The leased item can be insured against the risks of loss, shortage or damage from the moment the property is delivered by the seller until the end of the contract. The parties acting as the insured and beneficiary, as well as the period of insurance of the leased asset, are determined by the contract, as follows from paragraph 1 of Article 21 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”. Thus, by agreement of the parties, the obligation to insure the leased asset can be assigned to both the lessor organization and the recipient organization. The insurance premium itself is a fee for a service that the policyholder, that is, the beneficiary, is obliged to pay to the insurer in the manner and within the time limits established by the contract (clause 1 of Article 954 of the Civil Code of the Russian Federation).

The first thing you should pay attention to is the provision of subparagraph 7 of paragraph 3 of Article 148 of the Tax Code. According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium.

Accounting for insurance of the leased asset

Insurance of the leased item allows you to receive compensation in case of loss or damage to property.

Tengiz Bursulaya, leading auditor of Yurinform-Audit LLC, will talk about tax accounting for transactions involving the payment of insurance premiums. The leased item can be insured against the risks of loss, shortage or damage from the moment the property is delivered by the seller until the end of the contract. The parties acting as the insured and beneficiary, as well as the period of insurance of the leased asset, are determined by the contract, as follows from paragraph 1 of Article 21 of the Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”. Thus, by agreement of the parties, the obligation to insure the leased asset can be assigned to both the lessor organization and the recipient organization. The insurance premium itself is a fee for a service that the policyholder, that is, the beneficiary, is obliged to pay to the insurer in the manner and within the time limits established by the contract (clause 1 of Article 954 of the Civil Code of the Russian Federation).

The first thing you should pay attention to is the provision of subparagraph 7 of paragraph 3 of Article 148 of the Tax Code. According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium.

Insurance when purchasing equipment on lease

| INSURANCE OF LEASING ACTIVITIES |

Global experience in legal relationships in leasing shows that when concluding leasing agreements, the lessee assumes the obligation to insure the transportation of leased equipment, its installation and commissioning, and property risks. The need to insure property leased is also noted by the Convention “On International Financial Leasing”, concluded in Ottawa on May 28, 1988. In accordance with paragraph Art. 21 of the Law “On Leasing”:

1. “The subject of leasing may be insured against the risks of loss (destruction), shortage or damage from the moment of delivery of the property by the seller (supplier) until the end of the lease agreement, unless otherwise provided by the agreement.” 2. Insurance of business (financial) risks is carried out by agreement of the parties to the leasing agreement and is not mandatory. 3. The parties performing the duties of the insured and beneficiary, as well as the terms of insurance, are determined by the leasing agreement. 4. The lessee, in cases determined by the legislation of the Russian Federation, must insure its liability for the fulfillment of obligations arising as a result of causing harm to the life, health or property of other persons in the process of using the leased property. It should be emphasized that in this formulation of the Law “On Leasing”, the leased item receives insurance protection from the moment the property is delivered by the seller. This means that if any extraordinary events occur, for example, during transportation, the lessor will not only incur additional costs for restoring the leased asset, but will also not fulfill its obligations to the lessee and will be obliged to pay him the compensation specified in the leasing agreement. Therefore, the lessor is interested in insuring the leased asset also for the period of its transportation. From clause 3 it becomes clear that by the time the leasing agreement comes into force, the corresponding insurance contracts must also come into force (which, in turn, come into force from the moment the insurance premiums are paid).

The law also contains Article 22 “Risks not related to insurance”

: 1. Responsibility for the safety of the leased asset from all types of property damage, as well as for the risks associated with its destruction, loss, damage, theft, premature breakdown, error made during its installation or operation, and other property risks from the moment of actual acceptance the leased item is borne by the lessee, unless otherwise provided by the leasing agreement.

2. The risk of insolvency of the seller (supplier) is borne by the party to the leasing agreement that chose the seller (supplier), unless otherwise provided by the leasing agreement. 3. The risk of non-compliance of the leased item with the purposes of using this item under the leasing agreement is borne by the party that chose the leased item, unless otherwise provided by the leasing agreement. The risks listed in clause 1 of Article 22 belong to the category of classic insurance risks

. There is an apparent contradiction between clause 1 of Article 21 and clause 1 of Article 22, when, on the one hand, “the leased asset can be insured against the risks of loss (destruction), shortage or damage from the moment the property is delivered by the seller until the end of the lease agreement ”and, on the other hand, when “the responsibility for the safety of the leased asset from all types of property damage lies with the lessee,” is easily solvable. The lessee must insure the leased asset against all types of property damage, and the beneficiary under the insurance agreement must be the lessor. Such insurance will significantly reduce the lessor's investment risk. We must not forget about the responsibility of the lessee, for example, for damage that may be caused to the life, health and property of third parties. Insurance of the lessee's liability for causing such damage significantly increases the financial stability of the lessee.

| FEATURES OF INSURANCE OF SELF-PROPELLED MACHINES AND TECHNICAL EQUIPMENT |

Specifics of insurance of self-propelled vehicles and technical equipment

is that, on the one hand, self-propelled vehicles are quite expensive mechanisms, which, often operating in harsh conditions, are prone to accidents and sudden breakdowns. Typically stored in open areas, they can also be subject to both malicious acts and natural disasters. Hence the need arises to insure self-propelled vehicles and mechanisms against the listed and other risks. Motor vehicle comprehensive insurance rules do not apply here. Insurance of self-propelled vehicles, mechanisms and other types of equipment falls into the category of “technical risk insurance”. Depending on the types of machines and the specifics of their use, they can be insured either individually or in combination, for example, under the following conditions: - rules for insurance of construction machines, mechanisms and mobile equipment; — rules for car insurance against breakdowns; — comprehensive insurance “against all risks” of construction and installation — during the construction of residential, public and industrial buildings, engineering structures, roads, airports, tunnels.

On the other hand, self-propelled machines and mechanisms that move and operate, like cars, on or near public roads, are “sources of increased danger.” Despite the fact that they move independently at low speeds, the potential damage that can be caused by self-propelled machines and technical means can be quite large. This especially applies to lifting mechanisms, construction machines, machines and mechanisms for agriculture, etc. The liability of operators of many types of self-propelled machines, especially lifting, loading and unloading, for excavation work, etc., must be insured on the basis of the Law of the Russian Federation “On Industrial Safety of Hazardous Production Facilities of 1997”. Article 15 “Compulsory liability insurance” is devoted to insurance. for causing harm during the operation of a hazardous production facility: 1. An organization operating a hazardous production facility is obliged to insure liability for damage to life, health or property of other persons and the environment in the event of an accident at a hazardous production facility. 2. The minimum amount of the insurance amount for liability insurance for causing harm to the life, health or property of other persons and the environment in the event of an accident at a hazardous production facility is for: a) a hazardous production facility specified in paragraph 1 of Appendix 1 to this Federal Law, in if on it: - hazardous substances are produced, used, processed, formed, stored, transported, destroyed in quantities equal to or exceeding the quantities specified in Appendix 2 to this Federal Law - seventy thousand minimum wages established legislation of the Russian Federation on the day of conclusion of the liability risk insurance contract; - hazardous substances are obtained, used, processed, formed, stored, transported, destroyed in quantities less than the quantities specified in Appendix 2 to this Federal Law - ten thousand minimum wages established by the legislation of the Russian Federation on the day of concluding the insurance contract risk of liability; b) other hazardous production facility - one thousand minimum wages established by the legislation of the Russian Federation on the day of conclusion of the liability risk insurance contract.” It is clear from the text that most self-propelled vehicles and technical equipment fall under the wording of paragraph b) of Article 15. It is clear that 1000 minimum wage (from 01/01/01 - 100,000 rubles) in most cases cannot cover damage that, for example, can be caused an unsuccessfully turned container lift or excavator. However, nothing prevents enterprises from insuring their liability on a voluntary basis, especially since, according to Decree of the Government of the Russian Federation of May 31, 2000 No. 420, insurance costs in the amount of up to three percent can be attributed to the cost of products (works, services), including up to two percent - for property and liability insurance of enterprises. Voluntary liability insurance for operators of self-propelled vehicles and other mechanisms is carried out on the basis of the rules of third party liability insurance during construction and installation work or on the basis of the rules of civil liability insurance of enterprises.

| BASIC PROVISIONS OF MOBILE EQUIPMENT INSURANCE CONDITIONS |

As an example, it is appropriate to cite the basic conditions of insurance for mobile equipment, on the basis of which the insurance rules of a number of leading Russian insurance companies have been developed. Insurance contracts are concluded in relation to the following property: - Construction equipment; — Additional equipment, i.e. mobile parts of equipment not attached to the main unit, as well as accessories and spare parts for the insured property; — Scaffolding made of steel pipes and metal structures, metal formwork, machines and devices for installing formwork; — Control and laboratory instruments, workshop equipment, radio equipment, fire and security alarm equipment; — Temporary buildings and structures, namely construction barracks, offices, warehouses, workshops, laboratories; — Other movable property, the place of operation of which may change. The insurance does not cover: - Loss or damage to vehicles approved for operation on public roads, floating craft or aircraft; — Equipment of temporary buildings and structures, namely construction barracks, offices, warehouses, workshops and laboratories; — Personnel property; — Basic and auxiliary materials consumed in the production process, such as fuel, chemicals, filters and filter materials, cooling, cleaning and lubricants; — Tools of all kinds, such as drills, jackhammers, knives, teeth, cutting saw blades and grinding discs; — Conveyor belts, sieves, hoses, ropes, belts, brushes, spikes, chains, tracks and cables.

The insurer, however, pays compensation for the parts and components listed in paragraphs 12 and 13 of this paragraph if they were damaged or destroyed along with the main components and assemblies of the equipment. The Insurer indemnifies the Insured for loss or damage to the insured property resulting from: - Direct impact of natural disasters, for example, earthquake, sinkhole, landslide, landslide, flood, inundation, storm, ice movement, except for cases specifically specified in the insurance contract), as well as unusually low temperatures; — Fire, lightning or explosion, as well as when extinguishing fire; — Installation or dismantling of objects; — Carrying out their loading or unloading.

By special agreement of the parties, the following events are recognized as insured events: - Internal breakdowns (including mechanical) that occurred as a result of: - Unavoidable impact on the insured equipment during its intended use; — The influence of low temperatures; — Lack of water, oil, lubricants; — The effects of other similar causes are not considered as insured events and are not covered by insurance. In addition, the insurance does not cover damage from loss or damage to the insured property caused by: - Defects that already existed at the time of concluding the insurance contract, which should have been known to the policyholder or persons responsible for the operation of the insured equipment; — Operation of property that is clearly in need of repair. The insurer, however, will pay compensation to the insured if it is proven that the loss and/or damage is in no way related to the need for repairs, or if the property was previously repaired with the consent of the insurer; - Theft. The insurer, however, will compensate the policyholder for losses associated with damage to property during an attempted theft; — Fire, lightning strike or explosion, or when extinguishing a fire in these cases in relation to the following items: control, laboratory instruments, workshop equipment, radio equipment, fire and security alarm equipment); - Military actions of any kind, civil war, civil unrest, strikes, lockouts, confiscation or other actions of administrative bodies; — Nuclear explosion, radiation or radioactive contamination; — During sea transportation. Only if this is specifically stipulated in the insurance contract, losses incurred as a result of: o Loss or damage to property caused by special rules for operating equipment, namely: - when working on underwater and surface structures; — in areas of rivers, lakes, seas, etc.; — on floating craft and ships or aircraft; — in tunnel or underground work; o Loss or damage to equipment caused by flooding or silt; however, such losses are subject to compensation if they occurred during the transportation covered by insurance.

Insurance territory

is the territory of a country or countries determined by agreement of the parties and specified in the insurance contract. If the insured vehicles are used exclusively for transportation, state roads are not considered part of the insurance territory. The insurance territory may be the premises or part thereof, determined by agreement of the parties and specified in the insurance contract. If destruction and damage to equipment occurred outside the insurance territory, insurance compensation is not paid. The insured amount for each insured object must correspond to its value: - Value means the corresponding list price (new value), including delivery and transportation costs (freight, packaging) and installation. — If the insured object is no longer listed in the price lists, then its value is determined at the latest list price. This price, however, may be adjusted depending on fluctuations in price indices; — If neither the list price nor the selling price can be determined, the basis shall be the costs necessary to manufacture the item of the required design and size. — The costs of rescue and clearing the territory in the event of complete loss of the insured object can be additionally insured by agreement of the parties. — When paying insurance compensation, the insured amount is correspondingly reduced. — When concluding an insurance contract, the policyholder must inform the insurer of all circumstances known to him that are significant for determining the degree of risk in relation to the insured property. The policyholder is also obliged to provide answers to all questions posed by the insurer in order to determine the degree of risk in relation to the insured property. If it is discovered that the information provided by the policyholder does not correspond to reality, in general or in particular, and there is an assumption that the policyholder provided deliberately false information, the insurer has the right to refuse to pay insurance compensation, as well as terminate the insurance contract without observing the established monthly period. In the event of a loss, the amount of insurance compensation is determined by the costs of restoring the insured property, minus the residual value of the damaged property. In case of total loss, the amount of compensation is determined based on the actual value of the insured object minus the residual value. Total loss occurs if replacement costs together with the residual value exceed the actual value of the insured item. If the insurance contract provides for additional insurance for the costs of rescue and clearing the territory, the insurer pays compensation in excess of the actual cost. A partial loss occurs if the insured object is damaged or partially destroyed. The insured object is considered damaged or partially destroyed if the costs necessary to restore it to the condition in which it was immediately before the occurrence of the insured event (restoration costs), including the residual value, do not exceed the cost of the undamaged object, including delivery and transportation costs at the time occurrence of loss (its actual value). Restoration costs include: - costs of spare parts and materials for repairs; — expenses for paying for repair work; — costs of dismantling and re-installation; — transportation costs, as well as expenses for urgent delivery; — costs of salvaging the insured property; - other costs necessary for such restoration. Restoration expenses do not include: - expenses for equipment overhaul, preventive maintenance and other expenses that would be necessary regardless of the occurrence of an insured event; - additional expenses caused by changes or improvements to the insured object, incurred in excess of the costs necessary for restoration; — additional costs caused by temporary or auxiliary repairs or restoration. In the event of loss or damage to motors, bearing drives, tracks, tires, bulldozer and grader blades, excavator buckets of all types, batteries and other parts that are usually subject to repeated replacement during the life of the insured equipment due to their increased wear (wear parts ), appropriate deductions are made from the amount of restoration expenses. The amounts of deductions are calculated based on the cost of these parts immediately before the occurrence of the insured event (actual cost). If damaged parts are replaced, despite the fact that their repair was possible without any threat to the safety of operation of the insured equipment, the insurer will reimburse the policyholder for the cost of repairing these parts, but not more than the cost of replacing them. If entire machine components are replaced, for example, an engine, clutch or other structural elements of the insured equipment, and if they contain, along with damaged parts, undamaged parts, the insurance indemnity is reduced taking into account the cost of the undamaged parts. The insurer does not pay compensation for indirect losses, in particular fines, for amounts of compensation paid to third parties, expenses for temporary replacement or rental of equipment, downtime or loss of marketability. If the insured amount is set in a smaller amount than the actual value of the insured item at the time of the insured event, the amount of loss and expenses are paid in proportion to the ratio of the insured amount and the actual value of the insured item. In case of disagreement on the amount and causes of loss, the insurer and the policyholder have the right to request an examination to determine the amount and causes of losses. In case of disagreement between experts, they select a third expert as the chairman of the expert commission. If two experts cannot reach a consensus on the issue of electing a chairman, the latter is appointed by the Chamber of Commerce and Industry at the place of examination at the request of one of the parties. The commission makes a decision by a majority vote. Compensation can only be paid after the causes and extent of the damage have been fully established. However, at the request of the policyholder and before this, the insurer may pay the unconditionally due amount at that time (advance payment). When filing a claim against the insurer, the policyholder is obliged to provide original documents confirming his interest in the insured property, the cost of the latter, as well as any additional documents, materials, information regarding a specific insured event that the policyholder or his agents have, which the insurer has the right to request from the policyholder any additional information necessary to clarify all the circumstances of the event that resulted in the damage. Final consideration of the claim is possible only after the insured has provided all the necessary documents. After payment of the insurance indemnity, the rights that the policyholder or the person in whose favor the insurance was concluded against the persons responsible for causing the damage are transferred to the insurer, within the limits of the paid amount. Upon the occurrence of an insured event, the policyholder is obliged to: - Immediately, but in any case no later than the period established in the insurance contract from the date of occurrence of the loss, notify the insurer about it in writing; — If possible, take all possible measures to prevent or reduce damage to save the insured property, if circumstances permit, the policyholder is obliged to request instructions from the insurer; — The insurer or its representatives have the right to participate in the rescue and preservation of the insured property, taking and indicating the necessary measures for this, however, these actions of the insurer or its representatives cannot be regarded as recognition of the obligation to pay insurance compensation. If the policyholder prevents this, the insurance compensation is reduced to the extent that this led to an increase in the loss.

| BASIC PROVISIONS OF THE CONDITIONS OF INSURANCE OF MACHINES AGAINST BREAKDOWNS |

Self-propelled vehicles and mechanisms can also be insured on the basis of the terms and conditions of vehicle breakdown insurance, which are also offered by leading Russian insurers. The main feature of these conditions is the expanded scope of insurance coverage, which provides compensation for direct losses from loss and damage to insured property as a result of: - unforeseen breakdowns or defects of insured machines, mechanisms, equipment and tools; — errors or negligence of the policyholder’s personnel or third parties; — ruptures of cables, chains, falling of insured objects and their impact on other objects; — overload, overheating, vibration, disorder, jamming, blockages of mechanisms with foreign objects, changes in pressure inside mechanisms, effects of materials; — water hammer or lack of liquid in boilers and apparatus operating with steam and liquids; - the impact of electricity in the form of a short circuit, overload of the electrical network, voltage drop, atmospheric discharge, including damage resulting from the occurrence of a fire as a result of these phenomena; - explosion of steam boilers, internal combustion engines and other energy sources, provided that only damage caused directly to the named objects in which the explosion occurred is compensated; - breakdown or malfunction of attachments, protective or control devices; - wind, frost, ice drift. The exclusions of their insurance coverage, the procedure for concluding insurance contracts and the relationship between the parties upon the occurrence of an insured event are similar to the conditions for insurance of other technical risks.

| LIABILITY INSURANCE TO THIRD PARTIES during construction and installation work |

According to the terms of third party liability insurance, insurance covers liability for damage caused to the person and property of third parties as a result of accidents during construction, installation and commissioning work. Expenses in connection with causing harm to the person and property of third parties are reimbursed, provided that responsibility for causing harm lies with the person in whose favor the insurance was concluded and if the liability of this person is determined by the legislation of the country, the harm was caused in a direct causal connection with the production of the named work, the accident occurred within the territory of the work being carried out or in the immediate vicinity of it. Exclusions from insurance coverage, the procedure for concluding insurance contracts and the relationship between the parties upon the occurrence of an insured event are similar to the conditions for insurance of other technical risks.

| COMPREHENSIVE INSURANCE OF CONSTRUCTION AND INSTALLATION RISKS |

Such insurance may also include, in addition to the main sections of construction and installation insurance, such as insurance of construction and/or installation objects (buildings, industrial and civil structures, roads and railways, airports, etc.), and liability insurance to third parties during construction and installation work, as well as insurance of construction site equipment and construction vehicles, with the exception of those involved in road traffic. A distinctive feature of comprehensive insurance is that the “share” of the cost of each individual block of insurance in the total cost of insurance is significantly lower than when insuring individual risks.

Expenses for voluntary and compulsory insurance

Expenses in the form of premiums for all types of compulsory property insurance, as well as for types of voluntary, provided for in paragraph 1 of Article 263 of the Tax Code of the Russian Federation, are other expenses associated with production and sales, based on subparagraph 5 of paragraph 1 of Article 253 of the Tax Code. Such expenses are recognized in tax accounting if they are justified, documented and incurred to carry out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation). At the same time, expenses for mandatory types of insurance are taken into account for tax purposes within the limits of special tariffs approved by law and the requirements of international conventions.

The first thing you should pay attention to is the provision of subparagraph 7 of paragraph 3 of Article 148 of the Tax Code of the Russian Federation. According to it, insurance services provided by insurance organizations are not subject to VAT. This means that the insurer does not present tax to the organization in the amount of the premium.

If such rates are not approved, compulsory insurance costs are taken into account in the amount of actual costs, which follows from paragraph 2 of Article 263 of the Tax Code of the Russian Federation.

As for voluntary insurance, according to paragraphs 1 and 3 of Article 263 of the Tax Code of the Russian Federation, expenses for it are recognized in tax accounting in the amount of actual expenses.

Accounting on the balance sheet

If the leased asset is taken into account on the balance sheet of the lessor, then its expenses for voluntary insurance are recognized for profit tax purposes on the basis of subparagraph 3 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation. In the case where accounting is kept by the lessee, expenses are recognized on the basis of subparagraph 7 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation. The same conclusions follow from the resolution of the Federal Antimonopoly Service of the Moscow District dated December 13, 2012 No. A40-271/12-91-2.

Please note that under the accrual method, insurance costs are taken into account in the reporting period in which, in accordance with the terms of the contract, funds were transferred or issued from the cash desk to pay the insurance premium or contributions. Such rules follow from paragraph 6 of Article 272 of the Tax Code of the Russian Federation. Moreover, if the insurance contract is concluded for a period of more than one reporting period, then the premium amount must be distributed in proportion to the number of calendar days of the contract and taken into account evenly for tax purposes (clause 6 of Article 272 of the Tax Code of the Russian Federation).

Thus, there are two fundamentally different approaches to the distribution of insurance premiums. Thus, when using the accrual method, the contribution amount must be distributed in proportion to the number of calendar days of the contract in the reporting period and taken into account for tax purposes evenly over the term of the contract (Clause 6 of Article 272 of the Tax Code of the Russian Federation). If the organization uses the cash method, then expenses in the form of insurance premiums are recognized after their actual payment, regardless of the duration of the contract (Clause 3 of Article 273 of the Tax Code of the Russian Federation).

Payment under the leasing agreement: postings

The lessee reflects leasing payments for the car in accounting as follows. The accounting of lease payments, regardless of the time of payment, depends on whose balance sheet the car is registered on.

If the car is included on the lessor’s balance sheet, then leasing payments are considered expenses for ordinary activities.

The accrual and payment of lease payments in this case is reflected by the lessee with the following entries.

| Contents of operations | Debit | Credit | Primary document |

| Calculation of the amount of the current lease payment | 20 (44) | 76 — leasing payments | Accounting information |

| Reflection of VAT claimed by the lessor on the amount of the current lease payment | 19 | 76 — leasing payments | Invoice |

| Acceptance for deduction of VAT claimed by the lessor from the amount of the current lease payment (if there is a right to deduction) | 68 | 19 | Invoice |

| Current lease payment has been paid | 76 — leasing payments | 51 | Bank statement |

If the car is taken into account on the balance sheet of the lessee, then lease payments are included in the reduction of debt to the lessor.

Such transactions are reflected in the lessee's accounting with the following entries.

| Contents of operation | Debit | Credit | Primary document |

| Calculation of the current lease payment | 76 - lease obligations | 76 — leasing payments | Leasing agreement, accounting certificate |

| Acceptance for deduction of VAT claimed by the lessor from the amount of the current lease payment (if there is a right to deduction) | 68 | 19 | Invoice |

| If the leasing agreement does not provide for the redemption of the car, or the redemption price is not allocated as a separate amount, or it is paid at the end of the leasing period | |||

| Current lease payment has been paid | 76 — leasing payments | 51 | Bank statement |

The lessor takes into account lease payments (excluding VAT) in income from ordinary activities. As a rule, they are reflected in income monthly in the amounts agreed upon in the leasing payment schedule (clauses 5, 6, 6.1, 12 PBU 9/99 “Income of Organizations”).

The lessor's transactions for accepting payments are reflected as follows.

| Contents of operation | Debit | Credit | Primary document |

| Recognition of income in the amount of the lease payment | 62 (76) | 90-1 | Leasing agreement, accounting certificate |

| VAT calculation | 90-3 | 68 | Invoice |

| Receiving a lease payment | 51 | 62 76 | Bank statement |

Application of PBU 18/02

Particular attention should be paid to the requirements of PBU 18/02, since the procedure for taxation of bonuses depends on the accounting methodology for bonuses. Thus, with a one-time inclusion of the premium in expenses on the date of entry into force of the contract, when using the accrual method, expenses are recognized by the organization quarterly, and when using the cash method, expenses are not recognized. Thus, in the reporting period of payment of the insurance premium, a deductible temporary difference and a corresponding deferred tax asset are formed in accounting. This follows from paragraphs 11 and 14 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. The specified VVR and ONA are reduced (repaid) as insurance costs are recognized in tax accounting (clause 17 of PBU 18/02).

If expenses in the form of an insurance premium are recognized by an organization in accounting quarterly during the policy period when applying the accrual method, no differences arise between the procedure for recognizing expenses in accounting and tax accounting, and when using the cash method in the month of payment of the insurance premium in accounting, a taxable temporary the difference and the corresponding deferred tax liability (clauses 12, 15 of PBU 18/02). The specified NVR and IT are reduced (repaid) as expenses are recognized in accounting (clause 18 of PBU 18/02).

If expenses in the form of a premium are recognized by the organization as insurance costs relating to future periods and are subject to write-off by distributing them between reporting periods in the manner established by the organization, during the term of the contract when applying the accrual method of differences between the procedure for recognizing these expenses in accounting and tax accounting does not arise, and when using the cash method in the month of payment of the insurance premium, a taxable temporary difference and a corresponding deferred tax liability arise in accounting (clauses 12, 15 of PBU 18/02). The specified NVR and IT are reduced (repaid) as expenses are recognized in accounting (clause 18 of PBU 18/02).

Leasing: accounting features for legal entities

Currently, both individuals and legal entities can lease a car. But the obligation to record transactions with such a car in accounting and tax accounting arises only for legal entities.

At the same time, legal entities can take advantage of certain preferences that individuals do not have, in particular, reduce the tax base for profits on leasing payments and deduct VAT paid to the lessor. It is important to remember that these preferences are applicable under the general taxation system. The use of special modes by legal entities is characterized by its own nuances, for example:

- when applying the simplified tax system “income”, leasing expenses cannot be written off as a reduction in the tax base in the same way as other expenses for conducting business;

- when applying UTII, the calculation of tax payable is also carried out according to certain principles, which do not include the deduction from the tax base of the costs of payments under the leasing agreement.

The car is listed on the balance sheet of the lessor or the lessee, or even both of them.

Again, depending on the conditions that the bank provides to its clients, the leased object may become the property of the lessee even before the contract between them is terminated. From a practical point of view, this should be convenient, because... in this case, it is the owner who will be responsible for the serviceability of the vehicle, which will protect him from unnecessary disagreements with the credit institution. However, not every bank will be able to make such an offer. In most cases, he retains the leased objects on his balance sheet, thereby remaining their sole owner. The right of ownership also determines a certain number of powers that he can exercise in relations with the tenant (for example, to terminate the contract early and pick up the car just at the moment when it is most inconvenient for you). The legal side of the issue becomes even more “unpredictable” when the car is listed, by mutual agreement of the parties, on the balance sheet of both the credit and credited companies. In our opinion, the bank has the preemptive right of ownership in this case, however, only until the actual users of the car have finally bought it.

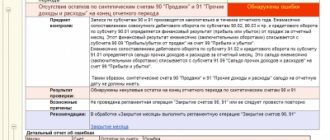

Accounting for MTPL and CASCO policies in 1C: Accounting 8

You don't have to be a trucking company or in the trucking business to be faced with the need to account for auto insurance policies. Many organizations require a vehicle to carry out their activities. For example, for the delivery of goods, the purchase of raw materials and supplies, or for the performance of courier services. In this article we will talk about accounting in 1C: Accounting for operations related to car insurance.

After purchasing a car, the first thing a company needs to do is obtain a compulsory motor liability insurance policy, otherwise the traffic police will refuse to register the vehicle. The obligation to obtain a compulsory motor liability insurance policy is enshrined in Article 4 of Federal Law No. 40-FZ of April 25, 2002 “On compulsory civil liability insurance of vehicle owners.”

The CASCO policy is not mandatory, but is voluntary. Due to the fact that compulsory motor liability insurance does not cover the entire cost of damage and payments are provided only to the injured party, many enterprises, in order to avoid risks and additional costs, enter into a voluntary property insurance agreement.

Mutual settlements with insurance companies are reflected in account 76.01.9 “Payments (contributions) for other types of insurance.” As a rule, a vehicle is insured for a period of one year, but car insurance costs in accounting and tax accounting are taken monthly (as RBP).

Let's look at how to carry out operations to record insurance contracts in 1C: Accounting 8. Let's assume that our organization has entered into insurance contracts: compulsory motor liability insurance in the amount of 5,000 rubles, and CASCO in the amount of 50,000 rubles.

How to reflect payment for insurance?

Let's start by transferring funds to the insurance company. To do this, go to the section “Bank and cash desk” – “Bank statements” and create a “Write-off from the current account”. When filling out, select the type of transaction “Other write-off”, debit account – 76.01.9, counterparty – insurance company. Next, you need to correctly fill out the “Future Expenses” reference book.

Step-by-step instruction

On April 2, a Ford Mondeo was purchased.

On April 03, the Organization insured the car with PJSC IC Rosgosstrakh and paid a CASCO insurance premium in the amount of 84,000 rubles. for the period from April 4 of the current year to April 3 of the next.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of insurance premium | |||||||

| April 03 | 76.01.9 | 51 | 84 000 | 84 000 | Payment of CASCO insurance premium | Write-off from current account - Other write-off | |

| 013 | 84 000 | Accounting for CASCO insurance policy | Manual entry - Operation | ||||

| Reflection in accounting for insurance premium costs for April | |||||||

| April 30 | 26 | 76.01.9 | 6 213,70 | 6 213,70 | 6 213,70 | Accounting for CASCO costs | Closing the month - Write-off of deferred expenses |

| Reflection in accounting for insurance premium costs for May | |||||||

| May 31 | 26 | 76.01.9 | 7 134,25 | 7 134,25 | 7 134,25 | Accounting for CASCO costs | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publication:

- Purchase of a fixed asset: car

Insurance for leasing - costs of insuring leased property

Depending on the agreement, payment for an insured event may be received by: the lessor, the lessee, or the lessor's bank.

- Nuances of insurance of leased property

- Who is the beneficiary of leasing insurance?

- OSAGO and CASCO for a leased car

- Actions in case of damage or loss of leased property

- Accounting costs for insurance of leased property

By concluding a finance lease agreement, the parties seek to minimize risks. Property insurance is a universal tool for solving this problem. When leasing, it has a number of features, which will be discussed in this article.

Nuances of insurance of leased property

Leasing insurance is provided by concluding a separate accompanying contract. Its validity period begins at the time of purchase of the property from the seller, and ends at the same time as the finance lease agreement (unless other conditions are specified in it).

According to Federal Law 164-FZ “On Financial Lease (Leasing),” insurance is not mandatory. However, both sides are interested in it:

- the lessor, since he is the owner of the property during the lease agreement;

- the lessee - due to his responsibility for the item received during the same period.

Insurance of the leased asset by the lessor is a situation that is rightly considered the most common. It is logical, since the party most interested in the safety of property is its owner. However, it also happens differently - the user of the item (lessee) can also act as an insured if the parties to the leasing agreement decide so and write this condition in the document.

Who is the beneficiary of leasing insurance?

The question is not superfluous, since usually the policy owner receives a compensation payment in the event of an insured event. To get the right answer, you need to delve into the very essence of the financial leasing process.

When leasing, the source of insurance premiums are payments made by the lessee. Of course, if for some reason they are terminated, the lessor is forced, as the owner of the item, to repay them from his own funds. However, this situation is not typical and, as a rule, leads to early termination of the finance lease agreement.

Another option is that insurance costs are fully borne by the lessee, and they are not included in the amount of lease payments. But even in this case, the owner of the property will be the beneficiary, since by giving it to the tenant, he is at risk.

Agreement and its contents

When applying for a CASCO policy, you must carefully check all the data specified in it. The form must be free of any inaccuracies or corrections.

All information must clearly coincide with the data of the original documents provided for registration.

An error made when concluding a policy may serve as grounds for refusal to pay financial compensation upon the occurrence of an insured event.

If, at the time of checking the document, even if the policyholder has already signed it, errors were discovered, they should be corrected immediately together with an employee of the insurance company.

The following items must be reflected in the policy:

- Information about the insurer: logo and full name, address and contact numbers of the head office and branch where registration takes place.

- Information about the policyholder (individual or legal entity).

- Beneficiary is the person to whom compensation will be paid upon the occurrence of an insured event.

- Information about people who have the right to drive a specific vehicle.

- Information about the car (make, year of manufacture, engine characteristics, color, etc.).

- CASCO type.

- Maximum amount of compensation.

- Duration of the policy.

After concluding the transaction, the policyholder receives the following documents:

- policy;

- CASCO rules;

- payment receipt;

- vehicle inspection report.

The rules that are attached to the policy indicate the following information:

- concept of an insured event;

- damage to the car that is subject to compensation during the policy period;

- cases that are not included in the list of risks specified in the policy;

- instructions for contacting the insurer upon the occurrence of an insured event;

- procedure for receiving material compensation in accordance with the policy.

The policy must necessarily contain the signatures of both parties to the transaction and the seals of the organizations.

Attribution of comprehensive insurance for leasing

Evgeniy Malyar June 20, 2021 # Nuances of business Depending on the contract, payment for an insured event may be received by: the lessor, the lessee, the lessor's bank.

- Accounting costs for insurance of leased property

- Actions in case of damage or loss of leased property

- OSAGO and CASCO for a leased car

- Nuances of insurance of leased property

- Who is the beneficiary of leasing insurance?

By concluding a finance lease agreement, the parties seek to minimize risks.

In what cases can insurance companies refuse to pay?

The insurance company's refusal to pay financial compensation may occur in the following cases:

- The insurer has been declared bankrupt. Before concluding a transaction, you should study the financial condition of the insurer.

- Revocation of an insurer's license. Such a measure may be temporary; after eliminating the causes, the company, as a rule, returns to its activities.

- Fake policy. This situation happens if the document is concluded with dubious representatives of the insurer. The authenticity of the CASCO policy can be checked using a single database.

- The insurance contract has expired. In the case of purchasing a car on lease, the policy is issued for the entire period of validity of the leasing agreement.

- The terms of the insurance contract have been violated. For example, an insured event occurred when a person who was not specified in the contract was driving a car.

- The deadlines for filing after the occurrence of an insured event were not met.

- Deliberate misrepresentation of information when contacting an insurer.

- When the insured event occurred, the driver was under the influence of alcohol or drugs.

- The insured event was a consequence of a gross violation of traffic rules on the road.

- The policyholder intentionally damaged the vehicle.

- There are no documents available confirming the good condition of the car, which allowed it to be used.

- The owner of the car refused the opportunity to demand compensation for material assets from the guilty party.

- All required documents were not submitted to the insurance company to receive compensation.

If a representative of the insurance company refuses to compensate for material losses under the CASCO agreement, then the policyholder has the right to file a claim with the top management of the company. If the answer does not satisfy the policyholder, then he has the right to file a claim in court, setting out the facts in detail and providing documentary evidence.

The issuance of a CASCO policy by the lessor for the lessee has certain benefits. Even if the cost of the policy is more expensive, then when an insured event occurs there are unlikely to be problems with payment of compensation, since cooperation with a leasing company is financially beneficial for the insurer. And even if a controversial situation arises, the issue of compensation for losses will be decided by the lessor’s lawyers

Acceptance of fixed assets for accounting

- Execute the document “Receipt of goods and services” by selecting the operation type Equipment. In this case, the amount of leasing payments for the entire term and the redemption price together are indicated, i.e. the full cost specified under the contract (usually in the payment schedule in the total line). Specify account 76.05 Settlements with other suppliers and contractors (the same for advances and for settlements). Thus, the document should create transactions: Dt 08.04 Kt 76.05.

- Draw up the document “Acceptance for accounting of fixed assets”. When filling out the tabular part of the “Fixed Assets” tab, create a new element in the “Fixed Assets” directory. On the “Accounting” tab, select “Depreciation” and fill in all the parameters. The useful life in this case is usually indicated by the period of validity of the leasing agreement (for example, if the contract is concluded for two years, then the useful life for the used lease is 24 months). Those. simplifiers must charge depreciation in accounting. And in tax accounting, under no circumstances, for organizations using the simplified tax system, there is no concept of depreciation.

However, there are some nuances when filling out the “Tax Accounting” tab: Firstly, the cost of fixed assets for tax accounting is indicated only by the redemption price specified in the leasing agreement. Since leasing payments will be included in the expenses of the current period, the cost of the fixed asset can be taken into account in the KUDiR only at the moment when ownership of the fixed asset is transferred.

On the NU tab in the document, the full useful life is indicated (for example, 36 months). In order for the cost of fixed assets to be included in KUDiR according to the rules (during the tax period by quarter as a percentage), the “Include in depreciation expenses” flag should be checked.

In addition, if an organization deals with a vehicle and is obliged to pay tax on the vehicle and provide a declaration to the lessee, then an entry should be made in the register of information “Vehicle Registration” about the fact of registering the car (to automatically fill out the declaration and calculate the tax).

Reflection in accounting for insurance premium costs

To automatically record the costs of the CASCO insurance premium on a monthly basis, you need to run the Month Closing routine operation Write-off of deferred expenses in the Operations - Period Closing - Month Closing section.

Postings according to the document

Accounting for CASCO costs for April

The document generates the posting:

- Dt Kt 76.01.9 - accounting for CASCO costs as part of general business expenses for April.

Accounting for CASCO costs for May

The document generates the posting:

- Dt Kt 76.01.9 - accounting for CASCO costs as part of general business expenses for May.

Similarly, CASCO costs are recorded for the following months before the end of the insurance contract.

Control

The calculation of the amount of costs for CASCO can be viewed using the report Calculation reference for writing off deferred expenses using the Calculation references in the Month Closing .

We will check the correctness of calculating the amount of costs for CASCO with the program:

Test yourself! Take a test on this topic using the link >>

For the continuation of the example, see the publication:

- Acceptance for accounting of fixed assets with bonus depreciation

See also:

- Cost accounting for compulsory motor liability insurance

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge