Account 68 in accounting

68 accounting account is intended to carry out the procedure for summarizing information on complete calculations of fees and taxes. This takes into account not only payments sent to the budget, but also taxes paid by the company’s employees.

Drawing up reports

To make a correct account analysis, you need to take into account all types of interest rates by type of taxation. Its peculiarity is that it is both passive and active at the same time. This is influenced by the data that should be displayed on it.

Important! Filling out account documentation has its own characteristics. In addition, there are special formulas for calculating personal income tax.

Calculation of taxes and fees

Postings for taxes

An integral responsibility of an accountant is the correct and timely calculation, registration and transfer of all tax payments.

Taxes and fees are mandatory payments levied on legal entities and individuals intended to finance state municipal expenditures. Tax payments are free of charge. Fees are payment for the performance of legal actions by the relevant authorities: issuing licenses, granting any rights.

The Tax Code of the Russian Federation establishes federal, regional and local taxes and fees. The Tax Code also provides for the following taxation systems:

- general;

- simplified;

- patent;

- single agricultural tax;

- a single tax on imputed income established for certain types of activities.

Characteristics

Accounting account 68 is an active-passive instrument in accounting. It represents generalized information on calculations, including taxes that the organization pays to the budget and for employees.

All individual entrepreneurs and organizations are required to make transfers to the budget upon conducting economic activities. For legal entities in accounting, account 68 should be used for this. All transactions for paying obligations to the budget will be taken into account and formed on it. The information contains complete information about all accrued and paid tax liabilities, reflects the amounts withheld from employees, as well as those that were declared for deduction.

The question often arises: is the 68 account active or passive? It belongs to the active-passive group. This is because it has a debit and a credit balance. It depends on the nature of the debt. If there is an overpayment of taxes, the balance is considered a debit. In the case of debt, everything is calculated the other way around. The amount that must be transferred to the budget will be placed on credit balances.

Analytical accounting for the calculation of taxes and fees 68 is carried out by type of tax. The amount received is added.

Important! In one case, the balance may be a debit, in the second - a credit.

Procedure for deductions to the budget

Account characteristics

The accounting chart of accounts establishes that account 68 is intended to summarize information on the implementation of settlements with the budget for various tax payments. The same regulatory act determines where, in an asset or liability, this account is included. It is considered active-passive.

An account can have two balances simultaneously, both on the debit side of the account and on the credit side:

- The debit balance of account 68 reflects the presence of overpayment of taxes at the beginning of the reporting period. The credit balance of this account determines the company's tax debt to the budget. Based on which balance, debit or credit, the following algorithm for determining the balance at the end of the period applies.

- If the opening balance is debit, the debit turnover on the debit should be added to it and the credit amounts on the account should be subtracted from it. If the result is positive, it is reflected as a debit balance in account 68 at the end of the month.

- If initially the balance at the beginning of the period was located on the credit account, then the turnover on the credit account 68 should be added to it and the debit turnover should be subtracted. If the result is greater than zero, then the balance is a credit balance and is located in the credit of the account. Otherwise, the balance will be reflected in the debit of the account.

You might be interested in:

Account 01 - Fixed assets in accounting: correspondence of accounts, postings

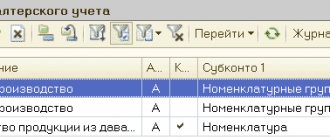

Subaccounts

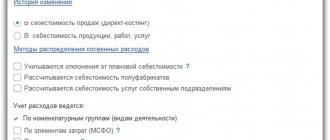

For each type of tax that an organization is required to transfer, there is its own subaccount. According to the methods of calculation, taxes are usually divided into the following types:

- property - they are paid for the use of objects. These include land, transport, and equipment. Everything that is on the balance sheet of the organization. The tax amount is calculated based on the value of the taxable base. It is not affected by the firm's performance;

- indirect - they are included in the amount for a product or service. This includes VAT, customs duties and excise taxes.

68 subaccount account is used for fees and taxes that the company must transfer. They depend on the field of activity and the chosen tax regime. For each type of tax, your own sub-account must be opened:

- 68.13 - trade tax;

- 68.12 - simplified tax system;

- 68.11 - UTII.

Classification of subaccounts is made based on the instructions for using the plan. In general cases, the composition includes:

- income tax;

- water, transport, gambling;

- local contributions to the budget;

- single imputed;

- agricultural tax.

Also included in the subaccount of account 68 is property tax.

To the question, which personal income tax account is in the chart of accounts, the answer will be as follows. For the calculation and payment of personal income tax, a subaccount 68.1 is opened. All information about charges, deductions, payments and any value-added transactions is reflected in account 68 02.

If a company pays excise taxes, then a subaccount 68.3 is opened for them. For organizations operating under the general taxation system, 68.4 is required.

Organizations on the general taxation system that pay income tax open a subaccount 68.4 to record it.

Classification

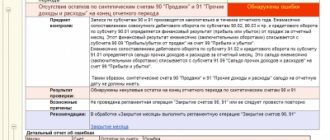

Final operations in tax accounting and balance sheet reformation

Reformation of the balance sheet is the final operation of accounting and tax accounting for the current year.

In 1C programs this procedure is automated. However, to reveal its essence, it is necessary to familiarize yourself with the procedure for reflecting information on the formation of financial results and calculations of income tax using PBU 18/02 during the reporting year. Consultants cover these issues. First, let's remember what transactions were reflected in accounting and reporting when making income tax calculations. When reflecting in accounting and financial statements calculations of income tax based on the results of the first quarter, half a year, nine months, year, the organization carries out actions recorded by the following changes in accounts (the digital code and names of accounts are given in accordance with the standard setting of the Chart of Accounts in the programs " 1C"):

Debit 90.9 “Profit/loss from sales” Credit 99.1 “Profits and losses” - financial result of the current period (profit received); Debit 91.9 “Balance of other income and expenses” Credit 99.1 “Profits and losses” - financial result of the current period (loss received); Debit 99.1 “Profits and losses” Credit 90.9 “Profit/loss from sales” Debit 99.1 “Profits and losses” Credit 91.9 “Balance of other income and expenses” - monthly advance payments for income tax; Debit 68.4.1 “Calculations with the budget” Credit 51 “Current account” - conditional income tax expense calculated according to accounting data (profit received); Debit 99.2.1 “Conditional income tax expense” Credit 68.4.2 “Calculation of income tax” - conditional income for income tax, calculated according to accounting data (loss received); Debit 68.4.2 “Calculation of income tax” Credit 99.2.2 “Conditional income for income tax” - permanent tax assets based on transactions made during the reporting period with positive permanent differences; Debit 99.2.3 “Permanent tax assets and liabilities” Credit 68.4.2 “Calculation of income tax” - permanent tax liabilities based on transactions made during the reporting period with negative permanent differences; Debit 68.4.2 “Calculation of income tax” Credit 99.2.3 “Permanent tax assets and liabilities” - deferred tax assets based on transactions made during the reporting period with deductible temporary differences when accrued; Debit 09 “Deferred tax assets” Credit 68.4.2 “Calculation of income tax” - upon repayment; Debit 68.4.2 “Calculation of income tax” Credit 09 “Deferred tax assets” - when written off; Debit 99.1 “Profits and losses” Credit 09 “Deferred tax assets” - deferred tax liabilities based on transactions made during the reporting period, with taxable temporary differences when accrued; Debit 68.4.2 “Calculation of income tax” Credit 77 “Deferred tax liabilities” - upon repayment; Debit 77 “Deferred tax liabilities” Credit 68.4.2 “Calculation of income tax” - when written off; Debit 77 “Deferred tax liabilities” Credit 99.1 “Profits and losses”.

Deferred tax assets and liabilities are written off upon disposal of the assets (liabilities) with which they were associated.

When moving from one reporting period to another, the amounts of the above indicators change. And for each reporting period, their value is either accrued anew (the amount accrued based on the results of the previous period is reversed in full), or adjusted by additional accrual or reversal of a part of the amount, determined as the difference between the values of the indicators accrued based on the results of the reporting and previous periods. As a result of adjusting the conditional income tax expense (income) by reflecting permanent and deferred tax assets and liabilities in the balance sheet, the credit balance of account 68.4.2 “Calculation of income tax” acquires a value equal to the amount of tax calculated from the actual profit of the reporting period , formed in tax accounting registers. This amount is determined in the income tax return and serves as the basis for calculating advance income tax payments transferred to the budget. Thus, the annual indicators of current income tax, deferred tax assets and liabilities are formed in stages (on an accrual basis from the beginning of the year).

As of December 31, the accounting records will include:

A) On the balance sheet

- on line 145 - the balance of deferred tax assets.

Account debit 09

- on line 240 - the composition of short-term receivables will also include an overpayment to the budget for income tax;

- on line 470 - the financial result obtained by calculation for the period from the beginning of the year will be included in retained earnings;

- on line 515 - the balance of deferred tax liabilities.

Account credit 77

- on line 624 - the debt on taxes and fees will be included, including the debt to the budget for income tax.

B) In the income statement

- on line 140 - profit (loss) before tax, total;

- on line 141 - deferred tax assets;

- on line 142 - deferred tax liabilities;

- on line 150 - current income tax;

- on additional line 151 - written off deferred tax assets and liabilities that change the net profit indicator;

- on line 190 - the amount of the financial result on an accrual basis from the beginning of the reporting year, obtained by calculation (net profit, loss);

- line 200 for reference - permanent tax assets and liabilities.

The state of settlements with the budget at the end of the reporting year is determined as the balance in account 68.4 “Income Tax”. Moreover, in the debit of account 68.4.1 “Settlements with the budget” and the credit of account 68.4.2 “Calculation of income tax” in accounting during the reporting year, the amounts transferred to the budget and accrued income tax are separately accumulated.

Balance sheet reformation occurs in 1C programs when posting the “Month Closing” document dated December 31. In this document, you must check the confirmation box in the “balance sheet reform” position.

To generate operations for closing the month of December, and, consequently, the current year, you must perform the following steps sequentially.

Rice. 1. Closing the month

At this stage, the financial result of the reporting year (profit or loss) is determined, written off from the debit (credit) of accounts 90.9 and 91.9 to the credit (debit) of account 99.1 “Profits and losses”.

2. Post the document (menu “Tax Accounting”) “Routine Operations for Tax Accounting” dated December 31 of the reporting year with all the boxes checked except the last one (Fig. 2).

Rice. 2. Closing the month for tax accounts

After carrying out this document, permanent and temporary differences can be identified between the tax base for income tax and the accounting financial result.

3. Post another document “Month Closing” dated December 31 of the reporting year, checking the boxes only in the positions corresponding to operations according to PBU 18/02 (Fig. 3).

Rice. 3. Closing the month (application of PBU 18/02)

When applying PBU 18/02, deferred and permanent tax assets and liabilities are recognized, repaid and written off, due to which the current income tax formed on the credit of subaccount 68.4.2 acquires a value equal to that calculated in the Income Tax Declaration, that is, in tax accounting .

The above sequence of actions corresponds to a monthly month-end closing operation during the reporting year.

Next, we move directly to the process of reforming the balance sheet and closing the current tax period.

4. Post another “Month Closing” document dated December 31 of the reporting year, checking only one checkbox for the “Balance Sheet Reformation” operation (Fig. 4).

Rice. 4. Balance reform

5. Carry out the second document “Routine operations for tax accounting” dated December 31 of the reporting year, also checking only one box for the operation “Closing tax accounting accounts” (Fig. 5).

Rice. 5. Closing tax accounts

Currently, some experts also include the closing of income tax accounts 68.4.1 “Calculation with the budget” and 68.4.2 “Calculation of income tax” in the process of balance sheet reformation. This operation is carried out manually. To do this, you need to post the document “Accounting certificate” (menu Journals, General documents).

Thus, we entered the last transaction into the journal of business transactions for the reporting year. The balance has been reformed. Tax accounts are closed. Accounting for profits and losses and income taxes will begin in the new year from the beginning, “from scratch.”

Now let’s look at what transactions will be generated by 1C: Accounting automatically when posting the above documents.

1. The amounts of advance payments for income tax made during the year are counted against the payment of current income tax:

Debit 68.4.2 “Calculation of income tax” Credit 68.4.1 “Calculations with the budget.”

According to the recommendations of a number of experts, when reforming the balance sheet, it is also advisable to write off balances from subaccounts 68.4.1 and 68.4.2.

Depending on the decision made by the organization to close the sub-accounts noted above, the following actions can be performed.

2. The amount of overpayment of income tax can be transferred from the debit of subaccount 68.4.1 to a specially created subaccount of account 68 “overpayment of income tax for previous periods” or included in deferred tax assets:

Debit 09 “Deferred tax assets” (overpayment of tax) Credit 68.4.1 “Calculations with the budget.”

3. The resulting income tax debt is transferred from the credit of account 68.4.2 to the credit of a specially created subaccount of account 68 “Debt to the budget for income tax.”

4. The balance on the subaccounts of account 90 is written off from the credit (debit) of subaccounts 1 to 8 to the credit (debit) of account 90.9 “Profit, loss from sales.”

How these transactions are reflected in the program, see Figure 6.

Rice. 6. Posting the balance sheet reformation.

7. The balance formed on account 99.1 “Profits and losses”, namely the net profit (loss) of the reporting year, is transferred to account 84 “Retained earnings (uncovered loss)”:

Debit 99.1 Credit 84 - profit made; Debit 84 Credit 99.1 - loss received.

As a result, at the beginning of the new reporting year, subaccounts 68.4.1, 68.4.2, as well as accounts 90, 91, 99 do not have a balance.

At the end of the tax period, the 1C program also closes tax accounts - analogues of accounting accounts in tax accounting.

If an organization receives a loss, then a special procedure for accounting for it, defined by the Tax Code of the Russian Federation, comes into force.

As a general rule, losses are carried forward to the future. That is, the tax base of the current period will not be reduced by the amount of this loss, it will reduce the tax base over the next ten years. And according to the rules of PBU 18/02, a future decrease in the tax base for profit tax and, accordingly, the profit tax itself leads to the formation of a tax asset of the organization (clauses 11, 14 of PBU 18/02).

Let's look at the example of tax accounting for losses.

Example

According to accounting data, a loss was received (-100,000 rubles).

If in the reporting (tax) period an organization incurred a loss, the tax base for profit tax in tax accounting in this period is recognized as equal to zero (clause 8 of Article 274 of the Tax Code of the Russian Federation). Thus, in accounting, a positive difference arises between the tax base for income tax and the accounting loss, in our example it is 100,000 rubles.

In tax accounting, the amount of loss is carried forward and reduces the tax base of subsequent reporting (tax) periods by no more than 30%.

In accounting, this operation will not lead to a change in financial results in the future, and, therefore, according to paragraph 11 of PBU 18/02, it will be recognized as a deductible temporary difference (RUB 100,000). Paragraph 14 of PBU 18/02 determines that in the reporting period when deductible temporary differences arise, the organization recognizes a deferred tax asset in its accounting. This is the amount of income tax that should lead to a reduction in income tax accrued and payable to the budget in subsequent reporting periods.

Deferred tax assets are reflected in accounting as non-current assets (subclauses 17, 23 of PBU 18/02).

In our example, a loss of 100,000 rubles. — deductible temporary difference.

Debit 68.4.2 Credit 99.2.2 - 24,000 rubles (100,000 rubles x 24%) - reflects conditional income for income tax in accordance with paragraph 20 of PBU 18/02; Debit 09 Credit 68.4.2 - 24,000 rub. (RUB 100,000 x 24%) - a deferred tax asset is reflected.

The balance in account 68.4.2 “Calculation of current income tax” according to accounting data will be equal to zero (24,000 rubles - 24,000 rubles = 0). This corresponds to the amount of income tax reflected in the income tax return, that is, in tax accounting.

As income is received in subsequent reporting (tax) periods, the temporary difference will be repaid. The deferred tax asset will be written off using the following transaction:

Debit 68.4.2. Credit 09 - for the full amount or part of it (subject to receiving sufficient income for no more than 10 years, in an amount of no more than 30% of the tax base of the corresponding year).

If within 10 years the organization has not received income sufficient to write off the deferred tax asset in full, then its remaining part is written off to account 99.1 “Profits and losses”. Thus, the balance on the debit of account 09 ceases to be recorded.

The situation described above is reflected in the Profit and Loss Statement as follows:

- On line 140 - Profit (loss) before tax - (100,000);

- On line 150 - Current income tax - 0.

Including:

- On line 151 - Conditional income - (24,000);

- On line 154 - Deferred tax asset - 24,000.

The company's production and economic activities are subject to thorough analysis, and all operations performed are recorded in accounting accounts, incl. calculation and payment of taxes. Article 12 of the Tax Code of the Russian Federation establishes several level categories of taxes that determine the corresponding budgets: federal, regional, local. Let's understand the features of accounting.

Correspondence with other accounts

68 account is credited for the amounts indicated in tax returns. Calculations in correspondence are also taken into account here:

- 70 - amounts for personal income tax;

- 99 - accrued income tax;

- 51- receipt of overpaid fees from the budget;

- 20, 26,25,44 - local taxes.

Account 68, in turn, corresponds with the following accounts:

- 50 - cash register;

- 51 - current account;

- 52 - foreign currency account;

- 19 — value added tax;

- 10 - materials;

- 20 - main production, 21 - auxiliary;

- 41 - goods;

- 26 - general expenses on the economic line;

- 90 - sales.

Drawing up declarations

Accounting for settlements with the budget

State social assistance from the budgets of the constituent entities of the Russian Federation

(Chapter 3 of the Law on Social Assistance). Recipients of state social assistance can be (Article 7): low-income families, low-income single citizens and other categories of citizens provided for by the Law on Social Assistance, who, for reasons beyond their control, have an average per capita income below... (Legal support for social work)

System of intra-company budgets

Budgeting by structure and type of business involves substantiating the technology for developing intra-company budgets. An enterprise's budget is a planning document that determines the sources and directions of use of funds for items adopted for the enterprise as a whole in accordance with the accounting policies... (Enterprise planning)

The procedure for calculating VAT payable to the budget

When performing transactions subject to VAT, taxpayers are required to calculate the amount of tax (Clause 1, Article 166 of the Tax Code of the Russian Federation). The calculation of the amount of tax to be paid to the budget is shown schematically in Fig. 1.2. Rice. 1.2. Scheme for calculating the amount of VAT payable to the budget Also calculating the amount of tax payable to the budget... (Taxation of commercial activities)

VAT refund from the budget. Application procedure for tax refund

If the amount of tax deductions exceeds the calculated amount of VAT (clause 2 of Article 173 of the Tax Code of the Russian Federation), tax legislation provides for a tax refund procedure, and only that part of the “input” tax that exceeds the amount of calculated VAT and is not covered by it is subject to reimbursement. Reimbursement… (Taxation of commercial activities)

Tax period and deadlines for paying taxes to the budget

The tax period is the period based on the results of which the tax base must be determined and the amount of tax payable to the budget must be calculated (Clause 1 of Article 55 of the Tax Code of the Russian Federation). For all taxpayers (including taxpayers acting as tax agents) a single tax period is established... (Taxation of commercial activities)

Calculation and payment of tax to the budget when carrying out transactions under agreements providing for special conditions

Simple partnership agreement In the practical activities of an organization, it may be necessary to join forces with another “partner” or group of “partners” to implement a joint project, without creating a legal entity specifically for this purpose. In… (Taxation of commercial activities)

The procedure for calculating and paying taxes to the budget

Excise tax payers Excise tax payers are recognized as: o persons producing, including those from customer-supplied raw materials (it should be borne in mind that tax legislation equates the bottling of excisable goods, as well as any types of mixing of goods in places of their storage, with the production of goods... (Taxation of commercial activities)

Concept, role and legal form of state and local (municipal) budgets

State and local (municipal) budgets are the central link in the financial system of the Russian Federation. In the material aspect, the state, like the local, budget is a centralized, on the scale of a certain state or municipal entity, monetary fund... (Financial law)

Budget drafting stage

This stage begins with the Address of the President of the Russian Federation to the Federal Assembly, which, in accordance with the norms of the Budget Code of the Russian Federation, must be received by the Federal Assembly no later than March of the year preceding the next financial year. Drawing up draft budgets is the exclusive prerogative of the Government of the Russian Federation, the highest... (Financial law)

Budget review and approval stage

In paragraph 1 of Art. 192 of the Budget Code of the Russian Federation stipulates that the draft federal law “On the Federal Budget” for the next financial year and planning period is submitted to the State Duma of the Russian Federation no later than October 1 of the current year. If it is necessary to make changes and additions to tax legislation, the Government... (Financial Law)

In accordance with clause 14 of PBU 18/02 “Accounting for calculations of corporate income tax”, a deferred tax asset (DTA) is that part of the deferred income tax that should lead to a reduction in income tax payable to the budget in the next during the reporting period or in subsequent reporting periods. It is the product of the deductible temporary difference and the income tax rate (CINP). The deferred tax asset is reflected in account 09.

Deferred tax liability (DTL), in turn, is that part of the deferred income tax that increases the income tax payable to the budget in the next reporting period or in subsequent reporting periods. Equals the product of the taxable temporary difference and the income tax rate. Reflected on the score 77.