Starting with reporting for the first quarter of 2015, form 4-FSS must be filled out according to the new rules. In this article we will look at the main changes in the reporting procedure.

So, the new form 4-FSS was approved by order of the FSS of Russia dated February 26, 2015 No. 59 and, as before, combines reporting:

- for contributions to compulsory social insurance in case of temporary disability and in connection with maternity - Section I. The procedure for calculating, paying and reporting on this type of contributions is established by Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212- Federal Law);

- for contributions to compulsory social insurance against accidents at work and occupational diseases - Section II. The procedure for accrual, payment and reporting for this type of contributions is established by Federal Law No. 125-FZ of July 24, 1998 (hereinafter referred to as Law No. 125-FZ).

Let us recall that the previous form of calculation was approved by order of the Ministry of Labor of Russia dated March 19, 2013 No. 107n.

Note that most of the changes affected Section I of form 4-FSS.

Due dates

Calculations in Form 4-FSS must be submitted quarterly, based on the results of each reporting period.

There are four such periods: the first quarter, half a year, nine months and a year (Article 10 of Law No. 212-FZ, paragraph 1 of Article 24 of Law No. 125-FZ). From January 1, 2015, new deadlines for submitting calculations in Form 4-FSS have been established. So, the calculation must be submitted:

- on paper – no later than the 20th day of the month following the reporting period;

- in electronic form - no later than the 25th day of the month following the reporting period.

Grounds: clause 2, part 9, art.

15 of Law No. 212-FZ and paragraph 1 of Art. 24 of Law No. 125-FZ. If the last day on which you need to submit a calculation falls on a weekend, then you need to report on the first working day (Part 7, Article 4 of Law No. 212-FZ).

Thus, in 2015, payments in form 4-FSS must be submitted within the following deadlines:

| Reporting period | On paper | Electronic |

| I quarter 2015 | no later than April 20 | no later than April 27 (April 25 and 26 are days off) |

| half year 2015 | no later than July 20 | no later than July 27 (July 25 and 26 are days off) |

| nine months of 2015 | no later than October 20 | no later than October 26 (October 25 is a day off) |

| 2015 | no later than January 20, 2021 | no later than January 25, 2021 |

Review of changes and their reasons

As for form 4-FSS, approved by Order No. 59, in general it repeats its predecessor - the form approved by Order No. 107n[2], which is currently in force[3].

Amendments to form 4-FSS are dictated by changes in legislation over the past few years. Let's consider how certain changes in legislation affected the new form of this calculation. The reporting deadline has been changed. Federal Law No. 406-FZ[4] changed the deadlines for submitting reports to the Social Insurance Fund. From 01/01/2015, Form 4-FSS on paper is submitted no later than the 20th day of the calendar month following the reporting period, and in the form of an electronic document - no later than the 25th day of the calendar month following the reporting period. This change is reflected on the title page of the report.

The list of persons subject to compulsory social insurance in case of temporary disability and in connection with maternity has been expanded. Thanks to the amendments introduced by Federal Law No. 407-FZ[5], foreign citizens and stateless persons temporarily staying in the Russian Federation are subject to compulsory social insurance in case of temporary disability and in connection with maternity (with the exception of highly qualified specialists in accordance with the Federal Law of July 25 .2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation” (hereinafter referred to as Federal Law No. 115-FZ)). In this regard, changes were made to tables 2 and 3 of the calculation and table 3.1 was added to it.

From 01/01/2015, reduced rates of insurance premiums do not apply to payers named in clauses 1 - 3, part 1, art. 58 of Federal Law No. 212-FZ. In this regard, the corresponding tables and codes used to determine the policyholder code are excluded from the calculation form.

Procedure for filling out the calculation

The new rules for filling out form 4-FSS are prescribed in the Procedure approved by Order of the FSS of Russia dated February 26, 2015 No. 59 (hereinafter referred to as the Procedure).

Mandatory for submission by all payers of insurance premiums (policyholders) are: title page, table 1, table 3, table 6, table 7, table 10.

Filled out and submitted only if the appropriate indicators are available : table 2, table 3.1, table 4, table 4.1, table 4.2, table 4.3, table 5, table 8, table 9.

“Taxpayer” for reporting 4-FSS

PC “Taxpayer PRO” and the online service online.nalogypro.ru were created to assist in maintaining financial accounting of an organization. The system allows you to compile a 4-FSS report for 2021, based on current instructions and valid document forms.

After filling out the form, the accountant will be able to check the file and submit it online. Using the program allows you to speed up work with reporting documentation, automate the accounting process and minimize errors. The service is regularly updated and informs the user about all the latest changes in the law.

Title page

Changes in the order of filling out the title page affected two fields:

- Registration number of the policyholder;

- Code of the payer of insurance premiums (policyholder).

In the “Insured Registration Number” field, you no longer need to specify an additional code for a separate division of the company.

Previously, for such departments, an additional code was indicated in this field. In the field “Code of the insurance premium payer (policyholder)” in the first three cells, as before, the code defined in Appendix No. 1 to the Procedure is indicated.

In 2015, two new ciphers appeared:

- 181 — for participants of the free economic zone in Crimea;

- 191 - for residents of territories of rapid socio-economic development.

The next two cells of the field “Code of the payer of insurance premiums (policyholder)” are filled in only by certain categories of policyholders (in accordance with Appendix No. 2 to the Procedure).

The last two cells of this field are filled in by government and budgetary institutions (in accordance with Appendix No. 3 to the Procedure). This is provided for in clause 5.13 of the Procedure.

Main design nuances

Detailed rules and secrets for filling out the new Form 4 of the FSS are also provided for by the Order of this service. Let's look at the main points.

In addition to the mandatory completion of the title page, you will need to enter data in tables 1 and 3 related to section I, as well as tables 6,7 10 from section II. If there is no data relating to the reporting period for the remaining tables, there is no need to fill them out.

Each page of the new form includes the policyholder's registration number at the top. It is provided to the enterprise in the relevant notice at the time of registration for the service. If the organization has separate divisions, you will also need to reflect their numbers.

The code of the corresponding regional insurance service organization is entered in the “Subordination Code” cell and consists of several characters, 4 of which indicate the FSS body itself, and the fifth refers to the policyholder. The procedure for filling out tables with monetary meters involves filling out fields indicating rubles and kopecks, which is provided even by the report form itself.

Section I Table 2

This table, as before, contains information about social benefits and payments accrued to employees from the funds of the Federal Social Insurance Fund of Russia (sickness benefits, child benefits, etc.).

New rows have now been added to Table 2 to reflect:

- temporary disability benefits for working foreign citizens and stateless persons temporarily staying in Russia (line 3);

- insurance premiums accrued to pay for additional days off to care for disabled children (line 13);

- accrued but unpaid benefits (line 16).

Let's look at each of them in more detail.

Line 3: sick leave benefits for temporary foreigners

So, line 3 of Table 2 now serves to reflect sick leave benefits for temporarily staying foreign employees (with the exception of citizens of the EAEU - Armenia, Belarus and Kazakhstan).

The fact is that from January 1, 2015, Russian employers are required to pay temporary disability benefits to such employees. But only if the following condition is met: the policyholder paid contributions for them to the Social Insurance Fund of Russia for at least six months before the month when the insured event occurred (employee illness). This is established by Article 2 of the Federal Law of December 29. 2006 No. 255-FZ.

Line 13: insurance premiums for days spent caring for disabled children

From January 1, 2015, another new line 13 is provided in Table 2 - to reflect insurance premiums from the average earnings for days caring for disabled children.

Let us remind you that upon written application of a parent (guardian, trustee), he is granted four days off per month to care for disabled children. For these days, the company pays the employee the average salary (Article 262 of the Labor Code of the Russian Federation). Accordingly, this average earnings are subject to insurance premiums (letter from the Federal Social Insurance Fund of the Russian Federation dated November 17, 2011 No. 14-03-11/08-13985).

So, until January 1, 2015, only the average earnings for days of caring for disabled children were compensated from the funds of the Federal Social Insurance Fund of Russia (its amounts were indicated on line 10 of Table 2). But the company paid the insurance premiums accrued on it from its own funds (letter of the Federal Insurance Service of the Russian Federation dated August 15, 2011 No. 14-03-11/08-8158).

Now both the costs of paying average earnings and the costs of paying insurance premiums from it are reimbursed by the Federal Social Insurance Fund of Russia (from funds financed from the federal budget). This follows:

- from Part 17 of Article 37 of the Federal Law of July 24, 2009 No. 213-FZ (as amended in force from January 1, 2015);

- clause 3 of part 1 of article 7 of the Federal Law of December 1, 2014 No. 386-FZ.

Accordingly, the new Table 2 reflects:

- on line 12 – average earnings for days caring for disabled children;

- on line 13 - insurance premiums from this earnings.

New line 16

New line 16 of Table 2 reflects accrued but not paid benefits for reference. Previously, such a line was not provided in form 4-FSS.

Line 1: new features

Line 1 of Table 2, as before, reflects the amount of sick leave benefits for employees.

Let us recall that, as a general rule, the following have the right to temporary disability benefits:

- citizens of Russia;

- foreigners permanently or temporarily residing in Russia.

In addition, from this year, citizens of the republics of Belarus, Kazakhstan and Armenia (EAEU countries) who work in Russia under employment contracts are paid sick leave benefits according to Russian legislation.

That is, guided by the same rules as for Russian citizens. The fact is that citizens of these states have the right to social security on the same terms as citizens of Russia (Clause 3, Article 98 of the Treaty on the Eurasian Economic Union). And social security includes, among other things, insurance in case of temporary disability (paragraph 9, paragraph 5, article 96 of the Treaty on the Eurasian Economic Union). That is, employees from Belarus, Kazakhstan or Armenia working in Russia under employment contracts are insured persons regardless of status (permanent or temporary residents, temporary residents). Similar conclusions follow from the letter of the Ministry of Labor of Russia in letter dated December 5, 2014 No. 17-1/10/B-8313.

Thus, in line 1 indicate the amount of hospital benefits:

- Russian citizens;

- foreigners permanently or temporarily residing in the Russian Federation (including citizens of the EAEU);

- EAEU citizens temporarily staying in the Russian Federation.

Payment of benefits directly from social insurance: nuances of filling out form 4-FSS

Reform of the social insurance system began in 2011. The current procedure (payment of benefits first by the employer, and then offset of the paid amounts against insurance contributions to the fund or reimbursement of overexpenditures) officials proposed to replace the payment of benefits to insured persons directly from the funds of the territorial branches of the Social Insurance Fund.

The direct benefit project was launched in July 2011:

- the first signs were the Karachay-Cherkess Republic and the Nizhny Novgorod region;

- in 2012, they were joined by the Khabarovsk Territory, Astrakhan, Kurgan, Novgorod, Novosibirsk and Tambov regions;

- in 2015 - the Republic of Crimea and Tatarstan, the federal city of Sevastopol, Belgorod, Rostov and Samara regions;

- in the summer of 2021, the Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions should join.

The full transition to direct payment of benefits is scheduled for 2017.

What will change with the introduction of the new system for employers and employees:

- This will simplify the work of policyholders, since the fund itself will calculate the amount of payment based on data on earnings and length of service. This data will continue to be provided by the policyholder. Disputes with the Social Insurance Fund about the legality of calculating benefits and their amounts will become a thing of the past.

- For employees, the new payment procedure means guaranteed correct transfer of sick leave and other benefits, as well as the choice of how to receive money - to a bank account or by postal transfer.

The mechanism for issuing a certificate of incapacity for work remains the same:

- the employee brings sick leave to work;

- the accounting department enters it into the electronic register within 5 days and transfers it to social insurance;

- the fund pays money to the insured person within 10 days from the date of receipt of the document.

In the future, a universal database of sick leave certificates throughout the country should help combat violations in the social insurance system, for example, the purchase of sick leave.

Already now, the above regions fill out form 4-FSS according to special rules - in accordance with Decree of the Government of the Russian Federation dated April 21, 2011 No. 294 and Order of the Federal Social Insurance Fund of the Russian Federation dated June 23, 2015 No. 267. Such insurers bear the cost of paying only for the first 3 days of the employee’s illness. They do not fill out Tables 2 and 5 of Section I of Form 4-FSS Table 8 of Section II and line 15 of Table 1 of Section I also remain empty.

Section I Table 3

In Table 3, as before, the base for calculating insurance premiums is calculated. In this case they indicate:

- the total amount of payments and other benefits to employees for the reporting period, both taxable and non-taxable with insurance contributions (line 1);

- amounts of payments not subject to insurance premiums (line 2). A complete list of such amounts is given in Article 9 of Law No. 212-FZ;

- amounts exceeding the maximum base for calculating insurance premiums (line 3);

- the actual base for calculating insurance premiums (line 4, defined as the difference between the indicator in line 1 and lines 2 and 3)

This table has undergone the following changes.

Firstly, in lines 1 and 2 it is now necessary to reflect payments accrued not only in accordance with Federal Law No. 212-FZ of July 24, 2009, but also based on the provisions of international treaties (clause 10.1, clause 10.2 of the Procedure) . In the previous form, similar lines were used to reflect payments accrued only under Russian law.

Secondly, new rows have been added to Table 3 to reflect payments:

- produced by pharmacy organizations and entrepreneurs (line 5);

- in favor of foreigners temporarily staying in Russia (line 8).

Previously, similar lines were not provided.

Thirdly, from January 1, 2015, the very composition of payments subject to and non-taxable with insurance premiums, as well as the maximum value of the base subject to insurance premiums, changed.

Let's look at this in more detail.

Line 2: non-taxable payments

Let us recall that in some cases, upon dismissal, the organization is obliged to pay the employee severance pay, average monthly earnings for the period of employment and (or) compensation. So, for example, upon termination of an employment contract due to the liquidation of an organization or a reduction in the number or staff, the dismissed person is entitled to a severance pay in the amount of average monthly earnings, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (from including severance pay). Such rules are established by Art. 178 Labor Code of the Russian Federation. The director, his deputy and the chief accountant of the organization are entitled to compensation if their employment contracts are terminated, in particular due to a change of owner. Its size should not be lower than three times the average monthly earnings (Article 181 of the Labor Code of the Russian Federation).

So, the amount of severance pay and average monthly earnings is now not subject to insurance contributions if a number of requirements are met. Namely, provided that it does not exceed:

- six times the average monthly salary - for the regions of the Far North and equivalent areas;

- three times the average monthly salary for other regions.

Insurance premiums must be calculated on the excess amount on a general basis.

The situation is similar with compensation for managers (deputy managers, chief accountants). They are not subject to insurance premiums provided that they do not exceed three times the average monthly earnings. Insurance premiums must be charged on payments exceeding this limit.

Such changes were made sub. "a" clause 3 of Art. 2 and sub. “a” clause 1 art. 5 of Law No. 188-FZ (in paragraph “e”, subparagraph 2, clause 1, article 9 of Law No. 212-FZ and paragraph 6, subclause 2, clause 1, article 20.2 of Law No. 125-FZ, as amended).

This means that now line 2 of Table 3 (non-taxable payments) will include payments upon dismissal only within the specified standards. And the excess amounts will not be reflected in this line.

Before January 1, 2015, there were no such restrictions: the amounts of severance pay, average monthly earnings and compensation upon dismissal were not subject to insurance contributions in full. And, therefore, in full they fell into line 2 of Table 3.

Payments to temporarily staying foreigners in 2015 are subject to contributions to the Russian Social Insurance Fund in the following order.

At a reduced rate, contributions are charged for payments to temporarily staying foreigners (except for temporarily staying highly qualified specialists and citizens of the EAEU).

Insurance premiums from payments to temporarily staying citizens of countries that are members of the EAEU are calculated at the general rate and according to the same rules as from the income of Russian citizens.

There is no need to pay insurance premiums on payments to foreigners who are temporarily staying in Russia and are highly qualified specialists - they are not recognized as insured persons under any type of compulsory insurance. The exception is citizens of the republics of Belarus, Kazakhstan, and Armenia.

Grounds - clause 15, part 1, art. 9, art. 58.2 of Law No. 212-FZ, sub. 1 and 2 tbsp. 2 of the Federal Law of December 29. 2006 No. 255-FZ.

This means that line 2 of Table 3 (as part of non-taxable amounts) will now only include payments to temporarily staying foreign highly qualified specialists (except for EAEU citizens), and not to all temporarily staying foreigners, as before.

In addition, as already noted, the income of temporarily staying foreigners (except for EAEU citizens) must be separately reflected in line 8 of Table 3.

Line 3: Limit value of the base for calculating insurance premiums

Line 3 reflects amounts exceeding the maximum base for calculating insurance premiums. In 2015, the maximum taxable base in the Russian Social Insurance Fund is 670,000 rubles. (Resolution of the Government of the Russian Federation dated December 4, 2014 No. 1316).

It is worth noting that such a limit is established only for contributions to the Russian Social Insurance Fund. The maximum size of the calculation base for contributions to the Pension Fund is different - it is 711,000 rubles. And for contributions to the Compulsory Medical Insurance Fund there is no maximum base established at all. Basis - Decree of the Government of the Russian Federation dated December 4, 2014 No. 1316.

Line 4: Taxable base

Line 4 indicates the base for calculating insurance premiums. It can be determined by subtracting lines 2 and 3 of this table from line 1.

By multiplying the taxable payments by the insurance premium rates, we obtain the amount of contributions, which, as before, must be reflected in Table 1.

The basic rates of contributions for compulsory social insurance in case of temporary disability and in connection with maternity in 2015 are as follows.

2,9 % — from payments:

- Russian citizens;

- foreigners who permanently or temporarily reside in Russia and are not highly qualified specialists;

- foreigners who permanently or temporarily reside in Russia and are highly qualified specialists;

- citizens of the republics of Belarus, Kazakhstan, Armenia, regardless of status.

1,8 % - from payments to foreigners who are temporarily staying in Russia and are not highly qualified specialists (with the exception of citizens of the republics of Belarus, Kazakhstan, Armenia).

Filling out 4-FSS for 2015

“Prepare the sleigh in the summer, and the cart in the winter” - this proverb is ideal for those who do not want to urgently fill out reports to the Social Insurance Fund during the New Year holidays or immediately after them, because the completed reports must be submitted by January 20, 2021 year, if we are talking about paper, and until January 25, 2021, if we are talking about filing reports electronically.

The first thing you need to remember is the deadline for submitting reports and that since 2015, reports must be submitted electronically if the company or entrepreneur employs more than 25 people.

For late submission or failure to submit reports in the prescribed form, the law provides for penalties:

- fine for failure to submit calculations for accrued and paid insurance premiums - not less than 1000 rubles;

- fine for failure to comply with the procedure for submitting calculations for accrued and paid insurance premiums in electronic form – 200 rubles.

The 4-FSS report form was approved by Order No. 59 of the Federal Insurance Service of the Russian Federation dated February 26, 2015. When filling out each page, it is important to remember that at the top of each page of the Calculation the “Insured Registration Number” and “Subordination Code” are indicated in accordance with the document issued upon registration with the territorial body Social Insurance Fund: the first ten cells are the registration number of the policyholder, the next ten cells are the code of a separate division of the organization. The subordination code indicates the territorial body of the Fund in which the policyholder is registered.

GOOD TO KNOW

The “Number of employees” field in the 4-FSS calculation reflects the number of women on maternity leave and employees on parental leave until the child reaches the age of one and a half years, as of the reporting date.

Section 1

It is more rational to start filling out section 1 “Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred” by filling out table 3 “Calculation of the base for calculating insurance contributions.”

Line 1 of Table 3 contains the amounts of payments and other remunerations accrued in favor of individuals in accordance with Art. 7 of Federal Law No. 212-FZ of July 24, 2009, but line 2 includes amounts that are not subject to insurance premiums on the basis of Art. 9 of Law No. 212-FZ.

IMPORTANT IN WORK

The calculation according to Form 4-FSS must necessarily contain the following sections: title page, table 1, table 3, table 6, table 7, table 10. All other sections of the calculation are filled out as necessary.

Section 1 Table 1

After this, you can fill out Table 1 “Calculations for compulsory social insurance in case of temporary disability and in connection with maternity.”

In line 1 “Debt owed by the policyholder at the beginning of the billing period,” we show the policyholder’s debt for settlements with the Federal Social Insurance Fund of the Russian Federation at the beginning of the billing period:

Page 1 = page 19 Calculations for the previous billing period (previous year).

Line 2 shows the amount of accrued insurance premiums. Let's start by filling out the table to the left of the line: we sequentially calculate the amount of contributions for the last three months (1 month = group 4, page 1 of table 3 x insurance premium rate, etc.).

Then, with a cumulative total from the beginning of the year, fill in the following lines:

- line 3 – the amount of insurance premiums accrued to the policyholder by the territorial body of the Fund based on the results of on-site and desk audits;

- line 5 – amounts of expenses not accepted for offset for previous billing periods based on reports of on-site and desk inspections conducted by the territorial body of the Fund;

- line 6 – amounts of funds received from the territorial body of the Fund to the bank account of the policyholder for the payment of insurance coverage in excess of the insurance premiums accrued by them.

IMPORTANT IN WORK

According to line 16 of table 2 and line 11 of table 8, when filling out the calculation in form 4-FSS, the organization must show the amount of benefits that it accrued but did not pay, since the next day of payment of wages to employees has not yet arrived.

Table 2 section 1

In Table 2 “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses carried out in accordance with the legislation of the Russian Federation through interbudgetary transfers from the federal budget provided to the budget of the Social Insurance Fund of the Russian Federation” we enter data on expenses for the purposes compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period in accordance with current regulations.

The amounts of benefits and payments are reflected separately for each type with the obligatory indication:

- number of cases of provision of benefits (column 1, lines 1, 2, 4);

- number of recipients (column 1, lines 7, 8, 9);

- the number of days for which benefits were paid (column 3, lines 1, 2, 3, 4, 10);

- number of payments (column 3, lines 7, 8, 9);

- number of benefits (column 3, lines 5, 6, 11).

IMPORTANT IN WORK

If there are no indicators to fill out Table 2, Table 3.1, Table 4, Table 4.1, Table 4.2, Table 4.3, Table 5, Table 8, Table 9 of Form 4-FSS, these tables are not filled out and not submitted.

Tables 4.1–4.3 section 1

These tables are filled out only in special cases.

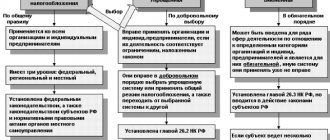

Table 4.1 is filled out by companies:

- “simplified” entrepreneurs;

- organizations combining simplified and patent taxation systems.

Table 4.2 – non-profit enterprises in simplified terms. The area of social services for citizens, development and research, education, healthcare and others.

Table 4.3 – entrepreneurs with a patent, except:

- lessors of real estate on the right of ownership;

- retailers selling through sales premises or points of sale;

- citizens providing catering services.

Table 5 section 1

In Table 5 “Decoding of payments made from funds financed from the federal budget,” payments are grouped by categories of recipients:

- in columns 3, 6, 9, 12, 15, 18 - indicate the number of recipients of benefits paid in amounts in excess of those established by the legislation of the Russian Federation on compulsory social insurance, financed from the federal budget;

- in columns 4, 7, 10, 13, 16 - indicate the number of days, the number of payments or the number of benefits paid in the billing period in amounts in excess of those established by the legislation of the Russian Federation on compulsory social insurance, financed from the federal budget;

- in columns 5, 8, 11, 14, 17, 20 – the amount of expenses for the payment of these benefits is reflected;

- columns 6–20 reflect the number of recipients, expenses, number of days, number of payments or number of benefits.

Please note: since 2015, it is necessary to enter data into the form regarding those foreigners who are temporarily staying in Russia. For example, a simplified worker needs seasonal workers; in this case, it is necessary to pay contributions for such workers at a rate of 1.8% and pay them sick leave. Information about such employees must be reflected in table 3.1 “Information about foreign citizens and stateless persons temporarily staying in the Russian Federation.” Exceptions are citizens of the republics of Belarus, Kazakhstan and Armenia, as well as highly qualified specialists.

GOOD TO KNOW

The amounts of benefits paid by employers to foreign employees from EAEU member states temporarily staying in the Russian Federation must be reflected in lines 1 and 2 of Table 2 of the calculation in Form 4-FSS, and the amount of benefits paid to foreign citizens and stateless persons temporarily staying in the Russian Federation , it is necessary to show on lines 3 and 4 of Table 2 of the calculation in Form 4-FSS.

Section 2

After this, you can fill out Section II “Calculation of accrued, paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases and expenses for payment of insurance coverage.”

In line 1 we show the amounts of payments to employees on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year, including for the last three months of the reporting period.

In line 2 - the amount of payments for the last 3 months of the reporting period, in lines 3–5 monthly.

Column 3 of Table 6 indicates the amount of payments for which insurance premiums are calculated for compulsory social insurance against accidents at work and occupational diseases in total, including in column 4 - the amount of payments in favor of working disabled people.

In special cases, Table 7 “Calculations for compulsory social insurance against industrial accidents and occupational diseases” is also filled out.

This table reflects the debt to the Social Insurance Fund as of January 1 of the current reporting year, accrued contributions for the quarter, and a breakdown of funds.

GOOD TO KNOW

In Table 7 of the Calculation there is a field “Contributions accrued based on the results of inspections” (line code 3), that is, it does not specify what inspections we are talking about. However, before the latest changes in clause 26.3 of the Procedure, it was determined that this field reflects the amount of contributions accrued by the territorial body of the Social Insurance Fund based on acts of on-site inspections only. Although, even during a desk audit, additional insurance premiums may be charged. Currently, this is taken into account in the specified norm.

Tables 8–9 show injury contributions.

These tables are filled out by the organization when hospital benefits are paid for injuries at work and occupational diseases. The full list is indicated in paragraph 1 of Art. 8 of Law No. 125-FZ. You should also pay attention to filling out Table 10 “Information on the results of a special assessment of working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year,” which reflects information on the results of a special assessment of workplaces. A special assessment of working conditions is mandatory for all employers.

Main changes in reporting

The latest changes were made in the summer of 2015. Thus, in the order of filling out, there is now no requirement to affix a stamp in the 4-FSS calculation - on the title page and when making corrections. Since not all organizations today are required to have it, the stamp is placed on the form only if it is available. But in order not to affix a stamp, it is necessary to make changes to the charter. Therefore, if you have a stamp, it is better not to be lazy and affix it.

But at the same time, the territorial bodies of the Fund do not have the right to require from payers of insurance premiums created in the form of LLC and JSC, affixing a stamp in the calculation of insurance premiums, certifying with a seal corrections in the calculation of insurance premiums, as well as affixing a stamp on applications for offset (refund) in excess paid (collected) amounts of insurance premiums, penalties and fines (letter from the Fund dated 06/10/2015 with explanations regarding the mandatory affixing of a stamp by policyholders).

With regard to civil law contracts, it should be noted that such contracts are not labor contracts, and therefore, the number of persons working under civil law contracts does not affect the total number, in this regard, the number of women indicated on the title page is now defined as the number of women insured rather than employed.

The changes also apply to participants in the “pilot project” in relation to payments from the Social Insurance Fund. Thus, in relation to the “pilot project”, the companies that joined it have specifics regarding disability payments; payments are made to employees directly from the Social Insurance Fund. Not all, but only certain regions can join such a project: the Karachay-Cherkess Republic, Astrakhan, Kurgan, Nizhny Novgorod, Novgorod, Novosibirsk, Tambov regions, Khabarovsk Territory, Republic of Crimea, Sevastopol, Belgorod, Rostov, Samara regions and the Republic of Tatarstan . For those who took advantage of the project, there are specifics for filling out Form 4-FSS.

In tables 1, 7 you do not need to fill out line 15.

Therefore, it is important to take into account a number of recent changes when filling out the form.

GOOD TO KNOW

Companies that have received permission to finance preventive measures submit, simultaneously with Form 4-FSS, a report on the use of insurance premiums in case of injury.

Section I Table 3.1

This is now an updated table.

It is called “Information about foreign citizens and stateless persons temporarily staying in the Russian Federation.” It is filled out by policyholders who accrue payments under employment contracts with foreign citizens and stateless persons temporarily staying in the Russian Federation. Data on highly qualified specialists and citizens of EAEU member states are not indicated in this table.

Columns 3 - 5 of the table reflect the information corresponding to each foreign citizen or stateless person: full name, INN, SNILS, citizenship (if available).

Reason – clause 11 of the Procedure.

Due to the fact that previously contributions to the Russian Social Insurance Fund were not accrued from payments to temporarily staying foreigners, there was no corresponding information in the reporting. And Table 3.1 indicated information about disabled people working in the organization.

Temporary foreign workers: reflection of contributions and benefits

From January 1, 2015, temporarily staying foreigners are considered insured under compulsory social insurance in case of temporary disability and in connection with maternity. And they have the right to apply for temporary disability benefits, provided that the employer paid insurance premiums for them for at least 6 months preceding the month in which the insured event occurred (see “From 2015, it will be necessary to pay contributions to the Social Insurance Fund for foreigners and temporarily workers staying in Russia"). The rate of insurance contributions to the Social Insurance Fund for payments to temporarily staying is 1.8% (Part 3 of Article 58.2 of Law No. 212-FZ). These innovations are reflected in the 4-FSS calculation form.

Table 2: reflection of benefits

Benefits paid to temporarily staying foreigners will need to be shown in line 3 of Table 2. However, keep in mind that there will be nothing to show for the first quarter of 2015, since in order to receive benefits, we repeat, contributions must be paid for at least 6 months. Therefore, even if we assume that a temporarily arrived foreigner has been working since January 1, 2015, he will be able to receive benefits no earlier than July 2015.

Do I need to submit empty 4-FSS tables?

- the title page, tables 1 3, 6, 7, and 10 are mandatory for submission by all policyholders;

- if there are no indicators for filling out tables 2, 3.1, 4, 4.1, 4.2, 4.3, 5, 8, 9, these tables are not filled out and not submitted (clause 2 of the procedure for filling out 4-FSS).

Table 3: calculation of the base for calculating contributions

Line 8 of Table 3 will now need to show payments to temporarily staying foreigners. At the same time, we note that in the title of this line a reservation is made that payments in favor of temporarily staying foreigners from Belarus, Kazakhstan and Armenia are not included in line 8. Therefore, they will need to be shown not in this row, but in row 1 of the table (that is, together with Russian employees). For more details, see “Workers from Belarus, Kazakhstan and Armenia: how to calculate insurance premiums, benefits and personal income tax for them in 2015.”

Table 3.1: information about foreign workers

Table 3.1 appeared in the calculation, into which data on temporarily staying foreigners should be entered: full name, tax identification number, SNILS and citizenship. Moreover, this table must be filled out without reference to the payment of benefits to them. That is, if in the first quarter of 2015 the organization has such employees, then the table needs to be filled out. However, workers from Belarus, Kazakhstan and Armenia do not need to be included in the table. This is directly stated in paragraph 11 of the procedure for filling out 4-FSS.

Section I Tables 4–4.3

They are filled out by policyholders who have the right to apply reduced rates of insurance premiums established by parts 3 and 3.4 of Art. 58 of Law No. 212-FZ. Namely:

- organizations operating in the field of information technology;

- organizations and individual entrepreneurs using a simplified taxation system, as well as combining the simplified tax system and UTII or the simplified tax system and the patent taxation system

- NPOs that apply a simplified system and carry out activities in the field of social services, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and mass sports (with the exception of professional);

- individual entrepreneurs on the patent taxation system.

Previously, the relevant information was reflected in tables 4.2 – 4.5.

Section II Table 7

In the section you need to show the calculation base, tariffs and the status of mutual settlements with the Federal Social Insurance Fund of Russia for contributions for insurance against industrial accidents and occupational diseases.

Table 7 is called “Calculations for compulsory social insurance against accidents at work and occupational diseases” and, as before, reflects the status of settlements with the Federal Social Insurance Fund of Russia for the corresponding contributions.

The Fund's debt to the company at the end (line 9) and beginning (line 12) of the reporting period must now be indicated with a breakdown, depending on how it was formed:

- due to excess costs (lines 10 and 13);

- due to overpayment of insurance premiums (lines 11 and 14).

In the old form, such a breakdown was not provided.

Procedure for collecting insurance premiums

The insurance system for citizens in case of temporary disability is represented in our country by the Social Insurance Fund. Every employer with employees must pay contributions to the fund. If an entrepreneur or organization has at least 1 employee, the company is considered the citizen’s insurer in case of illness, injury, occupational disease or maternity leave.

What is the essence of the social insurance system? If an employee is sick, injured, or an employee becomes pregnant, then they cannot work during illness or maternity leave. The state has provided a procedure for financial support for such citizens, obliging employers to pay insurance contributions from employees’ wages. This money goes to the Social Insurance Fund and is then not only distributed among sick people, those injured at work and women on maternity leave, but also goes to finance measures to protect labor and ensure safety in the workplace.

The employer pays 2 social security contributions:

- In case of temporary disability and in connection with maternity. The contribution rate is set in the range from 0 to 2.9% of wages (depending on the company’s activities and available benefits).

- From industrial accidents and occupational diseases. The contribution amount is from 0.2 to 8.5%. It depends on the degree of injury in the main type of activity at the enterprise.

Important! Even if your company is on the list of beneficiaries and does not pay contributions in case of temporary disability (for example, a simplified individual entrepreneur producing food), then you, as an employee, still have the right to pay for sick leave and parental leave.

Contributions are transferred to the fund monthly from the wages of each employee and are included in the costs of the enterprise. Merchants using the simplified tax system “income minus expenses” can accept the amount of paid contributions as expenses, and on imputation and the simplified tax system “income” they can partially reduce the tax payable.

The employee has the right to count on average earnings during the period of incapacity, but the final amount of the benefit depends on his length of service.

Note! In some cases, other rules for paying average earnings apply. For example, if an employee’s illness or injury was the result of intoxication, then the amount of benefits is limited to the minimum wage, regardless of the guard.

Section II Table 8

Table 8 “Expenses for compulsory social insurance against industrial accidents and occupational diseases”, as before, must be filled out if during the reporting period the organization paid sick leave benefits in connection with industrial injuries and occupational diseases, financed measures to prevent injuries, and incurred other expenses for insurance against accidents and occupational diseases.

A complete list of such expenses is given in paragraph 1 of Art. 8 of Law No. 125-FZ. Now it has added an indicator reflecting the amount of accrued and unpaid benefits - reference line 11.

| Tables excluded from the new Form 4-FSS: |

| Table 3.1 “Information required for the application of a reduced rate of insurance premiums by insurance premium payers specified in paragraph 3 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” |

| Table 4 “Calculation of the compliance of conditions for the right to apply a reduced tariff of insurance premiums by payers of insurance premiums - public organizations of disabled people specified in paragraph 3 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” |

| Table 4.1 “Calculation of compliance of conditions for the right to apply a reduced tariff of insurance premiums by insurance premium payers specified in paragraph 3 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” |

Unpaid benefits

The employer is obliged to provide sickness, maternity and child care benefits within 10 calendar days from the date of the employee’s application. And the assigned benefits must be paid along with the next salary. This is the requirement of Article 15 of Federal Law dated December 29, 2006 No. 255-FZ. However, this is not always the case. It happens that the employer delays the payment of benefits (for various reasons). So, starting from the reporting for the first quarter of 2015, assigned but not paid benefits should be shown in the reporting, namely:

- in line 16 of Table 2 you need to reflect unpaid disability and maternity benefits;

- in line 11 of Table 8 you need to reflect unpaid benefits from accidents and occupational diseases.

It is obvious that the FSS will not reimburse these benefits to employers.

EXAMPLE

Planet LLC employs four employees under an employment contract:

- Smirnov S.D., citizen of the Russian Federation;

- Danilko A.R., citizen of the Republic of Belarus, temporarily resides in the Russian Federation, is not a highly qualified specialist;

- Atambaev S.S., citizen of Kyrgyzstan, temporarily resides in the Russian Federation, is not a highly qualified specialist;

- Khvostova A.V., citizen of the Russian Federation, has a disabled child.

In addition, V.V. Gromov, a citizen of the Russian Federation, is working under a civil contract.

In the first quarter of 2015, the following patients were ill:

- Smirnov S.D. – 15 calendar days in February;

- Atambaev S.S. – 10 calendar days in March.

The average daily earnings of S.D. Smirnov, on the basis of which sick leave benefits are calculated, is equal to the maximum value in 2015 and amounts to 1,632.88 rubles.

The amount of sick leave benefits for S.D. Smirnov amounted to 24,493.2 rubles (1,632.88 rubles X 15 days), including:

- 4898.64 rub. (RUB 1,632.88 X 3 days) – at the expense of the employer;

- RUB 19,594.56 (24,493.2 rubles – 4898.64 rubles) – at the expense of the Federal Social Insurance Fund of the Russian Federation.

Smirnov’s insurance experience is more than 8 years, so he is entitled to 100% of average earnings.

Foreigners temporarily staying in Russia are also entitled to hospital benefits. But only if the policyholder paid contributions for them to the Social Insurance Fund of Russia for at least six months before the month when the insured event occurred. This procedure is provided for in Article 2 of Law No. 255-FZ of December 29, 2006. Temporary disability benefits for temporarily staying foreigners (non-EAEU citizens) are paid provided that the policyholder has transferred contributions for them to the Social Insurance Fund of Russia for at least six months prior to that month when the insured event occurred (Article 2 of Law No. 255-FZ). Atambaev S.S. was hired by Planeta LLC in February 2015. This means that he is not yet entitled to sick leave benefits.

In March 2015, Khvostov A.V. two additional days off were provided to care for a disabled child. Khvostova’s average daily earnings, on the basis of which additional days off are paid, is 3,000 rubles. Thus, the employee was accrued and paid 6,000 rubles. (3000 rub. X 2 days). This amount was accrued:

- pension contributions – 1320 rubles. (6000 rub. X 22%);

- contributions for compulsory social insurance - 174 rubles. (6000 rub. X 2.9%);

- contributions for compulsory health insurance – 306 rubles. (RUB 6,000 X 5.1%);

- contributions for insurance against accidents and occupational diseases (the organization is assigned the 2nd class of professional risk, the contribution rate is 0.3%) - 18 rubles. (6000 rub. X 0.3%).

Total accrued contributions to pay for additional days off - 1818 rubles.

(1320 RUR + 174 RUR + 306 RUR + 18 RUR). The amount of all payments to employees (both under labor and civil contracts) for the first quarter of 2015 is shown in the table.

Table. Payments to employees of Planeta LLC for the first quarter of 2015

Employee's name | Smirnov S.D. | Gromov V.V. | Danilko A.R | Atambaev S.S. | Khvostova A.V. | Total |

Type of payment | ||||||

salary for January | 70,000 rub. | — | 30,000 rub. | 20,000 rub. | 50,000 rub. | 170,000 rub. |

GPA remuneration for January | — | 30,000 rub. | — | — | — | 30,000 rub. |

salary for February | 17,500 rub. | — | 30,000 rub. | 20,000 rub. | 50,000 rub. | RUB 117,500 |

GPA remuneration for February | — | 30,000 rub. | — | — | — | 30,000 rub. |

sick pay for February | 24,493.2 rub. | — | — | — | — | 24,493.2 rub. |

salary for March | 70,000 rub. | — | 30,000 rub. | 12,000 rub. | 45,000 rub. | 157,000 rub. |

GPA remuneration for March | — | 30,000 rub. | — | — | — | — |

payment for days off to care for a disabled child (March) |