Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

In organizations, there are often cases of accounting with errors or not maintaining it at all, loss of documents due to fires, moves or departure of accountants. Management and counterparties do not receive accurate data on the activities and property status of the organization, making it difficult to control the safety of inventory, assets and funds. All this leads to the need to restore accounting. Restoring accounting is a complex and lengthy process when all documents are put in order and missing papers are restored.

Failure to keep records does not go unpunished. If you do not submit reports to the tax authorities on time, the organization’s work will be suspended, its current accounts will be blocked, and a fine will be imposed on its managers. Lack of records and primary documents will result in fines, penalties and collection of unpaid taxes during a tax audit.

When is accounting restoration necessary?

Restoring accounting records is a complex procedure that is aimed at putting all financial documents of an enterprise in order. In the course of work, the accounting data in the database and reports submitted to the tax authorities are brought into compliance with the law, and corrections are also made to previously submitted declarations.

In what cases is it necessary to restore accounting:

- For some reason, accounting was not kept at all, and there was a gap of several months in the documents.

- As a result of the accident, financial documents were completely or partially lost.

- Due to an incompetent employee, accounting was carried out with many gross errors and violations.

- An unscrupulous employee deliberately distorted accounting or tax information.

- After a company reorganization, a change in its status, and in other cases when for some reason it was not possible to immediately switch to the required accounting system.

It is also useful to restore accounting records before major tax audits. In this case, third-party specialists will help identify and eliminate major violations, if any, and the owner can be sure that all taxes and payments have been calculated correctly.

In addition, if an enterprise plans to automate processes, including accounting, it is worth carrying out a recovery procedure. This will help minimize risks, eliminate errors and configure programs correctly, complying with the requirements of current legislation.

What data can be recovered?

| Title of the document | Recovery method |

| Documents confirming accounts payable and receivable | You will need to write to sellers and buyers asking for reconciliation reports |

| Copies of calculations for unified social tax and insurance premiums | You will need to write a letter about issuing a copy of the calculations to the Pension Fund and the Social Insurance Fund |

| Money orders | You need to contact your bank for them. |

| Act of reconciliation of taxpayer's calculations for taxes, fees and contributions | Write a letter to the tax office with a request to provide a statement of reconciliation of calculations with the budget |

| Certificate about the status of settlements with the budget or the absence of debts on taxes and fees | You will need to submit an application for a certificate to the tax office. |

| Codes of types of activities according to OKVED | Fill out the notification on the Rosstat website |

Possible consequences

If for some reason accounting was not kept for a long time, gross errors were found, and the procedure for restoring accounting was not carried out, this threatens the company with various sanctions. Problems will inevitably arise with tax authorities and other government services. This will entail fines, seizure of bank accounts and company property.

In the case of the most unfavorable forecast, the management of the enterprise may incur criminal liability, and the company itself may be forcibly liquidated. In other cases, problems may arise with counterparties or partners of the company, as well as creditors.

In any case, accounting restoration services will cost much less than paying fines assessed for errors in declarations. In addition, such a procedure will avoid possible criminal penalties for tax evasion or other violations.

Visual reminder

| Link to law | Description |

| Clauses 6 and 8 of Article 23 of the Tax Code of the Russian Federation | Taxpayers are required to submit to tax authorities the documents necessary for the calculation and payment of taxes. In addition, for 4 years it is necessary to ensure the safety of accounting and tax accounting data and other documents necessary for the calculation and payment of taxes. These include, in particular, documents confirming receipt of income, expenses, and payment or withholding of taxes. |

| Subclause 1 of clause 1 of Article 31 of the Tax Code of the Russian Federation | Taxpayers have the right to demand from a taxpayer, fee payer or tax agent documents that serve as the basis for the calculation and payment (withholding and transfer) of taxes and fees, as well as documents confirming the correctness of calculation and timely payment (withholding and transfer) of taxes and fees. |

| Letter No. 03-02-07/1-288 of the Ministry of Finance of the Russian Federation dated August 11, 2011. | Liability established for failure to submit documents is regarded as a tax offense. |

| Clause 5 of Article 93 of the Tax Code of the Russian Federation | During a tax audit and other tax control activities, tax authorities do not have the right to request from the inspected person documents that were previously submitted to the tax authorities during desk or field tax audits of this inspected person. This restriction does not apply to cases where documents were previously submitted to the tax authority in the form of originals, which were subsequently returned to the person being inspected, as well as to cases where documents submitted to the tax authority were lost due to force majeure. |

| Article 126 of the Tax Code of the Russian Federation | For each document not submitted, the taxpayer will have to pay a fine of 200 RUR. |

The cost of restoring accounting records

There are two types of accounting restoration:

- complete;

- partial.

The partial restoration procedure is needed when existing reporting was submitted with violations that need to be corrected. In addition, it is used in cases where declarations have not been submitted for several months and information has not been entered into registers, or only certain types of accounting need to be put in order. A complete restoration of accounting is necessary if the entire information base was lost or it was not maintained at all. This is a rather long and labor-intensive process.

What determines the price of accounting restoration services:

- scope of work;

- recovery method;

- the tax system used by the enterprise;

- urgency of the procedure.

The recovery process can take several weeks or 1-2 months.

Penalties for violation of record keeping:

You submit your reports on time, pay your taxes regularly, but if you make a mistake in your balance sheet calculations by at least 10%, you face a fine of up to 50,000 rubles. You show in your return a tax amount that is less than what you owe according to the tax office - a fine of 20% to 40% of the difference plus penalties. If you do not correct yourself at the request of the tax office, your account will be blocked, and in especially severe cases, an on-site inspection will be ordered.

- Violated during one tax period, the fine will be 10,000 rubles;

- Violated in several blocks, already 30,000 rubles;

- If you are caught understating your tax base, pay 20% of the amount of unpaid tax, a minimum of 40,000 rubles.

A gross violation of accounting rules means the absence of primary documents or invoices, systematic (twice or more times during the year) untimely or incorrect reflection of business transactions, cash, tangible assets, intangible assets and financial investments. It is not difficult to make an unintentional mistake. Therefore, company accounting requires constant monitoring.

Important!

If the underpayment of taxes within three years reaches 2,000,000 rubles, the manager faces not only a fine, but also criminal liability. This is written in detail in Article 120 of the Tax Code of the Russian Federation.

VALEN company services

VALEN offers qualified assistance in maintaining and restoring accounting in Moscow and other regions. Our employees have many years of experience in various areas of law. Qualified accountants will put current documentation in order, eliminate errors, submit all necessary adjustment reports, and also advise on further accounting issues. To order the restoration of accounting in Moscow, leave a request on our website or call: +7 (495) 7-888-096. We are also waiting for you in our office.

What if the documents cannot be restored?

Sometimes it happens that some of the lost (missing) documents cannot be restored. For example, if the counterparty from whom you can request duplicates of the same invoices for the period being restored has managed to be liquidated.

In such cases, the question is divided into 2 parts:

- How to reflect data on non-recoverable documentation in reporting used for making management decisions?

- How to resolve the issue of loss of documents with regulatory authorities?

And if in terms of management information options are possible (for example, calculated indicators or the use of data from third parties, such as auditors of counterparties), then in terms of relations with tax and similar authorities, the procedure is always the same:

- The tax and other government agencies (for example, the Pension Fund of the Russian Federation, if it concerns information about the employment and income of employees) must be immediately notified of the impossibility of restoring documents. In this case, the notification should be supported by a formalized act and confirmation of third parties (for example, a certificate from the fire department about the fire). You should also provide confirmation that the documents cannot be restored (for example, confirmation of the liquidation of the counterparty).

- Regulatory authorities always consider such cases on an individual basis. However, it should be borne in mind that the absence of primary documents will almost certainly lead to the need to recalculate taxes for the period for which it is not possible to make a restoration. For example, if there are no invoices from a liquidated supplier, the VAT previously accepted for deduction on these invoices will have to be excluded from the calculations.

Read more about invoices and the procedure for VAT deductions here.

Recovery stages

restores accounting in the most difficult situations, if necessary, attracts auditors and lawyers. In each case, an action plan is developed to guarantee maximum effect.

- Inventory to identify existing assets. Processing of found documents, sorting, thorough analysis of the situation and development of optimal solutions for accounting restoration.

- Search and recovery of lost documents. Formation or adjustment of accounting registers.

- Audit and analysis of documents, organization of document flow, submission of updated reporting forms for the period under review. At this stage, the correctness of tax calculations and declarations is also checked, and work is carried out to restore personnel records.

- Restoring or installing new software (if necessary). Here we plan to check, create databases, reflect initial balances on accounting accounts in the accounting program (1C), etc.

8 out of 10 clients resolve their issue after the first call to us! Shall we check?

Call

By submitting the form, you agree to the rules for processing personal data

Form in block

How does restoration of accounting affect taxes?

When restoring accounting and adjusting tax obligations, situations arise when tax is overpaid or underpaid.

In the first case, the amount is returned to the company’s account, in the second, additional tax and a fine are paid.

Common mistakes

It is impossible to run a successful business without proper accounting organization. Even if reporting is submitted on time and the organization regularly makes tax payments, accounting errors that are not corrected on time lead to negative consequences.

For example, when working with the 1C program it is not allowed:

- incorrect reflection of transactions (negative balances appear);

- incorrect indication of accounting accounts;

- ignoring errors, manual corrections leading to system failures in calculations (divergence of benchmark indicators when tax registers in the program do not match the data in reports).

When restoring accounting, specialists pay attention to the following points:

- There may be discrepancies in settlements with tax authorities, especially at the end of the calendar year, when accruals are reflected taking into account final turnover.

- In accounting and tax reporting, there are errors associated with the occurrence of significant events in the period after the signing of the report, but before filing the reports with the tax authorities. This could be the payment of dividends, replenishment of funds from profits, etc.

- The head of the organization and the chief accountant are responsible for the safety of primary documentation, accounting registers and reporting and do not have the right to destroy documents necessary for the accounting restoration procedure.

Accounting services - what is it?

Just 3-5 years ago, it was not accepted to trust the solution of economic problems to “outsiders”, but progress does not stand still, and therefore most managers, having weighed the benefits of “outside intervention”, find this approach as rational as possible. And it is no coincidence, because, in essence, servicing a young company in the field of accounting is maintaining its accounting records (by experienced specialists) and providing full support for its activities.

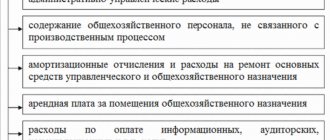

Helping companies in most cases offer the widest range of services:

- Drawing up (taking into account the latest legislative changes) and submission of: tax returns and calculations, updated declarations, reports to funds, enterprise reporting, zero reporting of an organization, report to the tax office.

- Formation and submission of: monthly, quarterly (full set) and annual reporting, zero report.

- Registration (carried out by experienced company lawyers) of an enterprise or private entrepreneurs.

- Maintaining correct accounting records.

- Help in recovering lost papers and correcting errors.

- Consulting on complex legal and taxation issues.

- This is not the entire list of services provided by such companies.

Reserves

Next, you should conduct an inventory of goods and materials by recalculating and weighing goods in warehouses. Based on the results of the audit, the accountant:

- Reflects the identified inventory balances according to DT10, and the remaining goods according to DT41. Registration is carried out in quantitative and total terms at market value.

- If, based on the results of the inventory, workwear was discovered, then it should be recorded in separate cards. One document is issued to one responsible person. If the useful life of clothing exceeds 1 year, then depreciation must be charged monthly for each item.

- The order on accounting policy must set out the procedure for recording and disposal of minimum wages and goods in the accounting and accounting records.