GLAVBUKH-INFO

The actual cost of materials purchased for a fee is the amount of the organization's actual costs for the acquisition, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).The list of actual costs taken into account when determining the actual cost of materials purchased for a fee is set out in paragraph 3 of this chapter.

First, let’s consider how to reflect in the accounting of transactions for the receipt of materials purchased for a fee from a supplier, without using account 15 “Procurement and acquisition of material assets.”

In this case, materials are accepted for accounting at actual cost, which is reflected by an entry in the debit of account 10 “Materials” and the credit of account 60 “Settlements with suppliers and contractors.”

Tax aspects. For tax accounting purposes in accordance with clause 2 of Art. 254 of the Tax Code of the Russian Federation, the cost of inventories acquired for a fee is determined based on the prices of their acquisition (excluding value added tax and excise taxes, except for cases provided for by the Tax Code of the Russian Federation).

The cost of goods may include commissions paid to intermediary organizations, import customs duties and fees, transportation costs and other costs associated with their acquisition.

VAT paid when purchasing materials is not included in their actual cost and in their accounting prices, unless otherwise provided by the legislation of the Russian Federation.

VAT refers to refundable taxes and the procedure for its accounting and deduction when purchasing materials is determined by the norms of Chapter. 21 Tax Code of the Russian Federation.

VAT paid on the purchase of materials is recorded on account 19 “Value added tax on acquired assets” (subaccount 19–3 “Value added tax on acquired inventories”) simultaneously with the acceptance of received materials for accounting.

In accordance with paragraph 4 of Art. 168 of the Tax Code of the Russian Federation in payment documents, including in registers of checks and registers for receiving funds from a letter of credit, in primary accounting documents and invoices, the corresponding amount of VAT must be highlighted on a separate line.

Subject to the conditions established by Ch. 21 of the Tax Code of the Russian Federation, the organization that purchases the materials may subsequently present the above amounts of VAT for deduction.

Amounts of VAT subject to tax deduction are written off from the credit of account 19 “Value added tax on acquired assets” (subaccount 19–3 “Value added tax on acquired inventories”), as a rule, to the debit of account 68 “Calculations for taxes and fees" (subaccount 68-1 "Calculations for value added tax").

Since January 1, 2006, it has been established that deductions of VAT amounts presented to the organization upon acquisition or paid when importing materials into the customs territory of the Russian Federation are made after the specified materials are registered.

In addition, VAT amounts can be deducted if there are correctly executed primary documents (including invoices) and provided that the purchased materials are intended for production activities or other operations recognized as objects of taxation.

It has been established that if the above conditions are not met, the amounts of VAT charged to the organization when purchasing such materials are not subject to deduction and are reflected in the accounting records in a different way.

In particular, when in the primary accounting documents (invoices, invoices, invoices, cash receipt orders, certificates of completion of work, etc.), confirming the cost of purchased materials, the amount of VAT is not allocated, then in the settlement documents (orders, demands-orders) , registers of checks and registers for receiving funds from a letter of credit) its calculation is not carried out by calculation.

The cost of materials purchased in such cases, including the estimated VAT on them, is taken into account as a whole in the materials accounts and is subsequently written off in the prescribed manner as production costs.

In addition, according to paragraph 2 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts presented to the buyer when purchasing materials on the territory of the Russian Federation or actually paid when importing materials into the territory of the Russian Federation are taken into account in their cost in the following cases:

- acquisition (import) of materials used for operations for the production and/or sale (as well as transfer, execution, provision for one’s own needs) of goods (work, services) that are not subject to taxation (exempt from taxation);

- acquisition (import) of materials used for operations for the production and/or sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation;

- acquisition (import) of materials by persons who are not VAT payers or are exempt from fulfilling taxpayer obligations for the calculation and payment of VAT;

- acquisition (import) of materials for the production and/or sale (transfer) of goods (work, services), operations for the sale (transfer) of which are not recognized as the sale of goods (work, services) in accordance with clause 2 of Art. 146 of the Tax Code of the Russian Federation.

Let's consider operations to purchase materials for a fee and register them in compliance with all norms of PBU 5/01 and the requirements of tax legislation.

Example 1. Let’s assume that an organization purchased materials for a fee from a supplier organization in the amount of 35,400 rubles, including VAT - 5,400 rubles. The costs of delivering materials to the organization’s warehouse amounted to 2,360 rubles, including VAT - 360 rubles.

The materials are intended for use in the production of products subject to VAT. All primary accounting and settlement documents are drawn up correctly, and the VAT amount is highlighted in a separate line.

No.

| Contents of business transactions | Corresponding accounts | Amount, rub. | ||

| Debit | Credit | |||

| 1 | The cost of purchased materials is reflected according to the supplier’s settlement documents (excluding VAT) | 10-1 | 60 | 30 000 |

| 2 | The amount of VAT presented by the supplier of materials is reflected | 19-3 | 60 | 5 400 |

| 3 | The cost of services of a transport organization for the delivery of materials is reflected (excluding VAT) | 10-1 | 60 | 2 000 |

| 4 | The amount of VAT presented by the transport organization is reflected | 19-3 | 60 | 360 |

| 5 | Payment has been made to the supplier for materials (including VAT) | 60 | 51 | 35 400 |

| 6 | Payment has been made for the services of a transport organization for the delivery of materials (including VAT) | 60 | 51 | 2 360 |

| 7 | VAT amounts paid on transport services accepted for registration by materials are presented for deduction. | 68-1 | 19-3 | 5 760 |

| 8 | The write-off of materials when they are released to the main production is reflected | 20 | 10 | 32 000 |

Now let’s look at transactions that reflect the receipt of materials purchased for a fee, using account 15 “Procurement and acquisition of material assets.”

In this case, the receipt of materials is reflected by an entry in the debit of account 15 “Procurement and acquisition of material assets” and the credit of account 60 “Settlements with suppliers and contractors”.

Subject to the conditions of example 1, transactions for the purchase of materials using account 15 and their acceptance for accounting are recorded using the following transactions:

| No. | Contents of business transactions | Corresponding accounts | Amount, rub. | |

| Debit | Credit | |||

| 1 | The purchase price of purchased materials is reflected according to the supplier’s settlement documents (excluding VAT) | 15 | 60 | 30 000 |

| 2 | The amount of VAT presented by the supplier of materials is reflected | 19-3 | 60 | 5 400 |

| 3 | The cost of services of a transport organization for the delivery of materials is reflected (excluding VAT) | 15 | 60 | 2 000 |

| 4 | The amount of VAT presented by the transport organization is reflected | 19-3 | 60 | 360 |

| 5 | Payment has been made to the supplier for materials (including VAT) | 60 | 51 | 35 400 |

| 6 | Payment for services for the delivery of materials has been made (including VAT) | 60 | 51 | 2 360 |

| 7 | Materials are capitalized at accounting prices | 10-1 | 15 | 32 000 |

| 8 | VAT amounts paid on transport costs accepted for registration by materials are presented for deduction. | 68-1 | 19-3 | 5 760 |

| 9 | The write-off of materials when they are released to the main production is reflected | 20 | 10 | 32 000 |

The amount of the difference in the cost of acquired inventories, calculated in the actual cost of acquisition (procurement) and accounting prices, is debited or credited to account 16 “Deviation in the cost of material assets” from account 15 “Procurement and acquisition of material assets.”

The differences in the cost of acquired inventories, calculated in the actual cost of acquisition (procurement), and accounting prices accumulated on account 16 “Deviation in the cost of material assets” are written off (reversed - if the difference is negative) to the debit of the production cost accounts (expenses for sale).

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | The amount of deviations of the actual cost of purchasing materials from the accounting price is reflected (the cost of materials at accounting prices is lower than their actual cost) | 16 | 15 |

| 2 | The amount of identified deviations is written off to production | 20 | 16 |

| or | |||

| 1 | The amount of deviations of the actual cost of purchasing materials from the book price is reflected (the cost of materials at book prices is higher than their actual cost) | 15 | 16 |

| 2 | The amounts of materials written off for production were reversed by the amount of identified deviations | 20 | 16 |

VAT accounting and deduction will be reflected differently in situations where at least one of the following cases occurs:

1) the materials are intended for use in the production of products exempt from VAT;

2) materials are purchased by an organization that is not a VAT payer in accordance with tax legislation;

3) materials are intended for transfer to the authorized capital of another organization, etc. (i.e., intended for operations that are not recognized as the sale of materials in accordance with paragraph 2 of Article 146 of the Tax Code of the Russian Federation).

In these cases, the amounts of VAT paid when purchasing materials are taken into account in their cost and are reflected in the following entries:

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| 1 | The purchase price of purchased materials is reflected according to the supplier’s settlement documents (excluding VAT) | 10-1 | 60 |

| 2 | The amount of VAT presented by the supplier of materials is reflected | 19-3 | 60 |

| 3 | Payment for materials has been made (including VAT) | 60 | 51 |

| 4 | The amount of VAT is included in the cost of purchased materials | 10-1 | 19-3 |

A situation is possible when an organization acquires materials for the purpose of using them to produce products subject to value added tax, and then uses these materials to produce products exempt from value added tax.

In this situation, the organization, after accepting the materials for accounting, could deduct VAT.

If in the future the organization uses these materials to produce products that are exempt from VAT, then, in accordance with tax legislation, the organization will need to restore the amounts of VAT previously accepted for deduction in the prescribed manner.

From January 1, 2006, in accordance with paragraph 3 of Art. 170 of the Tax Code of the Russian Federation in relation to materials, VAT amounts are subject to restoration in the amount previously accepted for deduction. Restoration of tax amounts is carried out in the tax period in which the materials were used to produce products exempt from VAT.

Tax amounts subject to recovery in such cases should not be included in the cost of materials, but should be taken into account as part of other expenses in accordance with Art. 264 Tax Code of the Russian Federation.

The restored VAT amounts should increase the amount of VAT payable to the budget by the organization.

| < Previous | Next > |

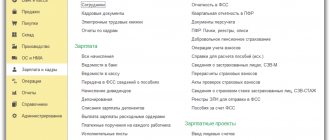

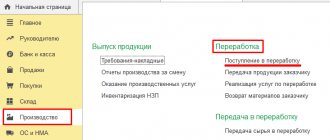

How to process the purchase of materials in 1C: Accounting 8th ed. 3.0

Often, organizations make purchases of various materials. In this regard, it becomes necessary to enter data about this purchase, and then the question arises: how to correctly reflect this purchase in the 1C program? In this article we will look at how to process the purchase of materials in 1C: Accounting 8th edition. 3.0.

To complete the purchase of material in the program, you need to carry out several operations. In total, these operations contain:

- payment to the supplier;

- receipt and acceptance of materials for accounting;

- accounting for input VAT;

- offset of the advance payment transferred to the supplier and VAT accepted for deduction.

Let's take a closer look at these operations. Namely: payment to the supplier (advance payment), receipt and acceptance for accounting and invoice received.

Payment to the supplier (advance payment). This operation is carried out using the document “Write-off from the current account”. Let us consider in more detail the implementation of this document.

- Go to the “Bank and Cash Office” section, then click “Bank Statements”.

- The next action will be the “Write-off” button. Select the document transaction type “Payment to supplier”.

- Next, fill out the document.

- After this, be sure to check the “Confirmed by bank statement” checkbox.

- Click on the “Proceed” button.

The next operation will be “Receipt and acceptance for accounting”.

Receipt and acceptance for accounting will be carried out using the document “Receipt” (acts, invoices).

- In the “Purchases” section we find “Receipts” (acts, invoices).

- Click “Receipt”. The transaction type of the document must be selected “Goods” (invoice).

- The next step will be filling out the document.

- The tabular part of this document is filled out using the “Add” or “Selection” button.

- In the “Nomenclature” line, you must select incoming materials, and when creating new elements, indicate the type of nomenclature “Materials”.

- Next, you need to indicate the quantity, price, VAT rate and check the account in the columns.

- Click on the “Proceed” button.

The final transaction in the purchase of material will be “Invoice received”.

- To register an invoice, which is located at the bottom of the “Receipt” document, you must fill in the “Invoice No.” and “from” fields, then click on the “Register” button. The “Invoice received” document will be automatically created; the fields of the document will already be filled in from the base document (in our case, from the “Receipt” document).

- Click on the link to open the “Invoice received” document. Next, you need to check that the document fields are filled in correctly.

- Record the document using the “Record” button (only if changes have been made to the document).

In each of these operations, you can check the result of its implementation by clicking on DtKt in the window above.

Also, to analyze the quantity and cost of received materials, you can create a balance sheet for account 10.01. Section “Reports” – “Account balance sheet”.

Thus, the purchase of materials contains three main operations, which we discussed above. By going through each document sequentially, processing the purchase of materials in the 1C: Accounting 8 program will be successful.

In this article, we examined the popular question of how to process the purchase of materials in 1C. We hope that our material was useful to you. If you still have additional questions, you can ask them on our dedicated 1C consultation line. We have extensive experience working with 1C and know exactly the answer to any question. The first consultation is completely free!

Purchase of materials by the contractor

The company carries out electrical installation work and design of electrical networks. Applies a simplified taxation system (6% of income).

When drawing up contracts for electrical installation work, the cost of the work is indicated (on which we pay a 6% tax), as well as the amount for consumable construction materials necessary to complete the work, which the customer transfers to our bank account or deposits in the cash register. We purchase the necessary construction materials and carry out the work.

Should we pay tax on the amounts transferred to us for consumables (after all, this is not our income)? Do I need to keep records of purchased and consumed materials? (the company does not keep accounting records in simplified format)? What is the correct way to draw up contracts for electrical installation work? Maybe a separate contract for materials is needed?

Art. 704 of the Civil Code of the Russian Federation

It is established that, unless otherwise provided by the contract, the work is performed

at the expense of the contractor

- from his

materials

, with his forces and means.

Price

in the contract includes compensation for the contractor’s costs and the remuneration due to him.

At the same time Art. 713 Civil Code of the Russian Federation

allows the contractor to perform work using

the customer's material

.

If the customer transfers materials to the contractor for processing without payment (that is, as toll), then these materials remain the property of the customer.

According to Art. 220 Civil Code of the Russian Federation

the right of ownership to a new movable thing manufactured by a person by processing materials that do not belong to him is acquired by the owner of the materials.

The owner of materials who has acquired ownership of an item made from them is obliged to reimburse the cost of processing

to the person who carried it out.

That is, if the customer transfers customer-supplied materials to the contractor, then the cost of these materials is not taken into account

in the contract price.

However, in your case, the customer gives the contractor not materials, but money

, for which the contractor purchases materials.

Consequently, compensation for the contractor’s costs occurs, which, in accordance with Art.

709 of the Civil Code of the Russian Federation is included in the price

of the contract.

When determining the object of taxation under the simplified tax system, taxpayers take into account income from sales determined in accordance with Art. 249 Tax Code of the Russian Federation

, non-operating income determined in accordance with

Art.

250 of the Tax Code of the Russian Federation (

Article 346.15 of the Tax Code of the Russian Federation

).

Income from sales according to Art. 249 Tax Code of the Russian Federation

recognised, in particular,

is revenue from the sale of work

, which is determined on the basis

of all receipts

associated with payments for work performed.

Thus, in the case considered, income under the simplified tax system will include both the cost of the work and the funds transferred by the customer for the purchase of materials necessary to complete the work.

You can avoid increasing the tax base for the single tax by using an intermediary agreement.

So, for example, in accordance with Art.

1005 of the Civil Code of the Russian Federation , under an agency agreement,

one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

In a transaction concluded by an agent with a third party on behalf and at the expense of the principal, the rights and obligations arise directly from the principal.

In this case, property acquired by the agent at the expense of the principal is the property of the principal.

That is, if your organization enters into an agency agreement with a customer, then, being an agent under the agreement, you will purchase materials on behalf and at the expense of the principal (customer).

In this case, the purchased materials will be the property of the principal (customer).

The customer, in turn, will transfer these materials to the contractor

as tolling for the performance of work under a contract (that is, without payment by the contractor).

According to paragraph 1 of Art. 346.15 Tax Code of the Russian Federation

When determining the object of taxation for a single tax,

income

provided for

in Art.

251 Tax Code of the Russian Federation .

P.p. 9 clause 1 art. 251 Tax Code of the Russian Federation

It has been established that when determining the tax base, income in the form of property (including cash) received by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement,

agency agreement

or other similar agreement, as well as

in compensation expenses

incurred by the commission agent,

agent

and (or) other attorney for the principal, principal and (or) other principal, if such expenses are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the concluded agreements.

The indicated income does not include commission, agency or other similar remuneration.

Thus, funds transferred to the contractor by the principal (customer) under the agency agreement in order to fulfill the principal’s instructions to purchase materials will not be taken into account as part of the agent’s income

(contractor).

You can do without concluding separate contract and agency agreements.

Art. 421 Civil Code of the Russian Federation

allows the parties to enter into an agreement that contains elements of various agreements provided for by law or other legal acts (mixed agreement).

The relations of the parties under a mixed agreement are applied in the relevant parts to the rules on contracts, the elements of which are contained in the mixed agreement.

a condition to a standard contract

that the contractor, as an agent, on behalf and at the expense of the customer, purchases the materials necessary to carry out electrical installation work.

You can write down the condition on the amount of the agent’s remuneration on a separate line

or indicate that the amount of the agency fee is included in the cost of work under the contract.

Organizations using the simplified tax system are not obliged

maintain accounting records with the exception of accounting of fixed assets.

According to the Procedure for filling out the Book of Accounting for Income and Expenses of organizations and individual entrepreneurs applying the simplified taxation system, approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 2005 No. 167n, in column 1

Accounting books... indicate the serial number of the recorded transaction.

In column 2

the date and number of the primary document on the basis of which the registered transaction was carried out is indicated.

In column 3

the content of the registered transaction is indicated.

In column 4

the taxpayer reflects income from sales.

Since the cost of customer's materials is not included

as part of the income of the contractor organization, then operations to obtain these materials in the Accounting Book...

are not reflected

.

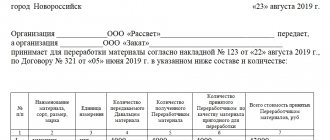

The customer transfers the materials to the contractor according to the invoice for the release of materials to the third party (unified form No. M-15, approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71).

The invoice is issued in two copies, the second copy remains with the recipient of the materials (contractor).

You can indicate directly in the invoice that the materials were received on a toll basis.

Such an invoice will help you document why you did not include the cost of materials in your income.

Also, no one forbids you to issue a receipt order

(unified form No. M-4), which is used to account for materials received from suppliers.

Only as in the first case, you need to make a note that the materials were received on toll terms

.