Accounting account 62 is a special analytical account that is used to reflect the supplier’s transactions with the buyer and customer. This article will give you an idea of the main transactions on account 62, which is reflected in the debit and credit of account 62, as well as the documents that are the basis for their implementation.

Account 62 - can reflect both our debt to the buyer (credit) and the buyer's debt (debit). Therefore, this account is considered active-passive - it can be included in the balance sheet as a Liability or an Asset.

Under loan 62, the account receives funds from, as well as prepayment amounts for goods and services. In this case, payments for services rendered and advances are taken into account in different subaccounts:

- Invoice – payment received in accordance with the general procedure;

- Check - .

In addition, there is a sub-account for separate accounting of bills received (). If the supplier receives a bill of exchange from the buyer providing for the payment of interest, the amount of interest is reflected at. Repayment of the principal amount of the debt is reflected by posting Dt (for foreign currency accounts Dt) and Kt 62.

For the convenience of the accountant, analytics for account 62 are carried out in the context of each invoice sent to the buyer, as well as separately for each counterparty and agreement with him. In addition, operations can be classified according to the following criteria:

- payment method (availability of advance payment or payment upon shipment, provision of services);

- payment deadline (payment is overdue or not due);

- availability (the bill has been accounted for in the bank, its maturity has not come or payment on the bill is overdue).

The accountant has the right to independently choose the criteria on which the analytical accounting of account 62 at the enterprise will be based.

Main entries for account 62

The main operations on account 62 are the reflection of settlements with customers in the general manner, based on the prepayment received, as well as in the presence of a bill of exchange. Let's look at each of these cases with an example.

Reflection of settlements with customers in the general manner

Let’s say that an agreement was concluded between Faktotum LLC and Vestra LLC for the supply of goods and materials in the amount of 34,000 rubles, VAT 5186 rubles. Product cost 000 rub. The contract stipulates that the buyer, Vestra LLC, pays for goods and materials after shipment.

This operation in the accounting of Faktotum LLC will look like this:

Using account 62 to account for advances received

Let's look at an example:

Hyper LLC is a supplier of office supplies. The organization entered into an agreement with Gamma LLC for the amount of 36,000 rubles, VAT 5,492 rubles. The contract provides for prepayment.

In this case, the accountant of OO "Hyper" will make the following entries in accounting:

| Dt | CT | Description | Sum | Document |

| 62/2 | An advance payment was received from Gamma LLC under the supply agreement | 36,000 rub. | Bank statement | |

| 76 Advances received | 68 VAT | VAT charged on advance payment 18% | 5492 rub. | Bank statement |

| 68 VAT | 76 Advances received | VAT 18% accrued on advance payment has been restored | 5492 rub. | |

| 62/1 | 90/1 | Reflected revenue from the supply of stationery | 36,000 rub. | Packing list |

| 62/2 | 62/1 | The advance received from Gamma LLC is credited | 36,000 rub. | Bank statement, delivery note |

| 90/3 | 68 VAT | VAT charged at 18% for transfer to the budget | 5492 rub. | Bank statement, delivery note |

Postings to account 62 “Bills received”

If the buyer does not agree to make an advance payment, and also does not have the opportunity to pay for the goods upon shipment, then in this case the supplier receives a bill of exchange from the customer, which acts as security for the receivables.

Let’s imagine that Nova LLC is the supplier, and Antika LLC is the buyer under a furniture supply agreement. Contract amount 114,000 rubles, VAT 17,390 rubles. As security for the debt, Antika LLC issues a promissory note to Nova LLC.

Nova LLC will record the following transactions:

Analytical accounting of account 62, organized taking into account all the necessary criteria, will ensure accurate and transparent maintenance of account 62.

In this article we will look at how relationships with customers are taken into account in accounting. Which account is used to record customers, what postings are made. Transactions during a regular sale, upon receipt of an advance from a buyer or a bill of exchange are considered.

To account for settlements with buyers, account 62 “Settlements with buyers” is used, the debit of which reflects the buyer’s debt to the seller, and the credit reflects payment for goods, work, and services.

Buyers can pay the seller either after receiving the goods, or by making an advance payment, that is, by transferring the advance to the seller’s bank account. Payment by the buyer for the goods is made on the basis of an issued invoice, a sample of which can be viewed.

Receipt of cash to the current account

The company’s revenue is not always transferred immediately to its current account. In some cases, it arrives at the company's cash desk in the form of cash. In this case, the wiring will be as follows:

| Business transaction | D | TO |

| Product sales | 62 | 90.1 "Revenue" |

| VAT calculation | 90.3 | 68 |

| Receipt of payment for products (work, services) to the company's cash desk | 50 | 62 |

| Cash delivery to the bank | 51 | 50 |

50 account “Cash” is used to reflect information about the availability of funds in the company’s cash registers and their movement. If, by law, a company is not exempt from operating cash register systems, then in the case of cash payments, it must use an online cash register (Law 54-FZ), which must be registered with the Federal Tax Service.

Important! You should remember about the cash limit at the cash register. If the cash limit is exceeded, the money in excess of the limit must be deposited with the bank. The company calculates the cash limit independently.

You should also remember that there is also a cash payment limit for payments between legal entities and individual entrepreneurs. This limit is set at 100 rubles. A limit is provided for cash payments for legal entities within one agreement in the amount of 100,000 rubles. When the contract amount exceeds the specified value, the balance should be paid by bank transfer, by transferring to the company's bank account. If a company enters into an agreement with an individual, then this restriction may not be observed. For clarity, we present the principles of cash payments, in which a limit of 100 thousand rubles applies and not:

| There is a limit of 100,000 rubles | The limit of 100,000 rubles does not apply |

| If settlements occur between legal entities If payments are made between legal entities and individual entrepreneurs If payments are made between individual entrepreneurs | If payments are made between individual entrepreneurs If payments are made between an individual entrepreneur and an individual If payments are made between a legal entity and an individual |

When concluding a transaction in foreign currency, its amount at the exchange rate of the Central Bank of the Russian Federation on the settlement date should not exceed 100 thousand rubles. Exceptions are cases in which cash payments between legal entities (and/or entrepreneurs) in excess of the established limit are allowed:

- Several contracts, even if they are concluded on the same day, together may exceed the specified limit, however, each individual contract should not exceed the limit.

- Under an agreement with a larger amount, payment can be made, but no more than 100 thousand rubles must be paid in cash, and the remaining funds must be transferred by bank transfer.

- For his own needs, an entrepreneur can take money from the cash register in any quantity without observing limits. Moreover, this is not formalized in a separate agreement, but exclusively in a cash receipt order.

Accounting for settlements with customers during sales

Revenue from the sale of goods (work, services) is recognized as income from an ordinary type of activity and is reflected in the credit of account 90 “Sales”.

If the sale is one-time and is not a regular activity of the enterprise (for example, the sale of a fixed asset), then the proceeds are reflected as part of other income under the credit of account 91 “Other income and expenses”.

These two accounts 90 and 91 will be discussed in detail a little later; they are interesting and unlike other accounts, they have their own characteristics. It is necessary to calculate VAT on the sale price of goods (works, services) and send it for payment.

Postings to account 62 during normal sales:

| Debit | Credit | Operation name |

| Revenue from the sale of goods (works, services) is reflected | ||

| VAT accrued on goods sold (work, services) | ||

| Revenue from the sale of fixed assets, intangible assets, materials is reflected | ||

| VAT accrued on sold assets | ||

| Payment received from buyer |

Product arrival May 15

On May 15, 6 computers and 1 printer arrived at the warehouse from the supplier Romashka LLC. To reflect this operation, go to the “Purchases and Sales” section and select “Receipt of goods and services” in the left panel:

Click the “Receipt” button on the toolbar and select “Products” from the drop-down list. Fill out the document form as follows (click to enlarge):

Click the “Post and Close” button and open the document transactions again ( DtKt ):

You can safely skip the first posting (closing the advance on subaccount 60.02) and go straight to the remaining two. They correspond to the entries in the “Operations Journal” notebook:

| 05.15.2014 Dt 41 (Computer 6 pcs.) Kt 60 (Chamomile) 9000 rubles [6 computers arrived at the warehouse] 05.15.2014 Dt 41 (Printer 1 pcs.) Kt 60 (Chamomile) 1000 rubles [1 printer arrived at the warehouse] |

Accounting for advances received in settlements with customers

If the buyer pays for the goods in advance and makes an advance payment, then to account for settlements with buyers, in this case, subaccount 2 “advance received” is opened on account 62, while subaccount 1 will reflect settlements with buyers in the general case.

Postings for accounting for advances received (account 62)

| Debit | Credit | Operation name |

| 62. Advance received | An advance was received from the buyer to the bank account | |

| 76.VAT on advances received | VAT is charged on the advance received | |

| Revenue from sales of goods is reflected | ||

| VAT accrued on goods sold | ||

| 62. Advance received | Offset of advance against debt repayment | |

| 76.VAT on advances received | Accepted for deduction of VAT in connection with the sale of goods paid in advance |

Methods for receiving funds to the organization’s current account

Funds can be transferred to the company’s current account in one of the provided ways, among which are the following:

- transfer from a current account to another organization or individual entrepreneur;

- in cash from the cash desk of another organization or individual entrepreneur;

- through the terminal from other companies and individuals;

- via bank cards;

- from the budget and extra-budgetary funds.

The following can be identified as supporting documents for non-cash payments: payment orders, demands and orders, letters of credit, collection orders, and checks.

An example of accounting for settlements with buyers and customers. Postings

In fact, account 62 “Settlements with buyers” reflects the buyer’s debt to the seller, that is, accounts receivable. Postings to account 62 are made at the time the sale is made, that is, at the time.

Thus, account 62 reflects settlements with customers and 3 sub-accounts can be opened on it:

- subaccount 1 – to reflect settlements for regular sales;

- subaccount 2 – to account for the advance received;

- subaccount 3 – for accounting for bills received.

In the next article we will look at how to carry out accounting of accounts payable: ““.

Receipt of foreign currency earnings to the current account

As noted above, the presence of foreign currency in foreign currency accounts and its movement through the account is reflected in account 52 “Currency accounts”. Foreign exchange earnings can be received in one of the following ways:

- by purchasing it from a bank;

- in case of sale of goods (provision of services, performance of work).

The purchase of foreign currency occurs with the simultaneous execution of a payment document. The form of this document contains the necessary information and the code of the currency transaction. If the date of receipt of proceeds in foreign currency to the current account does not coincide with the issuance of the settlement document, then this should be reflected in account 57 “Transfers in transit”. Currency is credited to the current account at the official rate established on the date of enrollment. In accounting, an entry is made both in the currency of the calculations made (that is, in rubles) and in the currency of payment.

Video lesson “Settlements with buyers and customers. Count 62"

In this video lesson, accounting account 62 “Settlements with buyers and customers” is discussed, standard transactions and examples are discussed. The lesson is taught by chief accountant N.V. Gandeva. (teacher, expert of the site “Accounting for Dummies”). Click to watch video ⇓

According to Art. 487 of the Civil Code of the Russian Federation, an advance payment is a full or partial payment for goods/services before the actual shipment by the seller. Prepayment is accounted for in special accounting subaccounts and is not the income of the supplier using the accrual method until the organization fulfills its obligations. Let's consider the nuances of reflecting an advance payment as a business transaction, and provide the main entries for advances issued and received.

Note! The legal status of the advance payment is fixed in the terms of the contract, the regulatory regulation of counter-fulfillment of obligations is carried out in accordance with Art. 328 Civil Code.

Advances received – postings

Accounting for advances received from buyers as payment for goods before their shipment is kept on the account. 62.2 “Advances received.” Prepayments for products are also reflected here if the seller, for various reasons, violates the sales deadlines. Regular settlements are carried out in subaccount 62.1.

Example

Let’s assume that the supplier company “Spectrum” and the buyer “Titul” entered into an agreement for the shipment of electrical equipment for a total amount of 708,000 rubles, including VAT 18% - 108,000 rubles. According to the terms of the transaction, payment is made with 100% prepayment, which was received into the Spectrum account on December 5, and the shipment was completed on December 8. The Spectra accountant will reflect the transactions as follows:

- 5.12 – advance payment received from the buyer, posting D 51 K 62.2 for 708,000.

- 5.12 – VAT charged D 76.AV K 68.2 on 108,000.

- 8.12 – equipment D 62.1 K 90.1 was delivered for 708,000.

- 8.12 – VAT allocated D 90.3 K 68.2 for 108,000.

- 8.12 - advance payment credited, posting D 62.2 K 62.1 for 708,000.

- 8.12 – VAT restored D 68.2 K 76.AB for 108,000.

Conclusion - when receiving advances, transactions regarding the calculation of VAT for payment are carried out 2 times: at the time the money is received in the current account and directly upon sale. Then, after shipment, the advance payment is counted and the amount of VAT from it is restored through reverse posting.

Receipt of revenue through a terminal or card

When revenue is transferred to the account through a terminal or bank card, the companies use account 57 “Transfers in transit.” This account allows you to summarize information about the movement of funds in transit, that is, those that have not yet been credited to the organization’s current account.

The postings in this case will be as follows:

| Business transaction | D | TO |

| Sales of products (services, works) | 62 | 90.1 "Revenue" |

| VAT calculation | 90.3 | 68 |

| Payment for products (services, work) through a terminal or by bank card | 57 | 62 |

| Crediting proceeds to the current account | 51 | 57 |

| Bank commission accounting | 91 | 57 |

The banking company is accounted for in 91 accounts, which are called “Other income and expenses.” It is intended to summarize data on the company's other income and expenses, excluding extraordinary ones.

Advances issued – postings

Advances transferred to the company's supplier counterparties are taken into account in the account. 60.2 “advances issued”, normal operations are carried out on subaccount 60.1. In situations where the amounts of prepayments turn out to be greater than the sales amounts, the difference remains with the supplier as payment for planned deliveries or is returned at the request of the buyer to the specified details.

Example

Let’s assume that Dorstroy LLC purchases materials for production from RPK LLC. On November 25, Dorstroy transferred an advance payment in the amount of 354,000 rubles, and the goods and materials were received at the warehouse in full on December 2. The Dorstroy accountant should reflect these transactions in the following order:

- 25.11. – advance payment is transferred to the supplier – posting D 60.2 K 51 for 354,000.

- 25.11 – VAT is accepted for reimbursement in the presence of an advance invoice from “RPK” D 68.2 K 76.AB for 54,000.

- 2.12 – materials received D 10.1 K 60.1 for 300,000.

- 2.12 – VAT allocated D 19.3 K 60.1 for 54,000.

- 2.12 – the advance was offset, posting D 60.1 K 60.2 for 354,000.

- 2.12 – previously refunded VAT D 76.AV K 68.2 was accrued for 54,000.

- 2.12 – VAT offset was completed upon completion of the transaction D 68.2 K 19.3 for 54,000.

When accounting for VAT on prepayments issued, you should keep in mind that the tax can be reimbursed without waiting for the goods to be shipped. The justificatory grounds are listed in Art. 172 clause 9. These are the following documents:

- Advance invoice submitted by the supplier.

- A document confirming payment of the advance payment.

- An agreement specifying the terms of the advance payment.

Attention! When an advance is issued to the supplier (the posting is given above), the invoice is issued for the amount of the advance payment, and upon shipment - for the sales amount. At the same time, it is legally possible to restore VAT even in the event of complete termination of a transaction for which an advance payment with VAT was previously transferred.

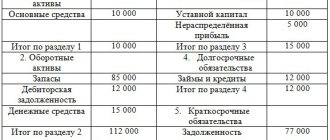

/ postings

It can be seen that the source of our asset (money in the bank) is the authorized capital. In fact, the postings here are different (through account 75), but we are not studying the postings here, but an asset with a liability - it’s simpler. Then we receive an advance payment from the buyer for the goods. 51 kr. 62.2 118000 (this amount includes VAT 18000) as a result, we have in the bank (debit account 51) 128000 (asset!): 10000 from the authorized capital (credit account 80), 118000 - from the debt to the buyer (credit account 62.2). Balance again! From this prepayment we must charge VAT on the advance payment: db. 76.AV cr. 68.2 18000 in the debit of account 68.2 - 18000 - we have to pay the tax - a liability, but we will offset this tax later - therefore this amount is taken into account in a special account 76.AB - an asset! (In general, VAT clutters the perception of very novice accountants - I know from myself) Then we receive the goods from the supplier (without prepayment - the supplier trusts us): db. 41 kr. Hello, can you check the wiring? Help me solve the problem! You need to: 1) Open accounting accounts using balance sheet data. 2) Enter correspondence with accounts Tatyana, no one will do such tasks for thanks. You need to spend 1-2 hours of time on this. Postings: Received from the supplier materials - D-t 10 K-t 60-35 Transferred from suppliers D-t 60 K-t 51 -94 Tools purchased through Ivanov D-t 10 K -t 71-90 The balance of funds from Ivanov was accepted to the cash register D-t 50 K-t 71-20 The invoice for materials received at the warehouse was accepted D-t 10 K-t 60-39 Registered by email. light bulbs purchased by Petrov D-t 10 K-t 71-15 Reimbursed for overexpenditure from the cash register D-t 71 K-t 50-5 Transferred to the enterprise with a settlement D-t 60 K-t 51-35 Issued to subdepartment Sidorov D-t 71 K- t 50-10 Repaid to the budget Dt 68 Kt 51-20. If you want to do everything, send it.

Advance reports - accounting entries

In addition to settlements with counterparties - buyers and suppliers, the company regularly issues funds to its employees. How to correctly make accounting entries for expense reports? And is it true that the amount from the advance report is deducted from profit? Let's look at a specific example.

Example of settlements with accountable persons regarding advances issued:

The Pit Stop enterprise reported to employee E.I. Kovalev. for a business trip 8,000 rubles. Kovalev spent 5,400 rubles, and unused funds amounted to 2,600 rubles. returned to the cashier. The accountant will need to do the following:

- An advance was issued for travel expenses - posting D 71 K 50 for 8000.

- The balance of unspent money was returned - posting D 50 K 71 for 2600.

The accountable person is obliged to report on the expenditure of funds within 3 days after the end of the issuance period, and in the case of being on a business trip - after the employee returns. Specific deadlines are set by the head of the organization. If an employee, without good reason, has spent more than the allocated funds and is unable to account for them, the excess is withheld from his income. Buh. The entries for expense reports in this situation look like this:

- The amount not returned on time is reflected - D 94 K 71.

- The shortfall from the employee’s earnings is withheld - D 70 K 94, but not more than 20% monthly.

Reflection of leasing advances

Regulatory regulation of leasing transactions is regulated by Law No. 164-FZ of October 29, 1998. All payments made before the fulfillment of the lessor's obligations are considered an advance payment. It is recommended to make an advance payment under a leasing agreement, postings according to which are carried out in accordance with the Chart of Accounts No. 94n, to the account. 76 with the creation of a separate sub-account.

Postings for accounting for advances received (account 62.2)

If the buyer pays for the goods in advance and transfers an advance, then to account for settlements with buyers, in this case, subaccount 2 “advance received” is opened on account 62.

VAT is charged on advances received.

The accrued amount of VAT on the advance received is restored, then an entry is made to offset the advance.

| Reflects revenue from the sale of fixed assets, intangible assets, materials (not core activities) |

| VAT accrued on sold assets (not main activity) |

| Payment received from buyer to bank account |

| Debit | Credit | Operation name |

| 62.2 Advance received | An advance was received from the buyer to the bank account | |

| 76.VAT on advances received | VAT is charged on the advance received | |

| Revenue from sales of goods is reflected | ||

| VAT accrued on goods sold | ||

| 62.2 Advance received | Offset of advance against debt repayment | |

| Accepted for deduction of VAT in connection with the sale of goods paid in advance |

Example 1. Reflection of settlements with customers in the general manner

Kalina LLC entered into an agreement with the buyer for the supply of goods and materials in the amount of 50,000 rubles, VAT 7,627 rubles. The cost of the goods is 23,000 rubles. The contract stipulates that the buyer pays for goods and materials after shipment.

Postings:

| Description | Sum | Document |

| Reflected revenue from the sale of inventory items | Packing list | |

| The cost of inventory items is written off | Costing | |

| VAT charged 18% | Packing list | |

| Payment has been received from the buyer for the shipped goods | Bank statement | |

| Profit from the supply of goods and materials is reflected (50,000 - 23,000 - 7,627) | Bill of lading, costing |

Example 2. Accounting for advances received on account 62

Kalina LLC entered into an agreement with the buyer for the amount of 60,000 rubles, VAT 9,153 rubles. The contract provides for prepayment.

Postings:

| Description | Sum | Document |

| An advance payment was received from the buyer LLC under the supply agreement | Bank statement | |

| VAT charged on advance payment 18% | Bank statement | |

| 76 Advances received | VAT 18% accrued on advance payment has been restored | |

| Reflected revenue from the supply of stationery | Packing list | |

| The advance received from the buyer is credited | Bank statement, delivery note | |

| VAT charged at 18% for transfer to the budget | Bank statement, delivery note |

Example 3

on account 62 “Accounting for settlements with buyers and customers”

Kalina LLC received an advance payment from the buyer for the shipment of goods in the amount of 250,000 rubles. A week later, Kalina LLC shipped another part of the goods worth 47,200 rubles. (including VAT RUB 7,200)

Postings:

| Debit | Credit | Sum |

| An advance has been deposited into the bank account | ||

| VAT charged on advance payment | ||

| Sales of goods | ||

| VAT restored | ||

| 62.2 Advances | VAT restored | |

| 62.2 Advances | Closing the advance |

Example 4

Kalina LLC sold the goods through an online store. The organization entered into an agreement with the bank, on the basis of which the remuneration is 1.5% of the receipt amount and the amount of proceeds minus the remuneration is transferred to the current account.

The buyer paid for the goods with a bank card in the amount of RUB 50,000.00, incl. VAT 18% - RUB 7,627.12. After receiving the money, Kalina LLC ships the paid goods to the buyer.

Postings:

| Debit Account | Credit Account | Transaction amount, rub. |

| The buyer made an advance payment by bank card | ||

| We charge VAT on the advance received | ||

| Receipt of proceeds to the current account | ||

| Bank remuneration under the agreement | ||

| Accounting for sales revenue | ||

| VAT accrual on shipment | ||

| Write-off of shipped goods | ||

| Settlement of advance received | ||

| VAT deduction on advance received |

Example 5.

Buyer using Yandex. Wallet" paid for goods in the amount of RUB 95,000.00, incl. VAT 18% - RUB 14,491.53.

The money was first credited to the seller’s “electronic wallet” and then transferred to a bank account minus a commission.

The bank's commission is 3.5% of the transfer amount - RUB 3,325.00.

The next day the goods were shipped to the buyer.

Postings:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| Advance received from buyer using electronic money | Register of payments. |

In accounting, an advance is considered to be full or partial prepayment of a concluded transaction. How advances are reflected in accounting, what entries are generated when receiving an advance from a buyer, as well as entries for advances issued, we will consider further.

An advance is often confused with a deposit. Both the advance and the deposit have one function - advance payment for a product or service, partial or full. There is no clear definition in the legislation to separate these concepts, but according to established practice, an advance payment is considered to be the amount of prepayment for the transfer of which a separate agreement to the contract has not been drawn up:

Retail revenue: capitalization, recording, filling out VAT documents

The procedure for recording cash proceeds received using cash register equipment (CCT) is established by the “Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation,” approved. Central Bank of the Russian Federation November 12, 2011 No. 373-P. According to clause 3.3 of the said Regulations, when a legal entity or individual entrepreneur conducts cash transactions using cash register equipment, upon completion of their implementation, based on the control tape removed from the cash register equipment, a cash receipt order 0310001 is issued for the total amount of cash received.

In the accounting of an organization, revenue received using cash register systems is reflected in the following entries:

Debit 50-2 Credit 90-1 – for the amount of cash proceeds;

Debit 57 Credit 90-1 – for the amount of revenue paid by payment cards;

Debit 90-3 Credit 68, subaccount “Calculations with the budget for VAT” - for the amount of VAT on revenue received per day.

The posting of cash at the organization's cash desk on the basis of a cash receipt order is reflected by the following posting:

Debit 50-1 Credit 50-2 – for the amount of revenue received in cash.

A cash receipt order is not issued for the amount of revenue paid with payment cards. The crediting of this revenue to the organization's current account is reflected on the basis of a bank statement:

Debit 51 Credit 57 – for the amount of revenue credited to the current account.

In accordance with paragraph 6 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services) to the population at retail prices (tariffs), the corresponding amount of VAT is included in the indicated prices (tariffs). At the same time, the tax amount is not allocated on product labels and price tags issued by sellers, as well as on checks and other documents issued to the buyer.

According to paragraph 7 of Art. 168 of the Tax Code of the Russian Federation, when selling goods for cash by organizations (enterprises) and individual entrepreneurs in retail trade to the public, the requirements for preparing payment documents and issuing invoices are considered fulfilled if the seller has issued the buyer a cash receipt or other document of the established form.

Thus, when selling goods to the public at retail, it is not necessary to issue invoices. In this case, cash register checks issued to customers replace invoices.

The forms and rules for filling out (maintaining) documents used in calculations of value added tax are approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Decree No. 1137).

According to clause 13 of the Rules for maintaining the sales book (Appendix No. 5 to Resolution No. 1137), the retailer registers the readings of the cash register control tapes in the sales book. This should be done based on the sales results for the day.

According to paragraph 3 of the Rules for maintaining a log of received and issued invoices (Appendix No. 3 to Resolution No. 1137), only invoices issued (compiled) by the seller are recorded in part 1 of the log. In this case, the documents on the basis of which VAT is calculated are attached to the journal in chronological order along with invoices issued (drawn up) and are subject to storage for at least 4 years from the date of the last entry (clause 15 of the Rules for maintaining a log of received and issued invoices - invoices). Since the original document reflecting the readings of the cash register control tapes is attached to the cashier-operator’s report, a certified copy of the specified document can be attached to part 1 of the accounting journal.

Advances issued

An advance payment is an advance payment to the supplier against future deliveries, work performed or services performed. Transferring an advance payment to a supplier does not mean receiving economic benefits, since the supplier may, for various reasons, fail to fulfill its obligations under the contract: fail to ship goods, fail to provide a service. In this case, the advance payment is returned to the buyer’s account if it was transferred through a bank, or to the cashier if received in cash.

In general, there is no obligation to return the deposit from the supplier.

To account for VAT on advances in the chart of accounts, there is a subaccount on account 76, most often its code is 76.AB.

The buyer can accept VAT as a deduction only if the following conditions are met:

Get 267 video lessons on 1C for free:

- Presence of an advance payment clause in the contract;

- Documents confirming the transfer of prepayment;

- The supply of goods (services, etc.) is intended for use in activities subject to VAT;

- Availability of a supplier's SF with a dedicated tax.

The buyer does not have the right to accept VAT as a deduction if all of the above conditions are not met. Acceptance of VAT deduction is not an obligation, but a right of the purchasing organization.

If an organization decides to use VAT deduction from an advance issued, then after the provision of the service and the closing of this advance, it will be obliged to restore this VAT to the budget.

Example

Let's say Altavista LLC transfers an advance in the amount of 23,600 rubles. (including VAT). Then Altavista LLC receives goods worth RUB 23,600 from this supplier.

The rate and amount of incoming VAT are indicated in the supplier's invoice.

Advances issued - postings

Advance to supplier May 15

On May 15, we gave 10,000 rubles from the cash register to the supplier Romashka LLC as an advance payment. To reflect this operation, go to the “Bank and Cash Office” section and select “Cash outgoing orders” in the left panel:

An expense cash order (abbreviated RKO or “consumables”) is the primary document reflecting the issuance of money from the company’s cash desk. Click the create button and fill out the document form as follows (click to enlarge):

Let’s click the “Post and close” button and again we will find ourselves in the “Cash outlay orders” journal. Let’s select our document there and click the “DtKt” button on the toolbar to view the consumable wiring:

The posting also generally corresponds to the one in your “Operations Log” notebook:

| 05/15/2014 Dt 60 (Romashka LLC) Kt 50 10,000 rubles [Money was given from the cash register to the supplier] |

- Amazing! - you are happy.

Advances received

When an organization sells goods, works or services, the buyer can make an advance payment before the moment of sale.

According to the requirements of the Tax Code, the seller is obliged to charge VAT on the advance received. VAT is calculated using the formula:

VAT on the advance received = Sales amount *18/100

Example

Let's consider the previous example from the point of view of the selling organization, that is. VAT is charged on the advance payment at the time of its receipt; the amount of such VAT is reimbursed to the budget at the end of the tax period - quarter.

VAT on sales is accrued at the time of shipment, that is, at the time the sales transaction is created Dt 62 - Kt 90.1

.

Advances received - postings

When receiving an advance from a buyer, the accountant makes the following entries:

Receipt of proceeds to the current account through collection

Funds can be deposited into the current account by a company employee or a collector. Regardless of how the funds arrive at the bank, this operation will look like this:

- First of all, a cash order is issued.

- A corresponding entry is made in the company's cash book.

- After this, an advertisement for a cash contribution is filled out.

If the collector deposits the proceeds into the current account, then:

- The cashier puts the money in a special collector's bag.

- The following documents are drawn up: a delivery note, a delivery note for the bag and a receipt for the bag.

- The sealed amount of money is handed over to the collector.

- The bank teller checks the amount transferred to him with the one indicated in the announcement for cash deposits and issues a receipt confirming the deposit of funds into the current account.

At the same time, cash withdrawals are also reflected through account 57. Let's look at what kind of postings are made:

| Business transaction | D | TO |

| Sales of products (services, works) | 62 | 90.1 |

| Receipt of payment to the company cash desk | 50 | 62 |

| Issuance of funds to collectors | 57 | 50 |

| Cash delivery by collector to the bank | 51 | 57 |