An employer who knows how to manage company funds is not always interested in employing workers. Previously, this could have been avoided by using outstaffing. Since it was banned in 2016, employers began to consider other options for interacting with employees. One of them is the conclusion of a civil law agreement .

Entrepreneur - tax agent for personal income tax for individuals

Individuals are required to pay taxes on income. Russian citizens pay 13% on every money they receive. Foreigners pay 30% if they received income in our country. These are the provisions of Art. 207, 224 Tax Code of the Russian Federation.

When an individual entrepreneur or organization hires an individual under a civil contract, the obligation to pay personal income tax passes to them. The customer becomes a tax agent. Plus, you have to submit reports quarterly and annually for other people’s taxes. And all tax obligations are removed from the individual. Rules - from Art. 226, 230 Tax Code of the Russian Federation.

It is impossible to write in the contract that an individual deals with personal income tax independently. Such a tax clause in the contract is an empty space. The obligation to transfer personal income tax from the entrepreneur will not be removed. This was confirmed by the Ministry of Finance in Letter No. 03-04-05/12891.

The duty of a tax agent is not removed, even if the individual entrepreneur himself switched to tax for the self-employed. It seems like I wanted to simplify accounting and reduce costs, but no. Grounds: Part 10 of Art. 2 of the Law on the Self-Employed.

Personal income tax is deducted from the amount of the individual’s remuneration. The tax agent is prohibited from writing in the agreement that he pays the amount of tax at his own expense.

For example, the programmer’s remuneration under the contract is 200,000 rubles. It is impossible to write that the customer is obliged to transfer 13% tax in the amount of 26,000 rubles to the budget at his own expense. The programmer will receive only 174,000 rubles.

In order not to deceive the programmer with the promised fee of two hundred, the contract states that the remuneration amount is 226,000 rubles. No reservations.

Personal income tax is transferred to the tax office the next day after payment of remuneration.

However, there are situations when the tax agent cannot pay the tax. For example, money in his account was seized. While the proceedings are ongoing, payments are paralyzed.

The tax agent is obliged to inform the individual and the tax office that he cannot transfer personal income tax. This must be done before March 1 of the next year. Then the individual pays personal income tax on his own. An individual is notified in free form, most importantly in writing, the tax office is notified when submitting a 2-NDFL report for 2021 or a 6-NDFL report for years starting from 2021.

How to apply

A GPC agreement with an individual does not have a unified form.

However, when drawing up a document, it is important to indicate some aspects and nuances of cooperation:

- Preamble indicating:

- Full name and other data of the customer and contractor;

- other authorized persons.

- An item indicating a specific expected result after completing a given task. For example, the subject could be building a house. In this case, it is important to describe the main characteristics of the structure, materials used, colors, etc.

- Deadlines for completion, without which the document cannot be considered legally valid. The GAP must specify the start and end dates of work, as well as the period of intermediate inspection. It is not necessary to indicate a specific date. Typically a time period or condition is used. For example, the term is the fact of completion of construction.

- Quality of work. Quality is determined according to the criteria specified in the contract. It also indicates the warranty period during which the contractor undertakes to correct defects if any are discovered.

- The procedure for performing work or providing services. Here are the basic requirements for cooperation and links to regulations. It is important to indicate which party provides materials, tools, equipment, etc.

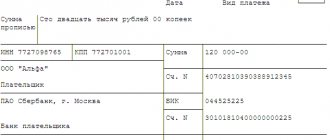

- Amount and procedure of payment. Payment is set based on results, tariffs or time spent at the discretion of the parties. This also includes the cost of materials and the nuances of paying taxes. The payment procedure is established - in cash or by transfer to an account, as well as terms.

- Responsibility. The section lists sanctions for failure to fulfill the obligations of the parties to each other. It is advisable to indicate the amount of fines or other sanctions.

- Change or termination. This part lists the conditions under which the agreement may be terminated or become invalid. They also establish the possibility of making changes.

- Conclusion. The final part indicates the validity period of the agreement, contact information and signatures of the parties.

A sample contract is available.

There is no need to pay personal income tax under contracts with self-employed people

Self-employed individuals do not pay personal income tax. Instead, they pay a reduced tax of 4-6%. And they always do it themselves, without agents.

It turns out that it is more convenient for an entrepreneur to work with the self-employed. There are no hassles with taxes and reports, and there are no penalties. However, it will not be possible to cooperate with the self-employed if:

- he is a former employee of an entrepreneur, and two years have not passed since his dismissal;

- works on behalf of an entrepreneur under an agency, commission or mandate agreement;

- provides courier services;

- earns more than 2.4 million a year.

If an individual cannot be self-employed, they cooperate with him as with an ordinary individual. And as a tax agent they pay tax for it.

Accounting as part of income tax expenses

Accounting for income tax expenses deserves special attention. The dates on which the certificate of completion of work was received cannot be reflected by the accountant in the costs of purchasing work results, since the drawn up contract does not indicate high-quality and timely provision of services by the counterparty. If the deadlines for completing the work are violated, this will not be taken into account as an error in the accounting department.

Costs incurred by the customer for the purchase of services are recognized as part of the costs for classic areas of activity at the time of signing the relevant act. The cost of work beyond the scope of the main activity of the enterprise is classified as other expenses and is recorded as a debit to account 91. The main entries look like this:

- Dt 20 (26, 44, 91) Kt 76 – carrying out settlement transactions under the GPC agreement;

- Dt 76 Kt 51 – payment of remuneration to the contractor.

Expenses incurred to pay the contractor's remuneration are recognized as expenses that are justified and have documentary evidence. In order to confirm costs that are taken into account for taxation, primary documents are used.

Under which contracts personal income tax is paid for an individual, and under which ones not?

You need to pay personal income tax if an entrepreneur cooperates with an individual or uses his property. But if he buys something from him, then no - Art. 208 Tax Code of the Russian Federation.

Personal income tax is withheld according to agreements: