All businessmen using hired labor are required to submit calculations for insurance premiums (DAM). The report combines information about contributions controlled by the tax service. Today, these are all off-budget mandatory payments, except for insurance premiums for injuries, which remain under the control of the Social Insurance Fund. Let's look at how to fill out and submit the calculation of insurance premiums for 9 months of 2021. We will also provide a sample of filling out the ERSV for the 3rd quarter of 2021.

Where to submit the payment

All policyholders must submit calculations of insurance premiums for the 2nd quarter of 2021 to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs (IP).

A new calculation of insurance premiums must be completed and submitted to all policyholders who have insured persons:

- employees under employment contracts;

- performers - individuals under civil contracts (for example, contracts for construction or provision of services);

- the general director, who is the sole founder.

Please note that the calculation must be sent to the Federal Tax Service regardless of whether the activity was carried out in the reporting period (the first half of 2021) or not. If an organization or individual entrepreneur does not conduct business at all, does not pay payments to individuals and has no movements on current accounts, then this does not cancel the obligation to submit calculations for insurance premiums for the 2nd quarter of 2021. In such a situation, you need to submit a zero calculation to the Federal Tax Service (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940).

Calculations for insurance contributions to tax inspectorates (PFR bodies do not accept calculations from 2021). A specific Federal Tax Service is determined as follows:

- organizations submit calculations for the 2nd quarter of 2021 to the Federal Tax Service at their location and at the location of separate divisions that issue payments to individuals. (clauses 7, 11, 14 of Article 431 of the Tax Code of the Russian Federation);

- individual entrepreneurs submit settlements to the Federal Tax Service at their place of residence (clause 7 of Article 431 of the Tax Code of the Russian Federation).

If the employer paid any benefits to its employees during the reporting period, it is necessary to correctly reflect this in the calculation in order to receive reimbursement of expenses incurred from the Social Insurance Fund. Insurance premiums for compulsory social insurance in the calculation are given in appendices 2, 3 and 4 to section 1.

Example of calculation of insurance premiums with benefits

In the second quarter of 2021, the organization paid sick leave to three employees for 15 days of illness: 5,000 rubles. in April, 6000 rub. in May and 4000 rubles. in June.

These amounts include sick leave paid at the expense of the employer - 3,000 rubles each. in every month. In June, one employee was paid a one-time benefit for the birth of a child - 16,350.33 rubles.

No benefits were paid in the first quarter. Income for the six months paid to employees is 700,000 rubles, including: in April – 120,000 rubles, in May – 119,000 rubles, in June – 115,000 rubles. Number of employees – 5 people. The FSS credit system of payments is used, the tariff is 2.9%.

In Appendix 2 of the calculation, we indicate payment attribute “2” - the employer pays benefits to employees, and then a credit is made against the payment of insurance premiums.

In our example of filling out the calculation of insurance premiums with sick leave, we will distribute the amounts of income (line 020), non-taxable amounts (line 030) and calculate the base for calculating social insurance contributions (line 050). In this case, the amount of all benefits is not subject to contributions, incl. and sick leave at the expense of the employer. On line 060 we calculate contributions for six months and for each month of 2 quarters.

On line 070 we indicate all benefits paid at the expense of the Social Insurance Fund, while we do not reflect the employer’s expenses for the first 3 days of illness (letter of the Federal Tax Service dated December 28, 2016 No. PA-4-11/25227). Personal income tax is not deducted from the benefit amount.

The amount of compensation from the Social Insurance Fund, if there was one in the reporting period, is distributed on line 080.

The calculated amount of contributions on line 060 minus expenses incurred on line 070 is the amount of contributions with the sign “1” payable (line 090). If the amount of expenses is higher than the amount of accrued contributions, line 090 indicates sign “2”. The calculation of insurance premiums for the 2nd quarter, an example of which we give, contains the total amount of expenses exceeding the amount of accruals for contributions; now the organization must reimburse this difference to the Social Insurance Fund.

Appendix 3, the calculation of insurance premiums for the 2nd quarter of 2021, a sample of which is provided, contains our payments. We distribute the benefits paid by type:

- line 010 – sick leave, excluding payments at the expense of the employer,

- line 050 – child birth benefit,

- line 100 – total amount of benefits.

In regions where a pilot project operates and the Social Insurance Fund pays benefits directly to employees, Appendix 3 does not need to be filled out, since the employer in this case only pays for the first 3 days of illness at his own expense, and they are not reflected in Appendix 3.

Appendix 4 is completed only if there are payments made from the federal budget.

Some insurance premium payers have the right to charge premiums at lower rates than all other insurers. This depends on the presence of certain factors - the use of a special regime, a special location, the performance of a certain type of activity, etc., all of them are listed in Art. 427 Tax Code of the Russian Federation. If the usual general insurance premium rate in 2021 is 30%, then the reduced rate can range from 0% to 20%.

When preparing the calculation, such policyholders fill out one of appendices 5-8 to section 1 to confirm their compliance with the conditions for applying the reduced tariff:

- Appendix 5 is formed by IT organizations (clause 3, clause 1, article 427 of the Tax Code of the Russian Federation),

- Annex 6 – “simplified workers”, whose main activity is indicated in paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation,

- Annex 7 – non-profit organizations using simplified language (clause 7, clause 1, article 427 of the Tax Code of the Russian Federation),

- Appendix 8 – IP on a patent (clause 9, clause 1, article 427 of the Tax Code of the Russian Federation).

Example of filling out the calculation of insurance premiums: reduced tariff

An organization on the simplified tax system is engaged in the production of food products, the income from this activity for the first half of 2021 is 8,650,000 rubles. The total amount of income on the “simplified” system is 10,200,000 rubles. According to paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation, an organization can apply a reduced tariff of 20%, of which “pension” contributions are 20%, and compulsory medical insurance and social insurance contributions are 0%.

In this case, the calculation of insurance premiums additionally contains data - you should fill out Appendix 6 to Section 1:

- on line 060 we will indicate the total amount of income on the simplified tax system for the period from 01/01/2017 to 06/30/2017,

- on line 070 we reflect only income from the main activity - food production for the same period,

- in line 080 we calculate the share of income from preferential activities:

line 070: line 060 x 100%.

If the result obtained is at least 70% of the total income, and the income from the beginning of the year does not exceed 79 million rubles, the right to a reduced tariff, as in our case, is retained.

Filling out the RSV form

The title page contains information about the paying company, entrepreneur or individual who paid contributions for hired personnel. It also indicates the person responsible for completing the report and submitting it.

If a person is reporting who is not registered as an individual entrepreneur, then it is necessary to fill out the second page of the title page, indicating on it information about registration (registration) and an identity document. Each page of the report is signed either by the head of the company or the person responsible for providing the information.

The first section of the DAM report contains general information on accrued and paid insurance premiums. It is filled out by type of insurance, pension, compulsory medical insurance, additional, etc.

Filling out lines with data on contributions for sick leave depends on the procedure for paying temporary disability to company employees. In the case when the region participates in the experimental “Direct Payments” program, or the amount of contributions payable is greater than the funds received by employees on temporary disability certificates, then fill out lines 110 - 113.

If the employer spent in the reporting period on paying for sick leave an amount greater than the accrued contributions for this type of insurance, information about the difference between the actual payment and the accrual is entered in lines 120 - 123.

For example, the amount of accrued contributions for temporary disability amounted to 73,000 rubles.

If the employer does not bear the cost of paying sick leave, then this amount is entered in line 110, and then indicated by month of the quarter.

In case of payment for sick leave in the amount of, for example, 42,000 rubles during the quarter, write the difference (31,000 rubles) in line 110 and also break down the payment by month in the following lines.

When the expenses of the hiring company exceeded 73,000 rubles and amounted to, for example, 113,000 rubles, then data on overexpenditure (40,000 rubles) must be entered in line 120, with details by month in lines 121 - 123.

The third section of the DAM form contains personal information for each insured employee. It also indicates the amount of accrued insurance premiums and the income that was taken as the basis for calculating contributions.

Unified calculation of insurance premiums 2021, form

Calculation of insurance premiums must be filled out according to the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. The form can be downloaded from this link. This form has been used since 2017. The composition of the calculation is as follows:

- title page;

- sheet for individuals who do not have the status of an individual entrepreneur;

- Section No. 1 (includes 10 applications);

- Section No. 2 (with one application);

- Section No. 3 – contains personal information about insured persons for whom the employer makes contributions.

Organizations and individual entrepreneurs making payments to individuals must include in the calculation of insurance premiums for the 2nd quarter of 2021 (clauses 2.2, 2.4 of the Procedure for filling out the calculation of insurance premiums):

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to section 1;

- Appendix 2 to section 1;

- Section 3.

In this composition, the calculation for the first half of 2021 should be received by the Federal Tax Service, regardless of the activities carried out in the reporting period (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940).

| What sections of the calculation and who fills it out? | |

| Calculation sheet (or section) | Who makes up |

| Title page | To be completed by all policyholders |

| Sheet “Information about an individual who is not an individual entrepreneur” | Formed by individuals who are not individual entrepreneurs if they did not indicate their TIN in the calculation |

| Section 1, subsections 1.1 and 1.2 of appendices 1 and 2 to section 1, section 3 | Fill out all organizations and individual entrepreneurs that paid income to individuals in the first half of 2021 |

| Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 | Organizations and individual entrepreneurs transferring insurance premiums at additional rates |

| Appendices 5 - 8 to section 1 | Organizations and individual entrepreneurs applying reduced tariffs (for example, conducting preferential activities on the simplified tax system) |

| Appendix 9 to section 1 | Organizations and individual entrepreneurs that paid income to foreign employees or stateless employees temporarily staying in the Russian Federation in the first half of 2021 |

| Appendix 10 to section 1 | Organizations and individual entrepreneurs that paid income to students who worked in student teams in the first half of 2021 |

| Appendices 3 and 4 to section 1 | Organizations and individual entrepreneurs that paid hospital benefits, child benefits, etc. in the first half of 2021 (that is, related to compensation from the Social Insurance Fund or payments from the federal budget) |

| Section 2 and Appendix 1 to Section 2 | Heads of peasant farms |

Download

They started talking about changing the form for the ERSV at the end of 2021. It was assumed that in the new version several pages would be removed, but there would be no global reshaping of the form. However, the updated version of the form has not yet received final approval.

DAM for the 3rd quarter of 2021: fines and blocking of accounts

If you do not submit the ERSV for the 3rd quarter on time. 2021, the Federal Tax Service may impose a fine. The minimum amount is 1000 rubles (Article 119 of the Tax Code of the Russian Federation). Such a fine is issued if the company was late only in submitting the ERSV, but transferred the obligatory contributions on time.

If the organization transferred the contributions late, the fine will be 5 percent of the unpaid amount for each full and partial month of delay. But no more than 30 percent and no less than 1,000 rubles (letter of the Federal Tax Service dated December 30, 2016 No. PA-4-11/25567).

The fine will be calculated for all three types of insurance payments that the company transfers to the tax office. Therefore, it will have to be transferred in three payment orders to different KBK (letter of the Federal Tax Service of Russia dated May 5, 2021 No. PA-4-11/8641).

Also, in 2021, tax authorities have the right to block accounts for payment of contributions (if they are not submitted).

Conditions for filling out unified reporting

Most policyholders will fill out insurance premium calculations for the 2nd quarter of 2021 electronically using special accounting software services (for example, 1C). In this case, the calculation is generated automatically based on the data that the accountant enters into the program. However, in our opinion, it is advisable to understand some principles of calculation formation in order to avoid mistakes. We will comment on the features of filling out the most common sections, and also provide examples and samples.

Let's calculate insurance premiums in 2021, example: GBOU DOD SDUSSHOR "ALLUR" applies OSNO; General tax rates are established for calculation. The average number of employees is 22.

Summary information about the first 6 months of 2021

Payroll accruals amounted to 759,300.00 rubles.

- Pension Fund of the Russian Federation: 759,300.00 × 22% = 167,046.00 rubles.

- Compulsory medical insurance: 759,300.00 × 5.1% = 38,724.30 rubles.

- Social Insurance Fund: 759,300.00 × 2.9% = 22,019.70 rubles.

For the reporting 3 months of 2021, payroll accruals amounted to:

- July - RUB 253,000.00;

- August - RUB 253,000.00;

- September — 253,000 rub.

We calculate insurance on a monthly basis.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rubles.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

September:

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rubles.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rubles.

There was no excess of the base for insurance accruals for employees for 9 months of 2021.

Final data to be entered into the reporting form:

- Accrued salary for the 3rd quarter - 759,000.00 rubles, contributions: to the Pension - 166,980.00 rubles, compulsory medical insurance - 38,709.00 rubles, Social Insurance Fund - 22,011.00 rubles.

- For 9 months of 2021: accruals - 1,518,300.00 rubles, Pension Fund - 334,026.00 rubles, Compulsory Medical Insurance - 77,433.30 rubles, Social Insurance Fund - 44,030.70 rubles.

Download

RSV is a report filled out with an accrual total. Therefore, the calculation for the 3rd quarter of 2021 will have to include data from January to September 2018 inclusive.

All companies and businessmen reporting contributions must provide the following sections of the form to the tax office:

- title page;

- section 1 - generalizing;

- subsection 1.1 of Appendix 1 of Section 1 - contributions to the Pension Fund;

- subsection 1.2 of Appendix 1 of Section 1 - compulsory medical insurance contributions;

- Appendix 2 of Section 1 - social security contributions;

- section 3 - information for each employee.

The remaining subsections and applications are filled out in individual cases, which we will talk about a little later. Now let’s move on to examples of filling out the above sections.

How to reflect benefits paid in connection with parental leave from 1.5 to 3 years

The benefit that is paid to employees on parental leave from 1.5 to 3 years must be reflected in the calculation of insurance premiums.

Payments within the limits established by the state are not subject to insurance premiums.

This manual, in particular, needs to reflect:

- in line 040 “Amount not subject to insurance premiums” of subsection 1.1 of section 1;

- in line 040 “Amount not subject to insurance premiums” of subsection 1.2 of section 1;

- in line 030 “Amount not subject to insurance premiums” of Appendix 2.

Payment methods in 2021

Calculations for insurance premiums must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting (settlement) period. If the last date for submitting the calculation falls on a weekend, then the calculation can be submitted on the next working day (clause 7 of Article 431, clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

The reporting period in our case is the first half of 2017 (from January 1 to June 30). Therefore, the calculation for the six months must be submitted to the tax office no later than July 31 (since July 30 is a day off, Sunday).

Also see “Deadline for RSV-1 in 2021: table.”

| Methods for submitting calculations for insurance premiums in 2017 | |

| Printed | Electronic (according to TKS) |

| Allowed to be used by enterprises and businessmen whose number of employees does not exceed 25 people (inclusive). | A method for submitting a report, which is mandatory for organizations and individual entrepreneurs with a staff of 25 or more people. |

Sheet “Information about an individual”

Reporting period

Therefore, in the calculation of insurance premiums for the 2nd quarter of 2017, the reporting period code will be “31”.

Tax office code

In the field “Submitted to the tax authority (code)” - indicate the code of the tax authority to which the calculation of insurance premiums is submitted. You can find out the value for a specific region on the Federal Tax Service website using the official service.

Performance venue code

| Code | Where is the payment submitted? |

| 112 | At the place of residence of an individual who is not an entrepreneur |

| 120 | At the place of residence of the individual entrepreneur |

| 121 | At the place of residence of the lawyer who established the law office |

| 122 | At the place of residence of the notary engaged in private practice |

| 124 | At the place of residence of the member (head) of the peasant (farm) enterprise |

| 214 | At the location of the Russian organization |

| 217 | At the place of registration of the legal successor of the Russian organization |

| 222 | At the place of registration of the Russian organization at the location of the separate division |

| 335 | At the location of a separate division of a foreign organization in Russia |

| 350 | At the place of registration of the international organization in Russia |

Name

Indicate the name of the organization or full name of the individual entrepreneur on the title page in accordance with the documents, without abbreviations. There is one free cell between words.

OKVED codes

In the field “Code of the type of economic activity according to the OKVED2 classifier”, indicate the code according to the All-Russian Classifier of Types of Economic Activities.

The sheet “Information about an individual who is not an individual entrepreneur” is filled out by citizens who submit payments for hired workers, if he did not indicate his TIN in the calculation. On this sheet, the employer indicates his personal data.

On the title page, the company and individual entrepreneur enter their output data. We decided to provide a sample of filling out the cover sheet for calculating insurance premiums for the 3rd quarter of 2021 in the table. At the end of it you will find an example of filling.

| Line title | What and how to enter |

| Correction number | 0 — primary report; 1 - first adjustment, 2 - second, etc. |

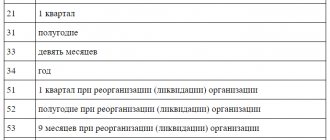

| Billing period code | 33 (means 9 months or 3 quarter) |

| Reporting year | 2018 |

| Location code | 214 - the enterprise submits payments at its location; 222 - a separate unit submits a report at its location |

| OKVED | By main activity |

| Reorganization form | Filled out by the successor of the reorganized company, if it, in turn, has not reported on contributions |

Sample filling subsection 1.1 and subsection 1.2

Subsections 1.1 and 1.2 of the ERSV decipher information about the payment of contributions to the Pension Fund and Medical Insurance. The fields of the subsections are completely identical, with the exception of lines 021, 061 and 062. These lines are present only in subsection 1.1. All other columns of the designated sections are filled out equally.

Subsection 1.1 contains data on the Pension Fund;

Subsection 1.2 contains data on Medical Insurance.

| Line no. | What does it include |

| 01 (fare code) |

|

| 010 | Total number of insured physicists January - September 2021, and monthly from July to September 2021 |

| 020 | Number of persons for whom contributions were paid total amount from January to September 2021, and monthly from July to September 2021 |

| 021 | The number of persons whose contribution base exceeds the maximum possible |

| 030* | Amount of employee income |

| 040 | The amount of employee income from which contributions are not taken |

| 050 | Basic income for paying contributions (must be equal to the difference in columns 030 - 040) |

| 060 | Amount of contributions |

| 061 | Amount of contributions whose base does not exceed the maximum |

| 062 | Amount of contributions whose base exceeds the maximum |

*In lines 030 - 062, all amounts are indicated from the beginning of the year, that is, the total for January - September 2021, as well as monthly for July, August, September.

Completing subsections 1.1 and 1.2

If the director is the only employee

Sometimes in small companies the only employee is the director.

If an employment contract has been concluded with the director, you need to submit a calculation of insurance premiums. In this case, the director is an insured person in the social insurance system, and his data must be taken into account when calculating insurance premiums.

In subsections 1.1. and 1.2 of section 1, the number of insured persons will be equal to 1.

If no payments were made to the director in connection with unpaid leave, the calculation still needs to be submitted.

Appendix No. 2 to section 1

Appendix 1 to section 1 of the calculation includes 4 blocks:

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance”;

- subsection 1.2 “Calculation of insurance premiums for compulsory health insurance”;

- subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation”;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.”

In line 001 “Payer tariff code” of Appendix 1 to section 1, indicate the applicable tariff code. See “Insurance premium rate codes in 2021: table with explanation.”

In the calculation for the 2nd quarter, you need to include as many appendices 1 to section 1 (or individual subsections of this appendix) as tariffs were applied during the first half of 2021 (from January to June inclusive). Let us explain the features of filling out the required subsections.

Subsection 1.1: pension contributions

Subsection 1.1 is a mandatory block. It contains the calculation of the taxable base for pension contributions and the amount of insurance contributions for pension insurance. Let us explain the indicators of the lines of this section:

- line 010 – total number of insured persons;

- line 020 – the number of individuals from whose payments you calculated insurance premiums in the first half of 2021;

- line 021 – the number of individuals from line 020 whose payments exceeded the maximum base value for calculating pension contributions (See “Limit value of the base for pension contributions in 2017”);

- line 030 – amounts of accrued payments and rewards in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not included here;

- in line 040 reflect: the amount of payments not subject to pension contributions (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is reflected within the limits determined by paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

- on line 061 - from a base that does not exceed the limit (RUB 876,000);

Record the data in subsection 1.1 as follows: provide data from the beginning of 2021, as well as for the last three months of the reporting period (April, May and June).

Subsection 1.2: medical contributions

Subsection 1.2 is a mandatory section. It contains the calculation of the taxable base for health insurance premiums and the amount of insurance premiums for health insurance. Here is the principle of forming strings:

- line 010 – the total number of insured foxes in the first half of 2021.

- line 020 - the number of individuals from whose payments you calculated insurance premiums;

- line 030 – amounts of payments in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not shown on line 030;

- on line 040 – amounts of payments: not subject to insurance contributions for compulsory health insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation.

Line 050 shows the basis for calculating contributions for health insurance (clause 1 of Article 421 of the Tax Code of the Russian Federation). In line 060 – the amounts of calculated insurance premiums.

Appendix 2 to Section 1 calculates the amount of contributions for temporary disability and in connection with maternity. The data is shown in the following context: total from the beginning of 2021 to June 30, as well as for April, May and June 2021.

In field 001 of Appendix No. 2, you must indicate the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity:

- “1” – direct payments of insurance coverage (if there is a FSS pilot project in the region, See “Participants in the FSS pilot project”);

- “2” – offset system of insurance payments (when the employer pays benefits and then receives the necessary compensation (or offset) from the Social Insurance Fund).

Next, we will explain filling out the lines with decoding:

- line 010 – total number of insured persons in the first half of 2021;

- line 020 – amounts of payments in favor of the insured persons. Payments that are not subject to insurance premiums are not shown in this line;

- line 030 summarizes: the amount of payments not subject to insurance contributions for compulsory social insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

On line 050 - show the basis for calculating insurance contributions for compulsory social insurance.

Line 051 includes the base for calculating insurance premiums from payments in favor of employees who have the right to engage in pharmaceutical activities or are admitted to it (if they have the appropriate license). If there are no such employees, enter zeros.

Line 053 is filled in by individual entrepreneurs who apply the patent taxation system and make payments in favor of employees (with the exception of individual entrepreneurs who conduct activities specified in subclause 19, 45–48 clause 2 of article 346.43 of the Tax Code of the Russian Federation) - (subclause 9 p 1 Article 427 of the Tax Code of the Russian Federation). If there is no data, then enter zeros.

Line 054 is filled out by organizations and individual entrepreneurs that pay income to foreigners temporarily staying in Russia. This line requires showing the basis for calculating insurance premiums in terms of payments in favor of such employees (except for citizens from the EAEU). If there is nothing like that - zeros.

On line 060 - enter insurance contributions for compulsory social insurance. Line 070 – expenses for the payment of insurance coverage for compulsory social insurance, which is paid at the expense of the Social Insurance Fund. However, do not include benefits for the first three days of illness here (letter from the Federal Tax Service of Russia dated December 28.

If you have received the amount of contributions to be paid, enter code “1” in line 090. If the amount of expenses incurred turned out to be more than accrued contributions, then include code “2” in line 90.

Appendix 3 to section 1: expenses for compulsory social insurance

In Appendix 3 to Section 1, you need to record information about expenses for the purposes of compulsory social insurance (if there is no such information, then the Appendix is not filled out, since it is not mandatory). As for the actual filling, the lines need to be formed like this:

- on lines 010–090 - indicate the number of cases of payments, the number of days paid, as well as the amount of expenses incurred)

- on line 100 – the total amount of social insurance expenses for all types of payments is entered.

Appendix 2 to Section 1 of the calculation of insurance premiums is needed to reflect information on the payment of contributions that will be used to cover expenses associated with certificates of incapacity for work due to illness and pregnancy and childbirth. This part of the RSV form is very similar to the previous subsections. Let's figure out how to fill it out.

| Line number | What and how to enter |

| 001 (Payout attribute) |

|

| 010 | The total number of insured physicists January - September 2021, and monthly from July to September 2021 |

| 020* | Amount of employee income |

| 030 | The amount of employee income from which contributions are not taken |

| 040 | An amount that is higher than the maximum possible base for payment of contributions |

| 050 | Basis for calculating contributions |

| 051 — 054 | Filled out not by all enterprises, but only by those indicated in the form |

| 060 | Amount of contributions paid |

| 070 — 080 | Filled out if the company paid for sick leave or there was compensation from Social Insurance |

| 090 |

|

* In lines 020 - 060, all amounts are indicated from the beginning of the year, that is, the total for January - September 2021, as well as monthly for the 3rd quarter.

Filling out Appendix 2

Contributions from payments to foreigners with a patent working under employment contracts

When concluding employment contracts with foreigners working on the basis of a patent, the company (IP) also pays insurance premiums.

The calculation of insurance premiums depends on the category of the foreign employee. In relation to permanently residing foreign citizens (have a residence permit) and temporary residents (have permission in the form of a mark in the passport), insurance premiums are paid at the rates established for citizens of the Russian Federation.

Based on the provisions of paragraph 1 of Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ, paragraph 1 of Art. 2 of the Federal Law of December 29, 2006 No. 255-FZ, foreign citizens (with the exception of highly qualified specialists in accordance with the Federal Law of July 25, 2002 No. 115-FZ) temporarily staying in the territory of the Russian Federation and working under an employment contract are subject to compulsory pension insurance and compulsory social insurance in case of temporary disability.

With regard to income accrued in favor of temporarily staying foreigners, payment of contributions to pension insurance occurs at general rates; contributions to social insurance in case of temporary disability and in connection with maternity must be calculated based on a rate of 1.8% (Articles 422, 425 of the Tax Code RF).

Foreign citizens temporarily staying in the Russian Federation are not subject to compulsory health insurance (Article 10 of Federal Law No. 326-FZ of November 29, 2010).

The amount of wages and other remuneration accrued in favor of temporarily staying foreign citizens working under a patent is excluded from line 030 of subsection 1.2 of Appendix 1 for calculating insurance premiums, since these citizens are not insured in the compulsory health insurance system of the Russian Federation.

Optional sections to fill out

In this chapter we will talk about those sections of the DAM that are intended for a limited number of enterprises, organizations and individual entrepreneurs.

| Optional sections of the ERSV for the 2nd quarter of 2018 | Who should apply |

| Subsection 1.3 | Payers of contributions on additional tariffs |

| Subsection 1.4 | Airline enterprises and organizations involved in coal mining |

| Appendix 3 | Employers who paid sick leave benefits during the reporting period |

| Appendix 4 | Budgetary organizations whose staff includes employees who are victims of the Chernobyl nuclear power plant |

| Appendix 5 | IT enterprises with preferential tariffs |

| Appendix 6 | USNO |

| Appendix 7 | NPO on the simplified tax system |

| Appendix 8 | Businessmen with a patent |

| Appendix 9 | Companies whose staff includes foreign workers temporarily residing in the Russian Federation |

| Appendix 10 | Companies that employ students |

| Section 2 and its Appendix | Farmers and peasant farms |

Section 1 “Summary data on insurance premiums”

In section 1 of the calculation for the 1st quarter of 2021, reflect the general indicators for the amounts of insurance premiums payable. The part of the document in question consists of lines from 010 to 123, which indicate OKTMO, the amount of pension and medical contributions, contributions for temporary disability insurance and some other deductions.

Pension contributions

On line 020, indicate the KBK for contributions to compulsory pension insurance. On lines 030–033 - show the amount of insurance contributions for compulsory pension insurance, which must be paid to the above BCC:

- on line 030 – for the reporting period on an accrual basis (from January to June inclusive);

- on lines 031-033 – for the last three months of the billing (reporting) period (April, May and June).

Medical fees

On line 040, indicate the BCC for contributions to compulsory health insurance. On lines 050–053 – distribute the amounts of insurance premiums for compulsory health insurance that must be paid:

- on line 050 - for the reporting period (half-year) on an accrual basis (that is, from January to June);

- on lines 051–053 for the last three months of the reporting period (April, May and June).

Pension contributions at additional rates

On line 060, indicate the BCC for pension contributions at additional tariffs. On lines 070–073 – amounts of pension contributions at additional tariffs:

- on line 070 – for the reporting period (half-year) on an accrual basis (from January 1 to June 30);

- on lines 071 - 073 for the last three months of the first half of the year (April, May and June).

Additional social security contributions

On line 080, indicate the BCC for contributions to additional social security. On lines 090–093 – the amount of contributions for additional social security:

- on line 090 – for the reporting period (half-year) on an accrual basis (from January to June inclusive);

- on lines 091–093 for the last three months of the reporting period (April, May and June).