At every accounting forum, the topic of not closing the 20th account has been repeatedly raised. The fact is that there is more than one or two reasons for this, and many factors need to be taken into account - these are the settings of the accounting policy, and the entry of production documents, and accounting by item groups, etc. Moreover, the account does not always have to be closed on 20! We will present in our publication the most common causes of this problem.

In general, to make it clear why we need the 20th account, let’s say this: to determine the cost of finished products.

During the entire production cycle, direct costs are debited to account 20. This is the cost of raw materials and supplies necessary for production, wages and insurance premiums for workers in the production workshop, rental of production space, depreciation of machines and other equipment, that is, everything that was spent on production. And the credit of the same account records the release of finished products.

Thus, if we divide the amount of expenses in debit 20 of account by the number of units of finished products, we will obtain the cost of production.

When you start the “Month Closing” processing in the “Operations” section, the program should automatically close account 20 so that the final balance on this account on the last day of the month is zero.

But it is not always the case. Let's look at situations where the closure of account 20 should not have happened, and how to distinguish this from an error.

“Main production”: account 20 in accounting

The organization's expenses that are allocated to carry out operations on the main types of activities should be attributed to a special accounting account 20 “Main production”. It should not be assumed that such costs are associated only with production cycles. This accounting account is supposed to take into account the costs of selling products, performing work or providing services, which are enshrined in the constituent documentation as the main type of activity.

In other words, Accounting Account 20 for Dummies is used to record expenses for the activities for which the company was created.

Unfinished production

Work in progress is a situation where production costs have been incurred, but no output has occurred. In this case, the program does not write off expenses from account 20, and it remains unclosed.

At this moment, the setting of the enterprise’s accounting policy is responsible. Let's go to the "Main" section and select the "Accounting Policy" item.

In the window that opens, you will see two types of activities that can be taken into account on account 20: “Production of products” and “Performance of work, provision of services to customers.”

If you are engaged only in the production of products and do not provide services, then you should only have the “Product Production” flag. It is during its installation that the program focuses on product output while writing off production costs.

If you have the “Performance of work, provision of services to customers” flag, then the program does not keep records of work in progress and closes account 20, regardless of whether you produced products or not.

Here the following question may arise: “How can we take into account work in progress if the organization is engaged in both the production of products and the provision of services to customers? Indeed, in this case, you need to set both flags and 20 the account will be completely closed.”

In such cases, the accountant needs to enter the document “WIP Inventory” in the “Production” section, which indicates materials transferred to account 20 that have not yet been processed or other direct costs that should not be closed in the current period.

When creating a new document “WIP Inventory”, in the header you need to indicate the organization and department in which the unfinished work remains, and then in the tabular section add item groups to which unspent materials were previously transferred. Unfortunately, the accountant will need to calculate the amounts for accounting and tax accounting manually.

The amount that will be indicated in this document will remain unclosed on the 20th account after the end of the month.

Features of accounting on an account 20

All expenses that the company incurs on its main activities or production are accumulated on active account 20. When accepting expenses for accounting, the accounting account is debited; when releasing finished products or providing services, the entries are credited.

A feature of accounting account 20 is that debit turnover cannot be greater than credit turnover. This means that the company cannot consume more raw materials than were written out from warehouses for the production process. Similar conditions apply to other types of expenses.

Postings to account 20 collect information about the cost of OP for the reporting period. In addition to inventories, the following can be written off as main production:

- salaries of key personnel;

- depreciation of equipment;

- administrative staff salaries;

- expenses for renting premises, paying for utilities;

- other expenses.

Features of objects

The concept of semi-finished products, which are created by the company independently, according to its economic principle, belongs to the category of work in progress.

That is, they cannot go through all stages of the technological process, and therefore cannot be called a final product suitable for consumption by the final retail consumer. But an essential feature of objects is that at the previous stage they were brought to a certain stage of readiness. So subsequently such objects may be subject to the following activities:

- Sales to third party companies.

- Release to subsequent workshops in order to create the finished product.

- Transfer to structural units.

Accounting for account 21 is carried out on the basis of acts, documents, and regulations adopted by the state. Also, internal business documents such as reports, statements, certificates, regulations, orders, decrees act as sources of information.

Account 20: accounting entries

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

Accounting for the 20th account: example

Let's look at an example of the procedure for reflecting the organization's expenses associated with the performance of work.

Example

When performing work according to the estimate, the construction organization required 32 sq. m of sandwich panels at a price of RUB 1,290. for 1 sq. m without VAT.

The wages of the builders (including insurance premiums) installing the panels amounted to 25,000 rubles.

The Gazelle car, owned by the organization, delivered the panels. The monthly amount of depreciation charges for such a car is 870 rubles.

A lift was rented for RUB 1,500.

Postings that need to be completed:

- Dt 20 Kt 10 — 41,280 rub. — 32 sq.m. written off m of sandwich panels (materials);

- Dt 20 Kt 70, 69 - 25,000 rub. — wages of builders installing panels and insurance premiums have been calculated;

- Dt 20 Kt 02 — 870 rub. — depreciation has been calculated on the vehicle;

- Dt 20 Kt 60 - 1,500 rub. — expenses for renting a lift are written off;

- Dt 90 Kt 20 - 68,650 rub. — expenses are written off against the cost of construction work performed.

How to close a 20 account: 3 methods

At the end of the reporting period, for example a month, it is not necessary to close account 20. The debit balance in the account reflects the value of the company's work in progress. The company's accounting department needs to organize an inventory of work in progress while simultaneously checking workshops, warehouses and payroll records.

Postings for closing account 20 are generated when releasing finished products, when transferring produced material assets directly to customers, or when performing work or services.

Current accounting standards provide for three methods for closing accounting accounts 20:

- Direct method.

- Intermediate method.

- Direct sales of manufactured products.

IMPORTANT!

The company must independently determine the method of writing off costs from account 20. The decision must be documented, detailing the chosen method in the accounting policy.

Before closing account 20, the accountant must highlight the balances of work in progress. But only if there are such residues. If the production cycle does not include work in progress balances, account 20 is closed completely.

Direct method of closing account 20

The direct method is used when the actual price of goods, works and services produced during the reporting period is unknown. Accounting is carried out according to conditional price indicators, for example, according to planned cost.

At the end of the reporting period, the cost of manufactured products is adjusted to actual cost figures.

Typical wiring:

| Operation | Account debit | Account credit |

| An adjustment to the cost of manufactured products is reflected | 43 | 20 |

| Identified deviations of the actual cost from the planned cost are written off to the cost of sales | 90/02 | 43 |

Work in progress: reflected in reporting

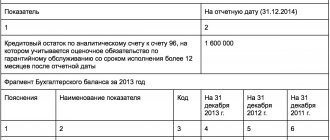

The cost of production costs not written off to the cost of finished products (work performed, services) is recognized as the cost of work in progress.

Work in progress is reflected in the balance sheet asset in the 2nd section “Current assets” in the line “Inventories”, being part of the amount of all inventories available at the reporting date. Read more about the structure of the balance sheet in the article “Balance sheet (assets and liabilities, sections, types)” .

You will find information on the procedure for filling out a balance sheet in this material .

You will learn how to fill out a balance sheet for “simplified” people by reading the material “How to fill out a balance sheet under the simplified tax system?” .

Intermediate method

When using the intermediate method of closing account 20, account 40 “Product Output” is additionally used as an auxiliary account. This account is used to record deviations of the planned cost from the actual cost. The credit of account 40 reflects the planned cost, and the debit shows the actual cost.

At the end of the reporting period, the balance is written off proportionally: part - to account 43 “Finished products” and part - to subaccount 90/02 “Cost of sales”.

Typical transactions during the month:

| Operation | Account debit | Account credit |

| The receipt of finished products at the planned cost is reflected | 43 | 40 |

| Products sold are written off at planned cost | 90/02 | 43 |

At the end of the month, the accounting records reflect:

| Operation | Debit | Credit |

| The write-off of the actual cost of manufactured products is reflected | 40 | 20 |

| Corrective entries are reflected that bring the planned cost to actual figures. | 43 | 40 |

| 90/02 | 40 |

Selling on the side

Instructions for using the chart of accounts recently began to include a new direction. It lies in the fact that the sale of such semi-finished products can be carried out not only to enterprises, but also to ordinary citizens.

If such transactions are carried out in a systematic manner, then 21 accounts are not used. Instead, it is customary to deal with account 43, which is general for information about finished products. But if such operations are episodic, then the account in question is described according to the following scheme:

- Dt 90-02 Kt 21;

- Dt 91-02 Kt 21.

The choice of one account or another (90 or 91) depends on whether the sale is an ordinary activity or not. Meanwhile, the key records will look like this:

- Dt 21 Kt 20;

- Dt 20 Kt 21.

Method of direct sales of released products

This method of accounting is used when manufactured products are sold to customers immediately and are not stored at the enterprise. In this case, production costs are written off to cost of sales. For example, services provided by organizations are closed on account 20 using the direct sales method.

Typical wiring:

| Operation | Debit | Credit |

| The actual cost of services provided is written off to cost of sales | 90/02 | 20 |

Cost Allocation

The accountant needs to keep analytical accounting on account 20 by type of product.

Costs related to several types of products (indirect costs) must be allocated to be included in the cost of each unit of output. The organization can independently determine the indicator in proportion to which the distribution of expenses will be made. This indicator can be the volume (cost) of materials and raw materials used in the production of a particular type of product, or the amount of wages of workers employed in production.