Fixed assets

All property of the organization is divided into non-current and current assets.

The first includes means that are not involved in the production process, but ensure the creation of a product or the provision of services. This: . fixed assets

- workshops, buildings, structures, i.e. premises adapted for production, as well as equipment, machines, installations and machines that support the process itself;

. intangible assets,

that is, property that does not have a tangible form, but can significantly enhance the company’s image and create a successful reputation for it (this includes current computer programs, licenses, brands, trademarks and much more).

All listed assets are combined in the 1st section of the balance sheet, and their value is indicated in line 1100. Note that fixed assets and intangible assets in the balance sheet are always accounted for at their residual value (that is, the original value reduced by the amount of depreciation). Depreciation charges are reflected in the company's accounting registers, and this amount cannot be seen on the balance sheet.

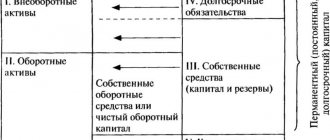

Passive, active in theory and practice

It will be easier to understand why current liabilities included in long-term projects remain current despite the time costs if we correlate the concepts of “asset” and “liability” in a general sense.

Assets are:

- financial – money;

- physical – buildings, equipment, etc.;

- intangible – brand and the like.

Liabilities are:

- obligations to suppliers and creditors;

- bank loans and the like;

- debt for all kinds of costs associated with payment;

- taxes and other charges.

If accounting is carried out according to international standards, current liabilities, the line in the balance sheet is the line Accounts Payable, Notes Payable, Accrued Expenses Payable, Federal Income Tax Payable. Obligations to suppliers and creditors are designated as Accounts Payable. Bank loans are entered in the Notes Payable line. The debt for expenses related to payment is designated as Accrued Expenses Payable. The Federal Income Tax Payable line means that we are talking about tax accrual.

Composition and valuation of current assets

To determine the composition of current assets, you need to refer to the second section of the balance sheet. Current assets are divided into groups with approximately equal liquidity. Each group is shown in the balance sheet as a separate line:

Inventories consist of:

- Raw materials;

- Finished products;

- Work in progress;

- Products

Inventories are shown on the balance sheet at the lower of 2 possible values – original cost and recoverable cost;

Accounts receivable includes settlements with customers and other settlements. The balance sheet is shown less the provision for doubtful debts.

In the balance sheet, the line for accounts receivable is only in the section with current assets. Some settlements with customers may be long-term; example - sale with installment payment for a period of more than a year. When preparing financial statements, the long-term component must be shown on a separate line of the balance sheet.

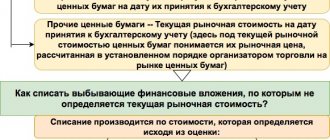

Short-term financial investments include:

- Loans issued to other companies;

- Deposits;

- Investments in shares, bonds, bills, and other securities.

Financial investments, depending on the type, are accounted for either at market or at historical cost less a provision for impairment.

Cash is reflected at par value and shows the amount of balances:

- On settlement, currency and special accounts of the organization in banks;

- At the cash desk of the enterprise.

Money is the most liquid component of assets. In practice, there are sometimes restrictions on their use. A typical example is the revocation of a license from a bank that maintains a company’s current account. Cash in such accounts must be transferred to accounts receivable or other current assets and shown on the balance sheet, taking into account the likelihood of their loss.

The concept and meaning of balance sheet items

The residual value of such real estate is reflected on line 130 of the balance sheet, which means that depreciation on them is taken into account when calculating this indicator. Fixed assets that, according to accounting rules, are not subject to depreciation, are reflected in line 120 at their original (replacement) cost.

The cost of fixed assets is reflected in the balance sheet regardless of whether they are in use or are under reconstruction, conservation, or in reserve. In some cases, account 01 may include fixed assets received by the organization for rent. In this case, tenants of the property complex and lessees show on line 120 of the balance sheet the residual value of fixed assets received for rent (leasing).

However, in the financial statements, data on these fixed assets as own assets must be shown not by the manager, but by the founder of the trust management. It reflects the residual value of fixed assets transferred to trust management on line 120 of the balance sheet.

The founder of the trust management does not indicate the corresponding balances on account 79 in the balance sheet. At the same time, types of fixed assets that are insignificant in cost and significance can be combined into the group “Other fixed assets”. First of all, it should be noted that the name of this line must be understood in a broad sense.

In addition, line 130 reflects the costs of acquiring intangible assets and fixed assets that require and do not require installation before their commissioning. Line 130 indicates the amount of costs for work performed both on-site and by contract. Unfinished capital investments are reflected in the balance sheet at actual costs for the developer (investor).

Please note: on line 130 of the balance sheet, the amounts of advances transferred to suppliers and contractors cannot be reflected as part of the costs of construction in progress. According to paragraph 3 of PBU 10/99 “Expenses of the organization”, amounts of advances and prepayments are not recognized as expenses of the organization.

If the organization’s capital investments are of a diverse nature, then to decipher the indicator of line 130, it can enter additional lines into the balance sheet form. The balance on account 09 may be small in amount. However, in terms of its significance, this is a significant indicator.

Therefore, deferred tax assets must be reflected in the balance sheet as a separate line item. PBU 18/02 gives organizations the right to reflect in the balance sheet the balanced (collapsed) amount of deferred tax assets and deferred tax liabilities (clause 19 of PBU 18/02). Line 150 indicates the residual value of assets that are not reflected in other lines of the “Non-current assets” section of the balance sheet.

Line 190 is the final line for section I of the balance sheet. This line reflects the cost of fixed assets leased by the organization. Deferred expenses are expenses incurred by the organization in the reporting period, but related to the following reporting periods.

The end of the year is traditionally a time for summing up results, including financial and accounting ones. There are objective reasons to take stock once a year. Current liabilities imply such maturities, the annual report is the most important in the case of a balance sheet. Regardless of anything, it is better to worry about the state of affairs in advance. It would be good for the accountant to inform management, and it would be good for management to show an interest in finance. If something has been overlooked during the period, it’s time to pay attention to it at the end of the year.

Liability balance

Dividing accounting indicators into two categories – assets and liabilities – helps to systematize data on the company’s activities and form a complete economic picture of the current state of the enterprise.

The main reporting of organizations - the balance sheet (Order of the Ministry of Finance dated July 2, 2021 No. 66n) is based on the equality of liabilities and assets. For Passive, the report has the right tabular part.

To allocate data to balance sheet items, use the amounts of account balances as of the reporting date.

Balance sheet liability: definition and rules for filling

Liability is a set of systematized final indicators about the sources of profit creation. In the report they are divided into groups with further detail. The criterion for dividing into categories is the origin of capital. Balance sheet items are regulated by PBU 4/99. The liabilities of the balance sheet are grouped:

- Capital.

- Liabilities of an enterprise of a long-term nature.

- Liabilities that must be repaid in the short term.

Liabilities consist of sections that are formed by groups of balance sheet items. Balance sheet items are represented by report lines intended for individual indicators. They are needed to reflect the values at the reporting dates of the enterprise’s property, its sources of origin and the company’s outstanding obligations.

Balance sheet liability structure

Each of the three sections of liabilities reflects the sources of formation of the organization’s assets and shows what basis the enterprise has for extracting material benefits.

Section 1 shows the institution’s own resources, represented by capital and created reserves. These resources are divided into permanent and temporary categories. The permanent part includes the authorized capital, which is formed when the organization is opened.

Variable indicators of the company's own resource base are formed through created reserves and revaluation.

The remaining sections of the balance sheet liabilities are reserved for recording obligations to counterparties.

Section 2 is devoted to the organization’s debt, which remained outstanding at the reporting date, and the final settlement date for the formed loans should occur no earlier than 12 months later.

Section 3 includes short-term liabilities, which are characterized by a high intensity of change in the overall debt indicator of the enterprise. These debts must be repaid by the company in full within the next 12 months.

The balance sheet liabilities reflect detailed values of indicators for each section thanks to the report items. The level of detail depends on the form of the balance sheet:

- in the full form of the report (Appendix 1 of Order No. 66n), item-by-item transcripts provide a detailed understanding of each indicator;

- in the abbreviated version of the balance sheet (Appendix 5 of Order No. 66n), items are combined into subgroups and show aggregated indicators, this is necessary to simplify the procedure for drawing up a report by persons using the simplified tax system.

Balance sheet liability items

The balance of the accounting accounts and the balance sheet lines are related as follows:

- for article 1310 of the liability, called “Authorized capital”, the value of the indicator is taken from the balance of account 80;

- line 1320 reflects the value of account balance 81;

- line 1340 is intended to detail the balance of account 83 as it relates to non-current assets;

- the remaining amounts for account 83 are displayed in balance line 1350;

- line 1360 corresponds to account balance 82;

- line 1370 accumulates the value of 84 accounts.

The liability accounts of the balance sheet must be expressed in positive numerical terms. An exception is made for line 1370, which can be in negative form. The sign in front of the amount depends on what the result of the financial activity of the enterprise was - profit or loss.

The section with long-term liabilities may be left blank if the organization does not have this type of debt. The indicator of long-term liabilities is taken from account 67. The peculiarity of loans with a long repayment period is that interest on them is reflected in the section of short-term liabilities in the balance sheet. Line 1420 corresponds to account 77, line 1430 shows the balance of account 96.

Why are current liabilities calculated for one year?

All assets and liabilities can be divided into two categories: current and long-term. This is the main difficulty of the report, a potential source of confusion and chaos. But chaos is easy to streamline and keep under control if you know about the existence of such a weakness. Not every enterprise has it, but many do.

It is convenient to repay current liabilities not only according to the schedule, but also within a time frame dedicated to some important event, for example, the New Year.

Paying off all debts within a year and ringing in the New Year debt-free is a good goal. Some people, however, prefer to start living in a new way on Monday. Debt obligations are part of the life of any enterprise, an absolute norm. Current liabilities require constant attention, rigor and punctuality.

Current liabilities are repaid using current assets or by attracting new current liabilities. The only exceptions are companies such as electricity, banking, and insurance. In some cases, the production cycle of an enterprise involves the creation of current liabilities that will not be converted into cash within 12 months. However, these are current liabilities. This could be raw material for the production of cognac, for example.

As you know, cognac must be infused according to the rules, in accordance with a special recipe. It's either a year, or three, or five. Perhaps even more. The finished cognac will theoretically be sold within 12 months. Raw materials are still called a current liability, although it takes more than 12 months to turn them into profit.

Video lesson Calculation of net assets

Net asset analysis is carried out in the following tasks:

- Assessment of the financial condition and solvency of the company (see → “ “).

- Comparison of net assets with authorized capital.

Solvency assessment

Solvency is the ability of an enterprise to pay for its obligations on time and in full. To assess solvency, firstly, a comparison is made of the amount of net assets with the size of the authorized capital and, secondly, an assessment of the trend of change. The figure below shows the dynamics of changes in net assets by quarter.

Analysis of the dynamics of changes in net assets

Solvency and creditworthiness should be distinguished, since creditworthiness shows the ability of an enterprise to pay off its obligations using the most liquid types of assets (see →). Whereas solvency reflects the ability to repay debts both with the help of the most liquid assets and those that are slowly sold: machines, equipment, buildings, etc. As a result, this may affect the sustainability of the long-term development of the entire enterprise as a whole.

Based on an analysis of the nature of changes in net assets, the level of financial condition is assessed. The table below shows the relationship between the trend in net assets and the level of financial health.

Comparison of net assets with authorized capital

In addition to the dynamic assessment, the amount of net assets for an OJSC is compared with the size of the authorized capital. This allows you to assess the risk of bankruptcy of the enterprise (see →). This comparison criterion is defined in the law of the Civil Code of the Russian Federation ( clause 4, article 99 of the Civil Code of the Russian Federation; clause 4, article 35 of the Law on Joint Stock Companies

). Failure to comply with this ratio will lead to the liquidation of this enterprise through judicial proceedings. The figure below shows the ratio of net assets and authorized capital. The net assets of OJSC Gazprom exceed the authorized capital, which eliminates the risk of bankruptcy of the enterprise in court.

Indicators characterizing the market stability of an enterprise

During the analysis, a number of indicators are calculated that allow one to judge the financial autonomy of the company. Let's take a closer look at them.

Financial autonomy coefficient (share of equity capital in total capital)

The autonomy coefficient shows what part of the debts can be repaid with one’s own funds. Normally, this figure should exceed 50%. It is calculated like this:

Equity: Total capital

Financial dependence ratio (share of borrowed capital)

The dependence coefficient is the inverse value of the autonomy indicator, showing the participation of borrowed funds in ensuring the functioning of the company. The indicator is calculated as follows:

Total capital: Own capital

Leverage of financial leverage (financial risk ratio)

This coefficient reads as follows:

Debt capital / Equity capital

Obviously, the lower the level of financial leverage, the greater the financial stability of the company.

Types of balances

Balances are divided according to various criteria, for example:

- by time (introductory, initial, intermediate, final and liquidation);

- by completeness of information (general, specific).

The opening balance sheet is drawn up upon the establishment of an organization, approval of a company, joint-stock company, etc.

The initial balance sheet is drawn up every year in order to clarify the property status of the organization after the annual work and determine the qualitative composition of the property. The opening balance drawn up at the end of the reporting year is the final balance for the past year and the initial balance for the coming year.

The interim (test) balance is drawn up quarterly and can be adjusted at the end of the financial year.

The final (liquidation) balance sheet is drawn up upon termination of the organization's activities. It is constituted by a special commission tasked with liquidating the organization.

General balance sheets contain information about the property, rights and obligations of the entire organization as a whole, and private balance sheets contain information about the property, rights and obligations of any individual part of the organization.

Company Balance Sheet

An organization's balance sheet is the summary of its activities for a specific period of time. This form most clearly demonstrates the principle of double entry accepted in accounting - the results of the active and passive parts of the balance sheet are always equal.

There are many types of balance sheets:

- By moment of filling: introductory and final;

- By degree of consolidation: single or consolidated;

- By period: annual or intermediate;

- According to the filling method: balance or reverse.

For analysis in practice, the annual balance sheet is most often used - form number one, filled out at the end of the year.

Working capital management

In the process of production and circulation, current assets are transformed from one type to another:

- The company uses the available money to purchase raw materials;

- Finished products are produced from raw materials;

- Finished products are sold to customers;

- Funds from customers are transferred to the company's account.

For a continuous production process, the enterprise must have current assets at each stage in sufficient quantities at any given time. Working capital management is essentially the management of this circulation of current assets.

Let's consider the concept, calculation formula and economic meaning of the company's net assets.

More found about balance sheet liabilities

- Analysis of the relationship between net profit and net cash flowIII 297,700 44,367,685 9100 302 5,559,985 Balance sheet liabilities 38,436,753 474,622 8,805,869 5

- Average annual cost of capitalThe data is the balance sheet line Balance sheet liability Average annual cost of capital formula Average annual cost of capital Balance sheet liability at the beginning of the year Liability

- Current issues and modern experience in analyzing the financial condition of organizations - part 2. If the asset of the balance sheet reveals the subject composition of the property mass of the organization, then the liability of the balance sheet has a different purpose. Under the liability, we consider the entire set of legal relations underlying

- Analysis of sources of capital formation The second section provides information on current assets, which include stocks of raw materials and materials in progress, finished goods, all types of accounts receivable, cash, short-term financial investments and other current assets. The liabilities of the balance sheet of the enterprise's liabilities are presented in three sections. Own capital. Section III, long-term liabilities. section. IV

- Model of automatic financial reporting of an enterprise Let's imagine the property of the enterprise - the asset of the balance sheet - by the sum of the values of the property functions of the capital of the enterprise - the liability of the balance sheet - by the arguments of these functions and the equality of assets and liabilities we will call the formula of the balance sheet of the enterprise. Note

- Interim liquidation balance sheets: problems and prospects. Shera proposed to consider each balance sheet as a liquidation balance sheet, where the right side of the balance sheet is the liability - the shared distribution of the organization’s property mass. After M Berliner, the asset began to be considered as

- Features of a liquidity audit of the balance sheet of commercial organizations Thus, the first three groups represent current assets and the fourth is permanent assets. Balance sheet liabilities are also divided into four groups according to the degree of urgency of their payment P1 - the most

- A matrix balance sheet will help control the solvency of the company. The assets and liabilities of the balance sheet are closely interconnected; to form long-term assets, long-term resources are attracted. If this is not

- Financial analysis of an enterprise - part 2 To carry out the analysis, the assets and liabilities of the balance sheet are grouped in Fig. 1.2 according to the following criteria - according to the degree of decreasing liquidity of the asset -

- Business transaction These business transactions simultaneously reduce the assets and liabilities of the balance sheet and, therefore, the total balance sheet by the amount of each of these operations. Next, the balance sheet

- Analysis of the arbitration manager As can be seen from the above diagram, the balance sheet liability as of 01/01/2015 consists of capital and reserves of long-term liabilities of short-term

- Analysis of financial and economic activities for administrations of constituent entities of the Russian Federation. As can be seen from the above diagram, the balance sheet liability as of 01/01/2015 consists of capital and reserves of long-term liabilities of short-term

- Analysis of the financial condition in dynamics As can be seen from the above diagram, the balance sheet liability as of 01/01/2015 consists of capital and reserves of long-term liabilities of short-term

- The content of the concept of the financial condition of a commercial organization. Sources of financial resources are the liabilities of the balance sheet. Thus, it is necessary to supplement the concept of financial resources - this is the availability of funds

- Financial potential of an enterprise: concept, essence, measurement methods Sources Balance Sheet Directions of spending 1. Revenue excluding depreciation SFR RFR 1. Cost commercial and administrative ... Social payments dividends 3 Liabilities excluding reinvested profit and VAT on acquired values 4. Assets excluding VAT

- Comparative analytical balance sheet As can be seen from the above diagram, the liabilities side of the balance sheet as of 01/01/2015 consists of capital and reserves of long-term liabilities of short-term

- Balance sheet currencyNext balance sheet liability balance sheet asset balance sheet profit The page was helpful

- Accounting codes TOTAL short-term liabilities 1500 BALANCE SHEET liabilities 1700 PROFIT AND LOSS STATEMENT 2000 Revenue 2110 Cost of sales 2120 Gross

- Long-term liabilitiesNext liabilities balance sheet liabilities current liabilities short-term liabilities stable liabilities permanent liabilities The page was helpful

- Balance sheet items Balance sheet liabilities The balance sheet consists of three sections. Section III of the balance sheet is represented by equity capital and in sections

specpreprava.ru

Online magazine for an accountant However, to adjust some of them, contrarian accounts are used, in this case counter-liability accounts, which have a debit balance, that is, they reduce the amount of liabilities. An example of such accounts is the discount on bonds payable or the discount on bills payable.

Intentions The liability-giving intentions of a company, such as signing a contract to receive goods or services in the future, although legally binding, are not reflected in the balance sheet until they are actually provided.

If the amounts of such intentions are material, they are disclosed in the notes to the financial statements. Important Contingent Liabilities Contingent Liabilities (eng.

Accounts receivable 1230 240 The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected. Financial investments (except for cash equivalents) 1240 250 The debit balance of accounts 55, 58, 73 is shown. (minus account 59) - information on financial investments with a circulation period of no more than a year Cash and cash equivalents 1250 260 The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) Other current assets 1260 270 Filled in if data is available (for the amount of current assets not indicated in other lines of the section) Assets total 1600 300 Total of all assets Explanation of individual indicators of the liability balance sheet Liability codes are also 4-digit: 1st digit is the line’s belonging to the balance sheet, 2 -i is the number of the liability section (for example, 3 - capital and reserves, etc.).

Total liabilities

Total liabilities in the balance sheet The balance sheet liability line characterizes the sources of those funds from which the balance sheet asset was formed.

The allocation of sections in the structure of the balance sheet is mainly due to the temporary factor. The 12 months will be significantly modified.

The breakdown of sections into articles is due to the need to highlight the main types of property and liabilities that form the corresponding sections of the balance sheet.

Decoding the balance sheet allows users to extract maximum useful information from its “sparse” figures.

Financial investments (except for cash equivalents) 1240 250 The debit balance of accounts 55, 58, 73 (less account 59) is given - information on financial investments with a circulation period of no more than a year Cash and cash equivalents 1250 260 The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) Other current assets 1260 270 Filled in if data is available (for the amount of current assets not indicated in other lines of the section) Total assets 1600 300 Total of all assets Explanation of individual balance sheet liability indicators Liability codes are also 4-digit: the 1st digit is the line’s belonging to the balance sheet, the 2nd is the number of the liability section (for example, 3 - capital and reserves, etc.).

What is included in total liabilities on the balance sheet?

Decoding the lines of the balance sheet (1230, etc.) The lines of the passive part of the balance sheet reflect the sources of funds received by the company, in other words, the sources of its financing.

The information contained in the liability lines helps to understand how the structure of equity and debt capital has changed, how much the company has attracted borrowed funds, how many of them are short-term and how many are long-term, etc. 470, 490, 590, 610, 620, 700).

The purpose of the asset and liability lines of the old balance sheet form (Order No. 67n) does not differ significantly from the purpose of the lines of the updated balance sheet - the only difference is in the list of these lines, their coding and the level of detail of the information.

Total liabilities in the balance sheet line

In practice, the most widespread are the following types of current liabilities: - settlements with suppliers and creditors (Accounts Payable); — short-term bank and other loans (Notes Payable); — debt for expenses payable (Accrued Expenses Payable); — taxes and other charges (Federal Income Tax Payable).

Since it is assumed that the reader is familiar with accounting, we will not consider in detail all the balance sheet items, but will only talk about those that require special knowledge or, more often, a special approach on the part of the analyst.

In industrial, trading and service companies, assets and liabilities are divided into current and long-term. However, not all companies can make do with only the “standard” lines of this reporting - many require expanded detail.

For example, this could be a bad debt from a counterparty or the value of stolen property for which investigative actions have not yet been completed. At the same time, it is important that for an organization that has a loss, the total of the “Capital and Reserves” section (net assets) does not turn out to be less than the amount of the authorized capital.

For the item “Deferred income” the value is taken as the sum of balances on accounts 86 (target financing) and 98 (deferred income).

Under the item “Other liabilities” in the section “Short-term liabilities”, liabilities with a maturity of less than 12 months are shown that are not included in other lines of short-term liabilities.

The balance sheet asset reflects the value of the organization's property, broken down by its composition and areas of placement.

- What is included in total liabilities on the balance sheet?

- Total liabilities

- Explanation of balance sheet lines (1230, etc.

) - Current liabilities in the balance sheet are line 1500 of the balance sheet

- Interpretation of individual balance sheet liability indicators

- Balance lines 2021: decoding

- Explanation of balance sheet lines for accounts

- Total liabilities in the balance sheet is the line

- Total liabilities in the balance sheet line

What refers to total liabilities in the balance sheet However, in the financial statements, data on these fixed assets as own assets must be shown not by the manager, but by the founder of the trust management. It reflects the residual value of fixed assets transferred to trust management on line 120 of the balance sheet.

Attention

Explanation of individual indicators of the liabilities of the balance sheet Attention The balance sheet reflects all the property, liabilities, capital, cash and working capital of the organization for a certain period.

The monetary value of each item makes it possible to analyze the assets and liabilities of the organization.

The principle of balance, regulated by double entry, ensures the balance of two sides of the balance sheet, each of which is systematized by type of liquidity of funds.

What are the liabilities of an enterprise can be found out from the right side of the table; for this you need to study its structure. Regulatory acts (Tax Code) establish the standard form of the balance sheet, its sections, and spell out the procedure for filling out each article. To decipher this reporting form, there are additional applications that reflect specific information for each type of assets or liabilities and capital.

Total liabilities in the balance sheet line 1230

Important

The information is deciphered in the explanations to the balance sheet (for example, in form 5) Other short-term liabilities 1550 660 To be filled in if not all short-term liabilities are reflected in other lines of the section Total short-term liabilities 1500 690 The total total of short-term liabilities is indicated Liabilities in total 1700 700 Total of all liabilities In the new form of the balance sheet there were fewer rows than in the old one, and, on the contrary, there were more columns. However, not all companies can make do with only the “standard” lines of this reporting - many require expanded detail. Therefore, sometimes additional items are used, for example, to line 1260 “Other current assets,” a detailing line 12605 “Deferred expenses” is opened.

The balance sheet in the language of accounting legislation was previously called Form 1.

Other current liabilities

may include

— targeted financing, which generates an obligation to transfer the financing object to customers within 12 months after the reporting date;

— VAT amounts accepted for deduction when transferring an advance payment and subject to restoration for payment to the budget upon actual receipt of goods or upon return of the transferred advance payment;

— special purpose funds to finance current expenses.

Articles 170, 171, 172 of the Tax Code

1) The site is under construction, please be understanding;

2) For correct operation, you need to enable Javascript in your browser settings;

4) A link to site materials when quoting or using them is required.

Other liabilities on the balance sheet are

On line 1550

other liabilities of the organization are reflected, the repayment period of which does not exceed 12 months:

(in terms of other short-term liabilities)

(in terms of other short-term liabilities)

Other current liabilities may include:

- targeted financing received by developer organizations from investors and generating an obligation to transfer the constructed facility to them within 12 months after the reporting date;

- amounts of VAT accepted for deduction when transferring an advance (prepayment) and subject to restoration for payment to the budget upon actual receipt of goods, works, services or upon return of the transferred advance;

- special purpose funds to finance current expenses.

Letter of the Ministry of Finance dated December 30, 1993 N 160 “Regulations on accounting for long-term investments”

Adequacy of cash in relation to current liabilities

In order to find out how much cash is required to pay current obligations, it is necessary to calculate the adequacy ratio. When determining it, an economic concept such as the degree of coverage is used. In other words, you need to determine the ratio of the amounts of current liabilities and assets.

If, as a result of calculations, it turns out that current assets have a fairly significant weight in balance sheet items, then there is confidence that current liabilities will be paid from own funds. This dominance allows the company to create a reserve stock in case of unexpected losses. The amount of reserve stock is an important indicator for lenders. If the resulting coverage ratio is greater than 2, then this value is a guarantee of the safety of current assets in the event of a decline in market prices.

The company's commercial cycle also plays an important role in the formation of current assets and liabilities. The enterprise's need for working capital directly depends on the timing of accounts payable and receivable. The longer the term of the supplier's credit obligations, the more confident the company feels in the event of delays in payments from customers.

The relationship between current liabilities and assets in the commercial activities of an enterprise is obvious. These concepts are the fundamental constants of the balance sheet. The size of working capital and liabilities characterizes the economic condition of the company and its financial stability.

Short term

are liabilities whose maturity does not exceed 12 months after the reporting date.

Short-term liabilities include short-term obligations of the organization to suppliers (for goods supplied, work performed and services provided for the organization), buyers (for advances received from them), founders and employees, to the budget and extra-budgetary funds, lenders and other creditors.

In addition, reserves for future expenses are reflected as part of the organization's short-term liabilities.

The procedure for generating indicators according to the lines of section V of the balance sheet liabilities

The organization’s liabilities (essentially its borrowed capital) are presented in two liability sections of the balance sheet, depending on their maturity date:

in Sect. IV “Long-term liabilities” – liabilities whose maturity is more than 12 months after the reporting date;

in Sect. V “Short-term liabilities” – obligations that must be repaid within the next year.

Section V “Short-term liabilities” of the liabilities side of the balance sheet reflects information about short-term borrowed sources attracted by the organization.

In line 1510 “Borrowed funds” the credit balance of account 66 “Settlements on short-term loans and borrowings” is entered, as well as part of the amounts from the credit of account 67 “Settlements on long-term loans and borrowings” (in the part subject to repayment within the next 12 months after the reporting period). dates).

On line 1520 “Accounts payable,” the organization needs to show the total amount of all types of short-term debt to other organizations and individuals, as well as to the state and extra-budgetary funds. To do this, add up the credit balances of the following accounts (in terms of short-term accounts payable):

62 “Settlements with buyers and customers” (in terms of short-term accounts payable for advances and prepayments received);

75 “Settlements with founders”, subaccount 2 “Settlements for payment of income”;

Organizations have the right to independently determine the detail of indicators for reporting items.

Therefore, in principle, an organization can add decoding lines to detail the indicator on page 1520 “Accounts payable”.

For example, for separate presentation of information on short-term accounts payable to suppliers and contractors, to the organization’s personnel, to the budget for the payment of taxes and fees, as well as to extra-budgetary funds, if the organization recognizes such information as significant.

The organization must fill out page 1530 “Deferred income” of the balance sheet liability in cases where the accounting provisions provide for the recognition of this accounting object.

For example, commercial organizations here reflect the sum of the credit balances of accounts 98 “Deferred income” and 86 “Targeted financing”.

The fact is that in commercial organizations receiving budget funds, amounts of targeted financing aimed at acquiring non-current assets or inventories are taken into account as part of deferred income. The balances of targeted financing are also reflected within this category of accounting objects.

Line 1540 “Estimated liabilities” is intended to reflect the credit balance of account 96 (except for amounts included in long-term liabilities).

Line 1550 “Other liabilities” reflects other types of short-term liabilities that are not included in the above lines.

For example, the amount of targeted financing received by developer organizations from investors and generating an obligation to transfer the constructed object to them within 12 months after the reporting date (in accounting they are taken into account in account 86 “Targeted financing”), or the amount of VAT accepted for deduction when transferring an advance (prepayments) and subject to restoration and payment to the budget upon actual receipt of goods, works, services or upon return of the transferred advance payment (prepayment), usually accounted for in account 76 “Settlements with various debtors and creditors.”

The total amount of lines 1510 - 1550 is reflected on line 1500 “Total for Section V”, which characterizes the total amount of short-term borrowed capital (liabilities) of the organization.

Codes and decryptions

The balance sheet document includes 5 main sections. Let's look at their names and contents.

Section 1 – Non-current assets

Section 1 is a direction that includes information about what assets that have a low degree of liquidity the organization owns. Traditionally, these include equipment, buildings, premises, intangible active parts and other elements.

The basis of the section is 7 lines, starting with intangible assets (1110) and ending with other elements (1170). In addition, this part contains lines with the results of research work (1120), fixed assets (1130), profitable investments (1140), tax assets (1160).

The last line (1100) summarizes all previous directions and elements.

Section 2 – Assets in circulation

Section 2 is a group of resources that are the most highly liquid. These include commodity items, debt from debtors, cash in the cash register, in the organization’s accounts, etc.

Considering a more detailed description of the document, it is worth paying attention to the inventories reflected in line 1210, VAT (1220), debt for the amounts that debtors must pay (1230), financial investments (1240), cash resources (1250) and so on.

Section 3 – Capital

Section 3 displays information related to the enterprise’s capital and the reserve portion on which it can rely. This part contains 6 main directions and one summary line.

The lines should include stock capital resources (1310), own securities, mainly shares, the redemption of which occurred from shareholders (1320), revaluation of assets outside of circulation (1340), additional funds not subject to revaluation (1350), reserve stock capital ( 1360), uncovered loss part (1370).

Section 4 – Long-term financial obligations

Section 4 includes various debts of the organization that it owns for the future. If we consider and study this part of the balance sheet in detail, we can highlight the following areas: borrowed resources (1410), deferred obligations for fees and contributions to the state treasury (1420), reserves created as part of contingent liabilities (1430), other debts (1450) . And finally, the final line, represented by the sum of all filled columns (1460).

Section 5 – Short-term liabilities

The assignment of code values and numbering in section 5 follows the same principle. There are 5 main directions and one final direction.

In line 1510, borrowed funds are reflected; in 1520, you can obtain information about data on accounts payable. Within the framework of page 1530, it is possible to obtain data on income receipts of future periods.

Reserves for upcoming expenditure areas appear in column 1540, and other liabilities are indicated in 1550.

Traditionally, code values are required so that bodies and structures of official statistics are able to combine information presented in different types of balance sheet data into a single whole.

But if the paper is compiled for a quarter or another, shorter reporting period, filling out the lines is not necessary, since they do not include any functional features.

Coding is only needed in those practical situations where documents are subsequently submitted to authorities.

Analysis of current assets

The values of current assets are used to evaluate the enterprise based on financial ratios.

Share of current assets in the overall balance sheet structure

Characterizes the property status of the enterprise and is calculated using the formula:

amount of current assets/balance sheet amount

On the one hand, a high level of current assets reduces the risk of insolvency. On the other hand, it is necessary to maintain a balance between short-term and long-term assets, since the latter increase the sustainability of the enterprise and ensure the production process.

Regulatory values vary by industry. For trading companies, the share of current assets is always significantly higher than for manufacturing enterprises.

Liquidity ratios

All balance sheet indicators in the formulas are taken as the average at the beginning and end of the reporting period.

Reduced values of liquidity ratios indicate the risks of untimely settlement of debts; too high values indicate ineffective management of working capital.

Profitability:

This is (net profit of the enterprise from the income statement/current assets) * 100%

Shows profit per 1 ruble of the value of current assets. A profitability of 18-20% is considered optimal.

Turnover:

Characterizes the company's business activity and is used to assess the effectiveness of management of current assets, especially inventories and receivables.

The turnover period is defined as:

(average amount of current assets for the reporting period/revenue) * number of days of the reporting period

The shorter the turnover period, the faster the current asset turns into cash.

In-depth structural analysis of the enterprise’s capital (stages, tasks)

A deeper structural study of the passive part of the balance sheet involves studying the relationship between borrowed and own sources of financing activities, a detailed assessment of changes in their levels with a study of the reasons for these changes, and searching for the optimal relationship between long-term and short-term debts.

Assessment of short-term and long-term sources of borrowed capital

When examining the structure of long-term and short-term debts, it is the growth of long-term liabilities that is positively assessed, since they have a number of advantages:

- Providing the company with prolonged financial sources necessary for investing in capital transformations;

- Increasing current solvency;

- Increased financial stability.

As for short-term accounts payable, the proportions between bank loans and debts to personnel, counterparties, tax and funds, etc. are examined here.

Bank loans are considered more expensive sources of financing compared to cheap (and sometimes free) other short-term obligations. However, you need to be careful here: sometimes penalties for late payment of taxes or late payment under an agreement can be quite significant.

Assessing the balance for signs of “good” balance

The final stage of the analysis is to evaluate the balance sheet for signs of a “good” report. It is considered that the position of the company is favorable and stable if:

- The amounts in the balance sheet totals are growing, and the rate of their increase exceeds the rate of inflation;

- The size of current assets increases faster than the amount of non-current assets;

- Current assets exceed short-term liabilities in value terms by at least 1.5 times (this also applies to their growth rate);

- In the active half of form No. 1 there is the minimum required amount of maximum liquid assets (that is, cash);

- The size, growth rate and shares of receivables and payables are approximately the same;

- The size and growth of long-term sources are greater than similar indicators for non-current property;

- The share of equity capital in the sum of all sources is at least 50%;

- There is no item in the balance sheet that directly indicates the financial ill health of the company - an uncovered loss.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How to show it on the balance sheet

Let's consider how the organization's current liabilities are located on the balance sheet. To do this, you need to remember that in the booze. in accounting they are classified as current liabilities. The location of short-term liabilities is as follows: they are located in section 5 of the balance sheet. The amount of liabilities in the balance sheet will be reflected on line 1500. As a result, they will be shown in the section as the sum of lines 15 (10, 20, 40, 50, 30) of liabilities.

Let's consider the procedure for entering into reporting for certain types of current liabilities:

- Short-term loans. When reflecting them, you need to record only the principal amount without the accrued penalty.

- Long term duties. Only the current repayment amount is shown.

- Short-term bills (which an organization issues as a means of payment for future services). The total amount of debt is reflected. If interest is to be paid, it is not included in the balance sheet.

- Accounts payable. The principal amount of debt for the delivered product or service is also recorded.

- Advance payments received. All prepayments for future supplies of goods and services must be reflected.

- Budget deductions. The credit balance of the corresponding subaccounts (all fees to the budget without exception) should be presented here.

- Insurance deductions. It is necessary to reflect all amounts going to extra-budgetary funds in the form of a credit balance in the required subaccounts.

- Settlements with participants. Here the debt to the founders and shareholders should be reflected. This will be the amount of accrued dividends.

- Internal calculations. The amounts for transactions with subsidiaries and joint ventures are reflected here.

- Other short-term liabilities (these are amounts that cannot be correlated with the listed items). They are reflected as a credit balance in account 372.

Depending on the type, the rules for entering into the balance sheet may differ.

When preparing reports, it is necessary to take into account that if receivables have been transferred from long-term to short-term, then now they should be posted on line 240 (and not 230, as before). It is intended to reflect the credit balance on the account. 69. On line 140 it is necessary to enter the amount of account balances. 58 and 55 (subaccount 3, which relates to long-term investments).

The accounting for current liabilities undergoes periodic changes. 2018 was no exception. Therefore, accountants and economists need to thoroughly monitor the editing of regulations.

Termination of obligations will be discussed in the video:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

When a current liability becomes a long-term liability

Raw materials, in the case of cognac, are purchased with certain funds. Expenses become a current liability. The raw materials themselves are considered the basis for making a profit and are also considered current liabilities. But this may not be reflected in the balance sheet, because this is a theory, not real numbers. If debt obligations provide for an increase in maturity, then raw materials are a current liability, taken into account in the balance sheet.

If the liability is equipment, then it is a current liability. If a liability refers to the building materials from which a building must be constructed, then it belongs to the category of long-term, nothing else. In a general sense, liabilities include start-up capital, additional expenses, and debts. This concept includes everything that should make a profit, but is not yet working. So the framework of the concept itself and the time frame associated with it are blurred. You can get confused and there are contracts to prevent mistakes. The deadlines specified in the accompanying documentation must be followed. But this work remains off the balance sheet.

Basic Concepts

Every legal entity, regardless of the type of activity, has obligations. They are usually divided into long-term and short-term (or current). From the name it is already clear that division is carried out on a temporary basis.

Current liabilities are those debts that the company needs to pay off within the next year. Their elimination is carried out using current resources, which include:

- Dividends intended for payment.

- Tax payments.

- Bills that are classified as short-term.

- Income received as an advance payment, but not worked out, etc.

Current resources have the main difference from long-term ones in that, theoretically, an enterprise could use them to carry out daily activities. Another distinctive feature of them is that they are converted into cash equivalent and spent in a short time. Most often this is a calendar year. If their repayment is postponed, then they become long-term. In this case, a penalty will be charged on the total amount.

An assessment of current liabilities is necessary when analyzing the liquidity of an enterprise, which can be important for both internal and external users. For example, to estimate the liability coverage ratio, the following formula is used:

This is a general formula, and the calculation of assets and liabilities is as follows:

According to the new balance it will look like this:

Debt to EBITDA ratio

Definition

The debt to EBITDA ratio (Debt/EBITDA ratio) is an indicator of the debt burden on an organization, its ability to pay off existing obligations (solvency). In this case, EBITDA is used as an indicator of the receipt of funds necessary to pay off the organization’s debts - earnings before interest, taxes and depreciation. It is believed that among financial performance indicators, EBITDA more or less accurately characterizes the cash inflow (the exact inflow can only be determined from the cash flow statement).

The debt to EBITDA ratio measures a company's solvency and is often used by both management and investors, including when evaluating publicly traded companies.

Calculation (formula)

The coefficient is calculated using the following formula:

Total liabilities / EBITDA

Total liabilities include both long-term and short-term debt, information about which can be obtained from the liability side of the organization's balance sheet.

Normal value

The debt to EBITDA ratio is a fairly popular ratio among analysts, cleared of the influence of non-cash items (depreciation). If the financial condition of the organization is normal, the value of this ratio should not exceed 3. If the value of the ratio exceeds 4-5, this indicates that the company has too much debt and possible problems with paying off its debts. For enterprises with such a high ratio, it is problematic to attract additional borrowed funds.

Like other similar ratios, the debt-to-EBITDA ratio varies by industry and is often compared to other companies within its industry. In addition, you need to take into account that such expense items as the purchase of new equipment, which affect the outflow of cash, will not be taken into account when calculating this indicator, because and the purchase itself does not change the financial result of the organization, and depreciation charges do not participate in EBITDA. Another important point is that when assessing the indicator, it is assumed that the organization’s receivables are regularly repaid by customers. If an enterprise has an increasing amount of unpaid debt from customers, this, of course, worsens its solvency, but does not in any way affect the ratio of accounts payable to EBITDA.

What is the book value of assets and what line of the balance sheet is it?

The entire amount of current and non-current assets of an enterprise is the book value of the assets. This is the balance line 1600. How to calculate this indicator? The book value of assets is equal to the sum of assets (current and non-current). We take it from the last approved balance sheet without reducing it by the amount of debts. Do not confuse here the book value and the value of net assets (clause 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 13, 2001 No. 62 “Review of the practice of resolving disputes related to the conclusion of major transactions by business companies in which there is an interest”). This is also indicated by the FCSM in its information letter dated October 16, 2001 No. IK-07/7003 “On the book value of assets of a business company.”

Example. Which line of the balance sheet shows the book value of assets.

Thus, it turns out that the book value of assets is balance sheet line 1600. And it is equal to the value of all assets of the enterprise, or, in other words, the total of the Assets of the balance sheet. And net assets are assets cleared of liabilities, i.e. in fact, the organization’s own capital is “Assets” minus “Liabilities”.

I. Non-current assets

II. Current assets

Results

The balance sheet is the main component of financial statements, a summary of the financial performance of an organization as of a certain date. It is drawn up in a certain form and according to certain rules. It is submitted to the tax office and also presented to other interested users. Starting from June 1, 2021, you must use the form as amended on April 19, 2019.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.