How to fill out a payment order for taxes and contributions in 2021

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

Payment orders for payment of land tax are made only by organizations. Individuals and individual entrepreneurs pay tax on the basis of tax notices generated by the Federal Tax Service at the end of the year.

Sources:

- Tax Code of the Russian Federation

- Regulation of the Bank of Russia dated June 19, 2012 No. 383-P

- Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n

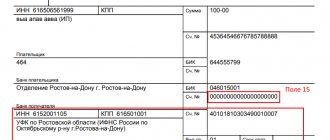

Taxpayers will have to correct several details at once. Changes to a tax payment order mainly apply to the recipient's account:

- in the name of the recipient's bank, the name of the corresponding treasury account is added through the “//” sign (field “13” of the order);

- a different BIC will be indicated (field “14”);

- a new detail is added - the recipient’s bank account number (field “15”);

- In field “17” the treasury account number is entered.

The Federal Tax Service warned that the recipient's bank account number, which is an integral part of the treasury account, is a mandatory detail. Previously, taxpayers did not fill out field “15”.

Before providing a sample payment order for taxes for 2021, we remind you that the document also indicates:

- details of the payer (TIN, KPP, if necessary - address of an individual, current account number, BIC and correspondent account of the taxpayer's bank);

- details of the recipient (TIN, KPP, in the name - territorial FK and in brackets the Federal Tax Service, administering this budget payment).

According to the order of the Ministry of Finance of Russia dated September 14, 2020 No. 199n, new rules for indicating information in payment orders will come into force in 2021. In particular, for foreign organizations or individuals that are not registered with the Federal Tax Service, it is allowed to indicate “0” instead of the Taxpayer Identification Number.

- Corporate income tax

- Value added tax

- Single tax when applying the simplified tax system

- Tax when applying the patent system

- Property tax

- Transport tax

- Insurance premiums

- Personal income tax

- Unified agricultural tax

- A single tax on imputed income

- Land tax

Procedure for paying property tax

Property tax taxpayers pay (Article 383 of the Tax Code of the Russian Federation):

- tax for the year;

- advance payments (for 1 quarter, half a year, 9 months), unless otherwise provided by the law of the subject of the Russian Federation (clause 2 of Article 283 of the Tax Code of the Russian Federation).

The deadline for paying property tax and advance payments is established by the constituent entity of the Russian Federation (clause 1 of Article 383 of the Tax Code of the Russian Federation).

Payment is made to the Federal Tax Service:

- for organizations and separate divisions that have a separate balance sheet - according to the location of the organization and each of the separate divisions (Article 384 of the Tax Code of the Russian Federation);

- for organizations on whose balance sheet real estate assets are located outside the organization’s location - according to the location of these real estate assets (Article 385 of the Tax Code of the Russian Federation).

- in relation to property for which the tax is calculated based on the cadastral value - according to the location of these real estate objects (clause 6 of Article 383 of the Tax Code of the Russian Federation).

Let's take a closer look at the procedure for generating and paying property taxes to the budget in the program.

In accordance with the property tax declaration, the amount payable was 33,000 rubles.

On March 30, the accountant prepared a payment order for the payment of property tax in the amount of 33,000 rubles. The tax was paid on the same day using a bank statement.

The organization pays property tax to the budget of the city of Moscow until March 30 (Moscow Law of November 5, 2003 N 64).

How to fill out a payment order for taxes in 2021

\r\n\r\n

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

\r\n\r\n

Until October 2021, when filling out field 101, these individuals must select one of the following values:

\r\n\r\n

- \r\n\t

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

\r\n\t

\r\n\t

\r\n\t

\r\n\t

\r\n

\r\n\r\n

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

Until October 2021, in payments issued when repaying debts for expired periods, in field 106 you can, if necessary, specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

Until October 2021, when filling out field 101, these individuals must select one of the following values:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

Payment of property tax to the budget

After paying the property tax to the budget, based on the bank statement, you need to create a document Write-off from the current account transaction type Tax payment . A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order .

Or it can be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service .

It is necessary to pay attention to filling out the fields in the document:

- from – date of tax payment, according to the bank statement;

- In. number and input date – number and date of the payment order;

- Tax – Organizational property tax , selected from the Taxes and Contributions directory and affects the automatic completion of the Debit Account ;

- Type of liability – Tax ;

- Reflection in accounting : Debit account - 68.08 “Property tax”;

- Types of payments to the budget - Tax (contributions): accrued / paid .

Postings according to the document

The document generates the posting:

- Dt 68.08 Kt – debt to the budget for property tax has been repaid.

Directory of Payment Orders 2021

From 01/01/2021, in the payment slip for the transfer of taxes and insurance contributions, you need to fill out 2 columns in a new way related to the recipient of the funds - the Federal Treasury. From October 2021, an updated list of payment grounds should be applied when repaying debts for past periods. In addition, a new BCC has been introduced for personal income tax on the income of an employee or founder, which during the year exceeded 5 million rubles.

Next, about all this in order.

These are the details of the recipient of the funds. The change in filling from 01/01/2021 is due to the transition to a new procedure for treasury services and a system of treasury payments. So:

- for field 17 – the new account number of the territorial body of the Federal Treasury (TOFK);

- for field 15 - from January 2021 you need to indicate the account number of the recipient's bank (this is the number of the bank account that is part of the single treasury account - UTS).

Note that until 2021, when paying taxes and contributions, field 15 was left empty.

From October 1, 2021 , when repaying debt for expired periods, the values “TR”, “PR”, “AP” and “AR” have been abolished . Instead, there will be one for all cases - “ ZD ”.

And until 10/01/2021, in field 106 on payments, you can, if necessary, specify one of the following values:

- “TR” - repayment of debt at the request of the Federal Tax Service for the payment of taxes, fees, insurance premiums;

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

If field 106 contains “ZD”, then fields 108 and 109 from 2021 must be filled out depending on the document justifying the money transfer.

If this is a requirement from the tax authority to pay taxes (fees, insurance contributions):

- field 108 “Document number” – TP0000000000000 (filling sample);

- field “109” “Date of payment basis document” – date of the request.

Decision to suspend collection:

- field 108 – PR0000000000000;

- field 109 – date of decision.

Decision on bringing/refusing to bring to tax liability:

- field 108 – AP0000000000000;

- field 109 – date of decision.

Executive document (executive proceedings):

- field 108 – AP0000000000000;

- date of the writ of execution (executive proceedings).

From October 1, 2021, codes “09”, “10”, “11” and “12” have been abolished . Instead, for field 101, a single value for all individuals (ordinary, individual entrepreneurs, lawyers and other privately practicing specialists) - “ 13 ”.

This applies to individuals who pay taxes, fees, insurance premiums and other deductions administered by tax authorities.

Until 01.10.2021, when filling out field 101, these persons must choose one of:

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a private notary who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of the peasant farm who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- "13" is an ordinary individual.

Period for which tax is paid

This field is filled in taking into account what exactly is indicated in the “Base of payment” field. If the field contains “TP” or “ZD”, they indicate the frequency of payment of property tax established by law. The entry might look like this:

- “KV.01.2018” (for advance tax payments). Here, respectively, indicate the number of the quarter and the year for which the tax is transferred.

- “GD.00.2018” (for paying tax for the year). The tax period for the tax paid is indicated.

If the “Base of payment” field contains “TP”, when determining the period, the taxpayer indicates the date of the request. If “AP” is written in this field, put “0”.

Filling out a payment order in 2021: sample

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

From January 1, 2021, new BCCs were introduced for personal income tax calculated on a progressive scale.

By Order No. 236n dated October 12, 2021, the Ministry of Finance added new codes to the KBK list for transferring personal income tax on income exceeding 5 million rubles. in year:

- for tax: 182 1 0100 110

- for stumps: 182 1 0100 110

- for fines: 182 1 0100 110.

From July 17, 2021, the rule for filling out a payment order will come into effect, when the employer deducts money from the employee’s salary to pay off the debt to the budget and transfers the withheld amount to the budget.

In the payment receipt, in the “Payer’s INN” field, you must indicate not the company’s INN, but the employee’s INN. This change is also provided for by Order of the Ministry of Finance dated September 14, 2021 No. 199n.

Repayment of debt for previous periods - fields 106, 108, 109

From October 1, 2021, changes will be introduced to the procedure for providing information when repaying debts for expired periods (also Order of the Ministry of Finance dated September 14, 2021 No. 199n).

Until October 1, 2021, in field 106 “Basis of payment” of the payment order, you can specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

According to the changes, the values “TR”, “PR”, “AP” and “AR” no longer need to be specified in field 106. There remains a single value for all the listed cases, which must be entered in field 106 - “ZD”.

And the codes “TR”, “PR”, “AP” and “AR” go to field 108 “Document number”.

For example, if money is transferred on the basis of a request from a tax authority to pay a tax (fee, insurance premiums), in field 108 write first TP and then, without a space, the request number for 13 acquaintances. If this is a writ of execution (executive proceedings), then in field 108 write AR and the document number, etc., in the same order.

In field 109 “Date of payment basis document” you will need to indicate the dates of the documents on the basis of which the money is transferred (demand, decision, etc.).

Land tax or any other type of tax is issued by payment order in order to pay it through the organization's current account. The document is drawn up in advance, in two copies, and sent to the bank to pay the tax from the current account. No later than three days after drawing up the payment order, but if the deadline has passed, a new payment order is printed, which must receive a tax payment stamp, for example, before the 20th day after the reporting period, otherwise late payment cannot be avoided, for which the tax inspectorate has the right to fine the organization, at best, charge a penalty.

If you fail to pay your tax on time, you should contact the tax office to calculate penalties and avoid seizure of your current account. On the same day, pay the land tax, as well as all existing debts and send a written notification to the tax office about the execution of payments.

Payment order in 2021

The Federal Tax Service may write such an index in the tax payment request for legal entities. And for individuals, the document index is present in the receipt (notification) of accrued taxes. If an individual does not receive such notifications, then you can find out the document index and print a receipt in your personal account on the Federal Tax Service website.

If you are transferring a current payment, arrears not at the request of the inspection, or the UIN is simply not indicated in the request, leave field 22 empty.

You can see how to correctly draw up a payment order using an example. The sample shows a payment slip for the transfer of personal income tax for March 2021. The personal income tax amount is 17,144 rubles. The drafter of the document and tax agent is LLC “White Bear”.

Name of the receiving bank

When creating a payment invoice, the tax payment will be double.

If now we simply indicate the territorial branch of the Bank of Russia, then from 2021 it will be necessary to indicate both the branch of the Bank of Russia and the corresponding territorial body of the Federal Treasury (via a double slash), for example:

VORONEZH BRANCH OF THE BANK OF RUSSIA//UFK for the Voronezh region, Voronezh

If now we indicate the BIC of the corresponding branch of the Bank of Russia, then from 2021 it is necessary to indicate the BIC not of the branch of the Central Bank, but of the BIC of the territorial body of the Federal Treasury.

Each regional department of the Federal Treasury in a constituent entity of the Russian Federation now has its own bank identification code.

When issuing a payment order, we currently do not fill in the account number of the recipient bank

(field 15), we only indicate

the recipient's account number

(field 17).

From 2021 we will have to fill in the recipient bank number

(field 15) and indicate the new

recipient account number

(field 17).

Under the account number of the receiving bank

now refers to the number of the bank account that is part of the single treasury account.

- The single treasury account is an account of the Federal Treasury, where funds from the federal budget are accumulated and operations on the execution of the federal budget are reflected.

When generating a payment for taxes, fees, insurance premiums under the name of the recipient

means the administrator of the corresponding budget revenues - this is the name of the tax office where the taxpayer is registered for tax purposes.

At the same time, we now indicate our tax office in brackets after the name of the corresponding regional department of the Federal Treasury, for example: UFK for the Voronezh region (IFTS of Russia No. 1 for the Voronezh region).

What KBK codes are used in 2021

Organizations paying property tax indicate the BCC, which differ for property that is or is not included in the Unified Gas Supply System:

- 182 1 0600 110, if the property is included in this system;

- 182 1 0600 110, for property not included in this system.

The BCC for payment of property tax for individuals depends on the location of the taxable property. It is indicated by tax authorities in the notice for payment of property tax.

New payment details for paying taxes

Under the recipient's account number

when making tax transfers, the number of a separate treasury account is now implied (in the case of paying taxes, these are revenues that are sources of income for the budgets of the budget system of the Russian Federation).

This means that from 01/01/2021, the recipient's account number in field 17 will be different from the number that we indicate now.

Thus, from 2021, payment orders will need to indicate two accounts, as well as new BICs.

New requirements for filling out new payment details for the payment of taxes, fees and insurance premiums come into force on 01/01/2021, but until the end of April 2021 there will be a transition period when “budget payments” can be executed using old bank details.

This is done in order not to expose people to stress in connection with innovations, to give them the opportunity to comprehend and implement them in a calm atmosphere.

- Prices

- Pay

From the name it is clear that this fee is established for land owners. Since local authorities have a greater understanding of the land plots in their area of responsibility, this tax is local. The funds go to the budget of the corresponding municipality and local authorities are vested with great powers in regulating it: they set tax rates and payment deadlines; at the federal level, only their maximum and minimum limits are indicated.

In accordance with Art. 389 of the Tax Code of the Russian Federation, the objects of taxation are land plots. The following areas are not recognized as such:

- withdrawn from circulation or limited in circulation due to the location within their boundaries of water bodies of federal significance or particularly valuable objects of cultural heritage;

- members of the forest fund;

- located under apartment buildings.

Maximum bet:

- 0.3% - for agricultural land occupied by housing stock or its infrastructure, acquired for the purposes of horticulture and livestock farming;

- 1.5% - for all other areas.

This percentage is calculated from the cadastral value, which is the tax base in this case.

Legal entities, like ordinary citizens, are taxpayers for this fee in favor of the state. The tax system does not matter in this case; simplified regimes do not exempt organizations from fulfilling the obligation to transfer a fee for land ownership. But unlike citizens who receive notifications from the tax office indicating the amount of tax and attaching a document for payment (or in their personal account on the government services portal), companies are required to independently draw up and submit a declaration to the regulatory authority at the place of their registration. Local authorities may provide tax benefits for certain categories of persons. These norms must be sought in the land tax laws of individual municipal districts.

A sample payment order is presented below. The code is indicated in field 104. The codes are the same for the whole country, the remaining details in the payment order must be entered according to the Federal Tax Service at the location of the site where the contribution is paid, according to Art. 397 Tax Code of the Russian Federation. To generate the document, use the unified OKUD form 0401060. The payment can be generated on the Federal Tax Service website.

Errors in specifying the BCC may result in the payment not being posted correctly. Accordingly, the obligation to fulfill the financial obligation will not be considered fulfilled. To correct the details, you need to write a letter to the tax office indicating the correct indicators. If penalties are accrued and the Federal Tax Service refuses to cancel them, such a decision can be appealed in court.

I note that new details will be introduced on January 1, 2021, but they will be valid simultaneously with the old details until May 1, 2021.

Starting from May 1, 2021, when filling out payment orders for paying taxes and contributions, it will be necessary to use only the new details of the Federal Treasury.

In accordance with the new rules, organizations calculate the tax amount independently and pay without submitting reports.

To control the correctness of the amounts paid, the Federal Tax Service verifies the taxpayer’s data with information received from Rosreestr.

Having carried out its own calculations, the Federal Tax Service sends a notification to taxpayers. The notification form was approved by order of the Federal Tax Service dated July 5, 2019 No. ММВ-7-21/337.

The notification form contains:

- information about the land plot (object of taxation);

- information about the value of the taxable object;

- information about tax deductions and tax base;

- information about the tax rate;

- the period for which the calculation was made is indicated;

- amount of calculated tax.

The notification is sent to the taxpayer within the following periods:

- within 10 days after calculating the tax amount (the Federal Tax Service must send a notification to the taxpayer no later than 6 months from the date of expiration of the deadline for paying the tax);

- if the tax office has received documents from the taxpayer on the basis of which it is necessary to recalculate the amount of tax, then the Federal Tax Service sends a notification no later than 2 months from the date of receipt of the above documents;

- If the Federal Tax Service has received information that the taxpayer organization is at the stage of liquidation, then the notification is sent within 1 month from the date of receipt of information about liquidation.

To notify the taxpayer of the calculated tax amount to the Federal Tax Service:

- sends a message in electronic form via TKS or to the taxpayer’s personal account;

- It is permissible to send a notification by registered mail;

- sends the notification personally to the head of the organization against signature.

Checking settlements with the budget for property taxes

To check the calculations with the budget for property tax, you can create a report Account Analysis 68.08 “Property Tax”, section Reports – Standard reports – Account Analysis.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of property tax Good afternoon! A small question: is it necessary to pay advance tax on...

- [01/29/2021 entry] Renting and leasing: there is nowhere to retreat! Application of FSB 25/2018, payment of property tax and other complex issues Seminar program Renting, leasing, subleasing - we understand the concepts and...

- Why is the property tax declaration for 2020 not completed if the property tax calculation for real estate for the 1st quarter of 2021 has been completed? You do not have access to view. To gain access: Complete...

- During the transition from 2.0 to 3.0, regulatory operations were not completed: calculation of property tax and calculation of transport tax. Good evening. The company kept records in accounting 2.0. It was carried out...

Sample of filling out a payment order for land tax

If the amount of tax calculated by the organization does not coincide with the amount reflected in the notification of the Federal Tax Service, then within 10 days you must provide evidence of the correct calculation of the tax to the inspectorate. For this:

- send an explanatory note to the Federal Tax Service, which indicates the facts of the correct calculation of the tax;

- You must attach documents to the note confirming your correctness (agreements, extracts, other documents)

Documents can be brought in person to the inspection, sent by mail or electronically, but only if there is an electronic signature.

Based on the results of consideration of your application, the Federal Tax Service will make a decision:

- take into account your clarifications and recalculate the tax amount;

- reject your evidence and send a demand for payment of arrears.

The inspectorate sends its decision within 1 month from the date of receipt of an explanatory letter from the taxpayer (subparagraph “b”, paragraph 25, article 1 of the Federal Law of April 15, 2019 No. 63-FZ).

→ → Current as of: February 1, 2021 In order for the money to go into the budget, you must correctly fill out the payment order for the transfer of one or another obligatory payment.

The rules for filling out a payment order are specified in and have not changed compared to 2021.

We have summarized these basic rules in a table: Name of the payment field field (field number) Payment of taxes Payment of contributions “for injuries” to the Social Insurance Fund Payer status (101) “01” - if the tax is paid by a legal entity; “09” - if the tax is paid by an individual entrepreneur; “02” - if the tax is paid by an organization/individual entrepreneur as a tax agent “08” INN of the payer (60) INN of the organization/entrepreneur KPP of the payer (102) KPP assigned to the Federal Tax Service Inspectorate to which the tax will be paid If contributions are paid by an organization, then its Checkpoint.

If the payer

> > > Tax-tax August 22, 2021 All story materials A payment order for penalties must be issued if the deadline for payment of mandatory payments (taxes, fees, contributions) is overdue. In this article we will talk about the features of preparing a payment order for the payment of penalties and provide a sample of it.

Documents and forms will help you: We have prepared video instructions for you on how to fill out a payment form to pay penalties. First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured.

At the same time, a penalty is not a sanction, but an interim measure. Read more about tax penalties here.

You can calculate penalties using.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences.

— — Back to Land Tax 2021 Land tax payments are filled out only by companies.

Individual entrepreneurs pay tax based on a notification from the inspectorate. To avoid mistakes, look at a sample payment order for land tax in 2021. Draw up a payment order for payment of land tax using standard form 0401060.

It is given in Appendix 2 to Bank of Russia Regulation No. 383-P.

Fill out each field of the payment order strictly according to the rules, otherwise there is a high probability that the inspection will not credit the payment to your personal account for the required tax. Let's comment on the main fields that you need to pay attention to.

In field 101 “Payer status” companies put the two-digit code 01, in field 104 “KBK” - the budget classification code for land tax.

Important Enter the payment amount in numbers.

Separate rubles from kopecks with a dash sign “–”.

In field 106, indicate:

- when transferring insurance premiums – value “0” (clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n);

- when transferring taxes - a two-digit letter code of the basis for payment (clause

7 of Appendix 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). For example, when transferring current taxes, indicate the code “TP”, and when repaying debts at the request of the tax inspectorate, use the code “TR”.

A complete list of payment basis codes is given in. In field 107, indicate:

- when transferring insurance premiums – value “0” (clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n);

- when transferring taxes - a 10-digit tax period code (clause

8 of Appendix 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

The first two characters of the code characterize the frequency of tax payment.

Payment of land tax Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media. networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > August 28, 2021 Only payer organizations transfer land tax by payment order. In this article we will tell you how to fill it out correctly.

The specifics of paying land tax depend on the category of payer - an individual or an organization. Individuals pay tax on the basis of a tax notice received from the Federal Tax Service (Clause 4, Article 397 of the Tax Code of the Russian Federation). The deadline for paying tax (starting with the tax for 2015) for them is December 1 of the year following the expired tax period (clause

1 tbsp. 397 of the Tax Code of the Russian Federation). For taxes for 2015, this payment procedure also applies to individual entrepreneurs. Corresponding changes to Chapter 31 of the Tax Code of the Russian Federation were made by Federal Law No. 347-FZ of November 4, 2014. Read the material for details.

- /

- /

June 26, 2021 1 Rating Share Filling out a payment document for penalties with the Federal Tax Service has a number of features that distinguish this process from the procedure for filling out a payment document for taxes.

Details are in our material. Penalties intended for payment to the Federal Tax Service are the amount resulting from the later payment of taxes to the budget compared to the deadlines established for this (clause

1 tbsp. 75 of the Tax Code of the Russian Federation). They are transferred to the same inspectorate where the corresponding taxes are paid.

The document for payment of penalties is drawn up according to the same principles as for the tax payment itself, but with a number of nuances. Just like for tax payments, the following is entered into it:

- name, TIN, KPP and bank details of the payer;

- name, TIN, KPP and bank details of the tax authority;

- priority of payment, OKTMO, basis for payment;

- purpose of payment.

With its own characteristics, the payment of penalties reflects:

- Sequence of payment. Her choice will depend on the basis for which the payment is made.

- Basis of payment.

Here there is not always enough reason for payment (there are several of them for penalties).Data may be required about the period for which the payment is made and the document against which the payment is made.

- Purpose of payment. It is indicated that penalties are paid and for what tax; there may also be a need for other information.

- KBK. The basic set of numbers for penalties is always similar to that used for the tax for which penalties are paid, but signs 14–17 are necessarily 2100, indicated only for penalties.

The rules for issuing payment orders for the payment of penalties on taxes from 2021 also apply to insurance premiums subject to the Tax Code of the Russian Federation.

But when paying penalties on contributions for injuries that remain under the jurisdiction of the Social Insurance Fund, you will also have to take into account a number of features. Reason for payment indicated

» There are also a number of other BCCs for paying tax penalties, relating to both individuals and legal entities. For tax obligations before 01/01/2006 in the territories:

- urban districts - 182 1 0900 110;

- urban settlements - 182 1 0900 110.

- rural settlements - 182 1 0900 110;

- intracity districts - 182 1 0900 110;

- urban districts with intra-city division - 182 1 09 04052 11 2100 110;

For information on how tax is reflected in accounting, read the article “Transactions for calculating land tax.”

To fill out a payment order for penalties in 2021, some details can be taken from the tax payment slip.

The following data will be the same:

- order of payment (field 21);

- payer status (field 101);

- name of the recipient, his TIN and KPP (fields 16, 61 and 103);

- bank details of the organization (fields 10, 9, 11 and 12);

- recipient's bank details (fields 13, 14, 15 and 17);

- name of the organization, its tax identification number and checkpoint (fields 8, 60 and 102);

- OKTMO (field 105).

Now let's talk about those details that are different.

KBK (field 104). The BCC for the tax and the BCC for penalties for this tax are similar. Only the code of the subtype of income differs (14 – 17 digits of the KBK).

For tax it is 1000, and for penalties – 2100.

For example, BCC for payment of personal income tax by a tax agent is 182 101 02010 01 1000 110, and BCC for payment of penalties for personal income tax is 182 10100 110. Basis of payment (field 106). When paying tax, the company will put TP in this field.

When paying a penalty, it will have one of the following values:

- TR - when paying penalties at the request of the Federal Tax Service;

- ZD – upon voluntary payment of penalties;

- AP – when paying penalties according to the inspection report.

Tax period (field 107).

When paying penalties of your own free will (the basis of the PP), 0 is indicated in field 107.

/ / 04/02/2018 160 Views 04/03/2018 04/03/2018 04/03/2018 This is dictated by the fact that revenues to the Federal Tax Service are divided into 3 types of budgeting:

- the regional budget, in turn, alienates part of the funds for expenses of the locality in which the storage facility is located.

- and regional;

- divided between the state budget;

Punishments are imposed by the local municipality, with the support of government bodies and structures, based on Article 122 of the Tax Code of the Russian Federation.

Therefore, answering a frequently asked question from our readers on social media. networks: “Do you need to pay land tax?”, you can safely say: “It’s definitely necessary!” Penalties and fines are accrued three months after non-payment or arrears.

The citizen will be presented with a notification with an attached receipt, which will include the amount of penalties for arrears (Article 69 of the Tax Code of the Russian Federation). Attention When paying the main amount of land tax by legal entities, the following values will remain unchanged in the KBK code (underlined): 182 1 06 06032 04 1000 110. Based on the classification rules, the unchanged values define the payment as tax (code “182” of the first block, “1” of the second block, “1100” of the fourth block), and also characterize the main amount of payment (not a penalty or fine) – code “1000” of the third block. Info According to Order of the Ministry of Finance No. 65n dated 07/01/13, when determining the BCC, the payer must take into account the location of the site on which the tax (fine, fine) is paid.

BCC penalties for land tax To pay penalties for land tax, the BCC is applied according to the generally accepted classification. In fact, the BC code of the main tax payment differs from the penalty payment in the values of block “3”: when transferring the tax amount to the BC, you should indicate “1000”, when paying a penalty - “2100”.

For the convenience of determining the BCC for payment of the main amount of tax and penalties, we suggest using the table below: No. BCC for land tax Description Basic tax payment Penalty

We have prepared video instructions for you on how to fill out a payment form to pay penalties.

First of all, let us remind you that through penalties the timely payment of mandatory payments is ensured. At the same time, a penalty is not a sanction, but an interim measure.

Read more about tax penalties in this article.

A payment order for penalties has both similarities with a payment order for the main payment (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. Let's look at the latter in more detail.

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: since 2015, we no longer fill out field 110 “Payment Type” .

Previously, when paying penalties, the penalty code PE was entered in it. Now we leave this field empty, and the fact that this is a penalty can be understood precisely from the KBK.

ATTENTION! Starting from 2021, the procedure for determining the BCC is regulated by a new regulatory legal act - Order of the Ministry of Finance dated 06/08/2018 No. 132n. Order No. 65n dated July 1, 2013 has lost force. But this will not affect the general procedure for assigning penalties to BCC.

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Advance payment of the organization’s property tax for the third quarter of 2021

Payer status: Payer status: 01 - for organizations / 09 - for individual entrepreneurs (if paying their own taxes).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Rice. .

Fig. Sample of filling out a payment order (Property Tax) in Business Pack.