Why are off-balance sheet accounts of MC needed (MC.01, MC.02, MC.03, MC.04)

In the chart of accounts of the 1C: Accounting program there is a number of additional off-balance sheet accounts in addition to the 11 generally accepted ones. This is done for more thorough and convenient accounting.

Account MC.04 is a subaccount of the MC account “Material assets in operation” along with three more subaccounts:

- MC.01 “Fixed assets in operation”,

- MC.02 “Workwear in operation”,

- MTs.03 “Special equipment in operation.”

МЦ.02—an off-balance sheet account used to account for special clothing issued to an employee to perform his official duties. Account MTs.03 accumulates information on special tools and equipment transferred into operation. Account MTs.01 is often used if the fixed asset is reflected differently in tax and accounting.

The introduction of these accounts into accounting is due to the need to control property written off from the organization’s balance sheet, included in costs, but used in the organization’s economic activities. Their debit reflects the values to be accounted for, broken down by item items, financially responsible persons and storage locations. The loan reflects the write-off of assets. In this case, transactions are recorded only in debit or only in credit of such accounts - correspondence is not typical for off-balance sheet accounts.

Find out what and how to take into account on off-balance sheet accounts in ConsultantPlus. Learn the material by getting trial access to the system for free.

You can familiarize yourself with the features of using off-balance sheet accounts in accounting in the article “Rules for maintaining accounting on off-balance sheet accounts.”

Typical entries for writing off bad debts

What entries for writing off “receivables” the accounting department needs to make depends on whether the organization forms a RSD. If yes:

- Credit 62, 60, 70, 71, 73, 76 (settlements with counterparties) – Debit 63 (RSD).

- Debit 007 (loss on debt of insolvent debtors).

In the case where the organization has not reserved funds for this debt for the entire amount, coverage at the expense of the RSD is only possible in part. The balance will be included in non-operating expenses under Dt91.2. “Receivables” are also written off there if no reserve was created.

A few words about account 007. This is an off-balance sheet account that records bad debts with detailed analytics: who is the debtor, how much, when and on what basis it was written off. If there is a chance to one day return lost money (by a court decision, with an improvement in the client’s financial situation), account 007 makes it possible to do this: by posting Kt91.1 (non-operating income) - Dt51 (company current account), then by writing off the amount of the paid debt from 007 .

Entries on the debit of account MTs.04

According to the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), the balance sheet account 10.09 is used to capitalize inventory and household supplies. To reflect this business operation in the 1C: Accounting program, the document “Receipt of goods and services” is provided.

When instruments and other inventory are accepted for accounting, a new document is created with the transaction type “Purchase, commission”. The document is filled out indicating:

- what has to happen

- from whom,

- in what quantity,

- at what price.

Account 10.09 “Inventory and household supplies” is selected as a debit accounting account.

An entry in the credit of account 10.09 occurs when inventory and other household property are transferred into operation. For this purpose, a document “Transfer of materials into operation” is created and carried out.

When transferring inventory, fill out the “Inventory and Household Supplies” tab:

- the nomenclature of transferred values is selected by position,

- the employee accepting them for use,

- the accounting account 10.09 and the method of reflecting costs are indicated.

When posting a document, values are written off from accounting account 10.09 to the cost account. At the same time, these values are debited to account MTs.04 in the context of nomenclature, quantity and financially responsible persons. In this way, proper control over the safety of the organization’s property can be organized.

The document “Transfer of materials into operation” allows you to print the issue record sheet (form MB-7) or the demand invoice (form M-11). If necessary, you can change the financially responsible person responsible for the safety of economic assets recorded on the balance sheet.

Inventory of account MC.04

For organizations, conducting an inventory is a mandatory procedure (clause 27 of the Regulations on accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In this case, both balance sheet and off-balance sheet accounts must be audited.

You can learn more about the procedure for taking inventory of off-balance sheet accounts in the material “Is it possible to carry out an inventory for off-balance sheet accounts?”

Off-balance sheet accounting of inventory and other business property is carried out to monitor its safety. Because of this, an inventory of such property is a necessity, allowing one to identify the actual presence of property listed in the records. The 1C: Accounting program provides additional processing used in the document “Inventory of goods in warehouse”. It allows you to inventory assets in the off-balance sheet account MTs.04.

Write-off of accounts receivable for balance

Debts in accounting should be written off using the reserve for doubtful debts. All enterprises are required to create it, with the exception of entrepreneurs (Clause 2, Article 6 of Law No. 402-FZ, Article 2 of Regulation No. 34n). If the reserve amounts are not enough to cover receivables, then the excess amount is included among other expenses (clause 11 of PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n).

Accounting entries for the formation of a reserve for doubtful debts and write-off of receivables:

| Debit | Credit | Contents of operation |

| 91 | 63 | A reserve for doubtful debts has been created |

| 63 | 62, 76 | Bad receivables written off against reserve |

| 91 | 62, 76 | Accounts receivable written off in excess of reserve for doubtful debts |

| 91 | 60, 62, 76, 73, 58 | The entire amount of bad receivables is written off as other expenses - if the company did not create a reserve for this debt. IMPORTANT! For accounting purposes only. To calculate taxes, only amounts calculated according to the rules of Art. 266 Tax Code of the Russian Federation. |

| 94 | 71 | Accountable amounts not returned by the employee on time are reflected |

| 91 | 94 | Uncollectible amounts are written off |

But that’s not all: written-off bad receivables must be taken into account on the balance sheet for another 5 years from the date of write-off. This is what the account is designed for. 007 “Debt of insolvent debtors written off at a loss.” The organization is obliged to monitor the possibility of still receiving the debt from the debtor for 5 years (clause 77 of regulation No. 34n). The write-off of receivables for the balance is reflected in the debit of the account. 007. If 5 years have passed and the money has not been received, the receivable is finally written off by posting a credit account. 007.

If within 5 years it became possible to collect the debt and the counterparty transferred the money, then the following entries should be made in the accounting:

| Debit | Credit | Contents of operation |

| 51, 50 | 91 | Money has been received to repay previously written off bad receivables. Other income is recognized in the amount of repaid bad receivables that were previously written off |

| 007 | The written-off receivables have been repaid |

IMPORTANT! If you have written off a bad debt of a counterparty (individual or employee), then the written off amount becomes the citizen’s income, and your company or individual entrepreneur becomes a tax agent for personal income tax (letter of the Federal Tax Service of the Russian Federation dated December 31, 2014 No. PA-4-11/27362). There is no need to charge insurance premiums on the amount of the employee’s debt written off - such amounts are not subject to insurance premiums (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009). However, officials insist on payment of contributions (letter of the FSS of the Russian Federation dated November 17, 2011 No. 14-03-11/08-13985), arbitration practice is ambiguous, disputes with inspectors are possible (resolution of the FAS Volga District dated December 17, 2013 No. F06-24/13 on case No. A65-4684/2013).

Another aspect that we recommend paying attention to is the write-off of VAT when eliminating bad debts. Whether it is necessary to adjust or restore the tax amount - find out from the article “How to take into account VAT amounts when writing off accounts receivable?”

Analytical accounting by account. 007 should be kept:

- for each debtor whose debt was written off at a loss;

- for each debt written off.

Information about accounts receivable on the balance sheet can be indicated in the explanations to the accounting records (Appendix 3 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

Topic: Write-off from MC.04

Quick link 1C Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Which “receivable” is subject to write-off

The formation of non-recoverable “receivables” is a real “headache” for the accounting department and the owners of the enterprise. Not only did the organization receive less of its hard-earned money, it was also forced to include the amount of debt in the calculation of net profit and pay taxes based on inflated figures. Thus, defaulted debts distort the picture of the financial situation, and the creditor company is interested in writing them off as quickly as possible. But this can only be done after all legal ways to collect the debt from the debtor have been exhausted.

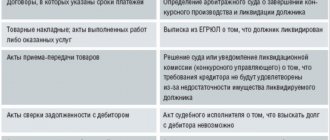

Debts are considered bad on the following grounds:

- The statute of limitations on the debt has expired. According to Art. 196 of the Civil Code of the Russian Federation, it is 3 years, provided that during this period the organization did not go to court and the debtor did not take any actions confirming the recognition of the debt. The recognition of claims by the debtor is evidenced by any, even penny, payments on existing debt, signed reconciliation reports, written responses, etc. From the moment any of these actions are committed, the limitation period begins to count anew.

- It is not possible to collect the debt for objective reasons: the debtor company no longer exists, has been declared bankrupt and its assets are not enough to pay creditors during the liquidation process. It is necessary to substantiate the unreality of collection with documents: an extract from the Unified State Register of Legal Entities on the closure of the debtor, a court decision on liquidation, a notice of the lack of company property to satisfy all requirements and other official papers.