Documenting

Document the fact of obtaining rights under the license agreement in a document in any form; there is no unified form for this. The main thing is that it contains all the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. For example, this could be an act of acceptance and transfer of intellectual property rights. This procedure follows from Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ. If the license agreement specifies a different procedure and conditions for the transfer of the use of rights, then it is not necessary to draw up a transfer and acceptance certificate (letter of the Ministry of Finance of Russia dated May 4, 2012 No. 03-03-06/1/226).

Calculations under license agreements

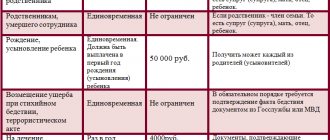

In particular, license payments may be transferred to:

- one-time fixed amounts (lump sum payment);

- periodic fixed or percentage payments (royalties);

- combined (mixed) payments (combination of royalty and lump-sum payment).

Such forms of remuneration are provided for by law, for example, for the transfer of non-exclusive rights to copyrighted works: creative and scientific works, computer programs (clause 4 of Article 1286 of the Civil Code of the Russian Federation). However, by analogy, these forms can also be applied to licensing agreements for other types of intellectual property (Article 6 and paragraph 1 of Article 424 of the Civil Code of the Russian Federation).

Accounting

The cost of the object received for use is determined based on the amount of remuneration of the licensor established for the entire period of validity of the license agreement. That is, based on the total amount of license payments. This procedure is established by paragraph 39 of PBU 14/2007.

The licensee does not charge depreciation on intellectual property, the right to use which it received under a license agreement. This is done by the licensor. This procedure is established by paragraph 38 of PBU 14/2007.

If an organization, on the basis of a license agreement, acquires the right to use someone else’s intellectual property, it must reflect in its accounting:

- expenses in the form of remuneration to the licensor (license payments);

- other expenses associated with the conclusion and execution of a license agreement.

Accounting: royalties

In accounting, reflect license fees as expenses on a monthly basis. Recognize expenses regardless of whether payment is transferred or not. This procedure follows from paragraphs 16 and 18 of PBU 10/99.

Reflect royalties as follows:

- deferred expenses, if the organization pays a fixed amount at a time for the right to use an object of intellectual property;

- current expenses if the organization makes periodic payments for the right to use the intellectual property.

This procedure follows from paragraph 39 of PBU 14/2007 and paragraph 18 of PBU 10/99.

At the same time, depending on the purposes of using intellectual property, reflect:

- or expenses for ordinary activities, if the object is used in business activities (for example, a trademark is applied to products sold) (clause 5 of PBU 10/99);

- or other expenses if the object is used for non-production purposes (for example, a work of authorship is published in a corporate magazine) (clause 11 of PBU 10/99).

Make the following entries in accounting:

Debit 97 Credit 76 – a fixed one-time payment for the right to use an object of intellectual property is taken into account;

Debit (20, 23, 25, 26, 44, 91-2...) Credit 76 – periodic payments for the right to use an object of intellectual property are taken into account;

Debit 19 Credit 76 – VAT is reflected on expenses associated with the use of intellectual property (for a list of intellectual property, license payments for the right to use which are subject to VAT, see the table).

This procedure follows from the Instructions for the chart of accounts.

License payments accounted for as deferred expenses should begin to be written off immediately after the start of use of the facility. The organization establishes the procedure for writing off expenses independently. For example, an organization can write off a one-time one-time payment evenly over the period for which the license agreement is concluded. Make such a decision by order of the manager. Fix the chosen option for writing off future expenses in the accounting policy for accounting purposes (clauses 7 and 8 of PBU 1/2008, letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5). In this case, do the wiring:

Debit 20 (23, 25, 26, 44, 91-2...) Credit 97 – part of the fixed one-time payment for the right to use an object of intellectual property is written off as expenses.

This procedure follows from the Instructions for the chart of accounts.

simplified tax system

Organizations that apply the simplification keep records of taxable income on the basis of Articles 249 and 250 of the Tax Code of the Russian Federation (clause 1 of Article 346.15 of the Tax Code of the Russian Federation).

The revenue date is the day on which the entity actually receives the royalties. Including the amount received in the form of an advance, include it in simplified income immediately at the time it arrives to the organization. This procedure follows from paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation, decision of the Supreme Arbitration Court of the Russian Federation dated January 20, 2006 No. 4294/05 and is explained in letters of the Ministry of Finance of Russia dated December 18, 2008 No. 03-11-04/2/197, dated 21 July 2008 No. 03-11-04/2/108, dated January 25, 2006 No. 03-11-04/2/15, Ministry of Taxes of Russia dated June 11, 2003 No. SA-6-22/657.

Accounting: other expenses

When obtaining intellectual property rights, the licensee may incur additional costs associated with concluding a license agreement (if the agreement does not assign this responsibility to the licensor). These include, in particular:

- expenses for notarization of documents;

- expenses for paying patent, state and other fees for registering a license agreement or amending it.

Situation: who bears the cost of paying the fee (state, patent) for registration of a license agreement: the licensor or the licensee?

The parties must agree on this issue among themselves, for example, when concluding a license agreement. The legislation does not assign this obligation to any one party to the transaction for the transfer (receipt) of non-exclusive rights to intellectual property.

Consequently, both the licensor and the licensee can register a license agreement.

Accordingly, the obligation to pay the fee may be assigned to the licensor or licensee, since this fee is paid by the organization that applied for legally significant actions.

This conclusion follows from Article 333.17 of the Tax Code of the Russian Federation and paragraph 4 of the Regulations approved by Decree of the Government of the Russian Federation of December 10, 2008 No. 941.

Such expenses apply to the entire term of the contract (for example, duties), so they need to be distributed. Reflect them as part of deferred expenses on account 97 “Deferred expenses” (Instructions for the chart of accounts and clause 18 of PBU 10/99). Do the following wiring:

Debit 97 Credit 76 (60, 70, 68, 69...) – reflected in deferred expenses are the costs associated with obtaining the right to use intellectual property.

BASIC

Tax accounting of income in the form of license payments depends on:

- classification of this income (income from the main activity or non-operating income);

- the method by which the organization calculates income tax (cash or accrual method). This follows from paragraph 1 of Article 248, Article 271 and paragraph 2 of Article 273 of the Tax Code of the Russian Federation.

Situation: when calculating income tax, which income should include license payments for the transfer of non-exclusive rights to intellectual property - non-sales income or sales revenue?

Income from the transfer of non-exclusive rights to intellectual property under a license agreement (license payments) is non-sales income if it does not relate to sales income (clause 5 of Article 250 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not establish a criterion for classifying license payments as sales revenue. However, it contains a condition for including costs associated with the transfer of non-exclusive rights in the costs of sales. Thus, if the licensor enters into licensing agreements on a systematic basis, the costs of such activities are associated with implementation (subclause 1, clause 1, article 265 of the Tax Code of the Russian Federation). Accordingly, income from it must be recognized as part of sales revenue.

Use the concept of systematicity in the meaning used in paragraph 3 of Article 120 of the Tax Code of the Russian Federation - two or more times during a calendar year.

For example, such an approach in relation to rent to the application of the concept of “systematicity” was enshrined in paragraph 2 of section 4 of the Methodological recommendations for the application of Chapter 25 of the Tax Code of the Russian Federation (approved by order of the Ministry of Taxes and Taxes of Russia dated December 20, 2002 No. BG-3-02/729) . At the moment, this document has lost force (order of the Federal Tax Service of Russia dated April 21, 2005 No. SAE-3-02/173). However, the proposed interpretation of the concept of “systematicity” remains relevant, which is confirmed by representatives of the tax department (see, for example, letter of the Department of Tax Administration of Russia for the Moscow Region dated March 25, 2004 No. 04-23/03451) and arbitration courts (see, for example, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 26, 2005 No. A28-4710/2005-34/29).

Although this rule is used to classify rental income, it can be extended to include royalties. Since for both types of agreements (lease agreement and license agreement) the basis is the transfer of the right to use (Article 606, paragraph 1 of Article 1235 of the Civil Code of the Russian Federation).

Accounting: writing off deferred expenses

The organization can independently establish the procedure for distributing future expenses during the term of the contract (evenly, in proportion to the volume of production, income received, etc.). Fix the chosen option in the accounting policy (clauses 7 and 8 of PBU 1/2008, letter of the Ministry of Finance of Russia dated January 12, 2012 No. 07-02-06/5). When writing off expenses, make the following entries:

Debit 20 (26, 44, 91-2) Credit 97 – deferred expenses (part of them) are expensed.

If the costs associated with obtaining rights are insignificant (compared to license fees), they can be taken into account at a time based on the principle of rationality (clause 6 of PBU 1/2008). Determine the materiality criterion yourself and reflect it in the accounting policy for accounting purposes (clauses 7, 8 of PBU 1/2008).

Accounting: balance sheet accounting

Intellectual property rights obtained for use under a license agreement should be recorded in off-balance sheet accounts. This procedure is established by paragraph 39 of PBU 14/2007.

The chart of accounts does not provide for a separate off-balance sheet account for accounting for intangible assets received for use. Therefore, you need to open it yourself, securing it in the working Chart of Accounts, and reflect this in the accounting policies of the organization. For example, this could be account 012 “Intangible assets received for use.”

Make the following entry in accounting:

Debit 012 “Intangible assets received for use” – the cost of an intellectual property item received under a license agreement is taken into account.

On account 012, you can organize analytical accounting for each license or its type (trademark, invention, etc.).

This follows from the Instructions for the chart of accounts and paragraph 4 of PBU 1/2008.

Situation: how to determine in accounting the value of an intangible asset received for use - intellectual property? The amount of the licensor's remuneration (the amount of license payments) cannot be accurately calculated.

Do not reflect such an object in accounting (including on off-balance sheet accounts).

One of the conditions necessary for recognizing an object of intellectual property as an intangible asset received for use is the ability to reliably determine its initial (actual) cost (clause 3 of PBU 14/2007).

In this case, the cost of an object for which non-exclusive rights are obtained under a license agreement is determined in a special way: based on the amount of remuneration of the licensor established for the entire duration of the license agreement, that is, based on the total amount of license payments. This procedure is established by paragraph 39 of PBU 14/2007.

Thus, if the amount of the licensor’s remuneration (the amount of license payments) cannot be accurately calculated, an intangible asset received for use is not formed in the organization’s accounting.

This can happen, in particular:

- if the licensor's remuneration is provided in the form of periodic license payments (royalties) based on any indicators of the licensee's activities (revenue, unit cost, production volume);

- if the contract is concluded for an indefinite period, and the licensor’s remuneration is established in the form of periodic license payments (royalties).

An example of reflecting in accounting expenses in the form of license fees for the acquired right to use the database

On January 12, Alpha LLC (licensor) entered into a license agreement with Torgovaya LLC (licensee) for the right to use the All Russia database. The duration of the agreement is three years (1096 days) from the date of entry into force. The agreement comes into force from the moment of its conclusion.

The license agreement provides for a one-time remuneration to the licensor in the form of a one-time (lump sum) payment in the amount of 100,000 rubles.

Additional costs associated with concluding a license agreement amounted to 1,000 rubles.

On January 12, Hermes paid the notary 1,000 rubles when concluding the contract. for notarization of documents. The costs associated with obtaining a license are taken into account at a time based on the principle of rational accounting.

January 12:

Debit 012 “Intangible assets received for use” – 100,000 rubles. – the cost of the “All Russia” database obtained under a license agreement is taken into account;

Debit 44 Credit 76 – 1000 rub. – the organization, using the principle of rationality, took into account the costs of notarization of documents.

On January 14, Hermes transferred a lump sum payment to Alpha.

Hermes distributes deferred expenses in proportion to the number of days falling within the period to which the continuing expenses relate.

The Hermes accountant reflected the license fee in accounting as follows.

January 14:

Debit 76 Credit 51 – 100,000 rub. – the license fee is transferred;

Debit 97 Credit 76 – 100,000 rub. – the license fee is taken into account in deferred expenses.

January 31:

Debit 44 Credit 97 – 1825 rub.

(RUB 100,000: 1096 days × 20 days) – part of the license fee is included in expenses.

Moment of revenue recognition

If an organization uses the cash method, then income from the transfer of non-exclusive rights to intellectual property must be reflected in the reporting period in which license payments are actually received (clause 2 of Article 273 of the Tax Code of the Russian Federation). They should be taken into account as income from an ordinary type of activity (Article 249 of the Tax Code of the Russian Federation) or non-operating income (clause 5 of Article 250 of the Tax Code of the Russian Federation). If an advance is received on account of license payments, then its amount is also attributed to the increase in taxable profit (subclause 1, clause 1, article 251 of the Tax Code of the Russian Federation, clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

If the organization uses the accrual method and the transfer of non-exclusive rights is one of the main activities of the organization, then recognize license payments on the date of sale of this service. In this case, the presence or absence of actual receipt of money at the time of recognition of income does not affect. In particular, the received advance does not need to be included in tax revenues (subclause 1, clause 1, article 251 of the Tax Code of the Russian Federation).

This procedure is established by paragraph 3 of Article 271 of the Tax Code of the Russian Federation.

Situation: at what point, under the accrual method, should the amount of the royalty be recognized in income? The organization accounts for such receipts as sales revenue.

When calculating income tax, take into account received license payments based on the terms of the agreement:

- for periodic payments - on the settlement date;

- in case of a one-time payment - evenly throughout the term of the contract.

For tax purposes, the transfer of the right to use intellectual property (non-exclusive right) under a license agreement is a service. Since a service for tax purposes is recognized as an activity whose results do not have material expression (clause 5 of Article 38 of the Tax Code of the Russian Federation).

If an organization uses the accrual method, then revenue from the main activities of the organization must be recognized on the date of sale of goods, works, and services.

As a general rule, the date of provision of services is the day of signing the monthly act. This conclusion allows us to draw paragraph 3 of Article 271 of the Tax Code of the Russian Federation.

However, the law does not oblige the parties to the license agreement to draw up this document. If the licensor and licensee do not draw up a monthly act on the provision of services for the transfer of non-exclusive rights, when determining the date of recognition of income, be guided by such arguments.

Under the license agreement, the licensor provides services continuously (daily) throughout the entire term of the agreement (Article 1235 of the Civil Code of the Russian Federation). Under the accrual method, income is recognized in the reporting (tax) period in which it occurred (Clause 1, Article 271 of the Tax Code of the Russian Federation). Thus, the profit tax base (including income) must be determined based on the results of each reporting (tax) period. For example:

- on the settlement date in accordance with the terms of concluded agreements, license payment schedules - if the agreement provides for periodic payments;

- evenly on the last day of the reporting (tax) period during the term of the agreement - if, under the terms of the agreement, the organization receives remuneration in a lump sum.

This procedure follows from the provisions of paragraph 2 of Article 286, paragraph 2 of Article 271 of the Tax Code of the Russian Federation and is confirmed by letters of the Ministry of Finance of Russia dated July 20, 2012 No. 03-03-06/1/354, dated August 9, 2010 No. 03-03- 06/1/534.

If the organization uses the accrual method and the conclusion of licensing agreements is not the main activity, then the date of recognition of income will be:

- or the date of settlements in accordance with the terms of the contracts;

- or the date of presentation to the licensee of documents serving as the basis for settlements (for example, invoices);

- or the last day of the reporting or tax period.

This procedure is established in subparagraph 3 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation.

Situation: in what order, using the accrual method, should royalties be reflected in income, the amount of which is set as a percentage of the licensee’s performance indicators?

Income in the form of license fees should be taken into account when calculating income tax after the moment you receive any document with which you can determine the amount.

When calculating income tax, an organization's income is determined on the basis of primary documents and other documents confirming the income received by the taxpayer. This follows from paragraph 1 of Article 248 of the Tax Code of the Russian Federation. In this case, the main document on the basis of which the licensor's remuneration is calculated (a report on the use of intellectual property) is missing. It is impossible to determine its value based on other documents (for example, a license agreement, payment documents).

In this situation, it is impossible to recognize income in the amount determined according to the rules of Article 105.3 of the Tax Code of the Russian Federation. This article is applied by tax inspectors only in relation to controlled transactions between related parties (Article 105.14 of the Tax Code of the Russian Federation). For more information about this, see: In what cases can the tax inspectorate check the correctness of the application of prices for tax purposes.

In the case where the organization’s income cannot be determined due to the lack of necessary documents (including due to the fault of the counterparty), the rules of Article 105.3 of the Tax Code of the Russian Federation do not apply.

If necessary, after the report has been received and income has been determined, submit an amended return for the appropriate reporting period. For more information about correcting tax reporting, see In what cases is an organization required to file an updated tax return.

Advice: to avoid claims from regulatory agencies, take measures to obtain the necessary documents (send a telephone message, a written request, etc.). Also in the license agreement, provide for the procedure for the licensor's actions in the event that the licensee does not submit a report on the use of intellectual activity on time.

For example, in addition to penalties for violating the terms of the contract, it can provide for the amount of a guaranteed payment that the licensor will take into account and receive if it does not receive a report on time. As well as the procedure for resolving disputes and conducting mutual settlements in the current situation.

If the licensee is a foreign person, then the licensor organization has the right to offset the amount of taxes paid (withheld) from license payments in a foreign country when paying income tax in Russia (Article 311 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated April 30 2008 No. 20-12/041936).