The manager and accountant may be held accountable for violating accounting, tax and criminal laws.

For administrative offenses and crimes

Different degrees of severity have different statutes of limitations:

- One or two years for an administrative offense.

- Two years for minor felonies.

- Six and ten years, respectively, for criminal offenses of moderate gravity and especially grave ones.

For tax offenses

As a general rule, the statute of limitations is 3 years:

- or from the day the tax offense was committed;

- or from the day following the tax (calculation) period in which he committed an offense in accordance with paragraph 1 of Article 113 of the Tax Code of the Russian Federation.

Limitation period for loan collection

Nowadays, it happens that a loan once taken out becomes an unbearable burden for a person, which he can no longer bear.

Moving to the legal plane, the statute of limitations in a credit case begins exactly when the debtor is overdue for payment. Referring to Article 200 of the Civil Code of the Russian Federation, this period is three years. At the same time, there is one important nuance for the borrower: the debt repayment period can be equal to zero if during these three years the debtor:

- received a registered letter from the bank demanding repayment of the loan in advance;

- established contacts with representatives of the creditor or agencies specializing in debt collection, recognizing at the same time the fact that he was obliged to return the funds and these words were recorded;

- the debt was not repaid for a significant period of time, but then a payment was made for a certain amount of funds.

At the same time, there are not only unscrupulous borrowers, but also lenders. It happens that representatives of a credit institution do not specifically communicate with the debtor on the topic of debt repayment and do not bother him at a time when penalties and fines are accumulating. In this case, the borrower must navigate situations that are not a reason to reset the period:

- conversation on the telephone without recording it on a voice recorder;

- having a receipt in hand indicating that the letter from the bank was received;

- visits to the bank on other issues (not credit).

These situations cannot be evidence of maintaining ties with the bank, so their interpretation as reasons for resetting payment periods to zero is fundamentally incorrect.

Write-off of accounts receivable: accounting and tax accounting

In this article we will consider the main issues of recording and writing off accounts payable and receivable, that is, how, where, when and on the basis of what documents to write off this debt, both in accounting and tax accounting.

Inventory of payments is a reconciliation of the amounts of receivables and payables according to the data of your organization and the data of its counterparties.

According to Federal Law No. 402-FZ “On Accounting”, namely Part 1 of Article 11, organizations are required to conduct an inventory of their assets and liabilities. In accordance with Part 3 of Article 11 of Law No. 402-FZ, economic entities themselves establish the cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory. But there is one exception: some assets and liabilities are subject to mandatory inventory, which is established by the legislation of the Russian Federation, federal and industry standards.

The inventory process establishes the correctness and validity of reflecting the amounts of receivables and payables through documentary verification. The basic principles of conducting an inventory are established by order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 “Guidelines for the inventory of property and financial obligations.”

The number of inventories in the reporting year, as well as the date of their conduct, the list of property and financial liabilities inspected, are established by the head of the organization (clause 2.1 of the Methodological Instructions), except for the cases provided for in clauses 1.5 and 1.6 of the Inventory Guidelines.

In accordance with paragraph 4 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n, when forming an accounting policy, the organization approves the procedure for conducting an inventory of its assets and liabilities.

According to paragraphs 27, 77, 78 of the Accounting Regulations No. 34n, an inventory of calculations is mandatory (Letter of the Ministry of Finance of the Russian Federation dated January 14, 2015 No. 07–01–06/188):

- when writing off receivables and payables;

- before preparing annual financial statements;

- when creating a reserve for doubtful debts.

The procedure for conducting an inventory is as follows. The accountant needs to draw up a certificate of debt (receivable or payable). The certificate indicates the information reflected in the accounting records of the debt. The certificate must also contain information about the names of the organization’s debtors and creditors, the grounds for the debt, the period when the debt arose and details of the documents confirming it. For convenience, debt amounts in the certificate are grouped by accounting accounts.

Based on a certificate of debt (receivable or payable), as well as acts of reconciliation with counterparties or other documents in which debtors and creditors confirm the existence and amount of debt, an act is drawn up (clauses 73, 74 of the Accounting Regulations No. 34n, Instructions, approved by Resolution of the State Statistics Committee No. 88).

The act is drawn up on the basis of the unified form No. INV‑17. The organization has the right to develop its own document to record inventory results. But it must be remembered that such a document must contain all the details established in Article 9 of Law No. 402-FZ, and its form must be approved by the manager. This can be done in the annex to the accounting policies.

If the organization decides not to create a reconciliation report, then the agreement on the amount of debt can be confirmed by a letter from the counterparty acknowledging its debt. Amounts of debt recognized and not recognized by debtors and creditors, as well as amounts of unrecoverable debts with an expired statute of limitations or for liquidated counterparties are reflected in the act separately.

Based on bad receivables or payables identified during the inventory, it is necessary to prepare an order from the manager to write off bad debts.

Accounts receivable

Accounts receivable are a property claim of an organization against its debtors, arising as a result of a concluded agreement or legal norm. Accounts receivable arise due to failure to fulfill contractual obligations.

Overdue receivables are debts that are not repaid on time. The debt is listed on the organization’s balance sheet until it is repaid by the debtor or is considered uncollectible.

The organization has the right to collect overdue receivables within the limitation period. According to Article 195 of the Civil Code of the Russian Federation, the limitation period is the period for protecting the right in a claim of a person whose right has been violated.

Accounts receivable are considered uncollectible and must be written off from the balance sheet in full, including VAT, if one of the following circumstances occurs:

- the statute of limitations has expired;

- the debtor is liquidated;

- excluded from the Unified State Register of Legal Entities as an inactive legal entity;

- The bailiff issued a decision to terminate the enforcement proceedings and return the writ of execution to the recoverer due to the impossibility of collection.

In accordance with paragraph 77 of Regulation No. 34n, on the basis of an inventory, accounts receivable with an expired statute of limitations, as well as debt that is unrealistic for collection on other grounds, are written off as expenses for each obligation, as well as in accordance with written justification and order of the head of the organization.

Accounts receivable are written off at the expense of the created reserve for doubtful debts or against financial results, if the reserve was not created in the manner prescribed by paragraph 70 of Regulation No. 34n.

Writing off receivables at a loss when the debt is not repaid and the statute of limitations has expired is not grounds for canceling the debt. The debt must be reflected on the balance sheet within five years from the date of write-off. This is necessary to monitor the possibility of collection.

According to paragraphs 4 and 11 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, the amount of written off receivables is included in other expenses.

Other expenses are reflected in account 91 “Other income and expenses” (Chart of accounts for accounting of financial and economic activities of organizations and Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

The procedure for writing off receivables

The procedure for writing off accounts receivable in accounting is as follows. On the date of recognition of receivables that are unrealistic for collection, that is, on the date of expiration of the limitation period, an entry is made for the amount of the created reserve:

- Debit 63 “Provisions for doubtful debts”

- Credit 62 “Settlements with buyers and customers” (60 “Settlements with suppliers and contractors”, 76 “Settlements with other debtors and creditors”, etc.) - a debt that is unrealistic for collection is written off against the reserve.

If the created reserve is not enough, the following transactions are made:

- Debit 91 “Other income and expenses”

- Loan 62 (60, 76, etc.) – a debt that is unrealistic to collect is written off;

- Debit 007 “Debt of insolvent debtors written off at a loss”—uncollectible debt is taken into account to monitor the possibility of its collection in the event of a change in the debtor’s property status.

If the debtor nevertheless pays the debt in the future, the following entries will be made in the accounting:

- Debit 51 “Current accounts”

- Loan 62 (60, 76, etc.) – funds received from the debtor;

- Debit 62 (60, 76, etc.) Credit 91 – debt received is included in other income;

- Loan 007 – a bad debt repaid by the debtor is written off.

In tax accounting, in accordance with paragraph 2 of Article 266 of the Tax Code of the Russian Federation, bad debts (debts that are unrealistic for collection) are those debts to the taxpayer for which the established statute of limitations has expired (3 years from the date the debt arose, Article 196 of the Civil Code of the Russian Federation), and also those debts for which, in accordance with civil law, the obligation is terminated due to the impossibility of its fulfillment, on the basis of an act of a state body or the liquidation of an organization.

Debts that are unrealistic for collection are also recognized as debts, the impossibility of collection of which is confirmed by a decree of the bailiff on the completion of enforcement proceedings, issued in the manner established by the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings”, in the event of the return of the enforcement order to the collector document.

The debts of a company that has ceased operations are uncollectible from the date of its exclusion from the Unified State Register of Legal Entities (Letters of the Ministry of Finance of the Russian Federation dated March 25, 2016 No. 03–03–06/1/16721, dated October 5, 2015 No. 03–03–06/2/56751, dated September 11, 2015 No. 03–03–06/2/52390, dated 06/24/2015 No. 03–01–10/42792, Resolutions of the Arbitration Court of the Moscow Region dated 02/24/2015 No. F05–413/2015, Arbitration Court of the Central District dated 06/18/2015 No. F10–1693 /2015).

When writing off debt due to the liquidation of the debtor organization, you must also have a document confirming the liquidation of the debtor organization - an extract from the Unified State Register of Legal Entities (Letter of the Ministry of Finance of the Russian Federation dated March 14, 2014 No. 03–03–06/1/11063).

Thus, the basis for writing off the debt may be the expiration of three years from the date the debt arose, or the debt may be written off on the basis of a resolution of the bailiff on the completion of enforcement proceedings (due to the fact that the debtor does not have property that can be applied to collection, it is impossible to establish the location of the debtor, his property, etc.), or liquidation of the organization, or exclusion of the organization from the Unified State Register of Legal Entities.

According to subparagraph 2 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation, receivables with an expired statute of limitations are written off as non-operating expenses.

| The general limitation period is 3 years. Count correctly these 3 years are simpler according to the table: | |

| Situation | From what point do you count? statute of limitations |

| The deadline for fulfilling the obligation is determined | Upon expiration of the obligation |

| The deadline for fulfilling the obligation is not determined | From the day the creditor made a demand to fulfill obligations (for example, sent a letter) |

| The execution period is determined by the moment of demand | |

| The creditor gave the debtor some time to fulfill the obligation | At the end of the last day of the obligation fulfillment period |

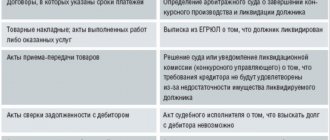

Documents confirming the formation of receivables

It must be remembered that one of the mandatory conditions for including a bad debt in tax expenses is the presence of primary documents confirming the formation of receivables with an expired statute of limitations (see Letter of the Ministry of Finance of the Russian Federation dated 04/08/2013 No. 03–03–06/1/11347) .

A business entity must have documents confirming the fact of the occurrence of debt, documents indicating the expiration of the limitation period. The formation of bad debts, as well as the amounts and terms can be confirmed:

- an agreement that specifies the due date for payment;

- invoices for the transfer of valuables, acts of acceptance of services rendered (when executed in accordance with the terms of the contract);

- payment orders, as well as an inventory report of receivables at the end of the reporting (tax) period, indicating that at the time of writing off the specified debt was not repaid;

- by order of the manager to write off receivables as bad debts (see: Letter of the Federal Tax Service of the Russian Federation for Moscow dated April 13, 2011 No. 16–15 / [email protected] ).

Also, documents confirming the fact of the occurrence of receivables can be any primary documents that comply with the requirements of Law No. 402-FZ on the completion of a business transaction, as a result of which the counterparty’s debt to the taxpayer arose (invoices for the transfer of valuables, acts of acceptance and delivery of work (services), payment documents, etc.) (see Letter of the Federal Tax Service of the Russian Federation dated December 6, 2010 No. ШС-37–3/16955)

In accordance with paragraph 7 of Article 272 of the Tax Code of the Russian Federation, the date for recognition of non-operating expenses for profit tax purposes is established. According to this article of the Tax Code of the Russian Federation, expenses in the form of bad debts for which the statute of limitations has expired are taken into account as part of non-operating expenses on the last day of the reporting period in which the said period expires (see: Letter of the Ministry of Finance of the Russian Federation dated 02/06/2015 No. 03–03 –06/1/4995).

The provisions of the Tax Code of the Russian Federation do not provide the taxpayer with the right to arbitrarily choose a tax period (at his own discretion) in which uncollectible receivables are included in expenses.

A business entity, conducting an inventory as of the last date of the reporting (tax) period, must, based on the results of the inventory, determine the amount of receivables, unrecoverable receivables (for example, for which the statute of limitations has expired), and write off this debt. This algorithm of actions is given by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 1574/10 dated June 15, 2010 in case No. A56–4354/2009. At the same time, the interpretation of legal norms contained therein is generally binding and is subject to application when arbitration courts consider similar cases.

Accordingly, a taxpayer may treat a bad receivable that arose in March 2015 as a bad debt for income tax purposes as of March 31, 2021. Overdue debt will be included in non-operating expenses in March 2021.

In order to avoid disputes with inspectors, the write-off of receivables that are hopeless for collection must be reflected precisely in the period in which they became hopeless (Clause 2 of Article 266 of the Tax Code of the Russian Federation). It is very risky to transfer the bad recognition of receivables as expenses to the next tax or reporting period (see Letter of the Ministry of Finance of the Russian Federation dated 04/06/2016 No. 03–03–06/2/19410).

In tax accounting, the procedure for writing off bad debts depends on the availability of a reserve for doubtful debts. If not, write off all bad debt as an expense. If a reserve was created, write off the debt against the reserve, that is, reduce the reserve for bad debts. If the reserve is not enough, include the remaining debt in expenses (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated January 16, 2018 No. 03–03–06/2/1551).

Accounts payable

Accounts payable are debts payable. Accounts payable arise when an advance is received from buyers, but goods (work, services) have not yet been sold, or if goods (work, services) have been received from a supplier, and money for them has not yet been paid.

On the one hand, accounts payable are funds raised to conduct business activities, and, as a rule, without paying interest. This is the positive side of accounts payable. At the same time, overdue accounts payable can lead to the need to pay penalties, bring lawsuits, and in the worst case, declaring the enterprise bankrupt. Accounts payable that cannot be collected due to the expiration of the statute of limitations are written off to increase the financial result.

The procedure for writing off accounts payable in the accounting records of an organization is regulated by the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n (hereinafter referred to as PBU 9/99) and Regulation No. 34n.

According to clause 7, 10.4 of PBU 9/99, the amount of accounts payable that is unrealistic for collection, for which the statute of limitations has expired, is other income and is included in the organization’s income in the amount in which this debt was reflected in the accounting records.

Amounts of accounts payable for which the statute of limitations has expired, in accordance with paragraph 78 of Regulation No. 34n, are written off for each obligation based on the inventory data, written justification and order (instruction) of the head of the organization and are included in the financial results of business entities.

Thus, the documents for writing off accounts payable are similar to the documents for writing off accounts receivable.

Amounts of accounts payable for which the statute of limitations has expired, according to the Chart of Accounts, are reflected in the credit of account 91 “Other income and expenses” during the reporting period in correspondence with accounts payable.

The write-off of accounts payable with an expired statute of limitations is reflected in the organization’s accounting records as follows:

Debit 60, 62, 76 Credit 91, subaccount “Other income” - accounts payable are written off.

Amounts of accounts payable in accordance with paragraph 18 of Article 250 of the Tax Code of the Russian Federation are taken into account as part of non-operating income in the full amount (including VAT).

If there is debt specified in subparagraph 21 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, it is not included in the income that forms the tax base for income tax.

Accounts payable with an expired statute of limitations are taken into account as part of non-operating income according to inventory data, written justification and order of the organization’s management.

The date of recognition of non-operating income for profit tax purposes is established by paragraph 4 of Article 271 of the Tax Code of the Russian Federation. Income in the form of accounts payable for which the statute of limitations has expired is taken into account as part of non-operating income on the last day of the reporting period in which the statute of limitations expires (see Letter of the Ministry of Finance dated January 28, 2013 No. 03–03–06/1/38 and Letter of the Federal Tax Service of the Russian Federation for Moscow dated July 4, 2008 No. 20–12/063584).

The Presidium of the Supreme Arbitration Court of the Russian Federation stated that “an economic entity must take into account the amounts of claims of creditors for which the statute of limitations has expired as part of non-operating income in a certain tax period (the year of expiration of the limitation period), and not in one arbitrarily chosen by the organization (clause 18 of Art. 250 of the Tax Code of the Russian Federation). This obligation is subject to fulfillment regardless of whether the organization carried out an inventory of the debt and whether, based on its results, an order was issued by the manager to write off the debt” (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 17462/09 in case No. A26–5933/2008 ).

The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2008 No. 3596/08 in case No. A57–10603/06–6 states that “the procedure for writing off accounts payable is regulated by Regulation No. 34n. Therefore, in the absence of an order (instruction) from the manager to write off accounts payable, there were no grounds for the inspectorate to charge income tax, as well as penalties and fines for the amount of accounts payable.”

Taking into account the above, we recommend that you take a more scrupulous approach to this issue, more carefully monitor the presence of the organization’s accounts payable and pay special attention to their statute of limitations (being on the balance sheet) in order to draw up all the necessary documents on time and write them off in the required period.

To avoid tax risks, we recommend issuing an order to write off accounts payable in the reporting (tax) period in which the statute of limitations expired.

In the same tax (reporting) period, it is necessary to take into account non-operating income from debt write-off. If an organization misses the date for writing off accounts payable due to the expiration of the statute of limitations, then it is safer to make corrections during the reporting (tax) period when the statute of limitations has expired and submit an updated declaration (clause 1 of article 54, article 81 of the Tax Code of the Russian Federation ). But it must be remembered that before submitting the updated declaration, it is necessary to pay the debt and penalties in order to avoid fines from controlled authorities.

VAT

When a taxpayer receives payment for upcoming supplies of goods (work, services), the VAT tax base is determined based on the amount of payment received, including VAT (clause 1 of Article 154 of the Tax Code of the Russian Federation).

In accordance with paragraph 8 of Article 171 of the Tax Code of the Russian Federation, VAT amounts calculated by the taxpayer from amounts of payment, partial payment received on account of upcoming supplies of goods (work, services) are subject to deductions.

According to paragraph 6 of Article 172 of the Tax Code of the Russian Federation, it is established that deductions of VAT amounts are made from the date of shipment of the relevant goods (work, services). Also subject to deductions are the amounts of VAT calculated by sellers and paid by them to the budget from the amounts of payment, partial payment on account of upcoming technical and technical works sold on the territory of the Russian Federation, in the event of a change in the conditions or termination of the relevant contract and the return of the corresponding amounts of advance payments (clause 5 of Article 171 Tax Code of the Russian Federation).

When the seller writes off, after the expiration of the limitation period, the amounts of unclaimed accounts payable generated by the amounts of advance payments received on account of upcoming deliveries of goods (works, services) and not returned to the buyer, there are no grounds for deducting the amounts of VAT calculated and paid by him to the budget from the amounts of advance payments (see Letter of the Ministry of Finance of the Russian Federation dated December 7, 2012 No. 03–03–06/1/635).

In accordance with paragraph 18 of Article 250 of the Tax Code of the Russian Federation, non-operating income is recognized as income in the form of amounts of accounts payable (liabilities to creditors) written off due to the expiration of the statute of limitations or for other reasons, except for the cases provided for in subparagraph 21 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation .

According to subparagraph 14 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, “non-operating expenses not related to production and sales include expenses in the form of taxes related to supplied inventories, works, services, if accounts payable (liabilities to creditors) such supply was written off in the reporting period in accordance with paragraph 18 of Article 250 of the Tax Code of the Russian Federation.”

Accordingly, an economic entity has the right to reduce the tax base for income tax by the amount of VAT only on accounts payable for inventories, works, services, written off in the reporting period in accordance with paragraph 18 of Article 250 of the Tax Code of the Russian Federation as part of non-operating income.

At the same time, Chapter 25 of the Tax Code of the Russian Federation does not provide for the possibility of taking into account in non-operating expenses the amount of VAT on advances received written off due to the expiration of the limitation period (see Letter of the Ministry of Finance of the Russian Federation dated December 7, 2012 No. 03–03–06/1/635, dated 10.02.2010 No. 03–03–06/1/58).

Consequently, according to the Ministry of Finance of the Russian Federation, VAT calculated on the advance received is included in income as part of written off accounts payable and is not taken into account in expenses, and it is also not accepted for deduction.

I would like to note that the courts also support this point of view expressed by the Ministry of Finance of the Russian Federation (see Resolution of the Federal Antimonopoly Service of the Volga Region dated 07.11.2012 in case No. A57-7766/2011, Resolution of the Arbitration Court of the Moscow Region dated 05.03.2015 No. F05-15737/2014 in case No. A40–179957/13).

Thus, in accordance with paragraph 2 of Article 266 of the Tax Code of the Russian Federation, it is safer to reflect the write-off of receivables that are unrealistic for collection precisely in the period in which they became uncollectible. And do not transfer its recognition as expenses to the next tax period (Letter of the Ministry of Finance of the Russian Federation dated 04/06/2016 No. 03–03–06/2/19410, Resolution of the Supreme Arbitration Court of the Russian Federation dated 06/15/2010 No. 1574/10).

Accounts receivable must be confirmed by primary documents indicating the transaction that resulted in the debt. These may be contracts that specify payment due dates; invoices; certificates of work performed, etc. An act of inventory of receivables, as well as an order from the manager to write off receivables as bad (see Letter of the Federal Tax Service of the Russian Federation for Moscow dated April 13, 2011 No. 16–15/ [email protected] ) .

Organizations that decide to write off bad receivables as expenses later than the last day of the reporting (tax) period in which the event occurred need to prepare for a dispute with inspectors.

In accordance with paragraph 18 of Article 250, paragraph 4 of Article 271 of the Tax Code of the Russian Federation, bad accounts payable must be reflected in income on the last day of the quarter or year in which they became bad. Moreover, it does not matter whether the manager issued an order to write off overdue debts (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 17462/09, Resolution of the Arbitration Court of the Moscow Region dated 02/02/2016 No. F05–19082/2015).

If an organization has missed the period for reflecting accounts payable in non-operating income, then it will have to submit an updated declaration, having previously paid additional tax and penalties (clause 1, clause 1, clause 4, article 81 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated December 8, 2014 No. GD- 4–3/ [email protected] ; Letter of the Ministry of Finance of the Russian Federation dated April 25, 2016 No. 03–03–06/1/23695).

Statute of limitations for taxes

To date, tax legislation has not established a statute of limitations for collecting tax liabilities. The tax issue requires taking into account the following periods:

- preparing and addressing a claim that an insufficient amount was paid in the agreed manner;

- repayment of the debt amount at the initiative of the debtor;

- preparation and submission by representatives of the tax service of a claim about violation of conditions by the debtor.

Collection of tax debt is the most important element in the system of tax relations. If it comes to confiscation of the debtor's property, then this process is given two years. In practice, the tax service has enough time to avoid bringing the matter to the bailiffs; the debt is returned through pre-trial negotiations. If the debtor tries with all his might to bring the matter to the bailiffs, then the tax authorities can fully file a claim in court to collect the tax liability, which is unlikely to be avoided. As in the future work of bailiffs.

The statute of limitations for bailiffs is also determined by law, so no deviations from existing Russian legislation are acceptable.

What debt can be written off?

The legislative norms of the Russian Federation determine that not every debt of a company can be written off freely. In order to be legally written off, a company's debts must meet the criteria of unrealistic collection.

Reasons for write-off

Debts can be written off only if they are documented. This is especially important if there are accounts receivable, since if they are written off, they are included in the company’s costs.

The term accounts payable of a company implies debts under obligations to other persons of any organizational and legal forms. The amount of monetary obligations is determined according to the data arising under the contract.

Accounts receivable reflect the amount of obligations of other companies, entrepreneurs, or individuals resulting from ignoring their responsibilities.

Causes of debt:

- sale of goods, performance of services or work;

- non-payment of wages;

- taxes and fees have not been paid;

- obligations to creditors have not been repaid.

Written documents confirming debt obligations:

- transaction contracts;

- payment documents confirming the advance payment for the upcoming payment;

- signed reconciliation report;

- other documents that can reliably indicate the debt.

Debt under obligations is also classified into current and overdue for collection. It is considered valid if the creditor or debtor has the opportunity to repay them through collection.

The provision on bad debt is interpreted by paragraph 2 of Article 266 of the Tax Code of the Russian Federation. The arrears are considered hopeless if the period during which it was possible to apply for debt collection to the court has expired, as well as if the debtor was excluded from the Unified State Register of Legal Entities due to the bankruptcy of the enterprise. It should be noted that according to the new bankruptcy law, a liquidated company must be excluded from the legal entities later than September 1, 2014.

The debt of organizations can be written off without expiration if:

- the debtor is declared bankrupt and the bankruptcy procedure is completed by court decision;

- a notification has been received from the bankruptcy trustee (liquidation commission) about the insufficiency of property to pay off the claims of creditors;

- the enterprise is excluded from the Unified State Register of Legal Entities;

- the bailiff issued an act on the impossibility of collecting the debt;

- if the parties have agreed to forgive the debt.

It is impossible to write off debt without documentary evidence and the consequence may be the imposition of penalties by regulatory authorities.

Statute of limitations for wage debt

The statute of limitations for wage debts is three months from the moment the employee quits. During this period, a person has every right to file a lawsuit against his employer for failure to pay the required wages.

If the employment contract is not terminated, no such period is established. If the employee continues to work, but at this time his wages are not accrued, then he has the right to file a lawsuit against his employer, who does not fulfill his direct responsibilities towards employees, increasing wage debts. In both cases, the employee whose rights were violated has every right to receive the entire debt in full.

The procedure for writing off accounts payable

The debt closure plan consists of three stages:

- inventory is carried out;

- an accountant's certificate is prepared;

- An order is issued from the manager to write off overdue accounts payable.

The amount of debt is determined by the results of the inventory (form No. INV-17). An appropriate management order must be issued to carry out this action. (Form No. INV-22). The closure of arrears occurs separately for each debt.

The accounting certificate records the write-off of debts in the relevant registers of the enterprise. The debt is closed for each obligation separately. Write-off increases the amount of non-operating income (clause 18 of Article 250 of the Tax Code of the Russian Federation).

The exceptions are:

- tax debts;

- to the founder with a share of ownership of the authorized capital of more than 50%;

- to a legal entity with a share of the organization’s authorized capital of more than 50%;

- to any founder of the organization if the purpose of debt forgiveness was to increase net assets;

- when writing off unclaimed dividends.

Postings are generated:

- Debit 60 (62, 66, 76)

- Loan 91 – accounts payable closed

Term

The limitation period for collection is counted from the moment the obligation of the parties to the transaction to fulfill their mutual obligations ends. The period for submitting claims to the court may be interrupted if:

- the reconciliation report has been signed;

- there is a letter from the debtor acknowledging the debt;

- the debtor has repaid the interest or paid a fine for late payment;

- The parties additionally decided to extend the deadline for fulfilling obligations.

After the deadline is interrupted, it begins to count down again. The total period, regardless of interruption, cannot be more than 10 years.

Statute of limitations for debt collection from an individual

If you have lent financial resources to any person, then if he refuses to repay the debts, you have three years to go to court and initiate the work of bailiffs. However, it is worth pointing out one important and significant nuance: you must have a receipt in your hands, which will indicate the exact deadline for repaying the debt. In this case, the limitation period for collection will begin the very next day after the specified date.

As practice shows, unfortunately, it is almost impossible to return your funds without a receipt, even if you go to court. In such a situation, the lender should rely solely on the borrower’s honesty and conscience.

Documents to confirm that the debt is uncollectible

In order to write off, you must confirm:

- Date of formation of the written-off debt (see resolutions of the Federal Antimonopoly Service of the West Siberian District dated June 15, 2011 No. A27-12499/2010, No. A27-18504/2009 dated April 22, 2010, No. A56-54758/2007 of the Federal Antimonopoly Service of the Northwestern District dated June 11, 2008 ). Typically the following documents serve as confirmation:

- contracts;

- invoices for payment;

- invoices;

- invoices for goods, acceptance certificates for work or services.

One agreement is not enough for these purposes (see letter of the Federal Tax Service dated December 6, 2010 No. ШС-37-3/16955);

- The fact that at the time of writing off the debt has not been repaid. Here you will need (clause 77 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, letter of the Federal Tax Service of Russia for Moscow dated April 13, 2011 No. 16-15 / [email protected] , determination of the Supreme Arbitration Court of the Russian Federation dated October 9, 2012 No. VAS-5055/12, resolution of the Federal Antimonopoly Service of the West Siberian District dated June 15, 2011 No. A27-12499/2010, Federal Antimonopoly Service of the Ural District dated July 8, 2010 No. F09-5115/10-S3, etc.) :

- debt inventory act at the end of the tax period (INV-17);

- manager's order to write off a bad debt;

- documents confirming its formation (agreement, reconciliation act, primary documents).

However, in some cases, arbitrators may consider writing off a debt justified only on the basis of a reconciliation report and an agreement on the procedure for repaying the debt, in the absence of an agreement and primary documents (Resolution of the Federal Antimonopoly Service of the Central District dated August 26, 2011 No. A64-3070/2010).

To ensure timely control over receivables and payables, many companies are developing debt write-off provisions.

Read about the nuances of drawing up this document here.

Is recovery possible after the statute of limitations has expired?

In fact, the creditor who lent money does not have the right to demand the money back in court after the statute of limitations on the debt has expired. This rule applies throughout the Russian Federation. However, there are certain cases where an exception may apply. This happens when the debtor has circumstances that prevent him from defending his rights. The circumstances for suspension are:

- impossibility of filing a claim due to an emergency or insurmountable obstacle;

- a representative of one of the parties is on compulsory military service;

- a deferment for the fulfillment of undertaken obligations is established by law.

In such cases, debt collection must be suspended. If these facts took place in the last six months, then the statute of limitations is extended for a similar period of time.

In addition to the concept of suspension, there is also the concept of a period break. The concepts discussed vary. A break is appointed in the case when the debtor has received a claim, or has independently admitted that he is in debt. This may be a direct or indirect admission, but it is considered factual.

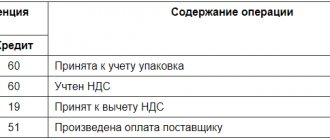

Accounting for writing off bad debts

Bad receivables are written off against the previously created reserve for doubtful debts in the context of each obligation. If the reserve is insufficient, the amount of debt is applied to the financial results of the company.

Uncollectible accounts receivable are reflected in accounting by the following entries:

| Dt | CT | Contents of operation |

| 91 “Other expenses” | 63 | A reserve for doubtful debts has been created |

| 63 | 62 (71, 76…) | Accounts receivable written off against reserve |

| 91 “Other expenses” | 62 (71, 76 …) | Accounts receivable written off in excess of reserve |

After the write-off, the amount of the bad receivable should be taken into account for 5 years on the off-balance sheet account 007 “Debt of insolvent debtors written off at a loss.”

Read about the nuances of accounting for uncollectible receivables here.

Bad accounts payable are taken into account as part of other income and are displayed in the credit of account 91 “Other income”.

Check whether you have correctly identified a receivable that is unrealistic for collection using the Ready Solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

How long does enforcement proceedings with bailiffs last?

According to No. 229-FZ “On Enforcement Proceedings,” the following deadlines are established for bailiffs:

- The bailiff must issue a decision to initiate proceedings within 3 days after receiving the relevant decision or other document.

- The debtor is given a period of 5 days to voluntarily pay off the court debt.

- Next, enforcement proceedings are opened for a period of 2 months, but the deadlines can be extended.

- In particular, if a search is carried out for the debtor and his property, then a period for the search is introduced (up to six months, but with the possibility of extension).

- After the search is completed, the bailiff restores the deadlines for enforcement proceedings (during the search, the deadlines are interrupted).

The following circumstances are also taken into account:

- the bailiff has the right to postpone work on enforcement proceedings for 10 days if he has received petitions from the parties;

- the debtor received a deferment or extended payment by going to court;

- the debtor is absent: he is undergoing treatment or is abroad for valid reasons;

- the debtor received executive holidays legally.

The essence of preferential executive holidays is as follows:

- Pensioners with an income below 2 minimum wages, as well as legal entities and individual entrepreneurs classified as small and medium-sized businesses can apply for holidays;

- Vacations can be obtained with a debt amount of up to 1 million rubles. (pensioners) and up to 15 million rubles. (small and medium businesses);

- pensioners can receive benefits only on debts to banks and microfinance organizations, and organizations and individual entrepreneurs can also receive benefits on taxes and insurance contributions;

- the holiday consists of providing an installment plan, during which the bailiffs will stop the forced collection;

- if the applicant meets the conditions and requirements for receiving vacations, the bailiff is obliged to issue an appropriate ruling;

- preferential installment plans can only be applied to proceedings initiated before October 1, 2021.

Most pensions in Russia are lower in amount than 2 minimum wages (currently the minimum wage is 12 thousand 130 rubles on average in the Russian Federation). Therefore, if you have a loan debt of up to 1 million rubles. the pensioner will be able to submit an application and for half a year the bailiffs will not have the right to demand his outstanding debt and initiate enforcement proceedings.

For enterprises and individual entrepreneurs, it is necessary to confirm inclusion in the register of small and medium-sized businesses (maintained by the Federal Tax Service), and it is also necessary to confirm the fact that the main activity of the enterprise belongs to the industries most affected by the coronavirus. The OKVED list for such industries is posted on the Russian Government website.

If the described circumstances occur, enforcement proceedings are suspended or extended.

PS Executive holidays can be obtained for productions until May 1, 2021. This deferment, provided for up to 1 year, is an innovation that was introduced in connection with the coronavirus crisis.

The essence of receivables

So, this is the payment of the amount due on due date to the debtors. Such debt is divided into two types;

- current;

- long-term.

The first option represents the amount of receivables that must be paid within one year after signing the contract. It does not occur during an operational type cycle if it proceeds normally. The second option is the amount of monetary obligations of the receivable type, which arises during the previously considered cycle; the debt is repaid within a similar time frame (the period in this case is the time allotted for repaying the loan)

Long-term debt is also called doubtful, because one cannot be completely sure of it, or rather, of the repayment of the debt for the elapsed periods specified in the contract. If confidence is completely absent, such debt is called bad debt.

Limitation periods in the activities of bailiffs

If the debt is outstanding, then the creditor has 3 years - this is the deadline for submitting a writ of execution to the bailiffs. He does not have to rush to the FSSP - this can be done later, but it is advisable not to miss the months established by law. And there are only 36 of them.

Please note that in some cases the deadlines are reduced or delayed:

- The plaintiff is obliged to contact the FSSP within 1 year if he has received a court decision on the return of a minor child or his removal from the defendant. As a rule, the parties to such disputes are parents when one of them is a foreigner.

- The plaintiff can wait to contact the bailiffs if the court has ordered the collection of regular payments. The 3-year limitation period begins to run after the date of the last regular payment. A striking example is alimony, which is paid until the child reaches adulthood. The statute of limitations is calculated after the child reaches the age of 18.