When can you receive a request from the Federal Tax Service to submit documents?

Article 93 of the Tax Code of the Russian Federation gives tax authorities the right to request documents from an organization as part of desk and field tax audits.

Article 88 of the Tax Code of the Russian Federation defines a list of documents that the Federal Tax Service may require during a desk audit.

List of documents that the Federal Tax Service may require at the camera:

- Documents that confirm the organization’s right to apply tax benefits. Clause 6 art. 88 Tax Code of the Russian Federation.

- Documents that justify the correct application by the organization of VAT deductions. Clause 8 Art. 88 Tax Code of the Russian Federation.

- Invoices, acts and other primary accounting documents that justify the indicators in the VAT return in the event that tax authorities find inconsistencies in the VAT return of the organization and its counterparties. Clause 81.1 art. 88 Tax Code of the Russian Federation.

- Documents on the basis of which changes were made to the primary data of the declaration and tax accounting registers with primary and amended data. P.8.3. Article 88 of the Tax Code of the Russian Federation.

- Documents that confirm non-taxable amounts or the application of reduced rates. P.8.6. Article 88 of the Tax Code of the Russian Federation.

If an organization is conducting an on-site audit, tax authorities may request any documents related to the calculation and payment of taxes. But, according to clause 12 of Art. 89 of the Tax Code of the Russian Federation, only documents related to the period under review.

If they check a partner

In addition to the fact that an organization may receive a requirement to provide documents as part of a desk audit of its reporting, it may receive a requirement to submit documents as part of a desk audit of a business partner. Even if they check the third or fourth party to the transaction in the overall business chain.

Documents outside of checks

Article 93 of the Tax Code of the Russian Federation allows tax authorities to request documents outside the scope of inspections.

The Federal Tax Service may request documents if inspectors are collecting information about a specific transaction. In this case, one Federal Tax Service Inspectorate sends an order to another Federal Tax Service Inspectorate, where the organization is registered.

As a result, you receive a request for documents from your INFS based on a request from another INFS.

The Ministry of Finance suggested how to save on the translation of foreign “primary documents”

The Ministry of Finance reminds that in order to reflect a company’s expenses in accounting for income tax, the amounts of appropriate expenses must be confirmed by documents drawn up in accordance with Russian legislation, and if the calculation was made abroad, with foreign business turnover.

Official paperwork in our country is conducted in Russian, so the “primary report” compiled in another language needs translation, the ministry notes.

If the standard form of foreign documents is found more often than others in accounting, officials consider it sufficient to contact a translator once to decipher its constant indicators. In the future, it will be possible to translate the updated form data, if necessary.

For reference, it is reported that the Tax Code of the Russian Federation does not establish a procedure for the transfer of foreign “primary documents”.

Letter of the Ministry of Finance of the Russian Federation dated April 29, 2019 No. 03-03-06/1/31506

Editor's note:

There is an opinion that foreign documents do not need translation for submission to inspectors. Thus, the Arbitration Court of the North-Western District, in Resolution No. F07-7835/2019 dated 07/08/2019, recognized the claims of inspectors to documents drawn up by various Norwegian suppliers as unfounded. The judges indicated that in terms of their design, content and details, all the disputed invoices coincided with each other, which allows us to conclude that they comply with business customs used in Norway. It helped to cancel the inspector's decision and the lack of references in it to norms of foreign law, which the disputed documents did not comply with. The arbitrators also ignored the argument about the lack of translation of invoices.

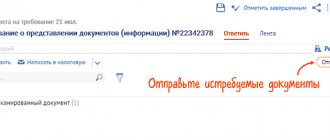

How the tax office sends requirements

The Tax Inspectorate is given the right to submit claims in the following ways (clause 4 of Article 31 of the Tax Code of the Russian Federation):

- hand over receipt directly to the person to whom the demand is addressed or to his representative;

- send by registered mail;

- send in electronic form via TKS through an electronic document management operator;

- post the request in the taxpayer’s personal account.

The right of the tax inspectorate to choose the method of sending a demand is limited only in relation to companies that, according to the Tax Code of the Russian Federation, are required to submit tax reports in electronic form. The vast majority of such companies. Tax officials must send requests to these organizations only electronically.

If an organization submits tax reports in electronic form, then requests for the submission of documents are sent to it in electronic format (clause 4 of Article 31 of the Tax Code of the Russian Federation).

If an organization submits reports on paper, requests for the submission of documents are sent to it on paper by Russian post or handed over against receipt.

An organization that submits electronic reporting is obliged to provide the technical ability to accept electronic documents from the Federal Tax Service via the TKS through an electronic document management operator.

The inspector himself decides which period documents he is interested in

While checking the company’s VAT return for the second quarter of 2021, inspectors asked its counterparty for documents on transactions completed in the first quarter of 2021. The company refused to provide the papers, indicating that the tax authority’s request went beyond the boundaries of the audited period. The organization appealed the request of the Federal Tax Service in court, but to no avail.

Arbitrators of all instances, including the district cassation, confirmed that inspectors themselves decide what events are relevant to the inspection period and are not obliged to explain their position to taxpayers or persons from whom documents and information are requested.

Resolution of the Arbitration Court of the Volga District dated January 16, 2019 No. F06-41326/2018

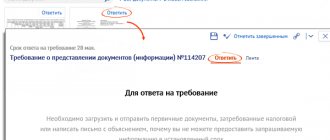

How to calculate the deadline for receiving a request for documents

If the request is received electronically

This issue is regulated by clauses 6,12,13 of the Procedure approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

The date of receipt of the electronic request is the date when the organization’s accountant (or director) opened the file with the request and sent a receipt to the Federal Tax Service.

Please note that according to clause 5.1 of Art. 23 of the Tax Code of the Russian Federation, the taxpayer is obliged to send a receipt to the INFS through the EDF operator no later than 6 working days from the date of sending the request by the inspectorate.

The request was sent through the taxpayer’s personal account

The ability to transfer claims through the taxpayer’s personal account has appeared since 2015.

The date of receipt of the request through the personal account is considered to be the day following the day the request was posted in the taxpayer’s personal account. Paragraph 4, paragraph 4, art. 31 Tax Code of the Russian Federation.

Requirement on paper

The date of receipt of a request sent by registered mail is considered to be the 6th day from the day the letter was sent to the addressee. This period is established in paragraph 4 of Art. 31 Tax Code of the Russian Federation.

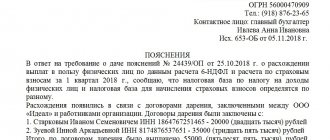

The chief accountant is not obliged to provide the inspectorate with the employee’s work history

The Federal Tax Service imposed a fine of 300 rubles on the chief accountant of the company under Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation for the fact that she did not submit to the inspection the documents requested in relation to one of her employees:

- application for a job;

- resignation letter;

- employment contract;

- The order of acceptance to work;

- personal card.

The chief accountant challenged the fine, and the court overturned it.

The fact is that the demand contained a reference to Art. 93.1 Tax Code of the Russian Federation. This meant that the inspection was interested in information about another company being inspected or about a specific transaction.

The chief accountant decided that the requested documentation did not relate to either one or the other. The company has no relationship with the audited organization. The listed documents do not relate to a specific transaction. The inspection did not indicate in its request what connection there is between this employee and the organization being inspected or a specific transaction.

Therefore, the accountant did not comply with the request. Moreover, she informed the inspectorate about the refusal, explaining the reasons. Additionally, the accountant wrote that the employee’s work documents contain his personal data, which the company has no right to transfer to anyone without his consent.

The judges came to the conclusion that the chief accountant was absolutely right. The documents listed in the request cannot be recognized as those that the company (its official) is obliged to submit to the tax authority.

In accordance with paragraph 11 of Art. 21 of the Tax Code of the Russian Federation, taxpayers have the right not to comply with unlawful acts and requirements of tax authorities.

Thus, the fine was imposed illegally.

Resolution of the Supreme Court of the Russian Federation dated April 26, 2019 No. 9-AD19-10

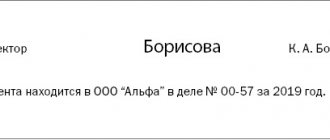

Send documents in paper or electronic form at the request of the Federal Tax Service

According to paragraph 2 of Art. 93 of the Tax Code of the Russian Federation, in electronic format you can submit documents that were originally compiled in electronic form in established formats or convert paper documents into electronic format and send them in the form of scans.

There is a format for transmitting scanned images; it is approved by order of the Federal Tax Service of Russia dated January 18, 2017 No. ММВ-7-6/ [email protected]

Documents sent to the Federal Tax Service on the basis of the requirement must be signed with an enhanced qualified electronic signature.

Documents drawn up on paper must be submitted in the form of copies certified by the head of the organization. All sheets must be stitched and numbered. In this case, there is no need to involve a notary to certify copies.

How to certify copies to confirm expenses

The Ministry of Finance considered an appeal on the procedure for certifying copies of documents confirming expenses for simplified taxation system activities.

There is a list of criteria that, if met, will allow these expenses to be recognized when calculating tax. They must be justified and documented. Justification means the economic feasibility of costs. Documentary confirmation is the compliance of the document’s execution with legally established rules.

In this case we are talking about certification of the copy. According to paragraph 5.26 of GOST R 7.0.97-2016, approved by Order of Rosstandart dated December 8, 2016 No. 2004-st, a copy will be provided with legal validity if the following details are present:

- the words "True";

- "Job title";

- "Signature";

- "FULL NAME.";

- "Date of".

If the copy is intended for transfer to another company, it must be supplemented with information about the place of storage of the original: “The original document is located in (name of organization) in file No. ... for ... year” - and certified with the seal of the organization.

To simplify the procedure for certifying a copy, a stamp may be used.

Letter of the Ministry of Finance of the Russian Federation dated April 22, 2019 No. 03-11-11/28986

Deadlines for submitting documents upon request of the tax authorities

If you have received a request from the Federal Tax Service to submit documents as part of a desk or on-site inspection, the documents must be provided within 10 working days from the date of receipt of the request. For consolidated groups this period is 20 working days. The deadlines are set in paragraph 3 of Art. 93 Tax Code of the Russian Federation.

If the company does not provide both documents and information about the counterparty, tax authorities may issue 2 fines at the same time (under Article 126 and under Article 129). This right is confirmed by the decision of the Supreme Court of the Russian Federation dated November 12, 2018 No. A33-16694/2017.

If you receive a request to provide documents as part of a “counter” audit, the documents must be prepared and submitted to the tax authorities within 5 business days from the date of receipt of the request. If the tax authorities have requested documents for a specific transaction, you have 10 working days from the date of receipt of the request in accordance with clause 5 of Art. 93.1 Tax Code of the Russian Federation.

When checking the declaration, inspectors have the right to request any documents

The company failed to challenge the fine for failure to provide a balance sheet. The organization submitted to the inspectorate an updated VAT tax return with the amount of tax to be reimbursed from the budget in the amount of 2 million rubles. The right to VAT tax deductions is declared on invoices. However, the inspectors doubted the reality of the transactions and, as confirmation of them, requested from the taxpayer balance sheets for all accounts.

The organization left the request for copies of documents unfulfilled. In addition, she did not even inform the inspectorate about the absence or impossibility of providing them. At the same time, the list of documents that tax authorities may require for the legality of providing VAT deductions is not exhaustive.

Therefore, when checking a declaration, the Federal Tax Service has the right to require any documents confirming the legality of applying tax deductions.

The court rejected the taxpayer's argument that the fine was calculated illegally.

Resolution of the Arbitration Court of the Ural District dated July 24, 2019 No. A60-53363/2018

Editor's note:

Let us note that the courts also take the opposite position regarding “turnovers”. The arbitrators recognize that it is unlawful to hold people accountable for failure to submit documents that are provided for not by tax law, but by accounting legislation (resolutions of the Arbitration Court of the West Siberian District dated July 27, 2018 No. F04-3054/2018, dated December 29, 2014 No. A27-1435/2014).

In general, there is a tendency towards an increase in the appetites of inspectors. Thus, with the recent Decision of the Federal Tax Service of the Russian Federation dated June 19, 2019 No. SA-4-9 / [email protected] , officials confirmed that their subordinates have the right to independently determine the completeness and completeness of the “primary”, accounting registers and analytics necessary for them to exercise control. This decision was made based on the results of consideration of the taxpayer’s complaint regarding the request for copies of the staffing table and Orders on the appointment of the manager and chief accountant as part of an on-site audit of the correctness of VAT calculations.

How to extend the deadline for providing documents at the request of the Federal Tax Service

If you do not have time to prepare documents within the time specified in the requirement, you need to send a written notification to the Federal Tax Service about the impossibility of submitting documents (information) within the prescribed period in the form approved by order of the Federal Tax Service of Russia dated April 24, 2019 No. ММВ-7-2/ [email protected ]

A notice of extension of the deadline for providing documents must be drawn up and sent to the Federal Tax Service within the day following the day the request was received. Based on this notification, tax authorities can make one of two possible decisions within two days: extend the deadline for submitting the requested documents or refuse the extension.

For ordinary companies, the period for which tax authorities can extend the period is not established in the Tax Code of the Russian Federation. For consolidated groups, the deadline for submitting documents can be extended by at least 10 days (Clause 3, Article 93 of the Tax Code of the Russian Federation).

Does an individual entrepreneur need to have a power of attorney certified by a notary?

If the entrepreneur’s documents for submission to the tax office are certified by an authorized person, then a power of attorney certified by a notary is required (subclause 4, clause 2, article 11, subclause 2, clause 3, article 29 of the Tax Code of the Russian Federation).

The following people share the same opinion:

- judicial authorities (see decision of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

- officials of the Ministry of Finance (letters dated 03/24/2014 No. 03-02-08/12763, dated 08/01/2013 No. 03-02-08/30900, dated 11/15/2012 No. 03-02-08/99, dated 08/07/2009 No. 03- 02-08/66);

- tax authorities (letters from the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692, dated October 16, 2013 No. ED-4-3/ [email protected] ).

The Federal Tax Service requires documents again

On the one hand, the Federal Tax Service has the right to request documents again. On the other hand, the organization has the right not to submit documents that have already been submitted a second time.

If you receive a request to submit documents again, you need to notify the tax office that the documents were submitted earlier. Indicate the details of the first request for the provision of documents, and a list of previously provided documents with details.

Previously on the topic:

Is it prohibited to re-request documents?

However, if the tax authorities lose the documents “due to force majeure circumstances,” you will have to submit the documents a second time.

The court exposed inspectors who confiscate documents and fine them for failure to submit them

As part of the on-site inspection, the company provided the inspectors with the originals of the requested documents. Three weeks later, the company received a notification via TKS about the suspension of control activities. In the accompanying letter, the inspectors reported that, in accordance with the requirements of the Tax Code of the Russian Federation, during the time-out, the original documents of the taxpayer must be returned before the inspection is resumed. The tax authorities attached to the letter copies of the lists of documents drawn up by the company when transferring the documentation, without notes on their return.

A month later, the audit was resumed, and the tax office demanded documents, the originals of which were never returned. The company nevertheless provided most of them, and for the missing papers it was fined more than 320 thousand rubles. The company went to court to appeal the punishment, where Themis supported its position.

The judges noted that the inspectorate does not have the right to demand from the taxpayer copies of documents whose originals were not returned to him. The procedure for returning papers, although not regulated, but, according to the court, should coincide with the registration of acceptance and transfer of documents from the taxpayer, that is, follow the inventory with the signature of the responsible person. The inspection, for its part, did not provide such evidence, which forced the arbitrators to cancel the tax authority’s decision.

Resolution of the Arbitration Court of the North-Western District dated January 21, 2019 No. F07-15324/2018