary storage, processing (neutralization), destruction and/or disposal of production and consumption waste; c) other environmental protection services, incl. for planting and caring for green spaces on the territory of the reporting enterprise, conducting an inventory of pollution sources, developing draft standards for maximum permissible emissions of pollutants into the atmosphere (MPE), developing projects for sanitary protection zones of enterprises, assessing risks to public health when exposed to environmental factors environment, development of draft standards for permissible discharges of substances and microorganisms into water bodies (VAT), development of draft standards for waste generation and limits on their disposal, environmental certification and audit, and other similar services and works.

This column does not reflect budget payments for negative impacts on the environment, other taxes and payments, fines and payments for compensation for damage caused to the environment, etc.

Column 8 includes the costs of capital repairs of fixed assets for environmental purposes in the areas of environmental activities.

Column 9 shows revenue (receipts) from the sale of by-products obtained in the course of environmental activities.

This kind of income, i.e. additional revenues are associated with the specific nature of some environmental work (and, accordingly, environmental protection costs). Revenue from sales of by-products represents the total sales volume (total sales value) of by-products. In addition, income can be expressed through a total reduction in costs (reduction in production costs) if the by-product is used at the same enterprise where it was obtained.

Energy and material savings that result from the use of more efficient production processes, as well as other production benefits from environmental activities are not included in the group of by-product income under consideration.

Examples of revenue from the sale of by-products may include:

— the cost of energy obtained from burning waste, which in turn was generated at this enterprise;

— the cost of collected, sold externally, reused waste (only for waste generated at a given enterprise, for example, scrap metal generated and sold externally).

This also includes the cost of returnable waste re-entered into our own main production.

Returnable production waste refers to the remains of raw materials, materials, semi-finished products, coolants and other types of material resources generated during the production of goods (performance of work, provision of services), which have partially lost the consumer qualities of the original resource (chemical or physical properties) and are therefore used with increased costs (decrease in product yield) or not used at all for their intended purpose.

Remains of inventories, which, in accordance with the technological process, are transferred to other departments as full-fledged raw materials (materials) for the production of other types of goods (works, services), as well as by-products obtained as a result of implementation of the technological process.

Returnable waste is assessed in the following order:

- at a reduced price of the initial material resource (at the price of possible use), if the waste can be used for main production, but at increased costs (reduced yield of finished products);

- at the selling price, if this waste is sold externally.

This guidance applies, in particular, to wood waste collected by dust settling chambers or other dust collection devices and subsequently used as fuel at the reporting enterprise, sold to other consumers, including the public. This may also include petroleum products obtained during wastewater treatment and also used in our own production (for our own needs) or sold externally.

If waste (products) are not transferred on a commercial basis (for example, given to employees of the same enterprise as fuel), the corresponding turnover is not reflected in column 4.

Overhaul of machinery, equipment and vehicles is considered a type of repair with a frequency of more than one year, which, as a rule, involves complete disassembly of the unit, repair of basic and body parts and assemblies, replacement or restoration of all worn parts and assemblies with new and more modern ones, assembly, adjustment and testing of the unit. During major repairs of buildings and structures, worn-out structures and parts are replaced or replaced with more durable and economical ones that improve the operational capabilities of the objects being repaired, with the exception of the complete replacement of the main structures, the service life of which in a given object is the longest (stone and concrete foundations of buildings, pipes underground networks, bridge supports, etc.).

Section 2. Payment for negative impact on the environment (environmental payments)

Section 2 reflects the funds actually paid in accordance with current legislation for discharges, emissions of pollutants and disposal of production and consumption waste, fines for violation of environmental legislation.

Lines 20, 25, 30 show actual payments made for environmental pollution (emissions and discharges of harmful substances, disposal of production and consumption waste). These indicators are composed of the amounts of actual payments made during the reporting year.

Line 20 shows the funds actually paid for discharges, emissions of pollutants, disposal of production and consumption waste within the limits of maximum permissible standards and within established limits (temporarily agreed upon standards).

Lines 21 - 24 indicate, respectively, actual payments for permissible (not exceeding maximum permissible standards and established limits (temporarily agreed standards) discharges of pollutants into water bodies (line 21) and underground horizons (line 24), emissions of pollutants into the air ( line 22), for the disposal of production and consumption waste (line 23).

Line 25 reflects actual payments for excess discharges of pollutants into water bodies (line 26) and underground horizons (line 29), emissions of pollutants into the air (line 37), for excess disposal of production and consumption waste (line 28).

Line 30 reflects the total amount of payments (excluding penalties and claims) actually transferred in the reporting year for environmental pollution (permissible and above the norm).

Line 31 shows all fines and payments collected by specially authorized state bodies of the Russian Federation in the field of environmental protection on claims for compensation for damage caused to the environment due to violation of environmental legislation. These include penalties for volley or emergency environmental pollution (except for established current payments for environmental pollution). Fines collected administratively from officials working in the organization are not taken into account here.

In case of payment of funds for voluntary or compulsory environmental insurance, the corresponding values are not included in this report.

Arithmetic and logical controls

Section 1

1. page 01 = page 02 + page 03 + page 04 + page 05 + page 06 + page 07 + page 08 + page 09 for all columns

2. gr. 4 < gr. 3 on all lines

3. gr. 5 < gr. 3 on all lines

4. gr. 6 < gr. 3 on all lines

5. gr. 5 + gr. 6 gr. 3 on all lines

Section 2

7. page 20 = page 21 + page 22 + page 23 + page 24

Zakonbase: In the electronic document, the numbering of paragraphs corresponds to the official source.

8. page 25 = page 26 + page 27 + page 28 + page 29

9. page 30 = page 20 + page 25

Features when filling out the 4-OS report

There are some specifics on how to fill out the 4-OS report in different cases.

As stated above, it is provided separately for each branch. This also applies to other separate divisions.

But there are exceptions when one report is submitted for branches. Allowed in the following cases:

- They are located at the same legal or actual address;

- Their addresses are different, but the branches are located in close proximity to each other, and their activities are closely interconnected.

A branch or separate subdivision is any part of an enterprise equipped with stationary workplaces, which is located separately from the head office.

It is allowed that a report in Form 4-OS for separate divisions can be sent to the territorial body of Rosstat both at its location and at the location of the company’s head office.

Regulations for 2021

Environmental reporting for 2021 includes about 10 types of documents, generated depending on the type of activity of the enterprise. Information can be provided both in paper and electronic form. If the second option is preferred, the form is available on the Rosprirodnadzor website or on the government services portal.

The legal basis for 4 OS environmental reporting 2018 is Federal Order of the Ministry of Nature No. 30 of February 2010. The report is of a notification nature. It is mandatory for representatives of small and medium-sized businesses whose activities interact with natural resources. The information concerns waste from the activities of enterprises, their use, processing, disposal, disposal or disposal. The report must contain information about the volume of waste, a special code for the classifier, information about the degree of hazard and type.

The completed form is accompanied by copies of licenses, waste transfer agreements, as well as a copy of the license of the receiving enterprise if the business entity uses the services of other companies.

Fine for violations of reporting 4-OS

An enterprise and officials are held administratively liable in the following cases:

- Late submission of reports (Article 13.19 of the Code of Administrative Offenses of the Russian Federation);

- The form contains inaccurate or false data (Article 8.5 of the Code of Administrative Offenses of the Russian Federation);

- The report includes deliberately false information (similar article).

In the first case, the fine ranges from 20 to 150 rubles. In the second - from 20 to 80 tr. In addition, Rosstat may suffer losses due to the lack of a report or incorrect information included in it. Their compensation is assigned to the violator.

Appendix No. 13. Form No. 1-farmer “Information on the results of sowing for the harvest”

Law of the Russian Federation dated May 13, 1992 N 2761-1 “On liability for violation of the procedure for submitting state statistical reporting.” Article 3 N 2761-1 states that enterprises, institutions and associations compensate statistical bodies for damage that arose due to the need to correct the results of consolidated reporting, distorted data or violation of reporting deadlines.

For reference! In the latter case, the types of activities are indicated in accordance with the international classifier CE 2000.

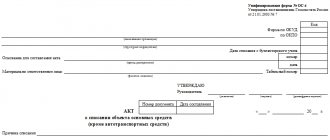

Drawing up an act in form OS-4 occurs when an organization needs to write off some fixed assets from the register.

In accordance with the above order, reporting in Form 4-OS must be submitted to the following enterprises:

- having treatment facilities;

- carrying out environmental protection measures (independently or in the form of consumption of third-party environmental services);

- making payments for a negative impact on the environment, if there are current costs for environmental protection and (or) payments for a negative impact on the environment in excess of 100 thousand rubles. in year.

Information is provided for a legal entity (a legal entity that has separate divisions), an individual entrepreneur if there are current costs for environmental protection and (or) payment for environmental services in excess of 100 thousand rubles per year.

The address part of the form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets.

Companies that provide environmental services may encounter a situation where they incur environmental costs that are not related to the services provided. Then fill out and submit reports for each sector. For sector 26, indicate all costs associated with your activities.

We have been cooperating with various regulatory authorities for a long time and successfully. The vast majority of projects developed by us are approved by supervisory authorities the first time.

If a legal entity has separate divisions, this form is filled out both for each separate division and for a legal entity without these separate divisions.

Form 4-OS is related to ecology and environmental protection. It reveals information about the costs of protecting nature and the income from the sale of by-products. The reporting is small. We will tell you in the article who fills out and submits the 4-OS form, how and in what time frame.

Indicate all expenses and income without VAT. The table has 10 lines and 9 columns that need to be filled out. In column 3, indicate the costs of environmental protection for the year, and in column 4, separately highlight expenses from your own funds. Columns 5 and 6 provide an explanation of column 3.

In the list that opens, select the desired division and then, by clicking on the line with its name, fill out the report that opens for this division in accordance with the procedure discussed below. Reports on the organization itself and other departments are filled out in the same way.

Many of our clients are not just customers; we build reliable and long-term partnerships with many of our clients. More than 500 different companies already trust us. The most important thing for us is long-term relationships with the customer, since this is the key to stability and confidence in the future for both parties.

If one industrial site is located in one district of the region, and another in another district, then for each they submit their own reports to their territorial bodies of Rosstat.

The title bar is similar to other statistical reports. Enter the reporting year, full name, postal address. Don't forget about OKPO. Then go to the tabular part.

If one industrial site is located in one district of the region, and another in another district, then for each they submit their own reports to their territorial bodies of Rosstat.

Report separately for branches and the parent company, but only if there is an event. If there is nothing to contribute to 4-OS, do not submit anything. Submit the completed report to the territorial Rosstat on paper or electronically.

Bankrupt organizations that have entered bankruptcy proceedings are not exempt from providing information in the specified form.

The web service Kontur.Accounting has everything for convenient work

In this case, one of the conditions must be met:

- During 2021, more than 100.0 thousand rubles were spent on environmental protection measures. in a year,

- During 2021, less than 100.0 thousand rubles were spent on environmental protection measures for a separate division, but if the amount for all separate divisions located in one subject of the Russian Federation exceeded 100.0 thousand rubles.

The purpose of the report is to reflect contributions from enterprises to compensate for damage to the environment, costs for the construction and operation of treatment facilities, and other measures aimed at preserving natural resources. This also includes air protection, waste disposal and treatment, waste management and soil rehabilitation.

The decision to liquidate fixed assets must be formalized by order of the manager. Data on the disposal of fixed assets must also be included in the documents that are drawn up by the company to record the presence and movement of fixed assets (for example, you can use an inventory card for recording a fixed asset item in Form No. OS-6).

The report must contain information about the volume of waste, a special code for the classifier, information about the degree of hazard and type.

The report template consists of 2 sections with the following data:

- The main page indicates the registration and legal information of the enterprise: name, address, OKUD and OKPO code.

- Current expenses on environmental protection measures and revenues from the sale of by-products. The section consists of five columns: names of measures to protect nature, expenses for the reporting period. The last point includes social, material and salary contributions. The amount is indicated without VAT.

- Payment for negative impact on nature. Environmentally, payments are reflected in two columns: the name of the damage caused and the actual amount paid for them during the reporting period.

- Revenue from the sale of by-products.

We will help you develop and submit a report on Form 4-OS for Moscow, the Moscow region and the Republic of Tatarstan. Moderate prices. Short time. We are waiting for your call.

The report in form “4-OS” is submitted to the territorial body of Rosstat in the constituent entity of the Russian Federation. It is possible to submit the report electronically.

N 420, and in pursuance of the Federal Statistical Work Plan, approved by order of the Government of the Russian Federation of May 6, 2008.

The reverse side of the form contains 2 tables “Brief characteristics of the OS object”, which consists of 7 columns:

- OS object name;

- quantity;

- name of precious materials;

- item number;

- unit of measurement;

- quantity;

- weight.

An environmental report is among the mandatory ones for businesses. For 2017, it is available for rent until April 2018 inclusive. Host authorities: Rosprirodnadzor and Rosstat. Subjects are commercial enterprises and individual entrepreneurs.

The report is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation in the manner established for legal entities.