Briefly about the specifics of the patent tax system

The patent taxation system (PTS) was introduced in the Russian Federation on January 1, 2013 (Chapter 26.5 of the Tax Code of the Russian Federation).

Its essence is that the entrepreneur pays a fixed percentage of the potential income determined for the place of business (subject of the Russian Federation). The ability to apply PSN is established at the level of a constituent entity of the Russian Federation or at the level of a municipal or district entity. To do this, a special law must be adopted by the local legislative body.

PSN allows individual entrepreneurs:

- do not pay VAT (except customs), personal income tax, property tax (except taxable at cadastral value);

- do not submit tax reports;

- do not keep accounting (but only a book of income in the form approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n);

- take advantage of a deduction in the form of the amount of costs for the purchase of cash registers.

Find out which individual entrepreneurs are allowed not to use CCP until 07/01/2021.

To use PSN IP you will need:

- Conduct activities in the area where this system is introduced.

- Carry out activities that allow the transition to PSN. All types of such activities are listed in Art. 346.43 Tax Code of the Russian Federation. However, there may be variations in local laws regarding the patent system (for example, the activities listed will be partially represented). Therefore, individual entrepreneurs should also familiarize themselves with local legislation on PSN.

- Receive income from activities under all patents of no more than 60 million rubles/year.

- Have no more than 15 employees (for all types of individual entrepreneur activities).

- Submit an application to your tax office for the transition to PSN (10 days before the start of the relevant activity).

- Pay for the patent within the established time frame:

- patents for a period of up to 6 months - completely before the expiration of the patent;

- patents for a period of 6 to 12 months - 1/3 during the first 90 days, 2/3 until the patent expires.

Find out about the pros and cons of PSN from our article.

Purpose of payment when paying for a patent IP 2021

From March 31, 2014, the UIN must be indicated in field 22 “Code” of the payment document. If the Payer independently calculates and pays patent and other fees, the UIN is not indicated in the payment document, and “0” is entered in field 22.

Entrepreneurs have not yet had time to evaluate its advantages, because it was put into circulation only in 2013; before that, the simplified tax system using a patent was used instead.

The individual entrepreneur did not pay the cost of the patent within the required time frame? Good is not enough, you will have to pay penalties and fines, and even at the rate of the general taxation system, starting from the first month of validity of the patent.

Budget classification codes for patents in 2021 - 2021

When paying for a patent, an individual entrepreneur must indicate the BCC. The BCC for payment of a patent, as well as the general list of BCCs, is approved by the Ministry of Finance. Please note that from January 1, 2021, the KBK is regulated by Order of the Ministry of Finance dated June 8, 2020 No. 99n.

For a complete list of BCCs for other taxes, see Ready-made solution Consultant Plus. Study the material for free by getting trial access to K+.

The specific value of the BCC is determined by the scale of the region where the activity is carried out:

| KBK patent 2021 - 2021 for payments to the budget | KBK |

| Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| Urban districts | 182 1 0500 110 |

| City districts with intracity division | 182 1 0500 110 |

| Municipal districts | 182 1 0500 110 |

| Intracity areas | 182 1 0500 110 |

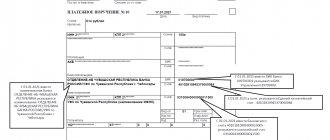

BCC is indicated in field 104 of the payment order.

Learn about the nuances of filling out field 104 in a payment order from this publication.

The service from the Federal Tax Service “Calculation of the cost of a patent” will help you calculate the cost of a patent.

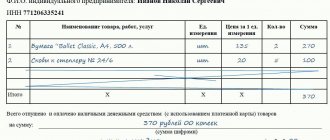

Sample payment order for payment of a patent:

IMPORTANT! The transition to PSN does not exempt individual entrepreneurs from paying compulsory insurance contributions (for employees and for themselves), as well as personal income tax for employees. At the same time, payment of personal income tax, regular insurance premiums paid to the budget, and “unfortunate” contributions transferred to social insurance must be made according to separate BCCs established for the corresponding payments.

How to issue a receipt for payment of a patent for an individual entrepreneur on PSN

At the same time, the BCC for the patent tax system in 2021 will also be needed, so you can immediately find out about them. Since this voluntary type of tax regime has some restrictions, an entrepreneur who is going to apply it will have to meet certain conditions: It is worth noting the nuances on some points.

Is it possible to pay for a patent through Sberbank online for another person? To obtain permission for another person, in addition to standard actions, you should:

- Fill in the TIN information of the document owner and OKTMO. Without this information, payment for the patent is impossible. The data can be found via SMS from the FMS, as well as at the Federal Tax Service office.

- After checking the entered information, click “Confirm”. An SMS notification will be sent to your cell phone number. It will display a special code that must be entered in the appropriate field. After all the manipulations, you should print out the receipt. It must be presented as proof of payment to the Federal Migration Service. In rare cases, you will need to go to a bank branch to get a stamp.

For legal entities - send a request to the chief accountant of Rospatent to credit the payment made to the correct CBC.

Sberbank Online has a function - saving data and creating a template. With its help, making monthly payments for a patent is very easy: all data is saved. The only thing you need to do is fill in the date of the current payment.

The petition must be drawn up on the organization's letterhead, signed by the head and chief accountant of the organization, and the signatures must be affixed with the organization's seal. A copy of the payment order must be attached to the application.

Solnechnogorsk This is justified by the fact that the city of Solnechnogorsk is the administrative center of the Solnechnogorsk municipal district and is located on the border of the urban settlement of Solnechnogorsk (Article 1.6 of the Law of the Moscow Region of January 21, 2005 N 27/2005-OZ “On the status and boundaries of the Solnechnogorsk municipal district and newly formed in its composition of municipalities").

What to do if there is an error in the KBK

In accordance with paragraph 7 of Art. 45 of the Tax Code of the Russian Federation, in the event of an error in the KBK when filling out the data of a payment document, the taxpayer should submit an application to clarify the payment to the tax office where he is registered. Copies of documents confirming the fact of payment must be attached to the application.

For information on how to draw up such an application, read the article “Sample application for clarification of tax payment (error in the KBK)” .

Tax authorities will make the necessary clarifications based on these documents.

IMPORTANT! Incorrectly indicated by the BCC as the basis on which the tax is considered unpaid in Art. 45 of the Tax Code of the Russian Federation is not listed. That is, after clarification, no sanctions should be applied to the taxpayer.

This approach is confirmed by the decision of the Moscow District Arbitration Court dated May 23, 2016 No. F05-6154/2016 in case No. A40-168537/2015, which decided in favor of the individual entrepreneur who paid for the patent on time, but according to the incorrect BCC. The Federal Tax Service Inspectorate considered that the date of submission of the application for clarification of the BCC, submitted after the expiration of the period allotted for payment of the patent, should be taken as the payment deadline. However, the judicial authorities did not support this position of the Federal Tax Service.

ConsultantPlus experts spoke about the nuances of clarifying a payment in the event of an error in the KBK. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Receipt for payment of a patent to a foreign citizen

Many Internet users are wondering: if your mobile phone device has the Sberbank Online application, is it possible to pay for the permit? Yes, this is easy to do with mobile banking. The actions will be similar to the above:

- go to the “payments” tab;

- select the required destination;

- fill in the requested data;

- confirm the payment.

For those who like to do everything on their own, let's look at how to calculate the cost of a patent for an individual entrepreneur for 2021 for different types of activities without a calculator. As an example, let’s take the most common types of patents for individual entrepreneurs—cargo transportation and trade.

In this case, the individual entrepreneur can give the amount of the cost of the patent in the way that is convenient for him - either immediately or by dividing it into certain shares. But the basic rule is that the entire amount must be repaid before the patent expires.

The list includes such activities as: repair, knitting and tailoring of any clothing, hairdressing salons, cosmetology services, dry cleaning, production of metal haberdashery, furniture repair, some motor transport services, photo studios, installation and welding work, etc.

Results

The payment for a patent, on which an individual entrepreneur has the right to choose to work if certain criteria are met, is a budget payment (analogous to a tax).

When paying for a patent, in the payment document, as for other taxes, you need to indicate the BCC. Depending on the scale of the region of activity, its importance varies. At the same time, we must remember that individual entrepreneurs may also have other budget payments (insurance premiums for themselves, insurance premiums and personal income tax on employee income). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Purpose of payment for patent IP

At the final stage, you must once again carefully double-check all the entered data and complete the payment. Confirm the action using a message received on your phone and be sure to print the payment result. This can be done by clicking on the “print document” link at the end of the payment field. In this case, you can simply save the document on your computer or send it to print immediately. See also: . From 2021, tax contributions can be clarified if the correct bank name and correct beneficiary account were provided. The remaining fees must be returned and paid again. (). Also, a payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank).

In 2021 (KBK) is reflected in a separate field of payment orders intended for the deduction of taxes, insurance premiums, penalties and fines, as well as a number of other payments to the budget. This field in 2021 is 104 (same as before).

Unlike individuals, organizations calculate and pay transport tax on their own, so it is important to indicate the correct BCC in the payment order. There is only one code for this tax, and separate BCCs are intended for payment of penalties and fines.

Receipt for payment of UTII for individual entrepreneurs in 2021

Internet banking is the most convenient service for paying for a patent. With its help, payment occurs quickly and without problems.

Incorrectly indicated by the KBK or OKTMO as the basis on which the tax is considered unpaid, in Art. 45 of the Tax Code of the Russian Federation does not appear.

The employee performs his work duties in the territory of a foreign state. This means that the salary you pay him relates to income from sources outside of Russia (subclause 6, clause 3, article 208 of the Tax Code of the Russian Federation). And if the employee is not a tax resident of our country, then he will pay personal income tax on the income he receives from a Russian organization only in his own country. Incorrect indication of OKTMO in the payment order does not lead to non-payment of tax and is not grounds for loss of the right to a patent for an individual entrepreneur. Such a payment is automatically attributed by the tax office to outstanding payments and you will then have to prove that you paid this tax.

How to issue a receipt for payment of a patent for an individual entrepreneur on PSN?

Good afternoon, dear entrepreneurs!

A few instructions on how to generate a receipt for paying for a patent for an individual entrepreneur. Many people fill them out manually, but in fact, there is a wonderful (and official!) service right on the website of the Federal Tax Service of the Russian Federation.

I highly recommend using it.

So, let's get straight to the point:

We go to the website of the tax office of the Russian Federation and fill out a special form:

· If you don’t know the Federal Tax Service code, then simply click the “Next” button.

Enter all your address information. Each time you press the “Next” button.

We see the codes of the Federal Tax Service and OKTMO, which are determined automatically.

· Then select the type of payment document “Payment document”;

· Select “Payment Type”. This is “Payment of tax, fee, payment, duty, contribution, advance (prepayment).”

Click the “Next” button if we don’t know the BCC;

· Select the tax to be paid.

This is where everything is quite complicated, since there are a lot of different payments in the drop-down list. It’s easier to use the input field by typing in the word “patent”, then the search circle will narrow down, and there it’s easy to find the payment we need.

In this particular case, this is “The tax levied in connection with the use of the patent taxation system, credited to the budgets of municipal districts (payment amount (recalculations, arrears and debt for the corresponding payment, including the canceled one) (18210504020021000110).

You may have another BCC, which you need to check with your tax office, as there are several of them.

The above examples show the 2015 BCC. Please note that in 2021 there will be new BCCs:

Accordingly, illustrations may vary. But the essence remains the same!

It’s even better to find out the current KBK on this page

(don’t forget to first select the desired region of the Russian Federation)

· Next, in the line “Status of the person who issued the payment document”, select “Payment of tax, fee, duty, contribution, advance (prepayment)”;

· Basis of payment – “TP – payments of the current year”;

· Tax period – “Specific date” and indicate the date of payment of the required amount.

Click the “Next” button.

· We indicate the Taxpayer Identification Number, Full Name, Amount (the address appears automatically).

In order not to make a mistake in the amount, check it again in your patent, everything is described in detail there.

Click the “Next” button.

· Now you need to choose a payment method.

Cash

Select “Cash” and click “Generate payment document”.

We print out the receipt and go to pay, for example, at Sberbank.

Of course, you need to pay for the patent AFTER the application to switch to PSN is approved.