The Board of the Pension Fund of Russia, by its Resolution No. 507p dated December 6, 2018, updated the reporting forms (the changes are valid from January 1, 2019). The changes introduced by this administrative document in the structure and content of reporting forms affected the SZV forms: EXPERIENCE, ISH, KORR, as well as the EDV-1 inventory.

Taking into account the innovations in the standard of the form, in today’s publication we will tell you how to fill out the SZV-ISH form in 2019, we will remind you about the procedure and deadlines for submitting the report, which insurers are required by law to submit this type of reporting to the Pension Fund.

SZV-ISH: form, purpose, regulatory order

After the transfer of the administration of insurance premiums, which were administered by extra-budgetary funds, to the fiscal authorities in 2021, a number of functions were retained by the Pension Fund, incl. Maintaining records for periods up to 2021. To generate reporting, the Fund approved a number of new forms, including the SZV-ISH form - a report on persons whose information was not submitted by the employer in a timely manner.

In its updated form, SZV-ISH is an optimized alternative to the previously (until 2021) existing RSV-1 report, which is used when it is necessary to submit to the Pension Fund personal information about insured persons for the period that was not provided in a timely manner. In this case, only accounting periods up to 2021 are considered.

This type of report includes data on income, other payments received by the employee, the calculation and payment of insurance premiums, and the length of service for the corresponding period.

The procedure according to which the SZV-ISH is filled out, as well as the electronic report form that can be used by clients of the electronic document management system, are approved by the same resolution of the Pension Fund Board No. 507p.

SZV-STAZH 2021 new form in the Pension Fund of Russia, bank and sample filling

Starting from 2021, companies and entrepreneurs submit new reports to the Pension Fund - information about the length of service of employees. The new forms SZV-STAZH, SZV-KORR, SZV-ISKH, ODV-1 are already in effect. For the first time, everyone submits them before March 1, 2021, but if an employee retires, reports must be submitted early in 2021. There are other reasons too. Details and samples are in the article. At the end there is a handy reminder.

New form SZV-STAZH from 2021: form

SZV-STAGE - new reporting on the length of service of employees of a company or individual entrepreneur. The form of the new SZV-STAZH form was approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. The document came into force on March 5, 2021. Additionally, the fund approved three more forms. More on this later. You may need reports as early as this year, 2021.

Download for free the new form SZV-STAZH (form) from 2021 in Excel

Sample of filling out the new form SZV-STAZH

The procedure for filling out the new SZV-STAZH form depends on who you are submitting information about. Let's consider the options.

Starting from 2021, fill out the new SZV-STAGE form for employees. In the report for all employees, list them one after another in one table. Leave sections 4 and 5 blank.

You fill out the new SZV-STAGE form in 2021 for a pensioner. In the report for a pensioner, fill out all sections of SZV-STAZH, including 4 and 5.

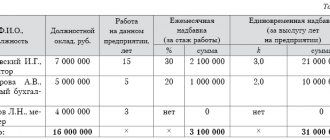

EXAMPLE

Vega LLC employee Ivanov is retiring in 2021. In April, he requested information about experience for 2021. From February 14 to February 20, the employee was on sick leave. Presumably, the fund will assign pensions on April 14. On April 6, the accountant filled out the SZV-STAZH for Ivanov as in the example below.

New form SZV-STAZH (sample filling)

Most employers will submit the new SZV-STAZH form to the Pension Fund of Russia for the first time at the end of 2021. The deadline for submitting the new SZV-STAZH form starting from 2021 is common to all – no later than March 1 inclusive. But if an employee retires and asks for information about length of service or the company is liquidated, the SZV-STAZH must be submitted in 2021.

On March 1, 2021, you must submit the new SZV-STAZH form for 2021 for the first time in 2021

New SZV-KORR form from 2021: when to submit

Submit a new SZV-KORR form from 2021 or earlier if you find an error in the submitted reports. For example, they found that in the report for 2021, the employee’s payments and contributions were incorrectly indicated, more or less length of service was given than necessary, and the wrong length of service code was used.

Download for free the new SZV-KORR form from 2021 in Excel

Send a report to the fund at any time. There is no need to wait until the deadline for submitting information about experience for 2021 comes. Previously, corrective individual information could only be submitted with current RSV-1 reporting. Now this rule doesn't work.

EXAMPLE

In April 2021, the accountant of Vega LLC discovered that in RSV-1 for 2021 he incorrectly filled out section 6 for Ivanov. There was an error in payments and contributions, but the length of service was correct. On April 6, the accountant filled out the SZV-KORR form for Ivanov as in the sample below.

Form SZV-KORR (filling sample)

Form SZV-ISH: form and filling procedure

Send the SZV-ISH form to the fund if you find that you did not report to the Pension Fund about any employee in 2021 or earlier. The form of the new SZV-ISH form was approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. You can use the link below for free.

Download free form of the new SZV-ISH form in Excel

Let's look at the situation using an example. and We will draw up a sample for filling out the new SZV-ISH form.

EXAMPLE

In April 2021, the accountant of Vega LLC discovered that in 2006 he did not submit individual information for Ivanov. The employee joined the company in October 2006, and then they forgot to report on him. On April 6, the accountant filled out the SZV-ISH form as in the sample below.

New form SZV-ISH (filling sample)

EDV-1 is an inventory that must be submitted along with each of the three new reports: SZV-STAZH, SZV-KORR and SZV-ISKH.

EXAMPLE

In April 2021, the accountant of Vega LLC discovered that in RSV-1 for 2021 he incorrectly filled out section 6 for Ivanov. There was an error in payments and contributions, but the length of service was correct. On April 6, the accountant filled out the SZV-KORR form for Ivanov and attached the EDV-1 inventory to it. He filled it in like the example below.

The new EDV-1 form was approved by Resolution of the Pension Fund Board of January 11, 2021 No. 3p. You can use the link below for free.

Download the new EFA-1 form for free in Excel

Form EDV-1 (filling sample)

See //www.glavbukh.ru/art/88708-qqqm3y17-novaya-forma-szv-staj/

Source: //bhnews.ru/szv-stazh-2021-novaya-forma-v-pfr-bank-i-obrazets-zapolneniya/

SZV-ISH: who takes it and when

SZV-ISH is a relatively new type of reporting, which employers have been working with since 2021, so the questions of who should submit a report to the Fund and within what time frame have not yet lost their relevance. Let's answer these questions.

SZV-ISH report: who submits it? Policyholders who have identified the fact of failure to provide personal information on the insured person (several insured persons) for any of the periods that expired before 2017.

When is it necessary to submit? There are no deadlines for submission of SZV-ISH reporting, regulated by regulations. The form is used for use as needed, and is submitted immediately after the fact of failure to provide information to the Pension Fund of the Russian Federation on individuals for past periods is discovered.

Together with the SZV-ISH, the legislation obliges the employer to submit the accompanying EDV-1 inventory form.

Where are the reports submitted?

This decision is also supported by the fact that the very structure of the report implies the presence in it of at least one line with information about the employee, and if there is none, then such a form will no longer be able to pass error control.

In relation to companies, this cannot be determined unambiguously. The thing is that the company initially has one employee - a director, information about whom is specified in the Charter. It follows that if the company has not signed a single employment contract, even with the director himself, then there is no need to draw up a report and send it, as well as to include the manager there.

Attention! On the other hand, if there is a signed agreement between the director and the company, but there is no activity, a report must be drawn up. In this case, the only person listed there will be the manager.

Problems of this kind also arose when entering the SZV-M form, but in that situation the Pension Fund quickly issued clarifications on how to act in such a situation. As for the new report, there have been no official comments yet.

Please keep in mind that using SZV-KORR, SZV-M monthly reports are not adjusted. After all, SZV-M is submitted solely for the purpose of informing the Pension Fund of Russia about the fact of work of insured persons in order to suspend the indexation of their pensions. The data from SZV-M does not affect the status of individual personal accounts in any way.

However, after the functions of managing contributions were transferred to the Federal Tax Service and the RSV-1 report was cancelled, the fund faced a problem. He lost a source from which he could quickly receive all the information necessary for calculating his length of service.

The new form, in appearance, is similar to another new PF report - SZV-M. But compared to the latter, it contains more detailed information for each person. However, both documents do not cancel each other's actions. Based on the SZV-M report, the fund collects information about pensioners working in organizations in order to cancel the indexation of their old-age pensions. From the new report, the Pension Fund will receive information about the length of service of each working person during the year, as well as about contributions.

As an annual report, the new form will only be submitted in 2018. However, if an employee is dismissed, the company will have to hand out a printed form. Or if the retiree brings confirmation of this event, then the electronic report will need to be transferred to the fund within 3 days.

But for companies the situation is controversial. The fact is that in any case they have a leader who is directly stated in the Charter. On the one hand, if there is no activity and not a single employment contract has been signed, even with the director, then there is no need to include it in the report, and there is no need to send such a report either. On the other hand, if a contract with him was nevertheless drawn up, but there is no activity, then the director must be shown in the report.

To fully clarify the situation, it is necessary to wait for any official comments from the Pension Fund. At the moment there were none.

Report on the SZV-ISH form: due date in 2021

By analogy with the answer to the question about the deadline for submitting the report, the 2019 SZV-ISH is also provided to the Pension Fund of the Russian Federation for insured persons for whom personal information was not provided for the periods of 2016 and earlier.

Note!

Often, when reporting to the Pension Fund of Russia, policyholders confuse two report forms - SZV-KORR/SZV-ISKH. Let's explain the difference between them:

- The SZV-ISH form is intended for those cases when the policyholder did not promptly submit to the Fund information about the insured person employed at the enterprise in any reporting period until 2021. With the submitted report, the employer supplements the information base for the deduction of insurance premiums about one or more insured persons;

- The SZV-KORR form is submitted when errors were discovered in the previously provided information, and it is necessary to clarify, cancel or supplement the credentials on the ILS (individual personal account) of the persons for whom incorrect information was provided.

What other forms exist for accounting?

From January 1, 2021, the calculation and payment of insurance premiums, except for contributions for injuries, are controlled by tax inspectorates (Chapter 34 of the Tax Code of the Russian Federation). But information about the insurance period is still controlled by the Pension Fund of the Russian Federation and its territorial bodies. In this regard, two reports must be submitted to the Pension Fund:

- monthly report SZV-M;

- annual report on insurance experience.

Until 2021, policyholders showed information about their length of service in section 6 of the quarterly calculation of RSV-1.

However, from 2021, the RSV-1 calculation is no longer applied. His form has lost its power. Instead, information about your experience will need to be submitted as part of your annual reporting. Let us recall that quite recently officials from the Pension Fund of the Russian Federation approved another set of personalized accounting forms, which are necessary, first of all, for registration as insured persons. These forms, in fact, are not reporting. These forms are simply necessary for the policyholder to fulfill his obligation to issue insurance certificates to employees, clarify information in the personalized accounting system, etc.

Among the approved forms:

- “Questionnaire of the insured person (ADV-1)”;

- “Insurance certificate of state pension insurance (ADI-1)”;

- “Insurance certificate of compulsory pension insurance (ADI-7)”;

- “Application for exchange of insurance certificate (ADV-2)”;

- “Application for issuance of a duplicate insurance certificate (ADV-3)”;

- “Request for clarification of information (ADI-2)”;

- “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation (ADV-6-1)”;

- “Accompanying statement (ADI-5)”;

- “Information on the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K).”

Features of the formation of SZV-ISH in 2021

There are no fundamental differences in the procedure for compiling the SZV-ISH from the previously filled out form. It has been clarified that the data on accrued insurance premiums for the additional tariff for the periods 2002-2009. should be reflected in column 4 “At an additional tariff” in the table of section 5.

The form itself has changed slightly: after the second section, one new line has been added - “Information about the dismissal of the insured person.”

The report is generated separately for each of the insured persons. If an individual was charged according to two (or more) tariffs, two (or more) SZV-ISH reports must be generated for him (separately for each tariff).

The structure of the form consists of 8 information blocks (sections). We present a table in which we indicate what information must be entered into each of them:

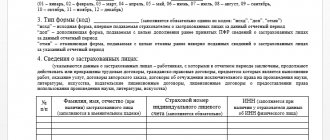

| Section number | Section name in the SZV-ISH form | Information reflected in information fields |

| Sec. No. 1 | "Information about the policyholder" | The registration data of the policyholder is indicated - INN/KPP, short name (as in the Charter), registration number in the Pension Fund of the Russian Federation |

| Sec. No. 2 | “Information about the insured person” | The full name and SNILS of the insured person, for which information was not previously provided, is filled in. The line “Information about dismissal...” is filled in with the value “December 31.yyyy” if the date of dismissal fell on December 31 of the year for which the form is being submitted. The information fields “Contract number” and “Conclusion date” are filled in only in cases where information is submitted for reporting periods up to 2001. (inclusive). “Type of contract”: “labor” or “civil law” is indicated. “Additional tariff code” is indicated (if one was used) in accordance with the Classifier given in the Appendix to the Post. Board of the Pension Fund No. 507p dated December 6, 2018 |

| Sec. No. 3 | "Reporting period" | Information fields are filled in in accordance with the Classifier given in the Appendix to the Post. Board of the Pension Fund No. 507p dated December 6, 2018 |

| Sec. No. 4 | “Information on the amount of payments and other remuneration accrued in favor of an individual” | Information about earnings, payments, income and other remunerations accrued by the policyholder in favor of the insured person is indicated. Only those information fields whose names of months must be included in the reporting period for which the report is generated must be filled out. The “category code of the insured person” is indicated in accordance with the Classifier in the Appendix to the Post. Board of the Pension Fund of the Russian Federation No. 3p dated January 11, 2017 (for hired workers, the code “NR” should be used). |

| Sec. No. 5 | “Information on accrued insurance premiums for the reporting period” | When filling out, entering data into the columns of the table depends on the period for which the report is provided:

|

| Sec. No. 6 | “Information about paid insurance premiums” | To be completed only if information is provided for the period from 2010 to 2013. |

| Sec. No. 7 | “Information on the amount of payments and other remuneration...” | Filled out only in cases where insurance premiums were calculated for the insured person at additional rates |

| Sec. No. 8 | “Periods of work of the insured person” | This block contains data similar to the information in section 3 of the SZV-STAZH report for the insured person in respect of whom the reporting form is being filled out: The “period of operation” is indicated within the reporting period for which the form is submitted. If there are several periods of work, each is entered on a separate line. |

How can I submit a report?

From January 1, all entrepreneurs and pension contribution payers will have to submit four new types of reporting documents.

Although previously the option of only one new document was considered: SZV-experience. This is justified by the transfer of contributions to the jurisdiction of the tax office, and the maintenance of workers' records remains on the shoulders of the fund. Pensioners need information in order to carry out personalized, or individual, accounting of workers, employers, and contribution payers. You can’t get rid of this with just one form of reporting document:

- SZV-STAZH - a form dedicated to the work experience of the insured persons.

- EDV-1 - this document will contain information relating to the policyholder.

- SZV-KORR is a form of document that will be used by an entrepreneur if any errors are identified and the need to change the data on the personalized account of the insured person.

- The SZV-ISH form is a document that is dedicated to all payments, remunerations of a person, insurance premiums paid for him, as well as periods of work that will be counted in the employee’s length of service.

Until 2021, organizations and entrepreneurs submitted a RSV-1 report to the Pension Fund, from which the body received information about the guardianship of the insured persons.

However, starting from 2021, the management of contributions was transferred, the report was canceled, and the fund had a problem - it lost the source of the necessary information for calculating the length of service.

For these purposes, SZV-STAZH was developed and introduced. In appearance, it resembles another report sent to the fund - SZV-M, but contains more detailed information for each of the employees.

The documents do not cancel each other in their effect - after all, on the basis of monthly information from SZV-M, the pension fund receives information about working pensioners in order to cancel the constant indexation of pensions. The new report will be a source of information about the length of service of each employed employee, as well as the amount of contributions accrued to them.

As an annual report, the new form will only be submitted to the fund in 2021. However, if during 2021 an employee decides to quit, the organization is obliged to issue him a SZV-STAZH. In addition, upon retirement and timely notification of this to the company, the responsible employee will have to submit an electronic version to the fund within 3 days of the application.

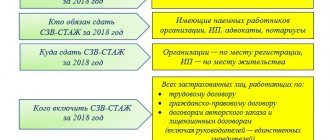

According to the developed rules, the new form will need to be submitted:

- Companies, as well as related divisions located in other regions;

- Entrepreneurs, licensed detectives, lawyers, notaries who have employees.

The completed report is submitted:

- If an entrepreneur does this, at his place of residence;

- If a company does this, at its location;

- Divisions that keep records independently - at their location.

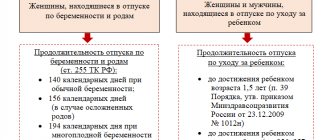

The SZV-STAZH form is required to be issued upon dismissal of an employee. However, there are some nuances here. So, if, when submitting for the reporting year, all available employees are included in the form, then in this case, information on only one person is entered into the document.

The form is filled out as follows:

- The form must be marked as original, the reporting year is the year of dismissal.

- One person is entered into the table, the period of work is from the beginning of the year or the date of admission (if it was registered in the current year) until the date of dismissal.

- Column 14 is checked only when the employee quit on December 31.

- Sections 4 and 5 are not completed for those resigning.

Attention! Entering information on all persons in this case is a violation of the law on personal data and may be punishable by penalties for those responsible. The report indicates only the person being dismissed.

SZV-STAZH includes general information about the organization or entrepreneur, as well as information about employees who were hired during this period.

In addition to the report itself, along with the form it is also necessary to submit the EDV-1 inventory, where information about the business entity and the total number of information about employees is entered.

The regulatory act, which determines exactly how this report must be filled out, establishes that SZV-STAZH is sent by companies and individual entrepreneurs who act as employers. Therefore, such a business entity must have at least one employee during the reporting period.

When individual entrepreneurs, notaries, lawyers, and people with self-employed status have not entered into a single employment contract, then there is no need to submit a report. In addition, when you try to submit it, the system will throw an error, since according to the rules, the document must contain at least one piece of information.

At the same time, the situation with organizations is still unclear. The fact is that such a person always has a director, who is indicated in the charter upon registration. And on the one hand, if an employment agreement has not been signed with him, then there is no need to submit a report on him. On the other hand, if an agreement has been signed with him, but there is no activity, then it is necessary to submit a report to the Pension Fund, indicating only the director.

At the moment, the Pension Fund has not given any explanations regarding the submission of a zero report by organizations.

Current legal norms provide for various amounts of penalties associated with failure to submit or inaccurate submission of data in the SZV-STAZH document.

- Violation of the deadlines for sending a report to the Pension Fund of Russia entails the company being punished with a fine of 500 rubles. for each employee included in it late.

- For failure to include individual employees in a report submitted on time, the company may be fined 500 rubles. for each such employee.

- A report submitted on time that contains incorrect data on the employees represented in it will entail a penalty for the company in the amount of 500 rubles. for each identified such employee.

- There are also penalties for officials of the organization for late submission of a report in the amount of 300-500 rubles.

- If the report is submitted to the Pension Fund in paper form instead of the established electronic one, the company may be punished with a fine of 1,000 rubles.

- If an employee is not issued with SZV-STAZH at the time of dismissal or, when applying for a pension, it was not sent upon request to the Pension Fund of Russia, the company expects a fine of 50,000 rubles.

Previously, the functions of the new report were performed by the RSV-1 form, which included data on the employee’s period of work at the enterprise. This register has been abolished since this year.

Since the Pension Fund of Russia remained responsible for recording the length of service of employees in order to calculate their pension, the body introduced a new form SZV-STAZH, which must be submitted at the end of the reporting year. It includes information about the period of a person’s labor activity at the enterprise.

If you look closely at it, you will immediately notice the similarity of this report with SZV-M, a form introduced last year to record working pensioners.

At the same time, SZV-STAZH has more detailed information, recording the start and end dates of work during the year, as well as indicating and deciphering the periods when the employee did not work, but his place at the enterprise was retained.

The legislation establishes a list of persons who must submit the SZV-STAZH report:

- Organizations of all forms of ownership that have employment contracts, fixed-term employment contracts and civil law agreements (GPC) with individuals, including their branches and representative offices.

- Entrepreneurs, as well as lawyers, notaries, licensed detectives who carry out private practice, when they use hired workers.

Attention! Thus, all employers must prepare and submit this reporting for employees and persons in whose favor the remuneration is paid, on which insurance premiums must be calculated.

The rules of law establish the obligation to submit the SZV-STAZH form:

- For individual entrepreneurs - at the place of their registration indicated in the passport;

- For legal entities - at their location;

- For branches and representative offices - at the address of the location of these structural units.

There are several ways to send this reporting:

- The report on paper can be submitted directly to the Pension Fund representative. To do this, you need to fill it out in two copies. It is best to prepare it on a computer using specialized programs so that you can generate an electronic file, which in this case also needs to be transferred.

- Through an electronic document management system for entities with more than 25 people involved. This method requires the mandatory presence of an electronic digital signature - EDS, as well as the execution of an agreement with a special communications operator. The majority of employers must submit the SZV-STAZH form this way.

Important! Reporting on paper can only be provided if the number of insured persons is no more than 25 people.

The current rules of law determine the employer’s obligation to issue the employee the SZV-STAZH form on the day of termination of the agreement. If it is formed by an enterprise based on the results for the year, all employees of the company are included in it.

In the case when it is compiled upon dismissal, the information included in this report should concern only the dismissed employee in order to prevent the disclosure of personal information of other employees, which is considered a violation.

When compiling this report for a dismissed employee, he is assigned the “Initial” status, and the current year number is entered, which is also the year of dismissal.

The tabular part indicates the start date of work (if the employee has been working since the beginning of the year, then the start day is indicated), and the date of completion of the employee’s work activity at the enterprise.

If the contract with an employee is terminated on December 31, then the corresponding mark is placed in column 14.

When the SZV-STAZH form is drawn up upon dismissal, sections 4 and 5 do not need to be filled out.

The SZV-STAZH form combines information about the business entity itself, as well as information about each employee or individual in whose favor the amounts for which insurance premiums need to be calculated were accrued during the year.

Attention! A mandatory appendix to the annual report is an inventory in the EDV-1 format, which is a document also containing basic information about the policyholder, as well as general data on calculated and transferred contributions, as well as the number of insured persons.

Form EDV-1

Form

“Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records” is an accompanying form. In clause 1.7 of the filling procedure approved by the Resolution of the Board of the Pension Fund of the Russian Federation from the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p it is said “Information in the form SZV-STAZH, SZV-ISKH, SZV-KORR is formed into packages of documents.

In this case, EDV-1 is a document containing information on the policyholder as a whole. So, for example, in this form you need to summarize information about the total amount of accrued and paid insurance premiums for the reporting period. EFA-1 includes the following sections:

- Details of the policyholder submitting the documents;

- Reporting period;

- List of incoming documents;

- Data in general for the policyholder;

- The basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.