Suppliers count 60

60.01 D remainder = 0! 60.02 K remainder = 0 !

76.VA D balance = 0 76.VA K = 60.02*18/118 - provided that all suppliers have issued an account for the advance. But in reality this doesn’t happen: 76.VA loan

It is useful to view the status of documents - Invoices from suppliers

60 - see Purchases - Invoices from suppliers? status = Not Received!

19.3 19.4 VAT from suppliers

19.3 balance Credit = Debit = 0 - everything should be closed without balances, all debit turnovers within the quarter are equal to credit ones.

Buyers 62.01 62.02

62.01 K remainder = 0 62.02 D remainder = 0

do not forget to create sales ledger entries and create purchase ledger

Search in " VAT reporting"

". I have a document created by 1C itself once at the end of the quarter.

This is where interesting moments arise in accounting. In fact, VAT from the buyer’s advance payment falls into the document “formation of the purchase book”. This is how things are - it’s like you’re buying VAT.

don't forget to make a count. in advance to buyers!

1C can do this automatically. Search in " VAT reporting"

«.

76.AB K balance = 0 Remember balance debit 76.AB = 62.2*0.18/1.18.

Note: during the transition from 18% to 20%, this formula will not work.

Invoice: Reflect the VAT deduction in the purchase book by the date of receipt

If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipt of goods” in the Invoice received have a checkbox “Reflect VAT deduction in the purchase book by the date of receipt.” Those. here we immediately make postings for VAT refund (68.02 All shipments are similar to and accordingly there are postings (90.03

Thus, as a result, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful. The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

VAT check cheat sheet

An amateur's cheat sheet regarding filing a VAT return (quarterly). What should you immediately remember to watch in the next quarter?

First we get all the documents from all suppliers and buyers

We do not leave “receipt of goods” and “invoices” (retail sales reports), etc. NOT posted.

We deal with suppliers for 60 contracts (invoices).

For 62, we also deal with buyers in terms of contracts (invoices).

Don’t forget to get statements from all your banks

There are spare (reserve) current accounts, in case one bank gets worse, you can try to transfer funds to another bank in time (“transfer of your own funds”).

Yes, and this happens - after all (as it turns out in fact) the fact that you use a current account in some bank and store some money there - it is you who are at risk, not the bank. These are today's realities.

Don’t forget to download the statements there, because the commission is most likely being charged, i.e. there is movement.

Suppliers count 60

60.01 D remainder = 0! 60.02 K remainder = 0 !

76.VA D balance = 0 76.VA K = 60.02*18/118 – provided that all suppliers have issued an account for the advance. But in reality this doesn’t happen: 76.VA loan

It is useful to view the status of documents – Invoices from suppliers

60 – see Purchases - Invoices from suppliers? status = Not Received!

19.3 19.4 VAT from suppliers

19.3 balance Credit = Debit = 0 – everything should be closed without balances, all debit turnovers within the quarter are equal to credit ones.

Buyers 62.01 62.02

62.01 K remainder = 0 62.02 D remainder = 0

do not forget to create sales ledger entries and create purchase ledger

Look in “ VAT reporting ”. I have a document created by 1C itself once at the end of the quarter.

This is where interesting moments arise in accounting. In fact, VAT from the buyer’s prepayment ends up in the document “formation of the purchase book”. This is how things are - it’s like you’re buying VAT.

don't forget to make a count. in advance to buyers!

1C can do this automatically. Look in “ VAT reporting ”.

76.AB K balance = 0 Remember balance debit 76.AB = 62.2*0.18/1.18.

We do SALT exactly 62.2 (i.e. under subaccounts we divide from 62.1 and 62.2)

Note: during the transition from 18% to 20%, this formula will not work.

Fool's method

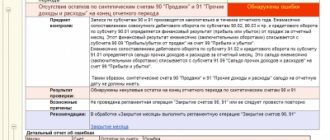

There is a cool method when, without understanding anything about the algorithms for calculating VAT payable, we focus only on the fact that 1C knows what it is doing.

We take it as a fact that, for example, “Express check of accounting (VAT)” checks everything correctly.

Let’s say our 62.2/6 does not beat 76AB (2019Q2), but there are suspicions that everything was done correctly (during the transition to 20% VAT). Those. “Express VAT check” shows that everything is Gut!

We do this:

We remove one line from the formation of the purchase book and see that “Express VAT check” noticed and began to swear. Aha - that means everything is correct in the document for creating the purchase book .

Next, similarly, we will post one invoice for the advance payment and see that “Express VAT check” noticed and began to swear. The conclusion and invoices for advance payments are also correct.

It's cool isn't it.

And so on …

We remove data from the OFD for cash registers

This means the cash register must also be verified with the OFD (there’s no escape)

We simply do an analysis of the 50th account - here we have Retail Revenue and Income from Customers (LEs) together. Usually the amount and the OFD data immediately agree. if it doesn’t match, we look for refunds, etc.

Note: there may be replacements for fiscal drives. Attention, you need to go through all the FN for this period)

VAT Accounting Assistant

We search for the word VAT, which may be related to the VAT check.

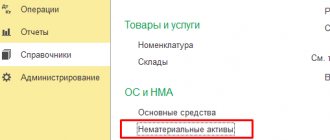

Let's start studying Operations / Closing a period / VAT Accounting Assistant .

There is also a useful summary report in 1C 8.3, see. Reports – Analysis of VAT accounting .

Invoice: Reflect the VAT deduction in the purchase book by the date of receipt

If payment and shipment (receipt) are in the same period, then everything is taken into account very simply: all my documents “Receipt of goods” in the Invoice received have the “Reflect VAT deduction in the purchase book by the date of receipt” ticked. Those. here we immediately make entries for VAT refund ( 68.

02 All shipments are similarly marked with “invoice issued” and accordingly there are postings (90.03

Thus, as a result, the document formation of the purchase book and sales book is almost empty. And all sorts of advances and other evil spirits ended up there, which makes the life of an accountant bright and eventful.

The problem is that if you give up and don’t deal with the advances, then it will all come out anyway. Therefore, we are looking for algorithms for checking advances.

During the transition to VAT 20% (2018/2019)

We analyze invoice 90.03 and see if we issued invoices with VAT 18% in 1Q. 2021 — We correct it by 20%.

What follows is old nonsense, it’s better not to read: What logic first tells us (or an amateur is delusional) is that all options (where there are 2 periods, payment in one, shipment in the other) are divided into:

- 1.

- 1.1 client prepayment

- 1.1a счф. for advance payment (76АВ

- 1.2 shipment of goods to the client + regular invoice (there are no postings here, but see its shipment 90.03

- 1.2a we cancel the SCHF. for an advance payment (occurs when creating a purchase book - oddly enough).

- 2.

- 2.1 shipment of goods to the client

- 2.2 payment by the client

- 3.

- 3.1 prepayment to the supplier

- 3.1a supplier to you SCHF. for advance payment (68.02 Purchases - invoice for advance payment

- 3.2 receipt of goods from the supplier + regular invoice (68.02

- 3.2a we cancel the SCHF. for advance payment (76VA

- 4.

- 4.1 receipt of goods from the supplier (19.03

- 4.2 payment to the supplier

Please note that for paragraphs. 2 and 4 no SCHF is created. for advance They only appear if payment is made first.

76AB This appears as a result of creating an invoice for the advance payment. The verification algorithm is as follows: according to 62.2, we look at the total amount at the end of the period, highlight from it how much VAT there will be, and this amount is the total according to 76.AB. This is provided, of course, that all goods have the same VAT.

God, how can I check all this crap with contractors, since since 2015. Each invoice must contend with the counterparty's accounting department.

Let's look at what the document “formation of a purchase book” contains. Attention! : the document can only be found through this path: Operations - Regulatory VAT reports

(it is not in the log of all transactions).

- “Creating a purchase book” - there is a division here:

- acquired values 68.02

- advances received 68.02

- Let’s look at what the document “formation of a sales book” contains:

- recovery on advances 76VA

First conclusions:

1. If the transaction has gone through 2 stages (shipment and payment) in full, then logically this can be seen in account 62 (there are no balances there) and, as a result, all advances are on the account. 76 of this counterparty must close, i.e. There should also be no leftovers.

2. If the client has an advance payment (there is a balance on account 62.2), then accordingly there will be a balance on account 76 in the ratio (62.2*0.18/1.18=76.AB). This is where a report on 62 with additional would be stupid. column according to the formula (62.2*0.18/1.18=76.AB).

3. If we made an advance payment to the supplier, then by law he must make an invoice. for an advance payment and send it to us, but usually this does not happen for obvious reasons: the supplier has made an SSF for himself. for an advance payment (paid VAT), but he doesn’t care about you - your problems, you need it - come for the SCHF yourself. for advance And it can also be understood - invoice documents and regular invoices are handed over with the delivery of goods, usually in boxes. If, after all, there is such a financial system. for an advance payment from the supplier, then it must be handled in Purchases - Invoices received - Invoice for advance payment

.

4. If there were schf. for an advance from the supplier, then after the full cycle the balance is on the account. 60 of our supplier is empty and, accordingly, the balance of 76.VA for our supplier is empty.

5. If there is a balance left in the prepayment to the supplier at 60.2, then there should also be a balance at 76.VA, in the ratio (60.2*0.18/1.18=76VA).

That's all, miracles don't happen. Everything is very simple! And by the way, having calmly spent 1 day getting to grips with the meaning of VAT charges and another 1-2 days sorting out mutual settlements with suppliers and customers, as well as re-processing documents + re-closing months 30 times, I had noticeable confidence (turning into euphoria ) that we did VAT correctly.

We reclose sequentially January, February, March through “close month”. In the same place, see the formation of a book of purchases and sales; by the way, the creation of these documents must be controlled manually, since it has been noted that they may not be created automatically.

We prepare a VAT return for the 1st quarter. It appears in Reports - Regulated reports - list (VAT Declaration)

. There is a sequence for filling out Sections - see the icon on the right? .

The restoration of VAT on advances issued is the result of its deduction and is not used very often. How to correctly recover VAT from advances? What conditions must be met in order to accept advance VAT as deduction? What entries need to be made in both cases? Let's look at all the pros and cons of VAT on advances in our article.

76av in the balance sheet as it closes

> Balance

16.12.2019

It is unlikely that any organization can manage its activities without an advance payment system. Remember the famous phrase: “money in the morning, chairs in the evening”? Accounting has long adapted to this situation, and accountants operate with separate subaccounts for advance VAT quite confidently.

But there is one issue that has not yet been resolved, and today they continue to break spears about it - how to reflect VAT on advances in the balance sheet? Before we talk about which line of the balance sheet should reflect the amount of VAT on advances in the balance sheet, let's remember how this VAT appears and on what accounts it exists.

Let's start with an example. LLC "Style" is engaged in tailoring women's clothing and is located on OSNO. The organization has just opened. Wherein:

— made an advance payment to the supplier Tweed LLC for fabrics in the amount of 59,000 rubles, including 18% VAT;

— received an advance payment from the clothing store Moda LLC in the amount of 141,600 rubles, including VAT 18%.

Amount of VAT on advances received: accrual and deduction

First, let's deal with the prepayment received from the store. According to the rules of the Tax Code, an organization on OSNO that is not exempt from VAT, when receiving an advance on account of upcoming deliveries of products, works, services upon receipt of them, must calculate VAT (clause 2, clause 1, Article 167 of the Tax Code). Let's do this:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

At the moment when the clothes are sewn and shipped, Moda LLC needs to charge VAT again - already on the cost of the shipped products:

VAT payable = 141,600 / 118 * 18 = 21,600 rubles.

And VAT accrued earlier on the advance payment is accepted for deduction (clause 1, clause 1 and clause 14 of Article 167, clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code).

A deduction is made if, after receiving an advance payment, the terms of the contract are changed or terminated and the corresponding amounts of advance payments are returned (clause 5 of Article 171 of the Tax Code).

But in our example, we have only received an advance. How to reflect its receipt and the accrual of VAT on advances received in accounting? To do this, they usually use one of the subaccounts to account 76:

Debit 51 “Current account” - Credit 62-2 “Settlements with customers for advances received” - in the amount of 141,600 rubles.

Debit 76-AV “Calculations for VAT on advances received” - Credit 68 “Calculations with the budget for VAT” - in the amount of 21,600 rubles. – VAT was charged for payment to the budget.

We must transfer the accrued VAT to the budget. We also issue an invoice to our buyer within 5 days after receiving the advance payment.

If the agreement between LLC “Style” and LLC “Moda” specifies an advance payment, then our buyer can claim VAT for deduction by receiving an invoice from us.

Read more about transactions when receiving advances .

Amount of VAT on advances issued: deduction and restoration

In the situation with Tweed LLC, the buyer is already Style LLC. And here the situation will be mirrored. We assume that the supplier is also on OSNO; upon receiving an advance payment from our organization, he charged VAT and issued us an invoice. The prepayment condition is specified in our contract.

We have the right (not obligated, but have the right, i.e. at will) to accept the amount of VAT on advances issued to the supplier for deduction (clause 12 of Article 171 and clause 9 of Article 172 of the Tax Code of the Russian Federation). In accounting, a special account is also used for these purposes. Because account 19 can only be used for purchased values.

Debit 60-2 “Settlements with suppliers for advances issued” – Credit 51 “Current account” - in the amount of 59,000 rubles. – transferred an advance payment to the supplier

Debit 68 “Calculations with the budget for VAT” - Credit 76-VA - in the amount of 9,000 rubles. – VAT on the advance payment to the supplier was deducted.

In the future, when we receive fabrics from the supplier, we will deduct another VAT - on the purchased values. And the amount of VAT on the advance payment will be restored (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation). It is for this reason that not everyone uses the deduction of the VAT amount from the advance payment, so as not to clutter up the accounting.

more about advances issued in a separate article on the website .

Reflection of VAT on advances in the balance sheet

Continuing our example, let's assume that at the end of the year the fabric has not yet arrived from the supplier, and therefore there is no shipment of finished goods either. What account balances do we have:

At the end of the year, when preparing reports, we need to show accounts receivable and payable (we do not look at payments to the budget), as well as VAT on advances in the balance sheet. But how?

This can be done in 2 ways:

- VAT is allocated as separate lines and is not balanced:

Assets:

- Accounts receivable (line 1230) – 59,000 rubles. (supplier's debt for the listed advance payment)

- Other current assets (line 1260) – 21,600 rubles. (VAT accrued on the advance received from the buyer, which we will then deduct)

Passive:

- Accounts payable to suppliers (line 1520) – RUB 141,600. (advance received from supplier)

- Other short-term liabilities (line 1550) – 9,000 rubles. (VAT on the advance payment, which we will then refund)

In the balance sheet we see in this case the debt of the buyer to the supplier along with VAT.

- Accounts receivable (line 1230) – 50,000 rubles. (supplier debt for the listed advance) – balance 60-2 minus balance 76-VA

- Accounts payable to suppliers (line 1520) – RUB 120,000. (advance received from the supplier) – balance 62-2 minus balance 76-AB

In the balance sheet in this case we see the buyer’s debt to the supplier without VAT. There is a “winding down” of advances and VAT related to them, and due to this there will be a decrease in the balance sheet currency.

So which option is right?

Position of the Ministry of Finance on VAT on advances in the balance sheet

Is it necessary to restore tax on advances received?

When receiving an advance payment, in most cases the seller is obliged to calculate the tax on it for payment to the budget (clause 1 of Article 154 of the Tax Code of the Russian Federation), and later, when making a shipment, against this advance payment, take all or part of the amount of the tax paid from the advance tax as deductions (clause 8 Article 171 and Clause 6 Article 172 of the Tax Code of the Russian Federation). In other situations (when the advance is returned to the buyer or the overdue debt on it is written off), VAT restoration will also not be required. In the 1st case, it can be taken as a deduction on the date of return (clause 5 of Article 171 of the Tax Code of the Russian Federation), and in the 2nd case it must be written off as expenses not taken into account in the calculation of income tax.

Thus, for advances received, the picture always turns out to be the opposite of the main condition for recovery: first, the tax is calculated for payment, and then taken as a deduction or written off. That is why there will never be a situation of VAT restoration on these payments.

VAT on advances received

When selling products (goods, services) to the buyer, a mandatory condition may be specified in the contract - advance payment in the amount of up to 100%.

On the received advance, the organization issues a tax return and charges VAT at a rate of 18/118%. The amount of this advance is included in the sales book as accrued VAT, that is, a tax that the organization is obliged to pay to the budget.

Get 267 video lessons on 1C for free:

In practice, after issuing a SF for the advance received, 3 situations are possible:

- during the advance period the sale occurred;

- no sales occurred during the advance period;

- return of advance payment to the buyer (termination of contract, change of conditions, etc.).

In the first case, after the shipment has been made, the selling organization has the right to present previously paid VAT on the advance received for deduction. That is, the advance SF is closed with a purchase ledger entry.

In the second case, the amount of the advance and the VAT accrued on it is reflected in the VAT return for the current period in line 070 of Section 3.

In the case of an advance refund, it is also possible to claim the VAT paid for deduction, that is, an entry is created in the purchase book. You can take advantage of the deduction within a year after termination of the contract.

In the event of liquidation of the purchasing organization before full fulfillment of the delivery conditions, if it is impossible to return the advance payment, VAT accrued upon receipt of the advance payment is not subject to deduction.

Conditions for deducting tax on advances issued

When calculating the tax on the advance payment received, the seller issues an invoice for it and sends 1 copy of it to the buyer. Based on this document, the buyer has the right to take into account the amount of tax allocated in it as deductions (clause 12 of article 171 of the Tax Code of the Russian Federation). Although he may not do this, since deductions are not an obligation, but are made voluntarily (clause 1 of Article 171 of the Tax Code of the Russian Federation). It is better to consolidate the taxpayer’s position regarding deductions for advances issued (whether they will be applied or not) in some document (for example, in the VAT accounting policy).

However, these 2 circumstances (payment and invoice) are not enough for the buyer to deduct it. Additional conditions for carrying out such an operation follow from other provisions of the Tax Code of the Russian Federation:

- a condition on the possibility of transferring an advance payment must be included in the supply agreement (clause 9 of Article 172 of the Tax Code of the Russian Federation);

- The invoice for the advance payment must be dated within the 5-day period allotted for issuing such documents (clause 3 of Article 168 of the Tax Code of the Russian Federation), and have all the required details for it (clause 5.1 of Article 169 of the Tax Code of the Russian Federation).

Acceptance of deductions from the buyer will be reflected in the following posting (for each individual document):

Dt 68/2 Kt 76/VA,

Accounting entries for VAT recovery from advance payment

The VAT recovery posting will always be the same for each individual invoice:

Dt 76/VA Kt 68/2,

68/2 - subaccount for accounting for settlements with the budget for VAT on account 68;

76/VA - subaccount for accounting for VAT on advances issued in account 76.

The results of VAT recovery for specific advance invoices will vary depending on the ratio of the amount of the advance and the cost of supply associated with it:

- for the first 2 cases (the amounts of the advance and delivery are the same or the amount of the advance is less than the cost of delivery), with this posting the amount of tax on the advance, listed in subaccount 76/AB, will be closed completely;

- in the 3rd and 4th cases (the amount of the advance is greater than the cost of delivery or the contract contains a condition on partial offset of the advance towards payment for the supply), in subaccount 76/AB after the restoration of VAT there will be a balance of unrecovered tax.

Read about the latest changes in the document reflecting tax recovery operations in the material “Sales Book - 2021: new form”

.

Score 76. AB

76 accounting account is an account that accumulates information about financial settlements with counterparties that are not permanent and do not directly relate to the organization’s activities. Relationships with such persons are usually irregular.

Account 76 used in accounting is called “Settlements with various debtors and creditors.” With its help, transactions are recorded that are incorrectly recorded using other records. On the account 76 entries are generated for certain types of business activities, including:

- insurance operations;

- claims settlements;

- deposited amounts of unpaid wages of employees;

- operations on executive documents;

- settlements on advances issued and received;

- accounting for mutual settlements with other counterparties.

Postings to account 76 are generated if it is necessary to fix the amount of legal costs on the basis of administrative documents. If it is necessary to calculate and withhold alimony amounts collected from employees, account 76 is also used.

The final balance for these entries can be of a debit or credit nature, depending on the specified conditions. Debit records any debt owed to the company. The loan collects information on the debts of the enterprise itself to third parties. Therefore, the account belongs to active-passive.

76 account in the balance sheet can be taken into account both in the active part and in the passive part. To do this, its expanded balance is analyzed. Debit balances constitute the asset item “Debit Accounts”. The credit balance increases the liability of the balance sheet under the item “Accounts payable”.

Analysis of account 76

Analytical accounting is maintained separately for transactions. Postings to account 76 form the final balance for each fact of mutual settlements with debtors and creditors. On account 76, subaccounts have many meanings, the most used among them are the following:

- 76.01 - calculations for property and personal insurance. This takes into account operations on life and health insurance of employees and contracts on insurance of enterprise property. Voluntary (within permissible limits permitted by law) and compulsory insurance are taken into account.

- Account 76.02 is used to generate cash flows for claims that have arisen, including the accrual of fines, penalties, and penalties for unfulfilled obligations. Account 76 of subaccount 02 can be applied both in relation to agreements with counterparties and in the event of an outstanding tax debt.

- Using subaccount 76.03, accrued and paid dividends to the founders of the organization are recorded based on the results of the financial year.

- Subaccount 76.04 shows reserved funds for unpaid salaries.

- Account 76.5 in accounting assumes the reflection of other settlements with suppliers and contractors that are not related to the main activities of the enterprise. Account 76.5 includes amounts such as settlements with a notary and the accrual of duty payments. Analytical accounting of account 76.5 is formed separately for each case.

- Account 76.09 in accounting is other settlements with various debtors and creditors, also not related to the main activities of the company. Account 76.09 forms transactions for settlements with auditors, third-party law firms, and reflects the amounts of sponsorship and charitable payments.

- Calculations for third-party debts of employees based on writs of execution, for example, alimony payments, are made using subaccount 76 41.

- Account 76.49 is intended for settlements with the employee for other deductions in accordance with the rules of the organization. Provided that these deductions do not apply to the main ones. Such amounts may include costs for mobile communications and assets purchased within the enterprise.

- Subaccounts 76.AB and 76.VA contain VAT amounts on advances issued and received, respectively. The used account 76 VAT allocates separately from the amounts of advance payment received or on the transferred advances against future deliveries.

The list of presented subaccounts can be supplemented, depending on the nature of the activity and operating conditions of the enterprise, not limited to the movement of funds through subaccount 76.09.

Standard entries to account 76 are used to record transactions that are not involved in the main activities of the enterprise and are of an irregular nature.

On the contrary, the balance sheet for account 76 gives an idea of the status of settlements under individual contracts.

To simplify the analysis of mutual settlements with other counterparties, the use of various sub-accounts is allowed, including account 76.05 or 76.09 (account for mutual settlements with other counterparties).

Account 76.AB

The used accounting account 76 is a reflection of other calculations of a legal entity. In cases of receipt of prepayments from counterparties or transfer of advances to suppliers, account 76.AB or account 76.VA is intended for accounting for VAT amounts.

If the payment received precedes the fact of shipment of the goods, then an advance invoice must be generated for the buyer within the next 5 days. In accounting, the use of posting 76.AB will mean reflecting the amount of allocated VAT:

- Dt 51 - Kt 62 - advance amounts received from buyers

- Dt 76.AV - Kt 68 - allocated VAT on prepayment

By analogy, correspondence from account 76.VA is used for advance payments transferred to the suppliers’ account:

- Dt 60 - Kt 51 - prepayment is made to the supplier;

- Dt 68 - Kt 76.VA - claimed VAT deduction on the advance invoice;

- Dt 76.VA - Kt 68 - reflection of the tax amount after offset of the prepayment in the sales book.

Receiving an advance payment obliges the seller to calculate tax on the amounts received to the budget with subsequent offset upon shipment. Accounting for the allocated amount of tax in the advance invoice by the buyer is his right.

Pros and cons of deducting VAT on advances issued

The positive aspects of the use of such deductions occur with significant amounts of advances issued and manifest themselves as follows:

- A large deduction amount can not only significantly reduce the total of the declaration drawn up for the period of its application, but also make it result in the amount of tax reimbursement from the budget.

- A deduction for an advance on account of several deliveries for it is made one-time, ahead of time and in a larger amount than deductions would be made for each of the deliveries separately. At the same time, VAT restoration occurs in parts and can be extended over several tax periods.

On the plus side, there are also conditions for payment of only part of the delivery using the transferred advance payment. In this case, deductions for the advance payment issued and for the delivery document will occur earlier and will be taken in full, and the VAT restoration will be made only in part of these amounts and will be extended over time.

The following points will be negative:

- increasing the volume of accounting operations and document flow;

- there is no point in using deductions for advances if we are talking about small amounts and the period for transferring the advance often coincides with the period of shipment for it.

Read about the rules for issuing invoices for advance payments.

Results

The question of recovering VAT on advances paid to suppliers arises if the taxpayer takes tax deductions on invoices issued by the supplier for prepayment. The provision for advance payment must be included in the supply agreement. VAT on advances issued is recorded in a separate subaccount of account 76.

How to restore VAT in the 1C 8.3 Accounting program

Two cases of “restoring” VAT in 1C 8.3 are shown in this illustration:

In the first case, the VAT previously paid to the budget is “restored”, i.e. The VAT amount is returned to us.

In the second case, we must pay the tax previously claimed for reimbursement.

In both cases the same term is used, but in practice it has two directly opposite meanings.

This is especially clearly seen when analyzing VAT on advances received and paid.

When we receive an advance from a buyer, an obligation arises to pay VAT on this amount. After selling the goods, we are also required to pay VAT. In order not to pay the same tax twice, we can submit the first payment for reimbursement, i.e. "restore".

A similar situation, but with the opposite sign, occurs when we pay an advance to the supplier. We have the right to claim VAT on the advance payment for reimbursement, thereby reducing the total amount of tax. But in the future, after receiving the goods, the VAT amount will have to be returned to the budget (so as not to submit the same amount for reimbursement twice).

Both situations are automated in the 1C 8.3 program.

The first option for restoring VAT in 1C

Let's consider the option with an advance payment from the buyer (Fig. 1.).

The 1C program itself determines the amount received as an advance and generates the corresponding transactions (Fig. 2).

The posting to VAT accounts is generated by the advance invoice (Fig. 3). Please note that advance invoices can be issued both at the time of receipt of funds to the current account, and at the end of the month through special processing.

Upon sale, the advance amount is automatically reversed (Fig. 4)

The sales invoice does not make any postings, but generates movements in other registers that are needed for further work with VAT (Fig. 5).

“Recovery” of VAT occurs in the document “Creating purchase ledger entries” (Fig. 6)

The “Received advances” tab in 1C 8.3 is filled in automatically and contains all the amounts for “restoring” VAT on previously received advances (postings in Fig. 7).

The final picture can be seen in the “Sales Book” and “Purchases Book” reports.

The sales book in 1C (Fig. 8) contains two entries for the Achilles counterparty. One entry is for an advance payment (dated 01/10/2016), the second is for sale (dated 01/26/2016).

The purchase book also contains an entry for this counterparty. It compensates for the advance entry in the sales book. All three entries are for the same amount (RUB 7,627.12).

As a result, you will only have to pay to the budget once.

Let's check that account 76.AB is closed (Fig. 10).

Closing accounts in 1C 8.3 Accounting

Traditionally, closing accounts in 1C causes a lot of difficulties for accountants. Most often - closing account 20 in 1C 8.3. And if an organization receives advances, difficulties may arise with how to close account 76.AB in 1C 8.3.

In this article we will look at the procedure for closing main accounts in 1C and analyze the most common errors associated with them.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

How to close account 20 in 1C 8.3

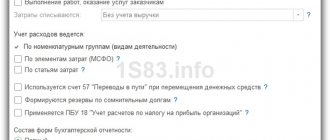

Account 20 in 1C is closed automatically in the Month Closing procedure using the routine operation Closing Accounts 20, 23, 25, 26 (section Operations - Month Closing).

The procedure for accounting for costs on account 20 is configured in the organization’s Accounting Policy (section Main – Accounting Policy).

If the Organization requires cost accounting on account 20, check the boxes for the appropriate activities:

And also a way to write off costs:

Learn more about the settings for cost accounting on account 20 in accounting and tax accounting:

- Cost accounting

- Link List of direct expenses

Account 20 does not close in 1C 8.3

If account 20 is not closed, this may be due to:

- with Accounting Policy settings;

- with accounting errors.

Errors

If errors are detected when closing account 20, 1C will issue a warning, for example:

In this case, simply follow the links provided in the message and make the corrections required by the program. After this, repeat the closing procedure.

There may be situations when the program does not detect an error, but the account will not be closed.

Make sure that:

- there is no duplication of item groups (section Directories – Nomenclature groups);

- costs are reflected in the same item groups as revenue - create SALT for account 20 in the context of item groups (section Reports - Account balance sheet).

How to close account 26 in 1C 8.3

Account 26 in 1C is closed automatically in the same way as account 20 in the procedure Closing a month using the routine operation Closing accounts 20, 23, 25, 26 (section Operations - Closing a month).

The procedure for accounting for costs on account 26 is configured in the organization’s Accounting Policy (section Main – Accounting Policy).

If the use of account 20 is enabled, options for reflecting costs on account 26 are available:

In the second option, Methods for allocating indirect costs must be configured using the appropriate link.

Account 26 does not close in 1C 8.3

If account 26 does not close, the problem lies in the incorrect configuration of the distribution methods. When closing a month, a warning is issued indicating errors:

The message states:

- problem;

- correct option;

- ways to fix it.

How to close account 44 in 1C 8.3

Account 44 in 1C is closed automatically in the Month Closing procedure using the routine operation Closing Account 44 “Costs of Distribution” (section Operations – Month Closing).

Account 44 must be closed monthly, only the balance is allowed:

- in accounting and accounting records at the end of the month and year: in the amount of transportation costs (distributed using the average percentage method);

- in the amount of standardized costs (advertising and representation).

Account 44 does not close in 1C 8.3

If account 44 is not closed, it means that this month there are costs for which the receipt document indicates a cost item with a standardized or distributed type of expense (section Directories - Cost Items):

- Fare

- Advertising expenses (standardized)

- Entertainment expenses

Analyze your account balance. If these costs are not distributed or standardized, go to the document that registered the receipt and replace the cost item. After that, re-close the month.

Learn in more detail the procedure for accounting for standardized costs:

Accounting scheme for advances and calculated VAT

Account 76.AB “VAT on advances and prepayments” reflects the tax calculated on the prepayment received from the buyer.

After the advance is offset, VAT is accepted for deduction, and account 76.AB is closed for this advance.

Learn more about the procedure for calculating and deducting VAT on buyer advances:

Account 76.AB is not closed in 1C 8.3

In account 76.AB there may be balances for those advances for which the shipment has not yet been completed.

If the advance has been offset, but there is still a balance, check:

- Has the document Generating Purchase Ledger Entries been created for this period and has the Advances Received (section Operations - VAT Regular Operations).

- SALT for accounts: 02 with grouping by Counterparty and Documents of settlements with the counterparty .

Make sure that the VAT not accepted for deduction is listed on the same document on which the advance was received. If there is a discrepancy, correct the errors and reformat the document Formation of purchase ledger entries.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge