Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/09/2017

Reading time: 17 min

0

294

Starting from the 1st quarter of 2021, the VAT return is submitted in the form approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected] as amended on December 20, 2016. The order came into force on March 12. It also establishes rules for completing reports.

- Documentation

- Procedure for submission in electronic form

- Presentation on paper

- Deadlines for submission and payment of VAT for 2021

- VAT payers

- Latest changes VAT rate

- Explanations in electronic form

- Other VAT changes

- Changes since July 2017

VAT declaration 2021 – form

From the first quarter of 2021, a new VAT declaration form will be used. The form was approved by order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558, as amended on December 20, 2016.

For VAT, reporting “on paper” has not been submitted since 2014 - you need to report to the Federal Tax Service electronically via TKS through a special operator. The paper form can only be used by non-paying tax agents and taxpayer agents exempt from calculating and paying VAT (clause 5 of Article 174 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated January 30, 2015 No. OA-4-17/1350).

The VAT return is submitted no later than the 25th day after the end of the quarter. For the 4th quarter of 2021, you must report by January 25, 2018, regardless of the form of submission of the report.

Filling out the title page

The title page is required to be completed even with a zero declaration. It consists of fields:

- TIN – line contains 12 cells. If it is filled out by a legal entity by entering a number of 10 characters, then dashes are placed in two empty cells;

- Checkpoint – reason code for setting. If absent, put dashes;

- fill in the three-digit page numbering of the document similar to “001”;

- adjustment number – when submitting a declaration for the first time for a certain period, put “0”, in the remaining cells – a dash, when submitting an adjustment for the first time, put 1—, then 2—;

- tax period – enter the code assigned to the reporting quarter;

- submitted to the tax authority - the code of the territorial department in which the individual entrepreneur or LLC is registered;

- reporting year;

- by location - code 120 (submitting a report at the place of residence of the individual entrepreneur), 210 (at the location of the organization) or 215 (at the location of the successor organization);

- other fields for identification of the entrepreneur and his activities - full name or company name are entered in full, codes are entered in accordance with the required code identification systems (OKVED), empty cells on completed pages are filled in with dashes.

Composition of the VAT return

The procedure for filling out the declaration was developed by the Federal Tax Service of the Russian Federation in Appendix No. 2 to the same order No. MMV-7-3/558, which approved the form.

The VAT form consists of a title page and 12 sections, of which only section 1 is mandatory for everyone, and the rest are filled out only if the relevant data is available.

Thus, for taxpayers who carried out only non-VAT-taxable transactions in the reporting quarter, section 7 of the VAT declaration is required to be completed. “Special regime officers” who allocated VAT in invoices, and persons exempted from taxpayer obligations under Articles 145 and 145.1 of the Tax Code of the Russian Federation, but those who have issued VAT invoices submit Section 12 as part of the declaration. VAT agents fill out Section 3 if they have had no other tax transactions other than agency ones. Sections 8 and 9 are intended for taxpayers keeping books of purchases/sales, and sections 10 and 11 are intended for intermediaries filling out a declaration according to the invoice journal.

Presentation on paper

The VAT return can be submitted on paper:

- tax agents who do not pay VAT, working under a special regime, or exempt from paying tax;

- organizations and organizations that are not VAT payers, or have received an exemption from payment, if they: are not large taxpayers;

- did not issue invoices with the indicated amount of VAT;

- acted on the basis of agency agreements in the interests of other persons, but used invoices;

- their number of employees does not exceed hundreds.

Any plot can be encumbered with an easement - both intended for individual housing construction and agricultural land. How to correctly draw up an application for the provision of a land plot? You will find a sample here.

To privatize a land plot, you need to collect a package of certain documents. You will find the list in our article.

VAT declaration 2017: filling out the required sections

The VAT declaration is filled out based on the following documents:

- Purchase books and sales books,

- Invoices from VAT evaders,

- Invoice journal (intermediaries),

- Accounting registers and tax registers.

The title page of the declaration is quite standard. It contains information about the organization/individual entrepreneur:

- TIN and checkpoint,

- Adjustment number – “0” for the primary declaration, “1”, “2”, etc. for subsequent clarifications,

- Tax period code, according to Appendix No. 3 to the Filling Out Procedure, and year,

- Code of the Federal Tax Service where reports are submitted,

- Name/full name VAT payer, as indicated in the company’s charter, or in the individual’s passport,

- OKVED code, as in the extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs,

- Number of pages of the declaration and attached documents,

- Contact details, signature of the manager/individual entrepreneur.

Section 1 of the VAT return, which is mandatory for everyone, reflects the amount of tax to be paid or reimbursed from the budget. The data is entered into it after calculating the results in other necessary sections of the declaration, and includes:

- Territory code according to OKTMO - it can be found in the territory classifier, or on the websites of Rosstat and the Federal Tax Service;

- KBK, relevant for this period,

- Lines 030-040 reflect the total amount of tax payable, and line 050 - the amount to be reimbursed,

- Lines 060-080 are filled in if the code “227” is indicated in the “At location” line of the title page.

The title page with section 1 is submitted to the Federal Tax Service and in the case where there are no indicators to be reflected in sections 2-12 of the declaration, such VAT reporting will be “zero”.

Filling out a declaration: what do you need to know before starting to work with the document?

The first thing every novice accountant should know is the reporting deadlines. In accordance with the current legislation of the Russian Federation, VAT reports are submitted to the Federal Tax Service every quarter by the 25th day of the month following the reporting period. VAT is subject to the “postponement rule”, according to which the filing date of documentation is postponed to the next business day if the deadline for submitting the report falls on a weekend or holiday. By what date do you have to submit VAT in 2021? The law establishes the following deadlines:

- 4th quarter 2021 - January 25, 2021

- 1st quarter 2021 - April 25, 2021

- 2nd quarter 2021 - July 25, 2021

- 3rd quarter 2021 - October 25, 2021

- 4th quarter 2021 - January 25, 2021

The Tax Code of the Russian Federation obliges taxpayers to submit returns electronically, so every accountant should know how to submit VAT according to the TKS. A completely reasonable question arises - where to submit the VAT return? In accordance with the current legislation of the Russian Federation, declarations are submitted through a digital document management operator, with whom the taxpayer must have an appropriate agreement. There is an exception to the rule. Tax agents who are not VAT payers or are exempt from the mandatory payment of this budget payment can submit a paper form to the Federal Tax Service. How to submit a VAT report: step-by-step instructions will help you cope with this task.

Sample filling

Let's look at an example of filling out a VAT return for the second quarter of 2016. Kolos LLC is located at OSNO and sells equipment. All transactions carried out by the company are subject to VAT at a rate of 18%.

During the period April - June 2021, the following operations were carried out in the Company:

- Stationery was purchased for the amount of 1,500 rubles, including VAT of 228.81 rubles (invoice No. 1 dated 06/02/2016).

- Equipment sold for the amount of 40,000 rubles, including VAT of 6,101.69 rubles (invoice No. 19 dated 04/11/2016).

- Invoice No. 5 dated February 12, 2016 was received in the amount of 5,600 rubles, including VAT of 854.24 rubles. Furniture according to this document was accepted for accounting on February 12, 2016. The Tax Code of the Russian Federation allows VAT to be deducted within three years after the goods are accepted for registration (clause 1.1. clause 1 of Article 172 of the Tax Code of the Russian Federation).

It is necessary to fill out the title page and section 1 of the declaration. The remaining sections are completed if the appropriate indicators are available. In this example, you also need to fill out sections 3, 8 and 9.

Step 1. Fill out the title page

This part contains general information about the taxpayer and the reporting period. The TIN and KPP are indicated at the top, which are then displayed on each sheet of the declaration. The full or short name of the reporting organization and the adjustment number are indicated. If the report is the first, then the adjustment number is 0. Then the tax office code is entered, the index at the place of registration in accordance with Appendix 3 of the filling procedure (for general cases - 214), the reporting year and the tax period code (for the 4th quarter of 2020 - 24). The specialist provides a contact phone number.

IMPORTANT!

The updated declaration for the 4th quarter of 2021 does not indicate the OKVED code!

Finally, the last name, first name and patronymic of the manager or other authorized person and the date of submission of the report are indicated in full. The document is certified by the signature and seal of the manager in case of filing a declaration on paper or by an electronic digital signature for online reporting.

Step 2. Fill out section 1

In line 010 of the declaration enter the taxpayer's OKTMO, in 020 - KBK for the transfer of value added tax. The order of filling is indicated: in field 030, the amount of VAT to be transferred to the budget is contributed only by individual entrepreneurs and organizations operating under clause 5 of Art. 173 Tax Code of the Russian Federation. In 040 - legal entities paying tax on a general basis.

IMPORTANT!

Section 1 added information about taxpayers who have entered into an investment protection and promotion agreement (IPA). Now you need to indicate whether the organization is a party to the SPPK.

Step 3. Fill out section 2

According to the established procedure, only tax agents enter information into this part of the declaration.

Step 4. Fill out section 3 and its appendices

In the tabular part of the third block, indicate the tax base and calculated tax in accordance with the applicable rate. In the 4th quarter form these will be 20%, 10% and the allocated amounts 20/120 and 10/110; for some taxpayers it is possible to reflect the old rates - 18% and 18/118.

Field 070 is intended for information about partial payment or prepayment.

In cells 080 to 100, contributions subject to restoration are entered, in 105–109 - information about the adjustment, and in 110 - VAT, taking into account the restoration made.

Fields 120 to 185 reflect the contribution subject to deduction under Art. 171 and 172 of the Tax Code of the Russian Federation, and in 190 the entered values are summed up.

In cell 200 the amount of VAT that the taxpayer transfers to the budget at the end of the reporting period is entered, in cell 210 - the total to be reimbursed.

Appendix 1 to Section 3 is reserved for completion by VAT payers who are reinstating the contributions paid when purchasing a property.

Appendix 2 to Section 3 consists of foreign companies operating in Russia through permanent representative offices.

Section 3 of the VAT return

This section collects all the data for tax calculation.

Line 010 of column 3 corresponds to the amount of revenue reflected on the credit of account 90.1 for the reporting period.

Line 010 of column 5 corresponds to the amount of VAT reflected in the debit of account 90.3.

Line 070, column 5 corresponds to the amount of advance VAT reflected in the debit of account 76 “VAT on advances” (VAT accrued on prepayment received).

Line 090 of column 5 corresponds to the amount reflected in the debit of account 76 “VAT on advances” (VAT on advances issued).

Line 110 of column 5 corresponds to the amount reflected in the credit of account 68 “VAT”. In addition, this line can be checked against the total VAT amount in the sales book.

Line 120 of column 3 corresponds to the amount reflected in the credit of account 19.

Line 130 of column 3 corresponds to the amount reflected in the credit of account 76 “VAT on advances” (VAT on advances issued).

Line 170 of column 3 corresponds to the amount reflected in the credit of account 76 “VAT on advances” (VAT accrued on the received prepayment).

Line 190 of column 3 corresponds to the amount reflected in the debit of account 68 “VAT” (excluding VAT transferred to the budget for the previous tax period). In addition, this line can be checked against the total VAT amount in the purchase book.

Step 5. Fill out the special sections

Section 4 is intended for individual entrepreneurs and institutions that have received or confirmed the right to apply VAT at a 0% rate.

Section 5 is similar to section 4, it is only for those taxpayers who have previously confirmed a value added tax benefit.

Section 6 is completed by those organizations that during the reporting period carried out transactions with VAT at a rate of 0%, but did not confirm the benefit.

In section 7, information indicates institutions that carried out tax-free transactions.

Step 6. Fill out section 8 and its appendices

This part reflects the data indicated in the purchase book for those transactions for which it became possible to apply a deduction during the reporting period. The filling procedure is as follows:

- line 005 indicates the transaction number;

- in 010 - its code;

- in 020 - invoice number;

- at 030 - the date when the payment document was generated;

- in fields 040 to 090 similar data for corrective invoices is indicated;

- in 100 and 110 - details of the payment order;

- in 120 - the date when the products were registered;

- in lines 130, 140 - INN and KPP of the seller, intermediary;

- in field 160 the currency code is indicated (for payments in national currency - 643);

- in 170 - funds, including value added tax, transferred to the seller for the purchase;

- in 180 - separately the value of VAT;

- the results are summarized in cell 190.

Appendix 1 to Section 8 is formed in the case of filing a clarifying declaration, which is drawn up if changes were made to the purchase book after the reporting period.

Step 7. Fill out section 9 and its appendices

A part similar to block 8 for transactions from the sales book. The lines are filled in the same way as in the previous section. The exception is filling out fields from 170 to 190, which indicate the cost of products without the tax burden at rates of 20%, 18%, 10% and 0%, and in cells 200, 205, 210 the amount of VAT is allocated at the corresponding rates. The results for this part are summarized in lines 230, 235, 240 and 250 for amounts without tax, and in 260, 265, 270 - the result for VAT. Line 280 indicates the amount corresponding to the amount of exemption from contributions.

Appendix 1 to Section 9 indicates the data of the clarifying declaration when making adjustments to the sales book after the end of the tax period for which the taxpayer has already reported and confirmed the figures with primary documents.

Step 8. Fill out the remaining sections of the declaration

Section 10 - for intermediaries whose invoices indicate value added tax.

Section 11 contains detailed information and details of documents from the previous block.

Section 12 reflects information about individual entrepreneurs and legal entities that are subject to special tax regimes (clause 5 of Article 173 of the Tax Code of the Russian Federation), but who sent invoices with allocated VAT.

Ask questions and we will supplement the article with answers and explanations!

Share with your friends:

Along with this material, people often search for:

Templates and forms

Instructions: fill out a declaration on payment for negative environmental impact (NEI)

The Declaration of Fee for Negative Environmental Impact is a mandatory document that is submitted to Rosprirodnadzor to determine the amount of the fee for environmental pollution. We'll tell you who processes it, how, and where it's delivered.

How to check the declaration

Before sending the completed declaration to the Federal Tax Service, you need to check that it is filled out correctly. This can be done using the “Control ratios of declaration indicators”, published in the letter of the Federal Tax Service of the Russian Federation dated 04/06/2017 No. SD-4-3/6467. The ratios are checked not only within the VAT return, but are compared with indicators of other reporting forms and financial statements.

If any control ratio for VAT is violated, the declaration will not pass a desk audit, the tax authorities will consider this an error and send a request for appropriate explanations within 5 days. Taxpayers are required to submit explanations, as well as the declaration, in electronic form according to the TKS (clause 3 of Article 88 of the Tax Code of the Russian Federation). Electronic formats for such explanations were approved by order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/682.

How to fill out the declaration correctly?

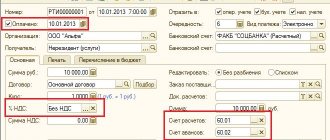

To prepare a report, you need to download its current form from the official website of the Federal Tax Service. Another option is to fill out the form in the accounting program used by the organization (for example, 1C).

The basic rules for filling out the declaration are as follows:

- Numerical and alphabetic values are entered from left to right.

- There are no empty cells left in the report: if there is no data to be entered in a field, a dash is placed in it.

- Each field of the form contains one indicator.

- Amounts are indicated without kopecks; standard mathematical rules apply when rounding.

- Form pages must be numbered in order in a three-digit format, for example, “001”.

- Data about the taxpayer is entered in accordance with its constituent documents.

- OKVED is written on the title page in accordance with the classifier in force since 2021. To transform old values into current ones, you can use various Internet programs.

The completed report is sent to the Federal Tax Service via Internet communication methods. It is certified by an enhanced digital signature made in the name of the general director of the company, private entrepreneur or other official of a commercial structure. You need to take care of the signature in advance.

If a business entity has the right to submit reports on paper, it must fill it out in blue, black or purple ink. Duplex printing and the use of correction tools to correct errors are not permitted. The finished declaration is certified by the handwritten signature of the company’s first person and a seal.

Sample of filling out a VAT return

Astra LLC uses OSNO and is engaged in wholesale trade of products. Let's say that in the 4th quarter of 2021 Astra had only three operations:

- Goods were sold to one buyer in the amount of 1 million rubles. excluding VAT. Goods sold are subject to VAT at a rate of 18%.

- Goods were purchased for the amount of 1416 thousand rubles. including VAT 18% (RUB 216 thousand). This tax, according to the documents, can be deducted.

- An advance payment was received from the buyer for future deliveries in the amount of 531 thousand rubles. including VAT 18% (RUB 81 thousand).

In this case, you need to fill out the following sections of the declaration:

- title page,

- Section 1 – the amount of VAT to be transferred to the budget;

- Section 3 – tax calculation for the reporting quarter;

- section 8 – indicators from the purchase book on the received invoice in order to deduct the submitted VAT from the total tax amount;

- section 9 - data from the sales book on issued invoices. In our case, this section needs to be filled out twice, because... There were two sales transactions, and we will fill in the total lines 230-280 only once.

General information about VAT

First, let's figure out what VAT is. Value added tax is a so-called consumption tax . In essence, such a tax is an addition to the price of the product being sold, that is, the buyer pays it when making a purchase. It is the enterprise that sells these products that submits the declaration to the inspectorate.

Various rates

The rate is regulated, it is not fixed and differs for different types of goods.

For example, for most services and products the value added tax is 18%.

An exception is made for certain types of services and goods: children's products, books and periodicals of an educational nature, as well as some medical goods have a reduced rate of 10%. There is also a zero rate for exported goods, some passenger transport and others.

Certain nuances of tax reporting for VAT (latest changes and clarifications)

Before filling out the declaration, you must correctly formulate the VAT tax base for the 2nd quarter of 2021.

A ready-made solution from ConsultantPlus will help you create a VAT tax base without errors. Try the system for free and get guidance and tips from the experts.

You also need to take into account the explanations that officials regularly give. After all, the VAT declaration consists of as many as 12 sections, and in the process of filling out each of them, difficulties may arise. In the table below you can find links to useful explanations and materials that will help you accurately calculate the VAT base:

| Problematic question | Links |

| Is it possible to apply a deduction on a duplicate invoice? | Letters of the Ministry of Finance dated 04/02/2019 No. 03-07-09/22581, dated 02/14/2019 No. 03-07-09/9057 More details |

| How to calculate VAT if it is not specified in the contract? | Letter of the Ministry of Finance of Russia dated April 20, 2018 No. 03-07-08/26658 More details |

| Is it possible to deduct VAT on work that is not subject to VAT if the tax is indicated in the seller's invoice? | Determination of the Constitutional Court of the Russian Federation dated April 18, 2018 No. 307-KG17-3553 More details |

| Will they refuse a deduction if the invoice does not indicate the legal entity that approved it? | Letter of the Ministry of Finance of Russia dated April 16, 2018 No. 03-07-09/25153 |

| Is it worth deducting VAT if there are errors in the address part of the invoice? | Letters of the Ministry of Finance dated April 2, 2019 No. 03-07-09/22679, dated November 23, 2018 No. 03-07-11/84720, dated August 30, 2018 No. 03-07-14/61854, etc. More details |

| Where can I find out the VAT transaction type codes? | Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/[email protected] Letters of the Federal Tax Service of Russia dated January 16, 2018 No. SD-4-3/ [email protected] , dated January 16, 2018 No. SD-4-3/ [email protected] More details |

| Is it necessary to restore VAT when writing off fixed assets before the end of depreciation? | Letter of the Ministry of Finance of Russia dated April 16, 2018 No. SD-4-3/[email protected] More details |

| Is it possible to obtain a VAT deduction based on a delivery and acceptance certificate containing all the required invoice details? | Letter of the Ministry of Finance of Russia dated March 30, 2018 No. 03-07-11/20234 More details |

| Is it possible to deduct VAT if, in the absence of invoices from the contractor, the fact of completion of the work is confirmed by the court? | Letter of the Ministry of Finance of Russia dated 04/05/2018 No. 03-07-11/22147 More details |

| Is it possible to deduct VAT on an advance payment to a foreign contractor? | Letter of the Ministry of Finance of Russia dated March 20, 2018 No. 03-07-08/17279 More details |

| Is it possible to deduct VAT when repairing public facilities? | See the position of the Federal Tax Service on this issue here |

| Should the buyer pay VAT if the seller paid for the destruction of defective goods? | Letter of the Ministry of Finance of Russia dated March 14, 2018 No. 03-07-11/15622 More details |

| Should reimbursement of expenses for third party services received from the customer of transport services in excess of the contract price be included in the VAT base? | Letter of the Ministry of Finance of Russia dated February 22, 2018 No. 03-07-09/11443 More details |

| Is compensation from the counterparty for failure to fulfill the contract subject to VAT? | Letter of the Ministry of Finance of Russia dated February 22, 2018 No. 03-07-11/11149 |

| Is it possible to deduct input VAT during a period of downtime in production activities? | Letter of the Ministry of Finance of Russia dated February 21, 2018 No. 03-07-07/11012 |

| When is VAT paid on dividends? | Letter of the Ministry of Finance of Russia dated 02/07/2018 No. 03-05-05-01/7294 More details |

| Do I need to wait until the installation of equipment is completed to deduct VAT? | Letter of the Ministry of Finance of Russia dated February 16, 2018 No. 03-07-11/9875 More details |

Don’t forget to monitor tax news - legislators plan to adjust the procedure for filling out VAT returns.