What is an expense cash order (RKO) and why is it needed?

A cash disbursement order (RKO) is a cash document that confirms the fact that cash has been issued from the cash register.

Since June 2014, individual entrepreneurs have the right not to draw up cash settlements, as well as other cash discipline documents - cash books and cash receipt orders. An expenditure order is issued in the following cases:

- issuing cash from cash registers for settlements with contractors and suppliers;

- depositing funds from the cash register for their subsequent crediting to the company’s current account;

- issuing money to provide financial assistance to an employee;

- settlements with employees, accountable persons, founders, etc.

What are the requirements for a cash receipt order?

To draw up the document, use the KO-2 form (OKUD code: 0310002). The document is drawn up in one copy. The order bears the signatures of the cashier, chief accountant, head of the enterprise, as well as the person to whom the funds from the cash register are transferred.

To issue money from the cash register according to an expense cash order, the cashier is obliged to request an identification document from the person to whom the funds are transferred. The warrant remains in the cash register and serves as confirmation that the money was issued legally.

How to fill out the RKO form?

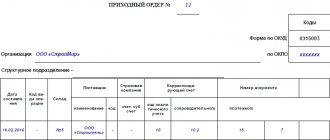

To prepare a document in form KO-2, you must enter information in the following fields:

- Organization – legal form and name of the enterprise.

- OKPO code according to notification from Rosstat.

- Name of the structural unit preparing the document (if necessary).

- Number – serial number of the order.

- Date of compilation - the date when cash was issued from the cash register.

- Code of the structural unit issuing the document (if necessary).

- Corresponding account, subaccount - the account number that reflects the cash withdrawal operation from the cash register.

- Analytical accounting code (if available).

- Credit – the number of the accounting account, the credit of which reflects the fact of cash disbursement from the cash desk.

- Amount – the amount of cash dispensed from the cash register (in numbers).

- Destination code (if available).

- Issue – the full name of the individual or the name of the organization to which the funds from the cash register should be transferred.

- Reason - the reason for issuing cash from the cash register.

- Amount – the amount of money received at the cash desk in words.

- Appendix – details of the attached primary documentation (if available).

- Received – the amount of money received, date and signature (filled in by the person to whom the funds are issued from the cash register).

- Issued by the cashier - the cashier's signature with a transcript.

- You cannot make any corrections when filling out an order.

Stop wasting time filling out templates and forms. The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single mistake, due to the complete automation of filling out templates. KUB is a new standard for issuing and sending invoices to customers. Start using CUBE right now14 days FREE

ACCESS

Regulatory framework

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”.

- OK 011-93 All-Russian Classifier of Management Documentation (OKUD).

- Directive of the Central Bank of March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.”

Sample cash receipt order for 2017-2018: download free template online

Stop wasting time filling out templates and forms. The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single mistake, due to the complete automation of filling out templates. KUB is a new standard for issuing and sending invoices to customers. Start using the CUBE right now14 days FREE ACCESS

Basic requirements of the Bank of the Russian Federation

Changes in the use of cash register systems, in particular, the introduction of online cash registers, entailed a number of adjustments in the procedure for recording cash transactions (instruction No. 4416-U dated June 19, 2017, which came into force on August 19, 2017). The procedure for conducting cash transactions with cash on the territory of the Russian Federation is established by the Bank of Russia. It is uniform and mandatory for legal entities.

It is necessary to establish a limit on the cash balance in the cash register by administrative document (order), which is calculated using a formula in accordance with the instructions of the Bank of Russia.

IMPORTANT!

Small businesses and individual entrepreneurs, in accordance with the letter of the Federal Tax Service of Russia dated 07/09/2014 No. ED-4-2/13338, have the right not to set a cash balance limit.

All cash transactions are documented with cash documents and reflected in the cash book. Operations for the receipt and expenditure of cash are recorded as receipt or expense cash orders (you can create one receipt and one expense order after the end of the shift).

Receipts and withdrawals of cash are reflected in the cash book, entries are made in it for each incoming and outgoing order. At the end of the working day, the cashier checks the cash in the cash register with the balance in the cash book and certifies the entries in it with a signature. If there is no movement of money through the cash register during the day, no entry is made in the book.

To whom should RKO be issued when paying wages according to the payroll?

Since there are no clear rules in the Directive regarding how to formalize cash settlement settlement when issuing wages according to a statement, we will proceed from the general rules. They are like that. The salary slip has a validity period of maximum 5 working days. 6.5 Instructions. The director must indicate a specific period in the statement, based on how many days are needed to pay salaries to all employees (taking into account the established deadlines for paying salaries, current business trips, vacations, time off, etc.). During this period, the amount to be issued according to the statement may be kept in the cash register in excess of the limit. 2 Directions. And until this period expires or the entire salary is paid before the end of this period. 4.6, 6.5 Instructions:

- RKO is not issued either for the total amount indicated in the statement, or for the amounts already issued according to the statement from the beginning of its validity period;

- The cash book does not reflect either the money intended for issue or the money already issued according to the statement to employees.

At the end of the last day of validity of the statement, the cashier signs the statement, marks the deposited amounts on it and transfers it to the accounting department. The accountant checks everything and also signs. And only after this, but always on the same day, the accountant draws up cash settlements for the total amount actually issued to employees para. 3 p. 6.5 Instructions, and its number and date are indicated on the last page of the statement. Then the cashier registers the cash register in the cash book. 4.6 Instructions.

If there are several statements, for example, each department has its own, then it is not necessary to create a separate cash register for each of them. You can make one RKO for the total amount of the salary issued and attach all the statements to it. Accordingly, the number of this cash register must be indicated in all statements.

In a regular, non-salary cash settlement, the indication of the recipient and his passport data, as well as his signature para. 2, 3 clause 6.1, clause 6.2 Instructions are needed so that the organization has confirmation that it paid a certain amount to a certain person, and that person received it. And such a cash settlement is drawn up before the money is issued to the recipient indicated in it. 6.1 Instructions.

But at the time of compiling cash settlements based on the payroll:

- the money has already been issued from the cash register to the employees according to the statement, some of it, perhaps, in previous days;

- There is already confirmation of the payment of a certain amount to each person - these are the signatures of the employees on the statement.

Therefore, the RKO, compiled on the basis of the salary sheet, is needed only for making entries in the cash book about the amounts issued according to the sheet and is not confirmation of the transfer of money. This means entering someone’s f. And. O. in the “Issue” line and passport data in the “By ___” line is not required. Accordingly, no one should sign the RKO for the recipient. That is why the Instruction mentions filling out these lines only in relation to the general procedure for issuing money from cash registers. 6.1, 6.2 Instructions. And for the payment of wages, a special procedure has been established that we have considered, in which there are no such rules. 6.5 Instructions.

At the same time, in practice one can encounter other, erroneous, options for registering cash settlements:

- <or>on the cashier himself - his name. And. O. put in the “Issue” line, and in the “By ___” line indicate his passport details. The reasoning here is this: the cashier issues the salary according to the statement, therefore, the cash register must be issued in his name. This is incorrect, since all the money in the cash register, including that intended to pay salaries, is already with the cashier, because he is the person financially responsible for the cash register. A cash settlement can be issued for someone who works as a cashier only if he acts not as a cashier, but as a recipient of money. For example, as an accountable person, when he is tasked with purchasing something for cash on behalf of the organization.

It happens that an organization has several cashiers per cash register, one of whom is a senior cashier. 2 p. 4 Instructions, and the salary is issued as follows: the senior cashier transfers money from the cash register to the others, and they then distribute it to the employees according to the statements. But even in this case, the transfer of money between the senior cashier and the others is not formalized by cash register for the same reason: as long as one of the cashiers has the money, it is considered to be in the cash register. Such a transfer is recorded in a special book for recording funds accepted and issued by the cashier (form No. KO-5utv. Resolution of the State Statistics Committee dated August 18, 1998 No. 88) p. 4.5 Instructions;

- <or>to the director or chief accountant. The wording in the “Issue” line in these cases is as follows: “Fomin A.A. for the payment of wages to employees for the second half of June 2015”, and below, in the line “By ___”, Fomin’s passport details are indicated. This is incorrect, since with such registration it will turn out that you transferred this amount from the cash register to the named person, and he must distribute the salary to the employees somewhere else. But this in fact did not happen: the cashier issued the salary - it is his signature that appears on the statement in the line “Payment made.” Of course, the director can conduct cash transactions himself. 4 Instructions, but then he acts as a cashier, and for the cashier, as we have already said, cash registers are not drawn up.

In some organizations, the following order has been established: the director, chief accountant, head of department, foreman, and so on, according to the cash registers registered in their name, receive salaries for their subordinates at the cash desk, and then distribute them to employees according to the payroll. They return the unpaid amounts, together with the statement, to the cash desk according to the PKO. But it's not right. The salary must be issued from the cash register by the cashier - this is the requirement of Directive No. 3210-Uabz. 2 clause 6.5, clause 6.2, clause 4, clause 6.1 Instructions, that is, it cannot be issued through accountable persons.

Therefore, the one who actually issues the salary must be appointed cashier with full financial responsibility for the money entrusted to him. Then the main cashier will be the senior one at this time, and the transfer of salary money to the distributor must be recorded in the book of accounting for funds accepted and issued by the cashier (form No. KO-5utv. Resolution of the State Statistics Committee dated August 18, 1998 No. 88).

How to calculate the advance amount?

The first salary payment of the month, or as it is better called, advance payment, does not have clear parameters in the Labor Code of the Russian Federation. But there is another document that contains parameters for calculating this payment of money to employees. We are talking about Resolution No. 566 of the USSR Council of Ministers dated May 23, 1957, which has still not lost its force and is valid in those parts that do not contradict the main document regulating labor relations. It sets the amount of the advance in an amount no less than the money actually earned for the actual period of time worked according to the tariff schedule. This calculation is very often used to determine down payments.

In addition, it is possible to calculate the first payment of the month in the following ways:

- in proportion to the established salary and the number of days actually worked;

- a set amount, which is once calculated as a percentage of salary or other method.

But the second option is quite risky for the employer and can bring additional trouble to accountants. After all, there may be cases when an employee, for one reason or another, will not be able to work out the advance payment. For example, he will go on sick leave, vacation at his own expense, and other options.

This situation leads to the employee’s debt to the employer. Retaining it is a rather difficult process for individual entrepreneurs, mainly in a documentary manner, even if the employee is ready to reimburse all overpayments.

The first option is much more difficult initially for accountants, but many times more reliable. This is due to the fact that an advance is paid for days actually worked according to time sheets. It is almost impossible to overpay with this form of advance payment calculation. The Ministry of Labor of the Russian Federation strongly recommends using this method of determining the amount of the advance payment.

There is one more thing that an individual entrepreneur should know in order to make correct payments to employees. We are talking about the requirement to notify each employee about this in a letter in which it is necessary to indicate:

- about the elements of wages for the month of payment;

- about all additional payments in the current period, including for violation of payment deadlines, sick leave, vacation pay and others;

- on the amounts of write-offs and deductions from accrued income;

- about the total amount to be paid.

Such a letter is a payslip, which is established by the entrepreneur based on the opinions of employees.

What day should I indicate in the “Date of compilation” field of RKO

This question arises if the salary is issued within several days. Instruction No. 3210-U directly states that RKO is drawn up for the amounts actually issued, para. 4 p. 6.5 Instructions. Consequently, the date of compilation of the cash register is the closing date of the statement, that is, the last day of payment of wages. This rule is explained by the fact that it is not known in advance whether all employees will come to the cash desk for their salaries, therefore, it is impossible to predict what amount will be issued.

Some organizations set the date of the 1st day of payment of wages (the 1st day of the period indicated in the statement), since they believe that the expense order formalizes the director’s order to issue wages in cash, and not transfer them to the accounts of employees. However, this is not true. Such an order is the payroll or payroll itself, signed by the director, and non-cash wages are transferred on the basis of the payroll. Instructions for the use and completion of forms of primary accounting documentation for accounting for labor and its payment (Payroll), approved. Resolution of the State Statistics Committee dated January 5, 2004 No. 1. In addition, since June 1 last year, the signature of the director in the RKO is not required.

How are transactions processed?

According to the rules of the Bank of the Russian Federation, registration of cash settlements, cash registers and cash books is carried out on paper or in electronic form. Electronically executed documents cannot be corrected after signing. It is allowed to make corrections to paper documents by indicating the date of correction, signatures of the persons who compiled the corrected document with surnames and initials. The chief accountant oversees the maintenance of the book.

IMPORTANT!

Individual entrepreneurs have the right not to draw up cash documents and not to maintain a cash book (clause 4.1 of Bank of Russia instructions 3210-U).

Cash transactions are carried out by a cashier appointed from among the employees of a legal entity or individual entrepreneur, or by the manager himself. Familiarization with responsibilities and rights is carried out against signature. The cashier has a seal with details (to confirm the transaction) and sample signatures of persons who are authorized to sign cash documents.

Sample of registration of cash settlements drawn up on the basis of a payroll

| ACCOUNT CASH WARRANT | Document Number | Date of preparation |

| 153Must be indicated on the payroll | 07/10/2015Must be indicated on the salary slip. In this case, the date of compilation of the cash register is the closing date of the salary sheet, that is, the last day of payment of wages on it |

| Debit | Credit | Amount, rub. cop. | Destination code | ||||

| structural unit code | correspondent account, subaccount | analytical accounting code | |||||

| 70 | 50 | 1,050,000.00 Amount actually issued to employees | |||||

| Issue | employeesThis line may not be filled in |

| (Full Name) |

| Base: | salary for the second half of June 2015 Possible options: “bonus for the first half of 2015”, “vacation pay”, etc. |

| Sum | One million fifty rublesActually issued to employees |

| (in words) |

| rub. | 00 | cop. |

| Application | Pay slip dated 07/06/2015 No. 6-1 If there are several pay slips, indicate their details separated by commas |

| Head of the organization | (job title) | The director's signature is not required. Instructions for the use and completion of primary documentation forms for recording cash transactions, approved. Resolution of the State Statistics Committee of August 18, 1998 No. 88; clause 4.3 Instructions. The director’s order to issue a certain amount of salary from the cash register is a statement signed by him (signature) | (full name) |

| Chief Accountant | (signature) | S.B. Eremina (signature transcript) | |

| Received | One million fifty rublesThe amount actually given to employees. Since 06/01/2014, cash rules do not require that the recipient enter the amount in this line in his own hand, so you can fill it out on the computer |

| (Suma in cuirsive) |

| rub. | 00 | cop. |

| "10" July 2015 Coincides with the date of compilation of the RKO | Signature | This line is left blank |

| By | pay slip dated 07/06/2015 No. 6-1 If there are several pay slips, indicate their details separated by commas |

| (name, number, date and place of issue of the recipient’s identity document) |

| Issued by the cashier | (signature) | Monetkina A.E. (full name) |

In the cash book, in column 2 “From whom it was received or to whom it was issued,” when registering a cash register issued on the basis of a payroll, write “employees” or leave the column blank. That is, fill out the column in the same way as you filled out the “Issue” line in the expense order.

What is the best RKO - in Word or other format

The cash receipt form can be presented in 2 main formats - Word and Excel.

Each of them has its own advantages and disadvantages. Word documents open in a larger number of programs - in common operating systems (Windows, Linux, MacOS), as a rule, there is always pre-installed software that can work with files of the corresponding format.

Relatively few solutions work correctly with Excel files - Microsoft Excel, Open Office Calc and their analogues, including “cloud” types of software. As a rule, they are not installed by default in modern operating systems.

If you have solved the cash receipt order in Excel format, then you will have a more universal file at your disposal. For example, when it is created in one version of Microsoft Excel, it can be recognized without problems in any other, and in most cases also in third-party programs. While Word files, due to the peculiarities of their structure, are not always correctly recognized in programs other than those in which they were created.

Another argument for using RKO in Excel is the convenience of filling it out on a computer. The structure of files of this type is such that it is more difficult for an accountant to make a mistake when filling out the necessary data on a PC, since the cells for entering information are highlighted. When filling out a Word document, there is a possibility of mistakenly affecting other elements of the document formatting, as a result of which its structure may be disrupted.

When you can do without a statement, and when you can’t

If only one employee receives a salary at the cash desk or you have few employees in your organization, then when issuing salaries, you can do without a statement, that is, create a separate cash register for issuing money to each employee. This will not be a violation, because the issuance of wages according to RKO is provided for in Directive No. 3210-U along with the issuance according to the pay slip. 6 Directions.

But then the expense order must be drawn up according to the general rules - indicating f. And. O. and passport details of the employee and obtaining his signature. Also, such a cash settlement order will have to be signed by the director, because in this case the expense order also serves as a written order from the manager to issue wages from the cash register.

You can also make a statement for a single employee, if for some reason it is more convenient for you. Then the employee must sign only the statement, and he no longer puts his signature on the RKO compiled on its basis.

At the same time, there is a case when it is impossible to do without a statement - if the employee for some reason did not come to collect his salary on the days it was issued. A statement with the entry “Deposited” opposite the name of this employee serves:

- additional evidence that the failure to pay wages on time was not the fault of the employer. Let us remind you: administrative fines are provided for failure to pay wages on time. 1 tbsp. 5.27 Code of Administrative Offenses of the Russian Federation and payment of compensation to the employee for each day of delay. 236 Labor Code of the Russian Federation.

The Labor Code specifically stipulates that the said compensation is payable even if the employer’s delay in paying wages is not his fault. 236 Labor Code of the Russian Federation. However, this rule does not work if the employee himself did not come to collect his salary, provided that at the beginning and end of the day of issue there was the required amount in the cash register and the money was prepared for issue according to a statement signed by the director. Indeed, in this case it is no longer possible to say that the employer delayed the salary;

- the basis for posting to the debit of account 70 and the credit of account 76, subaccount “Calculations for deposited amounts”;

- justification that personal income tax on wages was paid on time and not ahead of schedule.

Let us remind you: the tax agent must send personal income tax to the budget on the day the bank receives money for issuing salaries. 4, 6 tbsp. 226 Tax Code of the Russian Federation. But if one of the employees did not come for the money, then without a statement with the inscription “Deposited” there is no confirmation that the money withdrawn from the account was intended specifically for issuing a salary to this employee. , , tax authorities may regard the personal income tax transferred to the budget as an erroneous payment from the employer to the budget . since payment of tax at the expense of a tax agent is prohibited. 9 tbsp. 226 Tax Code of the Russian Federation. And fine the organization under Art. 123 of the Tax Code for the fact that personal income tax was not paid when the late employee finally came to collect his salary.

What should you do if you issued wages to present employees using “personal” cash settlements without drawing up a statement, and after that it turned out that one employee did not come for the salary? Then the payroll will have to be prepared only for this one employee. This is unusual, but there is no violation in this.

***

And finally, there is also a situation when there is a salary slip, but the cash register is not needed for it - if the entire amount indicated in the payroll has been deposited. After all, the money was never released from the cash register.

Other articles from the magazine "MAIN BOOK" on the topic "Cash register / cash desk / paying agents":

2019

- Who does not need to use cash register in 2021, No. 16 We understand the issuance of online checks, No. 16 We answer “check” questions, No. 16

- We are studying new amendments to the Law on CCP, No. 13

- Marking of goods in cash receipts, No. 1

2018

- CCT checks: to be or not to be, No. 7

- Hurry up to reflash the cash register, No. 23

- Loans and cash registers: when you need a check, No. 21

- The cost of a cash error, No. 20

- Should I punch a check?, No. 17

- Studying amendments to online cash registers, No. 14

- We answer “cash” questions, No. 13

- When you need an online cash register, No. 11

- Online cash register: buy or wait?, No. 10 Didn’t use cash register: how to avoid a fine, no. 10

2017

- Cash register receipts for goods in exchange containers, No. 24

- When “return of receipt” checks are needed, No. 22 VAT on the inter-price difference in cash register checks, No. 22 Indicator of the payment method in a cash register receipt, No. 22

- We answer the imputed people's CCP questions, No. 15

- How to save money at the online checkout, No. 13

- Online cash registers in online stores, No. 11

- How to get started with online cash register, No. 1 Cost of cash register violations, No. 1 Stages of transition to online cash register, No. 1

How often should employees be paid?

Very often, beginning entrepreneurs who plan to hire employees negotiate with future employees the size and payment of wages, offering it to be paid one-time for a monthly period. It is worth noting that this is a blatant violation of the norms of the Labor Code of the Russian Federation, which establishes the rule of remuneration every half month. This means that wages are paid at least twice a month. For most, it will be more common to talk about payment of an advance and salary. But it is worth noting that there is no such division officially. The Labor Code of the Russian Federation allocates only payments made in 2 approaches.

For other payments of the enterprise to employees, their own deadlines are also indicated:

- funds for the vacation period must be issued to the employee 3 days before it starts or earlier;

- upon dismissal, pay slips must be issued on the same day.

Sick leave payments are tied to regular wages. They must be accrued and paid from the next date after sick leave is assigned. This means that after submitting a certificate of incapacity for work, on the day of the next salary payment at the enterprise, sickness benefits must also be paid.

It is worth noting that paying employees twice a month is a rule that does not imply any exceptions. Regardless of the type of legal entity, or the formation of profitability, the staff must receive earned money in at least two amounts per month. Very often, individual entrepreneurs violate the requirements of laws on labor discipline and the Labor Code of the Russian Federation for the following reasons:

- employees do not work in the main staff, as permitted by the Labor Code of the Russian Federation, but as external part-time workers;

- the employee submits an application for payment only once a month;

- The individual entrepreneur issued an internal document for his enterprise stating that wages will be paid in full, that is, once a month.

In such cases, the documents referred to by entrepreneurs have no legal force. They are insignificant, since the Labor Code of the Russian Federation, which they contradict, has much greater legal force.

In addition, if such violations of labor laws regarding the payment of wages are detected, a fine of 1,000 to 5,000 rubles will be imposed on the individual entrepreneur in accordance with the requirements of the Code of Administrative Offenses, Art. 5.27. The Labor Inspectorate strictly ensures that labor laws are not violated, constantly checking entrepreneurs.

Basic rules for drawing up a cash receipt order

The document does not have a standard, uniform template recommended for use. This means that enterprises and organizations can independently develop its form or use one of the common templates.

When developing a cash order, you must always take into account the fact that it must include the name of the organization that issues it, information about who it is issued to, as well as the amount of the amount issued. In addition, the document must be certified by the signature of the head of the enterprise, accountant and cashier.

You can write out a document either in handwritten form (which is becoming less common these days) or on a computer. The “consumables book” is filled out in one copy directly by the employee who is responsible for issuing cash, but some information is entered into it by the recipient of the funds.

It should be noted that the cash order is often accompanied by documents that serve as the basis for issuing cash from the cash register (orders, management instructions, copies of contracts, etc.) and, if the application contains the signature of the director of the enterprise, then the order itself it is no longer necessary to certify it with a signature.

There is no need to put a stamp on the document, since it relates to the internal documentation of the enterprise and, moreover, from 2021 the requirement for legal entities to use seals and stamps in their activities has been canceled.

Nuances of using consumables

When an expense order is used to issue money to a legal entity (for example, payment for goods or materials), you cannot simply enter its name as a recipient.

In the “Issue” column you need to write down your full name. employee of the supplier company who receives funds. Or, if it is still necessary to indicate the name of the company, then the following entry is allowed: “LLC Firm through A. A. Ivanov.” In this case, the details of the presented power of attorney are written in the “Appendix” column.

If a consumable is issued to deposit cash proceeds to the bank, then in the “Issue” column you cannot write phrases like “Revenue”, “Deposit of proceeds” or similar. Here you need to indicate your full name. the responsible employee who performs this action, and in the “Appendix” column - details of the announcement for cash delivery.

When issuing salaries to employees, you can issue a single expense order for the entire payment amount. In this situation, in the “Issue” column it is written – “To employees of the enterprise.” Information about the payroll is recorded in the “Base” column. The order fields “By”, “Received” and “Signature” must be left blank.

Instructions for issuing a cash receipt order

Part one

At the beginning of the document, the full name of the enterprise that issues the money is indicated (indicating its organizational and legal form). Then the corresponding code (but not necessarily) is entered into the “window” called OKPO (All-Russian Classifier of Enterprises and Organizations). Next, the document number is indicated in accordance with the company’s internal documentation, as well as the date of its preparation (it must coincide with the day of issuance of funds from the cash desk).

The next thing you need to fill out is a special table. The first thing that is entered into it is

- code of the structural unit issuing money (if necessary and only if such coding is used at the enterprise),

- number of the accounting subaccount used to account for cash,

- analytical accounting code (also if necessary),

- credit (i.e. the account number that reflects the disbursement of money),

- specific amount in rubles (in numbers).

Part two

The second part of the order contains information about to whom the funds are issued (last name, first name and patronymic in full), the basis for their issuance - the name of the business transaction (issuance of financial assistance, advance payment for a business trip, etc.), and also the amount is entered in words.

Then, just below, information about the attached document is indicated (its name, number and date of preparation). The attachment can be a power of attorney, receipt, order, application, agreement, etc.

After entering the above information, the cash order must be certified by the head of the organization or any person authorized to sign such documents in his place, as well as by an accountant, who thus consent to the release of funds. Signatures must be decrypted.

The following lines are filled out directly by the person receiving the money. This person must again indicate the amount given to him in handwriting (kopecks - in numbers), and put a dash in the space left unfilled. Then he indicates the date of receipt of the money and signs. Without completing these lines, the document will not be valid, and the money passing through this cash order will be considered appropriated by the employee who issued it.

Next, passport data or information from any other document that serves as an identification document for the citizen receiving money from the enterprise’s cash desk is entered into the document, and the cashier who directly issues it also puts his signature on the “consumables”.

Do I need to register?

The statement contains information about who needs to be paid and in what amount. When receiving money, each employee puts his signature opposite the amount received.

That is, the statement reflects information about what amounts need to be paid, what amounts have already been issued, and what amounts have been deposited.

In order for an accountant to be able to record the expenditure of issued cash in accounting, one statement is not enough; a primary document is required - an expenditure cash order.

It is RKO that serves as the basis for making the entry for spending cash from the cash register - Dt 70 Kt 50.

In addition, the order serves as the basis for making a registration entry in the cash book about the expenditure made from the cash register.

Regulatory framework

The Federal Law of the Russian Federation obliges the cash desk of any enterprise to carry out settlement transactions with the registration of cash settlements.

The content and accuracy of the expense document is monitored by the chief accountant of the enterprise and his subordinates, who keep track of cash. The director of the company and all persons whose signatures are placed on the form must also have an idea of the consumables. The information specified in the document must be entered in the registration journal. If this was not done, the document is incorrectly drawn up or is missing altogether, penalties are provided. Making such mistakes in one tax period may be punishable by a fine of 10 thousand rubles. And this is only in the absence of more serious tax violations.

A malicious violation is considered to be the complete absence of RKO. A more serious punishment is expected here. Properly designed consumables must be stored for five years.

RKO form according to the unified form KO-2

Expense cash transactions are carried out by filling out the unified form No. KO-2. It was approved by Resolution of the State Statistics Committee of August 18, 1998 No. 88.

The legislation approved the structure of the document and the procedure for filling it out. Organizations using accounting programs can fill out and print cash settlements. The second option is to use printed forms or printed templates.

A prerequisite for their use is the presence of all the necessary details and compliance with the diagram of their location in the document.

Form KO-2 is filled out in the following cases:

- when depositing cash proceeds into a bank account (the Basis line must contain a corresponding phrase, for example, “Transfer of cash to a current account”);

- when transferring money to an employee on account in connection with the purchase of materials necessary for the needs of the organization, going on a business trip, issuing financial assistance (the reason must be specified in the “Bases” line).