What does it mean to repay a loan using the bank's created reserves?

Sometimes loans from individuals or legal entities are repaid if they are hopeless - that is, they are overdue for more than 90 days.

Writing off such loans at the expense of a reserve is a rarity for Russian credit institutions, since when writing off a loan, the bank will need to pay a considerable tax: 25% of the written-off amount for loans to legal entities and 15 percent for loans to individuals. Therefore, over the five years of this practice, a relatively small number of loans were written off from bank reserves. Commercial banks must have a reserve - funds that are stored in a correspondent account with the central bank.

https://www.youtube.com/watch?v=upload

Mandatory reserves were introduced to ensure the obligations of banks on deposits. In addition, reservation serves as a regulator of the volume of money supply in circulation.

When an individual or legal entity deposits funds into a bank, a certain percentage of this amount is necessarily transferred to an account with the Central Bank. Funds are stored in this account until they are withdrawn from the bank.

If a credit organization fails to provide reserve amounts in accordance with established standards, the Central Bank of Russia has the right to write off the deficiency from the correspondent account of the banking institution, as well as to collect a fine in court for violations of mandatory reserve norms.

The reserve for doubtful debts is formed by a credit institution to write off bad debts. That is, loans that will no longer be repaid.

In turn, failure to write off such debts leads to an increase in the tax base and, accordingly, an increase in the amount of income tax.

Repaying a loan using the reserve means writing it off by the bank. After the debt is written off, the debtor client is completely released from debt payment and the bank cannot, after the write-off, demand repayment from the client.

Writing off a loan at the expense of a bank reserve frees the borrower from the need to repay the loan balance, fines and accrued penalties for the period of non-payment.

However, a loan written off is considered a benefit received for the borrower. After all, this way you don’t pay interest. That is, you make a profit, purely legally speaking. And profits, you understand, must be taxed.

Therefore, after writing off the loan, it becomes necessary to pay income tax. Banks report to the tax authorities for income and losses received. And the written-off loan will be considered profit for the borrower in the reporting.

It is worth noting that income tax today is 13% of the amount of profit. They even take it from your salary. So you have to prepare such a share of the outstanding loan.

A bank's use of its reserves to pay off bad and doubtful loans is often not disclosed. And such information becomes known only during the trial. Such actions on the part of the bank can be called illegal with signs of fraud.

In order not to repay a written-off loan, it is necessary to have accurate information about its write-off. To clarify the situation, it is necessary to file an objection to the claim for debt collection and insist on verifying this information.

In addition, you may even receive an unfamiliar message stating that your loan has been repaid using the reserve. And you only have to pay very little.

Don't take my word for it. Check with the tax authorities. Are you really taxed?

Because there are many types of deception on the Internet. And they can simply steal money from you using such a move.

Now all new paid questions will be sent to you by email. You can unsubscribe in your Notification Settings

Supported by online chats

Statute of limitations

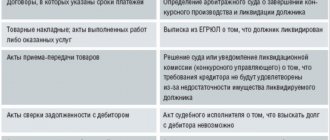

The general limitation period is three years. It will be easier to correctly count these three years using the table.

| Situation | From what date does the statute of limitations begin? |

| The deadline for fulfilling the obligation is determined | Upon expiration of the obligation |

| The deadline for fulfilling the obligation is not determined | From the day the creditor made a demand to fulfill obligations (for example, sent a letter) |

| The execution period is determined by the moment of demand | |

| The creditor gave the debtor some time to fulfill the obligation | At the end of the last day of the obligation fulfillment period |

This follows from the provisions of Article 196 and paragraph 2 of Article 200 of the Civil Code of the Russian Federation.

An example of determining the limitation period. The limitation period was not interrupted

Trading LLC shipped goods to Alpha LLC on January 13, 2021. According to the contract, payment must be made no later than 10 calendar days after shipment, that is, no later than January 23, 2016. However, payment was not received from Alpha on time.

The limitation period must be calculated from January 24, 2021 to January 24, 2021 inclusive (provided that the limitation period was not interrupted).

The limitation period may be interrupted when the debtor commits actions that indicate recognition of the debt.

After the break, the limitation period begins again. At the same time, do not count the time that elapsed before the break into the new limitation period. However, there is a limitation: the limitation period cannot exceed 10 years from the date of violation of the right, even if the period was interrupted. The exception is the cases established by the Law of March 6, 2006 No. 35-FZ on countering terrorism.

This is stated in paragraph 2 of Article 196, Article 203 of the Civil Code of the Russian Federation.

The debtor can recognize his debt even after the statute of limitations has expired. In this case, from the moment the debt is recognized, the limitation period begins anew. Such rules are established in paragraph 2 of Article 206 of the Civil Code of the Russian Federation.

An example of determining the limitation period. The limitation period was interrupted

On January 13, Trading LLC shipped goods to Alpha LLC. According to the contract, payment must be made no later than 10 calendar days after shipment, that is, no later than January 23. However, payment was not received from Alpha on time.

The limitation period begins to count from January 24.

On January 25, Hermes sent a letter of claim to Alpha. On February 1, the parties drew up a reconciliation report. This means that Alpha has admitted its debt. In this case, the limitation period begins to count again - from February 2.

Situation: what actions of the debtor indicate recognition of the debt and are grounds for considering the statute of limitations interrupted?

The legislation does not establish a list of actions by the debtor that indicate that he has acknowledged the debt. And which may serve as a basis for interrupting the limitation period (Article 203 of the Civil Code of the Russian Federation).

However, an approximate list of such actions is named in paragraph 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43. In particular, it includes:

- recognition of the claim. However, the response to the claim does not in itself indicate recognition of the debt. It must indicate that the debtor has acknowledged the debt;

- a change in the contract, from which it follows that the debtor acknowledged the existence of a debt. Or the debtor’s request to change such an agreement (for example, on a deferment or installment plan);

- signing the debt reconciliation act.

For example, three years have passed since the date when the obligations were due. But during this period, the parties signed a debt reconciliation act. This act is the basis for interrupting the statute of limitations (letter of the Ministry of Finance of Russia dated July 19, 2011 No. 03-03-06/1/426). Therefore, the three-year period must be counted from the day on which the last reconciliation act dates. There are exceptions to this rule - these are events due to which the receivables have become unrealistic for collection. A similar position is set out in the letter of the Federal Tax Service of Russia dated December 6, 2010 No. ШС-37-3/16955.

The contract may provide that the obligation can be fulfilled in parts (in the form of periodic payments). In this case, if the debtor has performed actions indicating recognition of only some part of the obligation, they do not constitute grounds for interrupting the limitation period for other parts of the obligation. This is stated in paragraph 20 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43.

Accounting and tax accounting

In situations where the calculated value of the reserve fund turns out to be less than the volume of deductions actually made to the reserve, the difference in values is allocated and transferred to income items of activity. During the next operation to assess the risk level of a loan, the loan category may be changed. In this case, the debt is reclassified.

FOR YOUR INFORMATION! The method of reflecting adjustments to the amount of reserves must be fixed in the local documents of the financial institution.

In reporting forms, banking structures must disclose information about new loans issued, the facts of writing off bad debts, the level of repayment of existing obligations by clients, and cases of loan reclassification. The size of reserve funds is determined for the bank as a whole, including the resources of branch divisions.

Displaying information on reserves for loans in accounting is carried out according to the rules approved by the Regulations dated February 27, 2017 under No. 579-P. The chart of accounts provides several sub-accounts for systematizing data on reserve funds. The movement on these accounts is carried out by a set of operations to accrue, increase reserves, restore previously deposited amounts into them, with subsequent assignment to income items.

More on the topic Check your savings book account using the Sberbank office

Accounts that systematize data on reserves for possible loan losses belong to the passive group. The process of reserve formation is displayed using credit turnover, debit movement shows a decrease in the created fund due to a reassessment of the quality of loans or writing off bad debts.

Art. 297.3 of the Tax Code of the Russian Federation regulates the issues of tax accounting for this type of reserves of credit structures. Deductions made are recorded as expenses of the organization. These costs are recognized as part of non-operating costs. Once a recognized bad debt is written off from the balance sheet, interest on the loan stops accruing.

The amount of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection, are written off in accordance with clause 77 of the Regulations on Accounting and Financial Reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n (hereinafter - Regulation N 34n).

Accounts receivable for which the statute of limitations has expired, other debts unrealistic for collection include:

- to the account of the reserve for doubtful debts;

- or on the financial results of a commercial organization, if in the period preceding the reporting period, the amounts of these debts were not reserved.

All organizations that must comply with accounting rules are required to create an allowance for doubtful debts in their accounting records and allocate the amount of the allowance to financial results. This complies with the requirements of PBU “Changes in estimated values” (PBU 21/2008).

The amount of the reserve must be determined by taking into account or assessing the degree of probability that the debt will not be repaid. In the future (in upcoming reporting periods), the amount of the reserve is subject to adjustment taking into account newly emerged information (letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01 “Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2011").

The amount of the created reserve is reflected in the debit of account 91 “Other income and expenses” (sub-account “Other expenses”) and the credit of account 63 “Provision for doubtful debts”.

In accounting, an organization has the right to independently determine the impossibility of collecting certain debts. That is, to write off a debt, it is not necessary to wait until the statute of limitations expires or the debtor is liquidated; it is only necessary to fulfill the conditions listed in clause 77 of Regulation No. 34n.

Receivables, which, in the opinion of the organization, are unrealistic for collection, can be written off, in particular, on the basis of the inventory data, written justification, order (instruction) of the head of the organization, without waiting for the liquidation of the debtor (resolution of the Autonomous District of the North Caucasus District dated July 22. 2015 N F08-4494/15 in case N A63-7109/2013).

Debit 63 Credit 62 (76) - the amount of receivables that cannot be collected is written off from the reserve for doubtful debts.

Moreover, after write-off, such debt is reflected within 5 years from the date of write-off on off-balance sheet account 007 “Debt of insolvent debtors written off at a loss” to monitor the possibility of its recovery in the event of a change in the debtor’s property status (clause 77 of Regulations No. 34n).

According to paragraph 70 of Regulation No. 34n, if by the end of the reporting year following the year in which the reserve for doubtful debts was created, this reserve is not used in any part, then the unspent amounts are added to the financial results when drawing up the balance sheet at the end of the reporting year.

https://www.youtube.com/watch?v=ytcopyrightru

As follows from the question, in the situation under consideration, the organization creates a reserve for doubtful debts in accounting, but the debt of debtors is not written off from the reserve, despite the fact that the statute of limitations on such debts has expired and some debtors have been liquidated. That is, in the financial statements, the amount of bad debts continues to be included in accounts receivable. At the same time, a reserve is formed from year to year in relation to such amounts.

Please note that accounting legislation does not establish a direct obligation to write off such debts.

At the same time, according to Part 1 of Art. 13 of the Federal Law of 06.12. 2011 N 402-FZ “On Accounting”, accounting (financial) statements must give a reliable picture of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period, necessary for users of these statements to make economic decisions (letter Ministry of Finance of Russia dated December 12, 2016 N 07-01-09/74292).

To ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and assessment are checked and documented (clause 26 of Regulation No. 34n).

Reflection in accounts receivable of the amount of bad debts, the probability of repayment of which is close to zero, in our opinion, distorts a reliable picture of the financial position of the organization. If an organization is subject to a mandatory audit, an opinion on the reliability of the financial statements is expressed by auditors during the audit (Part 2 of Article 6 of Federal Law No. 307-FZ of December 30, 2008 on auditing activities).

More on the topic Self-employed citizens of Russia in 2021: who are they in the understanding of the tax code

Please note that Art. 15.11 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability in the form of imposing an administrative fine on officials for gross violation of the rules of accounting and presentation of financial statements. At the same time, according to Part 2 of Art. 2.1 of the Code of Administrative Offenses of the Russian Federation, a legal entity is found guilty of committing an administrative offense if it is established that it had the opportunity to comply with the rules and norms, for violation of which this Code of Administrative Offenses of the Russian Federation or the laws of a constituent entity of the Russian Federation provides for administrative liability, but this person did not take all the consequences depending on it measures to comply with them (letter of the Ministry of Finance of Russia dated March 11, 2016 N 07-05-07/13456).

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (with the exception of expenses specified in Article 270 of the Tax Code of the Russian Federation), which recognizes justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred ) taxpayer.

In accordance with paragraphs. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, the losses received by the taxpayer in the reporting (tax) period in the form of the amount of bad debts are equated to non-operating expenses, and if the taxpayer has decided to create a reserve for doubtful debts - the amount of bad debts not covered by the reserve funds ( letter of the Ministry of Finance of Russia dated February 26, 2016 N 03-03-06/1/11047).

Based on clause 2 of Art. 266 of the Tax Code of the Russian Federation, bad debts (debts that are unrealistic for collection) are debts to the taxpayer for which:

- the established limitation period has expired (Article 196 of the Civil Code of the Russian Federation);

- the obligation is terminated due to the impossibility of its fulfillment (Article 416 of the Civil Code of the Russian Federation);

- the obligation is terminated on the basis of an act of a state body (Article 417 of the Civil Code of the Russian Federation);

- the obligation was terminated due to the liquidation of the organization (Article 419 of the Civil Code of the Russian Federation);

- the impossibility of collection was confirmed by the order of the bailiff on the completion of enforcement proceedings, issued in the manner established by Federal Law dated 02.10.2007 N 229-FZ “On Enforcement Proceedings”.

Consequently, an organization that has receivables can classify them as bad debts only if one of the above reasons occurs. For reasons other than those listed above, receivables that are unrealistic for collection cannot be considered uncollectible for profit tax purposes (letters of the Ministry of Finance of Russia dated 01.02.2017 N 03-03-06/1/5078, dated 23.03.2015 N 03- 03-06/1/15764, dated 03/28/2008 N 03-03-06/4/18, dated 03/17/2008 N 03-03-06/1/184, etc.)

Responsibility for failure to create a reserve for doubtful debts

Refusal to create a reserve for doubtful debts can be considered a gross violation of the rules of accounting and presentation of financial statements.

Under it, the current legislation recognizes the distortion of any article (line) of the financial reporting form by at least 10% (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

This may entail the imposition of an administrative fine on officials in the amount of 2,000 rubles. up to 3,000 rub.

In addition, when conducting an on-site tax audit, an organization may be held liable for tax liability in the amount of 10,000 rubles or more for violating accounting rules due to failure to accrue a reserve for doubtful debts. up to 30,000 rub. (Clause 1-2 of Article 120 of the Tax Code of the Russian Federation).

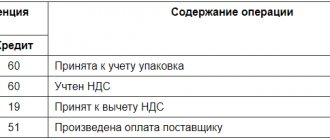

In conclusion, using an example, we present the stages of creating and using a reserve for doubtful debts in accounting:

Example:

The organization rented out the premises.

The rental amount was 118,000 rubles, incl. VAT-18,000 rub.

The accounting policy provides for the creation of a reserve for doubtful debts.

At the same time, the accounting policy states that the amount of contributions to the reserve is calculated quarterly based on the results of the debt inventory as a percentage of the debt amount depending on the duration of the delay as follows:

If the period of violation by the debtor of its obligations at the end of the quarter (six months, 9 months, year) does not exceed 45 days, then a reserve for this debt is not created.

In case of delay from 46 days to 90 days inclusive, 50% of the debt amount is reserved.

If the debtor does not pay for more than 90 days, the reserve increases to the full amount of the debt.

In tax accounting, a reserve for doubtful debts is not created.

Based on the results of the inventory, it was found that as of September 30, 2016, the tenant’s debt in the amount of RUB 354,000 was not paid on time. — the period of delay is 95 days.

How to account for the loan loss reserve

https://www.youtube.com/watch?v=ytaboutru

Banking organizations are required to create reserves that provide compensation in monetary terms for operating risks. One of the main risks is the possibility of non-repayment of issued loans. To evenly transfer possible financial losses to operating results, it is necessary to form a reserve for loan losses. It is formed in an amount that is calculated on the basis of the standards of the Central Bank of the Russian Federation.

The reserve is created to smooth out the negative impact of situations with depreciation of issued loan funds. This can happen under the influence of external factors and due to the debtor’s failure to return money. Thanks to the reserve, significant fluctuations in profitability are prevented. The formation of the reserve fund is carried out through regular deductions, which are recorded as expenses. Regulation of the issues of reserving money for probable non-repayment of loans falls within the scope of the Central Bank Regulation dated June 28, 2017 No. 590-P.

IMPORTANT! The assessment of issued loans and their distribution by quality categories is carried out by banks independently. The amount of potential losses included in the reserve is determined by the amount of possible depreciation of credit resources.

The amount of probable losses is equal to the difference between the book value of the loan (the outstanding balance of the debt) and the fair estimated value. Reserves can be created separately for each loan or in relation to a set of homogeneous loan obligations. The loan is assessed according to its quality level regularly from the moment the loan money is issued to the client.

REMEMBER! Conditions such as the financial position of the debtor and the dynamics of its changes, the good faith shown by the borrower in fulfilling obligations to repay the loan are used as evaluation criteria for loans.

Accounting for VAT when writing off a buyer's irrecoverable debt

In tax accounting, the write-off of accounts receivable is supplemented by VAT postings: Dt76 (deferred VAT calculations) – Kt68 (current VAT calculations). If there is a reserve for doubtful payments, all debts in it are attributed to non-operating expenses for which VAT is not paid until the end of the reporting period. At the end of the quarter, you need to compare the reserved amount with the amount of bad debt recorded in the inventory report. The difference in figures in favor of RSD means that not all payments not received from counterparties are non-refundable, and VAT must be paid on them. If defaulted debts deemed uncollectible exceed the reserve fund, the overpayment is deducted from the taxable amount based on the reconciliation report.

In the absence of reserves, this procedure will have to be carried out monthly, but if desired, the organization has the right not to write off overdue “receivables” until the limitation period for them has expired. However, when this happens, losses must be taken off the balance sheet urgently, in the same month, since they cannot be carried forward further.

As for the latest changes in tax accounting of debt obligations, by letter of the Ministry of Finance No. 03-07-15/6333 dated March 4, 2014, penalties for late payments were removed from the taxation of pricing elements. This means that they can be used to write off accounts receivable in 2015 using accounting entries. The issue of recognizing the entire amount of “receivables” as tax-free is being discussed at the level of government experts, but so far the introduction of such a provision is considered premature and inappropriate.

There is also the problem of writing off bad debts for those enterprises that have switched from general to special tax regimes, if their “receivables” arose during the period of application of OSNO. The Tax Code does not cover such situations, and accountants have to turn to the inspectors of the Federal Tax Service for clarification.

Accounting and tax accounting

According to paragraph 1 of Art. 266 of the Tax Code of the Russian Federation, a doubtful debt is any debt to the taxpayer arising in connection with the sale of goods, performance of work, provision of services, if this debt is not repaid within the time period established by the agreement and is not secured by a pledge, surety, or bank guarantee.

If a taxpayer has a counter-obligation (accounts payable) to a counterparty, doubtful debt is recognized as the corresponding debt to the taxpayer to the extent that exceeds the specified payables of the taxpayer to this counterparty.

At the same time, Art. 266 of the Tax Code of the Russian Federation does not contain provisions that make the formation of a reserve for doubtful debts dependent on the degree of probability of debt repayment.

1) for doubtful debts with a period of occurrence exceeding 90 calendar days - the amount of the created reserve includes the full amount of debt identified on the basis of the inventory;

More on the topic Conditions for applying the simplified tax system in 2021. Who has the right to apply the simplified tax system

2) for doubtful debts with a period of occurrence from 45 to 90 calendar days (inclusive) - the amount of the reserve includes 50% of the amount of debt identified on the basis of the inventory;

3) for doubtful debts with a period of up to 45 days - does not increase the amount of the created reserve.

At the same time, the amount of the created reserve for doubtful debts, calculated based on the results of the tax period, cannot exceed 10% of the revenue for the specified tax period, determined in accordance with Art. 249 of the Tax Code of the Russian Federation (for banks, credit consumer cooperatives and microfinance organizations - from the amount of income determined in accordance with this chapter, with the exception of income in the form of restored reserves).

When calculating the reserve for doubtful debts during the tax period based on the results of reporting periods, its amount cannot exceed the greater of the values - 10% of revenue for the previous tax period or 10% of revenue for the current reporting period.

The reserve for doubtful debts is used by the organization only to cover losses from bad debts recognized as such in the manner established by this Article. 266 Tax Code of the Russian Federation.

Thus, from the stated norms of the Tax Code of the Russian Federation it follows that an organization that has decided to form a reserve for doubtful debts writes off bad debts from the reserve, and if the amount of the reserve is not enough, the difference is taken into account as part of non-operating expenses.

Cases of accounts receivable

Accounts receivable may arise, for example, in the following cases:

| Who has the receivables? | Base |

| Buyer | The supplier did not ship the goods paid in advance to the buyer |

| Customer | The contractor did not perform (provide) the work (services) paid in advance to the customer. |

| Provider | The buyer did not pay the supplier for the goods supplied by him |

| Executor | The customer did not pay the contractor for the work performed (services provided) |

| Lender | The borrower did not repay the loan received to the lender |

| Employing organization | The employee did not report on the amounts received under the report |

Formation of reserve

When calculating the total volume of reserve funds, banking organizations take into account categories of loans. According to the quality standards of the Central Bank of the Russian Federation, there are five of them:

- For the first category of loans, reserve contributions are 0%. These are standard loans classified as the highest quality category. There is no obvious credit risk for them.

- The second group is characterized by regular enrollment of up to 20% of debts to the bank into the reserve fund. These are non-standard customer credit obligations that are assigned a moderate level of impairment risk.

- For debts of the third category, deductions amount to 21-50% of the volume of such loans. This is a portfolio formed by doubtful debts. The likelihood of material damage occurring during their maintenance is high.

- The fourth group includes debts whose repayment is doubtful. For them, reserves are created in the amount of 51-100%. Such problem loans have a high risk of non-repayment or late payments.

- The fifth category consists of bad debts, for which provisions are equal to the amount of credit funds.

NOTE! The amount of the reserve directly depends on the quality of loans.

The Central Bank recommends considering loans from 2-5 categories as sources of risk. They are called partially or fully impaired. Reserve fund resources are credited to an open interest-free account. This account is interest-free, its purpose is to accumulate funds and ensure their safety.

The formation of reserve funds is carried out in national currency. The reserve system must be applied by all banks issuing loans (regardless of the currency of the loan). When implementing guarantee deductions, it is recommended to first classify loans and compose homogeneous loan portfolios from them. The distribution of loans among portfolios is carried out according to several criteria:

- debts of individuals, legal entities and individual entrepreneurs are shown separately;

- loans are divided into groups of secured and unsecured;

- An additional division is made according to the degree of discipline of the debtors.

A professional value judgment is made on the basis of measures for a comprehensive analysis of the debtor’s activities and his financial situation. The completed results must contain the following information:

- about the existing level of risk of client insolvency;

- about the analytical procedures performed and the methodology used;

- to assess the quality of loan servicing;

- provision estimates for a specific debt.

https://www.youtube.com/watch?v=ytpressru

For legal entities, accounting documentation, tax returns, reporting, and the content of statistical forms serve as a source of information for analyzing solvency.

NOTE! The procedure for forming a reserve fund and the methodology for assessing the solvency of borrowers must be prescribed in the bank’s internal documents.

Documenting

The fact of the occurrence of receivables must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ).

Determine the amount of overdue accounts receivable based on the results of the inventory and reflect it in the act, for example, according to form No. INV-17. Carry out the inventory by order of the manager (form No. INV-22).

To write off accounts receivable, the manager must issue an appropriate order. The basis for this will be an inventory act and an accounting certificate.

This is stated in paragraph 77 of the Regulations on Accounting and Reporting, letter of the Federal Tax Service of Russia for Moscow dated December 13, 2006 No. 20-12/109630.

Attach documents confirming its occurrence to the accounts receivable inventory report, for example:

- agreements that specify the terms for repayment of obligations by counterparties;

- invoices;

- certificates of work performed (services rendered);

- acts of inventory of receivables at the end of the reporting (tax) period.

This procedure follows from letters of the Ministry of Finance of Russia dated April 8, 2013 No. 03-03-06/1/11347 and the Federal Tax Service of Russia for Moscow dated April 13, 2011 No. 16-15/035618.1.

Typical wiring

https://www.youtube.com/watch?v=ytdevru

The formation of the reserve is reflected in correspondence with the debiting of the cost account and crediting the sub-account allocated for reserve funds:

- D70606 – K32015 (32115, 32505, 32211, etc.) – when reserving resources for possible losses on loans issued to other credit organizations;

- D70606 – K44115 – reserve for loans provided to government agencies and extra-budgetary funds;

- D70606 – K45215 – creation of a reserve for loans to legal entities;

- D70606 – K45415 – reserves to cover possible losses due to depreciation of loans issued to individual entrepreneurs;

- D70606 – K45515 – reserving funds for the obligations of clients from the category of individuals.

Provided that the loan is repaid by the debtor, reserve resources lose their relevance. They must be restored to income. This is done by posting between the debit of the reserve subaccount and the credit of account 70601.