Form 6-NDFL was introduced in 2021, but still raises questions about its completion. And all because you need to take into account many details. Let's figure out what kind of insidious document this is.

6-NDFL is a report that declares information about: the amounts of income received by individuals; calculated and withheld personal income tax amounts; dates of actual receipt of income; dates and deadlines for withholding and transferring tax for the reporting period as a whole for the organization (separate division).

Do I need to submit zero 6-NDFL?

As long as payments are not made to individuals and taxable income is not accrued, i.e. all indicators of the 6-NDFL report are equal to “zero”, the obligation to submit 6-NDFL does not arise. There is no need to submit a “zero” 6-NDFL report. But, if you decide to play it safe and submit a “zero” report, the Federal Tax Service is obliged to accept it from you (Letter of the Federal Tax Service dated May 4, 2016 N BS-4-11 / [email protected] ).

It is worth considering that if you made income payments to individuals in the period from the 1st to the 3rd quarter, and in the 4th quarter the income was not accrued and no payments were made, then the obligation to submit 6-NDFL for the 4th quarter remains, because “Section 1” of the declaration is filled out on an accrual basis (Letter of the Federal Tax Service dated March 23, 2016 N BS-4-11/ [email protected] ).

Results

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

This article will help you check if you are making the most common mistakes when filling out 6 personal income taxes.

You can find more complete information on the topic in ConsultantPlus.

Full and free access to the system for 2 days.

Which income should be reflected in 6-NDFL and which not?

In 6-NDFL, you need to show all income from which personal income tax is subject to withholding as tax agents. Income that is only partially taxed must also be included in the calculation. For example, this could be income in the form of material assistance or the value of gifts, for which there is a limit of 4,000.00 rubles per year, because the total value of such income may exceed the non-taxable minimum during the year. The following income does not need to be included in the calculation of 6-NDFL:

1. Income that is completely exempt from personal income tax.

2. Income of individual entrepreneurs, notaries, lawyers, and other persons engaged in private practice.

3. Income listed in paragraph 1 of Art. 228 Tax Code of the Russian Federation. For example, this could be income from the sale of property owned by an individual.

4. Income of residents of other countries that are not taxed in the Russian Federation by virtue of international treaties.

In 6-NDFL, an error in the tax amount was allowed, taking into account rounding to the whole ruble

By letter dated March 10, 2021 N BS-4-11/ [email protected] the Federal Tax Service sent control ratios to verify the correctness of filling out the 6-NDFL calculation. This is already the third version of the relations for this calculation. The first appeared at the end of December, the second was sent out in a January letter.

The new letter changes ratio 1.3, which checks the calculation of the tax amount. If income is reduced by deductions, divided by 100 and multiplied by the rate, then now the resulting number should be equal to the amount of tax (according to the previous ratios, the amount of tax should not have been less, that is, it was assumed that the tax could be more than what was calculated). At the same time, it is now stipulated that, taking into account paragraph 6 of Article 52 of the Tax Code (that is, rounding to the nearest whole ruble), an error is allowed in both directions, defined as line 060 * 1 ruble. * number of lines 100 (that is, taking into account the number of individuals).

The ratio 1.5 “line 070 = sum of lines 140” has been abolished - checking the resulting withheld tax for equality to the sum of its components calculated on different dates and terms.

The structure of 6-NDFL and the procedure for filling out the calculation according to form 6-NDFL

Form 6-NDFL was approved by Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] and includes the following sections:

1. Title page;

2. Section 1 “Generalized indicators”;

3. Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

The calculation in form 6-NDFL is completed on the reporting date, that is, on March 31, June 30, September 30, December 31 of the corresponding tax period. To fill out the Calculation in Form 6-NDFL, information from tax registers for personal income tax is used.

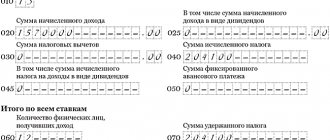

Example of filling line 040

Line 040 is generally not difficult to fill out. But for clarity, let's look at an example.

Example

At Sady LLC, the amount of accrued wages for the 1st quarter was:

- January - 30,000 rubles;

- February - 35,000 rubles;

- March — 49,000 rub.

No deductions are provided to employees. The report will be filled out like this:

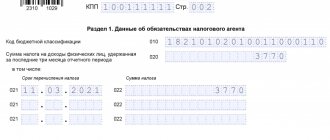

Filling out the Title Page of the 6-NDFL Report for the entire organization, without OP

If you are preparing the 6-NDFL calculation as a whole for an organization that does not have an OP, then everything is simple.

In the “TIN” and “KPP” line, you indicate the TIN and KPP of your organization.

In the Line “Submitted to the tax authority (code),” indicate the code of the Federal Tax Service with which your organization is registered.

In the Line “At the location (accounting) (code)” you must indicate Code “213” “At the place of registration as the largest taxpayer” or “214” “At the location of the Russian organization that is not the largest taxpayer.”

In the “Tax Agent” line, indicate the name of your organization.

In the “OKTMO Code” line, indicate the OKTMO code of your organization.

Filling out the Title Page of Report 6-NDFL for OP

When drawing up the OP Report, you will need to pay attention to filling out the following lines of the Declaration Title Page.

In the “TIN” and “KPP” line, you indicate the TIN of your organization and the KPP of your OP.

In the Line “Submitted to the tax authority (code),” indicate the code of the Federal Tax Service with which your OP is registered.

In the Line “At the location (accounting) (code)” you must indicate Code “220” “At the location of a separate division of the Russian organization.”

In the “Tax Agent” line, indicate the name of your organization.

In the “OKTMO Code” line, indicate the OKTMO code of your OP.

Filling out the Title Page of Report 6-NDFL for a closed OP

How to fill out the Cover Page of the Report on a closed OP depends on the moment you submit 6-NDFL - before the OP is deregistered with the Federal Tax Service or after.

If you submit a report before the OP is deregistered, then nothing changes when drawing up the report. You fill it out as a regular report on an OP and submit it to the Federal Tax Service at the place where this OP is registered.

If you submit a report after deregistration of the OP, then you will need to submit this report to the Federal Tax Service at the place of registration of your parent organization and when drawing up the report, pay attention to filling out the following lines of the Declaration Title Page.

In the “TIN” and “KPP” line, you indicate the TIN of your organization and the KPP of your closed OP.

In the Line “Submitted to the tax authority (code),” indicate the code of the Federal Tax Service where your parent organization is registered.

In the Line “At the location (accounting) (code)” you must indicate Code “213” “At the place of registration as the largest taxpayer” or “214” “At the location of the Russian organization that is not the largest taxpayer.”

In the “Tax Agent” line, indicate the name of your organization.

In the “OKTMO Code” line, indicate the OKTMO code of your closed OP.

How to correctly fill out line 120 taking into account non-working days

Non-working days were introduced by Presidential Decrees due to the spread of coronavirus, in honor of the Victory Parade and on the day of voting on amendments to the Constitution.

- days from 03/30/2020 to 04/03/2020, from 04/04/2020 to 04/30/2020, from 05/06/2020 to 05/08/2020 inclusive were declared non-working by Presidential Decrees dated 03/25/2020 No.-206, dated 04/02/2020 No.-23 9, from 04/28/2020 No.-294;

- June 24, 2021 - the day on which the Victory Parade was held - was declared a non-working day by Presidential Decree No. 345 dated May 29, 2020;

- July 1, 2021, the day of voting on amendments to the Constitution, was declared non-working by Presidential Decree No. 354 dated June 1, 2020.

Read in the berator “Practical Encyclopedia of an Accountant”

On non-working “presidential” days, organizations were obliged to maintain wages for employees. The procedure for determining it has some peculiarities.

Thus, the Ministry of Labor and Rostrud explained that these days and the amounts of earnings accrued on them are taken into account when calculating average earnings only if the employee was working at that time, including remotely.

If the employee did not work at this time, then these non-working days and the amount of average earnings for this period are excluded from the calculation of average earnings. Such recommendations were given by the Ministry of Labor in letter dated 05.18.2020 No. 14-1/B-585 and Rostrud in letter dated 07.20.2020 No. TZ/3780-6-1.

At the same time, the Presidential decrees specified organizations and areas of activity to which non-working days did not apply.

Thus, non-working days did not apply to:

- continuously operating organizations;

- medical and pharmacy organizations;

- organizations providing the population with food and essential goods;

- carrying out emergency repair and loading and unloading work,

- other organizations.

Thus, two groups of organizations emerged. Those who were obliged to suspend activities on non-working days (or switch to remote work). Those who do not have the right to suspend activities.

And each of these groups has its own characteristics in filling out some calculation lines. For example, line 120 of section 2 of the 6-NDFL calculation.

How to fill out line 120 of the 6-NDFL calculation

Line 120 of Section 2 indicates the date no later than which the personal income tax amount must be transferred.

Read in the berator “Practical Encyclopedia of an Accountant”

As a general rule, for vacation pay and sick leave this is the last day of the month, for other types of income - the next working day after personal income tax was withheld (clause 6 of Article 226 of the Tax Code).

The date in line 120 depends on whether the organization was classified as “non-working” or “working” according to presidential decrees (letter of the Federal Tax Service of Russia dated May 28, 2020 N BS-4-11 / [email protected] ).

How to fill out line 120 for organizations that have not suspended their activities on non-working days

If you are one of those organizations that, according to the Presidential Decree, could not suspend activities on non-working days, you had to pay personal income tax within the usual time limits (letter of the Federal Tax Service of Russia dated April 24, 2020 No. BS-4-11 / [email protected] ).

For example, on March 10, 2021, the employee was paid temporary disability benefits. In this case, section 2 of the calculation for the first quarter of 2021 indicates the date:

- on line 100 - 03/10/2020;

- on line 110 - 03/10/2020;

- on line 120 - 03/31/2020.

How to fill out line 120 for organizations that did not work on “presidential non-working” days

If you did not work from March 30 to May 8, 2021, but paid wages, the deadline for paying personal income tax is May 12, 2021 (letter of the Federal Tax Service dated May 13, 2020 No. BS-4-11 / [email protected] ).

For example, you paid your salary on April 10, 2021 for March. It should be reflected in section 1 of the calculation for the first quarter of 2021 and in section 2 of the calculation for the half year. In this case, section 2 of the calculation for the half year 2021 indicates the date:

- on line 100 - 03/31/2020;

- on line 110 - 04/10/2020;

- on line 120 - 05/12/2020.

What other mistakes can be made in line 120

When checking the calculation of 6-NDFL, tax officials will check those paragraphs of the Presidential decrees that list organizations that had the right not to cease their work.

Therefore, if the organization did not stop work in the period from March 30 to April 8, 2021, then indicating the date 05/12/2020 in line 120 may be an error.

As well as the fact that it is erroneous to indicate dates from the non-working period from March 30 to April 8, 2021 for organizations that were supposed to suspend work for this time.

Read in the berator “Practical Encyclopedia of an Accountant”

Calculations with such data may be considered unreliable by tax authorities and fined under Art. 126.1 of the Tax Code. But if you manage to correct the error and submit an updated calculation before conducting a desk audit, there will be no fine.

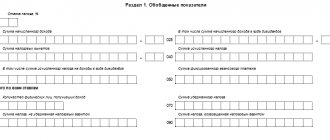

The procedure for filling out Section 1 of form 6-NDFL

Section 1 of the calculation includes income, deductions and tax on them as a whole for the organization (OP) for a total of 1 quarter, half a year, 9 months, a year on a cumulative basis from the beginning of the year.

Section 1 can be divided into 2 blocks. Block 1 is lines 010-050 and Block 2 is lines 060-090. Block 1, namely lines 010-050, are filled out separately for each personal income tax rate (if there were payments taxed at different personal income tax rates). But Block - 2, namely lines 060-090, are filled out once, for the entire organization (OP), without detailing personal income tax rates.

Line 010 “Tax rate, %”

This line indicates the personal income tax rate.

Line 020 “Amount of accrued income”

This line reflects the amount of income received by individuals at the rate specified in “Line 010”, if their actual receipt falls on the corresponding reporting period for which the 6-NDFL calculation is made.

The most common mistake when filling out this line is the fact that many people use accounting data to fill out this line, but they need to focus on tax registers.

For example, income under PP is recognized in the period in which it is accrued, but income under civil and gas agreements is recognized in the period in which they are paid. Therefore, to correctly fill out “Line 020”, it is important to correctly determine the date of actual receipt of income. Below is a list of main incomes indicating the date of their actual receipt.

Accordingly, to fill out “Line 020” you need to focus not on the date of accrual of income, but on the date of its actual receipt, which does not always coincide.

Table 1

| No. PP | Type of income | Date of receipt of income | Tax withholding date | Tax payment deadline |

| 1 | 2 | 3 | 4 | 5 |

| 1 | Salary (salary) | Last day of the month | Day of actual salary payment | Next business day after payment |

| 2 | Advance paid on the last day of the month or later | The last day of the month for which the advance was paid | Day of actual payment of Advance | Next business day after payment |

| 3 | Monthly production bonus | Last day of the month for which the Prize is awarded | Day of actual payment of the Prize | Next business day after payment |

| 4 | Quarterly production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 5 | Annual production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 6 | Non-production bonus | Date of payment of the Prize | Date of payment of the Prize | Next business day after payment |

| 7 | Rewards under GPC agreements | Reward payment date | Reward payment date | Next business day after payment |

| 8 | Vacation pay | Vacation pay date | Vacation pay date | Last day of the month in which Vacation Pay was paid |

| 9 | Sick leave | Sick leave payment date | Sick leave payment date | Last day of the month in which sick leave was paid |

| 10 | Material aid | Income payment date | Income payment date | Next business day after payment |

| 11 | Income in kind, if there are other payments to this employee | Income payment date | The day of actual payment of any income | Next business day after payment |

| 12 | Income in kind, if no other payments were made to this employee | Income payment date | 00.00.0000 | 00.00.0000 |

| 13 | Compensation for unused vacation | Income payment date | Income payment date | Next business day after payment |

| 14 | Income in the form of material benefits from % savings | Last day of the month | The day of actual payment of any income | Next business day after payment |

| 15 | Dividends | Dividend payment date | Dividend payment date | Next business day after payment |

Line 025 “Including the amount of accrued income in the form of dividends”

In this line you need to indicate the amount of dividends that were paid in the current reporting period, taxed at the rate specified in “Line 010”. This amount is informationally highlighted as a separate line, but is included in the total amount of accrued income shown on “Line 020”.

Line 030 “Amount of tax deductions”

Here it is necessary to reflect all deductions that are presented to individuals for the reporting period for the income indicated in “Line 020”. These can be standard, property, social and investment tax deductions. Also, on “Line 030” you need to show amounts that reduce the tax base and non-taxable amounts for income exempt within certain limits. For example, 4,000.00 rub. from gifts received by employees.

Line 040 “Amount of calculated tax”

On “Line 040” you need to indicate the total amount of personal income tax, which was calculated from the income indicated in “Line 020” and at the rate indicated in “Line 010” for the corresponding reporting period.

Line 045 “Including the amount of calculated tax on income in the form of dividends”

For information, you need to indicate the amount of personal income tax that was accrued on the dividends paid specified in “Line 025” and at the rate specified in “Line 010” for the corresponding reporting period.

Line 050 “Amount of fixed advance payment”

This line is filled in only if there are foreign workers who work under a patent.

In this case, here you will need to indicate the total amount of fixed advance payments for personal income tax, by which you reduce the tax of all foreign workers working on a patent.

After you have filled out Block 1, namely lines 010-050 for all bets, you can start filling out Block 2, namely filling out lines 060-090.

Line 060 “Number of individuals who received income”

Here, indicate the total number of employees to whom you paid income during the corresponding reporting period.

Do not include employees who did not receive taxable income in this indicator. If during the reporting period the same person was admitted twice, i.e. was hired, then fired and then hired again, it must be indicated once.

Line 070 “Amount of tax withheld”

On “Line 070” you need to indicate the amount of tax withheld during the reporting period at the time of payment of income. The fundamental difference between the indicators of Lines 040 and 070 is that “Line 040” indicates the amount of personal income tax on income received but not paid, and “Line 070” indicates the amount of personal income tax on transferred income. Those. these indicators may take unequal values. For example, personal income tax, which is withheld from the salary for December in January, is not reflected in “Line 070” of the calculation of 6-NDFL for the year, but is included in “Line 070” of the calculation of 6-NDFL for the 1st quarter of the next year.

Line 080 “Amount of tax not withheld by the tax agent”

On this line you need to indicate the amount of personal income tax that has been calculated but not withheld. For example, if the income was paid in kind and no other payments were made. Those. These are the tax amounts for which you must submit Certificate 2-NDFL with sign “2”.

You do not need to show income that you will retain in subsequent reporting periods on this line. For example, “Line 080” of Report 6-NDFL for the 1st quarter does not indicate the amount of personal income tax from the salary for March, which will be withheld in the 2nd quarter.

Line 090 “Tax amount returned by the tax agent”

Here we indicate the total amount of tax returned to the individual by the tax agent.

General rules for the 1st section of the report

The first section is a summary table of personal income tax data for the period of provision - the tax base and indicators calculated by the agent.

As we can see, there are two peculiar parts of the report. The top one is intended for income and tax calculated at different rates, the bottom one is for summing up information on all rates and indicating details (tax not withheld, returned).

The upper part must be completed for each tax rate applied by the agent. If, in addition to your regular wages, you paid winnings to an individual or you employ a non-resident whose income is taxed at a different rate than a resident, you will have to fill out several upper parts, one for each rate.

You will indicate the amount of income in field 020, the amount of deductions in field 030, and on page 040 you will need to indicate the amount of calculated tax. Separately, here you need to highlight the amount of tax calculated on dividends (on line 045) and indicate the advance payment (if you employ foreigners).

That's it, you've already filled out the top part of the section.

See also “How to fill out section 1 in the 6-NDFL report.”