Notification in Form N P15001 is used when the company's participants make a decision to liquidate it, form a liquidation commission (appoint a liquidator), draw up an interim liquidation balance sheet, as well as when canceling a previously made decision to close the company.

Form N Р15001, used in 2021, was approved by Order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ you can find the form Р15001 below.

We will tell you how to correctly issue a notice of liquidation of an organization in our consultation.

Notification on form P15001 (filling sample)

The notice of liquidation of a legal entity consists of a title page, sheet A and sheet B. The procedure for filling out form N P15001 is defined in section IX of Appendix No. 20 to Order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/

We will tell you how to fill out form P15001 when liquidating an organization based on a decision made by the LLC participants.

| Notice sheet | Intelligence |

| Title page | 1. Section 1 indicates information about the organization in respect of which the liquidation procedure is being carried out - OGRN, TIN and full name in Russian. 2. In section 2 about the reason for submitting the notification, namely: - clause 2.1 - making a decision on liquidation indicating the date of its adoption; - clause 2.2. — formation of a liquidation commission or appointment of a liquidator (if the commission is created or a liquidator is appointed) |

| Sheet A (filled out only if clause 2.2 is marked on the title page) | 1. Section 1 determines who is entrusted with the functions of conducting the liquidation procedure - the liquidation commission; - “2” - liquidator. 2. Section 2 indicates the date of formation of the liquidation commission (appointment of the liquidator). 3. Sections 3 - 8 indicate information about the head of the liquidation commission or liquidator (full name, TIN if available, residence address, date and place of birth, identification document details, contact information) |

| Sheet B | 2. Filling out other sections depends on the applicant’s status: - if the value is “1”, sections “5” and “6” are filled in; — with the value “2”, sections “2”, “3” are filled in (if the manager and “6” act on behalf of the participating legal entity; — with the value “4”, section “6” is filled in). |

You can view a sample of filling out a notice of liquidation of an organization here:

Example of filling P15001

Section 1: “Information about a legal entity contained in the Unified State Register of Legal Entities”

The name of the liquidated enterprise must be indicated exactly as it is registered in the Unified State Register of Legal Entities. It is mandatory to fill out all fields indicating the necessary information (OGRN, tax number, etc.).

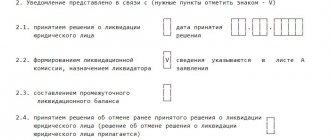

Section 2: "Notice submitted in connection with"

Here you need to mark the required positions with a tick (V). The founders of the enterprise must inform the registration authority about:

- the approved decision to begin liquidation activities (clause 2.1);

- appointment of a special liquidation commission or liquidator (clause 2.2);

- formation of an interim (liquidation) balance sheet (clause 2.3);

- in some cases - a decision to abandon the previously adopted conclusion on liquidation (clause 2.4).

The new form of document P15001 provides for the opportunity for the applicant to inform the registration authority about several events at the same time. To do this, check several boxes.

Example:

- making a decision on liquidation and appointing a working group (commission) of liquidators – (2.1 + 2.2);

- decision to reject a previously adopted conclusion on liquidation and adoption of a new decision to carry out liquidation measures – (2.4 + 2.1);

- cancellation of liquidation actions, appointment of liquidation again with the creation of a commission – (2.1 + 2.2 + 2.4);

- change of a previously appointed commission (liquidator) – mark in clause 2.2.

The law prohibits the simultaneous change of the liquidation commission and the submission of PLP Form 15. Such an action is possible only through forms (14 + 15), otherwise it will be refused.

When checking point 2.1 (on the start of application of liquidation measures), it is necessary to put the date of the decision on the title page, and when checking point 2.4, it is necessary to attach a protocol with the decision to refuse to use the liquidation procedure.

In the column provided for marks of the registration authority (“for official notes”), dashes should not be placed or filled out in any other way.

Notification on the preparation of an interim liquidation balance sheet (P15001)

When submitting a notification to the Federal Tax Service about the preparation of an interim liquidation balance sheet, the title page and sheet B are filled out.

Here's how to fill out form P15001 when preparing an interim liquidation balance sheet based on a decision to liquidate a company made by its participants:

| Notice sheet | Intelligence |

| Title page | 1. Section 1 provides information about the organization - OGRN, TIN and full name in Russian. 2. In section 2 about the reason for submitting the notification, namely clause 2.3. — drawing up an interim liquidation balance sheet |

| Sheet B | 1. Section 1 defines the status of the applicant: - “1” - participant-individual; — “2” — participant-legal entity; — “4” — head of the liquidation commission or liquidator. 2. Other sections are filled in depending on the applicant’s status: - if the value is “1” or “4”, sections “5” and “6” are filled in; — if the value is “2”, sections “2”, “3” are filled in (if the manager and “6” act on behalf of the legal entity-participant). |

The liquidation balance sheet is a balance sheet that is compiled during the liquidation of an LLC in order to determine the actual property state of affairs of the liquidated enterprise.

The liquidation balance is intermediate

and final.

The interim liquidation balance sheet is drawn up after 2 months from the date of publication in the State Registration Bulletin

notices of liquidation (unless the liquidation commission has established a longer period for filing claims by creditors).

Due to its specific nature, preliminary preparation of data and the preparation of the interim balance sheet usually fall on the shoulders of accounting workers. Although formally, by law, this procedure must be carried out by the liquidation commission.

Where is the notification provided?

One copy of this document is sent to:

- To everyone who participated in various legal relations that took place while the organization was functioning properly.

- To certain government bodies that at one time registered this company. There they get acquainted with all the information contained in the notification and make an entry in the Unified State Register of Legal Entities that the company is in the process of terminating its activities.

- Another copy should be sent to the Federal Tax Service department, which is in charge of the territory where the organization is located. Based on this application, the tax service closes all accounts that are registered with the company and identifies possible debts.

- Next, you need to send a notification to various funds with which the company collaborated during its activities. As a rule, there are no more than three. This:

- Lastly, you should notify the persons who provided loans to the company and all counterparties who collaborated with the organization. This step should be taken with special attention, since the above-mentioned persons can challenge the start of the liquidation process in court if they deem it necessary.

To be sure, it is necessary to publish information about the curtailment of the company’s work in specially created media. Before preparing such a publication, you need to know that not all media outlets have the legal right to post such information in the public domain. Today, only a magazine called “Bulletin of State Registration” has this right.

The procedure for drawing up an interim liquidation balance sheet

In addition to financial indicators, the interim liquidation balance sheet must contain:

Information on the composition of the organization’s property

The interim liquidation balance sheet must include (if available) data on property:

- List of machinery, equipment and other fixed assets indicating:

- object inventory number;

- brands;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of buildings and structures indicating:

- object inventory number;

- name of the object and its location;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of unfinished capital construction projects and uninstalled equipment, indicating:

- name of the object and its location;

- year of construction start;

- volume actually completed;

- their book value.

- List of long-term financial investments indicating:

- names of long-term financial investments;

- List of intangible assets indicating:

- names of intangible assets;

- their value according to the balance sheet asset.

- List of inventories, expenses, cash and other financial assets, expenses, cash and other financial assets indicating:

- industrial stocks;

- animals for growing and fattening;

- work in progress;

- deferred expenses;

- finished products;

- goods;

- VAT on purchased assets;

- other inventories and costs;

- Money;

- calculations;

- other assets (including indication of shipped goods).

- Settlements with debtors:

- for goods, works and services;

- on bills received;

- with subsidiaries;

- with a budget;

- with staff;

- for other transactions;

- with other debtors.

- Advances issued by suppliers and contractors.

- Short-term financial investments.

- Cash:

- cash register;

- current accounts;

- foreign currency accounts.

List of claims presented by creditors and the results of their consideration

When filling out the list of claims presented by creditors, indicate:

- name of the creditor (in order of priority);

- amount of debt;

- satisfaction decision.

The results must be reflected in a separate column

consideration of creditors' claims by the liquidation commission.

Note

, the above information can be included directly in the balance sheet itself, or can be issued in

the form of an appendix

() drawn up in any form (act, protocol, etc.).

When compiling an interim liquidation balance sheet, data from the last balance sheet prepared before the decision to liquidate was made is usually used.

The interim liquidation balance sheet can be drawn up more than once.

After drawing up the interim liquidation balance sheet

After the interim liquidation balance sheet has been drawn up, it must be approved by the persons who made the decision on liquidation. To do this, they need to draw up a protocol (decision) on approval or put the appropriate marks directly on the balance sheet.

As soon as the interim balance is approved, the tax office must provide:

- notarized notification in form P15001;

- interim liquidation balance sheet.

In addition, many Federal Tax Service may additionally require:

- protocol (decision) on approval of the interim liquidation balance sheet;

- documents confirming publication in the Vestnik

.

Completion of the liquidation procedure

The final stage of liquidation is the formation and approval of an interim (liquidation) balance sheet, which indicates the shares of the remaining property of each of the founders. Next, you need to notify the registration authority about the completion of the procedure: fill out the form P16001, attach the liquidation balance sheet to it and pay the amount of the state fee.

Document 16001 includes a title page and page “A” for the applicant - the head of the liquidation group or the sole liquidator.

The main sheet should reflect:

- information about the company that is going through the final stage of the liquidation process (clearly in accordance with the Unified State Register of Legal Entities);

- the date of publication of the decision on liquidation adopted by the participants in the official publication.

(Size: 107.5 KiB | Downloads: 24,152) (Size: 162.0 KiB | Downloads: 36,276) (Size: 172.5 KiB | Downloads: 40,801) (Size: 113.0 KiB | Downloads: 22 124)

Sample of filling out the interim liquidation balance sheet

Below is an example of filling out an interim liquidation balance sheet:

An organization can be liquidated voluntarily by a unanimous decision of its participants. The reasons for cessation of activity may be different, but liquidation of an enterprise is a rather lengthy and not simple procedure that raises many questions. To avoid delays, most often associated with the refusal of authorized bodies to register due to errors in documents, a special law firm is usually hired. Of course, this requires additional financial expenses, which in some situations is an unaffordable luxury. In the material on the site, we will consider in detail the procedure for filling out the main documents for submission to the registration authority in the event of independent liquidation of the organization by the owners.

Liquidation commission

After the decision to terminate the organization's activities,

the founders (participants) appoint a liquidation commission (liquidator) and establish the procedure and timing for carrying out the necessary measures in this regard. (Clause 3 of Article 62 of the Civil Code of the Russian Federation). From this moment on, the powers to manage the company’s affairs are transferred to the liquidation commission. (clause 4 of article 62 of the Civil Code of the Russian Federation).

The next step is the publication of a notice about the liquidation of the company, the procedure and deadline for filing creditor claims in the journal “Bulletin of State Registration”. The period for submitting claims by creditors cannot be less than two months from the date of publication of the notice of liquidation (Clause 1, Article 63 of the Civil Code of the Russian Federation. After the deadline for submitting claims by creditors, company employees must fill out a special accounting form - an interim liquidation balance sheet.

Notice of liquidation of a legal entity form P15001

Until July 2013, for each listed action, a separate document had to be filled out and submitted to the registration service of the Federal Tax Service:

- Р15001 (notification of a decision to liquidate a legal entity),

- R15002 (notification of the formation of a liquidation commission, the appointment of a liquidator (bankruptcy trustee)),

- R15003 (on the preparation of an interim liquidation balance sheet).

However, today each of the three actions is accompanied by filling out and submitting to the registration authority only one form P15001 “Notice of liquidation of a legal entity.”

When do new forms come into effect?

The Federal Tax Service order approving the new application forms came into force on November 25, 2020. From this date, documents must be filled out according to the new rules, otherwise registration will be denied. The notification is provided to the registration authority at the location of the company within 3 working days after the decision on liquidation is made, along with the decision itself. Please note that downloading the new form P15001 in Excel is still problematic, although many are accustomed to working with notifications in this program. But you can download it in PDF format, which is recommended for this document by the Federal Tax Service.

ConsultantPlus experts discussed how to fill out an application (notification) about the liquidation of a legal entity using form No. P15016. Use these instructions for free.

Requirements for filling out form P15001: step-by-step filling

Since forms P15001 and P16001 are the main ones for registering liquidation, we will consider the basic requirements for filling them out, which are established by order of the Federal Tax Service of Russia N MMV-7-6/. General requirements for filling out both forms are contained in Section I of a document such as “General requirements for the preparation of submitted documents.” In the same appendix to the order of the Federal Tax Service of the Russian Federation there is a sample of filling out forms P15001 and P16001 line by line.

So, when filling out these forms, legal entities must:

- black ink should be used both when filling out manually and when printing on a printer);

- it is necessary to write only in capital letters in Courier New font 18 points high, each of which, as well as quotation marks, dashes, hyphens and numbers are placed in a separate cell;

- do not allow corrections or additions, as they are prohibited;

- do not allow hyphens, the word that does not fit must be continued to be written on the next line (if it ends in the last cell of the first line), the next line begins with an empty cell (space between words);

- do not print or attach blank sheets to notifications;

- When printing an application on a printer, changing the location of fields and sizes of characters is not allowed;

- Do not use double-sided printing of completed forms, as it is prohibited.

Requirements for filling out form P15001 are contained in section IX of the Requirements. This form includes a first page consisting of two sections, as well as two separate sheets: sheet A and sheet B.

Fill out section 2 of form P15001

In this sheet, you should put a “tick” (“V” sign) in the relevant points in connection with which a notification is being submitted:

- if a decision has been made to liquidate a legal entity, then put a tick in clause 2.1, this field also indicates the date of its adoption;

- if a commission has been formed and a liquidator has been appointed, then put a tick in clause 2.2.;

- if an interim liquidation balance sheet has been drawn up, then check the box in clause 2.3;

- if a decision is made to cancel a previously made decision to terminate activities, then put a tick in clause 2.4.

The requirements do not contain a ban on filling out several items at the same time. Therefore, you can, for example, check two boxes: about making a decision to terminate work (clause 2.1.) and forming a liquidation commission (clause 2.2.).

If a decision is made to continue the work of the company (clause 2.4.), then the decision to cancel the decision to liquidate the legal entity must be attached to the notification.

The section “For official marks of the registering authority” is not filled out.

What changed?

In contrast to previously existing options, the current form of notifications used during liquidation events has become unified and is used as form P15001 - “Notice of liquidation of a legal entity.” The form reflects all liquidation activities and operations.

The fact of termination of the enterprise’s activities and completion of the liquidation process is recorded in the unified form of document R16001 - “Application for state registration of a legal entity for the purpose of its liquidation.”

Another additional point of the legislative act was the procedure for suspending the liquidation process prescribed in the law; this mechanism had not been previously defined.

Fill out sheet B

The first page and sheet B are filled out if clauses 2.1 (decision on liquidation), 2.3 (interim liquidation balance sheet) or 2.4 are noted in the application. (decision to cancel the liquidation decision). The first page, sheets A and B should be drawn up when appointing a commission (clause 2.2).

What do we fill out in sheet A “Information on the formation of the liquidation commission/appointment of a liquidator”? In section 1, “1” is entered if a commission is appointed, and “2” if a liquidator is appointed. Section 2 indicates the date of formation of the liquidation commission or appointment of a liquidator. Section 3 in Russian indicates the last name, first name and patronymic (if any) of the head of the liquidation commission or the liquidator. If he has a TIN, we indicate it in section 4. Section 5 indicates the date and place of birth of the liquidator, the telephone number by which he can be contacted.

Fill out sheet B

In sheet B “Information about the applicant” in section 1, we indicate with a number who the applicant is:

- “1” - for the founder (participant) - an individual;

- “2” - for the founder (participant) - a legal entity;

- “3” - for the body that made the decision on liquidation;

- “4” - for the head of the liquidation commission.

It is important to correctly determine in what cases and which of the entities listed above can act as an applicant. As the Federal Tax Service of Russia explains in a letter dated October 15, 2014 N SA-4-14/, when submitting form P15001 to the registration authority in connection with a decision to liquidate a legal entity, the applicants are the founders (participants) of the legal entity or the body that made the decision to liquidate the organization. If the document is sent in connection with the decision to liquidate the company and the formation of a liquidation commission (appointment of a liquidator), as well as in connection with the preparation of an interim liquidation balance sheet, then the applicant is the founders (participants) of the organization or the body itself that made the corresponding decision. The head of the liquidation commission (liquidator) can also act as an applicant.

Sections 2-5 should be completed depending on who the applicant is. Section 6 must be completed by hand in the presence of a notary. Next, you should indicate the most acceptable way to obtain a document confirming the fact of making an entry in the Unified State Register of Legal Entities, or a decision to refuse state registration (the document must be delivered personally to the applicant, to a person acting on the basis of a power of attorney, or by mail). Section 7 is filled out by the notary, indicating his status and TIN. You can download the form p15001 2021 for free, a sample of how to fill it out, at the end of the article.

We fill out the notice of liquidation of the company: form p15001

Form p15001 “Notice of liquidation of a legal entity” contains the following sections:

Title page

- Item 1 on the first page is intended for information about the company being liquidated: INN, OGRN, full name is entered according to an extract from the Unified State Register of Legal Entities.

- Step 2 – choose the reason for sending the document. The list of reasons includes: a decision on liquidation indicating its date, the creation of a liquidation commission, the preparation of an interim liquidation balance sheet, the revocation of a previously adopted decision on closure. One or more points o. If clause 2.2 on the appointment of liquidators is selected, be sure to fill in the information about the members of the commission on sheet A. The marked clauses 2.3, 2.1 or 2.4 require the attachment of an interim balance sheet, a decision on liquidation or its cancellation, respectively - do not forget to support these documents.

Sheet A

Sheet A contains information about the presence of a liquidator / liquidation commission:

- point 1 - put the number “2” if the liquidation will be handled by one person, “1” - if a commission;

- clause 2 – date of creation of the commission.

We fill in the remaining fields of sheet A with the data for the liquidator (chairman of the commission), checking his identity card:

- clause 3 - full name;

- item 5 - date and place of birth;

- clause 6 - passport details;

- item 7 - home address;

- item 8 - contact phone number;

- clause 4 - TIN.

When indicating addresses, we pay attention to the following nuance: we write down the place of birth exactly from the passport, and the address of residence - in accordance with the KLADR. We clarify the spelling of the names of address objects according to Appendix 2 to the mentioned order of the Federal Tax Service. For example, we shorten the word “street” to “street,” and write “house” or “apartment” in full.

Sheet B

Sheet B – information about the applicant. In clause 1, we select one of four options for the applicant’s status: 1 – founder – “physicist”, 2 – founder – “lawyer”, 3 – body that decided to liquidate the organization, 4 – liquidator.

The order in which the following fields are filled out depends on the number entered in paragraph 1 of sheet B.

- “1” - enter full information about the individual in clause 5;

- “2” - indicate the details of the participant - legal entity in clause 2 and the details of its manager (clause 5);

- if the founding company is managed not by a director, but by an organization - in clause 3 we enter information about the manager - in clause 4 we write the name of the body that made the decision to close, in clause 5 - the full name of the representative of the body and all his data;

- “4” - skip step and move on to filling out point 6.

Field No. 6 of Sheet B confirms all the information presented in the document. This is the last page that we draw up in the presence of a notary. The applicant enters his/her full name without abbreviations and signs. Each completed sheet is numbered in specially designated cells, after which the notary staples and certifies the document.

Regarding the identity of the applicant, the law clearly states that from the moment the person responsible for the liquidation procedure is determined, it is he who is responsible for all the affairs of the company. Thus, the responsibility to notify the state about the closure of a legal entity rests with the chairman of the commission. Except for the situation when the decision to terminate the activity has just been made and the liquidator has not yet been appointed. Then the founders deal with the registration of R15001.

If all necessary liquidation actions are carried out simultaneously, form p15001 is submitted once. In practice, the period of 3 days allotted for notifying the Federal Tax Service is not enough even to form a liquidation commission. And to draw up an interim balance, 2 months are generally given.

If you perform these steps one by one, there will be several notifications. We created a commission - filled out and submitted the form. We identified all the creditors and “knocked up” the balance - again we report this to the tax office. During the liquidation process, the head of the commission was replaced - there was a reason to draw up another paper.

Requirements for filling out form P16001

Form P16001 is submitted when the liquidation balance sheet is compiled. Requirements for filling out the P16001 form are contained in section X of the Requirements. This is a simpler form, consisting of one page and sheet A for the applicant (four pages).

On the first page, information about the liquidated organization is entered according to data from the Unified State Register of Legal Entities. Section 2 indicates the date of publication of the notice of the decision on liquidation in the press. In sheet A we put the number corresponding to the applicant. Information about it is filled out according to rules similar to those indicated above for form P15001. Section 3 is completed by hand in black ink and in the presence of a notary.

Correctly filling out notifications P15001 and P16001 will significantly shorten the period for registering the liquidation of an organization. The ability to fill out such forms yourself will naturally reduce the financial costs of the organization. Careful reading of the material presented and the documents linked to it will help resolve both of these difficulties. You can download form P15001 2021 for free and a sample of filling out its lines at the end of this material. This is Appendix No. 20 to the order of the Federal Tax Service of Russia dated January 25, 2012 N MMV-7-6/ “On approval of forms and requirements for the execution of documents submitted to the registering authority during state registration of legal entities, individual entrepreneurs and peasant (farm) farms” (registered in the Ministry of Justice of Russia 05/14/2012 N 24139).

A notification in form P15001 is filled out during the liquidation process of an LLC and serves to inform the tax inspectorate about the following types of liquidation actions:

- Making a decision on liquidation.

- Formation of a liquidation commission and appointment of a liquidator.

- Drawing up an interim liquidation balance sheet.

- Making a decision to cancel a previously adopted decision on liquidation.

note

, notification P15001 must be

notarized

.

Registering the liquidation of a company: filling out form P16001

Submitting an application for state registration of a legal entity on form p16001 in connection with its liquidation completes the process of closing the organization. Fill out the notification:

- Title page – information about the liquidated company from the Unified State Register of Legal Entities (full name, INN, registration number).

- Item 2 – indicate the date of publication in the media (magazine “Bulletin of State Registration”) of a message about the deadline for closing the company and the procedure for filing claims by creditors.

- Sheet A – we write the applicant’s data. In this case, this can only be the liquidator or the head of the liquidation commission. The procedure for filling out information about an individual is the same as in form p15001.

- The last sheet with the applicant’s signature is also notarized.

A mandatory attachment to form p16001 is the final balance sheet, which is drawn up by the liquidation commission after settlements with creditors and the “division” of the remaining property. We collect signatures on the balance sheet from all founders and support the document with the application. State registration of closure is subject to a fee - we pay 800 rubles and take the receipt with us.

Considering that an incomplete set of documents and the presence of errors in them are common reasons for refusal of registration, when registering, be sure to use the sample for filling out the new forms p15001 and p16001 during liquidation.

This will save you from unnecessary trips to authorities and unnecessary financial costs. When the application is returned, the paid fee is “lost.” The corrected papers have to be re-certified by a notary and taken to the tax office.

The application for liquidation does not have to be submitted in person. You can send an authorized person to the inspection, send documents by mail or via the Internet. Based on the receipt issued by the Federal Tax Service, within 5 working days you will receive documents confirming the liquidation of the legal entity: an entry in the Unified State Register of Legal Entities and a certificate of deregistration.

Instructions for filling out form P15001

Below are detailed instructions for filling out the notification in form P15001 in 2021:

General filling rules

- Form P15001 is filled out in capital letters using Courier New font (size 18).

- There are no dashes in empty cells.

Title page

In Section 1

The TIN, OGRN and full name of the legal entity being liquidated are indicated. All this data can be viewed in the extract from the Unified State Register of Legal Entities.

In Section 2

“V”

sign (checkmark) indicates the types of liquidation actions that you want to inform the tax office about:

- 2.1.

– adoption of a decision on liquidation + the date of the decision must be indicated. - 2.2.

– formation of a liquidation commission and appointment of a liquidator. - 2.3.

– drawing up an interim liquidation balance sheet. - 2.4.

– making a decision to cancel a previously made decision on liquidation.

In some situations, it is allowed to check several boxes at once. For example, you can immediately notify the Federal Tax Service about the decision on liquidation and the formation of a liquidation commission (2.1. + 2.2.).

Sheet A. Information on the formation of the liquidation commission / appointment of a liquidator

Sheet A is filled out and submitted to the Federal Tax Service only if

on the Title Page

.

Section 1

indicated:

- Code “1”

– if information about the head of the liquidation commission (LC) is filled out. - Code “2”

– if information about the liquidator is filled in.

Section 2

. The date of formation of the LC or appointment of a liquidator in accordance with the decision on liquidation is indicated.

Section 3

. The full name of the head of the company or the liquidator is indicated line by line.

Section 4

. Indicate (if available) the TIN of the head of the company or the liquidator.

Section 5

. The date and place of birth of the head of the LC or liquidator is indicated in strict accordance with the citizen’s passport.

Section 6

. The details of the identity document of the head of the company or the liquidator (usually a passport) are indicated.

Section 7

. The address of the permanent place of residence of the head of the LC or the liquidator is indicated (if absent, you can write the address of the place of residence).

note

, it is better to indicate the address in accordance with the KLADR with all the necessary abbreviations for settlements and streets (in this case, words such as:

“HOUSE”

,

“BUILDING”

,

“APARTMENT”

, etc. must be written without abbreviations).

Section 8

. The contact telephone number of the head of the company or the liquidator is indicated.

Sheet B. Information about the applicant

Who is the applicant

Depending on the type of liquidation action, the applicant is:

In Section 1

the code of the person who is the applicant is indicated:

- «1»

– founder (participant) – individual. - «2»

– founder (participant) – legal entity. - «3»

– the body that made the decision on liquidation. - «4»

– head of the LC or liquidator.

- Code “1”

– sections

5

and

6

. - Code “2”

– sections

2

,

3

(if the managing organization acts on behalf of the participant),

5

and

6

. - Code “3”

– sections

4

,

5

and

6

. - Code “4”

– section

6

.

In Section 2

the TIN, OGRN and full name of the legal entity - founder (participant) that made the decision on liquidation are indicated.

In Section 3

the TIN, OGRN and full name of the managing organization of the legal entity - participant are indicated.

In Section 4

The name of the body that made the decision on liquidation is indicated.

In Section 5

information about the applicant is indicated:

- Full Name.

- TIN (if available).

- Information about birth (date and place in exact accordance with the passport).

- Details of an identity document (usually a passport).

- Residence address (in accordance with KLADR).

- Contact information (phone, e-mail).

In Section 6

, you just need to indicate your preferred method of receiving documents from the Federal Tax Service:

- «1»

– to be issued personally to the applicant. - «2»

– to be issued personally to the applicant or to a person acting on the basis of a power of attorney. - «3»

- send by mail.

All other information in Section 6 must be completed by hand in the presence of a notary.

Section 7

filled out by a notary or his substitute.

You can download the official instructions for filling out form P15001 for free from this link.

Sample of filling out form p15001 upon liquidation of an LLC

The complete cessation of the activities of any organization is a system of complex and lengthy procedures. Moreover, the process may be challenged in the future by certain individuals. That is why people who do not want this must perform all the necessary actions in a certain sequence.

One of the most important documents drawn up in this case should be a notice of liquidation of a legal entity in form P15001. It must reflect all actions that were taken in the process of closing the company. Thus, this application for liquidation of an LLC must be drawn up without fail if there is a need to close any company.

https://www.youtube.com/watch?v=ytcopyrightru

The notification document p15001 can be filled out electronically on a computer, or in paper form by hand on a printed form, or printed out on a printer.

This form includes three sheets in total. However, only those that correspond to the current situation need to be filled out and submitted to the tax office. So, Sheet A needs to be filled out only when a commission is appointed, and Sheet B is drawn up in every situation that requires filing a notice of liquidation.

Title page

The title page must be completed in any case. Section 1 contains the full details of the person in relation to whom the LLC is being liquidated. The TIN, OGRN codes, as well as the full name are written here. All this information is entered into the form exactly as it is recorded in the state register of the Unified State Register of Legal Entities.

In section 2 of the title page, a mark is placed opposite the reason for filing the application.

There are four of them:

- It was decided that the LLC is being liquidated, indicating the start date - clause 2.1;

- A commission is formed or a separate liquidator is appointed - clause 2.2. If this item is checked, then you must also fill out Sheet A. In all other cases, this sheet is not included in the document;

- During liquidation, an interim balance sheet was drawn up - clause 2.3;

- The founders decided to stop the process of liquidation of the company - clause 2.4.

Attention!

The last point with the ability to cancel a previously started liquidation process is the main difference between the new form and the previously used one.

Points 2.1 and 2.2 can be checked at one time. This means that the decision to liquidate has been made and a commission has already been formed.

Sheet A

Sheet A consists of two pages. It needs to be filled out only if item 2.2 was selected on the title page. Otherwise it goes down.

Column 1 contains the code indicating who will carry out the liquidation process:

- Code 1 - a liquidation commission has been formed, and information about its leader is entered on the sheet;

- Code 2 - one person will perform the liquidation.

Column 2 includes the date as of which a liquidation commission was organized or a separate liquidator was appointed.

Details of the person performing the liquidation are then recorded on the sheet.

Column 3 contains the full name of this person. In column 4, enter the TIN code, if any.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Column 5 records the date and place of birth.

Column 6 contains information about the document that establishes the identity of the liquidator.

Page 2 of Sheet A contains information about the residential address of the liquidator. Depending on the status of the person, the lines of block 7.1 are filled in on the sheet - if his place of residence is on the territory of the Russian Federation, or block 7.2 - if outside its territory in another country.

If the first item is selected, then information about the region, city, street, house numbers, apartments, etc. is entered. All information is indicated taking into account the KLADR address directory.

In the second situation, the code of the country of residence and the address are entered without dividing into its components.

Column 8 contains a telephone number where you can contact the liquidator.

Sheet B

Sheet B is filled out each time a document is submitted and contains information about the person or company that is filing the application to close the company.

Column 1 contains the applicant's code. It could be as follows:

- 1 – submitted by an individual who is the founder;

- 2 - submitted by the company that is the founder of this;

- 3 - submitted by the body that decided to carry out the liquidation (if, for example, it is carried out by decision of the judicial authorities);

- 4 – submitted by the head of the liquidation commission or one liquidator;

- 5 - submitted by a person who, according to the Charter, can perform actions without a power of attorney.

All further information is indicated depending on what liquidator code was specified. All unused sections should simply be left blank, without strikethroughs or other marks.

- If code 1, 4, 5 was selected, you need to fill out sections 5 or 6.

- If code 2 was selected, the information is entered in sections 2, 3, 5, 6. In this case, section 3 is also filled out if necessary - if the company that is the founder has a management company. Sections 5 and 6 record information about the person who performs actions on behalf of the parent company.

- If code 3 was selected, then information is entered in sections 4, 5, 6. In this case, in section 4 the data of the government agency is indicated, and in 5 and 6 - the representative person.

Important!

One of the features of Section 7 is that it must be filled out by hand and only in the presence of a notary. The latter provides certification by indicating his personal data.

Sample of filling out form P15001 in 2021

Below are examples of filling out form P15001 for the following liquidation actions:

Making a decision on liquidation and forming a liquidation commission

If the owner of an enterprise decides to cease its activities and close it, current legislation obliges him to report his decision to the tax service. A similar procedure must be followed in case of forced liquidation of a company. For this purpose, the chairman of the commission draws up a notice of liquidation of the LLC in form P15001.

After the management of the company analyzes the current circumstances, they announce the convening of a general meeting of participants, at which it is necessary to jointly make a decision to close the company by drawing up the appropriate minutes.

In addition, at this event, a liquidation committee should also be formed, headed by a chairman, which will take into account the interests of the company during this event.

Its composition may include the owner, manager, heads of departments and other specialists who work in the company. The chairman must be chosen from among the members of the commission. If the commission includes only one member, then he is called the liquidator.