What is an organization's equity

This is a financial indicator that characterizes the amount of funds belonging to the participants of the organization.

The definition of equity capital (SC) is given in paragraph 66 of the Regulations on accounting and financial reporting (approved by order of the Ministry of Finance dated July 29, 1998 No. 34n). It says that the IC includes:

- capitals: authorized (share), additional, reserve;

- retained earnings;

- other reserves.

REFERENCE

Essentially, equity capital (also called equity) is the company's assets minus its liabilities. Another indicator is determined in a similar way - the value of the organization’s net assets (clause 4 of the Procedure for determining the value of net assets, approved by Order of the Ministry of Finance dated August 28, 2014 No. 84n). Therefore, the concepts of “equity” and “net assets” are often equated.

Assess your organization's financial condition and get tips on how to improve it

Own capital is...

Capital (in the broad sense of the word) is everything that is capable of generating income, or resources created by people to produce goods, works and services.

Equity capital is the value of all funds of a legal entity that belong to it by right of ownership and are used to form assets. Own capital consists of two main parts: capital that was invested by the founders when creating a business entity, i.e., invested capital, as well as capital that was created in excess of the initial one, i.e., accumulated. Accumulated capital is formed through the distribution of profits received as a result of the company's activities.

Thus, equity capital is the financial base on which the start of a business and all its further development are built. If at the end of the year the business entity receives a loss, then the amount of accumulated capital will decrease. Companies must constantly monitor the adequacy of their own capital and take measures to maintain and increase it.

Methods for calculating equity capital

In practice, two methods are usually used.

The first one is very simple. Its essence is to take the figure indicated in a certain line of the balance sheet as the value of the capital account.

The second method is a little more complicated. It is based on the equality of the concepts of “equity” and “net assets”. For calculations, you must use the procedure for calculating net assets approved by the Ministry of Finance. Take the resulting value as the SC. Note that for the second method (as for the first), the data sources are balance sheet indicators.

How to calculate equity from the balance sheet?

To calculate equity capital, a simple traditional method is often used: the total of line 1300 of the balance sheet is taken.

Also, to calculate equity capital, its average annual value can be used:

SK = (SKng + SKkg) / 2,

SK - the size of the annual equity capital;

SKng - the amount of equity capital (line 1300 of the balance sheet) at the beginning of the year;

SKkg - the amount of equity capital at the end of the year.

The total of a company's assets minus its total liabilities is equity on the balance sheet. Often the concept of equity is used on a par with the concept of net assets. International Financial Reporting Standards refer to equity as net assets (paragraphs 4.20–4.23 of the Conceptual Framework for Financial Reporting). We can say that net assets are a material base that, in the event of unfavorable conditions for a company, can be used to fulfill all its obligations and guarantee the protection of its interests.

Which line of the balance sheet contains the equity indicator

To apply the first method, you need to know where the company's own funds are reflected on the balance sheet. In the liability, in line 1300 “TOTAL capital”. The number in this line is the sum of the indicators of six lines.

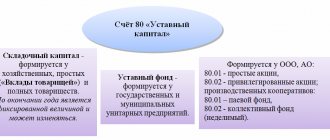

- 1310 “Authorized capital (share capital, authorized capital, contributions of partners).”

- 1320 “Own shares purchased from shareholders.”

- 1340 “Revaluation of non-current assets”.

- 1350 “Additional capital (without revaluation).”

- 1360 “Reserve capital”.

- 1370 “Retained earnings (uncovered loss).”

Fill out and print the balance sheet using the current form in the web service Fill out for free

The essence of the term “equity capital”

When characterizing equity capital as an object of economic analysis, two options for its definition are most often given:

- the value of the enterprise's assets unencumbered by the presence of external liabilities;

- a list of sources of financing the organization’s activities that make up the amount of its capital.

The first interpretation is often given in legal acts issued by government agencies:

- in Art. 35 Federal Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ for institutions of the credit and financial sector it is proposed to calculate the value of equity capital, and not net assets;

- in paragraph 29 of the order of the Ministry of Agriculture of the Russian Federation dated January 20, 2005 No. 6, attention is drawn to the fact that the amount of equity capital is the difference between the assessment of all assets and liabilities of the company, or, in other words, is identical to the term net asset value.

It can be seen that the recognition of the equivalence of the terms equity and net assets is justified, and both of these categories are defined as the difference between the assets and liabilities of a business entity.

The following version of the description of equity in the balance sheet is a combination of elements:

- authorized, additional, reserve fund;

- volume of shares purchased from shareholders;

- retained earnings of the company;

- amounts of revaluation of fixed assets and intangible assets.

All elements are reflected on pages 1310–1370 of the balance sheet. This idea fits well into the global theory of determining the size of equity capital.

The choice of method for calculating equity capital depends on the tasks facing the specialist performing the calculation. In this case, quite often it is necessary to take into account the wishes of investors, credit institutions or company owners. Management’s own views have a significant influence on the choice of algorithm.

Net Worth Formula

To apply the second method, you need to use a formula that determines the value of net assets. This formula is fixed by order of the Ministry of Finance by order of the Ministry of Finance dated 08.28.14 No. 84n.

SC = ASSETS (minus receivables of the founders for contributions to the authorized capital) - LIABILITIES (minus deferred income associated with receiving government assistance)

Table

Decoding the indicators involved in the formula

| Index | Decoding |

| ASSETS | Numbers from balance line 1600 “BALANCE (asset)” |

| Accounts receivable from founders for contributions to the authorized capital | Debit balance on account 75 “Settlements with founders” subaccount “Settlements on deposits in the management company” |

| OBLIGATIONS | The sum of the indicators in two lines of the balance sheet: 1400 “TOTAL long-term liabilities” and 1500 “TOTAL short-term liabilities” |

| Deferred income related to receiving government assistance | Credit balance of account 98 “Deferred income” sub-account “Gratuitary receipts from the budget” |

Line in the balance sheet “Own working capital”

Own working capital is a value that shows how much capital is in the company’s turnover, ensuring the continuity of its work. This indicator also determines the need to raise borrowed funds. This is a source of covering the company's working capital.

In the educational literature there are various algorithms for calculating the value of own working capital, among which the most often used indicator is the difference between the value of current assets and short-term liabilities.

The formula for calculating own working capital is as follows:

SOK - own working capital;

TA - current assets (line 1200 of the balance sheet);

TO - current liabilities (line 1520 of the balance sheet).

Optimal average equity capital

This indicator must be equal to or exceed the amount of the authorized capital (AC) of the company. If this condition is met, the business can be called successful.

IMPORTANT

By law, it is prohibited to allow the equity capital of an LLC to be less than the authorized capital. When faced with such a situation, society must take one of two paths. Either increase net assets to the level of the authorized capital, or reduce the authorized capital to the amount of net assets. If, as a result, the capital company turns out to be less than the minimum established by law (10,000 rubles), the LLC will have to be liquidated (clause 4 of article 4 of the Civil Code of the Russian Federation).

Get a sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs Get it for free

Sometimes financiers use the following approach to determine the optimal average amount of equity capital. Add up the value of assets with minimal liquidity (these usually include inventories, non-current assets and work in progress). Own capital must be equal to or greater than the value found.

The concept of fixed capital

In general, capital means financial resources invested by an enterprise in its own assets in order to obtain additional profit.

All capital can be divided into two large groups: fixed capital and working capital. OK, in fact, represents the volume of fixed assets and fixed assets of the enterprise, expressed in monetary value.

According to the All-Russian Classification of Fixed Assets (OKOF), approved by Rosstandart Order No. 2018-st dated December 12, 2014, fixed assets should be understood as manufactured assets that are repeatedly used to produce goods or provide services over a long period of time, but not less than 12 months.

OKOF includes the following as fixed assets:

- buildings and premises,

- buildings, structures

- expenses for land improvement,

- equipment (including computer and information equipment),

- household equipment,

- vehicles,

- objects of intellectual property,

- software, etc.

As we see, OK can be presented in both material and intangible forms.

The definition of non-current assets is in many ways similar to the concept of OK. According to the form of the balance sheet approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n, non-current assets also include fixed assets, intangible assets, exploration assets, profitable investments in materiel, financial investments, deferred tax and other non-current assets. To form the OK indicator, as well as the indicator of non-current assets, the data from section 1 of the balance sheet is used.

What are called non-current assets and what documents regulate their accounting, read the article “Non-current assets in the balance sheet (nuances)”.

Results

The amount of fixed capital at residual value consists of the indicators of the lines of the 1st section of the balance sheet “Non-current assets”, namely: 1110, 1120, 1130, 1140, 1150, 1160, 1170, 1190. The result obtained differs from the data in the final line 1100 by the amount deferred tax assets, since this asset is not included in fixed assets.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Place of capital turnover ratio among other indicators

The indicator discussed in this article is often used along with other turnover ratios (current assets, inventories, accounts receivable, accounts payable, assets). The effectiveness of a company's business model can thus be assessed based on a comprehensive analysis of the values of the relevant indicators.

If you have access to ConsultantPlus, check whether you have correctly calculated the turnover ratio of accounts receivable and accounts payable on the balance sheet. If you don't have access, get a free trial of online legal access.

What does the equity turnover ratio show?

As is the case with many other indicators related to a company’s revenue, equity turnover expressed in large values (from 10 and above) indicates that the company is generally doing well; in small values (less than 10) it indicates that there are possible business problems. However, these are fairly approximate values. And that's why.

The equity turnover ratio is one of the most significant indicators, but at the same time it is a very ambiguous indicator of the quality of a company's business model. The fact is that for some companies certain values of this indicator may be optimal, while for others they may be completely unacceptable.

Thus, in retail or, for example, in the construction industry, the turnover of equity capital appears to be very high, as a result of which the coefficient will reach a value of several tens of units. However, the level of profitability will not be very outstanding due to high costs. Therefore, any decrease in turnover in this case is very critical for business.

In turn, in consulting and other areas of business focused on providing services, the amount of revenue can be very modest, as well as the equity capital turnover ratio. But business owners can be quite satisfied, since the company, thanks to relatively low costs, will have good profitability indicators.

Why do you need a fixed capital analysis?

Analysis of the state of the organization's quality assurance allows one to assess the level of its technical equipment, draw conclusions about the interest of participants in increasing internal investment resources, and about the reliability, stability and competitiveness of the enterprise as a whole.

A thorough study of the structure of OC reveals hidden opportunities for its more effective use, which results in an increase in the profitability of the organization (in the form of obtaining additional profit, reducing the cost of production, reducing the time spent on work, etc.).

For a full analysis of the state of fixed capital and calculation of the coefficient of effective use of fixed assets, you will also need the information presented in Appendix No. 3 to the balance sheet, and the statistical report of Form No. 11, approved by Rosstat order No. 428 dated June 26, 2017.

QA analysis includes several stages:

- Study of the dynamics of changes in the OK indicator.

- Monitoring the technical condition of fixed assets, their timely renewal and maintenance.

- Analysis of the efficiency of asset use and identification of circumstances negatively affecting them.

- Search for additional reserves to improve or replenish your own fixed assets.