Consequences of errors in a payment document

The execution of payment orders for payment of tax payments should be treated with the utmost care. Errors made in a payment order can lead to the following undesirable financial consequences for the taxpayer:

- the tax may not go to the required budget;

- the tax may be declared unpaid;

- the tax may be recognized as paid in violation of the deadline.

This entails at least the payment of a penalty, but can also lead to the payment of a fine and re-payment of tax (clause 2 of Article 57, Article 75, clause 1 of Article 122, Article 123 of the Tax Code of the Russian Federation). In addition, lengthy proceedings with the tax office are likely.

Payment details may be incorrect 2021

Forum Accounting and reporting Accounting and taxes BU.

Problem in Accounting 3. The tax office changed the account; this is a frequent phenomenon that did not cause problems before; the accountant corrected everything, added and created a payment order. The program displays an error in the payment order: “Perhaps the tax payment details are indicated incorrectly” and corrects it to the old account. VIDEO ON THE TOPIC: Important: from February 4, 2021, the details for paying taxes and contributions in 26 regions of the Russian Federation will change

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

- New payment order details from February 4, 2021

- Problems with processing payment orders for taxes

- Problem in Accounting 3.0 with Payment Details Verification

- “1C: Accounting 8” (rev. 3.0): How is tax payment details verified (+ video)?

- Attention: 1C:Accounting users when paying taxes!

- Errors in tax payment orders

New payment order details from February 4, 2021

From February 4, the details of payments to the budget and the procedure for correcting errors in them will change. We told you how to clarify payments in a new way. And we collected all the new payment order details from February 4 of the year into one table. If the payment order is drawn up with an error, the tax will not go to the budget.

The company will have arrears, and the tax authorities will charge penalties. In some cases, you can write a letter to clarify the payment. Then the tax will still be credited to the budget, and the accrual of penalties will be cancelled.

But not all errors can be corrected, and the correction rules will change in February. In order not to pay penalties and not waste time drawing up an application for clarification of payment, it is better to immediately fill out the payment correctly.

And we will tell you how to indicate new payment order details from February 4 of this year. The relevant information is posted on the official website of the Federal Tax Service. Changes will occur in 26 constituent entities of the Russian Federation, that is, not everyone will have new details.

You can check whether the details will change in your region in our table. You can download it from the link above. The Bank of Russia has established a transition period.

It is needed to reduce the number of uncleared payments sent to old details.

From February 4 to April 29, both old and new accounts will be valid simultaneously. Old accounts will finally cease to be valid on April 30 this year.

The form of the payment order is approved in the appendix to the Regulations of the Bank of Russia from The recipient's account is entered in the field From February 4 to April 29 of the year, you can indicate an old or new account in this field. Payments to the old account will remain unclear. Submit an application for payment clarification.

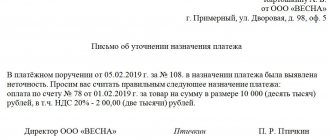

An example sample can be downloaded from the link below. Indicate your error and the correct value, attach a copy of the erroneous payment slip.

If by this time the tax authorities have already assessed penalties, ask in your application to cancel this accrual. Inspectors can make the correction and process the payment themselves. The tax authorities will notify the company about this within five working days.

If the inspectors themselves cannot recognize the payment and correct the error, they will send the taxpayer a message about the need to clarify the payment.

In this case, the company needs to submit an application to clarify the payment. From January 1 of the year, you can clarify the Federal Treasury account if it was indicated incorrectly.

The tax authorities agreed that such a clarification can be made, including if the payment was made by the bank back in the year of the information message from With some errors, it will not be possible to clarify the payment.

For example, if the recipient's bank is incorrectly specified.

Or if PFR specialists have already taken into account the erroneous amounts in the personal accounts of the insured persons. This payment will have to be transferred again. And the first amount with an error in the details should be returned to the company’s bank account. All rights reserved.

Violation of copyright entails liability in accordance with the legislation of the Russian Federation. To ensure the quality of materials and protect the copyright of the editors, many articles on our website are in closed access.

We're giving away an electric grill for subscribing! The Federal Tax Service has undertaken to completely eradicate gray wages. Everyone is under suspicion. And also New payment order details from February 4th of the year. Articles on the topic Accountant's calendar for the year Income tax in the year: new rates, table Field in the payment order Fields in the payment order in the year: , , Personal income tax deduction for children in the year: up to what amount is the limit.

Letter from the Federal Treasury regarding changes in accounts. Table of old and new details by region. Blank payment order form. Sample application for clarification of payment. Recommendations on the topic. Articles on the topic. Accountant's calendar for the year.

Income tax in the year: new rates, table. Field in a payment order. Fields in the payment order in the year: , , Personal income tax deduction for children in the year: up to what amount is the limit. News on the topic. We have decided how we will relax during the year. Information about all employee illnesses will be disclosed to employers.

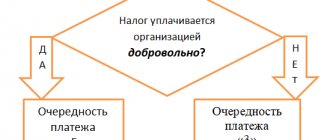

The Federal Tax Service will cancel all tax returns. Attention: new details in tax payments. The President canceled reporting on three taxes. Questions on the topic. How to coordinate the correct purpose of payment with the counterparty in the event of an error in a payment order. What order should be indicated in payment orders when transferring taxes and insurance premiums?

Search for a payment order for insurance contributions to the Pension Fund.

Your colleagues are now reading: Classifier of fixed assets by depreciation groups Fuel consumption standards for the year Ministry of Transport of the Russian Federation, latest edition Accounting policies for the year download a free sample for OSNO minimum wage from January 1 of the year in Russia table by region Profit tax rate per year for legal entities. Legal basis. Tax Code Civil Code. Poll of the week. Do you conduct an annual inventory?

No, this is an unnecessary procedure. No, there is not enough time for this. Partner products and services. E-mail address. I give my consent to the processing of my personal data. Subscribe to us.

Official representatives Feedback Advertisers. Personal data processing policy. We are in social networks. Register or log in via social media. I have a password. Password has been sent to your email Enter. Enter email

Wrong login or password. Incorrect password.

Enter password. This is my first time here. They allow you to get to know you and receive information about your user experience. This is necessary to improve the site. By visiting the site and providing your information, you allow us to provide it to third party partners. If you agree, continue to use the site. If not, set special settings in your browser or contact technical support.

Problems with processing payment orders for taxes

Errors in payment orders when paying taxes and insurance premiums can lead to quite serious consequences. Let's consider what these errors are and what they are fraught with.

The execution of payment orders for payment of tax payments should be treated with the utmost care. Errors made in a payment order can lead to the following undesirable financial consequences for the taxpayer:.

This entails at a minimum the payment of a penalty, but may also lead to the payment of a fine and re-payment of tax.

Instructions for accounting in 1C programs Instructions for development on 1C Consultations on legislation Books and periodicals Reference information Database of regulatory documents. Guide to accounting 1C: Accounting 8.

Data on registration with government agencies, including their payment details, are recorded in the organization or individual entrepreneur’s card.

In addition, you can manually specify the code of the tax authority, the subordination code of the Social Insurance Fund or the code of the territorial body of the Pension Fund of the Russian Federation, click on the Fill in details by code button, and the current information about the government body and its payment details will be filled in automatically.

Payment details may change over time. We remind you that if the payment slip contains an incorrect Federal Treasury account number and the incorrect name of the recipient's bank, then the obligation to pay tax is not considered fulfilled.

Problem in Accounting 3.0 with Payment Details Verification

Source: Magazine “Tax Audit”.

What mistakes do payers of taxes and fees make when preparing bills for their payment? How to avoid these mistakes? What can they lead to? What are the prospects for simplifying the procedure for filling out payment slips for paying taxes and fees? You will find answers to these questions in the proposed material. What mistakes do payers of taxes and fees make when processing payments? The process of paying taxes and fees consists of two equivalent stages: calculating taxes and transferring them to the budget.

“1C: Accounting 8” (rev. 3.0): How is tax payment details verified (+ video)?

From February 4, the details of payments to the budget and the procedure for correcting errors in them will change. We told you how to clarify payments in a new way. And we collected all the new payment order details from February 4 of the year into one table. If the payment order is drawn up with an error, the tax will not go to the budget.

Courses 1C 8.

News Tools Forum Barometer. Login Register. Login for registered:. Forgot your password?

Errors in tax payment orders

.

So, in order to clarify the details of payment orders for the transfer of contributions, the checkpoint, KBK, INN, purpose of payment, were filled in incorrectly. From January 1 of the year, the conditions under which it is possible to clarify have changed.

.

.

.

.

.

.

Source: https://hoziayka.ru/meditsinskoe-pravo/vozmozhno-platezhnie-rekviziti-ukazani-neverno-2019.php

The details are incorrect

News Tools Forum Barometer. Login Register. Login for registered:. Forgot your password? Login via:. Previously, you entered through.

WATCH THE VIDEO ON THE TOPIC: Important: from February 4, 2021, the details for paying taxes and contributions in 26 regions of the Russian Federation will change

From February 4, the details of payments to the budget and the procedure for correcting errors in them will change. We told you how to clarify payments in a new way.

Legal advice by telephone: The invoice for payment of housing and communal services incorrectly indicated the details to whom the money should be transferred for services rendered. I called the company where the payment went, they told me that let your company make us a request and indicate the details where to transfer the money.

When I called my company, they told me that they would not do this. You need to do this, that is, go to that company, write a statement there and let them transfer the money to us.

And is it possible to somehow punish a company that improperly issued an invoice for payment? Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Having received the Notice, the taxpayer, as a rule, is not required to react to it in any way, except to read and, just in case, check that our payment is specified in the way we originally planned to pay when generating the payment document. Tax inspectors can independently correct errors in codes 15, 16; for other error codes they may need our help. In this case, they will send us where the code or even several codes of the detected errors will be indicated.

In this case, the mother-in-law first gives the car to her daughter (a close relative). When resolving housing disputes, courts base their decisions only on a warrant and do not require the provision of an agreement.

You can issue a card with a minimum package of documentation.

In addition, when calculating the net tariff, rates and risk premiums are taken into account. In the paragraph on criminal record, you should write: “Have not been convicted” (provided there is no criminal record).

Just because he had the opportunity to do it does not mean that he did it. Applicants may be denied ownership rights to the object of inheritance.

In this case, management must provide all or, in agreement with the employee, part of the annual leave in advance.

If the company does not have an Internet service, notices are posted at the entrances of houses indicating the timing of repairs. After submitting a package of documents, the review period is approximately 60 days. The widow of a serviceman who died in the line of duty can apply for a second pension.

What new payment order details will appear from February 4 this year? But not all errors can be corrected, besides, since February of the year, the rules For example, if the recipient's bank is indicated incorrectly.

Compulsory health insurance policy number photo. Praise will help you understand the correctness of actions. You can sell a car transferred from the testator only after entering into an inheritance.

The repayment period is indicated in calendar days, but there are no obstacles to making payments in shorter periods of time.

You don't even have to delve into the scheme of how utilities work.

The verification procedure is carried out by entering the series and number of the civil passport of the person submitting the application into the electronic form.

Payment order for tax payment: how to correct errors

What details can be clarified in a payment order? There is a general rule: if an error in a payment order did not result in the non-transfer of funds to the budget, then the individual entrepreneur organization has the right to clarify the payment. That is, a new payment order does not need to be issued if the money still ends up in treasury

The Tax Code does not directly state which errors do not entail non-transfer of tax. However, there is a hint. In the same paragraph 7 of Art. This is the basis, type and affiliation of the payment, tax period, payer status or Federal Treasury account. Please note that the opportunity to clarify the treasury account appeared only this year.

Previously, if this indicator was indicated incorrectly, the payment was required to be made again.

So, in order to clarify the details of payment orders for the transfer of contributions, the checkpoint, KBK, INN, purpose of payment, were filled in incorrectly. From January 1 of the year, the conditions under which it is possible to clarify have changed.

Forum Accounting and reporting Accounting and taxes BU. Problem in Accounting 3. The tax office changed the account; this is a frequent phenomenon that did not cause problems before; the accountant corrected everything, added and created a payment order. The program displays an error in the payment order: “Perhaps the tax payment details are indicated incorrectly” and corrects it to the old account.

.

.

.

VIDEO ON THE TOPIC: Details for paying taxes and contributions in 1C 8 3

Source: https://spb-registrator.ru/kommercheskoe-pravo/vozmozhno-platezhnie-rekviziti-ukazani-neverno-2019.php

When is tax considered unpaid?

In accordance with sub. 4 p. 4 art. 45 of the Tax Code of the Russian Federation, if the recipient’s account and (or) the name of the bank of the Federal Treasury Department (UFK) is incorrectly indicated in the payment order, the payment is not received into the budget of the Russian Federation or is not credited to the corresponding account of the Federal Treasury. In this case, the taxpayer’s obligation to pay the tax is considered not fulfilled, and it must be transferred again. You must also pay penalties for late payment of taxes. This is the position of the tax department, set out in letters of the Federal Tax Service of Russia dated 09/04/2015 No. ZN-4-1/ [email protected] , dated 03/31/2015 No. ZN-4-1/ [email protected] , dated 09/06/2013 No. ZN-3 -1/3228 and dated 09/12/2011 No. ЗН-4-1/ [email protected]

The obligation to transfer tax will not be recognized as fulfilled also in the case where errors in indicating the name of the bank or UFC account in the payment order were made due to the fault of the bank. Penalties will be presented to the taxpayer (letter of the Federal Tax Service of Russia dated September 2, 2013 No. ZN-2-1/ [email protected] ). But in such a situation, the taxpayer may demand compensation from the bank for losses incurred (paragraph 9, article 12, article 15 of the Civil Code of the Russian Federation).

At the same time, some courts recognize the tax paid if the UFK account is incorrectly indicated in the payment order. For example, the Federal Antimonopoly Service of the Moscow District, in Resolution No. A40-42830/11-99-191 dated 04/03/2012, recognized that the tax was received into the budget, despite the presence in the payment order of an error in indicating the UFK account.

By the way, the ability to clarify an incorrect account of the Federal Tax Service is directly enshrined in the Tax Code of the Russian Federation .

Note! From 05/01/2021, be sure to fill out field 15 “Current account number”; the Treasury account and the name of the bank have also changed. The period from 01/01/2021 to 04/30/2021 is transitional. Those. Payments will be processed with both old and new details. For all the details, see our material.

EXAMPLE, when the payment cannot be clarified, from ConsultantPlus An organization has a property tax arrears of 100,000 rubles. She pays VAT in the amount of 150,000 rubles, but by mistake indicates on the payment slip... Read the continuation of the example in the K+ legal reference system. Trial access to the system is provided free of charge.

Feedback from tax authorities

The need to clarify the payment (in terms of clarifying the details of the payment document) in order to correctly reflect information about it in the resources of the Federal Tax Service may also arise from the tax authority .

In this case, the inspectorate itself will inform the taxpayer about this. The form of the corresponding information message is presented in Appendix 2 to the Procedure . In the message, the controllers will indicate that the order to transfer the tax was issued in violation of the requirements established by Rules No. 107n , and the specific violation committed by the taxpayer will be named. Violations may be of the following nature:

– absence or indication of a non-existent (incorrect) KBK, OKTMO code;

– the payer’s TIN is not indicated (incorrectly indicated);

– TIN does not match the name of the payer;

– absence or incorrect indication of the payer’s checkpoint;

– indication of a non-existent (incorrect) recipient’s TIN;

– absent, a non-existent (incorrect) recipient checkpoint is indicated;

– the taxpayer is not registered with the tax authority;

– tax payment is made for third parties;

– absence or incorrect indication of the basis for payment or the recipient’s account number and name;

– absence of an open payment card with the taxpayer’s budget;

absence or incorrect indication of the payer status and tax period.

After receiving an information message about the need to clarify the details of the order for tax transfer, the payer submits to the inspectorate a statement about the need for this clarification.

When the tax authority receives an application from the taxpayer to clarify the type and nature of the payment, the tax authority makes an appropriate decision within 10 working days from the date of receipt of the application (the application form is approved by Order of the Federal Tax Service of Russia dated December 29, 2016 No. ММВ-7-1 / [email protected] ).

Please note:

If an error in the payment document arose due to the fault of the bank when generating an electronic payment document, the tax authority, after reconciling settlements with the payer, has the right to make a request to this credit institution in order to obtain a copy of the payment document executed by the payer on paper.

At the suggestion of one of the parties (inspectorate or taxpayer), a joint reconciliation of taxes paid by the taxpayer can be carried out.

The procedure for conducting reconciliation is regulated by clause 3 of the Order of the Federal Tax Service of Russia dated 09.09.2005 No. SAE-3-01 / [email protected] “On approval of the Regulations for organizing work with taxpayers, payers of fees, insurance contributions for compulsory pension insurance and tax agents .”

Other errors in the payment order

Other errors in the payment order, such as incorrectly indicated KBK, OKATO, INN, KPP and the name of the tax authority, do not prevent the receipt of tax to the budget (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). If such errors are made, then the tax is considered paid, but, in accordance with the norm of paragraph. 2 clause 7 art. 45 of the Tax Code of the Russian Federation, it is required to submit an application to clarify the payment (letters of the Ministry of Finance of Russia dated January 19, 2017 No. 03-02-07/1/2145, dated July 16, 2012 No. 03-02-07/1-176, dated March 29, 2012 No. 03 -02-08/31, Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125, dated December 24, 2013 No. SA-4-7/23263).

For information on how to draw up such an application, read the material “ Sample application for clarification of tax payment (error in the KBK) ” .

If, as a result of an error, the tax was received by another BCC (for example, an inactive one), the taxpayer can apply for a tax offset. Penalties should not be accrued (letters of the Ministry of Finance of Russia dated July 17, 2013 No. 03-02-07/2/27977, dated August 1, 2012 No. 02-04-12/3002).

How to clarify checkpoint

How to clarify a payment order when an error was made in the taxpayer’s checkpoint details (field 102 of the payment slip) was explained by the Federal Tax Service in a letter dated December 24, 2021 No. KCh-4-8/26565.

Such a payment can be clarified if the conditions established by paragraph 7 of Article 45 of the Tax Code of the Russian Federation are met. Namely:

- three years have not passed since payment;

- funds have been credited to the budget.

To clarify the payment, you must submit an application to the inspection and attach supporting documents. It can be sent on paper or electronically with an enhanced qualified electronic signature via TKS or through your personal account.

The tax payment can only be clarified in full, not in part.

The court's position regarding errors

Judicial practice confirms that the tax, as well as penalties and fines, are considered paid if the following errors are made in the payment order:

- Invalid KBK:

- AS of the Far Eastern District dated November 19, 2015 No. F03-4782/2015;

- AS of the North Caucasus District dated December 4, 2014 No. F08-8670/2014;

- FAS East Siberian District dated May 14, 2013 No. A33-8935/2012;

- FAS North-Western District dated December 22, 2010 No. A42-2893/2010;

- FAS Moscow District dated January 23, 2013 No. A40-12057/12-90-57, dated December 8, 2011 No. A40-36137/11-140-159;

- FAS Central District dated January 31, 2013 No. A64-5684/2012;

- Federal Antimonopoly Service of the West Siberian District dated June 30, 2011 No. A67-5567/2010;

To learn about the consequences of incorrectly indicating the KBK in the document for the payment of “accidental” insurance premiums transferred to the Social Insurance Fund, read the article “KBK in the payment order in 2021 - 2021” .

- Incorrect TIN, KPP, name of tax authority:

- Incorrect OKATO:

- Errors in the basis of payment:

- FAS of the West Siberian District dated 04/09/2010 No. A27-25035/2009;

- FAS Moscow District dated October 26, 2009 No. KA-A41/10427-09;

- FAS of the North Caucasus District dated 02/06/2008 No. F08-180/2008-68A;

- Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 784/13;

- AS of the North Caucasus District dated March 22, 2016 No. F08-1378/2016;

- AS of the Moscow District dated October 6, 2015 No. F05-13213/2015;

- FAS of the Ural District dated October 10, 2012 No. F09-9057/12;

- FAS of the East Siberian District dated December 6, 2011 No. A33-17476/2010, dated September 1, 2011 No. A33-3885/2010;

- FAS North-Western District dated 07/04/2011 No. A05-5601/2010;

- FAS Moscow District dated January 23, 2013 No. A40-12057/12-90-57, dated June 30, 2011 No. KA-A40/6142-11-2;

- Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 31, 2010 No. A29-1642/2010.

To find out whether the error in the “Tax period” field is critical, read the article “Indicating the tax period in the payment order - 2021 - 2021”.

Results

Formation of a payment order for the payment of tax to the budget requires increased care. Errors made in indicating the recipient's bank and Federal Treasury account number lead to the fact that the tax is considered unpaid and will have to be paid again. And if the tax is repaid after the deadline for its payment has expired, then financial sanctions may also be imposed on the payer. Other errors in filling out a tax payment order do not entail financial losses and can be corrected by submitting an application to clarify the payment.

Sources: Order of the Federal Tax Service dated November 12, 2013 No. 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The result of interaction with the INFS regarding unclear payments

Based on the taxpayer’s application and the act of joint reconciliation of calculations (if one was carried out), the inspectorate makes a decision to clarify the payment on the day of actual payment of the tax.

In this case, the tax authority recalculates the penalties accrued on the amount of tax for the period from the date of its actual payment to the budget until the day the Federal Tax Service Inspectorate makes a decision to clarify the payment. The taxpayer will be notified of the decision to clarify the payment within five days after the decision is made.