A triple netting agreement is an example of a joint settlement by counterparties of debts arising under supply or service contracts in the event of a shortage of financial resources. The conclusion of such an agreement is recognized as a transaction in accordance with the provisions of Art. 153 Civil Code of the Russian Federation, Art. 154 allows the implementation of agreements between several participants by concluding a multilateral treaty. The basis for offset of funds is the existence of debts to each other by three organizations that agree to offset.

Basic nuances of drawing up an act of offset of funds

A unified form of the document has not been developed at the legislative level, so it is drawn up in free form. The act must indicate a list of documents confirming the fact of the occurrence of debt (agreements, invoices, etc.), their numbers and dates of preparation. Also in the text it is necessary to indicate the amount of obligations that will be liquidated by offset, the amount of unset off debt and the period for its repayment. All amounts are written in numbers and words (to avoid errors).

A tripartite act of offset of mutual claims, a sample of which you will find below, is drawn up in triplicate. The document form must be signed and sealed by all parties. The executed act is the basis for offsetting mutual obligations and making the necessary accounting entries.

The debt settlement procedure begins by sending an application from one company to another. The amount of debt can be determined using a reconciliation report. It should be taken into account that obligations that have not yet expired are subject to offset. If entrepreneurs have never encountered the preparation of this document before, they can use the example of a triple netting act as a basis.

Triple offset of mutual claims: example of filling out an agreement

Mutual repayment of debts between counterparties without the use of non-cash and cash payments is possible subject to a number of conditions:

- the debt of all parties to the transaction can be characterized as homogeneous;

- all companies agree to set off;

- This procedure is not systematic.

Tripartite netting is possible in the following situations:

- Transaction participant “1” did not pay, a possible reason is a violation of payment terms for products that previously entered into an agreement with transaction participant “1”.

- has a receivable to enterprise “3”, the balance sheet shows the outstanding amount of payment from organization “1”.

- acts as a debtor for legal entity “1”, while simultaneously performing the role of a creditor for institution “2”.

Triple offset, subject to partial debt write-off, can be used for the following case:

- LLC "Class" owed LLC "Svoe" 50,000 rubles for goods supplied;

- Svoe LLC has an outstanding invoice from Mel LLC in the amount of 43,000 rubles;

- Mel LLC did not pay Class LLC the amount of 77,000 rubles on the agreed dates.

Triple offset for these companies is possible in the amount of the smallest debt - 43,000 rubles. As a result, LLC “Class”, after concluding the transaction, will have to repay LLC “Svoe” a debt in the amount of 7,000 rubles (50,000-43,000), LLC “Mel” undertakes to repay the debt to LLC “Class” in the amount of 34,000 rubles (77,000- 43,000). The obligations of Svoe LLC to Mel LLC after signing the agreement and recording it in accounting will be considered repaid in full.

List of required details

- document's name;

- names of organizations participating in debt offset;

- date and place of drawing up the act;

- amounts subject to offset;

- signatures of responsible persons.

In addition to the listed details, the act should indicate the exact date of offset and a list of circular debt obligations of all organizations. A sample of a tripartite netting act will be given below.

Filling example

Alpha LLC supplied Beta LLC with construction materials in the amount of 200 thousand rubles. Beta LLC carried out repair work in the office of Gamma LLC, the cost of the work was 160 thousand rubles. In turn, Gamma LLC sold combustible materials to Alpha LLC in the amount of 90 thousand rubles.

The procedure for drawing up the act will be as follows:

- At the very beginning of the document, the title is written (“Act of Settlement of Mutual Claims of Three Legal Entities”).

- Below indicate the date of compilation and locality.

- Next, the essence of the agreement is stated.

- It is mandatory to list the existing mutual debt and the documents that became the basis for its occurrence.

- After this, the remaining debt of the parties to each other after the settlement is indicated.

- The document is certified by the seals and signatures of representatives of each company.

- An act of reconciliation of mutual debt is attached to the document.

Representatives of small and medium-sized businesses in the process of carrying out their activities often use an act of offset between three organizations, the sample of which is not approved by law, to quickly pay off part of their existing obligations.

Sample of a tripartite netting act

Settlement between two, three or more organizations in 2021

The relationship between buyers and suppliers is an integral part of the life of most organizations. Quite often, various situations arise when both organizations have some debt obligations to each other. In order to avoid paying bank commissions and get rid of unnecessary paperwork, a netting operation is carried out. There are certain rules that are important for the implementation of mutual settlements between two, three or more organizations, regulated by the legislation of the Russian Federation.

Rules for mutual settlement

The amount of debt when performing a netting operation can be differentiated. In case of unequal value of the debt, the offset will be carried out at the minimum amount. Then one counterparty pays off the entire debt, and the second only partially.

Cases when offset is possible

Art. 410 of the Civil Code of the Russian Federation provides for the possibility of repaying the obligations of companies to each other through offsets. This article specifies the requirements that are mandatory for the test:

- The presence of mutual debt, that is, all participants in the transaction are simultaneously creditors and debtors.

- The time has come to fulfill obligations; if there is no deadline, then the fulfillment of obligations will occur after a reasonable period of time; if the period is specified on demand, then the fulfillment of the obligation must be completed within seven days from the date of demand.

- The offset requirement must be uniform, that is, for example, all obligations of the offset participants must be monetary.

Impossibility of offset

Art. 411 of the Civil Code of the Russian Federation also describes cases of impossibility of offset:

- If the statute of limitations has expired for any of the claims, and this has been reported.

- Claim for compensation for harm to life or health.

- Maintenance requirement for life.

- Request for payment of alimony.

- In other cases provided for by the contract.

Act of netting between organizations - sample and form

Sometimes there are situations when mutual loan obligations arise between organizations that need to be repaid. For this purpose, a special document was invented that allows you to write off the obligations of both parties - an act of mutual settlement between organizations.

Settlement between two organizations

The company has the right to offset mutual obligations in two ways:

- unilateral statement by any of the participating parties;

- mutual agreement of both participants.

Unilateral procedure for offsetting mutual claims

Art. 410 of the Civil Code of the Russian Federation provides for the possibility of mutual offset at the request of any of the companies.

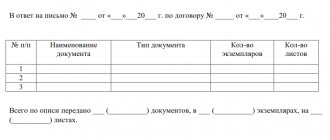

Documents for registration:

- Act of reconciliation;

- application for offset of mutual claims;

- agreements on the conclusion and terms of the transaction (required);

- invoices (required);

- invoices (required);

- acts on the provision of services (required).

Act of reconciliation

The reconciliation report plays a big role in the netting process (this is an optional document, but it is recommended to draw it up before the offset). It helps to study the information available to both organizations and determine the exact amount of debt. Subsequently, this will help prevent possible disagreements and court proceedings.

The reconciliation report includes a table of two columns containing information about the amount of debts according to each counterparty

The reconciliation report includes:

- date at the time of reconciliation;

- the names of both organizations;

- amount of liabilities;

- commitment agreements;

- balance as of the reporting date;

- signatures;

- print.

Settlement application

In the absence of a unified statement, it is written in any form with the presence of the main details of the primary accounting documents (Clause 2, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). And also the application must include information about the terminated obligations, the amount of offset, and the time of offset of mutual claims.

A prerequisite for carrying out offset at the request of any of the companies is to receive information confirming that the partner was notified of the termination of obligations by offsetting mutual claims, otherwise the offset requirement will be rejected.

Bilateral settlement procedure

This option is more reliable than the previous one. To carry out mutual offset, the same documents are required as for unilateral, only the application for offset of mutual claims is changed to a mutual agreement, which implies the signing of a mutual act (agreement) by both parties. This eliminates the possibility of cancellation. This document is also drawn up in any form with all the details.

The bilateral agreement should indicate the addresses and bank details of the parties

Accounting entries

Offsetting reflected in accounting does not lead to the formation of new expense or income items in the balance sheet.

Table: accounting of claims offset operations

| Account debit | Account credit | Contents of operation |

| Account 60 “Settlements with suppliers and contractors” (Account 76 “Settlements with various debtors and creditors”) | Account 62 “Settlements with buyers and customers” (Account 76 “Settlements with various debtors and creditors”) | Settlement |

Example of unilateral netting

Other nuances

There are nuances to reflecting the offset of mutual claims in tax accounting and VAT calculations.

Income tax

In case of netting, income tax will be accrued based on the method established in the organization for accounting for income and expenses. When using the accrual method, the offset operation is not reflected at all when calculating income tax, because neither income nor expenses will arise (clause 1 of Article 271, clause 2 of Article 272 of the Tax Code of the Russian Federation).

When using the cash method, income and expenses are taken into account if there is a fact of repayment of obligations (clause 2 of Article 273 of the Tax Code of the Russian Federation). That is, an income equal to the amount of the counterparty’s debt is reflected, and an expense equal to the amount of its own debt, repaid by offset.

When calculating VAT, the offset process is not taken into account, since the moment of shipment of goods (works, services) is the payment of VAT, and the right to deduction is the acceptance of purchased goods (services, works). It is necessary to recalculate VAT when the repayment of obligations occurs through mutual advances.

Multilateral netting

Rules and regulations that are also characteristic of trilateral can be applied to multilateral offsets.

Requirements for conditions and documents for netting

Each accountant needs to study the legal sources regulating the possibility of multilateral offsets, as well as become familiar with the specifics of drawing up supporting documents.

Table: documents required to offset claims and obligations

| Legal sources | Regulatory area | Names of mutual settlement documents |

| Article 410 of the Civil Code of the Russian Federation | Termination of obligations by offset | Settlement agreements |

| Article 411 of the Civil Code of the Russian Federation | Cases of impossibility of credit | |

| clause 2 art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” | Requirements for primary documents | Settlement agreement and reconciliation report |

Example of multilateral netting with accounting entries

Table: accounting of the enterprise LLC "A"

| Account debit | Account credit | Contents of operation | Amount (rub.) |

| D 41 | K 62/B | Acceptance of goods from the organization LLC "V" | 12 000 |

| D 62/D | K 90 | Supply of goods for LLC "D" | 10 000 |

| D 60/B | K 62/D | Settlement | 10 000 |

Table: accounting of the organization LLC "V"

| Account debit | Account credit | Contents of operation | Amount (rub.) |

| D 41 | K 62/C | Acceptance of goods from the organization LLC "S" | 25 000 |

| D 62/A | K 90 | Supply of goods for LLC "A" | 12 000 |

| D 60/C | K 62/A | Settlement | 10 000 |

Table: accounting

| Account debit | Account credit | Contents of operation | Amount (rub.) |

| D 41 | K 62/D | Acceptance of goods by the organization LLC "D" | 16 000 |

| D 62/B | K 90 | Supply of goods for LLC "V" | 25 000 |

| D 60/D | K 62/B | Settlement | 10 000 |

Table: accounting

| Account debit | Account credit | Contents of operation | Amount (rub.) |

| D 41 | K 62/A | Acceptance of goods by organization LLC "A" | 10 000 |

| D 62/C | K 90 | Supply of goods for LLC "S" | 16 000 |

| D 60/A | K 60/C | Settlement | 10 000 |

At the end of the offset, the organization LLC “S” will have no accounts payable left.

Other important nuances

There are various nuances of carrying out the operation of offsetting mutual claims. Often organizations have problems of various kinds due to their incorrect registration or non-compliance.

Table: errors when carrying out any of the listed offsets

| Points allowing you to refuse offset | Content |

| No statement or agreement | In Art. 410 of the Civil Code of the Russian Federation stipulates the mandatory presence of a statement from one of the parties (notification from the other) in the case of unilateral offset and the presence of an agreement in other types of offset |

| The date is not indicated (incorrectly indicated) in the agreement or application | In this case, the date of repayment of obligations will be the date of signing of the agreement by all parties |

| Heterogeneity of requirements | Art. 411 Civil Code of the Russian Federation |

| Meeting the deadline | The deadline for fulfillment of obligations must occur, but not after the limitation period |

| Offsetting in advance in favor of future periods | Offsetting can be carried out only in the amount of the debt as of the current date |

| Incorrect amount of debt | Offsetting is permitted only for a documented amount of debt |

Offsetting is a fairly simple operation that can greatly simplify payment between organizations. However, it is necessary and important to comply with all established norms and rules for repaying mutual claims, and also remember that offset is sometimes impossible.

Displaying tripartite settlements in 1C Accounting

24.10.2019

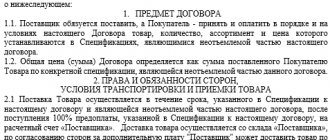

To begin with, we can focus on a specific example. On August 31, 2019, it signed an agreement to carry out a trilateral settlement of obligations in the amount of 120 thousand rubles with the organizations MetriUm and Trading House. At this time, all participating companies have certain obligations with a given payment period:

- , being a borrower, has obligations to MetriUm (lender) to repay a short-term loan equal to 240 thousand rubles.

- The organization "MetriUm" as a buyer must pay the supplier "Trading House" 360 thousand rubles (including twenty percent VAT of 60 thousand rubles) for the products provided.

- must pay transport costs, the cost of which is 120 thousand rubles (including VAT of 20 thousand rubles).

As a result, it turns out that in the process of trilateral mutual settlement it will be necessary to pay off:

- Debt on a short-term credit loan issued, the amount of which is 120 thousand rubles.

- Accounts receivable for transportation services provided, the cost of which also equals 120 thousand rubles including VAT.

The organization "Swift NET" applies the OSN (general taxation system), as well as the accrual method and PBU 18/02.

Drawing up reconciliation statements for mutual settlements

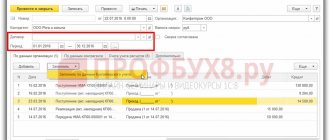

To analyze the size of the receivables of the organization "Trading House" and the debt on the loan from 1C Accounting, the user needs to use a report called Turnover value on the balance sheet: balance sheets numbered 62.01 and 66.03 (Fig. 1). You can find them in the section called Reports.

Drawing up and approval of reconciliation statements for mutual settlements with counterparties

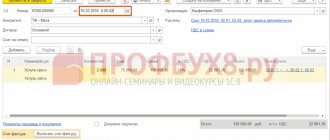

To begin, the user will need to select a document called “Act of Reconciliation of Calculations” (Fig. 2-3) and perform the following steps:

- First, select the Create item, and in the window that appears, indicate the counterparty who will participate in the reconciliation, as well as the agreement concluded with him (if he participates in the process).

- In the Period column, you need to enter the time interval during which the reconciliation of mutual settlements is performed.

- In the tab called Cost Accounts, you need to mark only those balance sheets that are involved in the reconciliation. If necessary, excess balances are deleted.

- In the tabs According to the company's information and also According to the counterparty's information, you just need to click on the Fill in button for the appropriate items. As a result, all the necessary information will be entered into the table.

- In the Additional tab you need:

- enter in the Company Representative column the individual from the relevant directory who signs the reconciliation report;

- enter in the Counterparty Representative column an authorized person from the relevant directory who signs the reconciliation report;

- activate the item Split by agreement if you need to display information broken down by agreement in printed versions of the act;

- activate the item Display full names of documentation if you want the names of the relevant documentation to be displayed in full in printed versions of the act;

- activate the Produce invoices item if you need to display information about the corresponding invoices according to the documentation in printed versions.

- Next, the user will need to activate the Reconciliation agreed item, provided that the counterparty has approved the operation. After this manipulation, all details, with the exception of information about representatives, cannot be changed.

- To complete the procedure, you must click on the Continue button. Important: the document in question does not constitute a posting.