Do I need to pay property tax and if so, at what rate? You will find out the answer by taking our short survey. To do this, you will need to indicate your tax system, depreciation group of property, its type (movable or immovable), and the date of registration.

Please note: the property tax cheat sheet is intended for organizations only. Individuals (including individual entrepreneurs) do not submit a declaration, but pay tax on the basis of a tax notice. In this case, the amount of tax is determined by the tax authorities (clause 1 of Article 408 of the Tax Code of the Russian Federation).

In what cases is a calculation of property tax advances for the 1st quarter of 2021 not provided?

If the residual value of fixed assets is zero, then information should be provided to the Federal Tax Service with a zero indicator. Those taxpayers who have at least one fixed asset on their balance sheet also submit a report. Legal entities whose property is not listed among taxable objects under the Tax Code of the Russian Federation, or whose property only has land plots, are exempt from submitting the calculation. It should be noted that fixed assets of depreciation groups 1 and 2, which are not subject to tax, are included in line 210 of the calculation of the advance payment for property tax.

Fixed assets 1 and 2 depreciation groups

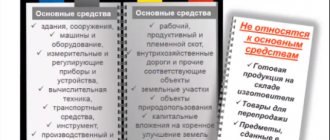

So, movable assets classified as the first and second AM are not taxable objects under the NNIO, just like land plots, water bodies, nuclear installations, cultural heritage items, icebreakers, etc. (Clause 4 of Article 374 of the Tax Code of the Russian Federation). Consequently, the value of such property should not be included in the tax base when calculating the payment. So what are these assets?

According to the Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (as amended on April 28, 2018), all short-lived property with a useful life of at least one year and no more than two years (from 12 to 24 months) should be classified as the first AM. When calculating property tax, the first depreciation group of fixed assets is not included in the base for calculating payments to the budget.

Examples of OS classified in this category may be hand construction tools (hammer, saw, axe), medical instruments (scalpel, surgical clamps), mining equipment and much more.

The second AM consists of property assets with a useful life of more than two years (24 months) and less than three years inclusive. For example, strawberries as a perennial planting, boom-type cranes, haystack throwers, snowblowers, sports equipment, etc. The second depreciation group of fixed assets does not participate in calculating property tax.

When and at what rates should organizations pay tax on OSNO?

The tax rate is set by the regions: it can be a single rate or differentiated rates depending on the category of taxpayer and type of property. There are limits for the rate - no more than 2.2%, unless Article 380 of the Tax Code of the Russian Federation establishes another limit.

For real estate that is assessed at cadastral value, regional rates apply. In 2021 and 2021, the limit for the tax rate is 2%.

Important ! If a region has not established its tax rates, we are guided by the Tax Code.

The tax period for payments is the same for everyone - 1 year. The declaration for the year must be submitted by March 30 (in 2021 - by April 1). The deadlines for advance payments and quarterly settlements are also set by the regions. The deadline is stated in Art. 386 of the Tax Code of the Russian Federation - the 30th day of the month following the reporting quarter.

Important ! In your region there may not be a division into reporting periods, then submit reports and pay tax once a year.

Errors in the database that prevent the application of the movable property exemption

Let's look at the main errors in the database that need to be addressed so that in 2021 the benefit for movable property registered since January 2013 will be automatically applied.

To apply the benefit, it is necessary that the details in the Fixed Assets directory be correctly filled out in accordance with the points indicated below.

Depreciation group

Since 2015, fixed assets of the I and II depreciation groups have been excluded from the list of objects subject to property tax (clause 8, clause 4, article 374 of the Tax Code of the Russian Federation). Therefore, to apply the benefit, it is necessary to set depreciation group three or higher.

Check yourself for errors!

The benefit for movable property will not apply if the Depreciation Group :

- First group (from 1 year to 2 years inclusive);

- Second group (over 2 years up to 3 years inclusive);

- Separate group (clause 1, article 322 of the Tax Code of the Russian Federation, until 2009)

OS group

Movable property in 1C are fixed assets, in the card of which fixed assets accounting group :

- Machinery and equipment (except office equipment);

- Office equipment;

- Vehicles;

- Industrial and household equipment;

- Draft livestock;

- Productive livestock;

- Other types of fixed assets.

Check yourself for errors!

The benefit for movable property will not apply if the fixed assets accounting group for real estate is established:

- Building;

- Facilities;

- Perennial plantings;

- Land;

- Natural resource management facilities;

- Other objects requiring state registration, classified by Article 130 of the Civil Code of the Russian Federation as real estate.

Date of registration

One of the main criteria for applying the benefit is the date of registration of the asset. Accepted for accounting field should reflect the date 01/01/2013 or later.

Check yourself for errors!

The benefit for movable property will not apply if the OS was registered before 01/01/2013.

Find out the specifics of calculating property tax on movable fixed assets accepted for registration in 2021.

OS type

Another criterion for excluding benefits for movable property is the type of OS .

OS type attribute is not displayed in the Fixed Assets directory . Previously, it was available for PDF editing, so it is necessary to exclude the possibility of not indicating it correctly in the OS card.

To apply the benefit, it is necessary that the Asset Type be specified as Asset Asset , and not Capital Investment in Leased Real Estate .

In order to check for which fixed assets the type of fixed assets Capital investment in leased real estate , you can use the report Fixed assets depreciation statement in the section Fixed assets and intangible assets - Reports - Fixed assets depreciation statement.

to make the following settings in the report on the Selection

- Field – Fixed asset. OS type;

- Comparison type – Equal;

- Meaning – Capital investment in leased real estate.

As a result of generating a report with the specified settings, it is clear which OS is installed. OS Type Capital investment in leased real estate .

Check yourself for errors!

The movable property benefit will not apply if the OS type is Capital investment in leased real estate .

Object with a special taxation procedure

If all the above points are checked, and the benefit is not automatically provided, then it is necessary to exclude fixed assets for which a special taxation procedure is specified.

the Property tax link in the fixed asset card.

Check yourself for errors!

If the Movable property subject to taxation , the benefit will not be applied.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- At what rate is property tax imposed on “movable property” adopted before 2013? You do not have access to view. To gain access: Complete...

- Is an apartment purchased for resale and recorded on account 41 subject to property tax? You do not have access to view. To gain access: Complete...

- Is the asset in account 08 subject to property tax? ...

- Are vehicles purchased from related and non-related entities subject to property tax? You do not have access to view. To gain access: Complete...

We explain the procedure for filling out a tax return for corporate property tax

Date of publication: 07/23/2015 03:47 (archive)

The Federal Tax Service of Russia for the Khabarovsk Territory explains that in paragraph 1 of Art. 374 of the Tax Code of the Russian Federation, the object of taxation for Russian organizations is movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), accounted for on the balance sheet as fixed assets in the manner established for accounting, unless otherwise provided by Articles 378, 378.1 and 378.2 of the Code.

In accordance with paragraphs. 8 clause 4 art. 374 of the Code from 01/01/2015, fixed assets included in the first or second depreciation group in accordance with the Classification of fixed assets approved by Decree of the Government of the Russian Federation of 01/01/2002 No. 1 “On the Classification of fixed assets included in depreciation groups” are not subject to taxation "

Since fixed assets of the first and second depreciation groups are not subject to taxation, when filling out columns 3 and 4 of section 2 of the advance calculation for corporate property tax, the residual value of these objects on lines 020-110 (residual value of fixed assets as of 01.01, 01.02, 01.03, 01.04., etc.) and does not need to be reflected in the benefits section.

At the same time, from paragraphs. 12 clause 5.3 of the Procedure for filling out a tax calculation for an advance payment of the property tax of organizations, approved by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 “On approval of forms and formats for submitting a tax return in electronic form and a tax calculation for an advance payment payment for the property tax of organizations and the procedures for filling them out” it follows that line 210 of section 2 of the calculation reflects the residual value of all fixed assets recorded on the balance sheet as of April 1, July 1 or October 1, with the exception of the value of property on the corresponding dates, not taxable on the basis of paragraphs. 1 - 7 p. 4 tbsp. 374 Code.

Thus, on line 210 of section 2 of the tax calculation for corporate property tax, the cost of non-taxable fixed assets of the first and second depreciation groups should be reflected based on paragraphs. 8 clause 4 art. 374 Code. Line 270 of section 2 of the tax return for property tax is filled out in the same way (clause 15, clause 5.3 of the Procedure for filling out a tax return for property tax for organizations).

In accordance with the letter of the Federal Tax Service of Russia dated 05/08/2014 No. BS-4-11/8871 until 2015, the cost of the property indicated on line with code 270 of section 2 of the tax return (on line with code 210 of section 2 of the tax calculation for the advance payment) included the cost of all movable property registered from 01/01/2013, which was not taxed in accordance with paragraph 8 of paragraph 4 of Art. 374 of the Code, as amended until 2015.

How is movable property taxed in 2018?

From the beginning of 2021, movable property of categories 3-10 of depreciation is accepted for calculation only by decision of the authorities of the constituent entities of the Russian Federation. If the property was registered before 2013, then the value in the tax calculation for property tax for the 1st quarter of 2021 is indicated in section 2. And property registered after 2013 is not subject to tax. Except for those situations where fixed assets were acquired during reorganization or termination of operations, as well as in a transaction with an interdependent party. Movable property is registered in the 2021 property tax declaration in lines 210, 120 and 020-050 at its residual value.

Regulatory regulation

Since 2015 until 2021 inclusively there is a benefit for movable property (clause 25 of article 381 of the Tax Code of the Russian Federation).

Movable property (registered as fixed assets since January 1, 2013) is not subject to taxation, with the exception of objects registered as a result of:

- reorganization or liquidation;

- transfer of property between related parties.

In 1C, the benefit is applied automatically in 2021 if the fixed asset:

- does not apply to real estate;

- registered on 01/01/2013

From 01/01/2018, the benefit will remain only if the relevant law is adopted by the constituent entities of the Russian Federation.

In the constituent entities of the Russian Federation, the laws of which do not provide for a benefit on movable property and the rate is not specified, movable property from 2021. taxed at a rate of 1.1% (Letter of the Federal Tax Service of the Russian Federation dated December 20, 2017 N BS-19-21/327).

Find out more How is property tax calculated on movable property from 2021?

How to calculate the tax base

The tax base is a value for calculating tax: the base is multiplied by the tax rate. There are two tax base options for property tax.

Cadastral value (CV) - for property specified in Article 378.2 of the Tax Code of the Russian Federation:

- shopping complexes and centers, administrative and business centers;

- non-residential premises with offices, shops, cafes and consumer services;

- real estate of foreign organizations, if they do not work through an official representative office;

- residential buildings and premises not included on the balance sheet as fixed assets.

- Calculate tax based on cadastral value if your region has passed a law on this. The following conditions must be met:

- your property is located in the region;

- The cadastral value of objects has been officially determined.

Average annual value of property - for other types of property. The average annual cost is calculated using the formula:

Average annual cost = ⅀ OS: (number of months in the period + 1) Here ⅀ OS is the sum of the residual value of the property on the 1st day of each month of the tax period and the last day of the tax period.

Example: Alpha LLC owns a packaging tape with an initial cost of 440,000 rubles.

| date | Residual value, rubles |

| 1st of January | 440 000 |

| 1st of February | 430 000 |

| March 1 | 420 000 |

| April 1 | 410 000 |

| 1st of May | 400 000 |

| June 1st | 390 000 |

| July 1 | 380 000 |

| August 1 | 370 000 |

| September 1 | 360 000 |

| October 1 | 350 000 |

| Nov. 1 | 340 000 |

| December 1 | 330 000 |

| 31th of December | 320 000 |

Average annual cost of tape = (440,000 + 430,000 + … + 320,000): (12 months + 1) = 380,000 rubles.

Particular attention to useful life

According to clause 20 of PBU 6/01 and clause 59 of the Methodological Instructions, the useful life of an item of fixed assets in accounting is determined based on:

- from the expected life of this object in accordance with the expected productivity or capacity;

- from the expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

- from regulatory and other restrictions on the use of this object (for example, rental period).

This rule actually provides the taxpayer with the opportunity to choose from essentially evaluative methods (who can determine the expected life or wear and tear better than the taxpayer?), based on certain objective restrictions.

A different picture emerges in tax accounting. In accordance with paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, the useful life is also determined by the taxpayer independently, but on the basis of the provisions of this article and taking into account the classification of fixed assets (hereinafter referred to as the Classification) approved by the Government of the Russian Federation.

Currently, the Classification established by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 is in force. Paragraph 1 of this resolution states that it can be used for accounting purposes. That is, until 2021, using the designated classification specifically for accounting purposes was the right, but not the obligation of the taxpayer.

In accordance with Decree of the Government of the Russian Federation dated July 7, 2016 No. 640, changes have been made to the Classification. This document generally eliminates the indication that it can be used for accounting purposes.

In any case, the taxpayer was never obliged to use it for these purposes.