Application of 80 accounts in accounting

Depending on the organizational and legal form, the authorized capital of companies can have different sizes, distribution by shares of owners and even a different name: share capital, authorized capital, etc. Types of authorized capital are presented in the figure:

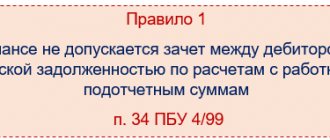

The balance of account 80 “Authorized capital” reflects the size of the authorized capital, which is recorded in the constituent documents of the company. Operations to form and increase or decrease the authorized capital are carried out only by decision of the founders when making changes to the constituent documents.

In analytical accounting for account 80, it is important to ensure that information is reflected on the founders, types of deposits and agreements, stages of capital formation and types of shares - depending on the form of ownership.

Important! The authorized capital of a JSC/LLC is equal to the par value of their shares/shares of participants, regardless of the amount actually invested in them.

The procedure for forming the authorized capital is regulated by the legislation of the Russian Federation and the constituent documents of the company.

Analytical accounting and subaccounts 80 accounts

Additional registers of information about the authorized capital are opened for the disclosure of information on the amounts stated in the charter and paid, types of shares and contributions. The number and type of subaccounts are not approved by law; the principles of construction and disclosure of information are determined by companies independently and specified in the accounting policy.

Account 80 “Authorized capital” can roughly structure the information according to the following parameters:

- The cost indicated in the registration documents;

- Amount deposited;

- Cash contributions;

- Property shares;

- Repurchased securities;

- Mutual fund of commercial and non-profit associations of citizens;

- Collective working capital of cooperatives;

- Types of shares;

- Coverage of losses, distribution of profits.

To analyze information about the timeliness of payment, types and amounts of accruals, account 80 in accounting is built for each participant in the organization. Changes in the nature of the authorized capital are recorded by internal postings between sub-accounts.

Typical entries for account 80 “Authorized capital”

Since this is a passive account, all contributions to the authorized capital are reflected as a credit, and all decreases are reflected as a debit of the account.

The main entries for account 80 “Authorized capital” are formed in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 75 | 80 | Registration of the declared amount of the capital | Constituent documents, accounting certificate |

| 08 | 75 | Actual receipt of deposits of founders/participants (according to subaccounts depending on the type of deposit) | Constituent documents, accounting certificate (Act No. OS-14, n-r) |

| 82/83/84 | 80 | Crediting reserve capital/additional capital/profit to the management company. | Constituent documents |

| 50,51,52,55/04,41, etc. | 80 | Crediting the contributions of partners under a simple partnership agreement (cash, property). Return – reverse posting. | Constituent documents, accounting certificate |

| 80 | 84 | Write-off of losses for the reporting year from the balance sheet (amount of capital = net assets) | Balance sheet, constituent documents |

| 80 | 75 | Withdrawal of deposits from the management company by the founders, reduction of the par value of shares/incomplete payment after registration | Constituent documents |

| 80 | 81 | Reflection of a decrease in the authorized capital by canceling the JSC’s own shares/shares from shareholders/participants. | Constituent documents, accounting certificate |

What account is the LLC's management company reflected in?

The amount of the authorized capital reflected in the charter of a registered limited liability company must be taken into account in the accounting department of the enterprise.

In accordance with the Plan, account 80 is provided for accounting for the share capital of an LLC.

The posting for the formation of the management company is carried out once on the date of registration of the constituent documents by the tax authority.

Changes to Article 80 are made only in two cases:

- Liquidation of an organization - accounting when closing an LLC.

- Change in the size of the authorized capital (decrease or increase).

Example with transactions to increase the size of the authorized capital

The authorized capital of Vesna JSC is 200,000 rubles. and divided into 100 shares with a par value of 2,000 rubles. accordingly, in this case:

- At the end of the year, a revaluation of fixed assets was carried out and as a result, the initial cost of fixed assets increased by 40,000 rubles, and the amount of accumulated depreciation by 20,000 rubles. Accordingly, additional capital increased by 20,000 rubles.

- At the general meeting of shareholders, it was decided to increase the authorized capital by the specified amount by converting all shares of Vesna JSC into shares of a higher par value - 1,200 rubles. for a unit.

The accountant of Vesna JSC generated the following entries in account 80 when increasing the size of the authorized capital:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 01 | 83 | 40 000 | Revaluation of the initial cost of the operating system | Documents on market value, revaluation statement, asset accounting inventory card |

| 83 | 02 | 20 000 | Additional assessment of depreciation on fixed assets | Accounting certificate-calculation |

| 83 | 80 | 20 000 | Increase in capital | Constituent documents |

It is important to take into account that if a founder-legal entity makes a contribution to increase the authorized capital before the official registration of changes in the constituent documents, the Federal Tax Service may require it to be taken into account as gratuitously received funds.

Therefore, it should always be indicated in the “purpose” field as “contribution to the authorized capital” in the payment order or invoice, depending on the type of contribution.

HIGHLIGHTS OF THE WEEK

05/21/20214:15 Accounting and reporting

New SZV-M from May 2021: differences from the previous form

24.05.202113:39

Business organization

The rules for issuing passports are changing - from July 1

24.05.202115:11

Personnel

We calculate salaries and advances for May 2021, taking into account non-working days

24.05.202113:33

Business organization

Will compensation be paid for damage during forced evacuation of a car?

24.05.202109:00

Personnel

Who will be able to relax for free in a sanatorium in 2021?

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

How are dividends taxed after a company is reorganized in the form of a merger?

05/28/2021 A zero income tax rate is applied if the organization receiving dividends...

Is bankruptcy grounds for depriving an employee of bonuses?

05/28/2021 If the bonus is part of the remuneration system and is of a production nature, it cannot be deprived...

Recommendations for identifying unjustified tax benefits have been published

05/25/2021 Article 54.1 of the Tax Code of the Russian Federation contains provisions aimed at combating the receipt of unjustified tax...

‹Previous›Next All comments

Characteristics - subaccounts, what is accounted for as debit and credit?

In accordance with the Accounting Plan, account 80 is intended to reflect information about the amount of the organization’s authorized capital (share capital), its changes in the course of the enterprise’s activities.

The balance of account 80 must always correspond to the amount of the capital reflected in the constituent documents of the company. If the amount of capital changes, then information about the new amount must be reflected both in the charter of the LLC and in accounting account 80.

That is, at any point in time, the amount indicated on account 80 must be equal to the Criminal Code from the charter.

For an LLC, the minimum authorized capital is 10,000 rubles; the enterprise can, at its own discretion, form a larger charter capital.

Account 80 is passive - intended for accounting for liabilities - authorized capital. Its amount is always reflected on the loan; the balance of account 80 is always in credit.

Limited liability companies do not open subaccounts on account 80. The exception is production cooperatives, which can open the following subaccounts:

- 80-1 – Mutual fund;

- 80-2 – Collective fund.

Sub-accounts can also be opened by joint-stock companies:

- 80-1 – Common shares;

- 80-1 – Preferred shares.

Analytics for the 80-account can be organized by founders.

Example of invoice 80

was organized by two founders. Everyone contributed:

- Ivanov – 100,000 rubles;

- Kostikov – materials worth 100,000 rubles.

Two years have passed. Kostikov decided to leave the company in order to organize his own. He took back the previously made contribution to the authorized capital. As a result, the accountant generated the following entries:

- Dt. 75 – Kt. 80 – 200,000 rubles

Registration of the total amount of the authorized capital.

- Dt. 08– Kt.75 – 200,000 rubles

Receipt of contributions from each participant.

- Dt. 80– Kt. 75 – 100,000 rubles

Kostikov took back his share of the authorized capital after deciding to leave the company.

Summary: two founders organized an enterprise with an authorized capital of 200 thousand rubles. A year later, one founder left, taking his share, after which the final amount of the authorized capital of 100 thousand rubles was formed on account 80.

Characteristics of account 73

Account 73 - active-passive. The loan reflects the company's debt to employees. That is, these are amounts due for payment in the form of financial assistance, compensation, fees for using a car, and so on. The loan records deductions from employee salaries, for example, the cost of training, workwear, and so on.

The credit balance of account 73 in the balance sheet is reflected in line 1520 “Accounts payable”.

The debit records the debts of employees to the company. The most striking example is loans issued. This also includes amounts that the employee must reimburse or compensate, for example, as a result of material damage.

The debit balance of account 73 in the balance sheet is reflected on the following lines:

- 1170 - financial investments in the form of long-term loans to employees;

- 1240 - financial investments in the form of short-term loans to employees;

- 1230 is the employee’s debt to the company.

Account analytics is built by employee.

Accounting for settlements with founders

To account for settlements with the founders, there is account 75.

As mentioned earlier, from credit 80 to debit 75 we record the value of the authorized capital of the enterprise.

Credit 75 includes contributions from the founders as they are received. Depending on the type of contribution account. 75 corresponds with the corresponding accounts. Repayment of a share in the authorized capital can be in cash or in the form of property.

If the founders transfer the contribution to the authorized capital in money to the current account, then the posting will be as follows: D51 K75, making a contribution to the cash desk - D50K75.

If the founder makes a contribution in the form of goods, then the posting will look like: D41 K75 , where account. 41 "Products".

If in the form of fixed assets, then transactions D08 K75 and D01 K08 .

Also on the loan account. 75 reflects the accrual of dividends to the founders. To do this, you can divide the account into 2 sub-accounts: one will reflect the contributions of the founders, and the other will reflect the payment of dividends.

The dividend accrual entry has the form: D84K75 , where account. 84 Retained earnings (uncovered loss). We will get to know this account in more detail later. Payment of dividends in cash or non-cash funds is reflected in the debit of the account. 75 using wiring D75 K50 (51) .

Postings for contributions to the authorized capital and accounting for dividends: (click to expand)

| Sum | Debit | Credit | Operation name |

| xxxx | 51 | 75 | Contribution in the form of non-cash funds to a current account |

| xxxx | 50 | 75 | Cash deposit to the cash desk |

| xxxx | 41 (10) | 75 | Contribution in the form of goods (materials) |

| xxxx | 84 | 75 | Calculation of dividends to founders |

| xxxx | 75 | 50 (51) | Payment of dividends to founders |