Who should provide SOP and to whom?

Who needs a certificate of supporting documents and in what cases, the procedure and timing for its provision - these and other issues related to the control of foreign exchange transactions are regulated by Instruction of the Central Bank of the Russian Federation No. 138-i. First of all, these provisions apply to organizations participating in foreign trade activities, legal entities and individuals making payments in foreign currency under contracts to foreign counterparties and in connection with their own activities outside the country. At the same time, the obligation to obtain permission for such transactions rests only with residents - organizations and citizens operating in the territory and under the jurisdiction of the Russian Federation:

- legal entities engaged in import-export operations;

- legal entities and individual entrepreneurs providing services and performing work abroad;

- non-profit organizations making settlements with foreign partners.

Having issued a transaction passport for an agreement with a foreign counterparty in the selected bank division, the resident is obliged to justify currency transactions with a certificate of supporting documents submitted along with the papers indicated in it. The SPD is formed on a document certifying the fact of delivery of goods or provision of services under a contract with a non-resident (certificate of completed work, invoice for payment, etc.). Having accepted the certificate, the bank files it in the file on currency transactions.

Where can I get the certificate form?

To register SPD, there is a special form 0406010 developed by the Central Bank of the Russian Federation, the body authorized to exercise currency control. But since the transaction passport is opened at a certain bank branch, it is logical to request a form for a certificate of supporting documents for currency control there.

Standard form 0406010 is given in Appendix No. 5 to Central Bank Instruction No. 138-I dated June 4, 2012; it can be taken for filling out if the servicing bank does not have special requirements for the execution of the document. As a rule, the templates of certificates in different banks, although slightly, differ, for example, in the “header”, which contains the name and details of a specific credit institution.

A document drawn up on someone else’s form may not be accepted: find out in advance whether you can download the “correct” template on the official website of a financial institution or fill out the SPD form in the Internet bank for legal entities. All transactions under one currency agreement must be carried out only in the department where permission for the transaction was received: it was there that the certification was carried out, the dossier is also located there, and currency transactions are processed through the same department.

Certificate of supporting documents

Clause 1.5 of Central Bank Instruction No. 138-I dated June 4, 2012. “On the procedure for the submission by residents and non-residents of documents and information related to the conduct of foreign exchange transactions to authorized banks, the procedure for issuing transaction passports, as well as the procedure for authorized banks to record foreign exchange transactions and control over their implementation” a certificate of supporting documents (hereinafter referred to as the Certificate) is classified as a form accounting for currency transactions, although several years ago the certificate referred to “documents and information related to the conduct of currency transactions” and a person was not held accountable for failure to submit it on time. The situation changed after Bank of Russia Regulation No. 258-P and Instruction No. 117-I came into force.

What is the situation today?

As practice shows, the Certificate is one of those documents that is often forgotten. At the same time, the provisions of Article 15.25 of the Code of Administrative Offenses of the Russian Federation provide for quite severe measures for this administrative offense in the field of currency legislation. “STANDARDS”, without which you can’t go anywhere:

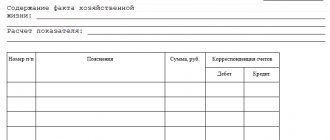

OKUD form code 0406010 ┌─────────────────────────────────── ───────── ─────┐ Name of bank PS │ │ ├───────────────────────────── ───────── ───────────┤ Name of resident │ │ └─────────────────────── ────────── ────────────────┘ REFERENCE OF SUPPORTING DOCUMENTS from _______________ ┌─┬─┬─┬─┬─┬─┬─┬─ ┬─┬─┬─┬─┬─┬ ─┬─┬─┬─┬─┬─┬─┬─┬─┐ According to transaction passport N │ │ │ │ │ │ │ │ │/│ │ │ │ │/│ │ │ │ │/│ │/│ │ └ ─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─┴─ ┴─┘ ┌───┐ Sign adjustments │ │ └───┘ ┌────┬──────────────┬─────────┬─ ────────── ───────────────────┬────────┬─────────┬── ───────── N │ │ │giving ├─ │ │(consignee)│ │ │ │document │ in units │ in units │ │ │ │ │ │ │ │ currency │ currency │ │ │ │ │ │ │ │ document │ contract │ │ │ │ │ │ │ │ │ (credit │ │ │ │ │ │ │ │ │ contract) │ │ │ │ │ ├──── ─┬────────┤ ├────────┬──────┼───────┬──── ──┤ │ │ │ │ │ N │ date │ │ code │amount │ code │amount │ │ │ │ │ │ │ │ │ currencies │ │currencies │ │ │ │ │ ├────┼── ───┼────────┼─ ────────┼────────┼──────┼───────┼──────┼─ ───────┼─ ────────┼─────────────────┤ │ 1 │ 2 │ 3 │ 4 │ 5 │ 6 │ 7 │ 8 │ 9 │ 10 │ 11 │ ├────┼─────┼────────┼─────────┼────────┼─ ─────┼─── ────┼──────┼────────┼─────────┼────────── ───────┤ │ │ │ │ │ │ │ │ │ │ │ │ ├────┼─────┼────────┼───── ────┼──────── ┼──────┼───────┼──────┼────────┼───────── ┼──────── ─────────┤ │… │ │ │ │ │ │ │ │ │ │ │ └────┴─────┴── ──────┴────── ───┴────────┴──────┴───────┴──────┴────── ──┴────── ───┴─────────────────┘ ——————————— Note. ┌─────────┬────────────────────────────── ───────── ───────────────────────────────────────── ───────┐ │ N lines │ Contents │ ├─────────┼────────────────────────── ──────── ───────────────────────────────────────── ───────── ───┤ │ │ │ ├─────────┼───────────────────── ─────────── ───────────────────────────────────────── ───────── ─────┤ │ … │ │ └─────────┴─────────────────── ────────── ───────────────────────────────────────── ───────── ────────┘ PS bank information

https://base.consultant.ru/cons/cgi/online.cgi?req=obj;base=LAW;n=133766;dst=2 1. The form (form) of the Certificate is given in Appendix 5 to Central Bank Instruction No. 138- AND. In different banks, this form may be slightly modified by adding columns about resident signatures, notes from bank employees, etc. In addition, the Certificate must correctly indicate the official name of the bank. Therefore, to submit a certificate to a specific bank, it is advisable to request in advance the Certificate form used by THIS BANK. Here is the procedure for filling out the Certificate: 1. In the header part of the certificate of supporting documents (hereinafter referred to as the SPD) the following is indicated: in the “Name of PS Bank” field – the full or abbreviated corporate name of the PS bank to which the resident submits the SPD or to which granted the right to fill out the SOP. In the cases established by Chapter 11 of this Instruction, the name of the territorial institution of the Bank of Russia is indicated; in the “Name of the resident” field – the full or abbreviated corporate name of the legal entity or its branch (for commercial organizations), the name of the legal entity or its branch (for non-profit organizations) or the last name, first name, patronymic (if any) of an individual - individual entrepreneur , an individual engaged in private practice in accordance with the legislation of the Russian Federation, who submitted the SOP, or on whose behalf it was completed. When writing the name of the resident, the use of generally accepted abbreviations is allowed. In the “from ____________” field – the date the SPD was filled out in the format DD.MM.YYYY. In the field “According to transaction passport N” – the number of the PS for which the resident submitted the supporting documents specified in the SPD. In the “Adjustment Attribute” field, the “*” symbol is entered when filling out the corrective SPD. In other cases, the “Adjustment Attribute” field is not filled in. When filling out the field “Adjustment Attribute” in the field “from ____________” the date of filling out the SPD, which contains the information to be adjusted, is indicated. When filling out the corrective SPD line, new data is entered into the columns whose information is subject to change, and all previously submitted information on this supporting document that does not require changes is reflected in the corresponding columns of the corrective SPD line unchanged. 2. Column 1 indicates in ascending order the line number of the SPD. If the “Adjustment Attribute” field is filled out, column 1 indicates the line number of the SPD previously accepted by the PS bank, which contains information to be adjusted. 3. Column 2 indicates the number of the supporting document. If the supporting document does not have a number, the symbol “BN” is entered in column 2. 4. In column 3 in the format DD.MM.YYYY, depending on the type of supporting document, the date specified in subclause 9.2.1 of clause 9.2 or in clause 9.3 of these Instructions is indicated. If the information to be reflected in line (columns 2 - SPD) is contained in several supporting documents, with the exception of the supporting documents specified in subclause 9.2.1 of clause 9.2 of these Instructions, then it is filled out on the basis of all such documents. In this case, in the columns 2 - 4 SPD information about the supporting document with the latest date of execution, which is determined in accordance with paragraph 9.3 of these Instructions. Information about the number (if any) and date of other supporting documents on the basis of which columns 5 - 8 lines are filled in SPD, indicated in the “Note” field in the “Content” field 5. In column 4, depending on the content of the supporting document, one of the following codes of types of supporting documents is indicated:

In different banks, this form may be slightly modified by adding columns about resident signatures, notes from bank employees, etc. In addition, the Certificate must correctly indicate the official name of the bank. Therefore, to submit a certificate to a specific bank, it is advisable to request in advance the Certificate form used by THIS BANK. Here is the procedure for filling out the Certificate: 1. In the header part of the certificate of supporting documents (hereinafter referred to as the SPD) the following is indicated: in the “Name of PS Bank” field – the full or abbreviated corporate name of the PS bank to which the resident submits the SPD or to which granted the right to fill out the SOP. In the cases established by Chapter 11 of this Instruction, the name of the territorial institution of the Bank of Russia is indicated; in the “Name of the resident” field – the full or abbreviated corporate name of the legal entity or its branch (for commercial organizations), the name of the legal entity or its branch (for non-profit organizations) or the last name, first name, patronymic (if any) of an individual - individual entrepreneur , an individual engaged in private practice in accordance with the legislation of the Russian Federation, who submitted the SOP, or on whose behalf it was completed. When writing the name of the resident, the use of generally accepted abbreviations is allowed. In the “from ____________” field – the date the SPD was filled out in the format DD.MM.YYYY. In the field “According to transaction passport N” – the number of the PS for which the resident submitted the supporting documents specified in the SPD. In the “Adjustment Attribute” field, the “*” symbol is entered when filling out the corrective SPD. In other cases, the “Adjustment Attribute” field is not filled in. When filling out the field “Adjustment Attribute” in the field “from ____________” the date of filling out the SPD, which contains the information to be adjusted, is indicated. When filling out the corrective SPD line, new data is entered into the columns whose information is subject to change, and all previously submitted information on this supporting document that does not require changes is reflected in the corresponding columns of the corrective SPD line unchanged. 2. Column 1 indicates in ascending order the line number of the SPD. If the “Adjustment Attribute” field is filled out, column 1 indicates the line number of the SPD previously accepted by the PS bank, which contains information to be adjusted. 3. Column 2 indicates the number of the supporting document. If the supporting document does not have a number, the symbol “BN” is entered in column 2. 4. In column 3 in the format DD.MM.YYYY, depending on the type of supporting document, the date specified in subclause 9.2.1 of clause 9.2 or in clause 9.3 of these Instructions is indicated. If the information to be reflected in line (columns 2 - SPD) is contained in several supporting documents, with the exception of the supporting documents specified in subclause 9.2.1 of clause 9.2 of these Instructions, then it is filled out on the basis of all such documents. In this case, in the columns 2 - 4 SPD information about the supporting document with the latest date of execution, which is determined in accordance with paragraph 9.3 of these Instructions. Information about the number (if any) and date of other supporting documents on the basis of which columns 5 - 8 lines are filled in SPD, indicated in the “Note” field in the “Content” field 5. In column 4, depending on the content of the supporting document, one of the following codes of types of supporting documents is indicated:

┌─────┬────────────────────────────────── ───────── ────────────────────────┐ │ Code │ Contents of the supporting document │ ├─────┼── ───────── ───────────────────────────────────────── ───────── ──────┤ │01_3 │On the export of goods from the territory of the Russian Federation with│ │ │submission of a customs declaration, with the exception of documents with│ │ │code 03_3 │ ├─────┼─── ───── ───────────────────────────────────────── ───────── ─────────┤ │01_4 │On the importation of goods into the territory of the Russian Federation with│ │ │submission of a customs declaration, with the exception of documents with│ │ │code 03_4 │ ├─────┼ ───── ───────────────────────────────────────── ───────── ────────────┤ │02_3 │On the shipment (transfer to the buyer, carrier) of goods when they are exported from the territory of the Russian Federation without filing a customs declaration, with the exception of documents with code 03_3 │ ├─────┼────────────────────────────────── ───────── ────────────────────────┤ │02_4 │On receipt (transfer by seller, carrier) of goods upon their import into the territory of the Russian Federation without filing customs │ │ │declarations, with the exception of documents with code 03_4 │ ├─────┼─────────────────────── ──────── 03_3 │ On the transfer by a resident on the territory of the Russian Federation of goods and│ │ │providing services to a non-resident under the contracts specified in subclause│ │ │5.1.2 of clause 5.1 of this Instruction │ ├─────┼─────────────── ────── ───────────────────────────────────────── ─────┤ │03_4 │ On receipt by a resident outside the territory of the Russian│ │ │Federation of goods and services from a non-resident under contracts specified│ │ │in subclause 5.1.2 of clause 5.1 of this Instruction │ ├─────┼───────── ─ ───────────────────────────────────────── ───────── ───────┤ │04_3 │About the work performed by the resident, services provided, transferred│ │ │information and results of intellectual activity, including│ │ │exclusive rights to them, with the exception of documents with│ │ │code 03_3 │ ├─────┼────────────────────────────────── ───────── ────────────────────────┤ │04_4 │About work performed by a non-resident, services provided, information transferred│ │ │and results of intellectual activity, in volume│ │ │the number of exclusive rights to them, with the exception of documents with│ │ │code 03_4 │ ├─────┼───────────────────── ───── ───────────────────────────────────────── ┤ │05_3 │On debt forgiveness by a resident ( principal debt) to a non-resident under a loan agreement ─────── 05_4 │About forgiveness non-resident debt (principal debt) to a resident by│ │ │loan agreement │ ├─────┼──────────────────────────── ────────── │ │obligations of a non-resident to repay the principal debt under the credit agreement, the obligations are terminated completely or changed (the amount of the principal debt is reduced) ───── ───────────────────────────────────────── ────┤ │06_4 │O offset of counter homogeneous claims, in which│ │ │the resident’s obligations to repay the principal debt under the loan│ │ │agreement are terminated completely or obligations are changed│ │ │(the amount of the principal debt is reduced) │ ├─────┼────── ───────────────────────────────────────── ───────── ───────────┤ │07_3 │On the assignment by a resident of a claim against a non-resident debtor for the repayment of the principal debt under a loan agreement to another person -│ │ │a non-resident │ ├─── ──┼── ───────────────────────────────────────── ───────── ───────────────┤ │07_4 │On the assignment by a non-resident of a claim to a resident debtor for│ │ │return of the principal debt under a loan agreement in favor of another│ │ │resident person │ ├── ───┼───────────────────────────────────── ───────── ─────────────────────┤ │08_3 │On the transfer by a non-resident of his debt to repay the principal debt│ │ │under a loan agreement to another person - a resident │ ├ ─── ──┼────────────────────────────────────── ───────── ────────────────────┤ │08_4 │On the transfer by a resident of his debt to repay the principal under a loan agreement to another person - a non-resident │ ├─ ─── ─┼─────────────────────────────────────── ───────── ───────────────────┤ │09_3 │On the termination of obligations or on a change (reduction in the amount)│ │ │of a non-resident’s obligations under a loan agreement in connection with a novation│ │ │(replacing the original obligation of a non-resident debtor by another│ │ │obligation), with the exception of novation carried out│ │ │by transfer by a non-resident debtor to a resident of a bill or│ │ │other securities │ ├─────┼───── ─── ───────────────────────────────────────── ───────── ─────────┤ │09_4 │On the termination of obligations or on the change (reduction of the amount)│ │ │of the resident’s obligations under the loan agreement in connection with the novation│ │ │(replacement of the original obligation of the resident debtor with another one│ │ │ obligation ), with the exception of innovation carried out through the transfer by a resident debtor to a non-resident of a bill or other securities ──── ───────────────────────────────────────── ────────┤ │10_3 │On termination of obligations or changes (reduction of amounts)│ │ │obligations of a non-resident related to payment for goods (works,│ │ │services, transferred information and results of intellectual│ │ │activities, including exclusive rights to them) contract│ │ │or with the return by a non-resident of the principal debt under a loan│ │ │agreement through the transfer by a non-resident to a resident of a bill or│ │ │other securities │ ├─────┼────────── ──── ───────────────────────────────────────── ───────── ───┤ │10_4 │On termination of obligations or changes (reduction of amounts)│ │ │resident’s obligations related to payment for goods (works, services,│ │ │transferred information and results of intellectual activity,│ │ │including exclusive rights on them) under a contract or with│ │ │return by a resident of the principal debt under a loan agreement│ │ │by transfer by a resident to a non-resident of a bill or other│ │ │securities │ ├─────┼──────── ── ───────────────────────────────────────── ───────── ───────┤ │11_3 │On full or partial fulfillment of obligations to repay│ │ │the principal debt of a non-resident under a loan agreement by another person -│ │ │resident │ ├─────┼──── ─── ───────────────────────────────────────── ───────── ──────────┤ │11_4 │On full or partial fulfillment of obligations to repay│ │ │the principal debt of a resident under a loan agreement by a third party -│ │ │a non-resident │ ├─────┼─ ─── ───────────────────────────────────────── ───────── ─────────────┤ │12_3 │On changes in obligations (increase in debt on the main debt) of a resident to a non-resident under a loan agreement │ ├─────┼── ──── ───────────────────────────────────────── ───────── ───────────┤ │12_4 │On changes in obligations (increase in debt on the principal│ │ │debt) of a non-resident to a resident under a loan agreement │ ├─────┼──── ──── ───────────────────────────────────────── ───────── ─────────┤ │13_3 │On other methods of fulfillment (change, termination) of obligations│ │ │of a non-resident to a resident under a contract (loan agreement),│ │ │including the return by a non-resident of previously received goods, for│ │ │ with the exception of other codes of types of supporting documents indicated in this table ──── ───────────────────────────────────────┤ │13_4 │About other methods of execution (changes, termination) of obligations│ │ │of a resident to a non-resident under a contract (loan agreement),│ │ │including the return by a resident of previously received goods, with the exception of other codes of types of supporting documents specified│ │ │in this table │ └──── ─┴─────────────────────────────────────── ───────── ───────────────────┘

6. Column 5 indicates the digital code of the currency in accordance with the OKV or the Classifier of Clearing Currencies, in which the supporting document indicates the cost of goods, work, services, information and results of intellectual activity, including exclusive rights to them, or the amount of other execution ( changes, termination) of obligations under a contract (loan agreement). 7. Column 6 indicates the value in the currency specified in column 5 of goods, works, services, information and results of intellectual activity, including exclusive rights to them, or the amount of other fulfillment (change, termination) of obligations under the contract (loan agreement ). 8. Columns 7 and 8 are filled in if the currency code of the confirming document and the contract (loan agreement) currency code specified in the PS do not match. In other cases, columns 7 and 8 are not filled in. Column 7 indicates the digital code of the contract currency (loan agreement) specified in the PS. Column 8 shall indicate the amount specified in Column 6, recalculated into the currency of the contract (loan agreement) at the exchange rate of foreign currencies against the ruble on the date of execution of the supporting document specified in Column 3, unless a different procedure for recalculation is established by the terms of the contract (loan agreement) . 9. Column 9 is filled in only if column 4 contains codes for the types of supporting documents 01_3, 01_4, 02_3, 02_4, 03_3, 03_4, 04_3, 04_4. Column 9, as of the date given in Column 3, indicates one of the following characteristics characterizing the supply of goods, performance of work, provision of services, transfer of information and results of intellectual activity, including exclusive rights to them: 1 – fulfillment by the resident of obligations under a contract on account of a previously received advance from a non-resident; 2 – provision by a resident of a commercial loan to a non-resident in the form of deferred payment; 3 – fulfillment by a non-resident of obligations under a contract on account of an advance previously received from a resident; 4 – provision by a non-resident of a commercial loan to a resident in the form of deferred payment. 10. Column 10 is filled in only if the attribute “2” is indicated in column 9 and the codes of types of supporting documents 01_3, 02_3, 03_3, 04_3 are indicated in column 4. Column 10 shall indicate by the resident who has issued the PS information on the maximum period expected in accordance with the terms of the contract for receiving funds from the non-resident on account of the commercial loan provided by the resident in the form of a deferred payment for goods transferred to the non-resident, work performed for him, services provided to him, information transferred to him and results of intellectual activity, including exclusive rights to them. The expected period is indicated in the form of the last date (in the format DD.MM.YYYY) of the expiration date for crediting funds to the resident’s account in the PS bank, which is determined by the resident based on the terms of the contract and (or) in accordance with business customs. 11. In column 11, if the resident indicates in column 4 codes of types of supporting documents 02_3 or 02_4, in accordance with OKSM, the digital code of the country of location of the consignee, to which goods are exported from the Russian Federation, or the digital code of the country of location of the consignor, from which the goods are imported into the Russian Federation. 12. In the “Note” field, additional information about supporting documents may be indicated, in this case: in the “Line N” field, the number of the SPD line specified in column 1, to which additional information is provided, is indicated; in the “Contents” field, additional information about the supporting document is indicated, information from which was used when filling out the corresponding line of the SOP. 13. The PS Bank in the “PS Bank Information” field records the date of submission of the SPD by the resident, the date of return of the SPD by the PS Bank (indicating the reasons for the return), the date of acceptance of the SPD by the PS Bank. When filling out the SPD by the PS bank, in the “PS Bank Information” field, the date of submission by the resident of the supporting documents and information that is necessary to fill out the SPD, and the date of acceptance by the PS bank of the SPD are indicated. Dates are indicated in the format DD.MM.YYYY. The information recorded in the “PS bank information” field can be supplemented by an authorized bank.

2. Now, within what time frame must the certificate be submitted?

Clause 9.2 of Central Bank Instruction No. 138-I: 9.2. A certificate of supporting documents and supporting documents specified in clause 9.1 of this Instruction are submitted by the resident to the PS bank within the following deadlines (except for other deadlines established by clauses 7.3, 7.4, 9.7, 12.9, 13.4, 14.7 and 20.8 of this Instruction): 9.2.1 . within no later than 15 working days after the date specified in the second part of the registration number of the customs declaration, or the date of release (conditional release) of goods indicated by the customs official in the customs declaration, depending on which date is the latest. If there are several notes in the customs declaration from a customs official about different dates of release (conditional release) of goods, the period specified in this subparagraph is calculated from the latest date of release (conditional release) of goods specified in the customs declaration; 9.2.2. no later than 15 working days after the end of the month in which the supporting documents specified in subclauses 9.1.2 – 9.1.4 of clause 9.1 of these Instructions were issued. In addition, according to clause 2 of part 2 of Art. 24 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”: Residents and non-residents carrying out operations in the Russian Federation are obliged to: 2) keep records in the prescribed manner and draw up reports on their currency transactions, ensuring safety of the relevant documents and materials for at least three years from the date of the relevant currency transaction, but not earlier than the date of execution of the contract.

3. What will happen if this is not done?

For some unknown reason, at best, many believe that failure to submit the Certificate, if it entails any unpleasant consequences for them, will be very minor. The majority believes that no one will know about this at all, because the Certificate is submitted to the bank, and the bank is not authorized to bring administrative liability. I would like to dispel this myth. ..... clause 6 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation Failure to comply with the established procedure for submitting accounting and reporting forms for currency transactions, the procedure and (or) deadlines for submitting reports on the movement of funds on accounts (deposits) in banks outside the territory of the Russian Federation with supporting bank documents, violation of the established procedure for submitting supporting documents and information when carrying out currency transactions, violation of the established rules for issuing transaction passports or violation of the established storage periods for accounting and reporting documents on currency transactions, supporting documents and information when carrying out foreign exchange transactions or transaction passports - (as amended by the Federal Law dated November 16, 2011 N 311-FZ) (see text in the previous edition) entail the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles; for legal entities - from forty thousand to fifty thousand rubles. (as amended by Federal Law No. 116-FZ of June 22, 2007) (see text in the previous edition) 6.1. Violation of the established deadlines for submitting accounting and reporting forms for currency transactions, supporting documents and information when carrying out currency transactions for no more than ten days - entails a warning or the imposition of an administrative fine on officials in the amount of five hundred to one thousand rubles; for legal entities - from five thousand to fifteen thousand rubles. (Part 6.1 introduced by Federal Law dated November 16, 2011 N 311-FZ) 6.2. Violation of the established deadlines for submitting accounting and reporting forms for currency transactions, supporting documents and information when carrying out currency transactions for more than ten but not more than thirty days - entails the imposition of an administrative fine on officials in the amount of two thousand to three thousand rubles; for legal entities - from twenty thousand to thirty thousand rubles. (Part 6.2 introduced by Federal Law dated November 16, 2011 N 311-FZ) 6.3. Violation of the established deadlines for submitting accounting and reporting forms for currency transactions, supporting documents and information when carrying out currency transactions for more than thirty days - entails the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles; for legal entities - from forty thousand to fifty thousand rubles. (Part 6.3 introduced by Federal Law dated November 16, 2011 N 311-FZ).

Thus, as we see, the amount of the administrative fine directly depends on the period of failure to submit the Certificate, and for the last part the fine is not small at all.

4. Now to the question: “No one will know”

REGULATIONS of the Central Bank of the Russian Federation “ON THE PROCEDURE FOR TRANSMISSION BY AUTHORIZED BANKS INFORMATION ABOUT VIOLATIONS OF CURRENCY LEGISLATION OF THE RUSSIAN FEDERATION AND ACTS OF CURRENCY REGULATION BODIES BY PERSONS PERFORMING CURRENCY OPERATIONS” dated July 20 2007 N 308-P (quite old, but nevertheless valid in edition Instructions of the Central Bank of the Russian Federation dated July 23, 2009 N 2265-U, dated June 4, 2012 N 2828-U) define the following: .... 1. Authorized banks (branches), when exercising control over compliance by persons carrying out currency transactions, with the exception of credit institutions and currency exchanges (hereinafter referred to as clients), with acts of currency legislation of the Russian Federation and acts of currency regulatory authorities, and if there is information about violations, transmit information about indicated violations to the territorial branch of the Bank of Russia that supervises the activities of the authorized bank, in the form of an electronic message equipped with an authentication code, for subsequent transmission to the currency control authority. 4. Information about violations in the electronic system and archive files are transmitted by the authorized bank via communication channels or on computer media to the territorial branch of the Bank of Russia on a monthly basis, no later than the third working day of the month following the month in which the authorized bank identified the violation (hereinafter referred to as the reporting period ) (as amended by Directive of the Central Bank of the Russian Federation dated 06/04/2012 N 2828-U). 8. The territorial branch of the Bank of Russia, through the communication channels used by the Bank of Russia for transmitting statistical information, no later than the sixth working day (inclusive) of the month following the reporting period, sends information about violations received as part of the ES that have undergone verification of authenticity and integrity control, as well as a consolidated archival file of the territorial institution of the Bank of Russia, generated in accordance with paragraph 3 of these Regulations, to the Information Technology Center of the Bank of Russia for subsequent transfer to the currency control authority. (as amended by Directive of the Central Bank of the Russian Federation dated 04.06.2012 N 2828-U) 9. The procedure for the transfer by the Bank of Russia to the currency control authority of information on violations received from authorized banks in accordance with this Regulation is determined by the Bank of Russia on the basis of an agreement between the Bank of Russia and the authority exchange control...

As for “... no later than the third working day of the month following the month in which the authorized bank detected a violation, I think we are all adults and understand what THIS can mean. However, one should still take into account that there is a norm, it is quite strict. In addition, we must not forget that both customs authorities (currency control department) and currency control authorities and agents, primarily Rosfinnadzor, whose powers specifically include carrying out administrative proceedings in this category of cases, can request this information before you take any steps to resolve this “unfortunate misunderstanding” with the bank! Then the bank will not escape. And the customs itself can draw up a protocol and transfer the materials to Rosfinnadzor.

5. Limitation period

According to Art. 4.5 of the Code of Administrative Offenses of the Russian Federation, a resolution in a case of an administrative offense for violation of currency legislation cannot be made after one year from the date of commission of the administrative offense. , and then the deadlines will pass. However, the easiest way is to remember the norm and follow it. And yet, the Certificate must be issued only if you have a transaction passport (and it is not issued for a transaction amount of less than $50,000! If after the expiration of the established period you voluntarily show up with your expired Certificate, be prepared for that you will still be brought to administrative responsibility, but the fine, most likely, in this case will be minimal (since there is a mitigating circumstance) or it will not be due to its insignificance.

Good luck to everyone on the waves of currency legislation

WE PROVIDE SERVICES TO LEGAL ENTITIES AND INDIVIDUAL ENTREPRENEURS (WE DO NOT WORK WITH INDIVIDUALS), INCLUDING: DECLARANTS (IMPORTERS and EXPORTERS), CUSTOMS REPRESENTATIVES, TSW OWNERS, AUTHORIZED ECONOMIC ENTITIES SKI OPERATORS, CUSTOMS CARRIERS. WE PROVIDE LEGAL SERVICES RELATED TO OPERATIONS PERFORMED WHEN MOVEMENT OF GOODS AROSS THE CUSTOMS BORDER OF THE EAEU IN THE RUSSIA REGION. WE ARE READY TO EXPLAIN THE MECHANISM OF REGULATORY REGULATION OF PROCESSES RELATED TO THE MOVEMENT OF GOODS ALONG THE BORDER, TO EVALUATE THE LEGALITY OF THE ACTIONS OF THE STATE CONTROL AUTHORITIES, TO APPEAL INDEPENDENTLY OR TO HELP YOURS RISTS ARE NOW TO APPEAL ILLEGAL ACTIONS TO HIGHER AUTHORITIES AND THE COURT.

First oral consultation is FREE (call or WhatsApp +7(906)4-313-865 ) Oral consultation – 1000 rubles Written consultation – 5000 rubles Subscription service for a month (written and oral consultations) – 15000 rubles Subscription service for a month (written and oral consultations, appealing illegal actions and decisions) – 30,000 rubles Departmental appeal (decisions on classification, customs value, preferences, application of forms of control) – 20,000 rubles Supporting an administrative investigation and preparing a complaint against a decision in a case of an administrative offense – 20 000 rubles Legal challenge (preparing a position on the case + travel expenses) – 40,000 rubles Support of customs inspection (preparing a response to a request, drawing up objections to the inspection report) – 40,000 rubles The list and price of services can be changed by agreement of the parties. The price of services does not include VAT, since the services are provided under an agreement with an individual entrepreneur using a simplified taxation system. Email WhatsApp +7(906)4-313-865

Tweet

How to fill out the SPD?

The procedure for drawing up a certificate is prescribed in the same 138th Instruction:

- If you took the form directly from the bank, most likely you will not have to fill out the “header”. In the standard template, in the “Bank Name” field, you need to enter the full name of the credit institution and branch number. Conventional abbreviations are permitted.

- The date of preparation of the certificate is indicated by default in the international format “YYYY.DD.MM.”, unless the bank requests otherwise.

- Resident name – enter the name of the organization here. For NPOs - only the full one, for commercial legal entities a short designation is acceptable, for individual entrepreneurs - full name without abbreviations, passport details and registration certificate number.

- In the “Transaction Passport” field - the PS number, if the transaction is without a passport - is not filled in.

- In the “Supporting document” column - the number of the document (act, account, declaration) for which the certificate is issued, and its date in the format “DD.MM.YYYY”. The date entered last in the document is indicated - if there are several of them (for example, drafting and signing occurred at different times).

- In the “Document Code” column - a designation of the type of document, including numbers and an underscore, taken from the reference book 138 of Instruction.

- The transaction amount is indicated twice: in the currency of the confirming document and in the currency of the agreement. Currency code is a digital designation in accordance with the currency directory.

- The “Delivery indicator” field is intended to indicate the direction of payment and the method of fulfilling financial obligations: upon actual or prepayment. Possible options: 1 – an advance was received from a non-resident; 2 – the non-resident made payment upon delivery; 3 – prepayment from the resident has been made; 4 – payment to a non-resident upon delivery.

- The “Expected period” column is filled in subject to the delivery sign “2” and the following types of supporting documents: from 01_3 to 04_3, 15_3. The date is set in a standard format and is calculated based on the terms of the contract: it must be no earlier than the payment date under the contract, otherwise it will be regarded as late.

- When indicating the expected period in the “Notes” column, it is necessary to explain how this period is determined, with reference to the basis document.

- In the “Country Code” field, enter the digital code of the state - the shipper or recipient; the necessary codes are taken from the directory.

- The reliability of the information is confirmed by the signatures of the head of the resident company and its chief accountant.

Foreign trade activities: certificate of supporting documents

The article from the magazine “MAIN BOOK” is current as of October 5, 2021.

Contents of the magazine No. 20 for 2021 E.O. Kalinchenko, accounting and taxation expert If your contract with a foreign partner is registered with a bank, then after importing goods into Russia or exporting them from the country, providing services, performing work, you will need to submit a certificate of supporting documents to the bank. As well as the acts themselves, invoices and other documents confirming the fulfillment of obligations under the contract.

In what cases is a certificate of supporting documents submitted to the bank?

A certificate of supporting documents (SPD) must be submitted to the bank only in relation to contracts registered.

Let us recall that a contract with a non-resident requires registration if the amount of obligations under it (in ruble equivalent) is greater than or equal to p. 4.2 Central Bank Instructions No. 181-I dated August 16, 2017 (hereinafter referred to as Instruction 181-I):

•6 million rub. — for export contracts;

•3 million rub. - for import contracts.

SPD is submitted in the following cases. 8.1 Instructions No. 181-I:

• when fulfilling obligations under the contract. For example, when importing (exporting) goods, providing services, performing work;

• upon termination of obligations under the contract. For example, when carrying out an offset of counter homogeneous claims, concluding a novation agreement, liquidating a debtor (creditor);

•when the person in the obligation changes (in case of assignment of the right of claim or transfer of debt);

•when the amount of obligations under the contract changes.

In some cases, it is not necessary to provide a certificate of supporting documents when fulfilling (terminating) obligations under a contract. For example, under rental, leasing, communication or insurance contracts, if they provide only for periodic fixed payments. That is, payments that will be transferred more than once within the framework of the contract and the amount of which (or the method, algorithm for calculating it) is fixed in the contract. In this case, there is no need to submit the supporting documents themselves to the bank. However, if other payments (not periodic fixed ones) are made under such contracts, then the SPD and supporting documents will have to be submitted to the bank. 8.5 Instructions No. 181-I.

Another situation is the termination of obligations due to the complete assignment of a claim (transfer of debt) to another resident, as a result of which the contract is deregistered. In this case, you only need to submit documents confirming the assignment of the claim or transfer of debt to the bank. 6.1.3, 6.3 Instructions No. 181-I.

Deadlines for submitting a certificate of supporting documents

Supporting documents for which the certificate is issued are submitted along with it. The exception is the declaration of goods. This supporting document does not need to be submitted to the bank. The fact is that banks receive information about goods declarations registered at customs in electronic form from the Federal Customs Service. 8.8 Instructions No. 181-I; Government Decree No. 1459 dated December 28, 2012.

Please note that if the information provided in the SPD (except for information about you and the bank) changes, you will need to submit a new certificate. This must be done no later than 15 working days after the date of execution of documents confirming the changes. They will need to be submitted to the bank along with a certificate. 8.7 Instructions No. 181-I. For example, you will need to submit a new certificate of supporting documents if the expected date of receipt of revenue changes as a result of amendments made to the contract.

Reference

The deadline for submitting a certificate of supporting documents to the bank may occur during the period:

•or between the date of deregistration of the contract with one bank and the date of its acceptance for service by another bank;

•or between the date of revocation of the license from the bank where the contract is registered and the date of acceptance of the service contract in the new bank.

In such cases, the SOP must be submitted no later than 15 working days from the date of acceptance of the service contract by the new bank. 12.3, 11.3 Instructions No. 181-I.

SPD and supporting documents will be considered timely submitted if you submitted them within the time limits established by Instruction No. 181-I, and the bank, in turn, accepted them after verification. 16.7 Instructions No. 181-I.

The deadline for submitting a certificate of supporting documents depends on the event (execution, termination, change in obligations under the contract, etc.) in connection with which it is submitted. In addition, the terms vary depending on the method of fulfillment of obligations.

| Method of fulfillment (termination) of obligations under the contract | Supporting documents | Deadline for submitting a certificate of supporting documents and the documents themselves | |

| Export from Russia (import into Russia) of goods | •if customs declaration is required | •or declaration of goods p. 8.8 Instructions No. 181-I (type code of the supporting document (hereinafter referred to as the PD code) 01_3, 01_4p. 5 Notes to the certificate of supporting documents (Appendix 6 to Instruction No. 181-I) (hereinafter referred to as the Notes to the SPD)) | No later than 15 working days after the month of declaration of goods. 8.8 Instructions No. 181-I (SPD is submitted without a goods declaration and only in special cases) SPD is submitted to the bank only in the following cases. 8.8 Instructions No. 181-I: •export of goods from Russia under a foreign trade contract, which provides for the provision of a commercial loan by a resident to a non-resident in the form of deferred payment; •import of goods into Russia under a contract that provides for the transfer of an advance payment (advance payment). The certificate includes information about declarations for goods (except temporary and transit) registered by customs authorities during the reporting month |

| •or documents used as a declaration. For example, transport (transportation), commercial documents, etc. 8.1.1 Instructions No. 181-I; clause 6 art. 105 EAEU Labor Code (PD code 01_3, 01_4p. 5 Notes to the certificate of supporting documents (Appendix 6 to Instruction No. 181-I) (hereinafter referred to as Notes to the SPD)) | No later than 15 working days after the month of affixing the date of issue on the documents used as a customs declaration. 8.2.1 Instructions No. 181-IIf there are several marks on a document indicating different release dates, the period is counted from the latest of the dates stamped. 8.2.1 Instructions No. 181-I | ||

| •if customs declaration is not required. 8.1.2 Instructions No. 181-I Customs declaration is not required when exporting goods from Russia to the EAEU countries and importing goods into Russia from the EAEU countries. 5 p. 1 art. 25 of the Treaty on the EAEU (signed in Astana on May 29, 2014) | Commodity transport, commercial documents. 8.1.2 Instructions No. 181-I (PD code 02_3, 02_4p. 5 Notes to the certificate of supporting documents (Appendix 6 to Instructions No. 181-I) (hereinafter referred to as Notes to the SPD)) | No later than 15 working days after the month of registration of supporting (transportation, shipping and commercial) documents. 8.2.2 Instructions No. 181-I | |

| Execution of work 8.1.3 Instructions No. 181-I | Acceptance certificate, invoice, invoice and other commercial documents drawn up under a contract or in accordance with business customs. 8.1.3 Instructions No. 181-I; List, approved. MVES RF 01.07.97 No. 10-83/2508, State Customs Committee of the Russian Federation 09.07.97 No. 01-23/13044, EEC RF 03.07.97 No. 07-26/3628 (PD code 03_3, 03_4, 04_3, 04_4p. 5 Notes to the certificate on supporting documents (Appendix 6 to Instruction No. 181-I) (hereinafter referred to as Notes to the SPD)) | No later than 15 working days after the month of registration of supporting documents. 8.2.2 Instructions No. 181-I If services are provided (work performed, information and results of intellectual activity transferred) under a contract that also provides for the import (export) of goods, and in the completed customs declaration for goods, the cost of the latter includes the cost of services (work etc.), the SPD is submitted only if a deferred payment is granted to a non-resident (an advance is transferred to a non-resident) and is filled out on the basis of a goods declaration. 8.9 Instructions No. 181-I. Let's say you entered into a contract with a non-resident for the repair of equipment; you will pay for the work on it after importing the repaired goods. For equipment exported for repair as part of the customs procedure for processing outside the customs territory, upon its return to Russia, a goods declaration will be issued. 1 tbsp. 184 EAEU Labor Code. This declaration, which will indicate the cost of repair work, sub. 40 p. 15 Instructions, approved. By decision of the CCC dated May 20, 2010 No. 257, the bank will receive from the Federal Customs Service. In this case, it is not necessary to submit SPD to the bank. But if you transferred an advance payment to a non-resident under such a contract, an SOP would need to be submitted | |

| Provision of services 8.1.3 Instructions No. 181-I | |||

| Transfer of information and results of intellectual activity, including exclusive rights to them. 8.1.3 Instructions No. 181-I | |||

| Other (not specified above) fulfillment of obligations under the contract. 8.1.4 of Instruction No. 181-IK, another method of fulfilling obligations can include, say, the return by a resident (non-resident) of previously received goods. Another example is the situation with the withholding of a commission by a correspondent bank (regardless of whether it is stipulated in the contract or not) from the amount transferred to you by a non-resident (payment under the contract or a refundable advance). Please note that if the bank has enough information to independently reflect information about the withheld commission in the bank control statement, you have the right not to submit SPD and supporting documents to the bank. 8.6 Instructions No. 181-I | Documents confirming other fulfillment of obligations. 8.1.4 Instructions No. 181-I (PD code 13_3, 13_4, 16_3p. 5 Notes to the certificate of supporting documents (Appendix 6 to Instruction No. 181-I) (hereinafter referred to as Notes to the SPD)) | No later than 15 working days after the month of execution of documents confirming other fulfillment of obligations. 8.2.2 Instructions No. 181-I | |

| Change in the amount of obligations, termination of obligations, change of person in the obligation. 8.1.4 Instructions No. 181-I | Documents confirming the change, termination of obligations, change of person in the obligation. 8.1.4 Instructions No. 181-I (PD code 10_3, 10_4, 13_3, 13_4p. 5 Notes to the certificate of supporting documents (Appendix 6 to Instruction No. 181-I) (hereinafter referred to as Notes to the SPD)) | No later than 15 working days after the month of registration of supporting documents. 8.2.2 Instructions No. 181-II or together with an application for deregistration of the contract, if it was submitted earlier. 6.1.5, 6.3, 8.2 Instructions No. 181-I | |

The date of execution of the confirming document is highlighted in color - the latest date of its signing or the date of entry into force. And in the absence of these dates - the date of compilation or the date of import into Russia (receipt, delivery, acceptance, movement) or export of goods from Russia (shipment, transfer, movement) indicated in the supporting document. 8.3 Instructions No. 181-I.

Checking the bank's certificate of supporting documents

If the crop has been exported and the proceeds have not yet been received, you need to submit a certificate of supporting documents to the bank

The bank is allotted the following for verification of the submitted SPD. 16.2.2 Instructions No. 181-I:

•if the SOP is submitted in relation to a customs declaration (issued for imported goods paid in advance, or for goods exported on deferred payment terms) - 10 working days from the date of submission of the certificate to the bank;

•in other cases - 3 working days from the date of submission of the certificate.

Having received the SPD, the bank will check whether it is drawn up correctly and whether the information specified in it (including the type code of the supporting document) corresponds to the information in the attached documents. 16.1.3 Instructions No. 181-I.

The bank will not accept the SPD if it finds any inconsistencies in the data or errors when filling out the certificate. Or if the supporting documents and information submitted along with the certificate are not enough. You will receive back a certificate that is not accepted within the time limits established for verification, indicating the date and reason for the return. You will have to correct the comments and submit the certificate again. 16.5 Instructions No. 181-I. The bank will send you a certificate that has passed the verification, indicating the date of its acceptance. 16.3 Instructions No. 181-I.

How to fill out a certificate of supporting documents

The SPD is submitted in a unified form, which is given in Appendix 6 to Instruction No. 181-I. This form is practically no different from that provided by the previous “currency” Instructions. And the procedure for filling it out has not undergone any fundamental changes.

Reference

The certificate of supporting documents must be completed in one copy. 8.1 Instructions No. 181-I. By agreement with the bank, it can be presented pp. 15.2, 15.3, 15.11 Instructions No. 181-I:

•or via the “Client-Bank” system with scanned supporting documents;

•or on paper with originals or certified copies of supporting documents.

Strictly speaking, the only innovation is the transfer of the “Adjustment Attribute” field from the header part of the help to the tabular part (column 12). In this column, according to the line containing the changed data, indicate in the format DD.MM.YYYY the date of filling out the SPD previously accepted by the bank, which is subject to adjustment. 12 Notes to the SOP. Moreover, in the case of the second and subsequent adjustments to the same information, in column 12 you must indicate the date of filling out the initial SPD accepted by the bank. As before, in column 1 of the corrective certificate indicate the serial number of the line of the original certificate whose information needs to be changed. 2 Notes to the SOP. The line with adjustments reflects both changed indicators and indicators that remained the same.

Let us dwell on some features of filling out SPD.

| Contents of the supporting document | Amount according to the supporting document (column 6 of the SPD) | Sign of delivery (column 9 of SPD) p. 9 Notes to the SOP | Expected time frame for repatriation of currency or rubles (column 10 of the SOP) |

| Export of goods from Russia (provision of services, performance of work, transfer of information to non-residents) | |||

| Fulfillment of obligations against the received 100% advance | Enter the cost of goods (work, services, information) specified in the supporting document. 7 Notes to the SOP | 1 | Not filled in |

| Fulfillment of obligations on terms of 100% deferred payment | 2 | The last date of expiration of the period for crediting money. 10 Notes to the SPD To determine this date, the deadlines stipulated by the contract for receiving money from a non-resident for transferred goods (work performed, services rendered, transferred information and results of intellectual activity) must be added to the period that is necessary. 1.2 of Appendix 3 to Instruction No. 181-I: •for the export of goods from Russia (registration of customs declarations) and (or) for the preparation of documents confirming the fulfillment of your obligations; •for transferring money by banks. The bank will not check the correctness of your calculations; it will simply check the availability of such information in the SPDpp. 16.1.1, 16.1.3 Instructions No. 181-I. But this, of course, does not mean that if you find an error in your calculations, you won’t have to correct it. When monitoring compliance with repatriation deadlines, the bank will take into account exactly the date that you indicated | |

| Fulfillment of obligations under conditions of partial deferment of payment | They bring it in, separating the shot by sign. 9 Notes to the SOP: •the total cost of goods (work, services, information) specified in the supporting document; •the cost of that part of the goods (work, services, information) that are transferred (performed, provided) to a non-resident on deferred payment terms. Let's say you have completed an export declaration for a consignment of goods worth 90,000 euros. At the same time, goods worth 30,000 euros were exported on account of the previously received advance. And the non-resident must pay the remaining 60,000 euros after delivery. In this case, in column 6 of the SPD, you need to indicate 90,000/60,000. And in column 9 of the SPD, put attribute 2, which means that the resident provides a deferred payment to the non-resident, despite the fact that some of the goods were exported on an advance payment basis | ||

| Import of goods into Russia (provision of services, performance of work, transfer of information by a non-resident) | |||

| Fulfillment of obligations on terms of 100% deferred payment | Enter the cost of goods (work, services, information) specified in the supporting document. 7 Notes to the SOP | 4 | Not filled in |

| Fulfillment of obligations on account of the transferred 100% advance payment | 3 | ||

| Fulfillment of obligations on the terms of transfer of partial advance | They bring it in, separating the shot by sign. 9 Notes to the SOP: •the total cost of goods (work, services, information) specified in the supporting document; •the cost of that part of the goods (work, services, information) that were paid to the non-resident in advance. Let's assume that the non-resident provided you with services in the amount of 60,000 US dollars, of which you paid 12,000 US dollars in advance. Then in column 6 of the SPD you need to indicate 60,000/12,000. And in column 9 of the SPD - sign 3, which means the non-resident fulfills obligations under the contract on account of the resident’s advance, although the non-resident has provided you with a deferred payment for the amount of $48,000 | ||

You can grant the bank (for a fee) the right to fill out the SOP for you. In this case, you will only need to submit the supporting documents themselves to the bank. 8.4 Instructions No. 181-I.

* * *

A certificate of supporting documents is a form of accounting and reporting on currency transactions. 1.3 Instructions No. 181-I. Violation of the procedure and deadlines for submitting a certificate threatens the resident with fines. 6-6.5 tbsp. 15.25 Code of Administrative Offenses of the Russian Federation. Depending on the length of delay, the amount of sanctions for organizations ranges from 5,000 to 50,000 rubles. And violation of the procedure for submitting SPD can cost the company 40,000–50,000 rubles.

Other articles of the magazine "MAIN BOOK" on the topic "Foreign economic activity":

The form and procedure for filling out a certificate of supporting documents are approved by the Central Bank, the current version of the form is presented in Appendix No. 6 of the Instruction of the Central Bank of the Russian Federation dated August 16, 2021 No. 181-I (as amended on July 5, 2018). The certificate must be filled out by business entities conducting foreign economic activity; it is used to implement the control function during currency monitoring.

When is the certificate provided?

The certificate of supporting documents has clear deadlines for submission, fixed by Instruction 138-I:

- If there is a customs declaration for the cargo, the SPD is submitted no later than 15 working days from the date specified in it. It happens that the document is “stamped” several times, that is, the goods did not immediately pass through customs, then the last date is taken as the starting point. The actual time of receipt of the goods to the consignee in this case does not matter.

- In the absence of a customs declaration, the period of 15 days begins to count from the 1st day of the month following the month of customs clearance.

Failure to comply with the specified deadlines threatens the resident with penalties. The main mistake that organizations new to foreign exchange contracts make is a misunderstanding of the difference between the customs and commercial delivery date of the cargo, which results in a delay in filing Form 0406010.

What type of delivery sign should be indicated in the certificate of supporting documents?

A certificate of supporting documents is issued when carrying out transactions other than settlements carried out according to the transaction passport. The document is drawn up in one copy and must be submitted to the credit institution.

The tabular part of the form consists of 12 columns. Column 9 of the certificate contains the indication of delivery, expressed by an encrypted numeric designation.

The sign of delivery in the certificate of supporting documents in column 9 must be indicated if one of the following documents specified in column 4 serves as confirming documents:

- declaration for goods certifying the fact of their export from the territory of the Russian Federation (document type code in column 4 - 01_3);

- declaration for goods when imported into Russia (code 01_4);

- a document that confirms the shipment or receipt of goods, but a declaration for them has not been completed (codes 02_3, 02_4);

- a document on the transfer or receipt by a resident of goods or services in transactions with a non-resident (code 03_3, 03_4);

- documentation on work and services performed by residents and non-residents, on the results of intellectual activity transferred by them (codes 04_3, 04_4);

- documents on leased property owned by a resident or non-resident (codes 15_3, 15_4).

The delivery attribute in the certificate of supporting documents (column 9) is used to indicate the type of transaction and settlement for it. There are several possible options for supply characteristics:

- Code “1” is used to reflect a transaction in which a resident of the Russian Federation fulfilled his obligations under an agreement with a non-resident, and the counterparty made payment in advance.

- Code “2” is used for deliveries under an agreement between a resident and a non-resident, under the terms of which the resident provides the counterparty with a deferment in payment for goods or services (commercial loan).

- Code “3” indicates a situation where the payer and recipient of goods or services is a resident of the Russian Federation, and a non-resident fulfills his obligations on the basis of prior receipt of advance payment.

- Code “4” is typical for transactions in which a non-resident provides services or ships goods to a resident of the Russian Federation on the terms of a commercial loan, that is, when payment is deferred for products already shipped or work actually completed.

What will be the delay of SPD?

A failure to provide or a delayed certificate of supporting documents is a violation of currency legislation. For residents who are late in submitting the SPD and its annexes, administrative liability is provided in the form of fines differentiated by the time of delay (Article 15.25 of the Administrative Code):

- up to 10 days - for a legal entity a fine of 5 - 15 thousand rubles, for individual entrepreneurs and officials - 0.5 - 1 thousand rubles;

- 10 – 30 days – fines 20 – 30 thousand rubles. and 2 – 3 thousand rubles. respectively;

- over 30 days – 40 – 50 thousand rubles. organizations and 4-5 thousand rubles - individual entrepreneurs.

Incorrect execution of the certificate or violation of its storage period is fraught with the same fines as if the documents are delayed for a month or more. Papers related to foreign exchange transactions must be stored for at least 3 years.

How to correct certificate 0406010?

The SPD may be rejected by the bank on the following grounds:

- the information specified in the certificate does not correspond to the data in the supporting documents;

- the necessary attachments to the certificate are not provided or their package is not complete.

If the documents are not accepted, the organization is obliged to correct all comments and resubmit the entire set. The credit institution must notify the resident that the SPD will have to be redone within 3 days from the date of submission.

A situation is possible when adjustments need to be made to a certificate already placed in the currency dossier. For example, a foreign counterparty is late with payment, does not sign the work completion certificate, and therefore, if the expected deadline is not moved forward, then a violation of currency control rules will occur. The adjustment is made within 15 days from the date of entry into force of the documents confirming changes in the completed transaction by submitting a new form 0406010 with a note in the “sign of adjustment” field.

Question answer

1) Is it necessary to formalize a declaration (certificate) of conformity?

— I personally don’t formalize it, but I set the presentation sign to “0.”

This applies to national DS and SS, i.e. those whose number begins with CU, EAEU. The fact is that the inspector sees from “his” database whether the DS is operating, this is enough. If the number is indicated incorrectly or the document is invalid, Welkam refuses to issue it. Therefore, it is better to check the eligibility of the DS and SS on the website of the Russian Accreditation Service before submitting it, make a “print screen” and attach a 44 gram image of it. under code 09023. If the document is ROSS, then the customs database does not yet see such documents, in this case I set the submission flag to “1”, formalize it and attach a print screen.

2) What date should I indicate in column 44?

— I don’t indicate the date, not at all. Just a number.

3) What documents confirm the product code and how to indicate them in column 44?

— The HS code is confirmed by documents describing the product from the manufacturer. These can be catalogs, explanations, instructions, photographs, quality passport, quality certificate, product passport, etc. They must contain complete information specified in column 31-1. These documents are indicated in column 44 under codes 09020-09023. You need to select the desired code based on the code name in the classifier. These documents are formalized in the form of attaching files in pdf format no larger than 3MB (otherwise the program will give an error that the file is too large).

4) Where and how to indicate the number of the declaration for which the cost has already been accepted?

— If you have previously submitted a declaration of declaration, it was issued against security and subsequently the value was accepted based on the results of an additional check, then the number of this declaration when subsequently declaring this product, of the same country and under the same contract, it is advisable to indicate in column 44 under code 09031 /0. There is no need to formalize this document.

5) How to determine which costs were included in the customs value (CV) in the issued declaration?

— To do this, you need to request a DTS (declaration of customs value) from the declarant. It describes in detail how the customs value was formed, incl. all expenses for transportation, insurance, and any others. When “stuffing” the declaration, the result of calculating the vehicle from the DTS is transferred to column 45 of the DT.

6) Is it necessary to issue a declaration of conformity (DC) or a certificate of conformity when delivering for your own needs?

- No, don't. I talked about this in more detail in this article.

7) What does the request “provide a binary view of the document” mean?

— As absurd as it sounds, the inspector requests a document in graphic form. Those. he wants you to send the requested document in scanned form (pdf file). Technically, the electronic data exchange system with customs authorities currently allows the transfer of files no larger than 3MB in size.

Is it necessary to redo the declaration of conformity (or certificate of conformity) when the legal address of the applicant (manufacturer) changes?

Is it necessary to redo the declaration of conformity (or certificate of conformity) when the legal address of the applicant (manufacturer) changes?

— Yes, you need to issue a new DS (certificate). The Ministry of Industry and Trade answered this question in letter No. 12928/10 dated May 14, 2015.

If you find an error, please select a piece of text and press Ctrl+Enter.

Is it always necessary to submit an SOP?

There are conditions that exempt a resident from submitting a certificate for a currency transaction:

- clauses of the contract provide for the regular payment of fixed payments (for example, rent, leasing);

- the transaction passport is liquidated due to the assignment of debt to a third party;

- the resident authorized the servicing bank to independently generate a certificate based on the supporting documents provided by the organization.

You can entrust a financial institution with the preparation of a certificate for currency control when concluding an agreement for cash settlement services or later by submitting an appropriate application.