Opening a foreign currency account

To receive foreign currency, you will need a foreign currency account.

To open it, you need to prepare a package of documents almost the same as when opening a regular current account. Each bank has its own requirements for the required set of documents, so check this information in advance. If you open a foreign currency account in the same bank where you already have a ruble account, the procedure will be much simpler. Along with a foreign currency account, the bank will open a transit account for you - a kind of transfer point for funds. It is needed so that receipts pass exchange control. While the money is in the transit account, you will not be able to use it. Once the legitimacy of your transactions is confirmed, you can withdraw funds to a foreign exchange account or immediately sell the currency. Otherwise, the amount of money will be returned back to your client.

Reasons for switching in 2021

As we reported above, starting from the new year, a much larger number of companies will have a real opportunity to change the tax regime. The following criteria are already known as guidelines that firms must adhere to:

- For the first 9 months of 2021, the organization’s income should not exceed 112.5 million rubles, and for the year as a whole no more than 150 million. By the way, last year’s criteria were lower – 59.8 million for 9 months and no limit for individual entrepreneurs. The last point is also relevant for 2021. We draw these conclusions based on paragraph 2 of Article 346.12, as well as paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation;

- As of October 1, 2021, the total value of the organization’s fixed assets should not exceed 150 million rubles compared to 100 million in 2021. The basis is subclause 16 of clause 3 of Article 346.12 of the Tax Code of the Russian Federation. By the way, it is worth emphasizing here the fact that the cost of intangible assets is not included in the overall calculation;

- As for the number of employees employed by the company, their number, as in 2021, should not exceed more than 100 people. Reason - subclause 15 of clause 3 of Article 346.12 of the Tax Code of the Russian Federation;

- The share of third-party companies in the authorized capital of organizations, as before, should not exceed 25%, which, in general, is indifferent for most domestic companies, because A small number of enterprises resort to this management method. Reason - subclause 14 of clause 3 of Article 346.12 of the Tax Code of the Russian Federation;

- A company can switch from OSNO to the simplified tax system even if it does not have branches, in accordance with subparagraph 1 of paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation.

Obviously, this state of affairs is intended to facilitate the transition to a simplified taxation regime. The stumbling block to the transition, in most cases, was precisely the total cost of fixed assets and the level of income of the organization for the year. Fortunately, the legislator “corrected” these limits upward. In our opinion, this was a completely reasonable step. As for the number of personnel of the organization, as well as the presence or absence of branches, we are sure that the scheme with different legal entities will again work perfectly here. As our client correctly noted: “Not all is well that ends well. It would be nice if it started well”...

Don't miss: “Likes” are the reason for loan refusal

Contract with the customer

The contract is usually drawn up in Russian and English. To do this, the pages of the contract are divided in half.

When drawing up a contract, pay attention to a very important point - terms and conditions of payment. When passing exchange control, you need to inform the bank of the maximum period for receiving funds. If the customer transfers money later than the deadline specified in the contract, disputes with exchange control may arise. The fine for failure to receive earnings in foreign currency on time is set at 1/150 of the refinancing rate of the Central Bank of the Russian Federation of the amount of money credited in violation of the deadline for each day of delay and (or) from 75% to 100% of the amount not credited to the account on time.

To avoid such fines, there are two ways: greatly increase the payment period under the contract or not establish it at all. In the second case, make sure in advance that the customer is honest so that he does not delay the transfer of funds.

To simplify the work with the client, you can specify a condition in the contract so as not to issue closing documents - after a certain period has expired from the moment of payment by the customer, the services are considered provided and the work accepted. And even easier, instead of a full-fledged contract, you can issue an invoice and indicate the terms of the transaction in it. Payment of the invoice will confirm that the terms of the transaction have been accepted.

Why are they afraid to cross?

Despite all its attractiveness, some companies try to avoid applying the simplified tax regime. As a rule, this is due to the fact that the organization's key clients also adhere to OSNO. The ability to deduct VAT, the availability of multimillion-dollar contracts, as well as the basic “prestige” of participating in tenders have an impact. We spoke with the leaders of some of our client companies to find out how they view the possibility of regime change. We did not consider those who would be happy to switch but do not have the appropriate opportunities; on the contrary, we were interested in those companies who really simply do not want to do this. Here is the most revealing answer to our question:

“In principle, my accountant and I don’t see any obvious point in this. Yes, theoretically, we can “divide” our company into several legal entities, but we don’t need this. I can roughly imagine how much less we will pay to the Federal Tax Service due to the absence of income tax, VAT and property tax. However, believe me, the general mode gives us a real opportunity to interact with large customers. As you yourself know, we have multi-million dollar accounts, our counterparties are interested in VAT deductions. If we switched to the simplified tax system, they would easily prefer our competitors. And by the way, they all work on OSNO. Plus, opening new legal entities is also a headache. We can do this quickly enough by finding a good lawyer, but we’ve been working on the reputation of our name for a long time. In terms of finances, we cannot qualify for a “simplified” plan, but in terms of the number of employees we qualify. There are serious people behind our clients - I think they will not be very pleased to see the seal of another organization in the contract. They all know very well how much effort and money, in the end, we spend on maintaining the quality of service. And imagine here that they receive an agreement for approval from Romashka LLC. Who is she? Probably, our managers will be able to explain this correctly, but the name of the general director will be different. They will think that the quality of customer service will really be different. In other words, the idea of a transition is not for us”...

From this answer we can conclude that tax benefits may not always be the basis for switching to a simplified regime. In fact, reducing the cost of paying taxes, in this particular case, according to the director, can lead to an outflow of clients interested in VAT deductions. It is quite possible that earlier he and the accountant had already tried to calculate everything and became convinced over time of the need to apply the general regime. Another interesting topic is also touched upon here – quality of service. We cannot judge to what extent the director’s statement in this case will be fair. At the same time, who knows, maybe he’s really right? In any case, until you try, you won’t understand. True, their reputation is “at stake”, therefore, they are unlikely to take risks.

Currency control

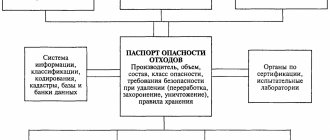

And although the transaction passport was cancelled, currency control has not gone away. The bank can still request supporting documents from you for transactions over 200 thousand rubles in ruble equivalent. Therefore, save all contracts, transaction passports and other documents with information about currency transactions. The full list of documents that you may be asked to provide is contained in the law.

Banks charge a commission for currency control services and agreement registration. Everyone's conditions are different, so check in advance what the conditions are at your bank.

Summary

Despite the fact that among businessmen there are people who do not consider the transition from a general tax regime to a simplified one useful for themselves, there are many for whom this will be one of the few opportunities to increase their capital by reducing the tax burden. It is worth recalling here that at least 6 million legal entities operate in our country, a third of which use OSNO. It is quite possible that, if they prefer the general simplified tax system, their real income from commercial activities will have to increase significantly. However, I don’t want to make too optimistic forecasts, because from year to year we have the same problems - illegal actions of Federal Tax Service inspectors, the arbitrariness of the “firemen”, the impudence of the “Ministry of Emergency Situations”, attacks from Rospotrebnadzor and much more from the same series. Eh, if only we could solve these problems... We have no choice but to wait for the weather by the sea.

Thank you for your attention.

Tax simplified tax system

Before freely disposing of the proceeds received from a transaction, do not forget to calculate the tax. All taxes are calculated in rubles, so recalculate the amount of revenue at the exchange rate of the Central Bank of the Russian Federation on the date of receipt of money in the transit account. You can view the current exchange rate of the central bank on the website cbr.ru.

Please note that exchange rate fluctuations do not affect the amount of tax payable. Tax is imposed only on the exchange rate difference that arose when selling currency at a higher price than the Central Bank of the Russian Federation exchange rate on that day. Negative exchange rate differences in simplified taxation system expenses are not taken into account.

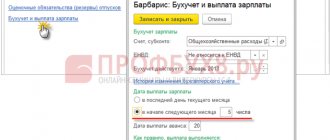

If you use Elba, you don't have to remember this at all. The system itself monitors the exchange rate and calculates the exchange rate difference.

Submit reports in three clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How to pay taxes when exporting to the simplified tax system

For many entrepreneurs, when they hear the word “export,” a terrible picture of VAT refunds and tax audits immediately appears in their heads. Let's slowly get rid of these pictures and dispel the myths.

VAT does not always arise when exporting. Often taxpayers work on the simplified tax system. Basically, these are small businesses. And export transactions can arise quite often, especially within the Customs Union. Indeed, when you hear the word “export,” there is a fear that you will have to reimburse or pay VAT or undergo an in-depth inspection. But for those who pay the simplified tax system for their main activity, no VAT arises.

Let’s look at two situations for the “simplified” ones – export within the Customs Union and export to other countries. The actions of taxpayers will be completely different.

Export within the Customs Union

Let us recall that the Customs Union includes five countries: Russia, Armenia, Belarus, Kyrgyzstan and Kazakhstan. Within this Union there are no borders for the purposes of the movement of goods and customs posts at which customs declarations are checked. In other words, the procedure for document flow and trade between countries has been simplified. What is the export process within the customs union?

Step 1. An agreement is drawn up between the buyer and seller.

Step 2. An advance payment invoice is issued (mostly international trade is based on such payment terms).

Step 3. The seller undergoes currency control at his bank if the transaction size is more than 6 million rubles (limit for export contacts).

Step 4. The delivery is prepared, an international cargo waybill is drawn up (CMR - if delivery is carried out by road, if by air - this is an air waybill, if by rail - a railway waybill).

Step 5. The goods are delivered to the buyer.

Step 6. The buyer contacts his tax office and pays indirect VAT (in the amount of the tax rate that applies in his country). In Russia, this is an indirect tax declaration and notification. Submitted by the 20th day of the month following receipt of the goods.

Step 7. After paying VAT, the buyer provides the seller with a notice of payment of indirect tax. This way the seller can confirm the fact of export. However, if he is on the simplified tax system, then he does not need to do this. This step is important for those who pay VAT on their main activities, in order to pay VAT on export supplies not 20%, but 0%.

Step 8. The seller provides the customs authority with a statistical form on shipments of goods to the countries of the Customs Union by the 8th day of the month following the shipment.

It is step 8 that prevents the seller and buyer from evading paying VAT in the country where the goods are received. After all, the customs authority sends information to the tax authority of the buyer country. All interaction takes place via electronic communication channels, so it is almost impossible to hide.

Example. The Russian supplier, who pays the simplified tax system, sends a house made of laminated veneer lumber to Armenia. The cost of the house is 2 million 400 thousand rubles. In this case, it is mandatory to undergo currency control. The essence of passing currency control is to send information about the contract to the bank. The supplier issues a CMR together with the carrier and ships the cargo on July 23. The buyer receives the cargo on July 31, prepares documents and pays VAT on the delivery amount, including delivery, to the tax office by August 20. After this, it sends a notification by express mail to the supplier that VAT has been paid in the country of import. The supplier electronically submits the statistical form to the customs authority by August 8. The supplier who pays the simplified tax system does nothing else. The tax is paid based on funds received into a foreign currency account (if receipts are in foreign currency) at the Central Bank exchange rate on the date of receipt. Nothing additional is submitted to the tax office in any way.

Export outside the Customs Union (rest of the world)

Step 1. An agreement is drawn up between the buyer and seller.

Step 2. An advance payment invoice is issued (mostly international trade is based on such payment terms).

Step 3. The seller undergoes currency control at his bank if the transaction size is more than 6 million rubles.

Step 4. The delivery is prepared, an international cargo waybill is drawn up (CMR - if delivery is carried out by road, if by air - this is an air waybill, if by rail - a railway waybill).

Step 5. A customs declaration is completed with the help of customs representatives. The cost of a customs declaration is 15-20 thousand rubles.

Step 6. The goods are delivered to the buyer.

Example. The Russian supplier, who pays the simplified tax system, sends a house made of laminated veneer lumber to Iraq. The cost of the house is 2 million 400 thousand rubles. In this case, it is mandatory to undergo currency control. The essence of passing currency control is to send information about the contract to the bank. The supplier issues a CMR together with the carrier, completes a customs declaration in the shipping region and ships the cargo on July 23. The buyer receives the goods on August 1. The shipment is completed, the buyer and supplier do not need to take any further actions. Customs authorities know about exports through the customs declaration; tax authorities, together with the bank, check the fact of receipt of funds through the exchange control mechanism. The seller pays tax based on funds received into a foreign currency account at the Central Bank exchange rate on the date of receipt. Nothing additional is submitted to the tax office in any way.

It turns out that exporting from a company to the simplified tax system is much easier, because then the issue of VAT refund and mandatory tax audit does not arise. There are only restrictions on the use of the simplified tax system, including the amount of revenue of 150 million rubles. This limitation must be strictly controlled.

Nadezhda Skvortsova, financial director of the consulting company for organizing exports (FEA) EST-Group website: www.proexportrus.com phone: 8-880-551-85-82 (calls within Russia are free)

Regulatory regulation

As noted above, the key regulatory and legal act regulating the issue of payment of this fee under the simplified regime is Article 346.11 of the Tax Code of the Russian Federation.

In addition, the issue of paying tax to the state budget when simplifiers carry out transactions under simple partnership or trust agreements is regulated by the provisions of Article 174.1 of the country’s main document regulating relations between taxpayers and the state.

In general, exceptions when companies operating on a simplified basis acquire the status of a VAT payer are indicated in Article 161 of the Tax Code of the Russian Federation.

Delivery documents

For customs clearance of delivery, an individual entrepreneur will need:

The complete list of documents depends on the type of goods and the customs post at which the cargo is cleared.

VAT under the simplified tax system in case of lease of state property

According to the requirements of paragraph 3 of Article 161 of the Tax Code of the Russian Federation, individual entrepreneurs and companies operating on a simplified tax system are recognized as VAT payers. In this case, taking into account the terms of the signed agreement, the following possible options for calculating tax debt should be highlighted:

- a property agreement providing for a lease clearly stipulates the amount of tax. In such a situation, the simplifier is transferred a specified amount to the state treasury, and the lessor receives a fee for services minus the specified amount;

- the agreement does not stipulate the amount of debt to the fiscal services. Then: under the terms of the contract, the tenant fulfills obligations to the fiscal services independently. The tax rate is 18%. In this case, the lessor receives the entire amount agreed upon by the terms of the contract; the contract may indicate that the amount of obligations to the budget is part of the rental cost. In this situation, municipal authorities receive an agreed fee excluding VAT, and the amount of obligations is transferred to the account of the fiscal service.

Taxpayers who have chosen the simplified regime, in the case of renting public property, are required to issue an invoice indicating the amount of payment, including tax, and the document itself must be registered in the sales book.