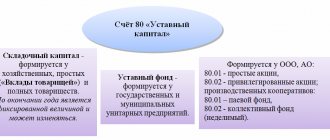

Authorized capital is the organization’s assets in cash and property, which the founders contribute after registering the LLC. The minimum authorized capital of an LLC is generally 10,000 rubles. At the stage of creating a company, the founders are often limited to this amount, but later there may be a need to increase the authorized capital of the LLC.

If this need is dictated by the fact that money is required for business development, you can avoid making changes to the Unified State Register of Legal Entities by issuing a loan to the LLC. We discussed this option in more detail in the article about an interest-free loan from the founder and the tax consequences of 2021.

It will be necessary to increase the authorized capital in the following situations:

- the company includes a participant who contributes to the authorized capital;

- the organization changes its line of business to one for which a different minimum amount of authorized capital is provided;

- the charter is brought into compliance with Federal Law No. 312 of December 31, 2008 (for those organizations whose authorized capital at establishment was less than 10,000 rubles);

- a company participant wants to increase the size of his share in the management company;

- increasing the authorized capital is a requirement of potential investors or creditors of the company, because this guarantees their interests.

The authorized capital of an LLC can be increased at the expense of the property of the company itself, i.e. accumulated net assets, or additional contributions of participants and third parties. In this article we will look in detail at the procedure for increasing the authorized capital of an LLC.

Please note: an increase in the authorized capital of an LLC is allowed only if the contributions declared upon formation of the company were fully made by the existing participants.

Briefly about changes in authorized capital

The procedure for increasing the financial basis of an enterprise is described in articles of Law 14-FZ. General regulation of the procedure is carried out by the norms of the Civil Code of the Russian Federation. Thus, additional contributions to the authorized capital of the association are allowed after full payment of the shares by the participants. A prerequisite is notarization. The number of owners does not matter. Even a sole participant will have to contact a notary (official clarifications of the Federal Tax Service of the Russian Federation No. GD-3-14 / [email protected] dated 02.24.16).

The owners of a business company come to the conclusion about the advisability of making contributions to the management company on their own. If the company belongs to several persons, the issue is brought to the general meeting, and the decision is made by voting.

Analysis and sources of increasing the organization's profit

First of all, in order to maximize the profit of an enterprise, you first need not to develop specific methods, but to analyze the market, competitors, customers and much more. Analysis is the basis on which any actions are based to increase the company’s own profit.

Sources of profit in an organization can be:

- reduction in production costs;

- diversification of production;

- implementation of budgeting and financial planning;

- cost reduction;

- opening new markets;

- competitive advantage;

- increasing the volume of products sold;

- sale or rental of unused property;

- introduction of the latest technologies and equipment in production;

- restructuring.

Types of deposits and methods of making them

The law does not establish strict restrictions on the form of contributions. You can contribute money or property to the authorized capital of a company. They do not contain regulations or prohibitions on combined deposits. Partial additional injections are made in cash, and partly in material assets (Article 15 of Law 14-FZ).

The law does not specify how to properly make additional contributions. General calculation rules apply.

- Money. Non-cash funds are transferred to the company's bank account. The nature of the transaction must be indicated in the payment order form. Otherwise, the regulatory authority will try to classify the receipts as income and charge taxes. Cash is allowed to be deposited into the cash register provided that the limit of 100 thousand rubles is observed. The restriction is established by Directive of the Central Bank of the Russian Federation No. 3073-U dated 10/07/13.

- Property. Valuable things are transferred to society by deed. If the value of the asset exceeds 20 thousand rubles, you will need to order an assessment from an independent specialist. In other cases, it is sufficient to agree on the indicators by the general meeting of owners. The decision on the value of the property transferred as a contribution to the management company is made unanimously. The assessment rules are enshrined in Article 15 of Law 14-FZ and explained in the review of the practice of the Federal Tax Service of the Russian Federation No. GD-4-14 / [email protected] dated December 28, 2016. If real estate and transport are transferred to the enterprise as payment for the share, the obligation is considered fulfilled from the moment of state registration. A similar rule applies when alienating in favor of the company other assets, the rights to which are recorded in federal registers.

Article 17 of Law 14-FZ establishes the following types of additional contributions:

| Equal payments from all participants | Initiative of one of the owners | Inclusion of a new founder |

| At least 2/3 of the owners must speak in favor of increasing the authorized capital. The progress of the meeting is recorded. The document reflects the agreed assessment of contributions, their form, procedure and terms of payment. As a general rule, the decision must be executed within 2 months. However, participants have the right to change the time period either up or down (Part 2, Clause 1, Article 19 of Law 14-FZ). At the end of this period, the meeting is convened again. The owners sum up their results there. When participants make equal contributions, only the nominal value of the shares is subject to increase. Their ratio in percentage terms remains the same. Approve the results of the procedure in paragraph 1 of Art. 19 of Law 14-FZ prescribes no later than 1 month from the end of the period allotted for execution | If one of the owners of the company intends to increase its share, he can submit an application to the director. The appeal must indicate the amount of the additional deposit, the timing and procedure for fulfilling the obligation. The head of the enterprise is obliged to analyze the charter for prohibitions. The constituent document may establish the maximum permissible size of shares. This restriction is introduced to avoid the dictates of majority owners (Clause 3, Article 14 of Law 14-FZ). The participant's application is approved by voting. The issue is submitted to the general meeting for consideration. 2/3 or more of the founders must speak in favor of such a change. You have 6 months to make a deposit. There will be no further meeting. The distribution of company shares is made immediately after the actual replenishment of the management company. The nominal value of the deposits of the remaining participants does not change. The total amount of capital and the proportional ratio of shares are subject to correction | The initiative to increase the authorized capital of an enterprise may come from third parties. A statement describing the investment and the expected size of the share is submitted to the director. If the inclusion of new owners in the composition is not prohibited by the charter, the issue is submitted to the general meeting. All current owners of the LLC must approve the transaction. The initiator of the procedure is obliged to contribute property or money no later than 6 months after receiving the permit. The meeting has the right to shorten this period (Part 5, Clause 2, Article 19 of Law 14-FZ). Registration of changes in the Criminal Code is carried out upon the fact. At the same time, the ratio of shares of owners changes |

In all three cases, changes require state registration and amendment of the charter. Notification P13001 is submitted to the tax authorities by the director or the person entrusted with the functions of the sole executive body. The notice confirms the actual making of additional contributions and an increase in the company’s capital (Clause 2.1, Article 17 of Law 14-FZ). Registration takes 1 month.

Factors and reserves for increasing the profit and profitability of a company

There are many factors that can affect profit growth. And it is not always possible to accurately assess the degree of influence of one or another factor.

Factors influencing the amount of profit can be divided into internal and external.

External (uncontrollable) factors include:

- extraordinary events (natural disasters);

- political changes in the country;

- changes in legislation;

- competitors;

- social conditions in the state;

- inflationary processes;

- changes in the banking and financial sector of the economy;

- suppliers and partners;

- buyers.

Internal (controllable) factors:

- financial policy within the enterprise;

- social (trainings and courses for company employees);

- introduction of new technologies;

- release of new products.

List of documents and procedure for registration

The key conditions for increasing the authorized capital are the approval of the founders and state registration. The list of required documents depends on the type of additional deposit. The total package includes:

- Statement. A written request will need to be made by participants and third-party investors who initiated the procedure on their own. It is submitted to the current director of the company. If the financial basis is increased by equal contributions from all founders, no statements are made.

- Decision/Protocol. It is enough for a sole owner to consolidate his will in writing. If the company is owned by several people, the proceedings of the meeting will have to be recorded. The document records the agenda and voting results.

- New edition of the company's charter. Before Order No. 411 of 08/01/2018 of the Russian Ministry of Economic Development comes into force, everyone will have to correct the constituent documents. The requirement to reflect the current amount of capital in the charter is contained in Art. 12 of Law 14-FZ. The new edition will also need to be approved by a decision of the general meeting of owners.

- Receipts and acts. Documentary evidence of the actual making of additional contributions eliminates corporate disputes and conflicts with the registration service. Since the law allocates a strictly defined time for the execution of a decision, special attention should be paid to the “primary” dates. Contributions must be made within two or six months from the date of the decision. The specific period depends on the nature of the contribution. In addition, the time period can be reduced by the founders themselves at the meeting. An increase in the period is allowed only if all owners replenish the capital at the same time.

- Decision to approve the results. This document is needed only in the case of increasing the authorized capital with equal contributions from all founders. The meeting is necessary to establish the actual implementation of the original decision. If additional contributions were made by only some of the participants or one of them, then the size of the shares changes. The proportional ratio is also subject to adjustment. The rights of persons who evade payment are proportionately reduced. The legality of this approach was confirmed by the Constitutional Court of the Russian Federation by Resolution No. 3-P of February 21, 2014.

- Notice P13001. The obligation for the director to send a unified form is enshrined in clause 2.1 of Art. 17 of Law 14-FZ and Art. 17 of Law 129-FZ of 08.08.01. The notice is accompanied by an edited charter, a decision of the general meeting, documentary evidence of payment of shares and a receipt for the transfer of a fee of 800 rubles (Article 333.33 of the Tax Code of the Russian Federation).

Making changes to the charter and state register from 2021 will be a free procedure. A condition for exemption from the fee is the submission of documents in electronic format. The corresponding rule will be introduced by Art. 333.35 Tax Code of the Russian Federation.

The authorized capital is increased by the company's property

The LLC has the right to transfer to the management company the property that is listed on its balance sheet. A prerequisite is that data from last year’s financial statements must be taken into account. That is, it is impossible to increase capital in this way in the first year of activity. If the authorized capital is increased at the expense of the property of the LLC, the shares of the owners are not redistributed, only a proportional increase in their nominal value occurs.

When everything has been calculated, the owners need to announce a general meeting. At least 2/3 of the LLC participants must approve the increase in the authorized capital at the expense of property by default. But the charter may provide for a requirement that more votes must be cast in favor, up to 100% of the participants.

Development of activities and strategies to increase profits

There are several strategies to increase profits:

- creation of new products. Allows you to expand your circle of clients and expand your business scope;

- cross-selling system. This method is relevant in online stores. When a buyer selects a product, recommendations for a similar product that might interest him pop up;

- system of regular touches. Most businesses notify their customers about discounts or new product releases 2-3 times. If the client does not buy anything after this, then he is added to the list of hopeless ones. But, as the experience of many companies shows, if you notify the client 7-8 times, the percentage of sales will increase significantly;

- educational marketing. The essence of this method is that before you sell something to your potential client, you first need to teach him something useful that will help solve his problems.

Is it possible to increase the capital of an LLC with the help of an additional contribution?

Yes, the size of the authorized capital can be increased due to the additional contribution of the participant. Moreover, it can be contributed in any form - in the form of property (goods, materials, fixed assets), in monetary form - cash, non-cash.

This need arises when a new participant is introduced into the founders of the company. Also, the founders can make additional contributions when the size of their shares increases.

It is not enough to simply contribute money or property to the authorized capital. This procedure must be properly completed, changes must be made to the charter, and the tax authority that deals with state registration of legal entities must be notified of the adjustments.

The capital can also be increased at the expense of the company's property - at the expense of profit at the end of the year.

Increase store profit

One of the ways to increase a store’s profit is to increase the average check. For example, when a buyer goes to the checkout to order a product, the seller offers him to buy something else at a discount or as related products. Many customers agree to purchase another item at the checkout.

Very often in stores, especially if it is a clothing or cosmetics store, customers come in just to “look”. In this case, the seller should ask “Are you visiting us for the first time?”, and then offer the client an SMS newsletter with information about upcoming promotions or a club card.

As an example: increasing restaurant profits

The main ways to increase restaurant profits:

- Brag. If a restaurant has the best chef or the most talented singer in town, be sure to tell them about it.

- Increase in order cost. When ordering, the waiter can recommend an accompanying dish, for example, if a guest orders meat, then he can recommend a side dish (which turned out to be incredibly tasty today).

- Improvement of employee qualifications. The main thing in a restaurant is its waiters. In fact, waiters are the face of any restaurant. If the waiters are polite and know how to create a cozy atmosphere, then the guest will definitely come back again.

- Positive reviews. The more positive reviews about a restaurant are heard in the city, the more people will want to come there.

Gross profit increase

An increase in turnover inevitably leads to an increase in the gross profit of the enterprise. For this reason, it is important to monitor dynamics and ensure that production volumes are stable. Unsold products lying in the warehouse have a negative impact. To prevent this, you can sell products at discounts.

An analysis of the profitability of products sold will make it possible to understand which products need to be paid special attention to when selling them or removed from sales altogether in order to reduce the costs of their production.

An assessment of fixed assets will allow you to understand whether they generate gross profit. Otherwise, it would be better to sell off unprofitable fixed assets.

Measures to increase profits

The main measure to increase profits is profit planning.

Profit planning can be done in three different ways:

- direct account;

- revenue relationships;

- analytical approach.

The first method is the most common in organizations. The essence of the method is that profit is calculated as the difference between the proceeds from the sale of goods and its full cost.

The essence of the second method is to group expenses into fixed and variable.

The analytical method is used as an addition to the direct counting method and is used mainly with a large range of products sold.