“Financial Newspaper” (regional issue), 2008, No. 2. Article by the Leading Auditor of the Company, A. Vagapova. Almost all organizations in their activities encounter business transactions that must be accounted for off-balance sheet accounts. However, they often do not pay due attention to this consideration. Meanwhile, information on off-balance sheet accounts is important for users of financial statements. In addition, the data reflected in off-balance sheet accounts is included in the indicators of the financial statements, where they are reflected in the form of a reference table to the balance sheet. The types of property and liabilities that are subject to accounting on off-balance sheet accounts are determined by the Chart of Accounts and the Instructions for its application.

The need to maintain off-balance sheet accounts

Data on property, which is kept on the balance sheet, makes it possible to correctly evaluate all the assets of the enterprise. Without this information, no audit firm will be able to provide a positive opinion. Complete accounting of property will come to the aid not only of the enterprise, but also of the tax authorities inspecting its activities. For example, by recording data on leased fixed assets on account 001, you can always justify the costs of their repair.

If an enterprise transfers its property to other companies as collateral or for rent, then information about this reflected in off-balance sheet accounts (AB) will come in handy for drawing up a financial plan and maintaining management accounting. Off-balance sheet data is increasingly being used in the development of financial statements. Therefore, it is so important to maintain APs and periodically conduct their inventory.

Debt of insolvent debtors written off at a loss

To account for receivables that have been written off from the balance sheet due to the insolvency of the debtor or the expiration of the statute of limitations, off-balance sheet account 007 is used. This debt must be taken into account on the balance sheet for 5 years from the date of write-off to monitor the possibility of its collection in the event of a change in the property status of the debtors.

Transactions on the debit of account 007 are reflected on the basis of:

- act of inventory of settlements with buyers, suppliers and other debtors and creditors (form INV-17);

- primary documents (contracts, etc.);

- manager's order to write off accounts receivable.

If within 5 years the debtor pays off his debt, then an entry is made in the accounting based on the payment document for the credit of account 007. A similar entry, but on the basis of an accounting certificate, is made after 5 years.

Analytical accounting for account 007 is maintained for each debtor whose debt is written off at a loss, and for each debt written off at a loss.

Information reflected in off-balance sheet accounts

An enterprise has the right to use eleven legal provisions provided for by law. Their totality is conditionally divided into the following blocks (groups):

| Groups | AP taking into account |

| 1 | property that does not belong to the company |

| 2 | obligations and security |

| 3 | other property |

Purpose of the ZS:

- recording values that the company does not own, but temporarily uses or stores;

- control over the conduct of business transactions of a certain type.

If explicit APs do not provide for any objects specific to a particular enterprise, then it is possible to supplement their composition. Another solution is to introduce subaccounts to those already in use. All such actions must be recorded in the accounting policies.

What happens if you don't take inventory?

In general, the law does not provide for punishment specifically for failure to conduct an inventory. Only individual companies that are engaged in certain “specific” activities can suffer here.

For example, organizations that work with precious metals or stones are required to conduct an inventory of them annually on January 1 (clause 16 of the Government of the Russian Federation of September 28, 2000 No. 731). For violation of this procedure, Article 15.47 of the Code of Administrative Offenses of the Russian Federation provides for a fine of up to 100 thousand rubles.

However, due to the lack of inventory, distortions in accounting or tax accounting may occur. If inspectors prove this fact, they will apply penalties.

The fine for violations in accounting can be up to 20 thousand rubles. Also, the guilty person may be disqualified for up to 2 years (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

For distortions in tax accounting without understating the taxable base, the maximum fine is 30 thousand rubles. If the violation resulted in non-payment of taxes, then the fine will be 20% of the arrears, but not less than 40 thousand rubles. (Article 120 of the Tax Code of the Russian Federation).

If a company goes bankrupt due to lack of inventory, additional risks may arise. We are talking about bringing the persons controlling the debtor (KDL) to subsidiary liability for the obligations of the bankrupt organization.

One of the criteria on the basis of which CDLs are liable for the organization’s obligations is the distortion of accounting data (clause 2, clause 2, article 61.11 of the law of October 26, 2002 No. 127-FZ). In this case, the court can recognize not only the manager, but also an official or a third-party organization that was directly involved in accounting as a CDL.

Evidence that the accounting data is distorted may also be the absence of inventory reports from the company (Resolution 9AAS dated January 22, 2020 in case No. A40-33003/2017).

Features of inventory of assets on off-balance sheet accounts

Inventory is a form of monitoring the state of the property and liabilities of an enterprise and their actual availability. It is necessary to compare the data contained in the accounting with the actual data. There is no way to do without the results of inventory work when the time comes to compile the annual report.

The need to carry out an inventory of property recorded on the balance sheet is enshrined in the Federal Law and the Regulations on Accounting. Behind the specified documents, this method of actual control covers all obligations of the enterprise and its assets. Inventory in full concerns property that is registered but does not belong to the enterprise.

Results

Maintaining off-balance sheet accounting is the responsibility of a legal entity and the right of an individual entrepreneur. The legislation provides for an inventory of off-balance sheet accounts within the time frame and according to the rules for conducting an inventory of the remaining property and liabilities of the taxpayer.

For more information on how to record the results of an audit in accounting, read the material “Reflecting inventory results in accounting.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings reflecting the results of the inventory

At the end of the inventory work, the final acts are signed:

- Each member of the commission.

- Employees who are entrusted with financial responsibility.

The inspection may go smoothly and not reveal any discrepancies. But the discovery of excess property or a shortage of assets listed on the property owner is a completely possible phenomenon. Such facts are reflected in the corresponding accounting notes:

| Debit | Credit | Description |

| 003 | Writing off shortages of materials accepted for processing | |

| 91.2 | 76 | Losses are included in other expenses. They were obtained due to the lack of materials previously taken for processing |

When excess off-balance sheet assets are discovered, they are allowed to be taken into account in the balance sheet as other income:

| Debit | Credit | Description |

| 003 | Capitalization of surplus | |

| 10.1 | 91.1 | Excess materials taken for processing are included in the assets of the enterprise |

How to reflect inventory results in accounting

Based on the results of the inventory, both excess property and its shortage can be identified (clause 28 of order No. 34n).

If, during the audit, “extra” values are found, then they must be attributed to other income at market value.

DT 01 (10, 41, 43, 50) - KT 91.1

The organization can confirm the value of identified surpluses with a report from an independent appraiser or independently. In the latter case, you can use, for example, publicly available information on prices for similar property.

Shortages within the limits of natural loss norms must be written off as current expenses of the organization using account 94 “Shortages and losses from damage to valuables.” Such standards are established, for example, for food, dishes and table linen used in catering .

DT 94 - CT 10 (41, 43) - the cost of the missing property is written off

DT 20 (25, 26, 44) - CT 94 - the shortage is attributed to costs

If the norms of natural loss are exceeded, or for this type of assets (for example, for fixed assets) there are none at all, then there are two write-off options:

- At the expense of the guilty party:

DT 94 - KT 01 (10, 41, 43, 50) - excess shortage

DT 73 (76) - CT 94 - the shortage is attributed to the guilty person

DT 50 (51, 70) - CT 73 (76) - the deficiency is recovered from the guilty person or withheld from his salary

- At the expense of other expenses, if the guilty party is not identified, or if it was not possible to recover damages:

DT 91.2 - KT 94

Postings for identified deviations must be made in the reporting period to which the inventory date refers (Clause 4, Article 11 of Law No. 402-FZ dated December 6, 2011).

The inventory process of off-balance sheet accounts: step-by-step instructions

An inventory is carried out before preparing annual reports. By the beginning of such serious work, all information about the actual state of assets at the AP should be at the disposal of the accountant. It is quite acceptable:

- do not take inventory of property when it has already been checked in a similar way two to three months before the end of the year (October-December);

- an inventory of library collections should be carried out every five years, and fixed assets – once every 3 years;

- enterprises located in the Far North should take inventory of current assets when they have the least amount in their balances.

Sequence of the inventory process:

| Stages | Content | Explanation |

| First | Creation of an inventory commission | Formed by order of the head, has powers throughout the year. If there is a lot of work, you can create a working commission |

| Second | Issuing an order to conduct an inventory | Specific timing and reasons for control are indicated. Members of the commission are determined |

| Third | Fixation of asset balances with accounting data | Provided by the accountant on the start date of the inventory |

| Fourth | Direct inventory | It takes place in the presence of persons bearing financial responsibility. The actual amount of assets and how real the recorded financial liabilities are are revealed. Information is recorded in documents: acts and inventories |

| Fifth | Registration of results | The summary is made in the Statement of Results |

Inventory of off-balance sheet account 02

On May 8 of this year, the order of the Russian Ministry of Finance came into force. The changes extend their effect for a year, that is, they apply from January 1 of the current year. Among other things, the changes affected off-balance sheet account 02, which is now even called slightly differently - “Material assets in storage.” We'll talk about it in the article. The list of property subject to accounting on off-balance sheet account 02 is given in paragraph.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

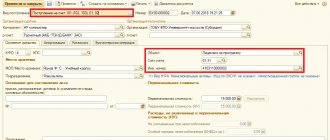

- Inventory of off-balance sheet accounts in Accounting 3.0, version 1.4.1

- Off-balance sheet accounting of property and liabilities

- What to consider on off-balance sheet account 02 in 2021?

- Inventory of off-balance sheet accounts

- Is inventory required for off-balance sheet accounts?

- Off-balance sheet accounts

- How to write off fixed assets that do not meet the asset criteria

Processing - Document processing.

Inventory of off-balance sheet accounts in Accounting 3.0, version 1.4.1

Processing - Document processing. Inventory warehouse accounting responsible storage off-balance sheet accounts. Property and liabilities recorded on off-balance sheet accounts must be inventoried in the same way as those recorded on accounting accounts. However, in Accounting 3. This processing allows you to partially fill this gap and use the existing Inventory of goods in warehouse document to inventory off-balance sheet accounts on which the item is taken into account, namely:.

Processing allows you to select accounts for inventory and filter balances by counterparty, responsible person for those accounts where the corresponding subaccount is provided.

Processing provides 2 operating modes. You can open processing through the menu File - Open. Next, select the existing Inventory of goods in warehouse document, set the filling parameters and click the Fill button. The current user must have permission to edit the selected document. You should also take into account the date when editing was prohibited. The second mode provides for embedding into the 1C database as filling processing. Categories Document processing. To whom Accountant. File type External processing ert,epf.

Accounting platform. Configuration 1C:Accounting 3. Operating system Doesn't matter. Country Doesn't matter.

Industry Doesn't matter. Taxes Doesn't matter. Type of accounting: Accounting. Accounting section Accounting for inventory items. The code is open Yes. Inventory of off-balance sheet accounts in Accounting 3. Use the Create button to add processing.

You don't have to change the settings. Universal account closure for 1C: Enterprise Accounting 3. Formation of payment orders for the date specified in goods receipts. Nightly restoration of the sequence of documents using a background job for BP 3.

Timesheet for Accounting 2. Automatic creation of “Debt Adjustment” documents with the type of operation “Offsetting”. Entering receipts based on sales. Enterprise accounting 3. Additional external processing. Strannitca Processing doesn't work! It's a waste of money to buy it.

Copy link Go. If there is an error in processing, I will correct it. If there is a problem with the installation, I will help you. Sergey, good afternoon! The processing was installed without any problems: I installed it using the second option through administration - external forms and reports. A corresponding button has appeared in the inventory document. But then there’s a glitch. When you press the button, processing switches to an additional window in which you are asked to select a MOL and a counterparty. I didn’t immediately pay attention, but why do you need to select a counterparty??

Remains are formed from warehouses and shopping malls. For inventory of warehouse balances, it does not matter at all from whom the goods were once purchased or whether they were found on the street and capitalized. After filling out the MOL field and clicking the “Fill out the inventory document of goods in the warehouse” button, an error message appears: “Type mismatch.”

Program version 1C:Enterprise 8. I once again checked the processing on various databases, in the server and file versions of the database, with user and administrator rights, in the basic version and professional. I didn't find any errors. I am ready to return your money if the processing still does not work for you.

Sergey, thank you! Everything worked. The error has been corrected, the website has an updated version. Donya Thank you, everything works. Good day, Sergey! Was the account considered for inclusion in processing? Equipment leased. Updated processing. Now you can select all off-balance sheet accounts of the current database that have the “Nomenclature” subaccount. 41 is also filled in in the document. My processing does not clear the document, but adds data on balances on off-balance sheet accounts.

If you want to receive a document with only balances on off-balance sheet accounts, but fill out a blank document with my processing.

Good afternoon, will there be processing for the buh corp? The analysis of accounts suitable for inventory occurs dynamically, the current chart of accounts is analyzed. So even if you have a non-standard chart of accounts, suitable accounts for inventory will be found.

Selection by warehouse does not work - it dumps the balances for all warehouses in the inventory document BP30 3. Airat How to download processing??? How to pay?? E-mail: Enter your E-mail.

Password: Enter your password Forgot your password? Confirmation code from email: Enter the confirmation code from the email. Download files. View all. Library News Articles Books. Labor Exchange Vacancies Company Resume. Training Webinars Courses. Programs 1C: Enterprise Configurations Development. Tenders Specialists Orders. About the portal Partnership Rules Help. What is startmoney?

Corporate rates Ask a question.

Off-balance sheet accounting of property and liabilities

Let’s say right away: sanctions for the lack of off-balance sheet accounting from the tax authorities are possible. In addition, a company that neglects this accounting is unlikely to receive a positive audit opinion.

And finally, the most important thing: without off-balance sheet accounting, it is impossible to fully and reliably reflect information about the organization’s activities and its property status. Thus, data on property that is taken into account off the balance sheet can be useful both to the enterprise itself and to tax authorities during an audit.

For example, if a company records leased fixed assets on its account, it may avoid additional questions from inspectors about the costs of repairing these assets.

What to consider on off-balance sheet account 02 in 2021?

Is an inventory of off-balance sheet accounts carried out? Off-balance sheet accounts are needed to reflect values that do not belong to the company, but are temporarily used or stored by it, as well as to control certain business transactions. The Chart of Accounts was approved by order of the Ministry of Finance of the Russian Federation dated. Accounting for such accounts is carried out using a simple accounting system, that is, the transaction is recorded only as a debit or credit to one off-balance sheet account. Off-balance sheet accounting is not a mere formality.

Establishing and maintaining off-balance sheet accounting is clearly not a priority for companies today. The reason is simple: although with the help of accounting management can control the company's assets and liabilities, as well as obtain operational information on them, the costs of accounting should not exceed the potential benefits from it.

Statement of results identified by inventory

Below is an example of a Statement of Results:

| No. | Name sch. | Account number | The result revealed during the inventory. | Established asset damage | From the total ∑ shortages and losses | ||||

| shortage | surplus | Credited for regrading. | List in previous attrition rates | Attributed to the culprits | List for production costs | ||||

| 1. | OS | 01, 03 | |||||||

| : : | |||||||||

| Off-balance sheet accounts | |||||||||

| 1 | Rented OS | 001 | – | – | – | ||||

| 2 | Materials accepted for recycling A B IN | 003 | 10 000 | 4000 | – | 4000 | 6 000 | ||

Director Molotov R. Yu.

Main accountant Pronina A. O.

Chairman of the commission Malin N.D.

The identified surplus of material A is offset by misgrading, and the shortage of material B is written off as expenses (taking into account misgrading).

Important! If there is misgrading, you can count surpluses and shortages among themselves. Employees responsible for the safety of assets are required to provide explanations written in their own handwriting.

Consignment goods

To account for goods accepted on commission, account 004 “Goods accepted on commission” is intended.

In accordance with clause 14 of PBU 5/01, clause 158 of the Methodological guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, goods received for sale under a commission agreement are accounted for at prices agreed with principal, including VAT.

Accounting for accepted goods is carried out by type of goods and consignors. The basis for accounting entries for the debit of account 004 is the TORG-12 invoice or consignment note. Goods are written off from the credit of account 004 as they are sold on the basis of shipping documents issued in the name of buyers.

When there is a need for inventory on off-balance sheet accounts

An inventory of property should be carried out:

- Subleasing assets, selling them or buying them back.

- Before you start writing your annual report.

- When theft or damage to assets is established.

- In emergency situations caused by extreme conditions, natural disasters.

- When a company is liquidated or reorganized.

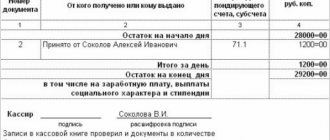

- If there is a change in responsible persons. An example would be hiring a new cashier. The previous employee must transfer the cases, and the commission takes an inventory of the cash register on the same day. The cashier is responsible not only for the movement of cash, but also for the storage of strict reporting forms. They are accounted for in off-balance sheet account 006.

An example of the main part of the required inventory is given below:

Inventory list of the Central Bank and BSO No. ________

| Organization _LLC August | ||

| Structural unit Cash register | ||

| Basis for inventory: order Number Date | 25 | |

| 19.04.16 | ||

| Inventory start date. | 20.04.16 | |

| Inventory end date. | 20.04.16 | |

| Accounting account number | 006 | |

| No. | Central Bank,BSO | Unit change | Fact. Availability | According to accounting data | Result | |||||||||||||||||

| name | code | name | COEI code | № | series | denomination, rub. | quantity | amount, rub. | № | series | denomination, Rub. | quantity | amount, rub. | surplus | shortage | |||||||

| № | series | quantity | amount, rub. | № | series | quantity | amount, rub. | |||||||||||||||

| 1. | BSO | 012 | PC. | 012 | 12-22 | CA | 100,0 | 12 | 1200 | 12-22 | CA | 100,0 | 12 | 1200 | ||||||||

Strict reporting forms

To summarize information about the availability and movement of strict reporting forms stored and issued for reporting, account 006 of the same name is intended, on the debit of which all specified documents are accepted in a conditional valuation.

Strict reporting forms include: receipt books, forms of certificates, diplomas, various subscriptions, coupons, tickets, forms of shipping documents, work books, forms of securities, etc. Organizations must keep books of strict reporting forms. When forms are received, a receipt order (unified form M-4) must be filled out according to the actual quantity. Based on this document, an entry is made to the debit of account 006.

The cost of used strict reporting forms is written off from the credit of account 006 based on the invoice request (unified form M-11). Write-off of forms in case of their damage is carried out on the basis of a write-off act approved by a special commission.

Features of inventory of off-balance sheet accounts in budgetary organizations

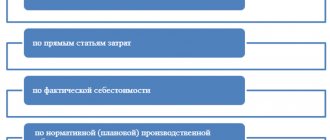

There are many more APs in budget accounting - 30. In addition, institutions can additionally enter more if this will help collect the necessary data for maintaining objective management accounting. It is carried out according to the so-called “simple system”, which provides for reflection:

By debit:

- values received;

- guarantees received or issued.

By loan:

- removal of valuables;

- repayment of those obligations that were secured by guarantees.

There is no correspondence from the AP. Transactions are reflected on them depending on what happened to the accounting object. Records are made reflecting its increase (admission) or decrease (departure). The inventory of off-balance sheet accounts is carried out in the manner described above.

Important! Only the commission can decide, for example, to write off the debt of insolvent debtors from account 04.

Inventory assets accepted for safekeeping

Account 002 of the same name is intended to record these material assets. In what cases does custody arise?

Firstly, if storage agreements are concluded. In this case, the basis for making an entry on the debit of account 002 with the custodian is Act MX-1 “Act on the acceptance and transfer of inventory assets for storage”, the unified form of which is approved by Resolution of the State Statistics Committee of Russia dated 08/09/1999 N 66. Accordingly, the basis for write-off of these values from the credit of account 002 there will be an act MX-3 “Act on the return of inventory items deposited.”

Secondly, these are goods (materials) for which ownership has not yet been transferred (for example, if the condition for its transfer is payment for goods). In this case, the basis for the entry in the debit of account 002 is the TORG-12 invoice. Write-off of goods from the credit of account 002 will be made on the basis of the same invoice, but only after a record has been made for payment of accounts payable.

Thirdly, these are goods (materials) that were received by the organization by mistake or for which the buyer refused to pay. Such goods can be accepted for accounting on the basis of an act of acceptance of goods received without a supplier’s invoice (form TORG-4). The unified form of this document was approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132. In accordance with the instructions for the use and completion of unified forms, this document can be used to register any receipt of materials to the organization based on actual availability.

Fourthly, this account records the goods purchased by the commission agent for the principal. The goods are accepted for accounting at the value indicated in the invoices. Such property is written off from account 002 on the date of its transfer to the principal.

Analytical accounting of the account is carried out by owner organizations, by type, grade and storage location.

When conducting an inventory, inventory items held in safekeeping are subject to mandatory recalculation. The inventory results are reflected in a separate inventory list INV-5.