Any property sold or intended for sale is a commodity (Clause 3 of Article 38 of the Tax Code of the Russian Federation).

The sale of goods is recognized as the transfer of ownership of goods on a paid basis, as well as the transfer of ownership of goods on a free basis (clause 1 of Article 39 of the Tax Code of the Russian Federation).

This determines the taxation procedure for payment of dividends in kind.

The letter of the Ministry of Finance of Russia dated August 25, 2021 No. 03-03-06/1/54596 explains the procedure for taxing VAT and income tax on the operation of issuing dividends on products of own production.

Operations for the sale of goods on the territory of the Russian Federation are subject to VAT (Clause 1, Article 146 of the Tax Code of the Russian Federation). The tax base for VAT in the case of payment of dividends using own products should be determined on the day of transfer of property to the participants (founders) (clause 1 of Article 167 of the Tax Code of the Russian Federation).

From the point of view of income tax, income from sales is recognized as proceeds from the sale of goods (work, services) both of one’s own production and those previously acquired, as well as proceeds from the sale of property rights (Article 249 of the Tax Code of the Russian Federation).

Since the payment of dividends on its own products is the sale of goods, this means that the company must determine the tax base and calculate income tax. The object of taxation for income tax is the profit of the organization, which represents income reduced by the amount of expenses incurred (Article 217 of the Tax Code of the Russian Federation).

We add that if a loss arises as a result of the transfer of property, then it reduces the taxable profit of the organization (Article 268 of the Tax Code of the Russian Federation).

Payment of dividends from the organization's cash desk, what threatens 2021

The legal topic is very complex, but in this article we will try to answer the question “Payment of dividends from the organization’s cash desk, what does 2021 threaten.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Payment of dividends through the cash register in 2021

The Directive states that the proceeds can be spent on payments to employees included in the wage fund and social payments. What social payments are is not explained in the Directive.

The founders decided to distribute the annual profit - 1,000,000 rubles. They met at the Hole in the Wall bar and signed minutes of the meeting. In the evening, the accountant transferred 500,000 rubles to Smirnova, 450,000 to Smirnova - and exhausted the limit for the day. The next day, the accountant was dealing with the 6-NDFL report and forgot about the third founder.

- Let participants know the time and agenda 30 days before the meeting. Send them a copy of the accounting report.

- At the meeting, propose to distribute profits among the founders and receive a majority of votes.

- Record the decision of the meeting in the minutes and send a copy to all founders no later than 10 days later. Print out the protocol and sew it with others. Any founder has the right to familiarize himself with them.

When you can't get dividends

Any person or company that owns an interest in the capital stock of an LLC. The amount of compensation does not depend on how you help the organization. When distributing profits, you will receive as much as the percentage of the authorized capital you own. It is allowed to use a different scheme for calculating dividends if you adopted it when creating the organization or all the founders voted to change the charter.

Indeed, the possibility of paying dividends in cash depends on the legal form of the organization planning to make payments to the founders. Let's start with LLC. The legislation does not provide for any restrictions on the payment of dividends from the cash register of a limited liability company. Is it possible to issue dividends to the founder of an LLC through a cash register? It is possible if we are talking about an LLC.

We recommend reading: How the queue for improving housing conditions in Moscow is moving

Such profits paid to owners are called dividends. When the decision on profit distribution is made, the question arises about the procedure for its payment. Is it possible to pay dividends to the founders through the cash register? Let us say right away that the answer to this question depends on the form of creation of the business company.

Capital income

Sometimes it is convenient for organizations to issue dividends through a cash register. What does the current legislation say about this? Convenience is convenience, but everything must be according to the law. Is this method of making payments to the founders allowed? We will answer these and other questions in the article.

However, this definition does not apply to restrictions on the expenditure of cash proceeds. The Directive does not say that by social payments we mean exactly those that are named as such in the order of Rosstat on filling out statistical reporting forms. Therefore, you have the right to understand this term more broadly, focusing on other regulations. Thus, the organization pays benefits for disability, pregnancy and childbirth, and childcare for children under one and a half years of age as part of compulsory social insurance. 2 tbsp. 8 of the Law of July 16, 1999 No. 165-FZ. From this we can conclude that they are of a social nature and you can issue them from cash proceeds.

Rules for receiving and spending cash from the cash register

The Central Bank has prescribed what needs cash can be spent on. There are a number of organizations that are allowed to operate without cash registers. But most companies still face “live” charges, even if they do not trade for cash. To begin with, a logical question arises: “Where does the cash at the till come from?” So here it is:

- revenue;

- funds from the current account;

- various returns (advances, loans).

It’s like there are rubles, but you can’t spend them wherever you want. There are several rules here. Income from these sources is spent only on salaries, benefits, purchasing goods, and returning money, for example, to dissatisfied customers.

What you can’t give out cash for from a cash register

Everything is very strict with revenue. When making payments with different LLCs, individual entrepreneurs, individual entrepreneurs according to:

- real estate lease agreements;

- operations with the Central Bank;

- issuance/repayment of loans.

All this is paid only from the current account. It is prohibited to take money from the proceeds for these purposes.

For example, you can rent a car by paying expenses from the proceeds. This is movable property. But in order to rent a room, you need funds from your current account, since inappropriate spending is punishable by law. Retained earnings, as you can see, are not included in this list.

Payment of wages through the cash register: terms and rules

Everything related to wages, terms and payment rules is documented at the enterprise - for example, this is an employment or collective agreement.

The deadlines are the same for all companies. Even if the employees themselves express a desire to receive their salary once a month or on other days, this cannot shift the deadlines. Therefore, the advance payment is issued before the 30th of the current month, and the payment is issued before the 15th of the next month.

If day X falls on a weekend, then the salary is issued on the previous day. In addition, the duration of payment of wages is strictly limited by the same Central Bank: wages can be kept in the cash register for 5 days, then the remainder is handed over to the bank.

If employees are paid in cash, it is the employer's responsibility to ensure there is money in the cash register on payday. The entire process of issuing a salary is taken into account by documentation, starting with the order of the boss and ending with entries in the cash book.

Dividends to employees in cash: only in LLCs and only not from cash proceeds

: It is better to pay dividends to legal entities by bank transfer, because any organization has a current account to which they can be transferred. And cash is issued only in extreme cases, for example, at the request of the recipient organization whose bank accounts are blocked.

Example. Calculation of the amount of cash that can be used to issue a loan

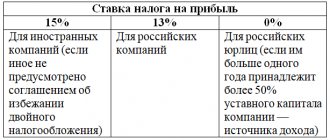

- Personal income tax for individuals - 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) for citizens of the Russian Federation and 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation) for foreigners;

- income tax for legal entities - 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation) for Russian companies and 15% (subclause 3, clause 3, article 284 of the Tax Code of the Russian Federation) for foreign legal entities.

Of course, you don’t have to read the company’s dividend policy, but simply wait for the dividend amount to be announced. However, understanding the financial results and dividend policy together allows us to predict the size of dividends in advance.

Recommended news

Once credited to a brokerage account, dividends lose their status. They are equal to free money in the account. Therefore, upon withdrawal, personal income tax is withheld, but not for dividends received, but for income from trading securities. According to the law, upon withdrawal, the broker is obliged to withhold personal income tax.

Expected events for June 3

“In accordance with the recommendations, it is proposed to pay dividends on ordinary registered shares of PJSC Magnit in the amount of RUB 15,000,332,342.45. (Fifteen billion three hundred thirty-two thousand three hundred forty-two rubles 45 kopecks), which is 147.19 rubles. (One hundred forty-seven rubles 19 kopecks) per one ordinary share.”

The control procedure itself is entrusted to commercial banks, which are entrusted with the functions of requesting additional information on transactions. Of course, the bank is not officially an inspection body, and the company may refuse to comply with its requirements. However, in such a situation, it will find itself without banking services and, therefore, will not be able to carry out its activities.

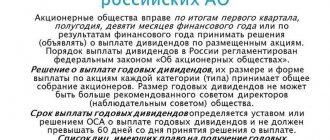

Dividends can be issued in cash or in kind, that is, other property. Moreover, dividends can only be paid to shareholders in cash. For LLC participants - both through the cash register and to a bank account. This procedure follows from Article 28 of the Law of February 8, 2021 No. 14-FZ and Article 42 of the Law of December 26, 1995 No. 208-FZ.

We recommend reading: Additional payment to pension after 80 years of age for a disabled person of group 3 in 2021 in Moscow

Is it possible to pay dividends in cash from the cash register?

Moreover, even if you have a small initial capital, you can still open your own business. Many people have opened a profitable business with little or no investment, so money is not the most important thing here, the main thing is desire and desire!

Every company reaches a stage in its development when it begins to pay dividends. By purchasing shares, an investor becomes a co-owner of the company in proportion to his share. You can make money both from price growth and from dividends.

The dividend currency can be found in the company’s message, as discussed above. Dividends on GDRs (global depositary receipts) are also paid in foreign currency. This is a security that gives the right to a share traded abroad.

Analysts' opinions. Yandex may buy 45% of Yandex.Market from Sberbank

Let's take the same example with Magnit's dividends, which amounted to 147.19 rubles. Let's say we opened a short position for 1 share before the dividend cutoff. After this date, 147.19 rubles were debited from you, but the final result will be different. Your earnings from a price fall is the size of the dividend gap - about 120 rubles. We closed the deal immediately after it occurred, and the final result was 120 - 147.19 = -27.19 rubles.

After the entry appears in the enterprise’s balance sheet, accounts payable arises as a liability to participants in the payment of dividends. Turnover in the debit of account 84 reduces net retained earnings, which is recorded in section 3 “Balance”. The source of payment of dividends is net profit, the economic meaning and legal nature of this operation is fully consistent with reality and does not contradict the law.

LLC paid dividends in cash from the cash register

*(2) The fact that the organization is a small business entity, and the return of amounts previously issued on account and the payment of the distributed part of the profit occur on the same day, in the situation under consideration is not significant.

8

Paragraph 4 of the Directive establishes another limitation, according to which cash payments in Russian currency for the transactions listed in this paragraph must be carried out using cash received at the cash desk of the participant in cash payments from his bank account. However, operations for the payment of part of the distributed profit to LLC participants are not mentioned in this paragraph, therefore such payments can be made using cash received to the cash desk not from a bank account, but, for example, from money returned to the cash desk that was previously issued on account *( 2).

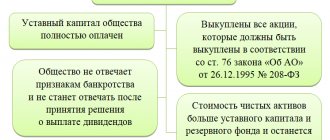

Net profit must be confirmed by the company's financial statements. Accordingly, if you want to distribute profits more than once a year, you need to prepare interim financial statements before each payment.

In the case of payments to a single founder (as well as for a situation with several founders), insurance premiums are not paid, since they are not considered as wages. At the same time, the procedure itself is much simpler, since the sole founder can independently make the appropriate decision on distribution and then make the payment. He will receive net profit in full (minus taxes), since his share in the authorized capital is 100%.

The procedure for paying dividends to founders of an LLC in 2021

But when paying from the cash register, one condition should be taken into account. The income of participants is not included in the list of transactions that the company has the right to pay from cash proceeds received for goods sold (clause 2 of Bank of Russia Directive No. 1843-U dated June 20, 2007). Similar rules are enshrined in the new Directive No. 3073-U dated 10/07/13, which will soon come into force. Therefore, to pay dividends from the cash register, you first need to receive the required amount by check from the current account and only then give it to the founder.

The deadline for issuance is either contained in the charter or established by the meeting. But it cannot go beyond the period of 60 days from the date of the meeting that made the decision on payments (clause 3 of Article 28 of Law No. 14-FZ). If the period is not fixed anywhere, then it is considered to be 60 days.

The LLC has the opportunity to choose the frequency of dividend payments to the founders: quarterly, half-yearly or annually - depending on the amount of net profit for each of these periods. Considering that profit is considered an accrual total for the year, its final amount will be known at the end of the tax period, and only then will it be possible to establish the final amount of income possible for payment. Therefore, in order to avoid situations where dividends paid during the year exceed the permissible amount for the year, it is better to distribute them at the end of the year based on the results of the approved annual accounting reports.

Source of LLC dividends

EXAMPLE from ConsultantPlus: LLC decided to distribute profits in the amount of RUB 2,500,000. to the following members of the company: - an individual who is a resident of the Russian Federation - in the amount of 500,000 rubles; - Russian organization - in the amount of 2,000,000 rubles. Another organization in which the LLC participates accrued dividends in the amount of 1,000,000 rubles. Profit tax was withheld from them at the source of payment in the amount of RUB 130,000. The amount of dividends received by the LLC amounted to RUB 870,000. (RUB 1,000,000 - RUB 130,000). The LLC did not receive any other dividends in the reporting year. Previously received dividends were taken into account when determining the amounts of tax to be withheld from the income of participants in previous periods. Personal income tax on dividends of an individual was calculated as follows. Read the continuation of the example after receiving trial demo access to the K+ system. It's free.

Is it possible to pay dividends in cash from the cash register? Joint stock companies do not have the right to issue dividends from the cash register. They are required to transfer them to the recipients' bank accounts (if there is a corresponding application) or send them by postal transfer (clause 8 of Article 42 of Law No. 208-FZ). The document came into force on June 1, 2014. There is no such rule in relation to limited liability companies. Therefore, they need to follow the general rules for cash transactions. They are established in the Instruction “On making cash payments”, approved by the Bank of Russia dated October 7, 2013 No. 3073-U. According to paragraphs 2 and 4 of the Instructions, companies cannot use received cash proceeds to pay dividends. Cash proceeds do not include: - withdrawn from the settlement accounts cash; - unused imprest amounts returned by employees and loans received; - shortages reimbursed by employees, etc. Therefore, these cash funds can be used to pay dividends, it is written that funds withdrawn from the current account are not cash. So you can or Is there no way to issue dividends to the LLC in cash, withdrawn to the cash register from the current account?

You may be interested in:: Grachev, a WWII participant, receives an old-age insurance pension; what legal relations regarding social security is he subject to?

The owners of the company can be either one person or several participants. In the first case, the need to distribute dividends does not arise. However, if there are several founders, then it is necessary to determine the procedure for distributing dividends.

Accounting for dividends: postings, examples, accrual

In accordance with clause 3.4 of Resolution No. 637, cash is issued from the enterprise's cash desk using cash receipts (standard form No. KO-2, Appendix 3 to Regulation No. 637) or expense statements. Documents for cash disbursement must be signed by the manager and the chief accountant or an employee of the enterprise authorized by the manager. The issuance of cash to persons who are not on the staffing table of the enterprise is carried out according to cash receipts, which are issued separately for each person, or according to a separate expense sheet drawn up for each participant - recipient of dividends. For the payment of dividends to several participants - employees of the enterprise, one expense sheet can be drawn up. Recipients of cash provide passports or documents replacing them and sign in the appropriate column of the document. The authorized person (cashier), after paying on the statement of funds against the names of employees to whom dividends have not been paid, makes an o, and at the end of the statement indicates the actual amount paid and the unpaid amount of dividends. Settlements may be attached to cash receipts. The expenditure order should indicate the passport details of the recipient, information about the period for which dividends are paid, as well as details of the order for the payment of dividends. Cash disbursement must be confirmed by the recipient's signature.

Of course, the corresponding restrictions established by acts of the Bank of Russia must be taken into account. Paragraph 2 of the Central Bank Directive dated October 7, 2013 N 3073-U (hereinafter referred to as the Directive) establishes an exhaustive list of purposes for which cash in the currency of the Russian Federation received by the cash desks of legal entities (individual entrepreneurs) for goods sold by them, work performed by them and (or) services provided by them, as well as received as insurance premiums. Payment of the distributed portion of profits (“dividends”) to LLC participants is not included in this list. Therefore, making such payments from cash proceeds received for goods sold (work performed and (or) services provided) is a violation of Directive *(1). However, it is obvious that money previously issued on account, not spent and returned to the cash desk cannot be considered as received by the cash desk for goods sold, work performed or services provided. Consequently, the above restrictions established by clause 2 of the Directions do not apply to the expenditure of such funds.

The first method is the simplest and most understandable, however, if the corporate procedures established by the charter of the LLC are followed, questions from the regulatory authorities will not arise if such a procedure is carried out no more than once every three months.

Payment of dividends in cash through the cash register

- the company provides employees with wages, temporary disability benefits and other similar payments;

- the company carries out settlements with citizens;

- the company issues cash to its employee going on a business trip or based on an advance report.

- Law No. 208 of 1995 and No. 14 of 1998 say that the decision on the payment of dividends is made by the general meeting. For this purpose, an appropriate protocol must be prepared and signed;

- Law No. 14 of 1998 determines that profits can be distributed every 3, 6 or 12 months;

- The Russian Tax Code establishes the obligation of LLCs to independently calculate the amount of taxes for transferring them to the budget;

- the deadline for paying taxes is regulated by letters from the Ministry of Finance;

- The law allows dividends to be paid with property if there are no funds in the company’s accounts - this method is not profitable, since it involves paying additional taxes, such as personal income tax and VAT.

Thus, the list of payments to which cash proceeds can be allocated is limited and the payment of dividends to shareholders (participants) is not included. Tax authorities, when checking compliance with cash discipline, can hold the organization liable under Part 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation for failure to comply with the procedure for storing available funds, resulting in the expenditure of funds for purposes not permitted by Directive No. 1843-U.

Payment of dividends through the cash register

Enterprises have the right to keep cash received from the bank in the cash register for payment of dividends in excess of the established cash register limit for three working days, including the day the cash is received from the bank. If you received cash to pay dividends, but within the prescribed period (3 days) did not use it for the intended purposes (or to pay for other economic needs of the enterprise), then hurry to the bank! After all, as stated in the same paragraph 2.10 of Regulation No. 637, in this case, unused excess cash should be returned to the bank no later than the next business day of the bank.

You may be interested in:: Will Sberbank increase monthly payments to its former employees and pensioners?

Mandatory insurance contributions to the Social Security Fund and insurance contributions to Belgosstrakh are not accrued , regardless of whether their recipients are employees of the organization that accrued the dividends or not. This is due to the fact that this payment is made to participants (shareholders, owners of the unitary enterprise) not on the basis of an employment contract or a civil contract for the provision of services, performance of work and creation of intellectual property.

Net assets

— In section 3 of the balance sheet “Capital and reserves”, profit appears in the line “retained earnings” or “uncovered loss”. The balance sheet shows all profits as of a specific accounting date. This line takes into account the amount of net profit not only for the last reporting period, but also for previous years, if it remained and was not distributed at the time.

Kontur.Accounting - cloud accounting for business!

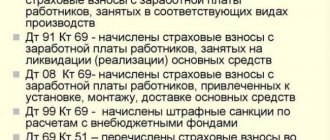

— Another option for paying dividends is payment at the expense of the enterprise’s property . If the general meeting decided to pay dividends by transferring fixed assets or materials to shareholders, then the disposal of these assets should be reflected through 91 accounts. We reflect these operations like this:

*(1) Please note that there are no formal grounds for bringing to responsibility for such a violation (Question: The tax authority held the organization liable under Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation for repaying a loan to an individual at the expense of cash proceeds, seeing in this a failure to comply with the procedure storage of cash in the cash register. Are the actions of the tax authority legal? (response from the GARANT Legal Consulting Service, September 2021)).