When providing services to clients of an organization, an integral part of the documents that must be created is the act of completion of work. Let's look at how to create it, fill it out and print it in 1C 8.3.

The 1C 8.3 program allows you to implement the following methods of filling out reconciliation reports for services provided to the organization’s counterparties:

- fill out acts for one or more services for one counterparty. This method is convenient if the organization provides one-time services;

- fill out acts for one service for several contractors. The method is suitable for services provided regularly for several contractors.

Submit certificates of completed work online with us

Convenient to use

Print and send documents from the service. Save time.

Reliable

Your documents will not fall into the wrong hands: after sending they are automatically deleted

Simple and clear

Even a beginner can submit an act online in the service; no knowledge of accounting is needed

Fast

We will fill in the details automatically using the Taxpayer Identification Number (TIN), and instantly evaluate the counterparties.

Economical

No need to waste paper or install additional paid programs

Available

Use the service anywhere in the world where there is Internet

VAT deduction

When deciding not to allocate VAT in the act of provision of services, it is necessary to take into account the interests of the consumer of services when receiving a deduction.

The fact is that in paragraph 4 of Art. 168 of the Tax Code of the Russian Federation states that in settlement documents, including registers of checks and registers for receiving funds from a letter of credit, primary accounting documents and invoices, the corresponding amount of tax is highlighted on a separate line.

According to the opinion of the Federal Tax Service, expressed in the letter of the Federal Tax Service dated February 28, 2013 N ED-19-3/26 “On value added tax,” the right to deduction can be made dependent on such an allocation.

In accordance with paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, tax deductions are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services), property rights, documents confirming the actual payment of tax amounts when importing goods into the territory of the Russian Federation and other territories under its jurisdiction, documents confirming the payment of tax amounts withheld by tax agents, or on the basis of other documents in the cases provided for in paragraphs 3, 6-8 of Article 171 of this Code.

Speaking about deductions, it makes sense to mention the opinion of the Constitutional Court of the Russian Federation, contained in the ruling dated February 15, 2005 N 93-O. The Constitutional Court of the Russian Federation indicated that, within the meaning of Art. 169 of the Tax Code of the Russian Federation, compliance of the invoice with the requirements established by paragraphs 5 and 6 of this article makes it possible to determine the counterparties to the transaction (its subjects), their addresses, the object of the transaction (goods, work, services), the quantity (volume) of goods supplied (shipped) ( works, services), the price of goods (works, services), as well as the amount of accrued VAT paid by the taxpayer and subsequently accepted by him for deduction. The literal meaning of paragraph. 2 p. 1 art. 172 of the Tax Code of the Russian Federation allows us to make an unambiguous conclusion that the obligation to confirm the legality and validity of tax deductions with primary documentation lies with the taxpayer - the buyer of goods (works, services), since it is he who acts as the subject who applies, when calculating the final amount of tax payable to the budget, deduction of tax amounts accrued by suppliers.

Thus, the taxpayer’s right to tax deductions is conditioned by his acquisition of goods (work, services) used to carry out activities that are subject to value added tax, the acceptance of these goods (work, services) for registration and the availability of invoices and relevant primary documents , reliably confirming the fact of a business transaction.

Indication in the act of provision of services the cost of the service, including VAT, without highlighting the amount of tax may raise questions among inspectors. However, during court proceedings, judges do not agree with the practice of tax authorities in refusing deductions on these grounds.

Thus, the resolution of the Federal Antimonopoly Service of the North-Western District dated May 19, 2009 N A05-9925/2007 states that the provisions of Chapter 21 of the Tax Code of the Russian Federation do not establish special requirements for the volume and types of primary documents confirming the fact of acquisition of goods (works, services) and their acceptance to accounting. However, in order to obtain the right to deduct value added tax, the taxpayer must prove the fact of purchasing the goods and accepting it for accounting with primary documents drawn up in accordance with the requirements of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”.

A similar point of view is expressed in the resolution of the Federal Antimonopoly Service of the Ural District dated 08/09/2012 N F09-6167/12 in case N A60-34756/2011.

In addition, the reality of a business transaction by the company is confirmed not only by primary documents, but also by the contract, the fact of payment, including VAT in the case of the acquisition of goods, by documents confirming their transportation and sale.

This approach is demonstrated in the ruling of the Supreme Arbitration Court dated 02/11/2010 N VAS-989/10, resolutions of the FAS of the Ural District dated 08/09/2012 N F09-6167/12 in case N A60-34756/2011, FAS of the Central District dated 09/22/2010 in case N A36-2828/2009.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Why do you need a certificate of completion?

Without acts, all company expenses cannot be taken into account when calculating income tax. The act of performance of work and services (or, as it is also called the “act of acceptance and transfer”) is provided for in the contract signed between the customer and the contractor as a closing document.

The act is written evidence of the completion of certain work or part thereof. The acts indicate the deadlines for completing work and services, list the work and services provided, and reflect the deadlines for completing the volumes of work that were specified in the contract.

The acceptance certificate is not a strict reporting document; the enterprise has the right to develop it independently in accordance with the Accounting Law. In this case, filling out the act is mandatory under the Tax Code of the Russian Federation. If for each missing act a fine is imposed on the violating organization, additional taxes may be assessed. Penalties will also be imposed for errors in filling out the act. If you do not yet have an accountant, then you can always turn to trusted partners of SKB Kontur for help. Submit your application!

Certificates of completed work for one counterparty in 1C 8.3

To generate acts, the “Sales” tab provides the item “Sales (acts, invoices)”:

In the “Implementation” section, add a new document “Services (act)”:

When you select the item, a new document opens in which you need to fill in the “Counterparty” and “Agreement” fields. Data for the first field is selected from the directory, contract data is loaded automatically:

The table part is filled in when you click the “Add” button.

In the line that appears, the “Nomenclature” column has 2 fields:

- indication of the item from the contract, this field is already filled in automatically;

- field for a text description of the content of this service. Here you can manually enter in more detail the characteristics of the service.

Everything that is entered into the text field will appear in the act.

Next, fill in the “Quantity” and “Price” columns. The “Amount” and “Accounts” columns will be filled in automatically based on the entered data. In order not to lose the entered data, it is recommended to write the document without posting. After this you need to create an invoice:

When you click on the button, an invoice will be automatically generated, and a document for the sale of services can be processed.

The correctness of the transactions is reflected when you press the “Dt/Kt” button. If everything is correct, then you can start printing the “Act of Services Rendering” form. To do this, select the appropriate item when you click the “Print” button:

Before outputting a document to a printer, the 1C 8.3 program allows you to see what the printed document will look like. Here you can check the correctness of filling in the details, service name, contract number:

If everything is correct, then the document is printed in two copies. They are signed by both parties and are kept in one copy each by the organization and the counterparty.

You can also print the following forms from the received document:

- deed of transfer of rights

- invoice

- universal transfer document (UTD)

- reference-calculation

You can configure printing so that the required set of documents is immediately output to the printer. To do this, in the menu of the “Print” button, select the “Set of documents” item, in the window that opens, check the boxes opposite the names of the printed forms that must be printed:

Thus, it is possible to generate an act reflecting several services provided to one counterparty. They are entered into the tabular part of the document using the “Add” button. For each service, the document fields are filled in as described above. The invoice and printed documents are generated after filling out the entire table.

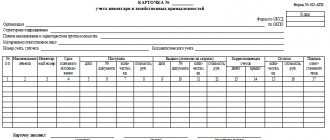

What information should the document contain?

Russian legislation does not provide for a unified form of primary documentation.

It can be developed by a business entity independently. You can also download the individual entrepreneur’s work completion certificate for free in Excel or Word using the links below. When developing the form yourself, you must be guided by the requirements for the primary documentation. Required details:

- Title of the document;

- Date of preparation;

- link to the agreement;

- names of the parties;

- bank details specified in the agreement for the transfer of funds by the customer;

- the names of the positions of the persons who performed the transaction and are responsible for the execution of the document and completion of the transaction;

- the name of the goods supplied, work performed or services provided;

- volume of work or unit of production;

- total cost, VAT is included separately;

- signatures and seals.

The document is drawn up in two copies by the contractor and sent to the customer at the address specified in the contract. The acts are certified with wet seals and signatures, one of them is returned to the performer. Each counterparty retains one copy. How to issue a certificate of completed work for an individual entrepreneur without VAT? Entrepreneurs who are tax evaders submit a standard document. The total amount is stated without VAT.

Sample filling

certificate of completed work. *doc file (Word), file size 46 KB.

certificate of completed work. *doc file (Word), file size 46 KB.

The form of the certificate of work performed is not prescribed by law, so an organization can develop its own form to fill out and use.

In order to correctly (and in as much detail as possible) draw up the act, you must indicate the following points:

- The serial number of this document for its registration in the accounting department.

- Date of document creation.

- Number of the contract according to which the work completion certificate is drawn up.

- Deadlines for completing the agreed work.

- Volumes of work performed.

- Total cost of work (including mandatory VAT).

- The invoice number that is provided to the customer to pay for the work (service) performed.

- Full name of the customer and contractor, according to the constituent documents.

- Stamp of the seal of both interested organizations.

- Signatures of the contractor and the customer, or persons authorized to sign.

certificate of completed work. *doc file (Word), file size 37 KB.

certificate of completed work. *doc file (Word), file size 37 KB.

Taxation

Each individual entrepreneur carrying out commercial activities in Russia must be guided by the regulations of the Tax Code and other legal acts. In accordance with Article 252 of the Tax Code, an individual entrepreneur (in this case he acts as a customer of services), like any other business entity, has the right to reduce his expenses with documented costs. In this case, the work acceptance certificate will be the primary document that allows you to legally reduce taxable income.

Attention! The purpose of this act is to record the work performed under a specific contract. The absence of this form threatens business entities with penalties.

If, during the calculation of taxes, an entrepreneur underestimated expenses without reason (there are no reports), then during the audit the regulatory authorities will assess additional tax liabilities and apply penalties.