| A busy schedule prevents you from attending professional development events? We found a way out! |

Consultation provided on May 15, 2015.

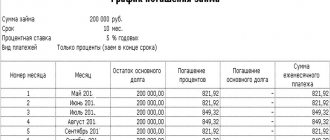

The lender organization works on the simplified tax system, the borrower organization works on the general taxation system. The borrower repays the loan in installments.

In these organizations, the founder is the same individual. His share in the authorized capital of the lender company is 100%, in the borrower company - 50%.

Does the borrowing organization generate income when repaying an interest-free loan? How is a loan repayment transaction reflected in accounting?

Having considered the issue, we came to the following conclusion:

When a borrowing organization repays (partially repays) an interest-free loan, it does not generate income either for profit tax purposes or for accounting purposes.

Rationale for the conclusion:

First of all, we note that the parties to civil law relations are free to conclude an agreement, both provided for and not provided for by law (Article 421 of the Civil Code of the Russian Federation).

Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality (Clause 1 of Article 807 of the Civil Code of the Russian Federation).

In accordance with Art. 809 of the Civil Code of the Russian Federation, a loan agreement can be gratuitous (interest-free).

Legal basis

Let us recall that until June 1, 2015, compensation was provided not only by transfer of property, but also, in particular, in the form of performing work (rendering services), since the previous version of Article 409 of the Civil Code of the Russian Federation contained an open list of methods for providing compensation.

It is important to know that the obligation is considered extinguished at the moment the compensation is provided, and not at the moment the agreement on it is signed. This means that on the date of concluding the agreement on the provision of compensation, the borrower’s obligation does not terminate. To terminate the obligation, the actual provision of compensation, that is, the transfer of property, is necessary. Therefore, if the loan is interest-bearing, then interest accrues until the borrower transfers the property. And if real estate is provided as compensation, then the compensation agreement is considered executed only after state registration of the transfer of ownership of the real estate to the creditor. This conclusion follows from the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 17, 2014 No. 2826/14 in case No. A57-2430/2011.

And one more important point. Within the meaning of Article 409 of the Civil Code of the Russian Federation, unless otherwise follows from the compensation agreement, with the provision of compensation all obligations under the contract are terminated, including the obligation to pay a penalty (clause 3 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102). This means that if the loan was interest-bearing, then with the compensation agreement all obligations are repaid, including the payment of interest. Unless, of course, otherwise provided in the agreement. Therefore, if the lender wants to receive his interest in cash, and the body of the loan itself is ready to receive “in kind,” then the corresponding procedure must be specified in the agreement. Otherwise, with the provision of compensation, the entire debt will be repaid, that is, the loan itself and the interest on it.

The value of the property transferred as compensation does not have to be equivalent to the debt under the terminated obligation (clause 4 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102, Resolution of the Federal Antimonopoly Service of the North-Western District dated March 16, 2012 in case No. A56- 30457/2009). Therefore, the borrower can set the value of the transferred property either higher or lower than his debt. In this case, the parties must decide whether the transfer of “unequal” property will repay the loan obligation in full? Or will it “cover” the debt only partially (in terms of the value of the transferred property)? The fact is that if this point is not reflected in the compensation agreement, then by default it is considered that the obligation is terminated completely (clause 4 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102).

Repayment of the loan to the founder

In this case, the former lender becomes the buyer, and the former borrower becomes the seller. The cost of the transferred goods does not have to be specified in the agreement. The main thing is to indicate its name and quantity, otherwise the novation agreement will be considered not concluded. 3 tbsp. 455 Civil Code of the Russian Federation; clause 3 of the Information Letter of the Presidium of the Supreme Arbitration Court dated December 21, 2005 No. 103. Schematically, the innovation looks like this. Accounting with the lender-buyer Accounting with the borrower-seller Income tax (accrual method) 1.

Goods are accepted for accounting in the amount of the obligation that was terminated by novation.2. The purchase price of these goods can be taken into account in expenses. 2 tbsp. 254, paragraph 1, art. 257, paragraph 1, art. 268 of the Tax Code of the Russian Federation. Before signing the novation agreement, the amount of interest accrued at the end of each month and on the date of signing the novation agreement is included by the lender in non-operating income. 6 tbsp. 250, paragraph 6 of Art. MPZ, No. 2

- The penalty for late payment of utilities has been increased, No. 1

- 2015

- Parting with the debtor, No. 24

- The Supreme Court clarified when recognition of a debt does not interrupt the statute of limitations, No. 22

- To account for expenses, fine and fine are different, No. 20

- Supply contracts in e.: we deal with transitional provisions, No. 19

- When you have to pay legal interest, No. 17

- Supreme Court: a few touches to the “tax and business” picture of the day, No. 15

- Settlement without problems, No. 13

- Your debt has been paid by your debtor, No. 11

- Nuances of bad debts of individuals, No. 9

- A bad peace is better than a good quarrel, No. 8

- What to do if the debt “hopelessness” quarter is missed, No. 8

- What was yours is now ours, No. 5

- Is it possible to collect a debt from an unexpectedly liquidated debtor, No. 4

Transferred the property? Add VAT!

The tax base is defined as the value of the transferred property, calculated on the basis of prices determined in accordance with Article 105.3 of the Tax Code of the Russian Federation, and without including tax in them (clause 1 of Article 154 of the Tax Code of the Russian Federation). According to paragraph 1 of Article 105.3 of the Tax Code of the Russian Federation, prices used in transactions in which the parties are persons who are not recognized as interdependent are recognized as market prices. In fact, this means that the value of the property that the parties agreed upon, excluding VAT, should be included in the VAT tax base. By adding VAT on top (multiplying by 118%), we get the value of the property including VAT. It is this value that should be specified in the compensation agreement.

Since the transfer of property as compensation is a VAT-taxable operation, an invoice must be issued along with the transfer act. It should be registered in the sales ledger and then included in the VAT return.

Reflected in accounting

For clarity, we will consider the reflection in accounting of transactions for the transfer of compensation using a practical example.

Example:

Financial House LLC issued Skazka LLC an interest-bearing loan in the amount of 110,000 rubles. The parties entered into a compensation agreement. As compensation, equipment is transferred at a cost of 118,000 rubles. (including VAT – 18,000 rubles). The residual value of the equipment was 60,000 rubles. At the time of transfer of property, the interest debt amounted to 8,000 rubles. and the total debt under the loan agreement is 118,000 rubles, which corresponds to the cost of the transferred equipment, including VAT.

Debit 62 (76) Credit 91

— 118,000 rub. – equipment was transferred as compensation;

Debit 91 Credit 01

— 60,000 rub. – reflects the residual value of the property;

Debit 91 Credit 68

— 18,000 rub. – VAT is charged on the value of the transferred compensation;

Debit 66 Credit 62 (76)

— 118,000 rub. – reflects the repayment of debt on a loan obligation.

Unequal compensation

In such cases, tax risks are likely. If the value of the property exceeds the terminated obligation, then the risks arise with the receiving party (the lender). Officials believe that in this situation the organization must reflect non-operating income on which it is necessary to pay income tax. This conclusion can be seen, for example, in Letters of the Ministry of Finance of the Russian Federation dated February 3, 2010 No. 03-03-06/1/42, Federal Tax Service of Russia for Moscow dated December 5, 2007 No. 19-11/116142. By taxing this difference to income tax, the company will eliminate tax risks.

At the same time, officials note that for a borrower who transferred property worth more than the amount of his debt, the resulting difference cannot be attributed to a decrease in taxable profit.

In the opposite situation (the value of the property is less than the amount of the terminating obligation), risks arise with the transferring party, that is, with the borrower. The Federal Tax Service will consider that it has generated non-operating income in the amount of the excess. At the same time, the loss that the other party (the lender) receives, according to officials, cannot be accepted for tax purposes (Letter of the Federal Tax Service of Russia for Moscow dated December 5, 2007 No. 19-11/116142).

Taking all this into account, it is better for the parties not to resort to “unequal exchange”. Or the value of the property transferred as compensation should be adjusted to the amount of the debt being repaid. This will not be a violation, because the prices used in transactions, the parties to which are persons who are not recognized as interdependent, are recognized as market prices (clause 1 of Article 105.3 of the Tax Code of the Russian Federation). In other words, the price that the parties determined in the agreement will be the market price.

Repayment of the loan to the founder

Clerk.Ru Accounting General Accounting Accounting and Taxation Repayment of a loan in goods and a loan in goods PDA View full version: Repayment of a loan in goods and a loan in goods Anonymous 02/03/2009, 13:07 Dear, please tell me, I’m completely confused. The founder leaves the LLC, he has a cash loan received from him, he wants to receive it in goods, is it possible? After this, he wants to open his own personal company and contribute a loan from the founder there in goods, so that the company will then repay him this loan in money.

Encyclopedia of solutions. Repayment of a cash loan in things

Repayment of a cash loan in things

Under the loan agreement, the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality (clause 1 of Article 807 of the Civil Code of the Russian Federation).

Obligations must be fulfilled properly - in accordance with the terms of the contract and the requirements of the law (Article 309 of the Civil Code of the Russian Federation).

If funds were transferred to the borrower under a loan agreement, then the basis for its execution will be the return by the borrower to the lender of funds in the same amount. The discrepancy between the loan items when issuing and returning means the fulfillment of the obligation improperly.

The loan was returned with goods, what should I do?

And without accusations of concealing the implementation either. MiLLaP 09/08/2009, 11:07 black magic session with exposure. To be honest, I don’t see any scheme-free options for avoiding VAT here, and the manipulation of the loan doesn’t even amount to a scheme.

So, tease the Federal Tax Service. So if the goal is only to avoid VAT, forget about these repayable loans, look for something else. about innovation, the question is clear... the whole idea is not to pay VAT... LLC for wholesale. Borrowed money sooner or later has to be returned to the borrower. Often the founder of a legal entity acts as a borrower. How to properly process a loan repayment to the founder? Is it necessary to draw up a new contract or not? What is important to consider when repaying a debt The founder can issue money for the needs of his company with or without interest. In any case, it is necessary to draw up and sign a loan agreement. Since one of the parties is a legal entity, then according to Art. 808 of the Civil Code of the Russian Federation, it must be concluded in writing. The loan is repaid within the period specified in the agreement with or without interest, as specified in the agreement.

Important! The loan agreement is considered concluded not from the moment it is signed, but from the moment the funds are transferred. The same applies to loan repayment - obligations under the agreement terminate when the borrower returns the money to the lender.

The signed agreement does not affect the interest taken into account in expenses. After signing the agreement, the former borrower does not have “profitable” obligations associated with the loan agreement, since neither the receipt of the loan nor its repayment is recognized as income/expenses. 10 p. 1 art. 251, paragraph 12 of Art. 270 of the Tax Code of the Russian Federation VAT 1. The money transferred under the loan agreement after the new obligation becomes an advance payment for the upcoming delivery.

- Accounting for writing off bad receivables, No. 23

- Is it possible to create a reserve for non-overdue debts of buyers, No. 21

- What does the seller risk when receiving money not from the buyer, but from a third party, No. 21

- Financial assistance from a friendly company: accounting, taxes, registration, No. 20

- New customer claims - new tax solutions, No. 20

- Do you owe me? I forgive you, No. 20

- Do you have any complaints about the work performed? There is a tax decision, No. 19

- There is no one to receive the debt... So there will be income!, No. 17

- Bad debt is not related to sales: should it be written off from the tax reserve?, No. 17

- The contract is terminated: what then?, No. 17

- We calculate and collect penalties, No. 16

- Your debtor has disappeared from the Unified State Register of Legal Entities.

MAIN LEDGER" on the topic "Receivable / Creditor": 2021

- They paid an advance, but did not receive the goods: what about taxes, No. 9

- The buyer is bankrupt: safe execution of the transaction, No. 5

- Test: accounting for money in a burst bank, No. 24

- Problematic accounts receivable: write off or collect?, No. 23

- The pre-trial procedure can be used less frequently, No. 14

- You were paid “for that guy”: what to do, No. 11

- Debts in e., arising before 2015: accounting and write-off, No. 3

- Verification of contracts, No. 24

- We paid the seller using the old details: what to do, No. 19

- I want to know everything: we charge legal interest, No. 14

- Dealing with a bankrupt's debt, No. 12

- How does drawing up a reconciliation act affect the statute of limitations, No. 11

- Legal interest under Article 317.1 of the Civil Code of the Russian Federation: opinion of the Supreme Court, No. 8

- Agreement in e.

Therefore, depending on which taxation system the borrower uses, the following must be paid from the proceeds from sales:

- VAT;

- income tax

- single tax in a “simplified” form.

Through the cash register According to clause 2 of the Bank of Russia Instructions dated October 7, 2013 No. 3073-U, cash from the cash register, which is sales proceeds for goods sold, services provided or work performed, can only be used in the following areas:

- salary and other social benefits (sick leave or maternity leave);

- payment of insurance compensation to individuals under insurance contracts with individuals;

- issuing money to employees on account;

- payment for goods, works or services.

As can be seen from this list, repayment of the loan to the founder from the proceeds is not provided for in this list.

Repayment of a commodity loan with money is not trade.

The article “Return of a commodity loan” in NTV No. 32 dated August 8, 2017 caused heated discussions on social networks.

In the opinion of readers, a transaction involving the receipt of money for materials transferred under a commodity loan (by novation of debt) will not be considered trading.

This is justified by the fact that:

firstly, the materials are transferred under a commodity loan, and not under a purchase and sale agreement;

secondly, when nominating a commodity loan agreement, existing obligations change, and not the subject of the transaction;

thirdly, the transaction transfers materials, not goods purchased for resale.

However, not everything is so simple. Let's try to analyze the situation.

Materials and their purpose

A material is a substance from which products are made during the process of technological influence, or on its basis certain properties are imparted to manufactured products.

According to NAS No. 4 “Inventories” (registration of the Ministry of Justice No. 1595 dated July 17, 2006), materials are divided into main and auxiliary.

The main materials are those that are part of the manufactured product, form its basis or are a necessary component in its manufacture (for example, flour in the production of bakery products).

Auxiliary materials are those involved in the production of products or consumed for household needs, technical purposes and to assist the production process (for example, salt or dyes in the production of bakery products).

Thus, we can include as materials a product purchased for the purpose of using it directly in production .

In practice, there are situations when small manufacturing enterprises are forced to purchase a large batch of raw materials or materials, even if there is no production requirement for such a volume.

This may be due to supplier requirements for a minimum supply volume or wagon deliveries (mainly for imports), as well as the possibility of receiving a discount from suppliers when purchasing a large quantity.

The manufacturer has the right to use part of the purchased materials (surplus) for other – non-production purposes. He can sell them, transfer them to third parties in the form of a commodity loan, etc.

If we intend to use some of these materials for other purposes (for example, sell or lend), then their purpose will change.

You can give an example opposite to the above. An enterprise engaged in production and trading activities intends to use part of the goods for production purposes. In this case, the goods become materials.

Product functions

A commodity is any thing that participates in free exchange for other things, a product of labor that can satisfy human needs and is specially produced for exchange. Today, a commodity is anything that can be sold. This includes work and services, all types of energy, information, labor, intellectual property, etc.

When a thing is transferred under a commodity loan agreement, it is the subject of exchange for other identical things defined by generic characteristics, or for money when the loan is repaid in money. In this case, the materials loaned are considered as goods.

Was there any implementation?

Let us return to the question of whether a transaction involving the receipt of money for materials transferred under a commodity loan (by novation of debt) will be considered trading.

Trade is a type of entrepreneurial activity (Articles 3, 5 of the Law “On guarantees of freedom of entrepreneurial activity”).

According to tax legislation, sales are recognized as the shipment (transfer) of goods, performance of work and provision of services for the purpose of sale, exchange, gratuitous transfer, as well as the transfer by the pledgor of the right of ownership of the pledged goods to the pledgee.

Wholesale trade is considered to be the sale of purchased goods via non-cash payment for use for commercial purposes or for one’s own production and economic needs (clause 2 of the Regulations, approved by PKM No. 407 of November 26, 2002).

To recognize any activity of a person as entrepreneurial, the presence of 2 circumstances is required:

1) systematic actions taken aimed at making a profit;

2) carrying out such activities as the main one, that is, professional.

Based on the indicated signs, it is prohibited to recognize one-time civil law transactions as entrepreneurship (clause 3 of the post of the PVS No. 20 of December 11, 2013).

Thus, if the replacement of obligations to return materials with cash is carried out once, such an operation cannot be recognized as trade or other entrepreneurial activity.

But if such transactions are carried out purposefully or are of a systematic nature, then they can be qualified as trading activities with the ensuing consequences (the presence of a license).

Therefore, recognition as sales of the replacement of materials received under a loan agreement with cash and payment of taxes will depend on the above circumstances.

Muzaffar MIRZAGANIEV,

Features of the agreement

People often confuse loan and credit agreements, although Russian legislation quite clearly distinguishes between the two types of such agreements.

Let's look at how a loan agreement differs from a credit agreement:

- possibility of conclusion without the participation of the bank;

- the permissibility of obtaining a loan with or without interest;

- the ability to stipulate penalties in advance;

- mandatory indication in the contract of the characteristics of the transferred materials, raw materials or other things.

According to the legislation of the Russian Federation, loans can only be provided to organizations that have the appropriate license from the Central Bank of the Russian Federation. At the same time, loans can be issued and received by absolutely any companies and citizens who have reached the age of 18.

A loan always requires the borrower to pay interest. In loans, everything is different. The parties themselves can agree on the interest rate or even enter into an interest-free loan agreement.

If necessary, a certain fine may be collected from the lender for improper performance of the contract. Its size should be clarified in advance in the text of the contract.

A commodity loan agreement must necessarily include the following information:

- details of the parties;

- loan term;

- availability and amount of interest;

- characteristics of the product and its monetary value.

Important! It is unacceptable to indicate in a commodity loan agreement that it can be repaid in cash. Only interest on the use of goods loaned can be received by the lender in cash.

As already mentioned, absolutely any person can be a party to the transaction.

In practice, three types of loan agreements are common:

- both parties to the transaction are ordinary citizens;

- two organizations are involved in the transaction;

- One party is the company, and the other is an ordinary citizen.

Important! A non-monetary loan agreement must be concluded in paper form and certified by the signatures of the parties.

It is worth noting that the loan agreement is considered concluded only after the transfer of goods, and not from the moment the papers are signed. This is another significant difference between loans and credits.

Legislative justification

Obtaining commodity loans is regulated by Chapter 42 of the Civil Code of the Russian Federation. Article 807 of the Code states that in case of commodity (non-monetary) loans, a person is provided with a certain item. He is obliged to return an item with similar generic characteristics. The latter refers to these characteristics:

- Volume of production.

- Quality.

- Type of packaging.

- Width of assortment, etc.

When describing the objects provided, you can use the standard rules that are relevant when concluding a purchase and sale agreement.

Documenting

The main document that governs the receipt of a commodity loan is an agreement. When drawing up it, you need to take into account the nuances of the form of lending in question, as well as the rules for drawing up a purchase and sale agreement. Let's consider all the nuances of drawing up a contract:

- A clause is indicated on the right to transfer ownership of a thing from one legal entity to another.

- The provisions of a standard purchase and sale agreement are prescribed: type of asset, its characteristics, quantity.

- Additional items are indicated: availability of interest, loan repayment terms.

As a rule, the contract contains information about the real value of the transferred object.

FOR YOUR INFORMATION! The agreement is recognized as concluded from the date of transfer of the thing on the basis of Article 760 of the Civil Code of the Russian Federation. If an agreement is concluded between legal entities, it must be drawn up in writing (clause 1 of Article 761 of the Civil Code of the Russian Federation). The debtor must return the object within the time period specified in the agreement.

Hocus pocus: loan repayment turned into delivery of goods

The loan can be issued in both rubles and foreign currency. However, repaying a loan to a non-resident founder in foreign currency can cause many problems for the chief accountant. A foreign currency loan must be repaid in rubles at the exchange rate of the Central Bank of the Russian Federation on the day of repayment. Interest is also expressed in foreign currency, but is accepted for accounting in rubles. If the founder issues a loan with interest, then their amount and payment procedure must be specified in the agreement.

If the amount of interest is not specified in the agreement, then it is considered “by default” to be equal to the refinancing rate of the Central Bank of the Russian Federation on the day the interest is paid. If the agreement does not specify the payment procedure, the borrower must pay them monthly throughout the entire term of the agreement.

In the case where the lender is both the founder and director of the borrower company, the agreement must be drawn up in the same way as with any other borrower.

Taxation

The item received and returned does not affect the calculation of income tax. Objects are not required to be included either in the structure of income (clause 1 of Article 251 of the Tax Code of the Russian Federation) or in the structure of expenses (clause 12 of Article 270 of the Tax Code of the Russian Federation). Commodity loans sometimes involve interest charges. In this case, the accumulated interest is included in the structure of non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation). However, it is necessary to take into account the restrictions listed in Article 269 of the Tax Code of the Russian Federation. If you receive an interest-free loan, no income is generated from the lack of interest.

The actual value of the item received and returned may vary. How to take into account the difference when determining income tax? There is no clear explanation in the law on this matter. The term “amount differences” is in Chapter 25 of the Tax Code of the Russian Federation, but it does not apply to the lending operations under consideration.

When determining income tax on a commodity loan, the difference is not taken into account. This is explained by the fact that a loan in kind does not need to be included in the structure of income (clause 1 of Article 251 of the Tax Code of the Russian Federation) and the structure of expenses (clause 12 of Article 270 of the Tax Code of the Russian Federation).

The issuance and receipt of commodity loans is subject to VAT. Can it be taken as a deduction? Not long ago, paragraph 4 of Article 168 of the Tax Code of the Russian Federation appeared, according to which VAT will be deductible on standard grounds.

Let's look at the transactions that allow you to take VAT into account:

- DT10 KT66, 67. Obtaining a commodity loan.

- DT19 KT66, 67. Allocation of VAT on assets received.

- DT68 KT19. Acceptance of VAT deduction.

VAT will also be charged on interest. However, this only applies to those interests whose amount exceeds the limit. The latter is determined by the Central Bank refinancing rate (subparagraph 3, paragraph 1, Article 162 of the Tax Code of the Russian Federation). The VAT rate is established by calculation method (clause 4 of Article 164 of the Tax Code of the Russian Federation).

The transfer of things and their shipment to repay the loan do not constitute expenses on the basis of paragraph 12 of Article 270 of the Tax Code of the Russian Federation. Only interest on the loan will be recorded in tax accounting.

Hocus Pocus: Loan repayment turned into goods delivery

Ovsyannikova A.

Tax and accounting consequences of innovation.

We have already written more than once about replacing obligations (novations). For example, how an obligation to pay for goods supplied can be transformed into an obligation to repay a loan. In this article, we propose to deal with the following situation: the borrower, instead of repaying the loan, supplies the lender with goods.

After signing the novation agreement, all obligations under the loan agreement cease. In this case, the former lender becomes the buyer, and the former borrower becomes the seller.

We warn the manager

If your lender company plans to terminate the borrower’s obligation by novation only to repay the “body” of the loan, then this condition must be specified in the novation agreement. Otherwise, after concluding the agreement, all obligations of the borrower will cease, including repayment of interest under the loan agreement.

This is interesting: Insurance payment is... Definition of the concept

Note. The cost of the transferred goods does not have to be specified in the agreement. The main thing is to indicate its name and quantity, otherwise the novation agreement will be considered not concluded.

Schematically, the innovation looks like this.

Tax and accounting during innovation

Accounting with the lender-buyer

Accounting with the borrower-seller

Income tax (accrual method)

1. Goods are accepted for accounting in the amount of the obligation that was terminated by novation. 2. The purchase price of these goods can be taken into account in expenses. Note. Before signing the novation agreement, the lender includes the amount of interest accrued at the end of each month and on the date of signing the novation agreement as part of non-operating income. The signed agreement does not affect the interest recorded in income. After signing the novation agreement, there are no “profitable” obligations under the loan agreement, since the transfer of the loan and receipt of the returned money are not recognized as income/expense

1. On the date of transfer of goods, income arises in the amount of the obligation repaid by novation. 2. Income can be reduced by the purchase price of the goods transferred. Note. Interest accrued at the end of each month and on the date of signing the novation agreement is included by the borrower in non-operating expenses within the standard. The signed agreement does not affect the interest taken into account in expenses. After signing the agreement, the former borrower does not have any “profitable” obligations associated with the loan agreement, since neither the receipt of the loan nor its repayment is recognized as income/expense

VAT

1. The money transferred under the loan agreement after the new obligation becomes an advance payment for the upcoming delivery. But even if there is an advance invoice from the former borrower, it is impossible to accept VAT from the advance for deduction, since in fact there is no payment order for the transfer of the advance (with the corresponding purpose of payment) and a supply agreement providing for prepayment. 2. When the delivered goods are accepted for accounting, and there is also a “shipping” invoice from the seller, input VAT can be deducted. Note. After signing the novation agreement, the former lender does not have VAT obligations under the loan agreement, since the loan is not subject to VAT

1. After signing the novation agreement, you need to charge VAT and issue an advance invoice to the buyer (former lender) within 5 days (since the money under the loan agreement after novation is an advance). 2. Having shipped the goods, you need to charge VAT on the cost of the goods, issue a “shipping” invoice within 5 days, and accept the previously accrued advance VAT for deduction. Note. After signing the novation agreement, the former borrower does not have VAT obligations associated with the loan agreement. After all, the loan is not subject to VAT

Tax under simplified tax system

1. The goods received are considered paid for on the date of signing the novation agreement, and they must be taken into account in the amount of the obligation that was terminated by the novation. 2. The cost of goods can subsequently be taken into account as expenses. Note. Accrued interest for tax purposes is included in income on the date of signing the novation agreement. The transfer/repayment of a loan is not an income/expense when calculating tax under the simplified tax system, therefore, when signing a novation agreement, no tax obligations arise

1. To calculate tax under the simplified tax system, income from the sale of goods is recognized on the date of signing the novation agreement. 2. The purchase price of goods sold can be recognized as expenses if these goods are paid for. Note. Interest that accrued before signing the agreement is included for tax purposes, within the limits of the standard, as part of expenses on the date of signing the agreement. The transfer/repayment of a loan is not income/expense for tax purposes, which means that no tax obligations arise upon signing the agreement

Example. Accounting innovations

Condition

Solution

Accounting entries from the buyer (formerly the lender).

Accounting

The debtor must keep records of the loan on the basis of PBU 15/01 “Accounting for Loans”, established by Order of the Ministry of Finance No. 60n dated August 2, 2001. Calculations will be recorded on accounts 66 and 67. Debt is taken into account in the valuation of acquired assets (clause 3 of PBU 15/01).

The resulting assets must be capitalized at a value determined using the same algorithm that is used when valuing similar objects. However, an accountant can make his job easier. For the posting price, you can take the amount specified in the agreement. If no amounts appear in the contract, you can take the cost stated in the invoice.

The transfer of ownership rights to objects is considered a sale on the basis of paragraph 1 of Article 39. The operation is considered an object of taxation. In particular, it is subject to VAT.

Often, with a commodity loan, the debtor receives one item and returns another item with similar characteristics. In this case, the real value of the transferred assets may differ from the real value of the returned items. The difference that arises is attributed either to income or to expenses, depending on its positive or negative value. Differences are accounted for on the basis of PBU 18/02, approved by Order of the Ministry of Finance No. 114n dated November 19, 2002.

The lender must also take into account the commodity loans provided. Accounting is carried out on the basis of PBU 19/02, approved by the Ministry of Finance No. 126n dated December 10, 2002. Paragraph 3 of this act states that a trade loan will be considered a financial investment. The amount must be recorded in account 58. The loan is assessed based on the actual value of the transferred assets. After classifying things as financial investments, the cost of the objects is compared with their cost during regular sale without VAT. The resulting difference is attributed either to income or expenses.

What does it mean to borrow goods?

Borrowed funds are often sought when it is necessary to purchase certain things. At the same time, many people forget that they can borrow not only money, but also various goods.

Banks rarely resort to trade loans, trying to record all transactions in monetary terms. Unlike loans, loans can be issued and taken by any legal entity or individual.

According to the law, the borrower must return completely similar goods to the lender. Moreover, all important characteristics must coincide, for example, size, color, and so on.

Often a commodity loan is issued between companies. Typically, the terms of such agreements are more favorable, since the lender is a party interested in the partner’s development, for example, an affiliated company.

Wiring used

Let's look at the entries used by the providing party as part of accounting:

- DT58 KT41. Write-off of products provided to the debtor.

- DT58 KT68. VAT accrual on the market value of assets.

- DT58 KT91. Correction of the volume of financial deposits to the market value of objects.

- DT58 KT41. Formation of the cost of deposits at the expense of the cost of things.

The borrower's accounting will depend on the type of loan (short-term/long-term):

- Score 66 if the contract is valid for less than a year.

- Score 67 if the agreement is valid for more than a year.

Let's consider the transactions used by the borrower:

- DT10, 41 KT66, 67. Receipt of things under the loan agreement.

- DT19 KT66, 67. VAT on assets.

- DT91 KT66, 67. Monthly accrual of interest on the loan.

- DT66, 67 KT51. Transfer of funds based on interest.

When returning items, these records are used:

- DT66, 67 KT10, 41. Accounting for the actual cost of things on a loan.

- DT66, 67 KT68. VAT accrual.

- DT91, KT66, 67. The value of the assets is adjusted to that specified in the agreement.

The same entries are used when paying interest. The main primary document for accounting is the commodity loan agreement.

The loan was returned with goods, what should I do?

For example, returning a loan to the founder with a car, which is the property of the borrower. Its approximate cost will pay off the debt to the lender. Cash As mentioned above, repayment of a loan to the lender in cash from the cash desk is not possible, according to clause 2 of the Bank of Russia Directives dated October 7, 2013 No. 3073-U. Even if the lender, when issuing a loan, deposited money in cash, according to these Instructions, the borrower must hand it over to the bank on the same day. Upon expiration of the loan term, he must withdraw money from the account, indicating the basis for “returning the loan to the founder,” and then issue it from the cash desk on the same basis, only according to RKO.NDFL. The lender must pay personal income tax only if he issues an interest-bearing loan . Income tax is paid only on interest on the loan, since the main debt is the founder’s money, and he receives his money back in due time.

Latest publications

When purchasing square meters, it is important for citizens applying for a property tax deduction to pay attention to the status of the property: whether it is residential or not. Explanations from the Ministry of Finance were published by the Federal Tax Service (FTS).

Due to the direct instructions of the Labor Code, labor relations are of a remunerative nature. Receiving timely and full wages is one of the key rights of an employee, and timely and full payment is the main responsibility of the employer. Moreover, in the case of an employee performing work, no external factors - emergency circumstances, disasters or threats of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and other cases that jeopardize the life or normal living conditions of the entire population or part of it are not must prevent the exercise of this right and obligation. Although there are still some reservations on this matter in the Labor Code of the Russian Federation.

According to the law, the period for conducting both documentary and on-site inspections cannot exceed 20 working days. In the case where a legal entity operates in several regions, the duration of any of these inspections is determined separately for each of its branches, representative offices or separate structural units. In this case, as established, the total period of the inspection cannot be more than 60 working days. Courts have differing opinions on what time period is meant here: all inspections of a legal entity and its branches and divisions, or inspections of each of them, and this is clearly illustrated by one of the cases considered recently by the Supreme Court of the Russian Federation.

Compensation for work in rural areas serves as a social guarantee for medical workers. We will explain in the article what conditions such payments are made and whether they are subject to personal income tax.

On March 11, the State Duma adopted in the third, final reading the Law of the Russian Federation on an amendment to the Constitution of the Russian Federation “On improving the regulation of certain issues of the organization and functioning of public power.” Let us recall that the law provides for the introduction of targeted adjustments to individual articles of Chapters 3-8 of the Basic Law of the state regarding the establishment of additional social guarantees, expansion of the powers of public authorities, clarification of the procedure for forming the Government of the Russian Federation, etc.