General information about the pilot project

A pilot project is a procedure for paying benefits, determined by government decree No. 294 of 04/21/2011. In accordance with this document, for the pilot project, 3 days of sick leave are paid by the employer, the remaining amount is subject to calculation by the Fund’s specialists and transfer to the details of the individual.

The procedure for direct payments is as follows:

- The employee submits to the accounting department a certificate of incapacity for work closed by the medical institution, to which is attached an application for the transfer of funds.

- If there is no data on income for the two previous years, other documents must be attached: a certificate of earnings from the previous place of work, an application to change the period for calculating benefits, etc.

- The accountant calculates the average earnings and the amount due for the first three days of illness.

- Within five days from the date of receipt of documents from the employee, information on sick leave with an electronic registry attached is submitted to the Social Insurance Fund.

- The fund calculates the benefit and transfers money to the employee using the details specified in the application. The established deadline for transferring sick leave to the Social Insurance Fund during the pilot project is 10 days from the date of receipt of the package of documents from the employer.

- The procedure for paying for the first three days of incapacity for work remains the same: money is transferred on the next payday (Part 1, Article 15 of Law No. 255-FZ of December 29, 2006).

The Direct Payments project has been applied in all constituent entities of the Russian Federation since January 1, 2021.

ConsultantPlus experts sorted out what an accountant should do when switching to a pilot project on sick leave. Use these instructions for free.

to read.

Who fills it out: accountant or personnel officer

Those responsible for filling out sick leave are the head and chief accountant of the organization.

They are the ones who sign the form. Filling out a sick leave certificate or checking that it is filled out correctly is the task of those officials whose signature certifies the form. The responsibilities of a personnel employee may include entering some data into the sick leave sheet: company name, insurance experience and other non-accounting information.

The job description of the personnel officer must provide for these powers, otherwise it is unlawful to require him to fill out a sick leave form.

How sick leave is filled during a pilot project

Paper certificates of incapacity for work are filled out in accordance with the order of the Ministry of Health No. 925n dated 09/01/2020. The form was approved by order of the Ministry of Social Development No. 347n dated April 26, 2011.

It is recommended to issue a memo for employees on how to submit sick leave to the Social Insurance Fund in 2021 on paper for direct payments:

- attach a statement to the certificate of incapacity for work in the form approved by Appendix No. 1 to the order of the Social Insurance Fund No. 578 dated November 24, 2017;

- check the filling out of the details by the medical institution: name of the organization that issued the sheet, disease code, period of illness, date of return to work, doctor’s name and presence of a seal.

The rules for filling out a paper sick leave certificate for direct payments by the employer have one difference from the credit system: the columns “At the expense of the Social Insurance Fund of the Russian Federation” and “Total accrued” remain empty. These data are filled in by the Foundation.

The employer should fill out the lines:

- Name of the organization or full name of the individual entrepreneur.

- Place of work (check the box “Primary” or “Part-time”).

- Employee Taxpayer Identification Number.

- SNILS.

- Insurance experience.

- Period of illness.

- The amount of earnings for the billing period.

- Average daily earnings.

- The amount of benefit is at the expense of the employer.

- Full name of the manager and chief accountant, their signatures and seal of the organization.

Correcting errors on sick leave

If the employer made a mistake when filling out a sick leave certificate, it is prohibited to cover up the incorrect entry with a correction agent (). The erroneous entry must be carefully crossed out, and the correct entry must be made on the back of the sick leave sheet.

You will find a sample of making corrections to a sick leave certificate in.

If the employer discovers errors made by the medical institution that issued the employee a sick leave certificate, then it is necessary to determine whether the sick leave certificate needs to be reissued or whether these errors are not critical.

For example, if the sick leave is filled in capital letters, then there is no need to re-issue it ().

If, for example, the name of the sick employee is incorrectly indicated on the sick leave certificate, you will have to obtain a corrected duplicate of this certificate of incapacity for work. Otherwise, the Social Insurance Fund may refuse to reimburse the employer for hospital expenses. True, according to the Supreme Court, mistakes made by a medical institution cannot be the basis for such a refusal ().

How to clarify information on sick leave

The adjustment procedure is regulated by clause 63 of Section IX of Order No. 925n of the Ministry of Health.

If an error was made by a medical institution and discovered by the employer before submission to the Social Insurance Fund, then the document should be replaced with a duplicate.

If an error is made by the employer, corrections are allowed. The erroneous entry is crossed out, and a correct entry is made on the back of the document with the note “Believe the corrected one,” certified by the seal and signature of the responsible person.

The use of correction fluid and eraser is prohibited.

If errors are detected in the amount of electronic sheets, the accountant sends an adjustment. If the benefit has already been paid by the Fund, a recalculation is made.

The organization has the right to view and edit sent sick leave certificates on the Social Insurance Fund portal in the “Certificates of Incapacity for Work” section of your personal account.

Correction of errors and inaccuracies

Paragraph 65 of the rules approved by Order No. 624n states that the use of corrective agents to cover up errors made when issuing a certificate of temporary incapacity for work for an employee is strictly prohibited.

Instead, you need to turn the document over and write the correct information on the back. In addition, the employer must review the records made at the medical facility. To do this, you should know how a doctor’s sick leave form should be filled out. Thus, the employer determines the degree of criticality of the mistakes made.

Thus, the employer determines the degree of criticality of the mistakes made. If the information in the document is written in capital letters, it is not necessary to reissue it. If the name or initials of the employee to whom the sick leave was issued are indicated with an error, then you will need to request a duplicate with the correct spelling.

Otherwise, the Social Insurance Fund receives grounds not to pay monetary compensation to the company employee for long-term illness. Also see "". It is almost impossible to find a photo of a correctly filled out sick leave certificate, for example, on the Internet.

After all, it contains a lot of personal information about a specific person.

But if you follow the rules for filling out sick leave, which are discussed in this article, this will guarantee the employee payment of the monetary compensation due to him and will save the company from problems with the Social Insurance Fund. This is why it is so important not to make mistakes. If you find an error, please select a piece of text and press Ctrl+Enter.

If you find an error, please select a piece of text and press Ctrl+Enter.

Accounting of transfers

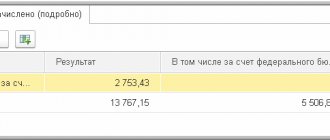

In 2021, the amount paid to an employee from the Fund is not reflected in the employer’s accounting records. The postings should reflect only the accrual of benefits for the first three days of illness. The accounting entries for sick leave in 2021 for the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit accrued for 3 days of incapacity for work | 20 (25, 26, 44) | 70 | 2054,79 |

| Personal income tax withheld | 70 | 68.01 | 267,00 |

The accounting entries for sick leave payments during the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit paid from the cash register | 70 | 50 | 1787,79 |

| Benefit paid to bank details | 70 | 51 | 1787,79 |

Rules for filling out sick leave

For a sick leave, you need to remember just a few rules:

- When filling out a sick leave certificate, only black ink is used;

- entries on the sick leave sheet should not go beyond the boundaries of the cells.

- The employer can fill out a certificate of incapacity for work with a gel/capillary/fountain pen (clause 65 of the Procedure, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n). A ballpoint pen cannot be used. By the way, you can fill out a sick leave certificate on a computer. In this case, a sick leave certificate filled out partly by hand and partly on a computer will not be considered damaged (FSS Letter No. 17-03-09/06-3841P dated October 23, 2014);

- entries on the sick leave sheet are made in printed capital Russian letters;

- entries are made starting from the first cell of specially designated spaces (rows/graph);

Instructions for filling out sick leave in 2021

The employer is required to complete the document within 10 working days after receiving it from the employee. At the same time, the legislation does not oblige the transfer of a sheet for temporary loss of ability to work to the Social Insurance Fund. Each date of a visit to a doctor with an extension of the period of loss of ability to work is entered into the form.

This is a mandatory requirement. In cases where there is no space left in the columns and the employee cannot yet begin his duties, the doctor is obliged to issue an additional form.

Popular

Payments to personnel HR records Economics and business Accounting statements Foreign workers | 10:00 June 24, 2021 Pension Fund Insurance premiums Economics and business Personnel records management Maternity leave Payments to staff Foreign workers Accounting statements Maternity leave Payments to staff UTII Modern entrepreneur Taxes and accounting for small businesses © 2006 — 2021 All rights reserved. When using materials in full or in part, an active link to spmag.ru is required, subject to compliance.

How to reimburse maternity benefits from the Social Insurance Fund

- Conducts all necessary calculations.

- The employer pays the benefit.

- The fund checks the report and if everything is fine, refunds the money.

- After payment, the employer submits a report and other necessary documents to the Social Insurance Fund to reimburse the funds spent on maternity benefits.

- The employer accepts sick leave from the employee.

- Child care benefits up to one and a half years old are paid every month.

- One-time benefit for the birth of a baby.

- A one-time benefit for women who registered with a medical institution in the early stages of pregnancy.

- Benefit for temporary loss of ability to work, from the fourth day of illness.

- Social benefits for funerals.

- Monthly child care allowance.

- Benefit in connection with pregnancy and childbirth.

Which pen should I use to fill it out?

Black ink is used. Order 624n of the Ministry of Health and Social Development allows filling out a certificate of incapacity for work only with a helium, capillary or fountain pen. The Supreme Court of the Russian Federation in 2015 came to the conclusion that the use of a ballpoint pen when filling out is only a technical defect.

It does not affect the payment of benefits. The main thing is that using a ballpoint pen does not lead to illegibility of the writing. The RF Armed Forces ordered the Social Insurance Fund to accept for payment the sick leave, which the doctor filled out with a ballpoint pen.

In this case, the employer, noticing the error, contacted the medical institution for a duplicate. Despite the court's approval, in order to avoid disputes with the FSS, it is advisable not to use a ballpoint pen to fill out forms.

FSS pilot project and direct benefit payments: how to set up in 1C

In the regions that are included in the pilot project of the FSS of the Russian Federation, payments of sick leave, children's and other benefits are carried out directly by the territorial branches of the FSS. The number of participants has expanded - from July 1, 2021, 39 constituent entities of the Russian Federation are already taking part in the pilot project for paying benefits directly from the Fund. 1C experts tell you how to use the capabilities of the 1C: Salaries and Personnel Management 8 version 3 program to interact with the Social Insurance Fund, including if the company uses electronic sick leave.

Filling out sick leave by an employer for a pilot project (sample)

For participants in the FSS pilot project, the sample for filling out sick leave is slightly different from usual cases.

You should be guided, like other organizations, by the Procedure approved by Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n. The basic rules are as follows:

- correction is made by crossing out incorrectly filled in information and reflecting the correct entry on the back of the form.

- You cannot use a ballpoint pen to fill out the form;

Participants in the pilot project do not enter data in the following fields in their section of the form:

- “Total accrued.”

- “At the expense of the Federal Social Insurance Fund of the Russian Federation”;

These fields are filled out by a social insurance specialist, since according to the legislative norms for the pilot project, it is stipulated that it is the Social Insurance Fund that calculates the amount of disability benefits.

IMPORTANT! If an error is made when filling out a certificate of incapacity for work that affects the amount of sickness benefits, the employer must make corrections and provide information about the changes to the Social Insurance Fund. Based on the updated package of documents, social insurance recalculates its part of the benefit and pays the difference to the insured person.

If due to an error an overpayment of sick leave occurs, the employer returns the difference to the Social Insurance Fund.

Support for the “ELN” project in “1C: Salaries and Personnel Management 8” (ed.

3)

In the program “1C: Salary and Personnel Management 8”, edition 3, a request from the FSIS UIIS “Sotsstrakh” for an electronic certificate of incapacity for work is made by clicking the Receive data from the Social Insurance Fund button when entering the document Sick leave (Fig.

2). In this case, it is enough to select an employee and indicate the number of the certificate of incapacity received by the employee at the medical institution. Rice. 2. Document “Sick leave” All data on the electronic certificate of incapacity for work is automatically downloaded from the FSIS UIIS “Sotsstrakh”, including information about the medical organization and special causes of incapacity. You can view the download results by following the hyperlink Filled in LN data.

The data in the Sick Leave document is automatically supplemented with information from the 1C: Salary and Personnel Management 8 program about the employee’s length of service, his average earnings, previous sick leaves for care, conditions for calculating personal income tax, etc.

n. Having received the ELN from the FSIS UIIS “Sotsstrakh” and having calculated it, the employer pays the employee benefits in the usual manner, and transfers to the FSS a register of electronic certificates of incapacity for work. It is convenient to create a register, send it immediately or upload it to a file in the 1C-Reporting service. The transcript of the ELN registry entry contains detailed information about the certificate of incapacity for work.

If, when sending the ELN register, some of the certificates of incapacity for work are not accepted by the FSS due to any errors, then the corrections of these errors will be taken into account the next time the specified register is sent. To do this, starting from version 3.1.10 of the program, its state is saved separately for each electronic device:

- Not accepted by FSS.

- Accepted by FSS;

The ENL status is automatically updated when the FSS response is downloaded.