Updated January 19, 2021

Hello, dear readers of the KtoNaNovenkogo.ru blog. Terms from economics are increasingly becoming part of our lives (for example, everyone has heard about debit and credit, which need to be combined).

Today I want to talk briefly about one of these terms, namely liabilities.

This term is most often used in relation to an enterprise or when doing accounting, but understanding what it is will also be useful for general development (as part of increasing erudition).

The concept of liability and asset, as well as liability and asset as part of household assets

Liabilities are certain material obligations of an organization, which can include various payments, for example, interest on bonds, wages, payment of taxes and the like. By conducting a comparative analysis of the concepts of these two terms, it is possible to highlight certain differences and relationships between these concepts.

Liability is a separate part of the balance sheet, which displays all sources of funds at the disposal of organizations, collected according to their specific affiliation and the purpose they serve.

Funds are collected by item, depending on management needs. Thus, it is determined who exactly owns the funds and for what purpose they are used. A liability is a contribution of money, it is the general concept of debts and obligations of a certain organization (which is the exact opposite of assets). Liability is the totality of the company’s debts, and also means the excess of expenses over income. Also, this concept is the side of the balance sheet that shows the sources of financing the income that makes up the asset, that is, it determines income receipts and ensures their liquidity.

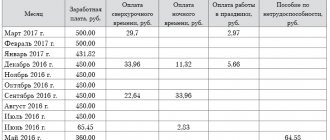

Liability is a community of legal relations that are the basis of the financing of a business entity and include both borrowed and personal capital. Liabilities are obligations that exclude subventions, subsidies, personal funds, as well as other sources of income of the company, consisting of any, be it borrowed or attracted funds, this can also include accounts payable. Let's consider a liability as an accounts payable. In this case, the liability will look like a community of obligations that imply the company's debt in the course of its business activities; settlements lead to an outflow of funds. Liabilities, as long-term obligations of an enterprise, are sources of formation of funds for the organization itself, its financing, collected into one according to their ownership, as well as purpose (both own and borrowed). Liabilities require certain additional costs, since their working capital is regularly used in business turnover and therefore they are equal to personal funds, but at the same time they do not belong to the enterprise itself. For example: wages owed to workers and employees, a reserve of future payments accumulated for vacations, as well as for other purposes. Liabilities can also include debts and prepayments. Liability is the source of origin of assets, reflecting whether these assets were obtained from the personal capital of the enterprise or due to the occurrence of any direct obligations in the organization. Liabilities are absolutely always equal to assets. Liability exceeds a country's cash expenditures abroad over its profits received from abroad. A liability is a mandatory reserve capital and means obligations of any kind to other individuals and legal entities - a loan, an obligation to pay bills, tax obligations and the like. The liabilities of an enterprise are the main sources of financing, with the help of which it is quite possible to obtain the necessary values, as well as funds. Liabilities consist mainly of :

- authorized capital;

- shares, shares in economic companies and partnerships;

- proceeds from sales of initial and additional issues of shares;

- accumulated or distributed inventories

- marketable securities;

- State capital owned by an enterprise at its own discretion.

This type of definition means fairly short-term obligations of the fund,

for example, his debt on loans for contributions to the budget, extra-budgetary funds and much more like that. It is also worth noting the fund's long-term liabilities (such as loans, borrowings and other outside funds). It is worth considering that the same things at different periods of time can be both liabilities and assets. To understand this better, consider the following examples. For example, transport is a liability. First you need to buy it, spend a certain amount of money on gasoline and maintenance. Therefore, it is a monetary liability. But if you use this transport to deliver goods and receive a certain salary for it, which will generate more income than expenses, then it turns out that the transport will make a profit, and therefore, it will act as an asset. Also, real estate is equally a liability: utility bills and the like must be paid every month. But if, for example, you rent out an apartment and receive rent for it, then it turns out that real estate automatically turns into an asset that generates a certain cash income. It is also necessary to consider the concept of temporary assets.

What are company liabilities?

The liabilities of an enterprise as the sources from which the organization’s property is formed. Those. from what sources the fixed and working capital assets were acquired or who owns them.

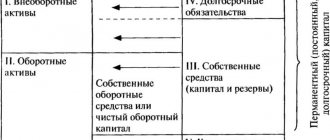

Liabilities are reflected in sections III, IV and V of the balance sheet

In order to more accurately understand what the company’s liabilities represent, we suggest considering an example:

The company has a car on its balance sheet as an asset; it can be purchased at the expense of:

Sources of funds for purchasing a car at the enterprise

It is with what funds this car was purchased that its value will be reflected in liabilities .

Here are examples of transactions for purchasing a car using your own and borrowed funds.

| Business transaction | Dt | CT | Amount, thousand rubles |

| We purchase a car using our own funds | |||

| 1. Funds contributed by the founder as a contribution to the management company | 51 | 75 | 1 350 |

| 2. A car was purchased using funds contributed by the founder | 08 | 76 | 1 350 |

| 3. The supplier’s invoice for the car was paid at the expense of the company’s own funds | 76 | 51 | 1 350 |

| 4. The car is put into operation | 01 | 08 | 1 350 |

| We purchase a car using borrowed funds | |||

| 1. Take out a bank loan to purchase a car | 51 | 66,67 | 1 350 |

| 2. Purchased a car using credit funds | 08 | 76 | 1 350 |

| 3. Paid the supplier's invoice for the car using credit funds | 76 | 51 | 1 350 |

| 4. The car is put into operation | 01 | 08 | 1 350 |

So in a broad sense :

Liability - sources of property formation

[flat_ab id=”5"]

Temporary liabilities

Temporary liabilities , as the name suggests, are closely related to a certain period of time, moreover, they take up time from their owner. For example, you came home after school or work, and of course you were very tired. You sit down at your computer and immerse yourself in the Internet. So the computer is the most basic temporary liability. He wastes our time in various ways. But, for example, you are writing a certain work or text, especially since the text is printed faster on a computer and looks much more representative. This is why a computer becomes an asset for a while. Now it’s worth taking a closer look at power liabilities. Powerful liabilities take away both strength and ability to work. Now let’s look at the most recent type of assets and liabilities; these are precisely the power assets. For example, sleep is a strength asset. It replenishes our strength spent throughout the day. For example, the gym itself can also be considered a strength asset as it significantly increases our physical strength. In the same way, bad food that gives you indigestion is also a power liability. In a general concept, power liabilities can be defined as a set or list of things or people that take away our strength, or charge of vigor. This can be considered either a job or a person who takes away your energy in some way, time or money, or after a connection with whom you don’t want to do anything at all.

It is worth noting one specific feature. If we consider this side with a philosophical view of this concept, it turns out that philosophy, then work is a power liability, but at the same time it can be considered a monetary asset, since we receive a salary for work. And quite a lot more similar ambiguous cases can be found.

Interpretations of the passive

In the modern understanding, the use of liabilities is generally successful, but its interpretation is very changeable and its forms also take on such forms, for example, when assets are completely equal to liabilities, taking into account capital. It is under the influence of Western accountants that this interpretation of capital takes on the form of an organization’s debt to its direct owner. As a result, the most well-known formulation arises: liabilities are considered as a list of legal entities and individuals who primarily own the assets. This leads to the following three conclusions :

- a liability is a consequence of an asset; if there is no asset, there will be no liability;

- the liability can rightfully be called a plan for the distribution by the owners of the property specified in the asset;

- It is necessary to collect liabilities according to the principle of withdrawal, so the best way is to start with what is subject to withdrawal in the very last place.

The most important takeaway is that liabilities equal assets. Of course, then it remains unclear how to understand such an item as the profit of future developments? In theory, and then in practice, there are three explanations of the passive from a purely informative side. The income items of such upcoming periods are a completely traditional understanding of the definition of a liability, which defines it as property at the disposal of the owner himself. There are basically two approaches to this. The first is a passive, it is understood as a purely legal category. And the second is like a plan for the distribution of certain assets, while loan debt is already formed by emerging obligations, and personal funds, at the same time, are normalized in accordance with the established, as well as a given limitation. The first option we are considering can be safely considered traditional for modern domestic accounting. This theory was confirmed by all the classics of domestic accounting. Namely: Lunsky, Rudanovsky, Kiparisov, Pomazkov and many others. The second option was more supported by accountants who wanted to vigorously link accounting with Marxist political economy. In both options there are no problems understanding the income of subsequent periods. They are taken into account as sources of personal funds. The accounting option was compared with Marxist political economy.

A new interpretation of the passive appeared relatively recently and serves as quite significant evidence of the priority of the content itself (economic relations) over the form (legal relations).

The whole essence of this approach is expressed as follows: liability is the future outflow of assets.

In this case, it does not matter at all who owns the real rights to the funds: however, it is important to know the exact or possible schedule for making payments. This type of distribution of funds should mean both repayment of loan debt and writing off reserved funds. (In addition, here it is necessary to take into account the possible possible withdrawal of funds by the owners themselves.) It is from here that the well-known revolutionary interpretation of loan debt follows, by which, as a result of all of the above, it is necessary to understand not only obligations, that is, debts to legal entities and individuals, but also reserves, which also require the release of funds within a predetermined time frame.

Repayment of debt on a loan in comparison with the options of the first interpretation gives rise to an understanding of completely different relationships between liabilities and personal funds, since inventories are personal funds - they are understood as non-own funds, however, profits of subsequent periods are understood in the same way as in

in the case of the first interpretation. So, for example, the interpretation of liability according to Schmalenbach, who lived in 1873-1955, who was a German accountant, he defined liability as follows: income, which at the moment cannot be called expenses. E. Schmalenbach was a great German accounting theorist in the 20th century. By right, it should be noted that the owners invested a certain capital, that is, the enterprise receives profit from its personal owner (initially, when conducting the business, it was their own, and at the time of the work they were transformed and capitalized into accounts payable and their personal income). The funds received must be invested in some business. And this is precisely what means that it is necessary to obtain the necessary equipment, materials, goods and the like in order for the company to turn such income into its costs. In this case, the entire total liability must be understood as profit of either past or future periods.

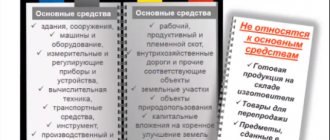

Balance sheet asset

The asset indicates the value of the organization’s property (intangible assets, fixed assets, materials, goods, etc.), as well as the amount of receivables (in other words, the debt of counterparties (buyers, customers) of your organization).

The asset consists of two parts:

- fixed assets;

- current assets.

Non-current assets are assets that are used to generate profit over a long period of time (more than one year). Current assets are assets that are repaid in less than one year.

No border between personal and outside capital

The distinctive features of this interpretation are that its adherents explain the liability as a cause, while the asset as a consequence. For the first time, a Russian accountant known as Gomberg, who lived in 1866-1935, drew his attention to this factor.

In fact, the basic understanding of what can and should be interpreted as the original cause, and what, in turn, as a consequence, is quite arbitrary. For example, the main receipts of goods are displayed both by asset and by liability. We can safely say that suppliers delivered goods, which is the cause, and the company’s inventory became significantly larger, which in turn is a consequence. However, with equal success we can safely say that growth

commodity mass led to a corresponding increase in loan debt, which is a consequence. Passive accounts display the main sources of household funds. Account balances show how and where the funds came from. In another way, the community of sources of funds is called the obligations of the enterprise itself. In accordance with the definition, a liability is a company’s debt existing as of a certain date, arising as a result of business operations that have arisen; the repayment of this debt leads to a significant reduction in the corresponding assets. It may be the payment of funds, the transfer of other assets, for example, through the provision of services, or the replacement of one type of existing obligations with others. A liability, in turn, is an organization’s existing debt at a certain point in time.

Authorized and share capital, theory and practice of liabilities

This type of liability is divided into authorized and share capital. Borrowed capital is one of the types of liabilities. Short-term liabilities are accounts payable to the organization's employees, lessors, creators, and the budget. Such obligations include payments for credit and borrowings, future expenses for the current year. Current liabilities or obligations are short-term financial obligations that must be repaid within a certain year from the date of drawing up the balance sheet or the current operating cycle of the company, this period is much longer. This concept implies that current liabilities will be repaid from assets defined as current in the same balance sheet. Liabilities of enterprises arise due to existing debts of the organization, or regarding the transfer of certain assets or services to another enterprise in the future for prepayment. Long-term liabilities are long-term liabilities for borrowings and borrowings, such as deferred tax liabilities.

As you know, what the theory is, therefore, so is the practice. In the most developed economy, accountants want to embellish the balance sheet in every possible way, but in an undeveloped economy, accountants actually become poor and mainly think about how to hide, for various reasons, profits. In this regard, the basic principle of conservatism is largely indicative; it can be defined as a requirement of prudence, which in turn involves a significant understatement of the size of assets and at the same time an exaggeration of liabilities. How to understand what a passive is? It is necessary to initially pay attention to the fact that the theory of passive, as well as

the practice of interacting with it, despite all the confusion of terminology and numerous interpretations, is nevertheless quite simple in its understanding compared to understanding the asset. You can safely say to an accountant: if you understand well enough what an asset itself is (and this is quite easy to understand), then you will have no problem understanding what a liability itself is. If you think about an asset, then understanding the meaning of a liability will come on its own. Liabilities should be considered as sources of assets. The composition of liabilities contains personal capital, both authorized and share capital, as well as borrowed capital, which includes loans, loans, collected into one in composition and repayment dates. The liability must clearly indicate in total terms data on the entire capital.

We briefly examined what a liability is, the difference between this concept and the term “asset,” as well as temporary liabilities, the concept of personal and outside capital, the concept of authorized and share capital, including the theory and practice of liability. Leave your comments or additions to the material.

Generating financial statements using “My Business”

Organizations in special regimes submit financial statements by March 31 of the following reporting year. Accounting statements in a simplified form consist of a balance sheet and a profit and loss statement. Always remember that if you make a mistake at one of the stages of preparing financial statements, you will have to go back and recalculate the indicators, again reconcile the asset with the liability. So that your work does not become similar to similar stories, and the balance converges in a matter of minutes, trust the online accounting “My Business”!

You can generate the organization’s financial statements using the simplified tax system or UTII using the “My Business” online accounting service. The service is updated online, so you will have only the latest forms at hand, and also generate reports that meet all the requirements of current legislation. Go through the Reporting Wizard and generate all the necessary reporting! If you have any questions, you can seek free advice from service specialists.