- Purpose of the article: displaying the state of the authorized capital (share capital, authorized capital) of a legal entity at the end of the reporting period.

- Line in the balance sheet: 1310.

- Account numbers included in the line: credit account balance..

The authorized capital of a legal entity is the initial provision of the organization’s activities by contributing funds (property, securities) by owners or shareholders.

Note from the author! The size of the authorized capital undergoes the procedure of official state registration and is displayed in the constituent documentation of the company; the data in the financial statements and documents must be identical.

Depending on the organizational and legal form of legal entities, a certain procedure for the formation of the initial property of the organization is established:

- JSC: authorized capital - the nominal value of shares purchased by shareholders.

The minimum amount for a PJSC is 100 thousand rubles, a non-public company is 10 thousand rubles. - LLC: authorized capital - the initial amount of funds contributed by the founders.

Minimum amount: 10 thousand rubles, funds must be deposited within 4 months from the date of state registration of the company.Note from the author! The initial deposit can be formed not only in cash, but also in tangible assets (fixed assets, goods, etc.), securities. When making a contribution with property, its value must be assessed by an independent appraiser.

- State and municipal unitary enterprises: the formed fund is the minimum amount of initial property that ensures the interests of potential creditors of the organization.

The minimum amount of the fund for a government institution: not less than 5,000 minimum wages established by the government on the date of registration.The minimum amount of the fund for municipal enterprises: not less than 1000 minimum wages established by the government on the date of registration.

Note from the author! From January 1, 2021, the Federal Law established the minimum wage at 9,489 rubles. Regions have the right to apply federal laws to determine the minimum wage for employees. From May 1, 2021, the minimum wage will be 11,163 rubles.

Line 1310 of the balance sheet of the financial statements belongs to the Capital and liability reserves section of the balance sheet: information on the state of the authorized capital of the organization as of December 31 of the current year, the previous year and the previous one is displayed here. The data must completely match the registered constituent documentation.

Note! In the financial statements, the amount of the authorized capital is reflected in full, regardless of whether it has been paid at the moment.

Change in the amount of authorized capital

In the course of business activities, legal entities have the right to make adjustments to the size of their authorized capital.

Goals:

- Attracting additional financing for the joint-stock company by issuing new shares or changing the par value of the current one;

- Obtaining certain licenses;

- Capital restructuring, etc.

Note from the author! To increase the authorized capital, a necessary condition is the full repayment of the debt of the founders according to the current size of the fund.

In a number of cases (the value of the net assets of a legal entity is less than the size of the authorized capital, withdrawal of participants from the company, etc.), a reverse operation can be carried out to reduce the fund, for example, by repurchasing its own shares from shareholders.

In accounting, all adjustments are reflected only after registration of changes in the constituent documentation.

Equity on the balance sheet - what is it?

Shareholders' equity is the total of a company's assets minus its total liabilities. It is one of the most common financial ratios used by analysts to determine the financial health of a company.

Shareholders' equity represents the net cost of a company, or the amount that would be returned to shareholders if all of the company's assets were liquidated and all debts were paid off.

A practical example of the formation of authorized capital

On November 15, 2017, a new limited liability company “Prestige” was registered with the Federal Tax Service of Russia.

The minutes of the meeting of the company's participants determined the size of the authorized capital - 15 thousand rubles, contributions will be made in cash in equal shares by all founders (3 owners 5 thousand rubles each) within 4 months from the date of state registration. The size of the fund is determined and included in the company's Charter.

After the state registration of “Prestige”, the following entries were made in the company’s accounting:

Dt75.1 Kt80

15 thousand rubles. – the size of the capital is formed and displayed and the debt of the founders to the company is reflected.

Dt51 Kt75.1

10 thousand rubles. – 2 out of 3 founders contributed their share to the management company and paid off the debt to the company.

At the end of 2021, the amount of 15 thousand rubles will be entered in line 1310 of the balance sheet of Prestige LLC, regardless of the date of repayment of the debt by the third founder.

Negative equity on balance sheet

Sergei Cheremushkin

In practice, there are often “miracles” (in the bad sense of the word), which in principle should not exist. One of them is negative equity. In theory, if a company's equity falls to zero and the owners do not contribute additional capital, it becomes the property of creditors. In fact, such companies can exist for some time, some of them even survive and subsequently achieve positive financial results. The problem is what to do with the relative indicators of financial performance that describe the activities of such unusual organizations. For example, the return on equity indicator ROE turns out to be negative in the case of a profit and negative equity, and, on the contrary, in the presence of losses, it is positive. If you don't go into detail and look at profitability for a group of companies, you can fall into a trap. Of course, such an error will later be discovered, but the very fact that the usual method of calculation leads to absurd conclusions is important. Not a single financial indicator that deals with equity capital is designed for its negative values. Equity actually cannot be negative for limited companies! Owners may lose all invested capital, but no more. The remaining losses fall on creditors. Therefore, the error lies not in financial indicators (ROE, EVA, etc.), but in the imperfection of the accounting system. And you have to put up with this. Therefore, when calculating return on equity, you should use something like this formula =IF(Equity In the case of economic added value (residual income), it will not be possible to calculate the WACC cost of capital rate. Do not think of using a negative equity value as a calculation of the weighting coefficient, since the result will be greatly distorted. It will be necessary either to restore the accumulated losses, as a result of which negative equity is formed, or to transfer the negative capital of non-creditors. In fact, the problem is much deeper. Accumulated losses and asset impairments always unjustifiably reduce the amount of equity for the purposes of assessing the return on investments. From the point of view of determining the residual value of the property (liquidation value of the business), everything is correct. But when assessing profitability, the goal is to determine what percentage the business brings in relation to the amount invested in it. This is where the trap lies. Let's say that at the beginning of 2008 the equity capital was 200 million rubles. This year 40 million rubles were received. net profit (10 million is distributed to the owners, 30 is added to the balance sheet as retained earnings). Profitability will be 20%. Everything is simple here. Now, suppose that in 2009 the company suffered a huge loss of 100 million rubles. Profitability in 2009 will be -43.5% (-100/230). Own capital at the beginning of 2010 will be 130 million rubles. In 2010, the company again returned to normal operation and at the end of the year showed 40 million rubles. net profit. But now the same amount of profit gives a profitability of 30.77% (40/130), 10.77% higher than in 2008. Is it correct? Yes and no. Judging from the point of view of the initially invested (and later reinvested) capital, the level of profitability remained the same, the assets performed with the same success (or rather, somewhat worse, since another 30 million rubles were reinvested and income should also “drip” onto them ). And it turns out that the previous loss led to a sharp rise in profitability. Only managers should not be praised for this. They didn't work miracles. This is only related to mathematics. On the other hand, if in fact half of the capital was lost in 2009, then the financial result in 2010 is calculated relative to the amount that investors could hope to get back if the company were liquidated at the end of 2009. The question is whether to count against the amount initially invested or against the balance of the investment at the end of each period.

Highlights

In order to correctly form the authorized capital, it is important to remember several features. They are related to basic operations, posting, balance sheet balancing.

Basic Operations

Nowadays, founders often sell their own share of capital. Alienation can be accomplished in several ways. In the first case, the share is transferred to other participants. This allows you to maintain the amount of capital by changing the distribution of parts.

The option of transferring funds to a person who is not related to the founding board is also available. Then the authorized capital becomes smaller.

Any transactions are considered valid after appropriate corrections are made to the Unified State Register. All transactions are reflected in accounting. To understand the nature of the changes being made, it is necessary to consider an example.

One of the owners buys a share at par value. Then it is necessary to enter into the accounting record D 75 about the settlement with the founder, K 91-1 about other income to reflect the proceeds received from the sale of the share. It is also necessary to write down D 91-2 on other expenses and K 81 on own shares to reflect the write-off of the nominal value of the company’s share.

In addition to selling the share, the starting cost of capital can be increased. This is necessary to increase working capital and comply with licensing requirements.

Capital transactions entries

You can increase capital using your own property or additional contributions from new participants.

It is important to take into account some conditions:

- it is necessary to repay the debts of the participants to the company in full;

- the increased amount should not be greater than the difference between assets and debts;

- the net asset must be greater than the authorized capital.

Reflection of share capital is carried out similarly to the authorized capital. It is necessary to account for the company's profits.

Nuances of formation

The formation of the authorized capital is carried out depending on the type of property. The size is determined by the participants who contribute to the development of the enterprise.

When depositing not cash, but property, it is assessed. An independent person participates in it. The cost cannot be reduced after the documents reflect what assessment was made by the invited expert.

Responsibility for the procedure carried out lies with both the appraiser and the participants of the company themselves. If less property is contributed, additional subsidies will be made. The rule is considered valid for five years after the company is registered or changes are made to the charter.

This requirement does not apply to organizations that have privatized state or municipal unitary enterprises.

Payment for valuation services must be included in the initial cost of the transferred property, which includes:

- intangible assets;

- fixed assets;

- materials;

- goods.

If another organization acts as the founders, then when making a contribution, the amount of input VAT is restored. It is important that it is accepted for deduction earlier.

Tax restoration on property that has depreciation is carried out on the basis of its residual value. If other values are used, then the actual cost is taken into account.

If the tax is not recognized as part of the deposit, the amount is reflected in line 19 with account 83. In another situation, account 19 is used and account credit 75.

When contributing property less than the nominal share value, the founders' debt on deposits is formed. Otherwise, the difference is reflected in additional capital.

The profitability threshold shows the sales volume at which the LLC can cover all its expenses without making a profit. The types of business activities for which UTII is introduced are listed here.

The property that is a contribution to the authorized capital is allowed to be transferred into production, sold or transferred free of charge. At the same time, the size of the authorized capital should not decrease.

Order and wiring

The company's funds are formed on the basis of share capital. It is required to carry out the activities of a company of an economic nature to make a profit.

The starting capital is reflected in the charter and is the nominal value of the company's shares (when forming an OJSC, CJSC) with a minimum amount of 1000 or 100 minimum wages. If an LLC is created, then the size is regulated at the legislative level and should not be less than 10,000 rubles.

Investments can be made using:

- Money;

- securities of value;

- copyright;

- other property.

You can contribute start-up capital in several parts. In this case, the first must be at least 50%. The outstanding debt must be repaid within the first year of operation of the firm. If the obligations are not fulfilled, the founder must reduce the size of his share. If the authorized capital is reduced to a level below that established by law, the company will be liquidated.

When transferring property against the authorized capital, it is important to take into account some features:

- Participants must evaluate the property. At the same time, they can determine its value higher than that established by the appraiser.

- When transferring a natural share, a transfer and acceptance certificate is drawn up.

- The charter may contain information about restrictions on the use of this or that property as authorized capital.

- The amount of capital is reflected not only in the charter, but also in the balance sheet. It is accounted for in passive account 80. After fixing, posting D75 is made on settlements with the founders and K80, which shows the size of the authorized capital. Using this information, you can confirm the availability of funds from the company based on the charter and track the amount of unpaid amounts by the founders.

- In the balance sheet, capital is reflected in line 1310 (Authorized capital). It includes the full amount even if partial payment is made. The debt is formed on account 1230 (Accounts receivable).

Receipt transactions are entered into specific accounts.

They can be expressed as follows:

| Cash | Dt 50, 51, 52 Kt 75 |

| Intangible assets | Dt 08 Kt 75 |

| Materials | Dt 10 Kt 75 |

| Securities | Dt 58 Kt 75 |

The importance of balance

Each company must have an equal number of assets and liabilities, expressed in ruble equivalent. This is why a balance sheet is maintained. It is a kind of scale with bowls in balance.

Assets are values owned by an enterprise. Liabilities reflect debt obligations. Thus, when paying off debts, the company has a zero balance.

When completing a balance sheet, the value of assets exceeds the value of liabilities. This does not indicate an increase in funds for the enterprise. Often accountants make mistakes, so the balance is upset.

At first glance, it may seem that balance is only required on paper. But it helps to find errors when inequality appears.

What is it and where does it come from?

Authorized capital on the balance sheet is required when creating an enterprise. At this moment, the owners do not have any common funds other than their own. Therefore, the founders invest certain shares in the company.

The authorized capital is expressed not only in monetary terms. It can be contributed by property, copyright. After the transfer of funds, each owner receives a certain number of shares.

The amount of capital is negotiated by the owners. The transferred amount is specified in the charter, therefore the capital is defined as authorized capital.

When creating an OJSC or CJSC, all funds are determined in the form of shares. They can later be exchanged for money or property. In this case, most often the shares are simply displayed in documents, but do not have a material expression to exclude counterfeits.

You can take into account the number of shares using a special register. It is a table in which data for each shareholder is recorded. Maintenance is carried out by special organizations, where accounting is based on tracking purchases and sales of shares.

When forming an LLC, no shares are issued. The owners fix their shares in the charter. Division can be done into equal parts.

Results

An idea of the amount of equity in the balance sheet is given by the value indicated in its line 1300. However, in its essence, equity corresponds to the concept of “net assets”. To calculate net assets, there is a formula approved by the Russian Ministry of Finance, based on balance sheet data, but taking them into account taking into account some nuances. The amount of equity capital is extremely important for assessing the financial position of the company. Of particular importance is its relationship with the size of the authorized capital.

Which line of the balance sheet contains the equity indicator

Calculating equity capital in the balance sheet using the Ministry of Finance method is a procedure that involves using data from the following sections of the balance sheet:

- lines 1400 (long-term liabilities);

- lines 1500 (current liabilities);

- lines 1600 (assets).

Also, to calculate equity capital, you will need information showing the amount of debts of the founders of a business company (let’s agree to call them DOO), if any (they correspond to the debit balance of account 75 as of the reporting date), as well as deferred income, or DBP (account credit 98 ).

For information on what kind of transactions are reflected in the accounting operations of the insurance company, read the material “Procedure for accounting for the equity capital of an organization (nuances).”

The structure of the formula by which net assets and at the same time equity capital in the balance sheet are determined is as follows. Necessary:

- Add the indicators along lines 1400, 1500.

- Subtract from the number obtained in paragraph 1 those that correspond to the credit of account 98 (for income in the form of assistance from the state and gratuitous receipt of property).

- Subtract the debit balance of account 75 from the number on line 1600.

- Subtract the result obtained in step 2 from the number obtained in step 3.

Thus, the formula for equity capital according to the Ministry of Finance will look like this:

Sk = (line 1600 – DUO) – ((line 1400 + line 1500) – DBP).

For information about who should apply this calculation procedure and how its result is formalized, read the article “The procedure for calculating net assets on the balance sheet - formula 2018-2019.”

Calculation methods

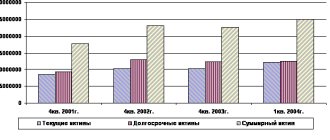

All the information needed to calculate a company's equity is available on its balance sheet. The calculation involves determining the companies' total assets and total liabilities, including current and long-term assets.

Current assets include retained earnings, stockholders' equity, and other cash held in bank and savings accounts, stocks, bonds, and money market accounts.

Long-term assets include equipment, property, illiquid investments and vehicles. Current liabilities include any payments and interest on loans in the current year, accounts payable, wages, operating expenses and insurance premiums.

Long-term liabilities include any debts that are not due in the current year, such as mortgages, loans and payments to bondholders.

Own capital is reflected in line 1300 of the balance sheet. The traditional calculation is as follows:

Equity = value in line 1300

Shareholders' equity can also be expressed as a company's share capital plus retained earnings, less the value of treasury shares. However, this method is less common. Although both methods should produce the same figure, using total assets and total liabilities provides a clearer indication of a company's financial health.

According to Order of the Ministry of Finance of Russia No. 84n, that net assets and equity capital are the same thing, their essence can be determined based on the criteria of Russian regulatory legal acts.

In turn, obligations must also be taken into account, except for some future income, namely, those associated with receiving assistance from the state, as well as the gratuitous receipt of certain property.

Calculation of net assets, and therefore equity capital according to the Ministry of Finance method, assumes information from lines 1400, 1500 and 1600 of accounting. balance.

You will also need information showing the amount of debts of the founders of a business company (DUO), if any (they are reflected by posting Dt 75 Kt 80), as well as deferred income, or DBP (account credit 98).

- The structure of the formula for determining net assets and at the same time equity capital is as follows: (Line 1400 + line 1500)

- Next, you should subtract from the resulting number the amount that corresponds to the credit of account 98.

- Next, calculate the indicators on line 1600 according to the posting Dt 75 Kt 80.

- From point 3, point 2 is calculated.

Thus, the formula for determining the value of the insurance premium using the Ministry of Finance method will look like this:

Sk = (line 1600 – DUO) – ((line 1400 + line 1500) – DBP)

By comparing specific numbers that reflect everything a company owns and all its liabilities, the net worth equation reveals a clear picture of a company's financial health that is easily interpreted by laymen and professionals alike.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculation must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

What is equity

In economic science and practice, there are two definitions of the essence of equity capital (SC):

- assets of an enterprise recorded without taking into account the obligations of the relevant entity;

- a set of indicators that make up the capital of an enterprise.

The approach based on the first definition is reflected in some legal acts. So, for example, in paragraph 3 of Art. 35 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ states that in banking and insurance organizations, as well as in non-state pension funds, equity capital is calculated instead of net assets. In paragraph 29 of the order of the Ministry of Agriculture of the Russian Federation dated January 20, 2005 No. 6, it is noted that the generally accepted understanding of the capital cost as the difference between the value of property and the company’s liabilities corresponds to the essence of the net value of property or net assets.

Thus, it is quite legitimate to consider the concepts of net assets and equity capital as interchangeable or as the same economic category, corresponding to the volume of a company's assets minus liabilities.

Now about the second definition of equity in the balance sheet - this concept (in accordance with another concept) contains a set of the following indicators:

- authorized, additional, and reserve capital;

- own shares purchased from shareholders;

- the firm's retained earnings;

- the result of the revaluation of the organization’s non-current assets.

It may be noted that these items correspond to lines 1310-1370 of the balance sheet.

Many experts consider this concept traditional. A similar approach is used not only in the Russian Federation, but also in other countries of the world (in this case, foreign economists may use indicators similar to those present in the lines of the Russian balance sheet).

The use of 1 or 2 approaches depends on the specific purpose of calculating equity capital. In particular, the company's management may be given a recommendation to use one or another method by investors, banks making decisions on loans, or the owners of the company. The choice of one approach or another may depend on the subjective preferences of management, the influence of a particular management or scientific school on the development of appropriate decisions by the company’s management.

The approach to defining the concept of equity capital is also predetermined by the traditions that have developed in the legal and expert environment of a particular state. In Russia, in principle, both approaches are common. We outlined possible factors for choosing 1 or 2 above.